Order for the appointment of an accountant: why is it needed?

Hiring of such specialists is carried out on a general basis, according to the standard procedure:

- The employee is given instructions and is introduced to all local documentation.

- Studying the job description.

- Conclusion of an employment contract.

- Execution of an order in the T-1 form or in another version.

- Filling out a personal card.

- Entering information into the work book.

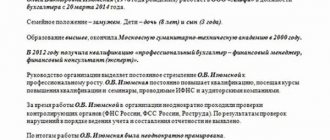

Chief accountants must have a higher education in their field. This can only be compensated for by practical experience. At least 5 of the last 7 calendar years must be spent in a similar position. If the length of service and experience meet the general requirements, it is not necessary to take advanced training courses.

The order of appointment to a position is not considered a mandatory document. Inspection authorities will not make demands or claims if there is no paper. Another thing is an order that specifically records the hiring of a citizen.

There are only a few situations where an employment order may be required:

- so that the employee can learn his duties;

- compiling a list of tasks that the resigning employee transfers to the new one;

- confirmation of statuses.

How to write a document correctly

These requirements are not mandatory for private enterprises. However, any manager will want to have a responsible, experienced chief accountant with no criminal record.

The order also indicates the place of work (for example, a specific structural unit or branch of the organization), the employee’s position, start date of work, salary and other conditions. An order is an operational act that is relevant until the occurrence of a certain circumstance. An example of such a document is an order on the formation of a commission. It will be in effect until this commission resolves the required issue. A relatively wide range of employees can sign orders.

Appointment of a chief accountant: features

The procedure for transferring powers and affairs from an employee who previously held the position becomes mandatory. The new chief accountant himself determines the reporting period for which he agrees to accept all the necessary information. According to the law, accounting documents are stored at enterprises for at least five years.

Accounting for the last few months requires detailed verification if it cannot be carried out for the previous five years.

When hiring at the beginning of the reporting period, all primary documentation is transferred by the predecessor in full. This applies to accounting journals and notebooks, a ready-made balance sheet for current funds.

That is, the following are subject to verification:

- Checkbook registers for banking organizations.

- Journal with invoices.

- Registration of powers of attorney.

- The same goes for securities.

- A book describing purchases and sales.

- Accounting documents related to cash register equipment.

- Primary reporting.

In essence, the procedure is similar to on-site tax audits.

Can a chief accountant work part-time?

A chief accountant is an employee whose main job functions are organizing, accounting and controlling all aspects of the enterprise’s economic activities. In fact, the head of the accounting department is called the chief accountant. This is one of the most significant figures in every company. The profitability and smooth functioning largely depends on how competent .

The work of the chief accountant is regulated by the Labor Code of the Russian Federation and Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”.

However, not all companies can afford a full-time chief accountant. Optimizing labor costs forces company managers to look for other employment options for this position. One of these options is part-time work.

Part-time work in accordance with Art. 282 of the Labor Code of the Russian Federation - labor activity of an employee in his free time from his main job.

Russian labor legislation does not contain norms that would prevent part-time employment as a chief accountant. However, in this case, when hiring, it is necessary to take into account the general restrictions on employment for part-time workers provided for in Art. 282, 329, 276 Labor Code of the Russian Federation.

According to these Labor Code standards, part-time work is not used for the following categories of workers:

- minors;

- state and municipal employees;

- persons working in harmful (dangerous) working conditions - under similar conditions at the place of primary employment;

- persons associated with transport management – already working under the same conditions at their main job;

- military personnel, judges, lawyers, prosecutors (except for pedagogy, science and creativity);

- security guards - in relation to public service and paid work in public associations;

- heads of organizations (without permission for part-time work received from the general meeting of participants of the organization (board of directors) where they work at their main place of work).

In practice, many legal entities currently prefer that a manager . An order is issued about this and an agreement is concluded. However, in accordance with Art. 7 of Federal Law No. 402-FZ dated December 6, 2011, not every manager can be a part-time chief accountant. This is valid for:

- economic entities that have the right to conduct accounting in a simplified form, including submitting simplified financial statements;

- legal entities - medium-sized businesses;

- organizations that are not included in the list specified in Part 5 of Art. 6 of the Federal Law “On Accounting”.

