Beneficiary: definition of the term

A beneficial owner - this is enshrined in the legislation of the Russian Federation - is recognized as an individual who directly or through third parties owns more than 25% of the capital of a legal entity or has the ability to exercise control over the actions of this legal entity (Article 3 of the Law “On Combating Money Laundering” dated 07.08.2001 No. 115-FZ).

The law also provides for the status of the beneficial owner of an individual (by default, this is the same individual, unless there is reason to believe otherwise). See also “The procedure for identifying a client in a bank according to Law 115-FZ.”

Example

The authorized capital of Salut LLC belongs 70% to Lux LLC, 20% to V. S. Petrov and 10% to A. V. Stepanov. At the same time, Stepanov owns 100% of the authorized capital of Lux LLC. Thus, Stepanov is the beneficial owner of Salyut LLC, despite the fact that de jure his share in this organization is 2 times less than Petrov’s share.

Thus, the status of beneficial owner is a legal category, and its characteristics are prescribed at the level of industry-wide legal norms. However, what position can a beneficiary occupy in the business management structure? Let's consider how the key positions in the company of the founder and general director correlate with the status of the beneficial owner - this is important from the point of view of a more detailed understanding of the role of beneficiaries at various levels of legal relations.

Who are the controlling persons?

The modern concept of controlling persons was introduced into legislation in connection with the activities of foreign companies, the real owners of which were Russian businessmen. We are talking, first of all, about offshore companies.

So, the controlling person of a foreign organization is:

- an individual or legal entity owning more than 25% of the shares or shares of a controlled company;

- a person (individual or legal entity) owning 10% of shares or shares in a company, provided that more than 50% of such shares or shares (in total) are owned by residents of the Russian Federation;

- a person who does not fall under the first two points, but controls a foreign company in his own interests or in the interests of a spouse or minor children.

Is the beneficiary the founder or the CEO?

Fundamentally, it does not matter what position a person holds in a business - founder, director or co-owner. The main thing to establish the status of the beneficial owner is the compliance of the person’s role in the business with the criteria defined in Art. 3 of Law No. 115-FZ. He can be the actual owner (without having a legally secured share in the business - we will consider the features of this status later in the article) and at the same time the general director, or de facto make key decisions in the management of the organization, while the director will be another person.

Of course, in general, the beneficial owner is the founder of the company (or one of them). But it is possible that he will be the person who subsequently purchased the required share of the authorized capital. There are common cases when the beneficial owner of a legal entity is the founder of the company that owns the main share of the relevant legal entity.

Example

Citizen Lvov A.E. owns 55% of the shares in PJSC Victoria, which, in turn, owns 70% of the shares in PJSC Almaz. In fact, Lvov does not directly own Almaz shares, but is an indirect participant in this company. The share of his indirect participation will be 0.55 × 0.70 = 0.385, or 38.5%. Consequently, Lvov has a dominant participation (more than 25%) in the capital of PJSC Almaz and meets the criteria of the beneficial owner of this company.

So, the concept of a beneficiary is enshrined in law. But can we say that the status of beneficial owner is the same concept as implied by another common term - “actual owner”?

Are the beneficiary and the actual owner (legal entity or individual) the same thing?

The concept of “actual owner” at the level of legislation of the Russian Federation, in turn, is not fixed. In some sources of law it is given in the same context as the term “beneficial owner” (for example, in the letter of the Ministry of Finance of the Russian Federation dated 04/09/2014 No. 03-00-РЗ/16236). Is it possible to identify them in this regard?

In principle, this is legal, and the reason for this is given by the definition of beneficial owner given in Law No. 115-FZ. This regulation states that a beneficiary may correspond to a person who has the ability to influence decisions made by a legal entity (even though he may not own any shares in the authorized capital of the company).

It is quite acceptable to call the “actual owner” a person who, for one reason or another, is the beneficial owner of an individual. Moreover, in this case it is legitimate to talk about some “pure form” of actual ownership, since the legislation does not provide for the allocation of the authorized capital of an individual. For example, the beneficiary (actual) owner of an individual can be called the recipient of funds indicated by the individual in his will.

Thus, the status of beneficial owner is a legal category that can be identified with the concept of “actual owner,” and this identification is best applied in the context of control over the actions of a legal entity or an individual. In the context of ownership of the authorized capital of a legal entity, it is better to use only the term “beneficial owner”.

Which companies must keep records of beneficiaries?

Obligations for accounting of beneficiaries are assigned to legal entities other than:

- state or municipal structures;

- international organizations;

- by issuers of shares within the framework of organized trading (when disclosing information on securities in the prescribed manner);

- foreign issuers of shares as part of trading on a foreign exchange (if the exchange is included in the list determined by the Bank of the Russian Federation);

- foreign subjects of legal relations that do not have the status of a legal entity and do not provide for the presence of beneficiaries and the position of a general director.

Organizations are obliged to know their beneficiaries and, if necessary, take measures to obtain information about them listed in subparagraph. 1 clause 1 art. 7 of Law No. 115-FZ, update this information annually, store the received data for at least 5 years.

