Dates and place for filing notification in form TS-2

At the beginning of an activity for which payment of a trade tax is required, the company informs the tax authority of the start date of the activity. At the same time, the Federal Tax Service registers the company as a payer of the trade tax. If the activity is completed, then the obligation to pay the fee is lost, which must be reported to the Federal Tax Service, where the organization (IP) is registered.

That is, the place where the TS-2 form is submitted is the branch where the company was registered at the beginning of its activities subject to the fee.

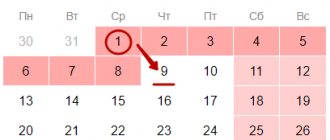

The notification must be submitted within five days following the end of the trade. Days must be counted in working days.

The payer has access to any method of submitting notification paper:

- Paper in person at the tax office.

- Paper, sent via Post.

- Electronic, sent through TKS.

Sample notification TS-1

Initially, the issuance of notifications on the application of the trade tax was advisory in nature. However, soon the tax authorities approved the official form TS-1.

The Trade Fee Notification Form is available for download on our website.

You can also download a sample form for filling out a notification of a trade fee from us.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Rules for filling out the TS-2 form

The notice may be handwritten or typewritten.

If manual filling is used, then:

- the ink should have a blue or black tint;

- indicators must be entered starting from the leftmost cell;

- letters should be written in capitals and printed;

- In the empty cells remaining after filling, you need to put a dash.

When filling out typescript, you should use the courier new font, as well as a size within the range of 16 to 18. If the TS-2 form filled out in this way is printed, then there may be no margins or dashes in empty cells.

The notification form is located on one sheet of paper; when completing it, you must comply with the following requirements:

- Do not print text typed on a computer on both sides of one sheet of paper;

- Do not cross out incorrect data or paint over it with corrective means;

- Enter only one value (number, letter, sign) into a cell;

- Assign a number to the completed sheet of the form in format 001;

Form TS-2 (trade fee) | Sample filling

notifications

for filling out form TS-2

Below are instructions for filling out

Notification TS-2 is submitted to the Federal Tax Service for deregistration of a legal entity (IP) - a payer of the trade fee (TS) upon termination of trading activities.

Notification form No. TS-2 KND 1110051 was approved by order of the Federal Tax Service dated June 22, 2015 No. MMV-7-14/ [email protected]

Where to submit the notification

The notification is submitted to the same inspectorate with which the business entity was previously registered as a trade tax payer.

Form submission deadlines

It is recommended to submit the document within 5 days from the date of termination of trade using objects subject to the levy (shops, kiosks, trays, trailers, etc.).

It should be noted that the date of deregistration under the vehicle is not clearly established by the Code. But as long as the subject continues to be listed as a payer, he will have to bear additional costs for paying the fee.

Inspectors will deregister the taxpayer within 5 days from the date of receipt of Form TS-2 by sending the applicant a notification in Form No. 1-5-Registration.

Is it necessary to surrender upon liquidation or merger of a subject?

It is not required to submit a separate notification of deregistration for the trade fee upon closure of a legal entity (IP). Liquidation of an entity automatically means loss of the status of a vehicle payer.

If there is a procedure for joining another legal entity, inspectors will deregister the payer of the vehicle independently based on the information from the Unified State Legal Entity. That is, there is no need to submit Form TS-2 to a company that is part of another company.

Deregistration of a vehicle without the participation of the taxpayer (Moscow)

The Department of Economic Policy and Development of Moscow is engaged in identifying new objects of taxation of the vehicle, sending the corresponding act to the tax authorities.

The department also exercises the authority to control the completeness and reliability of information about the objects of taxation of vehicles in accordance with the legislation of the Russian Federation and the city of Moscow.

If DEPiR submits to the Federal Tax Service information about the cancellation of the act certifying the identification of a commercial facility, the inspectorate removes the taxpayer from the collection register unilaterally by sending him a notification in Form No. 1-5-Accounting.

Notification methods

You can submit Form TS-2 in the following ways:

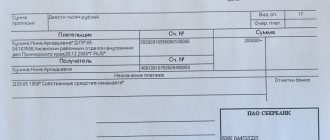

1) On paper (the form is filled out manually or on a computer and then printed out) - in person, through a representative (in this case, a power of attorney will be required: notarized - for an authorized person of an individual entrepreneur, ordinary - for a representative of an organization) or by post (with a list of attachments).

Notice on paper is submitted:

- in 2 copies. – when submitting to the tax authority;

- in 1 copy. – when sent via Russian Post.

2) In electronic form through the website of the tax service or an electronic document management operator (in both cases a qualified electronic signature will be required).

Instructions for filling out the TS-2 form

The procedure for filling out the TS-2 notification is contained in Appendix No. 5 to the Federal Tax Service order No. MMV-7-14 dated June 22, 2015 / [email protected]

1. The form must be filled out manually with blue (violet, black) ink or on a computer.

2. It is not allowed to correct errors using a proofreader or other similar means, to print sheets on both sides, or to fasten document pages with metal staples.

3. For each indicator, a certain number of familiarizations is provided, and only one indicator is entered in one field.

4. Numerical, text and code indicators are entered into the notification from left to right, from the leftmost sign.

5. Text information is filled in capital letters. If the document is generated using software, you must use the Courier New font (16 - 18 points high).

6. If any information is missing, dashes are placed in empty cells. Moreover, if the form is designed using software, then when printed on a printer there may be no boundaries of familiar spaces and dashes in empty cells.

1. Information on the title is filled out by the organization (IP), except for the block “To be filled out by an inspection employee.”

