Salary below the minimum wage: responsibility and fines

Why is the minimum wage important? For many reasons. First of all, wages depend on it. The employer does not have the right to pay full-time employees a salary below the minimum wage, as stated in Art. 133 of the Labor Code of the Russian Federation: “The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.”

Rostrud on its official website clarifies that wages may be less than the minimum wage if the employee works part-time or part-time. “The salary may be less than the minimum wage. In addition to salary, wages include compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation). Thus, taking into account all salary increases or incentives, the employee receives an amount greater than or equal to the minimum wage. If the employee’s salary is still less than the established minimum wage, the employer must make an additional payment up to the minimum wage.”

The employer must understand that he is at great risk if his employees receive wages below the minimum wage. The labor inspectorate may fine him. According to Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, such a violation entails a warning or the imposition of an administrative fine on officials in the amount of 10,000 to 20,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

For repeated violations, the fine for officials ranges from 20,000 to 30,000 rubles. or disqualification for a period of one to three years; for legal entities - from 50,000 to 100,000 rubles.

Salary is less than the minimum wage for a part-time worker

Experts from Rostrud draw attention to the fact that in case of part-time work, remuneration should not be lower than the minimum wage, calculated in proportion to the time worked - depending on output or on other conditions determined by the employment contract (Article 285 of the Labor Code of the Russian Federation).

Thus, the wages of a part-time worker should not be lower than the minimum wage, calculated in proportion to the time worked.

And yet, can a salary or salary be less than the minimum wage?

Let's consider the options when an employee can quite legally receive less than the minimum wage or his salary is less (which is not the same thing):

- The salary may be less than the regional figure if the organization has not joined the regional agreement in accordance with Art. 133.1 of the Labor Code of the Russian Federation (i.e., within 30 days after publication of the proposal, it sent objections).

- An employee’s salary (fixed payment per month) can be less than the minimum wage only in 1 case: if the employee receives incentive payments, compensation and allowances in addition to it (confirmed by the decision of the RF Armed Forces dated August 30, 2013 No. 93-KGPR13-2). However, regional coefficients should not be included in these categories. They apply to wages, which must no longer be less than the minimum wage.

- The employee did not comply with working time standards or labor standards (the condition for compliance is stipulated in Article 133 of the Labor Code of the Russian Federation). This case should not be confused with situations where reduced working hours are established by law (for example, for people with disabilities - Article 92 of the Labor Code of the Russian Federation).

- An employee can receive a salary that is less than the minimum for the reason that 13% personal income tax is withheld from it. The eligibility requirement applies to the original earnings.

How to calculate and arrange an additional payment up to the minimum wage, read the ready-made solution ConsultantPlus. If you do not have access to the ConsultantPlus system, you can register for free for 2 days.

***

Thus, the employee's salary may be less than the minimum wage.

But you need to remember that the minimum wage is changing upward, and there are also nuances in calculating wages, and avoid violating legal requirements, given the high level of responsibility applied to the employer in this case. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Regional minimum wage

According to Art. 133.1 of the Labor Code of the Russian Federation, in addition to the federal minimum wage, which is valid throughout Russia, regions can set their own minimum wage. It is determined taking into account socio-economic conditions and the cost of living of the working population in the corresponding subject of the Russian Federation.

By law, the minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law. At the same time, regional authorities have the right to equate the minimum wage to the federal standard or increase it.

Employers have a period of 30 days during which they can send to the labor body a written refusal to join the regional agreement on the minimum minimum wage in a specific subject. Silence automatically means consent, that is, if they do not refuse, they join the agreement.

The minimum wage in the constituent entities of the Russian Federation: table

Minimum wage in Moscow for 2020

The minimum wage in Moscow is 20,195 rubles. established by Decree of the Moscow Government dated September 10, 2019 No. 1177-PP and has already been in effect since October 1, 2020.

Minimum wage in the Leningrad region from January 1, 2020

On November 28, 2020, a Regional Agreement on the minimum wage was concluded in the Leningrad Region for 2020, according to which the minimum wage here is set at 12,800 rubles.

It follows from this that the monthly salary of a person working in the Leningrad region and in an employment relationship with an employer subject to a regional agreement cannot be lower than the minimum wage in the Leningrad region if this person has fully worked the standard working hours during this period and fulfilled labor standards.

