About legal regulation

One party to the agreement must return the borrowed assets to the other in compliance with all clauses of the agreement (loan repayment period, transactions, return procedure, etc.)

In addition to money and things, foreign currency, securities, and jewelry can be transferred.

The full validity of the agreement begins with the transfer of all, without exception, valuables to the borrower.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

Attention! The signing of the agreement can be challenged if the borrower has not received the loan in full. In this case, the testimony of witnesses, without other evidence of a failed transaction, will not be enough.

What does a standard (written) contract form for 2016 include?

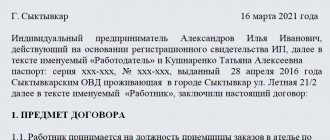

- place and date of registration;

- names of the parties;

- type of loan;

- terms for issuing and returning valuables;

- specified type of loan repayment;

- an indication of the parties' responsibilities in the event of termination of the contract or force majeure;

- details and signatures.

If there is no document drawn up on the basis of a loan agreement, you can use other types of written agreements (receipt, promissory note).

According to one agreement, the transfer of cash should not exceed 100 thousand rubles. In case of violation of the law, a fine is provided (up to 50 thousand rubles) in accordance with the Code of Administrative Offenses of the Russian Federation 15.1.

Most often, the transfer of funds is non-cash. It is possible to transfer a loan through the cash desk only if all legal norms are observed, with the initial provision of accounting entries.

What must be done when concluding a contract:

- check that all factual information is correct;

- reflect in the agreement the fact of transfer of values;

- transfer the loan in the presence of a notary and witnesses.

How are funds transferred?

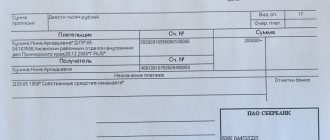

Funds under a loan agreement between legal entities in most cases are transferred from the lender's current account to the borrower's current account using the specified details, and then when the borrower repays the debt, the money is transferred in full or in equal shares, as well as interest from the borrower's current account to the lender's account.

If a loan is issued between legal entities in cash, then legal entities must comply with a number of mandatory rules and conditions in force in the territory of the Russian Federation.

According to the Directive of the Central Bank of Russia dated 07.10. 2013 No. 3073 - in 2020 there is also a limit for cash payments between legal entities.

It amounts to one hundred thousand rubles under one agreement or an amount in foreign currency equivalent to 100 thousand rubles at the official exchange rate of the Bank of Russia on the date of cash payments. A legal entity cannot issue more than this amount in cash.

If a legal entity exceeds the amount of one hundred thousand rubles under one agreement, then this will be a violation of the procedure for working with cash.

According to Article 15.1 of the Code of the Russian Federation on Administrative Offenses, if the limit on cash payments is not observed, a fine of 40 to 50 thousand rubles is imposed on a legal entity.

The official will pay 4,000 - 5,000 rubles. But it is possible to bring an organization to justice only within two months from the date of violation (Part 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

About the loan repayment procedure

If there is a possibility that the borrower will not be able to repay the borrowed money, some guarantees can be provided (collateral, guarantors, etc.). This will avoid possible litigation.

At the end of the agreement, the debtor must repay the funds he borrowed. When returning, it is better to make the necessary receipt and destroy the contract form so that both parties do not have any questions for each other.

Attention! If the debtor is late in repaying the loan, the lender can sue him.

The lender may receive interest on the loan provided. To do this, the agreement must indicate the procedure for their accrual; if this is not the case, then accruals are made based on the calculation of the refinancing rate at the borrower’s place of registration.

The subject of the loan may not be money, but, for example, raw materials or goods. The contract must specify the terms of repayment in the interest form, since the lender may lose benefits if the debt is repaid early. The interest-free type of transaction involves the return of money ahead of schedule without restrictions.

The loan can be extended an unlimited number of times, but in any case, it all depends on the lender.

Interest-bearing loan agreement between legal entities

Art. 808 of the Civil Code of the Russian Federation obliges the transaction to be formalized in writing if at least one of the parties is a legal entity. An essential condition of the loan agreement, which must be agreed upon in the document, is the subject of the transaction. If the subject is not agreed upon, the transaction is considered not concluded (clause 1 of Article 432 of the Civil Code of the Russian Federation).

