Salary reporting in 2020 is a set of forms and forms that disclose information about the number of employees, accrued income, calculated and paid taxes and contributions. All employers, without exception, are required to provide information.

All salary reporting is divided into four main categories. The composition and frequency of provision directly depend on the number of employees in the company. Let's determine what reports the payroll accountant submits in 2020:

- Fiscal reporting is a list of forms provided by employers to the Federal Tax Service.

- Reporting to extra-budgetary funds - since 2020, only a few reporting forms submitted to the Pension Fund and Social Security have been preserved.

- Statistical information - the frequency and deadlines for submitting statistical forms depend on the number of employees in the state.

- Other information is generated upon individual request from regulatory ministries and departments.

We will examine the features of providing information for each reporting category in more detail.

What has changed since 2020

There are quite a few innovations in the procedure and rules for submitting salary reports. Officials introduced new forms, for example, they updated the DAM form for the 1st quarter and subsequent periods of 2020. Some deadlines for submitting wage reports have also been updated. The adjustments also affected the reporting procedure. There are plans to merge individual reports altogether. For example, the bill on the abolition of information on the average number of employees has already been adopted in the first reading. They plan to include such information in the calculation of insurance premiums. Consequently, another new form of RSV will soon be approved.

Let's define everything new in salary reporting in 2020:

- New procedure for submitting reports to the Federal Tax Service. If your company has 10 or more employees, report electronically. Innovations affected reporting on personal income tax and insurance premiums. Those companies and individual entrepreneurs with a staff of 9 or fewer people are allowed to submit reports on paper.

- A new report has been introduced to the Pension Fund in the form SZV-TD. It will be submitted to generate information in electronic work books. Reporting must be done monthly, by the 15th of the next month.

- The deadline for filing 2-NDFL has been reduced by a whole month. Previously, reporting on income from which personal income tax was withheld was submitted before April 1. Now 2-NDFL certificates with all the characteristics of a taxpayer are submitted before March 1 of the year following the reporting year. For 2020 - until 03/02/2020, since March 1 is a Sunday.

- A new deadline has also been established for the annual calculation of insurance premiums. For reports for 2020, you will have to submit the calculation before 03/02/2020 (March 1 - Sunday).

- The DAM report form has been updated. You will have to use the new form when filling out information for the 1st quarter of 2020. The old form will not be accepted. The changes in form are minor and more of a technical nature.

Please note that the procedure for submitting reports to funds has not been changed. As before, submit paper reports if the average number of employees is 24 or fewer employees. Submit electronic information to the Pension Fund of Russia or the Social Insurance Fund if there are 25 or more employees on staff.

Nuances of filling out a VAT return in 2020

The procedure for filling out the declaration is regulated in Appendix No. 2 to the Federal Tax Service order No. MMV-3-7/558 as amended on November 20, 2019, where some rules have changed. These changes took effect in 2020.

Thus, for exporters who have refused the zero tax rate, the size of the base should be indicated on page 043 of Section 3, and in Section 9 page 036 is used for the same.

TaxFree system participants need to record such information on page 044, and the amount of compensation on page 135 of Section 3.

Federal Tax Service Order No. ММВ-7-3/579 dated November 20, 2019 also approved new transaction codes regarding VAT exemption when importing a number of goods into Russia. When preparing a report, the declarant should take these innovations into account.

Read more about them in our article “VAT transaction codes in 2019-2020 (table)”.

In the 2020 VAT return form, it remains possible to reflect VAT at the previous rate of 18% (pages 041 and 042 of Section 3) in case of adjustments in the cost of supplies in 2020.

We report to the Federal Tax Service

Payroll tax reports for 2020 are the largest category of all reporting. The inspectorate will have to prepare information about the income of employees and about the calculated income tax and insurance coverage.

2-NDFL

The certificate form was approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

IMPORTANT!

Fiscal reports on wages in 2020 are provided annually before March 1 of the year following the reporting year, regardless of the taxpayer’s characteristics specified in the certificate. The rule is valid from 01/01/2020. This means that reports for 2020 will have to be submitted by 03/02/2020 (March 1 - Sunday).

If the employer has 10 or more employees, then submitting reports is only allowed in electronic form. Companies and individual entrepreneurs with up to 9 employees report both electronically and on paper.

IMPORTANT!