In connection with the increase in the minimum wage, the question often arises about salary indexation - is it mandatory? We previously wrote about this in the article “Wage Indexation: An Employer’s Right or Obligation?”

Calculation of the minimum wage for wages

It is important to note that Article 133 of the Labor Code of the Russian Federation does not mean the regional minimum wage, which is established by the authorities of a particular subject of the Russian Federation, but the federal one. However, in order to use the federal minimum wage for calculating the wage fund and focus specifically on the federal “minimum wage,” the company must issue a written waiver of the regional minimum wage. See sample waiver here:

Sample refusal

Please note that tripartite commissions, one of which is mentioned in the sample refusal, operate both in Moscow and in the regions. The deadline for completing the refusal is 30 calendar days from the date of publication of the agreement (the date of state registration of the newly created company). If the refusal is not formalized, then the company will automatically be recognized as agreeing with the regional “minimum wage” and, accordingly, is obliged to use the regional minimum wage when setting wages, which, as a rule, is higher than the federal one.

You can find out the minimum wage in your region (and sometimes in your business segment)

Let's look at the example of calculating the minimum wage for wages, taking into account regional coefficients.

Example 1

In Yakutia, the minimum wage is 11,280 rubles. with the use of compensation payments on top of it for work in the Far North:

- regional coefficient (for all), the value of which is 2;

- percentage allowances for certain categories.

In this case, the calculated value should not be lower than 17,475 rubles. – the subsistence minimum for the working population in the Republic as a whole for the third quarter of 2020 (Resolution of the Government of the Republic of Sakha (Yakutia) No. 249 of 08/22/2018).

Currently, the minimum wage with the regional coefficient applied on top of it, even without percentage increases, is 22,560 rubles. (11,280 x 2), which is more than the subsistence level. Thus, the calculation of the minimum wage for wages should show a total of 22,560 rubles. or more if the employee is entitled to interest payments.

More details

Minimum wage when setting wages for LLC branch employees

There are often situations when an LLC is registered in one subject of the Russian Federation, and its employees work in a branch of the LLC in another subject. In this case, what minimum wage should we be guided by when setting salaries for branch employees?

In this case, it is legal to set the salary taking into account the minimum wage established in the subject where the LLC branch is located.

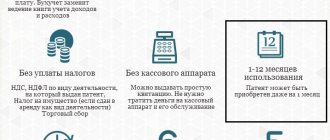

Are you an individual entrepreneur and don’t understand accounting? An electronic accountant will prepare reports for you and calculate taxes, help with issuing invoices and other documents.

To learn more

As stated above, in the regions the minimum wage can be established by regional agreement. In accordance with Part 2 of Art. 133.1. The Labor Code of the Russian Federation, the minimum wage in a constituent entity of the Russian Federation can be established for employees operating in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

Basic Concepts

The minimum wage (minimum wage) is a standard, the amount of which is established by law. It is impossible to pay wages below this to employees who have worked for a calendar month and completed the work in full. The minimum wage is used in the calculation:

- taxes;

- fees;

- benefits;

- fines.

Minimum wages are revised every year. The minimum wage is increasing in accordance with the inflation level and tariff indexation. Regions of the Russian Federation can regulate the size of the minimum wage independently, but only in the direction of increasing this indicator. In 2020, the minimum wage is 9,489 rubles. If the salary is below the regional minimum wage, a citizen has the right to complain against the employer. What threatens the employer if the salary is less than the minimum wage? These are penalties that are imposed on officials of the organization - the director and accountant. And also on the organization itself as a legal entity. Fines:

- for officials of the organization - from 1,000 to 50,000 rubles;

- for a legal entity – from 30,000 to 50,000 rubles.

If an employer pays remuneration within 2 months and it is lower than the regional minimum wage, he may be subject to criminal liability. The form of liability can be different, everything is classified depending on the severity of the criminal act, intent, etc. The employer may be subject to a fine under the Criminal Code of the Russian Federation, arrest, corrective labor, etc. In addition, officials are subject to suspension from work for 1.5 years if they commit guilty actions.

Minimum wage and northern allowances, regional coefficients

The minimum wage established by federal law does not include northern bonuses and regional coefficients. They are charged above the minimum wage.

In particular, Part 2 of Art. 146 Labor Code of the Russian Federation.

Remuneration for labor in the regions of the Far North and equivalent areas is carried out using regional coefficients and percentage increases in wages (Article 315 of the Labor Code of the Russian Federation).