The subject of a loan transaction, both with and without remuneration in the form of interest on the loan, is the transfer of funds in Russian currency (except for cases provided for by the Law “On Currency Regulation and Currency Control” dated December 10, 2003 No. 173-FZ) or other things determined by generic characteristics.

The percentage clause of the loan agreement is assumed unless otherwise expressly stated in the legislation or the contractual document (Clause 1 of Article 809 of the Civil Code of the Russian Federation). In this case, the amount and procedure for paying interest must be specified in the terms of the agreement. However, if the contract document does not contain agreement on these conditions, then:

- The amount of interest paid must correspond to the refinancing rate (bank interest rate) in force at the location of the lending organization on the day the debt is repaid or part of it is paid.

- Interest is paid every month until the debt is repaid.

When concluding a loan agreement between legal entities, it is necessary to take into account that the constituent documents of organizations may establish a ban on loan transactions. In this case, concluding a transaction is impossible. In addition, when concluding a transaction, the sole executive body (director, president, general director), if the relevant provisions are provided for by the organization’s charter, must agree with the founders on the possibility of concluding a loan agreement with another legal entity.

Interest loan

The agreement is concluded in writing (possibly without a notary). It is recommended to draw up a receipt that certifies the transfer of valuables.

An interest agreement is an agreement that does not stipulate that it is free of charge. If the type of contract is not defined, then it is considered interest rate by default.

A loan agreement between legal entities is an agreed transfer of valuables and the procedure for their return. If there is no evidence of the consistency of the transfer, but the transfer was carried out, then the receipt of valuables is considered unfounded (Civil Code of the Russian Federation, Art. 395).

Commodity loan between legal entities

A commodity loan agreement between legal entities is concluded in writing (Clause 1, Article 808 of the Civil Code of the Russian Federation). Moreover, you can choose how to conclude it:

- as a separate document with signatures of participants;

- through the exchange of letters, emails, telegrams.

Items received from the lender must be described in as much detail as possible (indicating their name, qualities, completeness, packaging, etc., as well as their quantity). If the quantity is not determined, then in order to recognize the conclusion of the transaction, it is necessary to prove the actual transfer of the borrowed property in this quantity (by the borrower’s receipt or other document). It is also necessary to specify the procedure for returning things to the lender. This is how things that are characterized as goods and subject to turnover are transferred.

Commodity loan agreements are available to any entity. Exceptions are possible when the subject of the agreement is things whose circulation is limited, since their transfer requires special powers. The rules of paragraph 3 of Art. apply to commodity loan agreements. 807 of the Civil Code of the Russian Federation.

The term is usually not an essential term of loan agreements. When there is no provision about it in the text of the agreements or when determining the period by the moment of demand, the borrower will have 30 days from the moment the lender submits a demand for repayment of the loan to satisfy it.

If the text indicates the consideration of the transaction, in addition to the type (money or in kind) plus the amount of interest, the payment mode should also be agreed upon. Otherwise, the situation will be resolved through Art. 809 of the Civil Code of the Russian Federation.

About tax consequences

With an interest-bearing loan, tax is paid depending on the amount of interest (recognized as expenses). When the loan is gratuitous (interest-free) or the interest is below the norm, then you need to show tax officials the benefits of the transaction.

Questions from tax organizations arise due to the possible benefit of one of the parties in the form of interest savings. Article 251 of the Tax Code does not accept the inclusion of such loans in the tax base, so the borrower may not pay all types of taxes.

An interest-free loan agreement (FLO) is a document indicating an agreement between the lender and the borrower, the purpose of which is the transfer of money or other assets for temporary free use by the borrower.

DBZ is drawn up with the participation of two parties: the lender and the borrower. Most often, such agreements are used by individuals who have family or friendly ties.

