What is the essence of offsets (under contracts for the provision of services and the supply of goods)?

Settlement is an agreement between the parties to civil legal relations on the mutual termination of certain obligations to the established extent.

For example, if the contractor performed work for the customer, while the customer delivered goods to the contractor, then each party can exempt itself from paying for the obligations performed by the other party in exchange for the fact that the other party, in turn, will also not pay for the fulfilled first obligation. Legally, such a condition can be enshrined in an offset agreement for the provision of services (or supply of goods). It is important that (Article 410 of the Civil Code of the Russian Federation):

- the obligations had a sign of homogeneity;

- the deadline for fulfillment of obligations at the time of offset has arrived (exceptions - if it is not specified, is subject to a separate indication, or there are grounds not to comply with this condition by law).

Offsetting cannot be carried out if (Article 411 of the Civil Code of the Russian Federation):

- the obligation of any of the parties is related to compensation for harm to health, lifelong maintenance, payment of alimony;

- the obligation of either party has expired;

- the conclusion of a netting agreement is expressly prohibited by law or agreement.

Settlement can be legally established not only in an agreement, but also unilaterally - through a statement of offset drawn up by any of the parties to the transaction. But in this case, the party drawing up the application must, if necessary, be ready to prove in court that:

- the application was clearly received by the counterparty;

- the counterparty had no objections to the offset.

Drawing up a bilateral agreement on mutual settlement has such disadvantages, and many companies use it.

How to offset mutual claims

Offsets are widespread between business entities. If we consider offsets from a legal point of view, they will represent civil transactions, that is, actions aimed at the emergence, termination or modification of transactions. It follows from this that offset is a transaction that is aimed at terminating civil rights and obligations.

Offsetting is a convenient means of payment, and most importantly, it is economically feasible. You do not have to redirect funds from accounts to accounts, this makes the situation much easier when you do not have funds.

The Civil Code of the Russian Federation does not have a clear concept of mutual offset. But the following articles regulate the procedure for its implementation:

- Art. 410 “Termination of an obligation by offset”;

- Art. 411 “Cases of inadmissibility of offset”;

- Art. 412 “Credit upon assignment of a claim.”

In accordance with the postulates of the above articles, when conducting a mutual offset, it is necessary to comply with important conditions under which its conduct is permissible:

1. The obligations of the parties must be reciprocal, that is, offsets, during which the parties take into account mutual obligations that are not recognized as reciprocal, are not a method of terminating obligations provided for in Art. 410–412 of the Civil Code of the Russian Federation, the parties to the offset must necessarily have debts to each other.

2. Obligations must be homogeneous:

- by subject (for example, money for money, goods for goods);

- on the grounds of occurrence (for example, contractual obligations versus contractual obligations). It is not permissible to offset claims for compensation of losses against claims for loan repayment. In practice, this usually means that each party owes the other money.

Example 1.

The company provided services to the counterparty. In turn, she purchased the goods from him. Essentially, these are two different contracts with the same counterparty, but with different obligations. Both contracts have actually been executed, acts of service provision have been signed without objection, the goods have been transferred according to invoices in full, and accordingly, the parties have obligations that are homogeneous in nature - to pay the amount of money specified in the contracts.

GOOD TO KNOW

If a business entity experiences a shortage of funds, non-monetary forms of settlement between the parties are usually used. In particular, they use such a form of non-monetary settlements as offset of counterclaims.

3. The deadline for fulfilling obligations must have arrived.

Example 2.

The supplier delivered the goods to the buyer on the terms of full payment within three days from the date of delivery. The buyer provides office rental services to the supplier, and payment is made to him once a quarter: within 10 days from the date of signing the act by both parties. If the goods are shipped in the middle of the quarter, which means that the payment deadline for it comes two months before the rent payment deadline, under such conditions the parties will not be able to set off. The party providing the services will need to change the terms of the payment agreement.

There is also one more condition for the offset – the presence of an official written statement from one of the parties. It must be handed to the other party under a personal signature.

The Presidium of the Supreme Arbitration Court of the Russian Federation pays special attention to paragraph 4 of Information Letter No. 65 dated December 29, 2001 “Review of the practice of resolving disputes related to the termination of obligations by offsetting counter-similar claims” (hereinafter referred to as Information Letter No. 65). It describes a situation where a letter was returned to the sender as unclaimed correspondence. In this situation, the court considered that since the party to the transaction did not receive an application for offset, the offset did not take place. We conclude that the application for credit must be submitted in person. If this is not possible, it is necessary to use delivery methods that make it possible to clearly establish the date of receipt of the statement of offset by the second party (letters with acknowledgment of receipt, courier services, e-mail, etc.).

