This article will focus mainly on conducting an assignment agreement in the 1C 8.3 configuration: “Enterprise Accounting 3.0”. This is due to the fact that in other configurations, in addition to accounting ledgers (entries that can be entered manually), there are management ledgers. These registers are formed by documents that do not exist in a standard form for carrying out operations under an assignment agreement.

Basic concepts and participants in the assignment agreement:

- Assignment agreement – assignment of the debtor’s claims (receivables);

- The assignor is the primary creditor;

- The assignee is the new creditor.

Let's look at the entries that an accountant must generate to reflect the transaction.

Manual reflection of transactions for registration of an assignment agreement in 1C 8.3 Accounting

Manual entries in this configuration are entered using the “Operations entered manually” documents, which are located in the “Operations” menu:

Get 267 video lessons on 1C for free:

The assignment of the debtor's claims in 1C is reflected by the following entries:

- First posting:

- Dt: 76.09 “Settlements with debtors - creditors.” Analytics is carried out for the counterparty, or more precisely for the “Assignee”.

- Kt: Credit 91.01 “Other income”.

- The transaction amount is the debt of the new creditor (assignee) under the assignment agreement.

- Second wiring:

- Dt: 91.02 “Other expenses”.

- Kt: 62.01 “Settlements with customers.”

- The amount of receivables as they are held by the assignor.

What entries need to be made under the assignment agreement with the assignee?:

- First posting:

- Dt: 58.05 “Providing financial investments.”

- Kt: 76.09 “Settlements with debtors - creditors”, analytics also for the counterparty.

- The transaction amount is the costs actually allocated to the acquisition of remote control.

In the accounting of the assignee, repayment of debt by the debtor occurs as follows:

- Dt: 76 “Settlements with debtors - creditors”, subaccount - “Settlements with the debtor”.

- Kt: 91.01 “Other income”.

- The amount of debt to be collected from the debtor;

- Dt: 91.02 “Other expenses”

- Loan 58.05 “Providing financial investments.”

- The amount is the actual costs received.

- Debit 51 “Current account”.

- Loan 76.09 “Settlements with debtors - creditors”, subaccount - counterparty.

- Amount – actual funds received.

Judicial practice on invalidation of assignment

The Civil Code of the Russian Federation recognizes two options when the debtor is able to challenge the assignment agreement and declare its invalidity.

The main option implies recognition of the insignificance of the contract signed by the parties only in the case where there is recognition of the assignment of rights of claim by the contract. The additional one is based on the discovery of non-fulfillment of the terms of the transaction by the assignee.

Study other reasons that the court may pay attention to when considering a case to invalidate a transaction:

- lack of documentation giving the right to transfer promissory notes;

- formation of a block of data and documents that does not meet the requirements of the law;

- payments specified in the contract were never received or were received but after the established deadlines had passed;

- the assignment was granted to third parties without presenting an appropriate license to carry out financial transactions in the bank;

- there is no assignment agreement itself.

It is possible to begin legal proceedings to invalidate the assignment agreement precisely when these reasons are discovered. Please note that judicial practice indicates that the judge, when considering such cases, rarely takes the side of the debtor, but if one of the above reasons is discovered, the contract is almost always declared invalid.

Accounting for an assignment agreement using a debt adjustment

As I already said, by entering only transactions manually, in most other configurations it is impossible to fully reflect the assignment agreement.

This is interesting: Final balance sheet during reorganization in the form of merger 2020

Most often, accountants use the “Debt Adjustment” document. It allows you to generate the necessary transactions and at the same time correctly reflect the amounts in the reporting, for example, in the profit declaration.

Here is an example of such an operation:

- Buying debt. Executed by the document “Dog Adjustment” - operation: carrying out mutual settlements:

- Dt: 58.05 - Debtor.

- K: 91.01.

- Amount: 16,000 rub.

- Selling debt. Document “Sales of services”:

- Dt: 79.09 - Creditor Kt. 91.01 = 22,000 rub.

- Dt: 91.02, Kt. = ((22,000-16,000)/118*18 rub.

- The next transaction is for 16,000 rubles. It can also be done through an “adjustment” (operation – debt write-off):

- Dt. 91.02

- Kt. 58.05 - Debtor

- Amount: 16,000 rub.