Tax consequences for a legal entity borrower

If the borrower is on the general taxation system, then the funds received into the organization’s account are not recognized as income, which is regulated by paragraphs. 10 p. 1 art. 251 of the Tax Code of the Russian Federation, as well as when repaying borrowed funds, will not be included in expenses, which is also regulated by clause 12 of Art. 270 Tax Code of the Russian Federation.

If the borrower is on a simplified taxation system, then the funds received will not be considered income on the basis of paragraphs. 1 clause 1.1 art. 346.15 of the Tax Code of the Russian Federation, and the return of these funds will not be included in expenses.

Taxpayers very often have a question about whether, with an interest-free loan, there will be material benefits from saving on interest. The answer to this question is that when saving on interest when using an interest-free loan, a tax base is not formed, and such savings are not subject to taxation, this is stated in the letter of the Ministry of Finance dated 02/09/2015 No. 03-03-06/1/5149

Form of interest-free loan agreement

The DBZ form must be drawn up in writing (Part 1 of Article 1047 of the Civil Code) subject to:

- If the transaction amount exceeds 10 times the minimum wage established by law.

- Regardless of the amount, if the lender is a legal entity. face.

However, despite the possibility of drawing up the DBZ orally, it is recommended that such agreements be drawn up only in writing.

Confirmation of the conclusion of the DBZ can be the provision (Part 2 of Article 1047 of the Civil Code):

- Receipts by the borrower.

- Drawing up another document confirming the transfer to the borrower of a sum of money or a certain asset.

At the same time, the absence of a written DBZ is quite possible (ruling of the Supreme Special Court in case No. 522/3694/16-ts* dated 11/09/2017). For example, if legal entities are involved in a transaction, then confirmation of the transfer of money instead of a receipt may be:

- Cash order.

- Payment order, with a note from the bank about the transfer of funds based on the DBZ.

- Statement from the bank.

- Acceptance certificate, etc.

How much can you lend?

The Civil Code of the Russian Federation does not provide for restrictions on the size of the BZ. Therefore, DBZ can be issued for any amount. However, there are 2 exceptions to consider:

- The second exception relates to the financial solvency of the lender. If a dispute arises, the lender has the right to claim the return of the issued loan if he can prove the actual availability of financial capabilities at the time of the loan.

For how long can a loan be issued?

When compiling the DBZ, it is recommended to record the period for which the loan is allocated. This period can be any, even more than 10 years. In this version, the rule of paragraph 2 of Art. 200 of the Civil Code of the Russian Federation will not be in effect, and the countdown of the limitation period (SIL) will begin from the date of failure to fulfill the obligation to repay the loan (clause 2 of Article 196 of the Civil Code of the Russian Federation).

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

Moreover, the Civil Code of the Russian Federation allows for the registration of DBZ without specifying the period for the return of money, or “on demand”. However, a number of restrictions on the loan term are still established.

For example, in accordance with paragraph 2 of Art.

200 of the Civil Code of the Russian Federation, IDA under open-ended agreements, or under “on demand” obligations, the validity of the agreement cannot exceed 10 years from the date of its origin. Consequently, based on this rule, if the creditor claims to return the transferred loan, the loan agreement cannot be concluded for a period exceeding 10 years.

That is, in order to prevent borrowed funds from becoming the borrower’s income, it is recommended to renegotiate the loan agreement once every 10 years.

Tax consequences for the lender of a legal entity

If the lender is an organization that is subject to the general taxation system, then the funds transferred to the borrower in the form of an interest-free loan, as well as the amounts received into the account as loan repayment are not included in expenses and income - this is regulated by clause 12 of Art. 270, sub. 10 p. 1 art. 251 Tax Code of the Russian Federation.

The return of funds to the lender's account as a return of the principal debt is not considered income, but there are exceptions in situations where the return of the loan is recognized as bad. This happens when:

- the debtor enterprise has been liquidated and a corresponding entry has been made in the Unified State Register of Legal Entities;

- the debtor enterprise is declared bankrupt, and the court’s ruling on the end of bankruptcy proceedings has entered into force.

In such situations, bad debt can be classified as unrealized expenses in accordance with subparagraph. 2 p. 2 art. 265 Tax Code of the Russian Federation.