There are other restrictions . So, part 3 of Art. 11.1 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities” prohibits combining the position of chief accountant of a credit organization with such a position in:

- credit institutions;

- foreign banks;

- insurance or clearing organizations;

- professional participants in the securities market;

- organizers of trade in commodity and/or financial markets;

- joint stock investment funds;

- specialized depositories of investment funds, mutual investment funds and non-state pension funds;

- organizations involved in pension provision and pension insurance;

- management companies of investment funds, mutual funds and non-state pension funds;

- microfinance companies;

- organizations engaged in leasing activities or affiliated with a credit institution.

Restrictions may also be established for state-owned enterprises , a conflict of interest may occur .

Thus, a commercial organization independently decides to hire an employee of another company for the position of chief accountant. After all, this can lead to leakage of commercial information.

possible to combine the position of chief accountant with another job , if this does not contradict the interests of employers. The main thing is that the following mandatory conditions are met:

- the future chief accountant is already in an employment relationship (that is, he has a main place of work where his work record book is kept);

- an employment contract has been concluded with the employee;

- the chief accountant will perform his work only in his free time from his main job;

- The part-time worker’s work will take place and be paid regularly.

Filling out an order

The first is not only the date of formation of the order, but also the number according to the rules of internal document flow. It is considered that from this time the new employee assumed his position, unless the document itself contains other adjustments.

Next, indicate the employee’s full name and information regarding whether the appointment is on a temporary or permanent basis.

Features of an employment contract with a part-time HOA accountant

An agreement with a part-time HOA accountant can be concluded for an indefinite period. Moreover, an accountant can work under such agreements in several HOAs at the same time . It is also possible to become an HOA accountant for remote work.

In the contract with the HOA accountant, it is important to clearly indicate job responsibilities . In particular, maintaining accounting and tax records, as well as interaction with the management organization (MC). The right to sign documents can be secured in an order or power of attorney.

What other nuances should be taken into account when making an appointment?

Based on the hiring order, entries are made in work books; this is a general rule. The order for appointment to a position is not used in this case. The main basis for all additional documents is the Employment Agreement with the employee, signed in accordance with current regulations.

The content of the employment contract itself is the subject of separate agreements. There is information that is among the most important:

- the urgency of the relationship itself;

- completeness of reflection of job responsibilities;

- responsibility;

- conditions related to remuneration.

Separately, they check that the candidate fully meets the requirements for the position.

Documentation is most often divided into categories so that accounting and storage cause as few problems as possible. It is assumed that absolutely all forms will be structured based on certain characteristics. This is also the responsibility of accountants, including chief accountants.

At the same time, enterprises are allowed to create their own classifications, since there is no single standard in this direction. You can add the necessary subclasses depending on how the working conditions develop.

Nuances when registering as a chief accountant

The legislation stipulates several grounds when working conditions may be determined for the chief accountant that differ from those established for ordinary employees:

- You can conclude a temporary employment contract with the chief accountant, without additional grounds. This is indicated by the article of the Labor Code of the Russian Federation. It states that a fixed-term employment contract can be signed by agreement of the parties. But in practice, the inclusion of a temporary work clause in the contract comes from the employer, and the employee can either agree with it or refuse employment.

- For the chief accountant, the probationary period can be increased to six months (Article of the Labor Code of the Russian Federation). This is not the employer’s obligation, but only his right, that is, he can set the trial period, for example, three or four months. Six months is the maximum possible period. This condition must be included in the text of the employment contract. If it is missing, then the person will be considered accepted without a probationary period.

- The employment contract may specify an irregular working day for the chief accountant (Article 101 of the Labor Code of the Russian Federation).

- For this category of workers, it is allowed to establish full financial liability (Article 243 of the Labor Code of the Russian Federation).

For chief accountants, as a rule, the standard forms of employment contracts in force at the enterprise are not used. An agreement with the chief accountant is drawn up individually and includes the above additional conditions, as well as detailing the duties and responsibilities of the employee.

Rights and responsibilities of the chief accountant according to Law No. 402-FZ

Let's first talk about the rights of the chief accountant, a person who occupies a fairly high position in any company.

