Individual entrepreneur's obligations

Is an individual entrepreneur obligated to hand over proceeds to the bank? This does not always need to be done. Money is transferred to a financial institution only if there is a current account. However, according to the law, an entrepreneur may not open a current account, for example, if the cost of one transaction does not exceed 100 thousand rubles.

The cash form of payment is associated with the direct use of funds. To conduct payments in cash/non-cash form, you must follow the rules of cash discipline. Violation of the established procedure may result in administrative liability.

How not to hand over these funds?

If an organization does not have a limit on the funds that can be in the cash register at the end of the working day, then this limit is considered equal to zero; therefore, such an organization will not be able to avoid depositing the proceeds into the bank.

If a limit on the cash register is established and the trade proceeds in the cash register do not exceed this limit, then the organization has the right not to deposit funds at the end of the working day.

Attention. Anything over the established limit must be handed over to the bank at the end of the working day.

What is cash discipline

Cash discipline is aimed at regulating the procedure for receiving, storing and issuing money during cash transactions.

It includes:

- registration of incoming/outgoing documents;

- compliance with limits on storing cash in the cash register;

- compliance with the rules when issuing money on account to staff.

You can't just put money in the cash register or take it out. Relevant documents must be completed. However, for individual entrepreneurs, the requirements for cash discipline are a little softer than for organizations. Entrepreneurs can refuse to set a limit on the cash balance in the cash register. For UTII, PSN and in some cases for the simplified tax system, you don’t have to use cash registers.

In this case, the entrepreneur needs to establish the amount that will be kept in the cash register at the end of the working day and ensure their safety. In the Republic of Belarus, cash register limits are established for everyone without exception. Even for private notaries working in the territory of the Republic of Belarus.

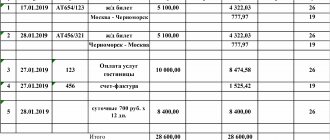

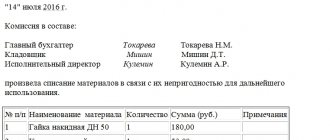

An example of filling out an expense cash order when depositing cash at a bank

Accountants usually explain this by saying that they indicate in the order the posting of Account Dt 51 - Account Kt 50, but in their opinion it does not imply the preparation of cash settlements for an individual. That is, they believe that the money under such a cash settlement is issued immediately to the bank, and the recipient’s signature is replaced by a bank receipt attached to the order. What is wrong. The following rules for drawing up cash settlements and the rules for issuing money from the cash register were violated.

Firstly, the RKO must indicate f. And. O. and passport details of the person to whom the money was issued, and his signature must be on it. This is a requirement not only of the Regulations on the procedure for conducting cash transactions. 4.2 Regulations, approved. Central Bank of October 12, 2011 No. 373-P (hereinafter referred to as the Regulations), but also the Law on Accounting. 2 tbsp. 9 of the Law of December 6, 2011 No. 402-FZ. After all, the RKO is the primary document. Secondly, the cashier does not have the right to give out money until the recipient signs and writes the amount in words. 4.3 Provisions. The attached primary and other documents on the basis of which money is issued (orders, statements, receipts) are indicated. The following lines are signed by the head of the organization and the chief accountant (or other authorized person). The signature of the manager in the RKO is not required, provided that he has given permission to carry out the operation in the documents attached to the consumables.

The line "Received". Filled out by the person to whom funds are issued from the cash register. In this case, rubles are indicated in words with a capital letter, and kopecks - in numbers. If there is a blank line left after writing the amount in rubles, a dash is placed in it.

Below is the signature of the recipient and the date of receipt of the money. When issuing money according to a debit order, the cashier requires the presentation of a document (passport, military ID, driver's license, etc.) identifying the recipient.

Why donate your proceeds?

Not everyone understands why an individual entrepreneur needs to hand over proceeds to the bank. This procedure is enshrined in the Directive of the Central Bank dated March 11, 2014 No. 3210-U and is associated with ensuring financial security. Establishing cash limits for organizations also allows the state to control the movement of money within the country.

Entrepreneurs who have not opened a current account and do not use cash registers (often working with the simplified tax system for a single tax) may not adhere to the limiting rules. Other business entities are required to set limits. Otherwise, entrepreneurs face administrative or criminal liability.

However, there are exceptions when the cash limit can be exceeded without being held liable:

- if it is a holiday or day off, but the enterprise is open;

- during statutory payments (salary, stipend).