Transactions that are related to the provision of a loan or its repayment are not subject to taxation and are not subject to VAT. Providing a loan only in cash is not subject to VAT.

How to draw up an interest-free loan agreement in 2020?

There are 2 forms of DBZ:

- Written.

- Oral.

The DBZ is drawn up in writing if the loan amount exceeds 10 times the minimum wage for citizens of the Russian Federation, as well as in the case where the lender is a legal entity. face.

Thus, according to the legislative norms of the Russian Federation, if the lender is a legal entity. person, the DBZ is drawn up only in writing, regardless of the loan amount (clause

1 tbsp. 808 of the Civil Code of the Russian Federation).

At the same time, the legislation does not establish a unified template for such an agreement. Consequently, according to Article 161 of the Civil Code of the Russian Federation, there is a rule on the mandatory written execution of the DBZ, which is drawn up between legal entities.

persons or between legal entities. person and citizen.

In this case, there is no need to draw up an agreement; it is enough to issue a receipt indicating:

- Place and date of its writing.

- Information about the parties with identification of passport and contact details.

- Loan amount (in numbers and words).

- Signatures of the parties.

At the same time, liability for late repayment of the loan is the same as when drawing up a loan agreement.

The main requirement for DBZ is a mandatory note in the document that the loan is free of charge. Otherwise, the contract will be considered executed on a condition of compensation.

Banks do not provide interest-free loans, as they are commercial institutions whose main purpose is to generate income from the loans they issue. However, banks can take part in the country's social programs.

In these situations, the state compensates the bank for lost income for citizens participating in such programs.

Most often, DBZs are concluded between relatives or friends.

Particular attention must be paid to the following points:

1) In the “header” of the agreement it is required to indicate the name of the document and assign it a number, in our case: Interest-free loan agreement No.__.

2) A little lower, on the left side, the locality where the document was drawn up is indicated, and on the right - the date of execution of the transaction.

3) Next, fill out the preamble of the agreement, indicating the details of the parties and their powers on the basis of which the transaction is concluded.

“Subject of the agreement” must be filled in , where the amount of the loan issued is noted, and it is noted that the loan is gratuitous. The validity period is displayed by agreement of the parties. However, it may not be specified. In this case, the DBZ is unlimited.

5) Next, you need to fill out the Rights and Responsibilities of the Parties . Here you can note the responsibilities of the parties to the transaction, indicating:

- Method of transferring money (cash or transfer).

- Loan repayment period and other conditions.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

6) It is imperative to fill out the “Responsibility of the Parties” section, where you can prescribe methods for resolving controversial issues and sanctions for violation of assigned duties.

7) Also in the document you can discuss and indicate at the discretion of the parties:

- Force majeure circumstances.

- Confidentiality of the agreement.

- Conditions for termination of the contract.

- Final provisions and other sections.

The final stage of registration of the DBZ includes the display of the “Details of the parties and signatures” of the document by the parties to the transaction.

The final stage of registration of the DBZ includes the display of the “Details of the parties and signatures” of the document by the parties to the transaction.

Before signing the DBZ, the parties are required to carefully re-read the text of the agreement. It should not contain errors, corrections or deletions.

The document is drawn up in 2 copies and comes into force after the money is transferred to the borrower.

Contract structure

It should be noted that there is no unified approved DBZ template, however, it is recommended to use the generally accepted document structure to design it. To compile a database, you can use the form.

At the same time, the parties to the agreement can ignore or add any conditions and requirements. However, the structure of the documents must reflect the essential conditions, without which the document will not receive legal status.

The structure of the document must certainly contain points showing:

- Date and place of conclusion of the DBZ.

- The amount of the allocated loan.

- Loan repayment terms.

- Conditions for issuing an interest-free loan.

- The procedure for considering controversial issues.

- Responsibility for non-repayment of the loan.

- Other terms of the agreement.

- Contact details of the parties to the transaction.

- Signatures of the parties.

The document is drawn up in 2 copies (one for each side). If there are additional documents, they must be attached to the main contract. This could be:

- Payment schedule.

- Acceptance certificate for the transfer of money.

- Borrower's receipt.