In general, the basic labor rights of any employee of any organization are controlled by the Labor Code of the Russian Federation, and the rights of the employee as a specialist are prescribed in his job description. What can you indicate when creating such instructions for the chief accountant? For example, the following:

- The chief accountant has the right:

- represent the interests of the organization’s accounting department, speaking in other structural divisions, before counterparty companies;

- request the necessary documents and information from other company specialists;

- submit for consideration to the director various financial plans, accounting structure, proposals for employee incentives or financial penalties;

- interact with other structural units to the extent necessary to perform their duties.

- By power of attorney, the chief accountant may be given the rights to represent the interests of the company in tax and other auditing structures.

We can also add that in addition to the main professional labor functions, the chief accountant, as a rule, himself selects the employees of his department, can regulate the search for an audit company to audit the enterprise, and, within the agreed framework, independently make decisions that affect the financial performance of the company, etc.

To determine the responsibilities of the chief accountant, you need to look not only at the law on accounting, but also at the professional standard. The current standard “Accountant”, approved. by order of the Ministry of Labor dated February 21, 2019 No. 103n. We wrote about it here.

Of course, compared to the rights, the responsibilities of the head of the accounting department are much more extensive. Let's consider it in detail; you can even divide all the responsibilities of the chief accountant into several groups.

- Financial group

- The main thing that the chief accountant does is keep records of the financial and economic activities of the company, and exercise control over the property of the enterprise.

- Forms the company's accounting policy in accordance with current legislation, including the development of a chart of accounts, primary forms, etc.

For an example of the correct approach to accounting policies, see our article “How to draw up accounting policies in an organization.”

- Organizes accounting of property received by the company, accounting of business transactions performed in the company.

- Organizes and controls the accounting of enterprise costs and sales of products.

- Generates complete and reliable accounting reports and, upon request, provides data on the company’s property status, income and expenses of the enterprise.

- Monitors compliance with tax legislation and the formation of tax reporting according to the rules corresponding to the Tax Code of the Russian Federation.

- Controls the correct calculation and payment of taxes, social contributions, administrative payments to state budgetary and extra-budgetary funds.

- Ensures the preparation of balance sheets and operational summary reports on income/expenses of funds, the use of the budget, and other statistical reporting, and their submission in the prescribed manner to the relevant authorities.

- Executive functions

- Monitors the job descriptions of his subordinates.

- Provides methodological assistance to employees of enterprise departments on issues of accounting, control, reporting and economic analysis.

- Informs the director of the enterprise about all identified shortcomings in the work of the accounting department of the enterprise, structural divisions with a mandatory explanation of the reasons for their occurrence, as well as proposing ways to eliminate them.

- Manages the accounting staff of the organization.

- Part of the work of controlling

- Takes measures to prevent shortages, uncontrolled spending of funds, and violations of current legislation.

- Responsible for conducting an inventory of fixed assets, inventory and cash.

- Analytical part of the work

- Takes part in the economic analysis of the company's activities.

- May take part in financial planning of the organization's activities.

To find out what it is, see our material “Main types of financial planning (description).”

Read more about the responsibilities of the chief accountant in our publications:

- “We are looking for extra responsibilities in the job description of the chief accountant”;

- “We are making changes to the job description.”

How to do accounting for an LLC yourself: step-by-step instructions 2020

Every organization immediately after its creation is required to keep accounting records. According to the law of December 6, 2011 No. 402-FZ, accounting and storage of documents is organized by the head of the LLC. The director is responsible for organizing accounting in the organization, and even financial statements are recognized as drawn up after the signature of the director, and not the chief accountant.

Entrepreneurs are luckier in this sense - they are not required by law. Accounting is the organization of collecting information about the state of the property and obligations of the company, as well as the continuous reflection of this information in special accounting documents.

We recommend reading: What is the tax on greenhouses and baths

But LLC accounting is not only about registers, accounting books and financial statements. These are also tax accounting documents, contracts, personnel and primary documentation, documents on cash flow (cash and bank). The entire extensive list of documents,

Hiring an employee. What an accountant needs to know

Since an accountant often performs the duties of a personnel officer, it is necessary to know the intricacies of hiring an employee.

