Where was the trading tax introduced in 2020?

A trade tax can only be established on the territory of cities of federal significance (Moscow, St. Petersburg, Sevastopol), but for this they need to adopt the relevant local law in advance.

As of 2020, the legal act (Law No. 62 of December 17, 2014) establishing the trade fee was approved only by the Moscow city authorities

and came into effect

on July 1, 2020

. Therefore, if you trade in the capital (regardless of which Federal Tax Service you are registered with - Moscow, Moscow Region, etc.) - you are required to pay a trading fee.

It is quite possible that with good budget revenues, the trade tax will be introduced in other municipalities

, but for this local authorities will need to pass a corresponding law. According to available information, due to the difficult economic situation in the country, the trade tax in 2020 will continue to be introduced only in Moscow.

Fines for non-payment

For violations related to the calculation and payment of trade fees, the following types of penalties exist:

| Type of violation | Fine | Base |

| Failure to submit notification TS-1, as well as untimely introduction of changes | 200 rub. | Clause 1 of Article 126 of the Tax Code |

| Trading without registering as a trade tax payer | 10% of revenue, but not less than 40 thousand rubles. | Article 116 of the Tax Code |

| 100-300 rub. with individual entrepreneur 300-500 rub. from a legal entity | Part 1 of Article 15.6 of the Administrative Code | |

| Indication of incorrect information in TS-1, resulting in a reduction in sales tax | 20% of underpayment | Article 120 NK |

| 40% of the underpayment in case of evidence of deliberate undervaluation of the vehicle | Article 122 NK | |

| Late payment of vehicle | Penalty in the amount of 1/300 of the Central Bank refinancing rate for each day of delay | Clause 4 of Article 75 of the Tax Code |

Who should pay the trade tax

The need to pay a trade tax directly depends on 2 factors:

- The chosen taxation system.

- Type of business activity.

Selected tax system

Trade tax must be paid only by individual entrepreneurs and organizations using OSNO or simplified tax system.

Payers of the Unified Agricultural Tax and entrepreneurs with a patent do not need

.

As for UTII, according to the new rules, it is impossible

. Therefore, if you apply UTII, and a trade tax has been introduced for your type of activity in the region, then you will have to cancel the imputation and switch to another taxation system.

Table 1. Payment of trade tax depending on the tax regime

| Tax regime | The need to pay a trade tax |

| General taxation system (GTS) | Need to pay |

| Simplified taxation system (STS) | |

| Patent tax system (PTS) | No need to pay |

| Unified Agricultural Tax (USAT) | |

| Unified tax on imputed income (UTII) | If a trade tax has been introduced in the region for the type of activity UTII, then it is necessary to switch to a different taxation system |

Activities subject to trade tax

Trade tax must be paid to individual entrepreneurs and organizations engaged in retail, small wholesale and wholesale trade through:

- stationary retail facilities with a sales floor;

- stationary retail facilities that do not have a sales area (with the exception of gas stations);

- non-stationary retail facilities;

- warehouses.

In this case, the trade fee is transferred only in the case when a specific type of activity is expressly specified in the law. For example, in Moscow, sales from warehouses

does not fall under the trade tax, this is due to the fact that this type of business is not provided for in the legal act of Moscow.

Regarding the activities of retail markets

, then it is also equated to trade. However, the fee is not levied on the retail outlets themselves, but on the entire market area itself.

Therefore, it can be expected that market owners will not want to pay the trading fee out of their own pockets and will simply distribute these costs among the traders, increasing their rent or the cost of the right to trade.

Note

: in Chapter 33 of the Tax Code of the Russian Federation there are no definitions for many key terms (sales area, what are objects of stationary trade, etc.) therefore, in such a situation, representatives of the Federal Tax Service recommend focusing on the concepts used for UTII and PSN (see Article 346.27 and Article 346.43 of the Tax Code of the Russian Federation).

Who pays it

Determining the need to pay a trade tax depends on two indicators.

Tax system

The law establishes a trade fee for individual entrepreneurs using the simplified tax system and OSNO, as well as companies using the same regimes. If a business entity applies an agricultural tax or a patent system, then they are exempt from paying the fee.

A special situation has been established for those who apply UTII. The law determines that it is impossible to pay imputation and trade fees at the same time. Therefore, it is necessary to withdraw from UTII, switch to a different system, and depending on this, determine the need to use the trade tax.

