What affects the amount of transport tax

Transport tax is a local tax, so the amount and terms of its payment vary depending on the region of Russia. The main rule regarding the size is that it should not exceed the figure established in the tax code by 9 times, either upward or downward. If a region does not set the transport tax rate at its discretion, then it is recognized as equal to the federal value.

The final amount of transport tax that an organization will have to pay is influenced by several factors.

- the number of transport units registered with the organization;

- the tax rate for transport tax established in the region - everywhere individually, depending on the characteristics of the administrative district;

- engine power of each vehicle, in accordance with the technical passport. For air transport, the tax base is the static thrust of the engine, for river and sea transport without an engine - cargo capacity in tons.

Transport tax is calculated for each transport unit separately, using the traditional algorithm: the tax base is first multiplied by the tax rate, then by the coefficient.

Important! It must be remembered that for cars there are so-called increasing and decreasing coefficients, that is, depending on the average price, age, degree of wear, as well as the time of use of the vehicle, the tax may be different.

For your information! You can find out the transport tax rate that is relevant for a particular region of the Russian Federation by contacting the territorial tax office.

Transport declaration – where to submit it

The control body that administers the TN is the tax office. In accordance with paragraph 1 of stat. 363.1, the declaration is submitted by legal entity taxpayers to the territorial division of the Federal Tax Service at the location of the vehicle. If an enterprise is classified as one of the largest taxpayers, it is necessary to submit a report to the Federal Tax Service where the legal entity is registered for tax purposes as the largest taxpayer.

What to do if the organization has separate divisions in other constituent entities of the Russian Federation? And such OPs include means of transportation. In this case, reporting on TN is submitted at the place of tax registration of the division. Since the auto tax is a regional tax, it will be accrued to the Federal Tax Service at the place of registration of the OP. And if the tax is transferred to the budget of the region where the parent organization is registered, a imbalance will arise - the accrual will occur in the tax department, and the payment will be made to the tax office of the parent company.

Accordingly, penalties and arrears will be charged on the personal account of the taxpayer-division. To avoid litigation with government agencies, it is necessary to correctly file a declaration and pay tax. The form on each page contains columns for indicating the taxpayer’s INN and KPP, and there are also lines with OKTMO, which help to fill out the information correctly. When submitting a declaration, a division of a legal entity enters the TIN of the organization and the checkpoint of the OP, and additionally enters the OKTMO code corresponding to the territory of the TN.

Vehicles not subject to tax

The law of the Russian Federation contains a detailed list of vehicles that are not subject to transport tax. These include:

- motor boats with an engine capacity not exceeding 5 hp, as well as any rowing boats;

- sea and river vessels whose purpose is fishing;

- combines, tractors, special vehicles used for agricultural work, as well as the production and processing of agricultural products, but only if they are registered to producers of agricultural goods;

- air, sea and river vessels, if they are registered with an individual entrepreneur or organization whose main activity is passenger or cargo transportation.

Important! For agricultural producers who use special agricultural equipment for their work, the share of profit from the sale of agricultural goods must be at least 70% of the total income for each year based on the results of commercial activities.

A detailed list of vehicles and equipment not subject to transport tax can be found in Article 358 of the Tax Code of the Russian Federation.

If we talk about individual entrepreneurs who use cars for their work that are registered to them as individuals, then they can be exempt from paying transport tax in those cases that are also provided for in the Tax Code of the Russian Federation. In particular, these may be cases when transport is used:

- disabled people;

- participants and veterans of military conflicts;

- individual entrepreneurs delivering their employees to their place of work;

- other cases prescribed in the Tax Code of the Russian Federation.

How to calculate the tax amount

The transport tax rate changes every year. Tax calculations in 2020 for individual entrepreneurs and companies are slightly different.

A ready-made receipt is sent to the individual entrepreneur’s postal address, indicating the amount to be paid. Calculations are made based on information from the traffic police, which is provided to the tax service. So you just need to pay the specified amount.

For companies that use the simplified tax system, a declaration is filled out. To calculate the transport tax, you need to multiply the rate by the tax base. In large fleets, the resulting figures are summed up.

What is the rate and tax base? Where do you get these numbers? The tax base is a figure equal to the engine power of the car. For example, let's take a passenger car with an engine power of 90 hp. With. Its tax base is 90. The rate is taken from the regional tax register.

