An invoice is a necessary document not only in accounting, but also in the office work of an organization in general. There are many nuances in filling out this document, ignorance of which can lead to problems with the Tax Inspectorate.

This is a form confirming the fact of shipment of goods or provision of services at a set cost. This is not the only function of this form. What is an invoice? An accounting form required to confirm the amount of VAT both on the sale of goods (services) and input VAT to prove the right to a tax deduction in order to avoid double taxation. The presence of an invoice is a prerequisite for crediting the amount of VAT on material resources (work, services) that were purchased by the taxpayer.

This is a very important document, often used in legal disputes, so it must be filled out correctly.

Who makes up

An invoice is issued by the seller (contractor, performer) to the buyer or customer. Drawing up this form is mandatory for business entities engaged in the sale of goods, performance of work or provision of services.

Why an invoice is needed has already been said (let us repeat briefly: it confirms the issuance and payment of VAT), accordingly, you need to fill out such a form:

- individual entrepreneurs and enterprises subject to the general taxation system (unless their services fall under the exceptions established by clause 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs and companies that partially work on OSN (for relevant types of activities), also combining it with UTII.

Taxpayers who have chosen UTII, the simplified tax system, or the patent system as their taxation system are exempt from paying VAT, with the exception of certain cases.

Why do you need an invoice if companies and individual entrepreneurs do not have to pay VAT? This may be required if there is commercial interaction with organizations and individual entrepreneurs that are VAT payers. In addition, the parties may decide to apply the invoice on their own initiative.

Exposure deadlines

The general rule is as follows: an invoice is issued within 5 days from the date of transfer (shipment) of goods, performance of work or provision of services. In this case, calendar days are taken into account. This norm is enshrined in paragraph 3 of Art. 168 Tax Code of the Russian Federation. The rules are the same for both paper and electronic invoices. Also, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when preparing advance documents, this form must be issued within the same 5 calendar days, but from the moment of receipt of payment for future deliveries, performance of work, provision of services.

Registration procedure

An invoice is necessary for both the customer and the contractor , which means that it is prepared in two copies with the same content. As mentioned above, the Tax Code of the Russian Federation in Art. 168 regulates the deadline for issuing this document in the following order:

- On the day of receipt of advance payment for future deliveries of goods (transfer of ownership rights).

- On the day of actual shipment of goods or transfer of ownership.

The five-day period begins on the day following the date of first shipment. An invoice for the advance payment is also provided within five days from the date of receipt of funds by the contractor on account of the future provision (provision) of work.

When an invoice is not needed

The legislation specifies cases when an invoice is not a mandatory document, and the completion and execution of a transaction is confirmed by other data: an invoice, an invoice for payment. Based on the regulations, the invoice is not filled out under the following circumstances:

- the transaction is not subject to VAT (Articles 149 and 169 of the Tax Code of the Russian Federation);

- when selling goods for cash (in this case, a check or a strict reporting form is sufficient);

- when applying simplified taxation regimes;

- a legal entity - an employer transfers goods to its employee without providing counterpayment, that is, free of charge (according to Letter of the Ministry of Finance of the Russian Federation dated 02/08/2016 No. 03-07-09/6171);

- when sending goods for export, taxed at a zero rate, if the buyer is not a VAT payer, if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment (according to Letter of the Ministry of Finance of Russia dated January 18, 2017 No. 03-07-09/1695).

When is an advance invoice issued?

If the buyer makes an advance payment for a future delivery, the supplier must also issue an invoice. In this case, it does not matter whether the buyer made the payment in full or in part - the document is issued for the transferred amount. The seller charges VAT on the prepayment received, and the buyer, subject to certain conditions, can claim his input tax as a deduction.

When is an advance invoice issued? The issuance period is 5 days, calculated from the date on which the advance payment was received. The document is taken into account by the supplier in the following order:

- the advance invoice is reflected in the Sales Book;

- when the goods are sold, a shipping invoice, that is, a “real” invoice, is drawn up;

- the shipping document is noted in the Sales Book for the entire amount of delivery;

- at the same time, an entry regarding the advance invoice is made in the Purchase Ledger.

The buyer has a similar document accounting procedure, but with the opposite sign: instead of entries in the Purchase Book, there is a Sales Book, and vice versa. Both the buyer and the seller's documents are also subject to registration in the Journal.

Kinds

There are three main types of invoice:

- ordinary, shipping. This document confirms that the goods have been transferred. This is the most common type of invoice, but legislation provides for more than just one;

- advance payment, written out and drawn up upon concluding a contract and receiving an advance payment for work performed or services rendered. This form does not confirm the fact of transfer;

- adjustment, filled in when the price or quantity of shipped products changes.