On video: Cash transactions. Legislative changes

Enter the site

RSS Print

Category : Accounting Replies : 49

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (5) »

| Dimka |

| Good afternoon, please tell me. Individual entrepreneur, retail trade, has a cash register. Do I have to deposit the proceeds into a bank account and why should I deposit them? What penalties can be applied for failure to hand over the proceeds and who should have notified the individual entrepreneur that it must be handed over if so? The individual entrepreneur makes all payments through the bank’s cash desk, including taxes, purchase of goods, Social Security Fund for himself, etc. |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Tananda// [email hidden] Wrote 13010 messages Write a private message Reputation: 2382 | #2[853524] November 9, 2020, 11:13 |

Notification is being sent...

all women are angels, but when their wings are clipped, they have to fly on a broom| Dimka [email hidden] Wrote 14 messages Write a private message Reputation: | #3[853531] November 9, 2020, 11:33 |

Notification is being sent...

| Bagheera [email hidden] Belarus, Minsk Wrote 418 messages Write a private message Reputation: | #4[853569] November 9, 2020, 12:49 pm |

Question: Is an individual entrepreneur obliged to hand over proceeds to the bank? Answer: Yes, he is obliged if he has a current (settlement) bank account (hereinafter referred to as the account) opened at the bank. Individual entrepreneurs (IP) are required to open bank accounts if: - the monthly amount of revenue from the sale of goods (work, services), except for revenue received from activities for which these individual entrepreneurs pay a single tax in accordance with legislative acts, exceeds the amount , equivalent to 1000 basic units, on the first day of the month in which the goods (works, services) were sold; — cash is accepted by them using cash registers or special computer systems. The Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2011 N 107 (hereinafter referred to as the Instruction), establishes a unified procedure for conducting cash transactions and the procedure for cash settlements funds in Belarusian rubles (hereinafter referred to as cash) on the territory of the Republic of Belarus (clause 1 of the Instructions). Individual entrepreneurs who have opened accounts, in accordance with the law, deposit cash: - to the servicing bank and (or) its divisions, other banks; - employees of the collection service; — in organizations subordinate to the Ministry of Communications and Informatization of the Republic of Belarus (clause 5 of the Instructions). Individual entrepreneurs who have opened accounts independently, in writing, unless otherwise provided by law, determine the procedure and terms for depositing cash (Part 1, Clause 10 of the Instructions). Certain procedures and deadlines for depositing cash are valid for the period established by the individual entrepreneur who opened the account, independently in writing (part 5, clause 10 of the Instructions). The procedure and terms for depositing cash may be revised by the individual entrepreneur who opened the account in the event of a change in the volume of cash turnover and for other reasons (part 6, clause 10 of the Instructions). Individual entrepreneurs who have opened accounts inform the servicing bank (by decision of the head of the bank or a person authorized by him) within the time limits determined by the agreement between the individual entrepreneur who opened the account and the servicing bank, information about the specific procedure and deadlines for depositing cash, the amount of cash planned for delivery, changes in delivery deadlines and amounts of cash (Part 8, Clause 10 of the Instructions). Example. The wording in the IP decision: “1. Deliver the proceeds to the Bank. Hand over the proceeds to the Bank on the last working day of the month during the time established by the Bank for servicing individual entrepreneurs. If the working days of the individual entrepreneur and the Bank do not coincide, the proceeds are surrendered on the last working day of the Bank. 2. The validity period of this procedure for the delivery of proceeds to the Bank shall be established from 01/01/2016.” Thus, if an individual entrepreneur, in accordance with the requirements of the law, has an account opened in a bank, then he is obliged to hand over the proceeds.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Dimka [email hidden] Wrote 14 messages Write a private message Reputation: | #5[853580] November 9, 2020, 1:18 pm |

Bagheera wrote:

Scroll

Question: Is an individual entrepreneur obliged to hand over proceeds to the bank? Answer: Yes, he is obliged if he has a current (settlement) bank account (hereinafter referred to as the account) opened at the bank. Individual entrepreneurs (IP) are required to open bank accounts if: - the monthly amount of revenue from the sale of goods (work, services), except for revenue received from activities for which these individual entrepreneurs pay a single tax in accordance with legislative acts, exceeds the amount , equivalent to 1000 basic units, on the first day of the month in which the goods (works, services) were sold; — cash is accepted by them using cash registers or special computer systems. The Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2011 N 107 (hereinafter referred to as the Instruction), establishes a unified procedure for conducting cash transactions and the procedure for cash settlements funds in Belarusian rubles (hereinafter referred to as cash) on the territory of the Republic of Belarus (clause 1 of the Instructions). Individual entrepreneurs who have opened accounts, in accordance with the law, deposit cash: - to the servicing bank and (or) its divisions, other banks; - employees of the collection service; — in organizations subordinate to the Ministry of Communications and Informatization of the Republic of Belarus (clause 5 of the Instructions). Individual entrepreneurs who have opened accounts independently, in writing, unless otherwise provided by law, determine the procedure and terms for depositing cash (Part 1, Clause 10 of the Instructions). Certain procedures and deadlines for depositing cash are valid for the period established by the individual entrepreneur who opened the account, independently in writing (part 5, clause 10 of the Instructions). The procedure and terms for depositing cash may be revised by the individual entrepreneur who opened the account in the event of a change in the volume of cash turnover and for other reasons (part 6, clause 10 of the Instructions). Individual entrepreneurs who have opened accounts inform the servicing bank (by decision of the head of the bank or a person authorized by him) within the time limits determined by the agreement between the individual entrepreneur who opened the account and the servicing bank, information about the specific procedure and deadlines for depositing cash, the amount of cash planned for delivery, changes in delivery deadlines and amounts of cash (Part 8, Clause 10 of the Instructions). Example. The wording in the IP decision: “1. Deliver the proceeds to the Bank. Hand over the proceeds to the Bank on the last working day of the month during the time established by the Bank for servicing individual entrepreneurs. If the working days of the individual entrepreneur and the Bank do not coincide, the proceeds are surrendered on the last working day of the Bank. 2. The validity period of this procedure for the delivery of proceeds to the Bank shall be established from 01/01/2016.” Thus, if an individual entrepreneur, in accordance with the requirements of the law, has an account opened in a bank, then he is obliged to hand over the proceeds.

And if the bank account was closed by the bank itself, the bank did not notify the individual entrepreneur about this, and the individual entrepreneur himself, let’s say, never handed over the proceeds to the bank, but there was a current account, what should he do, surrender, to whom should he surrender? And what fines are provided and are there any ways out of this situation? In fact, the individual entrepreneur paid a single tax, paid the Federal Social Security Fund + salary, made payments for the goods for sale, and after all the above actions he did not have a penny left, which he had to hand over to the bank, or at least 500 thousand remained old.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Bagheera [email hidden] Belarus, Minsk Wrote 418 messages Write a private message Reputation: | #6[853583] November 9, 2020, 1:22 pm |

Notification is being sent...

| Dimka [email hidden] Wrote 14 messages Write a private message Reputation: | #7[853595] November 9, 2020, 1:46 pm |

Notification is being sent...

| Tananda// [email hidden] Wrote 13010 messages Write a private message Reputation: 2382 | #8[853600] November 9, 2020, 1:51 pm |

Dimka wrote:

Bagheera wrote:

Scroll

Question: Is an individual entrepreneur obliged to hand over proceeds to the bank? Answer: Yes, he is obliged if he has a current (settlement) bank account (hereinafter referred to as the account) opened at the bank. Individual entrepreneurs (IP) are required to open bank accounts if: - the monthly amount of revenue from the sale of goods (work, services), except for revenue received from activities for which these individual entrepreneurs pay a single tax in accordance with legislative acts, exceeds the amount , equivalent to 1000 basic units, on the first day of the month in which the goods (works, services) were sold; — cash is accepted by them using cash registers or special computer systems. The Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2011 N 107 (hereinafter referred to as the Instruction), establishes a unified procedure for conducting cash transactions and the procedure for cash settlements funds in Belarusian rubles (hereinafter referred to as cash) on the territory of the Republic of Belarus (clause 1 of the Instructions). Individual entrepreneurs who have opened accounts, in accordance with the law, deposit cash: - to the servicing bank and (or) its divisions, other banks; - employees of the collection service; — in organizations subordinate to the Ministry of Communications and Informatization of the Republic of Belarus (clause 5 of the Instructions). Individual entrepreneurs who have opened accounts independently, in writing, unless otherwise provided by law, determine the procedure and terms for depositing cash (Part 1, Clause 10 of the Instructions). Certain procedures and deadlines for depositing cash are valid for the period established by the individual entrepreneur who opened the account, independently in writing (part 5, clause 10 of the Instructions). The procedure and terms for depositing cash may be revised by the individual entrepreneur who opened the account in the event of a change in the volume of cash turnover and for other reasons (part 6, clause 10 of the Instructions). Individual entrepreneurs who have opened accounts inform the servicing bank (by decision of the head of the bank or a person authorized by him) within the time limits determined by the agreement between the individual entrepreneur who opened the account and the servicing bank, information about the specific procedure and deadlines for depositing cash, the amount of cash planned for delivery, changes in delivery deadlines and amounts of cash (Part 8, Clause 10 of the Instructions). Example. The wording in the IP decision: “1. Deliver the proceeds to the Bank. Hand over the proceeds to the Bank on the last working day of the month during the time established by the Bank for servicing individual entrepreneurs. If the working days of the individual entrepreneur and the Bank do not coincide, the proceeds are surrendered on the last working day of the Bank. 2. The validity period of this procedure for the delivery of proceeds to the Bank shall be established from 01/01/2016.” Thus, if an individual entrepreneur, in accordance with the requirements of the law, has an account opened in a bank, then he is obliged to hand over the proceeds.

