Knowledge of what the organizational and legal forms of a legal entity are will be needed primarily by those who have decided to open their own business. Having received information about what they are like, it is easier for a future businessman to determine which form is suitable for him to create his own company.

Before choosing a legal form, you need to decide on the following questions:

- How will the company be financed? Whether it is necessary to attract investors or only the owner will invest in the company.

- Does the owner want to run the business independently or hire a director, accountant and other employees?

- How big will the business be, what is the expected monthly and annual turnover?

- Which settlement with counterparties is preferred: cash or non-cash?

- Is it possible to sell the business in the future?

The solution to these issues determines the form of doing business, as well as the number of reporting forms and the frequency of their submission.

What is the organizational and legal form of an enterprise

Before moving on to considering organizational and legal forms, it is necessary to understand what they are.

Organizational and legal forms of a legal entity (OLF) are forms of activity that are directly established by the legislation of the country and determine the rights, obligations and procedure for disposing of the assets of a legal entity.

The main criteria by which legal entities are classified are:

- Goals of activity.

- Forms of ownership.

- Participants' rights.

- Composition of owners.

The Civil Code of the Russian Federation includes two main forms of doing business:

- Commercial companies. The main goal they pursue in the course of their activities is to make a profit, which the owners of the company distribute among themselves.

- Non-profit organizations. They are not created for profit, and if profit does arise, it is not distributed among the founders, but is spent on statutory purposes.

Legal capacity

This term means the ability to acquire rights (including property) and bear responsibilities. The legal entity receives it from the moment of registration. The types of legal capacity of a legal entity are few, there are only two of them: general and special. General provides an unlimited range of rights: the organization can carry out any permitted activity. In a special organization, it has the right to conduct only those activities that are prescribed in the Charter or provided for by law. Thus, banks cannot engage in trading, manufacturing and insurance activities, and insurance companies cannot engage in any other activity at all.

Classification of commercial organizational and legal forms

The organizational and legal forms of commercial organizations, in turn, are also divided into several types:

- Business partnerships are either full or faith-based (Article 69.82 of the Civil Code of the Russian Federation). The difference between them is the degree of responsibility of the comrades (participants). In a full company, they are liable for the obligations of the company with all their property, and in a faith-based (limited partnership) - only to the extent of their contributions.

- Business companies (Articles 87, 96 of the Civil Code of the Russian Federation) - limited liability companies (LLC), joint-stock companies (JSC). The capital of an LLC consists of contributions from participants and is divided into shares, while in a JSC the capital is divided into a certain number of shares.

- Production cooperatives (Article 106.1 of the Civil Code of the Russian Federation) - citizens unite in such organizations voluntarily on the basis of membership and share contributions. Such cooperatives are based on the personal labor of their members.

- Economic partnership is quite rare and is practically not mentioned in the Civil Code of the Russian Federation; it is regulated by a separate law No. 380-FZ.

- Peasant farming (Article 86.1 of the Civil Code of the Russian Federation) is an association of citizens for farming. Based on their personal participation in the business and property contributions.

To commercial structures in accordance with Art. 113 of the Civil Code of the Russian Federation also includes unitary organizations, which are of two types:

- government;

- municipal.

Important! The property of unitary enterprises is recognized as indivisible and cannot be distributed in the event of their liquidation.

Commercial structures and their characteristics

For commerce, the main goal of achievement is considered to be increasing wealth; among the common types of such enterprises are the following.

Business partnerships

The capital of such organizations is formed through equity investment. These partnerships are divided into full and limited partnerships. In addition, they come with limited liability and joint stock.

Moreover, each company is endowed with certain legal nuances:

- A general partnership is characterized by the unconditional liability of the participants with their own property for obligations; these formations are quite risky. Here you will learn how to create a general partnership and what documents are needed for this;

- In a limited partnership, there are, in addition to general partners, investors who risk losing their deposits if their obligations are not fulfilled. The rights and obligations of participants in a limited partnership are in this article.

Important: such societies are not very common in Russia. Besides them there are:

- LLC - in this company there are participants who have made a certain contribution to it, and in case of unfulfilled obligations, they are liable only for this contribution, without losing personal property;

- JSC - has many similarities with LLC, with the exception of the name of the form of ownership; here the founders, instead of an equity share, own a certain number of shares. These structures are closed - shares are distributed among predetermined persons, public - with the right to publicly place shares.