Sample contract for the assignment of the right to claim a debt

| Moscow | January 21, 2020 |

Limited Liability Company Private Security Organization "Alpha" (LLC Private Security Organization "Alpha"), hereinafter referred to as "Assignor", represented by General Director Ivanov Vyacheslav Nikolaevich, acting on the basis of the Charter, and

Joint Stock Company "Omega", hereinafter referred to as the "Assignee", represented by Denis Anatolyevich Golovanko, acting on the basis of the Charter, together referred to as the "Parties", have entered into this agreement (hereinafter referred to as the Agreement) as follows:

Postings under the assignment agreement in 1C 8.3

We propose to analyze in detail how, based on the 1C 8.3 Enterprise Accounting 3.0 program, the assignment agreement is reflected. This is determined by the fact that other configurations have, in addition to accounting registers (entries generated manually), also management registers. The creation of register data occurs using documents that are not available in a standard form for registering transactions under an assignment agreement. Let's define the concepts:

An assignment agreement is an agreement for the assignment of rights of claim of the debtor (receivables) to a third party (individual or legal) without the consent of the debtor.

The assignor is the creditor who transfers the rights.

Assignee is a creditor who accepts rights based on an agreement.

Reflection of transactions in the 1C 8.3 Accounting program is completed manually using the document “Operations entered manually.” Located on the Operations menu tab.

Upon assignment of debt in the 1C program, accounting entries must be generated:

Dt 76.09 (Settlements with debtors/creditors) – Kt 91.01 (Other income). In this case, accounting will be kept for the assignee, and the reflected transaction amount will determine the debt of the assignee, the creditor who accepted the rights of assignment on the basis of the assignment agreement.

Dt 91.02 (Other expenses) – Kt 62.01 (Settlements with the buyer). Here the transaction amount will reflect the value recorded by the assignor.

In turn, the assignee under the assignment agreement registers transactions Dt 58.05 (Provision of financial investments) – Kt 76.09 (Settlements with debtors/creditors). The transaction amount will reflect the actual costs of acquiring the receivables.

The repayment of debt by the debtor according to the accounting records of the assignee is recorded by the following entries:

Dt 76 (Settlements with debtors/creditors) – Kt 91.01 (Other income). For debit, you must indicate the subaccount “Settlements with the debtor”. The transaction amount will reflect the value that must be collected from the debtor.

Dt 91.02 (Other expenses) – Kt 58.05 (Provision of financial investments). The amount in this case will reflect the actual value of the funds received.

This is interesting: Request the LLC charter for the tax year 2020

As mentioned above, in some 1C programs with a different configuration it is impossible to fully reflect the assignment agreement using manually entered transactions. On the basis of which accountants use the “Debt Adjustment” document. This document makes it possible to generate the necessary entries and correctly reflect the amounts in the accounting reports (for example, a profit declaration). Below is an example of registering this operation:

Dt 58.05 – Kt 91.01. The debit account must go through the debtor. Reflection of the purchase of debt under the document “Adjustment of debt” indicating the type of operation “Carrying out mutual settlements”.

Dt 91.02 – Kt 58.05. The debtor must be indicated on the credit account. The posting is generated based on the “Debt Adjustment” document with the selected type of operation “Debt Write-off”. The amount reflects the balance of the debt.

Assignment of debt between legal entities and tax consequences

If the agreement for the transfer of rights to claim obligations is concluded on a reimbursable basis, the calculation of VAT and income tax is necessary. All this data must be reflected in accounting and tax reporting. The VAT base in this case is the difference between the original amount of obligations and the cost of sales. However, this is true for a loan agreement. The picture is different regarding the supply of goods or services. The complexity of calculating the tax base is determined by the conflict of rules. On the one hand, we are dealing with the transfer of property rights, which means we will have to pay VAT. On the other hand, it is not clear how to determine the tax base in this case - there is no corresponding norm that provides clear explanations. In accordance with practice, it depends on the fact of transfer of rights: it must be calculated on the date of conclusion of the contract.

Transactions with his obligations do not affect the debtor - the amounts remain unchanged, and claims can change only with the consent of the debtor.