And if the bank account was closed by the bank itself, the bank did not notify the individual entrepreneur about this, and the individual entrepreneur himself, let’s say, never handed over the proceeds to the bank, but there was a current account, what should he do, surrender, to whom should he surrender? And what fines are provided and are there any ways out of this situation? In fact, the individual entrepreneur paid a single tax, paid the Federal Social Security Fund + salary,

made payments for the goods for sale, and after all the above actions he did not have a penny left, which he had to hand over to the bank, or at least 500 thousand remained old. and who did he pay the salary to?... i.e. ran the cash register with registration of PKO and RKO?

Notification is being sent...

all women are angels, but when their wings are clipped, they have to fly on a broom| Dimka [email hidden] Wrote 14 messages Write a private message Reputation: | #9[853604] November 9, 2020, 14:00 |

Notification is being sent...

| Dimka [email hidden] Wrote 14 messages Write a private message Reputation: | #10[853608] November 9, 2020, 2:06 pm |

Notification is being sent...

« First ← Prev.1 Next → Last (5) »

In order to reply to this topic, you must log in or register.

What determines the size of the limit?

According to the Directives of the Central Bank of the Russian Federation, a business entity must calculate the limit of money available in the cash register.

The following values are used for this:

- volume of cash receipts from commercial activities;

- the billing period in which the individual entrepreneur receives funds from the sale of goods and services.

- the period between the moments of depositing funds into the bank.

The latter indicator is calculated based on criteria such as operating hours and seasonality. The maximum period is 7 days.

General procedure

According to clause 2 of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, all cash in excess of the established limit must be kept in a bank account.

An organization can deposit funds to the bank in the following ways:

- Through the organization that is part of the Central Bank of the Russian Federation system (for example, through the collection service).

- By independently transferring funds to the operating cash desk of a banking institution.

The list of officials who have the right to deposit funds in the bank is not established by law. However, it would be more appropriate for the organization to have the cashier hand over the cash to the bank and be financially responsible for the safety of the money entrusted to him. According to the Regulations of the Central Bank of the Russian Federation dated January 29, 2018 No. 630-P, credit institutions can provide cash collection services.

How is the proceeds distributed?

If everything is clear with the question of whether individual entrepreneurs should hand over proceeds to the bank, then difficulties arise with how to do this. How to deposit proceeds from an individual entrepreneur to the bank? The money is transferred to the bank where the entrepreneur’s current account is opened. You can bring the proceeds yourself or with the help of collectors.

When you transfer money to an employee of an enterprise yourself, you need to prepare an announcement for a cash contribution.

Bank employees can also deal with this issue on the appropriate instructions of the individual entrepreneur. Cash collection is the collection of funds from entrepreneurs for their further transfer to the bank.

Advantages of collection through specialized institutions:

- There is no risk of accidental loss or theft of money.

- If you exceed your balance, you don’t need to stop what you’re doing to immediately take the money to the bank.

- If the balance limit is exceeded, and the collectors did not manage to take out and hand over the money on time, then the organization that provides collection services bears responsibility.

The only disadvantage of using third-party organizations is the additional costs associated with paying for the services of collectors. Therefore, the individual entrepreneur decides independently how to hand over the proceeds.