Required documents

Before drawing up an employment contract, you need to check that he has all the necessary documents. In order to hire an employee, the organization must request the following documents from him:

- citizen's passport;

- work book. If the employee has not worked anywhere before, a new work book is created;

- TIN;

- SNILS – insurance certificate. If it was not there either, it is necessary for the employee to receive it from the Federal Tax Service;

- educational documents;

- military registration document (for those liable for military service);

- medical certificate.

In some cases, before hiring an employee, a medical certificate is required; for this, he must undergo a medical examination in a special center, after which he will be given a supporting document.

A medical certificate is required if a minor is hired, as well as if working in the catering and food industry.

For example, it is mandatory to undergo a medical examination for workers in contact with food products and medical personnel.

So, what needs to be done when hiring an employee, step by step:

Step 1: Accept a Job Application

Step 2. Conclude an employment contract with the employee

Step 3. Register the employment contract in the journal

Step 4. Issue a hiring order

Step 5. Introduce the employee to his job responsibilities

Step 6. Make an entry in the work book

Step 7. Register the work book in the accounting book.

Step 8. Filling out a personal card

Step 9. Time tracking

Step 10. Mandatory registration with the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund as an employer

Accepting a job application

The basis for hiring is the employee writing a job application. However, at present, an application is not a mandatory document for employment; you can do without it. This follows from the fact that the basis for concluding an employment relationship between an employee and an employer is precisely an employment contract. Based on the employment contract, an employment order and other personnel documents will be generated.

Conclusion of an employment contract

The basis for establishing labor relations between an employer and an employee is the conclusion of an employment or civil contract with him in writing and securing the contract with seals and signatures on both sides. If an employment contract is concluded with an employee, he is included in the staff of the enterprise. If a civil contract is concluded with an employee, the employee will work outside the state without paid vacations and sick leave. Most enterprises hire staff based on a work book with a fixed-term or open-ended employment contract. The employment contract is drawn up in 2 copies - one remains with the employee, the other with the employer. The employer's copy is subsequently stored in the employee's personal file.

What conditions are considered essential terms of this agreement?

All terms of the employment contract must not contradict labor legislation. The contract with an employee hired must contain all essential working conditions. The following conditions are mandatory for inclusion in an employment contract:

- place of work (name of employer) (paragraph 2, part 2, article 57 of the Labor Code of the Russian Federation).

- work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; the specific type of work entrusted to the employee (paragraph 3, part 2, article 57 of the Labor Code of the Russian Federation).

- the start date of work, and when concluding a fixed-term employment contract, also its validity period and the circumstances (reasons) that served as the basis for concluding such an agreement in accordance with the Labor Code of the Russian Federation (paragraph 4, part 2, article 57 of the Labor Code of the Russian Federation).

Under a fixed-term agreement, an employee is involved in work for a certain period, indicating the date of dismissal. If after completion of the contract the employee is still working, then the contract is converted into an open-ended one. An employment contract whose validity period is not specified is considered to be concluded for an indefinite period. In this case, it is considered that the employee is hired on a permanent basis (clause 3 of Article 58 of the Labor Code of the Russian Federation);

- terms of remuneration (including the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments) (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation);

- working hours and hours (paragraph 6, part 2, article 57 of the Labor Code of the Russian Federation);

- guarantees and compensation for work with harmful and (or) dangerous working conditions, if the employee is hired for such work, indicating the characteristics of working conditions in the workplace (paragraph 7, part 2, article 57 of the Labor Code of the Russian Federation);

- working conditions in the workplace (paragraph 9, part 2, article 57 of the Labor Code of the Russian Federation);

- conditions that, if necessary, determine the nature of the work (for example, the nature of the work may be traveling or traveling) (paragraph 8, part 2, article 57 of the Labor Code of the Russian Federation);

- condition on compulsory social insurance of the employee (paragraph 10, part 2, article 57 of the Labor Code of the Russian Federation);

- other conditions in cases provided for by labor legislation (paragraph 11, part 2, article 57 of the Labor Code of the Russian Federation).