When submitting a 2-NDFL certificate on paper, you will have to fill out the register of certificates (KND 1110306).

Instructions for filling out: Certificate 2-NDFL in 2020: form, codes and due date.

A company or individual entrepreneur that fails to submit 2-NDFL on time will be fined. The amount of penalties is 200 rubles for each certificate not provided (Article 126 of the Tax Code of the Russian Federation).

In addition, a fine for responsible officials is likely - from 300 to 500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

6-NDFL

The form was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450 as amended on January 17, 2018 No. ММВ-7-11/ [email protected]

Provided to the inspection within one calendar month after the reporting period. The final calculation for the calendar year must be submitted to the Federal Tax Service by March 1 of the following year. Deadlines in 2020:

- for 2020 - 03/02/2020;

- 1st quarter 2020 - 04/30/2020;

- half year 2020 - 07/31/2020;

- 9 months 2020 - 02.11.2020;

- 2020 - 03/01/2021

Instructions for filling: How to fill out form 6-NDFL. Complete guide.

For each full or partial month of delay in submitting 6-NDFL, the company will be fined 1,000 rubles.

In addition, the Federal Tax Service has the right to block a company’s current accounts if the payment of 6-NDFL is delayed for more than 10 days.

Calculation of insurance premiums

The new form is attached.

The DAM must be submitted by the 30th day of the month following the reporting period:

- for 2020 - 01/30/2020 - submit the calculation using the old form;

- 1st quarter 2020 - 04/30/2020 - a new report form is in effect;

- half year 2020 - 07/30/2020;

- 9 months 2020 – 10/30/2020;

- 2020 - 02/01/2021.

The electronic format is provided for policyholders whose average number of employees is 10 or more. The rest have the right to report both on paper and electronically.

Instructions for filling out: Sample of filling out the DAM form in 2020.

The minimum fine is 1,000 rubles for each full and partial month of delay. Or 5% of the amount of insurance premiums payable for the reporting period, for each month, but not more than 30%.

Information on the number of employees

The form is provided by order of the Federal Tax Service dated March 29, 2007 No. MM-3-25/174.

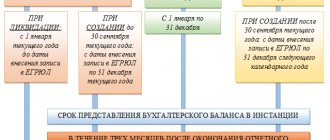

The report is submitted annually, before January 20 of the year following the reporting period.

The method of submission is not legally approved. It is acceptable to submit information both on paper and electronically. We recommend following the rules established for other tax forms. If there are more than 100 people on staff, then report electronically.

Instructions for filling: .

If you do not submit the form on time, you will be fined 200 rubles under Article 126 of the Tax Code of the Russian Federation. Officials will also be punished under Article 15.6 of the Code of Administrative Offenses of the Russian Federation - from 300 to 500 rubles.

If the delivery day falls on a weekend, the report should be submitted on the first working day.

Reduction of insurance premiums paid for employees

Also, when submitting reports for 9 months/III quarter of 2020, it is necessary to take into account changes in insurance premium rates.

Let us recall that in accordance with Federal Law No. 102-FZ dated April 1, 2020, for organizations and individual entrepreneurs included in the SME register, until December 31, 2020, reduced contribution rates were established for payments to individuals exceeding the minimum wage.

According to the new rules for payments in favor of individuals in the part not exceeding the minimum wage, contributions are calculated at general rates (22% - to the Pension Fund of the Russian Federation, 5.1% - for health insurance and 2.9% - for social insurance in case of temporary disability and in connection with motherhood).

At the same time, for payments to employees in the part that exceeds the minimum wage, insurance premiums are calculated at reduced rates.

Thus, in the Pension Fund of the Russian Federation, contributions are calculated at a rate of 10% for payments not exceeding the maximum size of the contribution base and 10% for payments above the maximum size of the contribution base. Contributions for health insurance are calculated at a rate of 5%, and for social insurance in case of temporary disability and in connection with maternity - 0%.

Previously, the Federal Tax Service, in a letter dated April 29, 2020 No. BS-4-11/ [email protected], explained that organizations and individual entrepreneurs can apply reduced insurance premium rates from the 1st day of the month in which information about them is entered into the SME register, but not earlier than April 1, 2020.

Reporting to funds

Despite the 2020 reform in insurance coverage, salary reporting in 2020 to extra-budgetary funds was only partially cancelled. You will have to submit information about calculated contributions for injuries to Social Insurance. And the Pension Fund will have to report on the length of service of the insured persons.

