How to write

Trust documents are made in writing. Signed by the manager or other authorized executor (clause 4 of article 185.1 of the Civil Code of the Russian Federation, subclause 2 of clause 3 of article 40 of the 14-FZ). Here's how to compose them:

- Title the document.

- Indicate the city and date of issue.

- Indicate the details of the organization, full name of the head.

- Enter information about the person you trust: his full name, passport details and address.

- List powers.

- Certify the signature of the trustee if he is entrusted with the right to sign on behalf of the institution.

- Sign the document with the head of the enterprise.

Rules for drawing up a document

There is no unified power of attorney form in the Social Insurance Fund, so enterprises and organizations can write it in any form or use an internal template registered in the company’s accounting policies. To ensure that the power of attorney does not raise doubts among the receiving party, the form must contain a number of necessary information:

- information about the principal company: its full name, position and full name of the director, as well as personal information about the representative (full name and passport details),

- the structure for presentation into which the document is developed is named,

- a detailed list of functions that the principal’s representative has the right to perform on the basis of this document is listed.

Rules for issuing a power of attorney in the FSS

There is no need to follow any special rules when drawing up a document. They are standard for similar documentation. The document must contain a header, a body and an ending. Information can be entered not only by hand, but also using a computer. As already mentioned, many companies use special forms for this. But a power of attorney drawn up on a simple piece of paper is also considered valid.

The principal has the right to indicate any information related to this power of attorney. At the same time, you should avoid vague information and wording. You need to try to avoid mistakes. They can be so rude that FSS employees recognize the document as invalid. As for the seal, today companies can work without them, so a stamp in the power of attorney is not necessary.

A trust document is drawn up in one copy. It is handed over to an authorized person. After the power of attorney expires, the representative is obliged to return the power of attorney to the head of the company.

Contents of the power of attorney

As for the content, it is logical to assume that all important information must be present here. The power of attorney must indicate not only the essence of its execution, but also detailed information about the participants in the transaction. So, first the so-called “cap” must be filled out. This includes not only the title of the document, but also the place and date of its preparation. Below is the main part, which is considered to be as detailed as possible. The following information is entered here:

- information about the principal party. The full name of the organization, its organizational and legal form, and information about the constituent documents are noted. The full name and other information of the director, who is the initiator of drawing up such a power of attorney, is also written down;

- information about why a power of attorney is needed. If it is compiled by the Social Insurance Fund, you can indicate which specific structural unit will be submitted to;

- It would be useful to specify on what basis the director issues this power of attorney. It can be noted according to which documents he holds this leadership position;

- Next comes the personalization of the confidant. Not only his full name, but also other passport details are indicated here. Since this is often an employee of the company, it is necessary to indicate the position he occupies;

- a list of actions for which the representative has permission. Usually, if an employee is vested with some kind of authority, it is not just receiving documents. It is possible that upon receipt you will have to sign some documentation. This must also be written down. If a representative is vested with several powers, each of them should be indicated in a separate paragraph. This way, the person to whom the power of attorney will be presented will be able to quickly find the necessary information;

- mark the information about the period during which the authorized person will be able to use this document;

- It would not be out of place to indicate that the representative is deprived of the opportunity to draw up a transfer of power. If he is endowed with such powers, it should be written: “With the right of subrogation.”

Then comes the final part. It must include the signatures of all interested parties. Moreover, the principal's autograph is mandatory. Without it, the document is considered void. As for the attorney, his signature is desirable, but not required. In some cases, such powers of attorney are certified through a notary office. In this case, a notary signature and seal are affixed here.

How to upload to the FSS portal

Those who submit electronic reports to the fund confirm their rights to act on behalf of the organization in electronic form. Here's how to upload a power of attorney to the FSS portal from the policyholder:

- Go to your personal account.

- Open the “Form 4-FSS” section, and in it - the “Authorized” tab.

- Select the “Add” action and find the policyholder from the proposed list. Save.

- Load the form from the “File” tab and find the one you need in the PC system. Save changes.

- Submit the original trust papers and the trustee’s passport to the territorial office of the fund for verification of personal information.

How to compose correctly

The sample power of attorney in the FSS has a free form of writing. The manager has the right to independently decide which clauses to include in the text of the contract, what the structure and scope of the contract will be. You can draw up an official sheet on a regular A4 sheet or on the company’s letterhead; this does not play any role. A correctly drawn up agreement: a power of attorney in the Social Insurance Fund has:

- name of the form;

- date of compilation and name of the locality in which it was registered;

- details of the principal;

- a list of documents that serve as the basis for actions performed by the principal;

- information about the authorized person;

- list of duties of the attorney;

- validity period of the form;

- signatures of both parties to the agreement.

In cases where the principal has lost confidence in the representative, he can revoke the document before its expiration date. To do this, you will need to draw up an act, indicating in it that the person is no longer a representative of the company. The completed official sheet is sent to the competent structure, and then, if possible, the power of attorney is withdrawn from the authorized person.

For an authorized representative

In order to draw up a power of attorney for the social insurance fund, you must:

— Indicate the name of the document, date and place of signing (A4 sheet is used).

— We indicate the details of the principal - an individual (full name, passport details, date of issue, place of registration) or a legal entity (full name of the general director, tax identification number, checkpoint, actual and legal address of the organization). All data is filled in based on the original documents.