2. The TIN/KPP codes are indicated in the following order:

- a Russian legal entity indicates the Taxpayer Identification Number (TIN) and KPP assigned to the Federal Tax Service upon registration at its location;

- foreign company - codes assigned at the place of business through a separate division located on the territory of the Moscow Region where the fee is collected;

- Individual entrepreneur - only the TIN code assigned to the entrepreneur at the place of residence.

Moreover, if after recording the indicator there are empty cells in the row, dashes are added to them. Thus, the TIN of a legal entity is filled in in the following format: “7748255795–”.

3. Fill in the four-digit code of the inspection to which the document is being submitted.

4. In the “Information about the vehicle payer” field, the full name of the legal entity or full name of the entrepreneur is indicated (line by line).

5. Next, enter the OGRN code of the organization (OGRNIP of the entrepreneur).

6. Then you should fill in the date of termination of business activity in respect of which the TC was paid.

7. The number of pages of attached supporting documents is indicated below.

8. Block “Reliability and completeness of information”:

The code of the person signing the document is indicated:

- “1” – individual entrepreneur;

- “2” – representative of the individual entrepreneur;

- “3” – head of the legal entity;

- “4” – authorized person of the legal entity.

The full name of the person who certified the notification is written down line by line, while the individual entrepreneur certifying the document with a personal signature does not fill in the full name.

The TIN of the person who signed the form (if available) is entered below if this person uses the TIN along with personal information.

Fill in the contact phone number and email address (it is not necessary to specify an e-mail) to contact the payer of the vehicle.

Next, the signature of the person confirming the accuracy of the information provided and the date of signing the form are affixed.

The last line indicates the details of the document confirming the authority of the representative.

Programs for preparing notifications

You can generate a notification through standard software: “1C: Accounting”, “Bukhsoft”, “My Business”, etc. or use a free program from the Federal Tax Service: “Taxpayer Legal Entity”.

Source: https://nalog-spravka.ru/uvedomlenie-forma-ts-2.html

Procedure for filling out notification TS-2

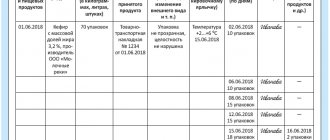

The form for notification of deregistration of a trade duty payer consists of one sheet, in the fields of which the information specified in the table below must be entered. The notification is submitted if the economic entity has completed all activities subject to the trade tax.

| Field name | Information to be filled in |

| TIN | Taxpayer number assigned to a legal entity (Russian or foreign) or individual entrepreneur upon registration with the tax office. The field consists of 12 cells. Individual entrepreneurs fill in all cells when indicating their TIN. Organizations enter the number in the first 10 cells, the remaining two cells are crossed out. |

| checkpoint | This code is indicated only by organizations |

| Tax code | The 4-digit code of the Federal Tax Service branch to which the notification is sent (where the notifier is registered as a payer of the trade tax). |

| Name of legal entity/full name of individual entrepreneur | Either the full name of the company is entered if the payer is an organization, or the full name if the payer is an individual entrepreneur. The name is entered on the basis of the constituent documentation, full name - on the basis of an identification document, for example, a passport |

| OGRN | The field is filled in only by Russian legal entities; foreign entities and individual entrepreneurs do not fill in the field. |

| OGRNIP | The field can only be filled in by individual entrepreneurs. |

| date | The date, month and year of completion of the activity subject to the fee is the last day of operation of a retail outlet, store, etc. |

| Number of sheets | Number of sheets of attached documentation, if any. Such documentation is a power of attorney for representation of interests, issued by the payer to the representative for submitting a notification to the Federal Tax Service. |

| Credibility | In the field consisting of one cell, you must indicate the digital code corresponding to the person submitting the notification:

In the TIN field, the corresponding number of the person submitting the TS-2 form to the Federal Tax Service, if any, is written. Additionally, contact information is indicated - telephone and email. The signature is placed by the person who actually submits the notification to the tax office. If this person acts under a power of attorney or other form transferring authority, then the details of this document must be indicated below. The original paper is attached to the notification. |

Submission methods

There are two places for receiving registration notifications:

- At the place of registration of the stationary facility. When the object of trade is a building or premises with long-term activities on its premises, a notification to the tax office is submitted at the location of the object.

- If the object of trade is not stationary, submit a notification to the tax service at the place of registration of the entrepreneur.

In situations where several retail facilities are involved, all of them are indicated in the notification. However, the place of filing will be the tax authority territorially related to the point located first in the list.

Notification can be given in several ways:

- On paper . Submission is made in person.

- In postal form . To do this, the notification is sent by Western letter with a mandatory list of attachments.

- Electronically . For this purpose, there is a service on the FSN website, or the procedure is performed through an EDF operator under a contract.

Attention! Notification can be given when a new point, shift or change of premises appears. If an object changes its address, a notice of deregistration at the old address is first submitted, and then a notice of registration at the new one is submitted.

Who is on the list of vehicle payers?

Chapter 33 of the Tax Code of the Russian Federation is devoted to the trade tax. It was introduced by Federal Law No. 382-FZ of November 29, 2014.

For 2020, the collection was and continues to be valid only in Moscow .

Payers of the fee include entities that carry out activities that fall under the Customs Union. That is, if an organization or individual entrepreneur is registered in Moscow, and the store is located in another region, they are not payers of the vehicle. And vice versa: if an entity is registered in another region, but trades in Moscow, it is obliged .

TS is established in relation to types of trading activities at certain facilities.

TS payers are organizations and individual entrepreneurs that conduct trading activities at trading facilities . We will reveal further what is meant by these concepts.

The legislation made it possible not to pay TC to some categories of business entities. These include individual entrepreneurs on a patent and payers of the unified agricultural tax (Article 411 of the Tax Code of the Russian Federation).