Production cooperative

It is a voluntarily formed variant of activity to achieve a single production or other goal. Their main nuance is the personal voluntary participation of citizens in the process of activity.

Peasant farming

This association is based on the family ties of the participants, but this is not necessary, creating it for the purpose of performing agricultural work for profit.

Such a farm must have a head who is the unconditional leader. All decisions on the farm are made by the general meeting, and property is also common.

Unitary structures

These enterprises are created to solve problems at the state level, provide the population with scarce food, sew the necessary clothes, and so on. Enterprises are allocated ownership of certain property, it can be an entire economic complex, but they have no rights to the property.

Since such enterprises are created by authorities, the right to property remains with the owner. In addition, they must coordinate any production decisions with the creator.

Classification of forms of non-profit organizations

The organizational and legal forms of non-profit organizations presuppose that the monetary profit received in the course of their activities goes towards the implementation of their statutory goals and objectives, often these are social, educational or humanitarian goals. Non-profit organizations have the great advantage of being exempt from paying most taxes. Businessmen readily take advantage of this.

It is beneficial to establish non-profit forms of organization in the areas of education, media, and communities of interest. They are such widows:

- A consumer cooperative (Article 123.2 of the Civil Code of the Russian Federation) is a non-forced association of people and their property for the implementation of entrepreneurial activities and joint projects.

- Public and religious organizations (Articles 123, 26, 123.4 of the Civil Code of the Russian Federation) are a united group of people who have united at their own discretion to satisfy non-material needs (for example, spiritual, political, professional, etc.).

- Fund (123.17 Civil Code of the Russian Federation) - has no membership, an organization established by legal entities and/or citizens, which exists thanks to voluntary contributions. Such an organization can only be liquidated by a court decision. May have goals: charitable, cultural, social, educational.

- Association of real estate owners (Article 123.12) - unites the owners of apartments and other buildings, including dachas and land plots in joint use.

- Association and union - based on membership, created to represent common interests, including socially beneficial and professional ones.

- Cossack societies are regulated by separate legislation (No. 154-FZ). Created for voluntary service.

- Communities of indigenous peoples of the Russian Federation of small numbers (Article 123.16 of the Civil Code of the Russian Federation) - such communities are created in order to protect the original habitat and preserve the traditions of nationalities.

- Institutions (Article 123.21 of the Civil Code of the Russian Federation) - are created for managerial, social or cultural purposes.

- Autonomous non-profit organizations (Article 123.24 of the Civil Code of the Russian Federation) - involves the provision of services in the field of education. medicine, culture, science, etc.

We have systematized all the information about each of the forms of management, as well as their pros and cons, in the table:

| Name of OPF | Short title | Definition |

| Commercial organizations | Organizations whose main goal is to generate profit and distribute it among participants | |

| Business partnerships | Commercial organizations in which contributions to the share capital are divided into shares of the founders | |

| General partnership | PT | A partnership whose participants (general partners) on behalf of the partnership are engaged in entrepreneurial activities and are liable for its obligations not only with their contributions to the joint capital of the PT, but also with the property belonging to them |

| Partnership of Faith | TNV | A partnership in which, along with general partners, there is at least one participant of another type - an investor (limited partner) who does not participate in entrepreneurial activities and bears risk only within the limits of his contribution to the share capital of TNV |

| Business societies | Commercial organizations in which contributions to the authorized capital are divided into shares of the founders | |

| Limited Liability Company | OOO | A business company whose participants are not liable for its obligations and bear risk only within the limits of their contributions to the authorized capital of the LLC |

| Additional liability company | ODO | A business company whose participants jointly and severally bear subsidiary (full) liability for its obligations with their property in the same multiple of the value of their contributions to the authorized capital of the ALC. |

| public corporation | OJSC | A business company whose authorized capital is divided into a certain number of shares, the owners of which can alienate the part they own without the consent of other shareholders. Shareholders bear risk only to the extent of the value of the shares they own. |

| Closed joint stock company | Company | A joint stock company whose shares are distributed only among its founders or other predetermined circle of persons. Shareholders of a closed joint stock company have a pre-emptive right to purchase shares sold by its other shareholders. Shareholders bear risk only to the extent of the value of the shares they own. |