- Payment order.

- An extract from the bank confirming that funds have been credited to the borrower.

Loans between individual entrepreneurs

An individual entrepreneur can provide a loan to another individual entrepreneur with or without interest, but should not do this often, since otherwise a microfinance organization will have to be established. With the interest option, you will need to pay income tax. For example, when using the simplified tax system, lenders pay 6% of profits. The borrower pays for the interest-free loan.

For loan agreements to be valid, they note:

- Dating (with document number).

- Who is participating?

- Amount of debt and currency.

- Interest rate or necessarily no interest rate.

- Debt repayment period.

- How will repayment occur?

- Rights and obligations of participants.

- How disputes are resolved.

- Details plus visas of the parties.

Sample loan agreement between legal entities

Sample loan agreement between LLC and LLC

Loan in tranches

Application for tranche

Commodity loan

Is notarization required?

When drawing up a DBZ, the question often arises: is the agreement required to be certified by a notary, or will a promissory note signed by the parties to the agreement be sufficient?

It should be noted that the legislative norms of the Russian Federation do not provide for notarized confirmation of the DBZ. However, if the parties do not really trust each other, then they can have the document certified by a notary. This is not prohibited by law.

If you limit yourself to a receipt, then if you fail to fulfill your debt obligations, you will have to go to court. In this case, it will be necessary to:

- Expert research on the receipt to prove the authenticity of the borrower’s handwriting, which will delay the repayment of the loan.

- Additional expenses.

- Other actions that will delay your refund.

Therefore, notarization of the DDBZ:

- It will help reduce the risk of non-repayment of borrowed funds.

- It will facilitate the procedure for returning a loan if the borrower fails to fulfill its obligations.

General aspects

Registration of a loan agreement between legal entities. persons is permissible and possible. However, when it comes to providing a gratuitous loan, certain difficulties may arise.

Current legislation does not prohibit the provision of loans to one legal entity. face to another. Not only money, but also property can be issued on credit.

Loans that are issued in the form of property are considered gratuitous. If we are talking about a monetary loan, then the payment of interest is provided here, unless otherwise specified in the agreement.

What you need to know

Absolutely all loans are divided into two types - reimbursable and gratuitous. If the loan is reimbursable, then according to the terms of the agreement, interest is paid for using the money.

If we are talking about a gratuitous loan, then the agreement between the legal entities. faces must be written correctly, the following features must be taken into account:

- legal persons are required to draw up a written loan agreement;

- The document must indicate that the loan is interest-free.

The agreement also specifies the period, loan amount, frequency of payments, possible penalties, etc.

The main feature of an interest-free loan agreement is that it must indicate an interest-free loan.

In another case, the loan will be considered interest-bearing, and the interest for its use will be equal to the refinancing rate of the Central Bank of the Russian Federation on the day the loan period ends. The rate is 8.25% per year.

A loan agreement is a real agreement, that is, it is considered legal not from the period of signing, but from the period of transfer or things on credit.

In the interest-free loan agreement between legal entities. faces there is one more nuance. If the lender has not yet had business relations with the borrower, then he may end up with an unscrupulous borrower.

Therefore, the agreement must necessarily establish a final period for repayment of the debt.

It is necessary to describe in detail the responsibility of the parties for failure to fulfill the terms of the agreement.

A gratuitous loan does not provide for the receipt of income for the borrower, so he cannot be against early repayment. Prompt return of his money or property will be beneficial for him.

What is its purpose

Organizations can sign agreements with each other on targeted loans.

Then the borrower will be able to spend the money received only on those tasks that were specified in the document.

The borrower can take out a loan for the development of his company. The lender must control how their money is spent.

If the funds were spent on other purposes, the lender can request his money back at any time without meeting deadlines.

Legal basis

The legality of an interest-free loan between legal entities is proven by the Civil Code of the Russian Federation.

According to the current legislation, namely Art. 809 of the Civil Code of Russia, interference that could arise when signing a gratuitous agreement between legal entities. faces cannot appear.