The buyer of the debt pays VAT as part of the purchase price, the amount is taken as a deduction. To do this, you need to record the purchase and obtain an invoice from the seller. In the future, the secondary creditor will charge VAT on the amount of the debtor’s tranches or in the case of repeated resale of obligations.

Adjusting debt in 1C 8.3 - step-by-step instructions

Very often, accountants in their work are faced with accounts payable and receivable. They can be both from the organization and from the counterparty. There can be many reasons for their occurrence. This includes incorrect data entry into the program, repayment of debt with another equivalent, etc. Debt, as a rule, is revealed in reconciliation reports.

There are two ways to make mutual settlements and adjustments to debt in 1C 8.3: partial repayment of the debt and full repayment (the debt will be fully repaid). Let's look at the step-by-step instructions.

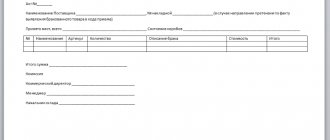

acceptance and transmission of documents

| G. _______________ | "__" ____________ 20___ |

________________________________, hereinafter referred to as the “Assignor”, represented by ________________, acting on the basis of ________, and __________________, hereinafter referred to as the “Assignee”, represented by_____________________, acting on the basis of _________________, together referred to as the “Parties”, have signed this act as follows:

1. According to the Agreement on Assignment of the Right of Claim (Assignment) No. ___ dated “__” _________ 20__, the Assignor transfers and the Assignee accepts the following documents:

- a notarized or duly certified copy of the Assignor Agreement __________________ No. _____ dated “____” ____________ 20___;

- notarized copies or originals of acceptance certificates for services provided, provided for in paragraph ____ of Agreement No. ____________ dated ____________;

- original act of reconciliation of mutual settlements dated “___”________ ____ between ____________ (debtor) and _____________________ (assignor);

- __________________________

- __________________________

2. The above documents were transferred by the Assignor and received by the Assignee in full.

The lender has the opportunity to transfer the right to repay the debt to another person, which allows him to quickly receive the amount loaned. A similar procedure may be necessary in cases of urgent need for funds or for other reasons.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

To avoid problems after drawing up the contract, the parties must draw up an agreement according to all the rules.

Debt adjustment

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

Conditions and application of the contract for the assignment of debt rights

- If the original agreement was created in simple or notarial form, then the assignment must be drawn up in the same form.

- If the agreement has been registered, then the assignment must also be registered.

- The defaulter will not be able to challenge the transaction if it is formalized within the framework of the law.

Cases when it is prohibited to transfer the right of claim:

- It is impossible to assign a debt without notifying the debtor, if the result of the fulfillment of obligations depends on it.

- If the agreement specifies two or more creditors, then one of them may assign the debt, but subject to obtaining consent from the remaining creditors.

- A debt obligation can be transferred to third parties, provided that it is precisely specified in the contract or other related documents.

An example of writing off accounts payable in 1C 8.3

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

This is interesting: Act on the audit of budget reporting in a government institution in 2020

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

What form does the contract take?

In order for a transaction to be considered legal, the agreement must be concluded in the same form in which the original transaction was concluded between the Creditor and the Debtor. The agreement can be drawn up in the following form:

An important nuance: if the original agreement was subject to mandatory state registration, this procedure must be repeated when transferring debt obligations. When drawing up a contract, you should be guided by the provisions of Art. 389 of the Civil Code of the Russian Federation.

This agreement must be paid, i.e. The new debtor must receive a certain amount of compensation. The parties must agree in the contract on the amount of payment and the period for receiving it. It should be taken into account that courts often recognize contracts of this type as invalid due to gratuitousness.

Manual reflection of transactions for registration of an assignment agreement in 1C

To perform manual entries, you must use the “Operations” menu - the “Operations entered manually” subsection.

To carry out the assignment, you need to generate a couple of transactions:

Debit 76.09 “Settlements with debtors - creditors” - Credit 91.01 “Other income”. The amount reflected in the posting corresponds to the amount of debt of the new creditor.

Debit 91.01. “Other income” - Loan 62.01 “Settlements with customers.” The amount indicated is equal to the value of the assignor.

Postings to be completed under the assignment agreement with the assignee

Debit 58.05 “Providing financial payments” Credit 76.09 “Settlements with debtors - creditors”. The amount of funds is equal to the amount of costs incurred in the process of acquiring receivables.