In addition, information about the beneficiaries of the company may be disclosed in its reporting - in the manner prescribed by law (clause 7, article 6.1 of law No. 115-FZ). The procedure for disclosing information is defined in PBU 4/99 “Accounting statements of an organization”, PBU 11/2008 “Information about related parties” and in the recommendations to auditors contained in the Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01 ( Letter of Rosfinmonitoring dated July 29, 2019 N 01-04-05/17015). In particular, information about such persons is disclosed in the notes to the balance sheet and income statement.

Who is the beneficiary?

Many people confuse the beneficiary and the beneficiary. In fact, these are identical concepts, but with some differences. They both have profits from the company's activities, but the beneficiary has a quarter or more share of the ownership, and the beneficiary has less or no share.

The beneficiary and the beneficiary can be the same person or completely different. In the first case, the beneficiary has income and controls the work of the company, and in the second, he only receives income (or part of it) for performing his duties.

Which firms must disclose their beneficiaries?

Legal entities, as well as individual entrepreneurs, are required to provide information about beneficiaries upon request (Clause 6, Article 6.1 of Law No. 115-FZ, Clause 10 of the regulations approved by Decree of the Government of the Russian Federation of March 19, 2014 No. 209):

- to Rosfinmonitoring;

- to the Federal Tax Service.

In addition, when contacting an organization or individual entrepreneur that manages funds, the legal entity and individual entrepreneur provide information about their beneficial owners - this is also their legal obligation, provided for in paragraph 14 of Art. 7 of Law No. 115-FZ. The scope of this information is defined in paragraph. 2 subp. 1 clause 1 art. 7 of Law No. 115-FZ.

ConsultantPlus experts explained step by step how companies record and disclose information about beneficiaries. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The form of information about beneficial owners is not approved by law. But it should include:

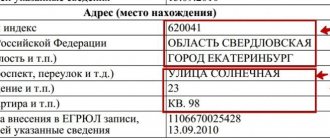

- Full name of beneficial owners;

- citizenship;

- Date of Birth;

- passport data (or information from another identification document);

- residence address;

- TIN.

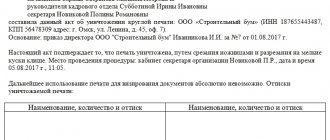

A sample form for completing the certificate can be downloaded below.

Failure by a company to provide information about beneficial owners to the specified government agencies is a reason for applying sanctions against it under Art. 14.25.1 Code of Administrative Offenses of the Russian Federation. Namely, a fine for officials in the amount of 30,000-40,000 rubles, for legal entities - 100,000-500,000 rubles.

Results

A beneficial owner is a founder or director, one of the owners or the actual owner of the company (even if de jure he does not own any shares in the authorized capital of the organization), who has the ability to at least control the activities of the relevant business entity. In this case, the organizational and legal status of this entity does not matter - it can be either a legal entity or an individual entrepreneur.

To legally determine the status of beneficial owner, it is necessary that an individual owns at least 25% of the authorized capital of the organization. Firms and individual entrepreneurs are required to inform Rosfinmonitoring, the Federal Tax Service, and organizations managing funds about their beneficiaries upon request.

You can learn more about the specifics of the work of financial control authorities (which, in particular, have the authority to request information about their beneficiaries from legal entities and individual entrepreneurs) in the articles:

- “Auditors will report all suspicious transactions to Rosfinmonitoring”;

- “Bodies exercising financial control in the Russian Federation (list)”.

Sources:

- Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” dated 07.08.2001 N 115-FZ

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Meaning of the concept

Beneficiary - who is it? This name is actively used in various areas of life. It can be found in economic and tax relations. Depending on the situation, the meaning of the word changes somewhat.

The name implies that the person making a profit

From the name it is clear who exactly the beneficiary is. Essentially, this is a person who receives material benefits. However, for a clearer understanding, something needs to be clarified.

In a broad sense, this is the name given to the party to the agreement who receives certain income. They do not always have a monetary equivalent. We can also talk about other benefits. The French word “beneficiary” is considered a synonym for this concept. However, there are still certain differences between these words.

Important! In simple terms, a beneficiary is an enterprise or individual who, due to the occurrence of specified circumstances, receives money. This may be entering into a transaction or renting out property to others.

In Russian laws, such a concept can be found quite rarely. In the Civil Code it affects only the area of insurance. A more detailed interpretation can be found in the relevant law. The beneficiary, by definition, is primarily the person who receives the insurance payment.

For banking institutions

Who is the beneficiary for the bank? This term refers to a person who receives benefits when performing banking operations. By opening a deposit, the client becomes the recipient of the funds. A person deposits funds in a bank to receive interest on their growth in the deposit account.

But sometimes the deposit is made out to a third party. In such a situation, the client's beneficiary is another person. So, a father can open a deposit for his son or daughter. This means that according to the law, it is his child who becomes the beneficiary. He will subsequently be able to receive the deposit and the reward accumulated over the entire period of keeping the money in the bank.

For organizations

Who is the beneficiary of a legal entity? The management chain ends with a specific person or group of people who receives all the profits. Such a person will be the final beneficiary.

The beneficiary receives income from the organization

What is a beneficiary of a legal entity? In essence, this is a person who receives the main income from the work of the company or from performing managerial functions. This could be the founder. Also included in this category are the owners of the company.