Types of operations

Receipt invoice

The document with the type of transaction for receipt registers the invoice received from the supplier upon receipt of goods and materials, works, services, fixed assets, and intangible assets.

Find out the features of filling out the document Invoice received for receipt

Invoice for advance payment

A document with the transaction type for advance payment is registered upon receipt of an invoice from the supplier for the advance payment issued to him.

Find out the specifics of filling out the document Invoice received for an advance payment.

Invoice for advance payment from the principal for purchase

A document with the type of transaction for an advance payment from the principal for the purchase is used for registration in the program by the commission agent of invoices for advance payments received from the supplier when purchasing goods for the principal.

Find out the specifics of filling out an invoice received for an advance payment from the principal for a purchase .

Adjustment invoice

A document with the transaction type Adjustment invoice is used to register adjustment invoices received from the supplier in the program.

Find out the features of filling out an Invoice and the received type of operation Adjustment Invoice .

Invoice correction

A document with the transaction type Correction of invoice is used to register corrective invoices received from the supplier in the program.

Find out the features of filling out an invoice and the received type of operation Correction of an invoice .

Correcting your own mistake

A document with the transaction type Correction of own error is used to correct errors made by the user when registering invoices received.

Find out the features of filling out an invoice and the received type of operation. Correcting your own mistake .

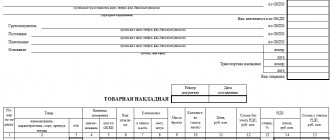

Requisites

What does an invoice look like? This is a table with columns about the product and a header providing information about the parties to the contract.

Required details:

- number and date;

- name, address and tax identification number, checkpoint of the buyer and seller, as well as the shipper and consignee, if any (please note, according to the new rules, the address must be written strictly as it is indicated in the Unified State Register of Legal Entities, you can check it on the Federal Tax Service website in the “Check yourself and the counterparty” section) );

- number of the payment document if an advance was received for future deliveries;

- product name and unit of measurement;

- quantity;

- currency (ruble code - 643, US dollar - 840, euro - 978);

- price per unit of measurement;

- full cost;

- excise tax amount;

- tax rate;

- the amount of tax to be paid;

- total cost including taxes;

- country of origin of the goods (codes are set in accordance with the OK classifier (MK (ISO 3166) 004-97) 025-2001); if goods are produced in Russia, a dash is added;

- customs declaration number (if the goods were not produced in Russia);

- signatures of the manager and chief accountant (or an authorized person - by order or power of attorney) - on a paper document; enhanced qualified digital signature - on electronic.

Among the latest changes is the line

“Identifier of a government contract, agreement (agreement).” Applies to deliveries under government contracts. The Filling Rules specifically indicate that the line is filled only if there is an identifier. If absent, the line remains blank (there is no need to put a dash).

Filling by lines

Rules for filling out an invoice line by line:

- the first line is the serial number of the document in accordance with the established document flow rules;

- the date of preparation should not be earlier than the date of the original document;

- date and correction number are filled in if necessary;

- in the line “Seller” the full or abbreviated name is indicated in accordance with the constituent documents;

- the postal address is indicated in the “Address” line;

- in line 3, “same person” is entered if the seller and the shipper are the same person. Otherwise, you must provide the shipper's mailing address. When filling out an invoice for services and property rights, a dash is placed in this line;

- in term 4, according to the same rules, the data of the consignee is written;

- in line 5 “to the payment and settlement document” a dash is placed if the form is drawn up upon receipt of payment, partial payment or for upcoming deliveries using a non-cash form of payment;

- for line 7, the currency codes are given above.

The columns are filled in as follows:

- Column 1 indicates the name of the product or service provided;

- in column 2 - unit of measurement, if possible. A dash is placed upon receipt of payment or partial payment for upcoming deliveries. Columns 2 and 2a are filled out taking into account the All-Russian Classifier of Units of Measurement, introduced by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 366;

- Column 3 indicates the quantity or volume of the goods. If this indicator is not defined or is missing, you must put a dash. A dash is also added when payment or partial payment is received for upcoming deliveries;

- Column 4 (product price) is filled out according to similar rules;

- in column 6, if there is no excise tax amount, a corresponding note is made;

- in column 7 (tax rate) for transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made;

- Column 8 is filled out according to similar rules;

- columns 10-12 are filled in if the country of origin of the goods is not Russia, in accordance with the OK of the world (MK (ISO 3166) 004-97) - 025–2001.

This is what the completed document looks like.

If the form is an advance or correction form, this must be indicated, as well as what changes are being made to the form and on what basis. The signature of authorized persons is required: manager (trustee), chief accountant. A seal is not a mandatory requirement, but can be supplied (for example, at the buyer’s request).