According to the assignee's accounting, a posting is made Debit 76 Credit 91.01 “Other income”. The indicated amount is equal to the amount of the debt being collected.

Debit 91.02 Credit 58.05 “Provision of financial investments” for the amount of costs received.

Debit 51 Credit 76.09 for the amount of funds actually received.

DUTIES OF THE PARTIES

2.1. The Assignor, within 3 (three) working days from the date of signing the Agreement by both Parties, transfers to the Assignee:

- a copy of Agreement No. 01/03/2016 dated 03/09/2016 duly certified by the Assignor;

- notarized copies or originals of acceptance certificates for services provided, provided for in clause 4.4 of Agreement No. 01/03/2016 dated 03/09/2016;

- other documents: invoices for payment, copies of appendices duly certified by the Assignor, additional agreements to the agreement that are an integral part of it (if any), copies of accounting documents certified by the Assignor’s seal, a reconciliation act for mutual settlements, in accordance with clause 1.3 of this Agreement, as well as other available documents related to the execution of Agreement No. 01/03/2016 dated 03/09/2016.

Documents are transferred according to an act of acceptance and transfer of documents, drawn up in the form set out in Appendix No. 1 to this Agreement.

2.1.1. The document acceptance and transfer certificate is drawn up and signed by authorized representatives of the Assignor and Assignee and is an integral part of this Agreement.

2.2. The Assignor, within 5 (five) working days from the date of signing of this Agreement by both Parties, is obliged to notify the Debtor in writing about the assignment of the right of claim under Agreement No. 01/03/2016 dated 03/09/2016 and immediately notify the Assignee about this (with a copy of the notification to the Debtor, documents , confirming receipt of the notification by the Debtor) by registered mail with notification.

2.3. The amount of funds specified in clause 1.2 of the Agreement is paid by the Assignee by bank transfer within 10 (ten) working days from the date of signing by both Parties of this Agreement and the acceptance certificate of documents, while the start date of the specified period is the last day of fulfillment of the last of the listed conditions.

2.4. The Assignor is obliged to inform the Assignee of all other information relevant for the Assignee to exercise its rights under Agreement No. 01/03/2016 dated 03/09/2016.

The Assignor is obliged to transfer to the Assignee everything received from the Debtor on account of the assigned claim.

2.5. From the date of signing by the Parties of the acceptance and transfer certificate of the documents specified in clause 2.1 of the Agreement, the Assignor is considered to have fulfilled the obligation to transfer the rights of claim specified in clause 1.1 of the Agreement, and the Assignee becomes a new creditor under Agreement No. 01/03/2016 dated 03/09/2016 in the amount described in clause 1.1 of this Agreement.

Tripartite assignment agreement

As a rule, two parties are involved in such a transaction: the creditor and the party accepting the debt. But sometimes it is allowed to include a third party in the contract. This may happen in the following cases:

- If such a requirement is specified in the main contract.

- If such a desire is expressed by the creditor and the assignee, and the defaulter himself will act as a party to the transaction.

- If you plan to change the terms of debt payment, shift the repayment period, etc.

This is important to know: Certificate of family composition: where to get it, validity period, required documents

To facilitate the approval procedure, we advise you to adhere to the following rules:

- The creditor and the person accepting the debt enter into a customary agreement and give notice to the debtor.

- After the assignment has occurred, a bilateral agreement can be drawn up to change the terms of the debt obligation.

- The first creditor will no longer be able to take part in transactions, and this will facilitate the approval procedure.

Other ways to implement the procedure

In practice, quite often, a tripartite agreement is concluded between the parties, in which the old debtor, the new one and the creditor immediately participate. Registration of relations in this way will eliminate the need to conclude two separate contracts, which seems more convenient.

The text of the trilateral agreement states:

- details of the creditor, old and new debtor. In relation to organizations, you should indicate their legal addresses, details of representatives, TIN and OGRN, as well as bank details;

- subject of the contract. The fact of assignment of debt from one person to another and the consent of the creditor to this is indicated. Without expressing consent, a transaction is impossible, since any assignment of rights is carried out only if this requirement is met;

- rights and obligations of the parties;

- amount of debt. It is indicated whether the debt is transferred in full or in some part;

- liability of the parties for failure to fulfill obligations;

- signatures of representatives and date of agreement.