If a probationary period is provided upon admission, information about this must be recorded in the employment contract indicating the probationary period. According to the Labor Code of the Russian Federation, the probationary period cannot exceed 3 months, and a managerial employee can be hired with a probationary period of 6 months.

What agreements can be concluded together with an employment contract?

In addition to concluding an employment contract, it is possible to conclude an agreement on non-disclosure of the enterprise’s trade secrets and an agreement of full or partial financial liability (such an agreement is most often concluded with warehouse employees and other responsible persons). Thus, the procedure adopted in the organization may provide for familiarization with signature with internal regulations: labor rules, regulations and regulations. This procedure should be carried out before signing an employment contract with the employee (Part 3 of Article 68 of the Labor Code of the Russian Federation). For example, the following rules are required to be familiar with:

- internal labor regulations (part 3 of article 68 of the Labor Code of the Russian Federation);

- storage and use of personal data of employees (Article 87 of the Labor Code of the Russian Federation);

- instructions on labor protection (Article 212 of the Labor Code of the Russian Federation).

The fact of familiarization with local regulations is confirmed by the employee’s signature on the familiarization sheet indicating the last name, first name, patronymic, date of familiarization and affixing a personal signature.

The local regulatory act, together with the familiarization sheet, is numbered, stitched and sealed with the seal and signature of the official.

These papers are usually presented for reading and signing during the hiring process, and review sheets are placed in the employee's personal file.

Registering an employment contract in a journal

After an employment contract has been drawn up with an employee or several contracts - for example, another contract of liability, the numbers and dates of these contracts are indicated in the accounting journal.

As a rule, such a journal reflects the date and number of the concluded employment contract, the last name, first name, patronymic of the employee, the structural unit in which he works, the position held, the type and nature of the work, as well as the validity period of the employment contract indicating the date of its termination (for fixed-term employment contracts).

After receiving all of his copies of documents, the employee signs in the appropriate box so that subsequently, the organization could prove that such an employment contract was actually issued to the employee.

We issue an order for employment

Hiring is formalized by order (instruction) of the employer in the unified form N T-1, which must be prepared within three days from the date of conclusion of the employment contract.

For this purpose, a unified form No. T-1 is provided.

The order should reflect:

- employer's name;

- Enrollment Date;

- conditions of employment (for example, permanent work, temporary work or part-time work);

- position and department;

- salary in accordance with the employment contract;

- probation period (a record of the establishment of the test and its duration is made only if this condition is included in the employment contract).

After reading the order, the employee signs it, and the order itself is recorded in the personnel orders journal.

Introduce the employee to his job responsibilities

Before an employee begins to perform his or her job duties, such responsibilities must first be specified in the job description.

A link to the job description must be indicated in the employment contract.

A job description is drawn up, as a rule, in two ways: as an appendix to the employment contract or as a separate document.

After reading the job description, a stamp and date of familiarization are placed, and the job description is printed in two copies.

If the duties relate to a group of people, or they are typical, then you can make a familiarization sheet where all employees hired for this vacancy will sign, indicating their names and the date of signing.

Filling out the work book

After an order has been issued for an employee with a signature for familiarization, but no later than 5 working days from the date of the employment contract, an entry should be made in the employee’s work book about hiring.

We register the work book in the accounting book

Work books and inserts in them are subject to registration in the organization (clause 40 of the Rules for maintaining and storing work books).

For this purpose, the following books were approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69:

1) a receipt and expenditure book for recording the forms of the work book and the insert in it.

It is maintained in the accounting department of the organization and is intended for entering information about transactions for the receipt and expenditure of work book forms and the insert into it. In addition to the number of forms in this book, it is necessary to indicate their series and number;

2) a book for recording the movement of work books and inserts in them. A book of accounting for the movement of work books and inserts in them can be kept:

— in the personnel service of the organization;

- in another department in which the hiring and dismissal of employees is formalized.

This book is maintained for the purpose of registering work books and inserts in them from employees upon hiring, dismissal, as well as when preparing duplicates or creating new work books or inserts in them.