| Subsidiary business company* (a subtype of business company, not a private enterprise) | DRL | A business company is recognized as a subsidiary if the decisions it makes, due to one circumstance or another, are determined by another business company or partnership (predominant participation in the authorized capital, according to an agreement or otherwise) |

| Dependent business company* (a subtype of business company, not OPF) | ZHO | A business company is recognized as dependent if another company has more than 20% of the voting shares of the joint-stock company or more than 20% of the authorized capital of a limited liability company (LLC) |

| Producer cooperatives | A voluntary association of citizens on the basis of membership for joint production or other economic activities based on personal labor participation and the pooling of property share contributions by its members (to a cooperative mutual fund) | |

| Agricultural artel (collective farm) | SPK | A cooperative created for the production of agricultural products. Provides for 2 types of membership: member of the cooperative (works in the cooperative and has the right to vote); associate member (has the right to vote only in certain cases provided for by law) |

| Fishing artel (collective farm) | PKK | A cooperative created for the production of fish products. Provides for 2 types of membership: member of the cooperative (works in the cooperative and has the right to vote); associate member (voting rights are vested only in certain cases provided for by law) |

| Cooperative farming (co-farm) | SKH | A cooperative created by the heads of peasant farms and (or) citizens running personal subsidiary plots for joint activities in the production of agricultural products based on personal labor participation and the pooling of their property shares (land plots of peasant farms and private household plots remain in their ownership) |

| Unitary enterprises | A unitary enterprise is an enterprise that is not endowed with the right of ownership to the property assigned to it by the owner. Only state and municipal enterprises can be unitary | |

| State (state) enterprise | GKP | A unitary enterprise based on the right of operational management and created on the basis of property in federal (state) ownership. A state-owned enterprise is created by decision of the Government of the Russian Federation |

| Municipal enterprise | MP | A unitary enterprise based on the right of economic management and created on the basis of state or municipal property. Created by decision of an authorized state body or local government body |

| Peasant (farm) enterprise * (not a private enterprise) | peasant farm | The legal form of organizing agricultural production, the head of which, from the moment of its state registration, is recognized as an individual entrepreneur, is endowed with the right to make all decisions on its management, and bears full responsibility for its obligations. Within the framework of a peasant farm, its members pool their property and take part in its activities through personal labor. For the obligations of a peasant farm, its members are liable within the limits of their contributions. |

| Non-profit organizations | Organizations that do not pursue the goal of making a profit and do not distribute the profits between participants | |

| Consumer cooperative | PC | A voluntary association of citizens and legal entities on the basis of membership in order to satisfy the material and other needs of the participants, carried out by combining its members with property shares. Provides for 2 types of membership: cooperative member (with voting rights); associate member (has the right to vote only in certain cases provided for by law) |

| Public and religious organizations | A voluntary association of citizens based on common interests to satisfy spiritual or other non-material needs. The right to carry out entrepreneurial activities only to achieve the goals of the organization. Participants do not retain ownership of the property transferred to the organization | |

| Funds | An organization that does not have membership, established by citizens and (or) legal entities on the basis of voluntary property contributions, pursuing social, charitable, cultural, educational or other socially beneficial goals. Has the right to engage in entrepreneurial activities to achieve their goals (including through the creation of business companies and participation in them) | |

| Institutions | An organization created by the owner to carry out managerial, socio-cultural or other functions of a non-profit nature and financed by him in whole or in part | |

| Associations of legal entities | Associations (unions) created by legal entities for the purpose of coordinating business activities and protecting their property interests. Members of the association retain their independence and rights as a legal entity |

Which OPF to choose

The most common forms of business are LLC and JSC.

Limited Liability Company LLC

The organizational and legal form of an LLC is a company whose capital consists of the contributions of its participants; they do not bear the risk of losses associated with activities in the amount of their contributions.

Advantages:

- It is easier to create an LLC than other legal entities.

- The liability of the founders is limited to the size of their contributions.

- The minimum amount of authorized capital required by law is relatively small.

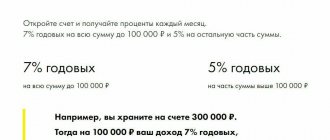

- As legal entities, LLCs can use bank loans, and their conditions are more favorable than for.

- By choosing special forms of taxation, an LLC can operate without an accounting report (or maintain it in a simplified manner) and pay taxes according to a simplified system.

- Selling a business is very simple, just change the composition of the founders.

Flaws:

- It is possible that disagreements between several founders may be difficult to resolve.