Subscribe to our Telegram channel to stay informed about the most important changes for business.

What is the minimum wage and how does it relate to salary?

The minimum wage is a value that is not constant. Its size is reviewed once a year at the federal level. Starting this year, for the working population, the minimum wage is equal to the subsistence level. When calculating payments, this indicator is taken into account.

Regions of the Russian Federation have the right to apply their own minimum wage values. But they cannot be less than those established by federal law. To introduce their own wage indicator, the constituent entities of the Russian Federation must sign a regional agreement.

All employers who employ individuals on the basis of an employment contract must comply with the minimum remuneration established by law.

What documents regulate the issue of remuneration? First of all, this is, of course, the Constitution of the Russian Federation, which stipulates the right of every person to work and guarantees him remuneration no less than the established minimum. This is provided for in Article 37 of the Constitution of the Russian Federation. It does not matter whether the employee is a citizen of the Russian Federation. For foreign citizens working in Russia, the same rules apply.

To specify the provisions contained in the constitution, as well as to determine the methods for their implementation, federal laws and the Labor Code of the Russian Federation are used. Therefore, if someone has a question about whether the salary can be less than the minimum wage, he should turn to these documents.

- Article 130 of the Labor Code of the Russian Federation contains provisions that determine the right of the state to regulate social guarantees for the working population.

- Article 133 of the Labor Code of the Russian Federation defines the standards in accordance with which the minimum wage is established.

- Article 133.1 of the Labor Code of the Russian Federation regulates the issue of establishing the regional minimum wage.

- Federal Law No. 82, adopted on June 19, 2000, is the main regulatory document defining the minimum wage.

As noted earlier, the minimum wage is not a constant value. Starting from January 1, 2020, it is eleven thousand two hundred eighty rubles.

Many employers mistakenly believe that the salary should be no less than the minimum wage under any conditions. This judgment is not entirely correct.

The indicator is used for:

- control over the level of wages and its adjustment;

- correct calculation of the amount of social benefits, for example maternity benefits, sick leave payments, and so on;

- pension insurance payments.

In accordance with current legislation it is necessary:

- take into account the nature of the employee’s working conditions, the amount of work performed by him and his qualifications when calculating wages;

- provide the employee with additional pay for difficult working conditions or long working hours;

- provide for the possibility of paying bonuses and allowances to employees.

If the final salary, including all possible bonuses, is less than the minimum wage, the manager must pay the employee the missing amount.

When an employee of an organization works at one and a half times the rate or performs a volume of work in excess of established standards, his salary must exceed the minimum minimum wage.

New living wage

It was also proposed to calculate the cost of living in a new way - as 44% of the median income of citizens. Growth will directly depend on the real growth of Russians' incomes if inflation is low or at the current level. The bill, Nilov specified, provides for a gradual increase in this coefficient from 44%.

“If you compare the values that are obtained by using the median method and the one that is in effect now, then the [new] cost of living will be slightly higher. But again, it's not tall enough. I believe that the living wage should be at least 20 thousand rubles,” the parliamentarian concluded.

According to the vice-rector of the Higher School of Economics, Liliya Ovcharova, from the point of view of assessing well-being, the new approach will be the same as the old one. Only in new terms and with a different calculation method.

Now the cost of living does not depend on the income of Russians, but changes following food prices. According to the new methodology, if the population’s incomes fall for some reason, the median will fall behind them, and therefore the cost of living. There is no protection against this in the existing regulatory framework.

“We had Covid, we had an economic shutdown. And if the median at the end of 2020 turns out to be lower than the median for 2020, in value terms the poverty line will fall below the minimum consumption standards that are provided for in the method when the basket is calculated,” Ovcharova noted.

Additional payment up to the minimum wage

The administration is obliged to pay the employee a salary no less than the established minimum wage each month. However, some employers had a question: is it possible to pay an employee a salary below the minimum wage for two months, and then in the third month, by charging an additional bonus or a special surcharge, to compensate for the missing amount for the quarter (i.e., the difference between the paid salary and the minimum wage).

You might be interested in:

How to arrange a business trip in 2020: instructions with sample documents

The Ministry of Labor issued a letter stating that this cannot be done. Salaries must be checked monthly for compliance with the minimum wage, and the quarterly bonus paid will be taken into account only in the month in which it was actually issued.

Important! Thus, the employer must pay the employee monthly the difference between his salary and the current minimum wage.