Activities

By law, all business entities that trade in retail, small wholesale or wholesale are required to make payments when using the following facilities:

- Stationary facilities with a sales area;

- Stationary facilities without a sales area;

- Non-stationary objects;

- Warehouses.

However, this type of activity must additionally be specified in local law. Thus, on the territory of Moscow, trade from warehouses is not subject to trade tax, since this type of activity is not prescribed in the adopted legal act.

Attention! The activities of retail markets are also subject to the trading tax. However, in this case, payment is made not from each trading place, but from the area of the entire market.

Activities not subject to trade tax

Local authorities have the right to establish types of activities in respect of which the trade tax does not need to be paid:

Preferential types of activities

According to Moscow Law No. 29 of June 24, 2020, the following were exempted from paying the trade tax:

- retail trade through vending machines;

- trading at weekend fairs, specialized and regional fairs;

- trade in cinemas, theaters, museums, provided that at the end of the quarter the income from ticket sales is at least 50%;

- trade in the territory of the agri-food cluster (vegetable warehouse);

- retail facilities located on the territory of retail markets;

- autonomous budgetary and government institutions;

- organizations of federal postal services;

- non-stationary retail facilities (kiosks, tents, open trays) selling printed products;

- religious organizations regarding trade in religious buildings.

In addition, consumer service

(hairdressers, beauty salons, laundries, dry cleaners, repair of clothing, shoes, watches, jewelry, repair and production of metal haberdashery and keys) subject to the following conditions:

- The main activity is the provision of household services, not trade.

- The area of the object does not exceed 100 square meters. meters, and, directly, the retail space occupied by equipment intended for display and display of goods is no more than 10% of the total area.

For example, a beauty salon with an area of 50 sq. meters, you will not need to pay a sales tax if no more than 5 square meters are allocated for the trade of related products (shampoos, creams, etc.). meters.

According to representatives of the Federal Tax Service, online stores

also do not have to pay a trade fee, but only on condition that their activities do not involve direct contact between the seller and the buyer (sales through couriers or forwarders).

Moreover, the sale of goods through an online store falls under the description of trade from a warehouse, and, as you know, in Moscow it is not subject to trade tax.

note

, despite the fact that the above types of activities are preferential and are exempt from paying the trade tax, it is still necessary to submit a notification (indicating the appropriate category of benefit) about registering as a payer of the trade tax.

Example 1. Installation of a vehicle in Moscow

Law of Moscow No. 62 dated December 17, 2014 established the TS in the capital from July 1, 2015, as well as differentiated rates and benefits for this fee. An authorized body has also been determined to perform the functions of processing and subsequent transmission to the Federal Tax Service of data on taxable objects, including monitoring for their reliability. This is the relevant executive body of the capital, which deals with the development and implementation of economic and tax policies.

The latest changes that were made to this law were dated December 26, 2020. It should be noted that the updated legal act also provides benefits for a certain group of people. In particular, certain types of activities in which trade objects are used are not subject to the fee. For example, fair trade (weekend or regional). In addition, Law No. 62 exempts state employees, autonomous and government institutions from paying. Federal postal organizations do not pay the fee either.

What is subject to trade tax?

The basis for calculating the sales tax is not the actual income received, but the very fact of using the retail facility

. Moreover, a retail facility is understood not only as real estate (shops, tents, kiosks, etc.), but also as movable property (delivery and distribution trade objects).

Therefore, the need to pay a trade tax does not depend on factors such as:

- Ownership of a retail facility

. The fee must be paid by those persons who directly use the facility for trade, regardless of whether it is the owner or the tenant. - The amount of income received

. The size of the trade fee directly depends only on the number of square meters, as well as the type and location of the trade facility. - Place of registration of a businessman

. The trade tax must be paid by everyone who trades in the territory where it is established, regardless of the place of residence of the entrepreneur (for example, an individual entrepreneur registered in Smolensk, but operating in Moscow is required to pay a trade tax). - Regularity of trade

. The trading fee is calculated and paid for the entire quarter at once. Therefore, regardless of the seasonality of the business and the number of days worked in the quarter, the trading fee will still have to be paid in full.