In accordance with clause 41 of the Rules for maintaining and storing work books, the receipt and expenditure book for recording the forms of the work book and the inserts in it and the book for recording the movement of work books and inserts in them must be numbered, laced, certified by the signature of the head of the organization, and also sealed with wax stamped or sealed.

Filling out a personal card

The list of documents required to be filled out when applying for a job for an employee includes the unified form No. T-2 “Employee’s Personal Card” (Resolution of the State Statistics Committee of Russia dated 01/05/04 No. 1).

A personal card is a mandatory personnel record document.

An employee’s personal card is issued in Form No. T-2 simultaneously with the employee’s appointment, in which his personal data is entered.

The employee’s personal card is filled out based on the following documents:

— order (instruction) on hiring;

— passport or other identity document;

— work book or document confirming work experience;

— insurance certificate of compulsory pension insurance;

— military registration documents (for those liable for military service and persons subject to conscription for military service);

- a document on education, qualifications or special knowledge (when applying for a job that requires special knowledge or special training).

Thus, a personal card is created at the time of admission and throughout the entire period.

After this, all events concerning the employee are reflected in the personal card.

When information about an employee changes, the corresponding data is entered into his personal card (Instructions, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

That is, the previous information is crossed out with one line and new data is written down (above or next to the corresponding column), which is certified by the signature of the HR employee.

In a similar manner, you can make corrections to the employee’s personal card if incorrect entries are discovered.

We keep track of working hours

During the operation of the enterprise and visits by employees, it is necessary to keep records of working hours for each employee.

Part 4 of Article 91 of the Labor Code of the Russian Federation establishes the employer’s obligation to keep records of the time worked by employees.

For this purpose, unified forms of working time sheets are provided (N T-12 and N T-13) (approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 N 1).

Form No. T-12 can be used if the company will keep track of working hours and pay salaries to employees. It is allowed to keep records without filling out the section on payroll calculation.

The compiled time sheet is signed by the head of the structural unit, an employee of the personnel department and transferred to the accounting department.

A completed and signed time sheet is the basis for settlements with employees and the calculation of wages.

Mandatory registration with the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund as an employer

After registering hired employees, it is necessary to register the organization with the funds as an employer.

There are certain deadlines for this:

- Pension fund – 30 days;

- FSS – 10 days;

- Compulsory medical insurance – 30 days.

Features for foreign workers

When applying for employment, a foreigner is required to present documents legalizing his stay on the territory of the Russian Federation (migration card, visa) and giving the right to work (work permit).

A work permit is a document that confirms the right of a foreign citizen to temporarily carry out labor activities on the territory of the Russian Federation.

Who can be appointed chief accountant

Contained in Art. 7 of the Accounting Law, the requirements for the chief accountant to have a higher education and a certain work experience do not apply to limited liability companies, unlike joint stock companies. Accordingly, the provisions of the Professional Standard for Accountants approved in 2014 are only advisory for such organizations.

However, no manager in his right mind would entrust the position of chief accountant to a person who does not have in-depth knowledge in the field of accounting and tax law, as well as experience in his specialty. Therefore, you can set the necessary requirements for a candidate for this position yourself, based on the specifics of your organization. Just don’t forget to indicate these qualification requirements in the job description of the chief accountant - this, among other things, will make it possible to reject candidates for this position who do not have the necessary skills.

Features of labor relations

Appointment to the position of chief accountant may be made by the general director of the LLC or another person having such authority.

By agreement of the parties, a fixed-term employment contract may be concluded with the chief accountant. The probationary period for him, unlike other employees, has been extended and can be up to 6 months (Part 5 of Article 70 of the Labor Code of the Russian Federation).

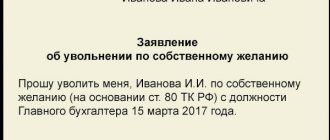

Also, for the chief accountant, additional grounds have been established for terminating the employment contract with him: when the owner of the organization’s property changes, the new owner, no later than three months from the date of his ownership rights, has the right to terminate the employment contract with him in accordance with clause 4, part 1, art. 81 Labor Code of the Russian Federation. Just do not confuse a change in the owner of property with a change in company participants - in this case there are no grounds for dismissing the chief accountant.