There are cases when offsetting mutual claims is impossible. In accordance with Art. 411 of the Civil Code of the Russian Federation prohibits offset of the following requirements:

1. Transactions for which the statute of limitations has expired. For financial claims, there is a limitation period of 3 years.

2. Obligations for lifelong maintenance of a person.

3. Appointment of alimony as determined by the courts or by mutual agreement secured by a notary.

4. Payments to compensate for damage caused to health.

The list goes on. This can be done by both legislators and the parties themselves within the framework of agreements concluded with each other.

Regarding the conduct of tests in practice, many controversial issues arise, which can be avoided by legally competent documents. It is very important to take into account several practical nuances of this procedure, namely to choose from:

1) classic notification of the fact of offset;

2) a set-off agreement signed by both parties to the obligations.

Notifying the counterparty about the offset is much simpler to complete and takes less time, since it does not require agreement between the parties. However, the agreement will eliminate possible misunderstandings between counterparties and will make it possible to determine in detail the parties’ attitude to the transaction, which will eliminate legal disputes in the future.

Signing a single document removes another risk: such agreements are signed, as a rule, by the top officials of the company, that is, by those who legally represent its interests before counterparties. If a dispute arises, this reduces the likelihood that the counterparty will deny the fact of set-off on the grounds that the notice of set-off was not received or was received or signed by an unauthorized person.

GOOD TO KNOW

Obligations are considered terminated by offset from the moment the deadline for fulfillment of the obligation, the due date of which came later, becomes due. Therefore, an application for offset of a counterclaim of the same kind, received before the deadline for fulfilling the obligation, does not terminate the corresponding obligations upon the onset of the mentioned period.

Example 3.

IP Ivanov must supply electrical equipment to IP Vasilyev. Vasiliev provided Ivanov with a cash loan in accordance with the agreement. The deadline for repayment of funds under the loan agreement is March 31, 2017. The payment deadline for the delivered goods is 03/01/2017. Both parties are late in fulfilling their obligations. Ivanov submits to Vasiliev an application for offset of similar counterclaims on 04/30/2017. In this case, the obligations will be considered terminated on March 31, 2017. In this case, payment under the supply agreement will be considered overdue and Ivanov, in addition to offset, may require Vasiliev to pay a penalty under the supply agreement for the period from March 1 to March 31.

It is important to remember, based on judicial practice, that if the amount of the counterclaim is insufficient to terminate by offset all obligations arising from several contracts, the obligation under the contract, the execution date of which has come earlier, is considered terminated, unless otherwise specified in the statement of offset (clause 19 of the Information letter No. 65).

The opinion of the judges is as follows: civil legislation does not contain rules that regulate cases of insufficiency of the amount of the debtor’s counterclaim to terminate by offset all his obligations under several contracts, by virtue of clause 1 of Art. 6 of the Civil Code of the Russian Federation it is necessary to apply the analogy of the law. Courts must be guided by Art. 522 of the Civil Code of the Russian Federation, from which it follows that in the event of insufficient performance to terminate obligations under all contracts, the obligations under the contract, the performance period of which came earlier, are extinguished. The parties' claims must be confirmed by reconciliation of calculations.

To summarize the above, let's remember the important thing:

Presence of mutual demands

participants must be both creditors and debtors to each other

Unconditionality of requirements

absence of third parties and indisputability of claims

No prohibition on surgery

the agreement should not contain a ban on offsets

Uniformity of requirements

this is a scheme for conducting a transaction, for example, payment in cash

Compliance with test deadlines

according to the agreement, enterprises can make a offset after the maturity date; no offset is made against future deliveries

Documenting

drawing up an act in any form that contains details that allow you to identify the operation

Accounting for the purposes of applying the simplified tax system

Enterprises using the simplified tax system are required to keep accounting of business transactions; they are allowed to use a minimum number of accounts and carry out standard transactions that are provided for by law. The instructions for using the chart of accounts provide for the repayment by offset of debts on the accounts in which these debts are recorded. Main accounts of mutual obligations: 76, 60, 62.

To carry out the offset, the following wiring is used:

Debit 60 (62, 76) Credit 62 (60, 76) – reflects the offset of mutual claims.

Example 4.