Vehicle rates

Trade tax rates are set by regions. Therefore, depending on the territory of coverage, rates may change similarly to preferential categories. Let us repeat that in 2020 we are only talking about bets in the city of Moscow.

The table of trade tax rates for 2020 is given in Art. 2 of the law mentioned above. You can see the full list of bets below:

Let's pay attention to an interesting fact. The list of trading activities for which the TC is established includes, among others, trading through release from warehouses. However, in the table you will not find rates for this type of trading. Therefore, in Moscow, trade from a warehouse is not yet subject to TC tax.

As can be seen from the table, the rate is not uniform and is differentiated according to the location of the trade facility, the size of the trade facility area and the type of trade activity.

Let's summarize the data in the table:

How to calculate the trading fee in 2020 (rates in Moscow from July 1, 2020)

Trade tax, mandatory payment, businessmen must calculate independently

, based on the tax rates established in the municipality.

It is worth noting that local authorities have the right to differentiate rates (up to 0), depending on the category of payer, retail facility, type of activity and its place of implementation.

Trade tax rates effective in Moscow from July 1, 2020

| Shopping facility | Within the Central Administrative District | Districts within the Moscow Ring Road (except for the Central Administrative District) | Outside the Moscow Ring Road | |

| Stationary and non-stationary trade facility without a trading floor | 81,000 rub. | 40,500 rub. | RUB 28,350 | |

| Non-stationary trade facility without a trading floor | 40,500 rub. | 40,500 rub. | RUB 28,350 | |

| Stationary trade facility with trading floors | Up to 50 sq. meters (inclusive) | 60,000 rub. | 30,000 rub. | 21,000 rub. |

| Over 50 sq. (for each square meter) | 1,200 rub. for each meter up to 50 sq.m. and 50 rub. for every meter over | 600 rub. for each meter up to 50 sq.m. and 50 rub. for every meter over | 420 rub. for each meter up to 50 sq.m. and 50 rub. for every meter over | |

| Object of distribution and distribution trade | 40,500 rub. | 40,500 rub. | 40,500 rub. | |

| Retail markets (per square meter) | 50 rub. | 50 rub. | 50 rub. | |

Please note

that when calculating the trading fee for activities related to the organization of retail markets, the fee rate is subject to indexation by the deflator coefficient of the current year.

In 2020, the indicated value is 1.371

.

Tax base and rates

When paying for a vehicle, a special increasing factor is used. It is used to change the collection rate. The initial value of this rate is 550 rubles per m² of retail space. This amount remains unchanged, only the value of the increasing coefficient changes.

The size of the increasing rate in 2020 is 1.382. Applying this coefficient to the base rate, we obtain the following value:

550 rubles * 1.382 = 760.10 rubles - this fixed maximum rate was established in 2020.

Rates differ not only according to the type of trading activity carried out, but also according to the location of the trading object, since profit primarily depends on this.

| Districts that are part of the Central Administrative District of Moscow | Southern Administrative Okrug, as well as all districts of the Northern Administrative District (except Molzhaninovsky), North-East Administrative District (except Northern), Eastern Administrative District (except for the Vostochny, Novokosino and Kosino-Ukhtomsky districts), South-Eastern Administrative District (except for the Nekrasovka district), South-Western Administrative District (except for the Northern Butovo and Southern Butovo districts) , ZAO (except for Solntsevo, Novo-Peredelkino and Vnukovo districts), North-West Administrative Okrug (except for Mitino and Kurkino districts) | Zelenogradsky, Troitsky and Novomoskovsky Autonomous Districts, Molzhaninovsky district of the Northern Administrative District, Northern District of the North-Eastern Administrative District, Eastern, Novokosino and Kosino-Ukhtomsky districts of the Eastern Administrative District, Nekrasovka South-East Administrative District, Northern Butovo and Southern Butovo South-Western Administrative District, Solntsevo, Novo-Peredelkino and Vnukovo CJSC, Mitino and Kurkino North-Western Administrative District | |

| Trade carried out through stationary outlets without trading floors (except gas stations) and through non-stationary outlets | 81 000 | 40 500 | 28 350 |

| Trade carried out through stationary points with trading floors (up to 50 m²) | 60 000 | 30 000 | 21 000 |

| Trade carried out through stationary points with trading floors (over 50 m²) | 1200 for each m² (up to 50 m²) 50 rubles for each meter after 50 m² | 600 for each m² (up to 50 m²) 50 rubles for each meter after 50 m² | 420 for each m² (up to 50 m²) 50 rubles for each meter after 50 m² |

| Retail trade activities (related to distribution and delivery) | 40,500 rubles | ||

| Retail markets | 50 rubles for each m² of retail space (the amount cannot exceed 550 rubles per m², taking into account the increasing coefficient) | ||

The rates given in the table are indicated for one quarter. Payment for vehicles is made once every three months no later than the 25th day of the month following the taxation period.