The rate depends on:

- year of manufacture of the car;

- capacity and category of transport;

- power;

- vehicle class.

Tax amount = tax rate × tax base.

How to save on transport tax using the simplified tax system

Many managers of enterprises that use vehicles in their work wonder whether it is possible to somehow save money on it. This is not an easy task, but it has a solution. Options for reducing this tax payment are:

- the vehicle is listed in the list of Art. 358 of the Tax Code of the Russian Federation;

- benefits provided by local legislators for certain companies or vehicles in the territory of a particular region of the Russian Federation;

- if a “simplified” person uses the object of taxation of income minus expenses of 15%, then he can include transport tax in expenses according to the taxable base. Thus, the tax base will be reduced by the amount of transport tax paid.

In addition, careful monitoring of the efficiency of the use of cars and special equipment in the activities of the enterprise can reduce the amount of transport tax paid. There is no need to pay this tax if the use of transport becomes impractical - it is wiser to deregister idle equipment. In the same way, it is necessary to deregister vehicles in a timely manner if they have been stolen - for this you need to provide the tax service with a certificate from the police recording the fact of theft.

Attention! In cases where the total cost of vehicles registered to an enterprise is more than 3 million rubles, it will not be possible to save on transport tax.

How to calculate the tax in the declaration and is it necessary to calculate it?

In general, the amount of transport tax is not the same for everyone, but depends solely on the vehicle and engine power, which is usually indicated in the vehicle documentation (technical passport). Power can be measured in either horsepower or kilowatts. But if the measurements are indicated in kilowatts, then such data should still be converted into horsepower, since the tax is calculated exclusively on horsepower.

The conversion formula is simple; we multiply the amount of kilowatts by horsepower. One kilowatt = 1.35962 horsepower. In practice, situations often occur when the data from the manufacturer does not correspond to those specified in the technical passport and in most cases exceeds the number of horsepower, and therefore the amount of transport tax increases.

Under such circumstances, the car owner has the right to conduct an examination and make appropriate changes to the technical passport, and after which the amount of overpaid tax will be returned to him.

Deadlines for payment of transport tax

Organizations that are on the Simplified Tax System and use vehicles in their work must pay transport tax throughout the year in advance payments - based on the results of the first quarter, half a year and 9 months. If the advance payment deadline falls on a weekend, the tax must be transferred to the tax office account no later than the next business day.

The final payment of transport tax for an LLC must be made before January 31 of the following reporting year, inclusive. Payment of transport tax for individual entrepreneurs (as an individual) is made until October 1 of the next year.

Question answer

Question:

Individual entrepreneur Savelyev owns a truck. On 07/12/16 the car was stolen. How should the transport fee for Savelyev be calculated?

Answer:

It all depends on whether there is documentary evidence of the theft. If Savelyev has a certificate from the Ministry of Internal Affairs stating that the car is wanted, then the tax is calculated based on the date when it was stolen. If the theft certificate is dated 07/12/16, then Savelyev will pay the tax for 6 months (January - June 2016).

Question:

Individual Entrepreneur Kondratyev violated the deadline for payment of the fee (until 10/01/16) and transferred the payment of 743 rubles. 08.11.16. What measure of liability is provided for Kondratiev in this case?

Answer:

For violation of deadlines, Kondratyev will pay a fine of 149 rubles. (RUB 743 * 20%). There is also a penalty for late payment, which is calculated as follows:

P = Arrears * Refinancing rate / 300 * actual number of days overdue.

Late payment is determined from the date of the last day of payment (01.10.16) to the date of actual repayment of tax obligations.

The calculation of the penalty for Kondratiev looks like this:

743 rub. * 11%/300 * 39 days. = 11 rub.,

where 11% is the Central Bank refinancing rate valid during the period of delay;

39 days – actual period of delay from 10/01/16 to 11/08/16.

Thus, in addition to repaying the principal debt (tax 743 rubles), Kondratyev must pay a penalty and a fine of 160 rubles. (149 RUR + 11 RUR).

Vehicle tax is levied not only on individuals, but also on entrepreneurs. Not everyone knows what pitfalls they can expect when paying this tax, which is why they make stupid mistakes. Let's take a closer look at what transport tax for individual entrepreneurs includes, as well as how and when it needs to be paid.

Submitting transport tax reports

At the end of the year, enterprises that are on the simplified tax system, when using cars and other equipment in their work, are required to submit a transport tax declaration to the tax office.