All forms are stored in chronological order for at least 4 years, recorded in the Journal of received and issued invoices, in the Book of Purchases and Sales in order to be able to verify the calculation and payment of VAT.

Procedure for filling out an invoice

We discussed above which fields need to be filled out. Now let's go through the lines:

- (1). There will be a date and number here.

- (2), (2a), (2b), (6), (6a), (6b). Name, addresses, tax identification number and checkpoint of the buying and selling parties. Everything is in accordance with the constituent papers and charter, even if it is written in an abbreviated form.

- (3), (4). The name and postal address that are indicated for the recipient and sender of the cargo. For the SF, which is prepared on the basis of works or services, a dash is placed in this field.

- (5). The date and number that was assigned to the payment document if an advance was given. When it was not issued or was not monetary, a dash is indicated.

- (7). What is the name of the currency and its code. Even if a company has always operated exclusively in rubles, this is written anew in each Federation Council. There should be no ambiguity or other options.

- Table with graphs. In column 1 the name of the products currently being sold and as it was written in the contract or invoice.

- Column 2, 2a, 3, 4. Code and designation of what the product is measured in, volume, cost excluding VAT.

- Column 6. The amount of excise tax or the phrase “without excise tax” depending on the type of product.

- 7, 8. The size of the tax rate and how much it amounted to in rubles and kopecks is not rounded to whole numbers.

- 5, 9. Total cost of everything sold. In the first case, without VAT, and in the second - already taking into account the accrued tax. It is registered twice even if the company operates without VAT.

- 10, 10a, 11. It is necessary to fill out only if the company sells or resells imported goods.

At the end, the head of the organization or his authorized person must sign - usually an accountant. Below is a seal that certifies the correctness of all filled fields.

Common Mistakes

Errors that are most often encountered when filling out an invoice and their consequences:

- if the name, TIN, and address of the organization are incorrectly indicated or missing, it is difficult to establish the authorship and addressee of the document, so it may be declared invalid;

- if it is impossible to determine from the document what goods were transferred or service was provided, VAT will not be refunded;

- incorrect indication of currency, incorrect indication of the quantity of goods, errors in prices, incorrect calculation of cost lead to the fact that the exact cost of the goods cannot be determined. Thus, the document becomes uninformative;

- incorrect calculation of VAT. The absence of a VAT amount may also raise questions from regulatory authorities.

Minor errors in the form of missing characters, capital letters, or inaccuracies in payment details are usually not pursued by the tax authorities. It is also possible to abbreviate names if such an abbreviation allows you to identify the enterprise or product.

Types of invoices

There are several types of s/f:

What is the difference between these types?

However, depending on the type of s/f, its main function - accepting VAT for deduction - does not change . That is, having received any invoice, the taxpayer has the right to reduce his VAT by the amount of VAT indicated in the received document.

In some cases (for example, when receiving an adjustment account), VAT is not reduced, but adjusted . Naturally, this can only be done if the contract is drawn up based on a valid transaction and in accordance with all legal requirements.

Adjustment invoice

When making adjustments, the following rules must be observed:

- changes are made to both copies;

- changes must be endorsed by the seller’s manager or an authorized person (the signature of the chief accountant is not required) and certified by a seal;

- it is necessary to set a date for making corrections;

- erroneous data is crossed out and new ones are entered, indicating the column, and the explanation “Corrected” must be included.

If there are too many errors, it is better to make a new document. The norms of the Tax Code of the Russian Federation do not contain a ban on such an action.

Relevance

The 2020 sample invoice is a transfer document that must be drawn up taking into account the above rules. It must take into account changes made since 10/01/2017.

Let's summarize: invoice - what is it in simple words? In short, this is confirmation of payment and payment of VAT. There are peculiarities of filling out this form, advance or corrective, but the essence does not change. It is in this form that there are signatures of authorized persons who actually confirm the execution of the contract. Therefore, this is an extremely important document that it is advisable to include in contractual obligations. Payers on the general taxation system will also need proof of payment of value added tax.

New uniform in 2020

In connection with the increase in the basic VAT rate to 20%, a new form of invoice was introduced in accordance with the order of the Federal Tax Service of the Russian Federation dated December 19, 2018 No. ММВ-7-18/ [email protected] Changes were made to the electronic format of documents used for exchange via telecommunications communication channels. The order of the Federal Tax Service provides for a long transition period; until December 31, 2019, the right to apply the old format remains. Documents created using old formats must be accepted until December 31, 2022. Tax authorities recommend switching to the new format now in order to improve work efficiency.