— We register the name and passport details of the authorized person. The authorized person can be an employee of the organization or a courier who will transfer documents to the Social Insurance Fund.

— The power of attorney form contains a list of what actions an authorized representative in the fund can carry out.

— This law does not establish prohibitions on the validity period of a power of attorney, so you can set any validity period for a power of attorney - from 1 day to several years.

— It is acceptable not to indicate the expiration date of the contract, but in this case the validity will last 1 year from the date of signing.

— The presence of signatures of both parties to the power of attorney, both the principal and the authorized representative.

The signature of an authorized representative can be confirmed by the head of the enterprise on whose behalf the power of attorney is issued, as well as by an employee of the Social Insurance Fund or a notary (if the principal is an individual).

When and who needs it

A sample power of attorney for submitting documents to the Social Insurance Fund, proposed below, must be issued to a representative of the organization if it is necessary to send various established reports to the government agency. In this case, there is a need to redistribute the load between the manager and the employee who will be entrusted with working with reports.

To represent the interests of an institution, a person must be vested with certain powers. In accordance with paragraph 1. Art. 182 of the Civil Code of the Russian Federation, an individual can act on behalf of a legal entity on the basis of:

- administrative act of an authorized government agency;

- direct reference to legislation (for example, on behalf of an LLC - its director);

- powers of attorney.

It can be issued to a citizen by either an organization or an individual entrepreneur. This document is required to confirm the authority of the representative. In the absence of such a certificate, any actions related to copies may be declared invalid in court.

There is no established sample of a power of attorney for the provision of documents to the Social Insurance Fund, therefore, when drawing up a paper that makes it possible to interact with a government agency, you must comply with the existing requirements of the Civil Code of the Russian Federation.

In accordance with paragraph 4 of Art. 185.1 of the Civil Code of the Russian Federation, a legal entity issues a document signed by the first person of the organization, that is, the head.

Stamping is not mandatory, since after September 2013 it is not a mandatory requirement.

The issuance period can be any, since the three-year limit was abolished in September 2013. If there is no information about the period in the text, the document is valid for one year from the date of issue (Article 186 of the Civil Code of the Russian Federation).

Any sample power of attorney (FSS is no exception) includes information about the date and place of execution. These details are presented entirely in words without abbreviation. A sample power of attorney for representation of interests in the Social Insurance Fund, which does not have a date, cannot be used, as it may be declared invalid.

The institution that entrusts certain actions to be carried out indicates the following information:

- name (full), including organizational and legal form (clause 1, 4, article 54 of the Civil Code of the Russian Federation);

- the address at which it is located (clauses 2, 3 of Article 54 of the Civil Code of the Russian Federation);

- OGRN and (or) TIN;

- information about the person issuing.

The organization enters information about bank details and other information at its discretion.

The official paper can be drawn up in free written form, on the institution’s own letterhead (the latter is not necessary, since the presence of the form is not the responsibility of the institution).

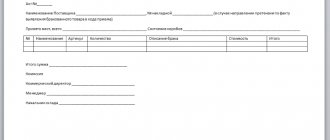

When registering credentials, the following information must be provided:

- Title of the document;

- start date;

- details of the trusting legal entity or individual entrepreneur;

- position and full name the head of the company issuing the document;

- details of the document that is the basis for the activity;

- data of the representative (full name, date of birth, passport details, place of residence, position);

- list of trusted powers;

- signature of a representative of the organization who is trusted to exercise powers;

- signature of the director (facsimile is not allowed).

The manager signs the paper in one copy and issues it to the employee indicated in the paper against signature. The employee must keep this document.

As a general rule, a power of attorney of this format is issued during the reporting period. A possible list of functionality that can be entrusted to an employee by a manager is as follows:

- sign and provide calculations for calculating insurance premiums;

- provide paperwork on the correct calculation of contributions;

- send documents for bilateral reconciliation of calculations regarding penalties and fines;

- sign and provide applications to clarify details;

- provide information, requests;

- familiarize yourself with inspection reports.

Sample power of attorney for Social Insurance Fund 2020

Payers of contributions have the right to submit documents and reports on paper to the Social Insurance Fund through their representatives. They may be accounting employees, couriers, drivers and other persons authorized by the payer. The powers of representatives must be confirmed by a properly executed power of attorney to submit reports to the Social Insurance Fund or other documents. Let's consider how to correctly draw up such a power of attorney.

General requirements for a power of attorney in the Social Insurance Fund

A power of attorney can be issued by both an organization and an individual entrepreneur. The FSS does not have a special form for such a document; you can draw it up yourself. When drawing up a power of attorney, please note that it can only be in writing and must contain the following information:

- the name “Power of Attorney”, the date of the document and the validity period of the power of attorney (if the period is not specified, the document will be valid for a year),

- information about the organization or individual entrepreneur who issued the power of attorney,

- passport details of the representative,

- the possibility or impossibility of entrusting it to another person,

- handwritten signatures of the authorized representative and manager, or individual entrepreneur,

- the seal of the organization, individual entrepreneurs must notarize the power of attorney.

A power of attorney can be one-time or issued for a long term. It is advisable to clearly indicate in the text for what purposes it was issued, but you can limit yourself to general functions if their scope for an authorized employee cannot be clearly defined.

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...