The deadline for filing a declaration is February 1 of the year following the reporting year.

Attention! Only organizations must submit a transport tax return to the tax authority; individual entrepreneurs are exempt from this obligation, since they can use vehicles that belong to them as individuals to carry out commercial activities.

So, the deadlines for payment and submission of transport tax reports for individual entrepreneurs and LLCs are in the summary table:

| Deadlines | IP | OOO |

| Due date | until October 1 (inclusive) of the next year | until January 31 (inclusive) of the year following the reporting year |

| Report submission deadline | not required | until February 1 (inclusive) of the year following the reporting year |

Payment of tax by organizations and individual entrepreneurs

As we can see, for both organizations and individual entrepreneurs using the simplified tax system, there is a unified procedure for calculating transport tax. But the fee payment scheme for individuals and legal entities is different from each other.

Individual entrepreneurs pay tax according to the notification received from the Federal Tax Service at the place of residence of the entrepreneur. The fiscal service receives information about the length of ownership of the car and the power of the vehicle from the traffic police. The notification comes by mail, it contains a calculation of the tax amount taking into account the period of ownership of the car. Along with the notification from the Federal Tax Service, you will receive a receipt with which you can contact the bank to pay the tax. According to the law, individual entrepreneurs are obliged to pay off their tax obligations by October 1 of the following year (for 2020 - by 10/01/17).

As for legal entities, organizations calculate taxes independently by submitting a tax return before February 1 of the following year (for 2020 - before 02/01/17).

If a “simplified” organization has branches, representative offices or other separate divisions in other cities, then the vehicle tax is paid at the location of such division, at the rates applicable in the given region. If the vehicle has been re-registered (the car is deregistered in one region and delivered in another, but to the same payer), then the tax is paid based on the fact where the vehicle was registered on the 1st day of the month.

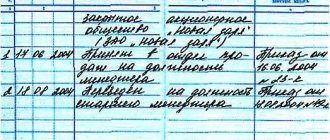

Example No. 3.

Khladprom LLC uses the simplified tax system and has two representative offices - in Voronezh and Belgorod. The Chevrolet Niva, owned by Khladprom, is registered in Voronezh. In March 2020, the car was deregistered and registered in Belgorod on June 15, 2016.

When paying the transport fee for 2020, Khladprom must submit 2 tax returns: one to the Voronezh Federal Tax Service (payment for 6 months - from January to June 2016), the second to the Belgorod Federal Tax Service (payment from July to December).

If individual entrepreneurs transfer the transport tax once a year upon receipt of a notification, then organizations using the simplified tax system pay the tax in advance. The scheme for calculating and paying advances is as follows:

- the organization calculates the entire tax amount for the year in advance;

- the resulting indicator is divided by 4 (payments for each quarter);

- the quarterly amount is paid before the 31st day of the next month (for the 1st quarter - before April 30);

- a declaration is submitted at the end of the year;

- the amount of tax paid in advance is compared with the figure indicated in the declaration;

- in case of underpayment, the final tax payment is made (until February 1 of the following year).

Example No. 4.

Techno Plus LLC uses a simplified taxation regime. As of 01/01/16, Techno Plus owns a Hyundai Solaris car (power 107 hp). When determining the amount of transport tax for the year, the Techno Plus accountant made the following calculation:

107 * 3.5 = 375 rub.

Thus, the quarterly payment was 375 / 4 = 93.75 rubles. This amount was deposited by Techno Plus on 04/03/16, 07/02/16, 10/08/16 and 01/08/17.

In November 2020, Techno Plus acquired Renault Sandero (power 82 hp). For 2 months of owning this car (November - December 2016), Techno Plus must pay the following tax:

82 * 2.5 * (2 / 12) = 35 rub.

In the tax return, Techno Plus indicated the total tax amount for two cars - 410 rubles. (375 RUR + 35 RUR). The final payment (35 rubles) was made by Techno Plus on 01/18/17.

Who pays tax and submits a return?

Transport tax is a regional tax, which means that the timing and reporting procedure are regulated by local authorities.

Companies and individuals must pay tax. But only legal entities must report on objects (Article 363.1 of the Tax Code of the Russian Federation). If an individual entrepreneur uses a car in business, then all tax calculations are carried out according to the rules for individuals, that is, the individual entrepreneur pays transport tax based on a notification from the Federal Tax Service, but the individual entrepreneur does not submit a declaration.