Download the tripartite assignment agreement (sample)

Legal assistance in preparing a contract >>

Copies of the initial agreements and other papers may be attached to the agreement if necessary for the transaction.

Notice of debt transfer

Notice of debt transfer is a document sent to the old debtor, as well as to the new one, with all the payment rules and grounds for this action. Must be accompanied by:

- Details of the parties.

- Seal of the organization.

- Signed by the parties.

- Payment schedule.

- Grounds for debt transfer.

- Obligations of the parties.

- Rights of the parties.

Issued personally to each party. It has legal force, which makes it possible to go to court if one of the parties fails to properly fulfill the obligations.

A sample notification of log translation can be downloaded here.

Correct formatting of a debt assignment letter

The document must be of a compensatory nature, otherwise tax inspectors may come and force you to pay the tax. The correct execution of payment obligations depends on the initial debt. If the transfer is only based on written contractual relations, then the transfer of debt is carried out in the same way.

When registering an agreement with the state, the agreement to transfer the debt is made in the same way. In addition to Article 391 of the Civil Code, it is also worth following Article 389. If the code does not contain specific information on a particular case, then it is worth looking at judicial practices.

Each party should familiarize itself with the legal aspects of this action in advance. Before concluding an agreement on the transfer of debt, you need to study several facts of the transaction, including where the obligations arose and documents confirming the fulfillment by the creditor of the obligations specified in the agreement.

More information about the transfer of debt and notification of this can be seen in this video:

Cases from practice

As a rule, transactions are concluded in two forms:

- Classic, that is, with the execution of an agreement.

- Modern, that is, transactions at electronic auctions.

This is important to know: Alimony from vacation pay: transfer deadline

The second option is very common in business. There are special online platforms where you can buy or sell any debts.

The first option is used mainly for one-time transactions. Lenders work in this format, often selling debts and having their own connections for this.

Before concluding a contract, a new lender must check:

- Does debt really exist?

- Can the first creditor claim debts and sell them.

- Is there another contract for the same obligation?

- Will the debtor be able to challenge the transaction?

- There are no reasons to invalidate the agreement.

Legal regulation

It should be clearly stated that an agreement on the assignment of debt between two legal entities can be concluded if one legal entity wishes to transfer its rights of claim regarding the repayment of debt voluntarily.

The most common example of such a relationship is the transfer of debtors who do not return money to the bank for a long time to collectors. The exception to such transactions is personal obligations. That is, it is impossible to transfer the debtor who owes the amount for moral or material damage, as well as alimony.

When referring purely to legislative acts in this matter, the following should be kept in mind:

| If the parties reach an agreement | Legal grounds for transferring debts | |

| What legal norms govern | Civil Code of the Russian Federation Articles 389 and 391 | Civil Code of the Russian Federation Article 59, 129 and 132 |

| Expression of free will | Agreement of all parties | The decision does not depend on the opinion of the first creditor |

| What documents are drawn up | Debt assignment agreement, written consent of the first creditor | Separation balance and transfer act |

Features of assignment between legal entities

Unlike individuals, assignments between organizations are quite common. For example, the creditor considers the return of the borrowed amount impossible and is looking for ways to return the borrowed funds, at least partially.

In addition to banks and other financial organizations, other legal entities can transfer debts to a third party. This provision of the law appeared at the end of 2020 and allowed enterprises faced with debt to get rid of non-recoverable (in the opinion of the legal entity) debt by selling it for the full amount of the outstanding balance, or at a reduced cost.

When a company goes through a reorganization stage, the name of the debtor changes, while in fact the organization remains the same. This happens when, at the time of organization, the balance (remainder) remains not zeroed. According to the concluded agreement and the signed reconciliation report on mutual settlements, the counterparty is changed in the accounting program.

A feature of an assignment agreement between legal entities is the permissibility of a transaction between affiliated parties.

An important requirement when signing an agreement between enterprises is to reflect the change of parties in the accounting entries. In addition, the issue of taxation in relation to the transaction is resolved, taking into account tax obligations for VAT. If it is established that a transaction has been deliberately undervalued, representatives of the Federal Tax Service are authorized to carry out additional tax assessments.