Registration as a trade tax payer (notification)

To register as a trade tax payer, you must submit a special notification in the TS-1 form

to the tax office.

This document can be submitted in the following ways:

- in person in paper form;

- by mail as a registered item with a description of the contents.

- in electronic form via the Internet (under an agreement through an EDF operator or a service on the Federal Tax Service website).

Note

: Many tax offices have computers on which you can also fill out and print the notice.

Accounting for taxes

The legislation provides for the possibility of reducing the amount of taxes paid by the amount of the vehicle. An entrepreneur who carries out trading activities can count on a reduction in the amount of personal income tax by the size of the vehicle. This benefit can only be obtained if the taxpayer has notified the tax service that he has registered as a vehicle payer.

This rule applies not only to individuals, but also to organizations. By the amount of the vehicle, they can reduce the income tax paid or the tax for organizations using the simplified tax system.

Where is the notification sent?

If the activity is carried out through a stationary facility, the notification is submitted to the Federal Tax Service at the location of this facility, and if through a non-stationary facility, then at the location (residence) of the taxpayer.

If there are several trade objects, then one notification is submitted, but indicating all objects at once. The place of filing the notification in this case will be the tax office to which the retail facility listed first in the notification belongs.

Note

: Notification is also given if the area of the facility changes or a new outlet appears. If the location of an object changes, a notice of deregistration is first written and only then a notification is submitted to the Federal Tax Service at the new address.

Within 5 working days after submitting the notification, the tax office must issue a certificate

payer of trade tax. The certificate is issued in hand or sent by mail.

How to calculate vehicle

Let's look at examples of how to calculate trading fees.

EXAMPLE 1

Let Principle LLC conduct trade in a store with a sales area of 120 square meters. m, which is located in the Central Administrative District of Moscow. Let's calculate the rate using the formula:

Thus, Principle LLC will pay a quarterly fee amount of 58,200 rubles.

EXAMPLE 2

Let IP Fomin A.V. trades through a non-stationary retail chain facility located in the Novokosino area of the Eastern Administrative District.

He will pay the vehicle on a quarterly basis in the amount of RUB 28,350. (in this case, it is enough to check the table of trading tax rates).

Penalty for late submission of notice

There is no point in avoiding filing a notification. Most retail facilities are already under the control of the tax inspectorate, which is well aware of what activities are carried out on them.

In addition, the Moscow Department of Economic Policy and Development is now also involved in identifying illegal traders, which, if detected, will independently transmit information to the Federal Tax Service.

For late submission of notification and trading without the required certificate, the tax office may issue a fine.

, the amount of which is

10%

of the income received during the period of illegal work, but

not less than 40,000 rubles

.

Also, for failure to submit a notification, an additional fine of 200 rubles

.

Note

: penalties can be imposed only if an on-site inspection has been carried out and a corresponding report has been drawn up regarding the absence of permits.

In addition to fines, there are other sanctions

for work without notifying the Federal Tax Service. For example, those who have not filed a notice are prohibited from reducing the basic tax by the amount of the trade tax paid.

Payment terms and liability for non-payment

Vehicle payers are required to make payments by the 25th of the month following the billing quarter. For example, for the first quarter of 2020, the required amount must be paid no later than April 25, 2020. The funds are transferred to the tax service, and then go to the budget. The tax office closely monitors vehicle payment deadlines. Penalties are provided for refusal to pay and for late payment.

Penalties are applied not only in case of late payment or refusal of payment. If an entrepreneur registers his trading enterprise later than the deadline prescribed by law or does not register with the tax authorities at all, then he also faces a monetary penalty.

Amounts of possible monetary penalties:

- For registering an enterprise after the due date, the fine is 10,000 rubles.