Cash limit

According to the instructions of the Bank of Russia (No. 3210-U), the organization’s cash in excess of the limit must be stored in a bank account. Money should remain in the cash register only within a certain limit. This limit is determined by the head of the company. The cash balance in the cash register is compared with the established limit, which is withdrawn according to the cash book at the end of the working day. If it turns out that there is more money in the cash register than the established limit, then the difference should be handed over to the bank. The company independently determines how often the proceeds in excess of the limit are deposited with the bank. This, for example, can be done once every 5 days. The main thing is that cash delivery should not be less than 7 working days. But if the company is located in a locality where there is no bank, then this period of time can be increased to 14 working days. However, if the limit at the cash desk is exceeded before the deadline for depositing cash is set, then the funds must be deposited without waiting for the deadline to expire. As long as the limit is not exceeded, there is no need to visit the bank (

Responsibility for failure to return balances

The Federal Tax Service letter ED-4-2/13338 describes in detail the procedure for holding an entrepreneur accountable for violating cash discipline. Main reasons:

- cash payments over a certain limit;

- expenditure of cash for non-target needs;

- exceeding the cash limit;

- non-receipt of cash proceeds. Here the Federal Tax Service includes incorrect maintenance of cash books and other documents by entrepreneurs.

The following liability is established for violations of cash discipline:

- imposition of a fine on the enterprise - 40–50 thousand rubles;

- imposition of a fine on an official of the enterprise – 4–5 thousand rubles. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Both penalties can be applied simultaneously. Control powers in the field of cash discipline are assigned to the tax authorities. Prosecution for a violation can only be held within two months from the date of its commission. After this period has expired, the entrepreneur cannot be held legally liable.

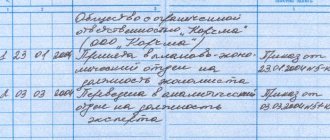

How to keep a cash book in 2020

Fill out the cash book only for those days when you received or issued cash. The basis for the entries will be incoming and outgoing cash orders. If you do not make entries, the inspectorate will fine you during the inspection (Clause 1, Article 15.1 of the Administrative Code):

- company - in the amount of 40,000 to 50,000 rubles;

- entrepreneur or director of a company - in the amount of 4,000 to 5,000 rubles.

The procedure for conducting cash transactions in 2020 provides that the cash book can be maintained in several ways:

- by hand on paper;

- fill out on the computer and then print;

- electronic.

Entrepreneurs who keep records of income and expenses or physical indicators in accordance with tax legislation have the right not to fill out a cash book (clauses 1 and 4.6 of Directive No. 3210-U). Individual entrepreneurs who have not refused to register cash transactions maintain one cash book.

For companies, the number of books depends on whether they have separate divisions. If not, companies keep the same book regardless of whether they have combined tax regimes. If there are separate divisions, then keep your own cash book for each division (paragraph 7, clause 4.6 of Directive No. 3210-U and letter of the Federal Tax Service dated May 17, 2013 No. AS-4-2 / [email protected] ).

How to deposit the balance of funds to the bank: registration procedure

Regardless of the method by which cash is delivered to the bank, you will need to issue a RKO (cash expenditure order) and also make an entry in the cash book. The RKO contains the following information:

- in the “Issue” line, the full name of the company employee who collects and transfers funds to collectors is indicated;

- in the line “Appendix” the dates and numbers of the primary documents are indicated.

If a company employee deposits cash directly at the bank’s cash desk, then an announcement for a cash deposit is filled out, consisting of the following parts: an announcement, a receipt and an order.

If cash is handed over to a collector, then before their arrival it is necessary to prepare the money, add it to a special amount issued by the bank and draw up the following documents:

- transmittal sheet;

- invoice for the bag;

- receipt for the bag.

The cashier places the statement in the bag with cash, which is then sealed so that it would be impossible to open it unnoticed during transportation. The bag of cash along with the invoice is handed over to the collector. The cashier will also need to fill out an appearance card, which the collector will present to him. Upon accepting the amount, the collector will sign the receipt and put a stamp on it. After this, the receipt is given to the cashier and remains with the company. The specified procedure is provided for by Bank of Russia Regulation No. 318-P.

The bank teller will have to check the amount of money handed over to him with the one indicated in the advertisement. If everything is correct, then he signs all the documents, and gives the receipt to the company employee. If the amounts are different, then the announcement for cash donation will need to be issued again. The bank teller will have to cross out the erroneous document and indicate the actual amount and his signature on the back. If, when checking cash, the cashier finds a questionable bill, the bank cashier will send it for examination. In this case, he will need to compile:

- act of opening the bag and counting the cash;

- order for the transfer of valuables;

- certificate of acceptance of banknotes for examination.

If, as a result of the examination, it turns out that the bill is in fact counterfeit, the company will be issued an examination report.