The Alpha enterprise maintains accounting using the simplified tax system with the object “income minus expenses”. "Alpha" shipped goods to "Beta" in the amount of 250,500 rubles. In the same month, Beta performed repair work for Alpha in the amount of RUB 41,800. The companies agreed to set off the amount of accounts payable that was the same for both organizations.

The following entries are made in Alpha accounting:

| Debit | Credit | Amount, rub. | |

| Settlement of mutual claims has been made | 60 | 62 | 41 800 |

| Revenue from the sale of goods is reflected | 62 | 90/1 | 41 800 |

| The cost of shipped products is taken into account | 90/2 | 41 | 41 800 |

| Works paid for by the act are taken into account | 20 | 60 | 41 800 |

A feature of mutual offsets is the lack of movement of money through bank accounts.

To identify cases of mutual claims and debts, taxpayers must maintain analytical records of receivables and payables. This must be done for each counterparty. To do this, a reconciliation act for mutual settlements is drawn up and signed by both parties.

After the parties to the agreement have agreed on the amount of debt and signed an agreement on mutual offset, they can begin the procedure of signing the act of offset. The netting act must contain the following mandatory information:

- Details of documents confirming the occurrence of debt.

- The total amount of debt of the counterparties, including VAT.

- The amount of debt that is repaid by offsetting with the allocated VAT.

Further, based on the above documents, accountants can make accounting entries.

Tax accounting for the purposes of applying the simplified tax system

Enterprises using the simplified tax system maintain tax records using a tax register - the Income and Expense Accounting Book. Based on the information entered in this book, the tax base is determined and a single tax is calculated. When registering mutual offset transactions, it is important to observe:

- Condition

for documenting the transaction - moment of revenue determination

- moment of determining expenses

- Description

Based on primary accounting documents, an entry is made in KUDiR

- income arises at the time of drawing up, signing the act or other date specified in the document accompanying the offset

- after shipment and mutual offset, the right to reflect expenses arises

Under the simplified tax system, income is recognized as receipts to the current account or cash desk of the enterprise. This procedure is regulated by paragraphs. 1–2 tbsp. 346.17 Tax Code of the Russian Federation. Carrying out an offset in tax accounting means the simultaneous receipt of payment from the buyer and the repayment of payment arrears to the seller. Therefore, we take into account revenue in tax accounting according to the date of offset in the amount of the offset debt of the counterparty. On the same date, purchased goods, works, services, as well as the amount of “input” VAT on them are also considered paid.

For “simplified people”, whose tax base is defined as “income minus expenses”, offset is an expense in the form of repayment of accounts payable (clause 1 of article 346.16, clauses 1, 2 of article 346.17 of the Tax Code of the Russian Federation). It is important to remember that in cases where mutual claims are partially taken into account, income (expenses) should be recognized:

- on the date of offset (for the amount of debt subject to offset);

- on the date of repayment of the balance of the debt in another way (payment to a current account, to the cash desk, etc.).

Example 5.

The buyer purchased fixed assets from the supplier in the amount of RUB 170,000. in February 2020. The supplier, in turn, provided services to the buyer for the delivery and assembly of equipment in the amount of 20,000 rubles. in March 2020. In April 2020, the parties agreed to offset claims. And the buyer, according to the terms of the agreement, repaid the remaining debt in July 2020 with a payment order in the amount of 150,000 rubles.

Thus, the buyer’s income will be reflected in the Income and Expense Book:

- 20,000 rub. – in April 2020;

- 150,000 rub. – in July 2020.

GOOD TO KNOW

If the organization does not notify the counterparty about the offset with it, the latter may challenge the legality of such an operation in court.

Multilateral offset

Multilateral netting is not regulated by civil law, but there is no direct ban on it. In this case, three parties, closely interconnected, take part in the transaction. At the same time, we remember that the offset is made for the amount of the smaller claim. Offsetting allows you to shorten the chain of passage of money and goods. If more than two parties are involved in the offset of claims (debts), then such a transaction is recognized as a multilateral offset. The legality of multilateral offset is beyond doubt if all conditions are met, as in cases of bilateral offset: the obligations presented for offset must be homogeneous; By the time the offset is carried out, the repayment period of the obligations must have arrived, either the period for such repayment is not determined, or it is determined by the moment of demand.