There are a number of objects on which taxes are not paid. They are recorded in Art. 358 Tax Code of the Russian Federation.

2019 is the last year for which you need to submit a declaration. The Federal Tax Service will calculate the corporate tax for 2020 independently based on data from the State Traffic Safety Inspectorate (Order of the Federal Tax Service of Russia dated November 26, 2018 No. ММВ-7-21/ [email protected] ).

Transport tax under the simplified tax system for LLCs in 2020

As mentioned above, for individuals the tax is calculated by government agencies. Under the simplified tax system, the tax must be calculated for each vehicle separately. The tax amount is equal to the product of the tax rate and the tax base.

The rules for calculating transport tax for LLCs have not changed ; an accountant of any level will be able to cope with such a matter; the most important thing is to correctly take into account all the coefficients.

The tax period for transport tax is one year, and for advance payments - 1, 2 and 3 quarters, however, it should be noted that some regions of Russia do not introduce reporting periods for advance payments.

The tax base is determined according to the following methodology:

- For vehicles that have engines, the tax base is horsepower .

- For aircraft, the tax base is the thrust of a jet engine, measured in Kgs (kilogram-force) .

- For watercraft required to tow, the tax base is gross tonnage in registered tons .

As mentioned above, tax rates are set at the regional level, that is, they may differ in different regions of the Russian Federation. Basic tax rates are established by Article 361 of the Tax Code of the Russian Federation . For example, the owner of a passenger car that develops a power of at least 100 , but not more than 150 hp , must pay tax in accordance with a rate equal to 3.5 rubles per horsepower .

If a car engine develops a power of more than 250 horsepower , then the rate here is already as much as 15 rubles per hp .

For example, if some company based in St. Petersburg had at its disposal a passenger car with a capacity of, say, 125 horsepower , then the tax would be: 120 * 35 rubles (this tax rate is currently provided in St. Petersburg ) = 4200 . This is the amount the company must pay at the end of the reporting period.

This formula is applied when the car was at the disposal of one or another company throughout the year .

If the car was owned by the company for several months , then it is necessary to calculate using a slightly different formula. Moreover, it should be taken into account that the new month begins on the 15th , that is, when purchasing a car on September 14, the tax for September must be paid by the previous owner.

For example, the same company in St. Petersburg buys a passenger car with a capacity of 120 horsepower on May 17th, uses it until October 16th. To calculate, you must perform the following steps:

- Calculate the total number of months when the car was in the company's possession. May is no longer counted, then June, July, August, September. Total four months.

- After this, you need to take the tax rate , which is equal to 35 rubles per horsepower, calculate the amount of horsepower , that is, repeat the action: 35*120=4200 .

- Then you need to enter a correction factor , which is equal to the quotient of the number of months when the car was registered to the company to the total number of months in the year, that is, you need to divide 4 by 12 - 4/12 = 0.33;

- At the end, you need to multiply the annual rate by the adjustment factor , that is, 4200 * 0.33 = 1386 . Everything is very simple and clear.

It is very important to take into account exactly how many months the car or other vehicle was at the disposal of the LLC!

Each subject of the Russian Federation can change these rates by no more than 10 times, either decreasing or increasing.

Also, the calculation can take into account various increasing factors, which depend on many factors. These coefficients include:

- A coefficient that increases the amount of tax by 10%, which is taken into account when paying tax on a car, the cost of which ranged from 3 to 5 million rubles less than 3 years have passed since its release .

- If the car also costs from 3 to 5 million rubles more than 2 years have passed since its release , then the coefficient here increases the tax amount by 30% .

- In the case when 1 year has not passed , and its average cost is from 3 to 5 million rubles , then the tax is multiplied by 1.5 . This coefficient adds 50% of the tax .

- If the original cost of a passenger car was more than 15 million rubles more than 20 years have passed since its release , then the increasing factor here triples the tax amount.

Thus, when independently calculating transport tax, it is very important to take into account all increasing factors, since if they are not taken into account, fines may be imposed on the company.

Transport tax under the simplified tax system (income minus expenses)

When filing a declaration of expenses and income, transport tax is included in the annual expenses. Thus, due to the amount of transport tax, it is possible to reduce the overall income tax.

This calculation procedure includes the following stages:

- The tax base is determined.