- More finance is needed to create an LLC than for an individual entrepreneur.

- Closing an LLC is more difficult than an individual business (IP); it often takes more than one month.

- Important decisions require the consent of all founders.

Limited liability organizations are suitable for medium-sized companies planning large turnover on their bank account and raising borrowed capital.

Joint Stock Company (JSC)

According to the Civil Code of the Russian Federation, a joint-stock company has an authorized capital, which is divided into a certain number of shares. Each shareholder has the right to count on receiving dividends and participating in the management of the company

A JSC must maintain financial statements, and they must be published in the public domain. Each issue of shares is registered in a special register. There is also a need to maintain a register of shareholders. The JSC must have a qualified lawyer and accountant to monitor any changes in legislation in order to avoid violations, as this promises large fines.

A JSC is in a more protected position from raider takeovers than an LLC. Exiting the founders of a joint stock company is simple - you need to sell your shares.

This form of business is suitable for large businesses - manufacturing and construction companies, banks and financial institutions.

Types of bodies of a legal entity

The criterion for distinguishing structures within a legal entity is their composition. They can be individual or collegial.

At the same time, there may be cases when they exist simultaneously within the same organization, but their legal status and competence differ.

Most often, the legal capacity of companies is exercised through a sole executive body. The main types of its name are director or general director.

However, there are cases when all management functions are implemented through a collegial body. An example would be the board of directors in a cooperative.

Despite the fact that it includes the chairman of the board, he has nominal competence and his legal status is limited to resolving organizational issues accompanying the activities of this collegial body.

Individual entrepreneurship

You can engage in entrepreneurship without forming a legal entity. This form of economic activity includes individual entrepreneurship (IP). This form of activity is simple and beneficial for small and medium-sized businesses.

Private entrepreneurship has its advantages and, of course, disadvantages that need to be known and taken into account:

Advantages of IP:

- It is easier to open or close than other forms of doing business.

- Opening an individual entrepreneur involves minimal costs.

- Accounting is not needed or requires a simplified form.

- Tax can be paid according to a simplified scheme.

- There is only one business owner - the entrepreneur.

Flaws:

- The owner bears absolute responsibility for all of his property.

- It is difficult for an individual entrepreneur to get a business loan.

- Legal merger or separation of capital between partners is difficult to achieve.

- It is often necessary to pay taxes even when the activity is not performed or results in a loss.

- Some counterparties prefer to work with legal entities.

Conducting this form of activity prevails among market traders, small shops, salons for providing any services to the population (for example, hairdressers) or online stores.

Doing business without legal entity status

In addition to forming a legal entity, it is possible to engage in commerce by obtaining the status of an individual entrepreneur, who is a full-fledged subject of civil relations. Becoming an entrepreneur is available from the age of majority by registering with government agencies.

The disadvantage of an individual entrepreneur, unlike a legal entity, is full liability with all his property in the event of liability to third parties. He can lose everything, including property acquired as an individual.

Important: however, there is also a positive factor - access to conducting any type of activity without additional creation of Charters and other constituent documents.

In addition to individual entrepreneurs, there are several other ways to conduct business without forming an enterprise - branches operating as legal entities and representative offices, whose activities are aimed at protecting the interests and rights of the business.

Changes made to the Civil Code of the Russian Federation that affected organizational and legal forms

On September 1, 2014, serious changes took place in the Civil Code of the Russian Federation, which significantly changed the classification of OPF:

- Now there are no additional liability companies. Their creation is no longer permitted in accordance with the requirements of Art. 66 Civil Code of the Russian Federation.

- No significant changes have been made to the LLC; now this company is merged with the ODO.

- New concepts have appeared: unitary and corporate enterprises. In corporate, founders can participate in management and be elected to management bodies (for example, LLC, JSC, etc.) In unitary - the founder is the state or municipality (SUE, MUP).

- Closed and open joint stock companies have changed to public (PJSC) and non-public (JSC).

Joint stock companies that exist both closed and open do not have to re-register OPF according to the new rules. At the same time, when changes are made to the constituent documents for the first time, they must be brought into compliance with the new norms of the Civil Code.

The most popular form of business – LLC – remained unchanged.

It is necessary to have information about OPF and changes in legislation related to the creation of enterprises of various forms of ownership in order to choose the organizational and legal form of activity that is beneficial for you.