On the other hand, in Art. The Federal Law “On combating proceeds from crime and the financing of terrorism” dated August 7, 2001 N 115-FZ clearly states that if gratuitous loans are issued by a legal entity. a person who is not a credit institution, then such a transaction is subject to verification by government agencies.

Art. 809 of the Civil Code considers a loan gratuitous if it meets the following requirements:

- The loan amount does not exceed 50 minimum wages.

- The loan is not related to the entrepreneurial business of the parties.

- During the execution of the agreement, an agreement on guarantee for the preservation of valuables must be signed.

The rules for issuing loans are also prescribed in the Law “On the Central Bank of the Russian Federation” and the Law “On Banks and Banking Activities” No. 395-1 of December 2, 1990.

Invalidation of the contract

In order for the DBZ not to be declared invalid, it is necessary to draw it up legally correctly.

In what cases can the DBZ be declared invalid? First of all, if the borrower refuses to sign.

If, as a result of legal proceedings, the borrower is able to prove that he did not sign the agreement, then such an agreement will be declared invalid. Therefore, when transferring money, there is an established practice of recording the transfer of a loan:

- There must be either a deed of transfer confirming the delivery of the amount, or a receipt for the loan, written by the borrower. And it will be better if the transfer of the loan is carried out in the presence of witnesses or confirmed by a notary. If all this is done, then the borrower will not be able to prove his non-involvement in the DBZ.

- Transferring funds by transferring payment to the borrower's bank account. In this case, proving receipt of the loan is not difficult.

Note. If the parties fail to reach an agreement pre-trial, then the recognition of the DBZ as invalid is allowed only through judicial proceedings.

Types of agreement

This document, drawn up between two legal entities, can be presented in two forms, as it can be interest-free or interest-bearing. Each type has its own characteristics:

- Interest-bearing loan agreement. It must be created in writing, but notarization is not an indispensable condition. It is important to additionally draw up a receipt proving the transfer of funds or valuable items from one representative of a legal entity to another. The agreement is interest-bearing because it specifies the rules for calculating and the amount of interest paid by the borrower to the lender. If the amount of interest is not indicated in the document, then it is still accrued monthly, for which the refinancing rate is used. When a loan is issued, each representative of the company must agree on the terms with the representative of the other party. If any disagreements arise, an appropriate protocol is drawn up. When transferring money, it is permissible to use not only this agreement, but also receipts, and business correspondence can also be drawn up. The property is transferred into the ownership of the borrower, and not for use limited by the duration of the contract. Therefore, he can dispose of it at his own request.

- Interest-free loan agreement. It is used by different companies that help each other in the process of crisis situations. However, in the process of using this document, certain legal requirements are taken into account, since if they are violated, there is a high probability of negative consequences from the tax authorities. During the preparation of this document, it is certainly indicated that it is interest-free. The fact is that in the absence of this precise wording, the lender has the right to demand that the borrower pay accrued interest in accordance with the established refinancing rate. The legislation indicates that it is permissible to use such an agreement, but not all the time, since otherwise this activity may be classified as illegal banking transactions. Typically, the purpose of an interest-free loan is to carry out various non-commercial transactions and operations. The document is drawn up in free form, but it is advisable to use standard agreements.

Thus, before drawing up a loan agreement, it is important to decide which type will be used.

Definition of loan

Borrowed legal relations imply a bilateral agreement, by virtue of which the lender transfers into the ownership of the borrower a certain material value that has a generic characteristic. The borrower, in turn, undertakes to return the equivalent material value to the lender within the time period established by the agreement.

As a rule, money in any currency acts as borrowed funds, but it can also be gold bars, diamonds or bitcoins. The main legal property of a loan is the transfer of material value into ownership, which the borrower can dispose of at his own discretion, subject to the condition of returning not the same value that he received, but its equivalent - rubles, dollars or buttons.

What is a loan agreement between legal entities

This form of legal relations between enterprises provides for an agreement in which one of the parties transfers and the other accepts ownership of money or goods. A loan agreement between legal entities additionally implies that:

- Upon expiration of the established period, the borrowing organization must return the same amount of financial resources or valuables (the same amount of bricks, concrete blocks, etc.).