- Next you need to calculate the minimum tax , which is equal to the product between income and 1%. If the tax base is less than 0, the minimum tax is paid. If greater than 0, then the tax base increases by 15%.

- Next, that was paid previously is calculated

- At the end that must be transferred to the regional budget is determined It is equal to the difference between the initial tax and the real one.

If in the end the final amount to be paid is greater than 0, then it is obligatory to pay it; if not, then vice versa. This taxation scheme applies to both LLCs and individual entrepreneurs using the simplified tax system.

Transport tax rates in Moscow

For a year

| Name of taxable object | Rate (RUB) for 2020 |

| Passenger cars | |

| up to 100 hp (up to 73.55 kW) inclusive | 12 |

| over 100 hp up to 125 hp (over 73.55 kW to 91.94 kW) inclusive | 25 |

| over 125 hp up to 150 hp (over 91.94 kW to 110.33 kW) inclusive | 35 |

| over 150 hp up to 175 hp (over 110.33 kW to 128.7 kW) inclusive | 45 |

| over 175 hp up to 200 hp (over 128.7 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 225 hp (over 147.1 kW to 165.5 kW) inclusive | 65 |

| over 225 hp up to 250 hp (over 165.5 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 7 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 15 |

| over 35 hp (over 25.74 kW) | 50 |

| Buses | |

| up to 110 hp (up to 80.9 kW) inclusive | 15 |

| over 110 hp up to 200 hp (over 80.9 kW to 147.1 kW) inclusive | 26 |

| over 200 hp (over 147.1 kW) | 55 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 15 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 26 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 38 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 55 |

| over 250 hp (over 183.9 kW) | 70 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 200 |

| over 100 hp (over 73.55 kW) | 400 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 250 |

| over 100 hp (over 73.55 kW) | 500 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 200 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 250 |

| Airplanes with jet engines (per kilogram of thrust) | 200 |

| Other water and air vehicles without engines (per vehicle unit) | 2000 |

FILES

Note to the table: the values are given in Moscow for 2020, 2020, 2020, 2020, 2020. To select rates for a specific year, use the selector.

The capital of Russia is the largest subject of the Russian Federation in terms of the amount of collected transport tax. More than 27 billion rubles are brought in annually by 2.9 million payers, subject to the requirements of Moscow City Law No. 33 of July 9, 2008.

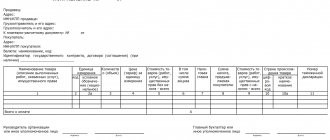

What has changed in the transport tax return form in 2020

The new version of the declaration came into effect on February 20, 2019. Changes were made by Order of the Federal Tax Service of the Russian Federation dated November 26, 2018 N ММВ-7-21/ [email protected] The current form was approved by Order of the Federal Tax Service of the Russian Federation dated December 5, 2016 No ММВ-7-21/ [email protected]

The composition of the new declaration has not changed in general. The declaration still has a title page and two sections. What's added:

- The barcodes on the declaration form have changed;

- Line 280 reflects the tax deduction code for a heavy vehicle weighing more than 12 tons;

- Line 290 reflects the amount of tax deduction in rubles in relation to heavy cargo.

- Annexes No. 5 and No. 7 have changed, that is, codes for types of vehicles and codes for tax benefits and deductions.

These changes apply to 2020 returns.

As for the zero declaration for this tax, Chapter 28 of the Tax Code of the Russian Federation does not say anything about the mandatory submission of zero tax returns.

If there are no notifications from the Federal Tax Service

If an individual taxpayer has not received a notification from his Federal Tax Service (at the place where the vehicle is registered), he is obliged to independently contact the tax authority to provide information about his vehicle. This obligation appeared in 2020 based on the introduction of a new clause 2.1 (Article 23) into the Tax Code.

Along with the message about the presence of a vehicle, the individual taxpayer must also submit title documents for this property and documents confirming its state registration.

Such information must be submitted before the end of the year that follows the expired tax period (if no tax notice was sent during this period). In this case, tax calculation will begin from the period for which the tax notice should have been received (clause 2 of Article 52 of the Tax Code).

NOTE! Taxpayers - individuals do not have an obligation to provide information about their transport if tax notifications were previously received or were not received in relation to this transport item due to the presence of a tax benefit.

Since legal entities will no longer independently report transport tax from 2021, they will also be required to transmit information about vehicles if they do not receive messages from the Federal Tax Service. Deadline until December 31st. See here for details.