Carrying out multilateral offsets does not contradict the norms of civil legislation. There are also no problems when determining the date of payment and the moment of determining the tax base. But the tax authorities consider the use of the deduction to be unlawful, since there is no fact of payment directly to the supplier of inventory items. However, debt closure is an agreement that combines the termination of obligations by offset and the transfer of the right of claim to a third party. Both the first and the second on the basis of paragraphs. 2 and 3 paragraphs 2 art. 167 of the Tax Code of the Russian Federation is payment for goods. If a document is drawn up, for example, an agreement between the parties on the repayment of debt, signed by all parties involved in the transaction, then the obligations of the persons are considered fulfilled, and the calculations are considered made. All requirements for the document and the information contained therein specified above must be met. The courts note that the legal structure of multilateral offset consists of mutual repayment of obligations and claims of its participants (Resolution of the Federal Antimonopoly Service of the Ural District dated July 30, 2001 No. F09-1214/2001GK). We draw conclusions and competently draw up acts.

GOOD TO KNOW

In accounting, the netting operation is reflected in the same way for both organizations.

We are drawing up an agreement on mutual offset: what to pay attention to?

When drawing up the agreement in question, the parties need to keep in mind that:

1. The agreement must necessarily reflect the following information:

- on the composition of obligations that are repaid as part of the offset;

- contracts and other documents of title (acts, invoices, invoices) under which obligations arose;

- financial value of the claims.

2. It is advisable to provide motivational formulations justifying its preparation.

For example, indicate that the agreement is drawn up in order to simplify and increase the efficiency of calculations between the parties.

3. In the agreement, it is advisable to indicate that the mutually offset claims are homogeneous, and to provide the main sign of their homogeneity (for example, indicate that financial obligations in rubles, similar goods in pieces, similar services in specific units of volume are offset).

4. It is advisable to reflect in the agreement the balance of debt of either party, since it is likely to arise as a result of mutual offset.

It would be appropriate to indicate in the preamble or other part of the agreement that it is drawn up on the basis of the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

Exceptions

They are defined in Art. 411 Civil Code. The norm specifies circumstances in the presence of which adjustment of the debt in this manner is not permitted. In particular, this applies to obligations:

- for compensation for harm caused to health or life;

- for the payment of alimony;

- about lifelong maintenance;

- to which the statute of limitations applies and has expired.

This list is considered open. The agreement or legislative provisions may provide for other cases in which it is impossible to conclude an agreement on the offset of mutual claims.

How to make offsets under different agreements with one counterparty?

A scenario is possible in which a company’s counterparty has obligations to it (or it to the counterparty) under two different agreements. This is not of fundamental importance from the point of view of the possibility of mutual offset. The main thing is to consistently set out in the agreement the procedure for mutual offset of the parties’ claims with references to different agreements, and to correctly reflect the financial component.

How to make offsets between contracts of one counterparty comply with legal requirements? The main thing here is to make sure that the content of the legal relationship does not imply any obstacles to the offset of claims from the point of view of the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

Thus, an obstacle to the offset of claims under several contracts with a counterparty may be the heterogeneity of obligations reflected in different contracts. For example, if one agreement is drawn up in rubles, and the other in foreign currency. In this case, netting between contracts of one counterparty will not be possible. To offset claims under each contract, the company needs to draw up a separate agreement with the counterparty (provided, of course, that he has claims against it in a similar currency).

Specifics

According to Art. 410 of the Civil Code, complete or partial termination of obligations, the period of which has not yet arrived, is not specified or is determined by the moment of the demand, is allowed by offset. To do this, a statement from one of the participants in the relationship is sufficient. The same business entities, as a rule, act as parties to two or more obligations, in accordance with which homogeneous counterclaims arise.

The method under consideration is used mainly in the presence of various contracts concluded by these persons. However, in practice, netting between organizations is also possible in the case when enterprises act as participants in one obligation. For example, if the terms of the contract are not properly fulfilled by the commission agent, the principal may file a claim against him. He has the right to demand payment of a fine and compensation for damages. These requirements may be presented against counterclaims relating to the payment of commissions.

Offsetting and tax accounting: nuances

Tax accounting of legal relations for the offset of obligations is characterized by the fact that:

1. The fact of signing a netting agreement between organizations does not change the composition of the VAT tax base. It does not matter if, for example, the company received an advance from the counterparty on account of future deliveries, and it was set off under an agreement to offset obligations, while goods or services were not delivered to the counterparty.

2. Carrying out offset does not change the composition of the tax base for income tax, since under the accrual method, income and expenses under the agreement with the counterparty will be recognized before offset. Under the cash method, income and expenses will be determined based on the fact of offset.