- Such a service may be paid in the form of a percentage. It is calculated in the same units (that is, money or a specific product) as the loan issued

Conditions of conclusion

The legal requirements for processing a loan between two organizations have their own characteristics that must be taken into account when drawing up official documents. It is not necessary to have the agreement certified by a notary office, but this can be done at the request of one of the parties. The law talks about the mandatory written form of the contract. If it is not formalized, and the money (or goods) is transferred to the borrower, the tax authorities will consider this unjust enrichment. A properly drafted document should:

- Include details of the parties.

- Comply with legal norms and requirements, be a multifunctional document that provides for all the features of the transaction.

- To avoid disputes, directly indicate the consideration of the transaction - whether payment in the form of interest for the service provided is necessary or not.

Moment of entry into force of the agreement

Issuing and receiving a loan between legal entities has an important feature that distinguishes it from bank loans. The agreement comes into force only at the moment of delivery of money or goods from the lender to the borrower and is valid for the specified period. Such a document can be signed in advance by the parties. If for some reason the creditor does not transfer funds or valuables, then the agreement is considered not to have entered into force

Features of loan agreements between legal entities

A legal entity is an organization registered in accordance with the procedure established by law. It has the right to carry out economic and entrepreneurial activities and has property on its balance sheet.

Because of this, any financial transaction of a legal entity must be reflected in its accounting statements. This means that borrowed funds must be shown on the balance sheets of both the borrower and the lender.

Since the activities of any legal entity are regulated not only by law, but also by the Charter, in order to implement a loan agreement, legal entities must meet the following criteria:

- have the right granted by law to carry out borrowing operations;

- have no statutory restrictions on borrowing operations.

A mandatory condition for a loan for legal entities is the transfer of borrowed funds to the borrower’s bank account. The same rule applies when repaying a loan. That is, there cannot be a loan between legal entities using cash.

The only exception to this rule is the option of transferring cash from the borrower's cash desk. However, this operation can only be carried out through a cash register and only in accordance with the rules of the bank.

Debt forgiveness between legal entities

After the end of the loan agreement, the lender may require the borrower to fully repay the existing debt.

To do this, the legal entity that issued the loan sends a written notice to the other party demanding payment of the debt. The borrower must fulfill all the conditions specified in the notice within one month.

If the loan amount is not repaid or not fully repaid, the lender files a lawsuit against the borrower with a similar demand to return the entire amount of the debt.

The borrower can sue within three years after the end date of the contract, because this is the statute of limitations that applies under loan agreements.

If the borrower does not repay his debt in full within three years, he includes the remaining amount as income and pays income tax on it.

Sometimes, after the end of the loan agreement, the borrower finds himself on the verge of bankruptcy, and he simply does not have the necessary financial resources to repay the loan amount.

In this case, the lender can only forgive the debt or part of it (Article 415, Part 1 of the Civil Code of the Russian Federation), but this is only possible if the interests of other persons who are associated with the lender’s property are not seriously infringed.

There is no legally established procedure for forgiving a borrower's debt. However, this decision must be formalized by a written agreement of the parties, which will clearly define all the details and the amount of the debt that the borrower no longer needs to repay.

If the loan agreement between legal entities was certified by a notary, then the additional agreement must be certified by him.

The Supreme Arbitration Court of the Russian Federation in letter No. 104 dated December 21, 2005 stated that the decision to forgive a debt cannot be considered a gift, since it most often carries only the desire of the lender to repay the remaining part of the debt or other debts that the given person has. recipient of loans.

In market conditions, enterprises can attract borrowed funds in the form of loans from legal entities. Such relationships are more beneficial for business entities compared to bank loans and are formalized in writing by a loan agreement.

A loan agreement is sometimes drawn up in the form of a promissory note or bonds. The loan may be gratuitous and the parties do not have any tax obligations, or it may also include the payment of interest, in which case it is reflected as accounts payable in the accounting accounts.

A loan between legal entities allows enterprises to conduct business activities more efficiently and minimizes their additional costs associated with servicing it.