- For refusal to register, the amount is equal to 10% of the total income of the enterprise (during the delay), but not less than 40,000 rubles. Separately, the manager is required to pay a fine of 2000-3000 rubles.

- For failure to notify the tax service about the deregistration of a trade enterprise - 200 rubles for each document that the entrepreneur did not provide.

- In case of non-payment of the vehicle (in whole or in part), penalties are equal to 20% of the amount that had to be paid.

- In case of intentional non-payment of the vehicle, the penalty is equal to 40% of the amount of the unpaid fee.

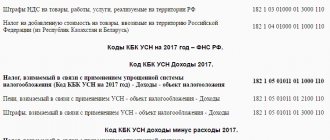

To avoid the accrual of fines, it is necessary to pay for the vehicle on time and ensure that payment documents are filled out correctly. An error in one KBK figure threatens the entrepreneur with the fact that the funds for payment of the fee amount will not reach the addressee, and there will be a delay in payment. This threatens the application of penalties.

Reduction of taxes on trade tax

For the quarter in which the trade tax was paid, the following taxes can be reduced:

- income tax for organizations;

- personal income tax (NDFL) for individual entrepreneurs;

- single tax according to the simplified tax system, if the object of taxation “Income”

.

Note

: tax under the simplified tax system

“Income”

can be reduced only if the tax and trade fee are paid to the same budget. For example, an individual entrepreneur registered in the Moscow region does not have the right to reduce the tax if he conducts trading activities and pays the fee in Moscow.

A direct indication that the tax can be reduced by the amount of the trade fee under the simplified tax system with the object “Income minus expenses”

No. Therefore, until official clarifications appear, the paid trade fee can only be taken into account as expenses incurred.

note

, the tax can be reduced only for the quarter in which the sales tax was transferred. Therefore, if the amount of the trade fee turns out to be more than the calculated tax, then it will not be possible to carry forward the remaining trade fee to reduce the tax in the next quarter.

I trade through the premises I rent. Who pays the sales tax, the tenant or the landlord?

— The one who carries out trading activities pays. If you rent a commercial property, then you are the payer, not the landlord.

How to pay tax if I combine the simplified tax system and a patent?

— Entrepreneurs who combine the simplified tax system and a patent need to understand the scope of the activity within which trade is carried out. Trade tax for individual entrepreneurs on the simplified tax system in Moscow is mandatory. If trade occurs within the framework of patent activity, there is no need to pay tax. If you trade through the same store simultaneously under a patent and the simplified tax system, you must register as a payer of the trade fee and pay only for those square meters that are involved in trading activities under the simplified tax system. If it is physically impossible to divide the area by type of activity, you will have to pay for all square meters of the store.

How to register and deregister

All organizations and individual entrepreneurs carrying out trading activities in Moscow are required to register, even if they fall under the exemption and are exempt from payment. To register, an entrepreneur must submit a notification to the tax office (form TS 1). It states:

- Object of taxation;

- Characteristics of the object (quantity, area);

- Kind of activity;

- Fixed rate per object or rate per 1 square meter;

- Calculated vehicle amount;

- Benefits for paying for vehicles;

- Amount for the quarter

Notification must be submitted no later than 5 days from the date of occurrence of the object.

If any characteristics of the object have changed, the payer is obliged to notify the tax authority of all changes no later than 5 days from the moment they occur. After the tax authority receives a notification from the payer, he is registered within 5 days. After registration, a certificate is issued within 5 days.

The notification is submitted in writing or electronically with an electronic signature. To be deregistered, you must provide a notification (TS form 2) about the end of use of the retail facility. The deadlines for submission are the same as for production.

If an individual entrepreneur has several retail facilities in different regions, then you need to submit a notification to the inspectorate upon the location of any of the facilities; it includes information about all retail facilities. The fee amount is transferred to the inspectorate where the notification was submitted. Fines:

| Type of violation | Fine |

| For late registration | 10,000 rub. |

| Not staged | 10% of quarterly income, but not less than RUB 40,000. |

| Late indication of changes | 200 rub. |

| Late notification | Fine 200 rubles. and an administrative fine from 300 to 500 rubles |

| Unintentionally provided false information | 20% of the collection amount |

| False information was intentionally provided | 40% of the collection amount |