3. With the simplification, the situation is similar to that observed with the cash method of accounting for income and expenses by the payer on the OSN. Income and expenses are recognized by the company using the simplified tax system only upon the fact of offsetting obligations with the counterparty.

Recommendations from ConsultantPlus experts will help you avoid mistakes when reflecting offsets in accounting:

If you do not already have access to this legal system, a full access trial is available for free.

You can download a sample netting agreement between legal entities on our website using the link below.

For a sample netting agreement between three organizations, see here.

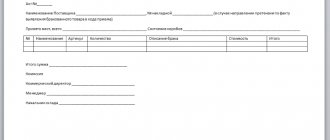

How to draw up an Act of Settlement?

The legislation does not define a strict form; it is drawn up in free form, taking into account certain requirements, in two copies for each of the parties involved. If more than two parties are involved in mutual settlements, then the number of copies must be equal to the number of participants in the act. Each copy must contain the signatures of the managers or their substitutes of all parties involved.

If desired, managers can affix a seal (from 2020, all legal entities are exempt from the obligation to have a seal in their organization). But you need to know that many government organizations, including the Tax Service, still require certification of all documents.

In addition, the legislation establishes the presence of the following mandatory details:

- the reason for the occurrence of obligations (it is enough to indicate the details of the relevant documents);

- details of organizations that participate in the mutual settlement agreement;

- the amount of debt in digital and written terms;

- list of credit obligations that have arisen.

Copies of documents that indicate the debt has arisen must be attached to the act.

Results

If two business entities have mutual homogeneous obligations (for example, to pay for goods or services supplied in the same currency), then such obligations can be canceled by drawing up a netting agreement. Such a document must comply with the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

You can learn more about the procedure for netting commercial obligations in the following articles:

- “The procedure for netting under the simplified tax system “income””;

- “How to deduct VAT during netting (nuances).”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Instructions for filling out the Settlement Certificate 2020

In order to correctly draw up an act of mutual settlements, you need to follow a certain procedure. The main requirement when drawing up this document is the absence of spelling errors and corrections, if the act is filled out by hand. You must also fill out everything in clear and legible handwriting.

- Filling out the act must begin with the “head” of the document. Here its name is indicated with a small indication of further content. The next line indicates the name of the locality in which the act was drawn up, as well as the date of drawing up.

- Next, fill in information about the first party, its organizational and legal form (IP, LLC, OJSC, CJSC), the name of the position of the responsible person, as well as last name, first name, patronymic.

- After which it is indicated on the basis of which document he represents the interests of the organization. The same information is filled in about the other party.

- Next are the documents that show the fact that obligations have arisen on both sides. Here it is indicated:

- Title of the document;

- number and date (if available);

- the amount of debt one party owes to the other and vice versa.

All mandatory details can also be found in Article 9402 of the Federal Law “On Accounting”.

If there is an outstanding amount, then the period for its repayment is stipulated from the moment of signing this act. Its size is also indicated. At the end, the names of organizations, officials, the names of their positions, as well as their signatures are indicated. If desired, a stamp can be placed.

Act of offset of mutual claims : download form and sample

Decor

According to the provisions of the law, an application from one of the parties to the relationship is sufficient to carry out the operation. However, it must be documented. For this purpose, a two- or three-party act can be drawn up. The law also allows for the execution of a protocol on repayment of obligations. Also, the parties to the relationship can enter into an agreement to offset mutual claims.

Any of these documents will act as a legal basis for recording the transaction in the accounting of enterprises. In addition, if they are available, there will be no disputes with the tax service. It should also be said that a netting agreement or other document documenting the transaction is necessary for the company’s legal department. The law does not allow its implementation without the consent of the counterparty. Otherwise, the second party to the relationship has the right to sue and collect the debt.

Additionally

In accordance with clause 3.12 of GOST, the registration number present on the document consists of a serial number, which can be supplemented at the discretion of the catering or trade enterprise with a business index, according to the nomenclature, information about the performers, correspondent, etc. When carrying out offsets, a reconciliation report is drawn up. It is formalized by all participants in the operation. The registration number of this document includes the document numbers from each party. They are placed through an oblique line in the order in which the participants indicate. An integral element of the required details is the signature. It includes the name of the position, the autograph itself and its transcript. The act of offset must contain information about all its parties. Accordingly, the document must contain the signatures of these participants. A similar rule applies when drawing up an agreement or protocol on mutual settlement between enterprises. After signing the documents, information about the completed transaction must be reflected in the accounting records.