Customer reviews of loans from the Alfa company are given in the article: Alfa loan. How to find private loans without being scammed against a receipt, see here.

There is information about the procedure for obtaining a targeted loan for maternity capital.

Contents of the agreement

For a loan agreement between legal entities, a simple written form is provided that does not require notarization. You can draw up an agreement yourself, or you can use the template available on the website.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

Those who decide to draw up an agreement on their own should know that the content of the agreement must include mandatory details, namely:

- the name of the parties to the agreement, the name of their status and legal addresses;

- names of officials signing the agreement on behalf of the legal entity;

- a clearly defined name of the subject of the agreement, that is, a loan of one or another type of material assets;

- conditions for repayment of the loan (with or without interest), date of full repayment, frequency of repayment, if the parties agreed on a phased repayment;

- interest rate if the parties have established a condition for repayment with interest;

- sanctions for violation of contract terms;

- reasons for possible termination or modification of the contract;

- signatures of the parties to the agreement and their details.

A payment schedule may be attached as an Appendix to the agreement if the parties have agreed on a phased return.

In accordance with Art. 809 of the Civil Code of the Russian Federation, a contract for borrowing money between legal entities is considered compensated, unless the parties have specified otherwise in the contract itself. That is, the loan will imply the accrual of interest for the use of borrowed funds.

If the parties missed a clause on the interest rate in the agreement, then the agreement will be considered an interest rate, and the rate will be calculated based on the Central Bank refinancing rate.

Interest-free, in accordance with the same Art. 809 of the Civil Code of the Russian Federation, an agreement between legal entities can be considered, according to which the borrowed funds are not money, but any other material assets united by generic characteristics.

It should be remembered that interest-free loan agreements between legal entities always attract the attention of tax authorities, who assume that hiding real interest rates is a way to evade taxes.

Also, those legal entities that often enter into loan agreements will also come to the attention of the tax authorities. This practice gives tax authorities the opportunity to suspect a legal entity of carrying out illegal credit transactions.

What are the requirements for the parties?

Not every company can act as a borrower or lender, as certain conditions must be met. The borrower is required to:

- a specific type of legal entity, in accordance with the law, has the right to borrow funds from other companies;

- the organization's Charter should not contain information about a ban on receiving money from other companies on the basis of payment and repayment;

- funds received from another company are certainly used for the purposes specified in the Charter.

The requirements for lenders are minimal, since they simply must have the necessary funds or valuable items to be loaned to another company.

FAQ

When concluding a transaction, the parties often ask questions: are there any restrictions on the loan amount, and what are the tax consequences of lending without interest?

Are there any restrictions on the amount

There are no restrictions on the amount determined by law. Legal individuals can provide and receive loans in any amount.

It is necessary to understand that if the amount of one transfer exceeds 600 thousand rubles, this will arouse additional interest of the regulatory authorities, and the banking organization may ask for an agreement.

There is no maximum amount under the loan agreement. Legal individuals can decide for themselves how much to receive or issue loans based on their capabilities.

Loans can be issued in cash or by transfer to a bank account. But there are certain aspects that need to be taken into account.

If the lender is an LLC, then issuing a large loan amount may require mandatory confirmation as a large transaction. This is written about in Art. 46 of the Law “On LLC”.

Also, the approval of the LLC members may be necessary if the issue is raised at the general meeting that the issuance of a gratuitous loan is an interested party transaction.

How to pay off debt?

Loans can be roughly divided by type of repayment:

- short-term – up to 12 months;

- long-term;

- unlimited

The last option deserves special attention, since the loan is repaid at the first request of the lender and is more often typical for affiliated structures.

Payments can be made at the end of the term or at certain intervals. If a debtor misses paying a monthly debt without signing an additional agreement, the creditor may go to court.

As for early repayment of an interest-bearing loan, it is permissible only with the consent of the lender. Please note that interest-free loans are repaid ahead of schedule without any restrictions.

Do you want to know how to get an express loan with bad credit? Then you need to read the following article. You can read how to fill out a sample interest-bearing loan agreement between individuals by following the link.

You can find out more about the interest-free loan agreement between the founder and the organization by following the link.