Calculation 4-FSS

The form is fixed by order of the Social Insurance Fund dated September 26, 2016 No. 381.

Please note that the deadline for submitting a calculation to Social Security directly depends on the method of submitting data.

Report electronically:

- for 2020 - 01/27/2020;

- 1st quarter 2020 - 04/27/2020;

- half year 2020 - 07/27/2020;

- 9 months 2020 - 10.26.2020;

- 2020 - 01/25/2021.

You submit 4-FSS on paper:

- for 2020 - 01/20/2020;

- 1st quarter 2020 - 04/20/2020;

- half year 2020 - 07/20/2020;

- 9 months 2020 – 10/20/2020;

- 2020 - 01/20/2021.

The method of provision is determined by the average number of employees:

- up to 25 people - allowed on paper or electronically;

- 25 or more employees - only in electronic format.

Instructions for filling out: Sample of filling out form 4-FSS in 2020.

Fines: 5% of the amount of insurance coverage payable for each full or partial month of delay. No more than 30%, but not less than 1000 rubles. Officials - a fine under Art. 15.33 Code of Administrative Offenses of the Russian Federation - from 300 to 500 rubles.

SZV-M

The form of the monthly form is fixed by the resolution of the Pension Fund of Russia board dated 02/01/2016 No. 83p.

Report by the 15th day of the month following the reporting month:

- for December 2020 - 01/15/2020;

- January 2020 – 02/17/2020;

- February 2020 - 03/16/2020;

- March 2020 - 04/15/2020;

- April 2020 - 05/15/2020;

- May 2020 – 06/15/2020;

- June 2020 - 07/15/2020;

- July 2020 - 08/17/2020;

- August 2020 - 09/15/2020;

- September 2020 - 10/15/2020;

- October 2020 – 11/16/2020;

- November 2020 – 12/15/2020;

- December 2020 - 01/15/2021.

It is allowed to submit reports earlier than the deadline, but only if verified information is available.

If the reporting form includes information about 25 employees or more, then report only electronically. Other policyholders have the right to report on paper.

Instructions for filling out: Reporting SZV-M: step-by-step instructions for filling out.

New SZV-TD

The report in the SZV-TD form is a new electronic book, the transition to which begins in 2020. Not all policyholders report, but only those whose staff has undergone personnel changes. The grounds for filling out and submitting the SZV-TD include:

- conclusion of a new employment contract;

- termination of an employment contract or agreement with an employee;

- assignment of qualifications, transfer to another job, other personnel changes that require reflection in the work book;

- submission by an employee of an application to choose the method of maintaining a work record in 2020 and subsequent years.

Rules for drawing up a new pension report are in the article “How to fill out a new monthly SZV-TD report.” Submit reports to the Pension Fund on a monthly basis. The timing coincides with SZV-M. Submit information for generating electronic work books by the 15th day of the month following the reporting month.

SZV-STAZH

Enshrined in Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p.

The report is submitted annually, before March 1 of the year following the reporting year:

- for 2020 - 03/02/2020;

- 2020 - 03/01/2021.

Instructions for filling out: Fill out and submit the SZV-STAZH form to the Pension Fund of Russia.

Responsibility for failure to submit SZV-M. SZV-TD and SZV-STAZH - 500 rubles for each employee. The fine for officials is similar - from 300 to 500 rubles (Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

If the due date falls on a holiday or weekend, then the accountant’s 2020 payroll reports are submitted on the first working day.

Statistical forms

In addition to the Federal Tax Service, Pension Fund and Social Insurance Fund, reporting on labor and wages is provided to Rosstat. Moreover, large fines are provided for failure to provide statistical information on time.

P-4 (NZ)

Quarterly, before the 8th day of the month following the reporting quarter:

- 1 sq. 2020 - until April 8, 2020;

- 2 sq. 2020 - until July 8;

- 3 sq. 2020 - until October 8;

- 4 sq. 2020 - until January 8, 2021.

P-4 (with 15 people or less)

Quarterly, before the 15th day of the month following the reporting quarter. Deadline for submitting the average salary report in 2020:

- 1 sq. 2020 - April 15, 2020;

- 2 sq. 2020 - July 15;

- 3 sq. 2020 - October 15;

- 4 sq. 2020 - January 15, 2021.