Hello dear readers. Today I would like to share with you important and structured information that we have prepared for you with our lawyers regarding the creation of a legal entity. Legislation changes every year and novice entrepreneurs do not always have time to keep up with it. In this article we will reveal all the secrets using clear examples of what forms of organization of a legal entity exist, how they differ and how to proceed when creating a legal entity.

Stage 1. Choice of organizational and legal form.

There are the following types of legal entities:

- Commercial organizations.

- Non-profit.

The first ones are created with the aim of extracting profit from the activities carried out and distributing it among the participants of the created organization.

The main purpose of creating the latter is not to make a profit, which means they cannot distribute it among the participants. Non-profit organizations include: housing cooperatives, political parties, charitable foundations, civil corporations, mutual insurance societies and others.

Since our site is about business, we will not consider non-profit organizations, but will talk further about the first ones - commercial organizations. So, carefully read the sign to understand which legal form of business enterprise to choose.

Basic methods

In the theory of business law, there are several options for creating legal entities. In particular, there are:

- Constituent-administrative method. The basis in this case will be the corresponding order of the municipal or state body. This could be, for example, a decision of the government, administration of constituent entities or territorial authorized structures. This procedure for creating a legal entity is used when forming unitary (municipal and state) enterprises. The owner, who is entrusted with these functions, is the relevant federal, subject and local executive bodies.

- Constituent method. It is used when forming a commercial organization with one participant. For example, it could be a business company. This method is also used to legitimize (legitimize) individual commercial activities.

- Treaty-constituent method. It is used when forming a commercial organization in which the number of founders is more than 1. It can also be a business company or partnership, as well as a production cooperative.

- Permissive-constitutive order. This option requires obtaining permission from a government agency.

Stage 3. Registration of a legal entity.

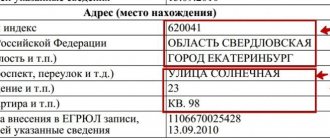

Only after registration in the Unified State Register of Legal Entities can a legal entity officially carry out commercial activities. The date of registration in the register is the date of creation of the legal entity.

Registration takes place with the Federal Tax Service at the location of the legal entity.

If any of the documents is submitted on more than 1 sheet, it must be stitched and numbered.

If documents are not submitted personally by an authorized person (for example, through the MFC or through a representative), then a notarized power of attorney is required. A power of attorney is not needed if you send all documents through a notary. This procedure is possible from January 1, 2016.

The period for registering a legal entity with the Federal Tax Service is 3 days.

download the application in the prescribed form P11001 , with the latest changes from us.

Some requirements for filling out the application:

- The application must be filled out in capital letters.

- The company name must be in Russian only.

- Each founder fills out their own sheet N. Do not rush to sign this sheet. This must be done in the presence of a notary who will verify your signature.

- The TIN of individuals must be indicated, if available.

The PDF file contains a detailed sample of filling out all pages. Excel and Doc blank forms to fill out.

- Sample of filling out an application for registration of a legal entity (PDF)

- Application for state registration of a legal entity upon creation (Excel)

- Application for state registration of a legal entity upon creation (Doc)

You can charter with us. It is universal when creating an LLC. You can make your own adjustments, remove items you don’t need, or leave it as is and use it for your company. All provisions of this charter comply with the latest changes in legislation.

- Sample LLC Charter

As you already understood from the article, when creating a JSC, an agreement is required. We also invite you to download a sample of it below. It is universal.

- Form (sample) of an agreement when creating a JSC

- Form (sample) of an agreement for the creation of a PJSC

Each organizational and legal form may have its own requirements for registration. Therefore, we advise you to read the following articles:

- How to open an LLC

- How to register as an individual entrepreneur

Rules for creating a legal entity

Note 1

The creation of a legal entity is the process of establishing or forming legal entities, which is carried out in accordance with the norms of the Civil Code (Articles 50-52) and the Law on Registration of Legal Entities and Individual Entrepreneurs. The formation of a legal entity occurs only in the organizational and legal forms prescribed in the Civil Code for commercial and non-profit organizations.

Depending on the nature and degree of participation of public authorities in the process of establishing a legal entity, there are several ways to create legal entities.

Methods for creating legal entities:

- express-normative - the founders independently decide on the creation of a legal entity, the authorized state body has the right to control the process of creating a legal entity through the state registration procedure; the rules of creation are legally established, the documents required for registration are listed;

- administrative - a legal entity is established on the basis of the order of the founder, this procedure is used when creating unitary enterprises, organizations and institutions;

- permissive - to create a legal entity, you must have permission from the relevant authorized state body that verifies the need to create this legal entity and the legality of its establishment.

Finished works on a similar topic

- Coursework Creation of a legal entity 490 rub.

- Abstract Creation of a legal entity 230 rub.

- Test work Creation of a legal entity 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Stages of creating an organization

This section of the site describes in detail the process of self-registration of a business: registration of an LLC and individual entrepreneur, as well as the actions necessary to start a business activity, and provides links for downloading the necessary document forms.

The issues of self-registration of non-profit organizations are also covered.

Since the information presented is not official, links are provided to the official websites of authorized government bodies that a novice entrepreneur will need.

Do not be intimidated by the large amount of information - this is not due to the complexity of the process, but to the detail of its description.

I would like to tell you another little secret, which, of course, should please you. I mean the principle of business taxation versus personal income taxation. If taxation of an individual's income occurs before any income is received (i.e., the individual first pays taxes and only after paying the tax receives income), then taxation of any business activity occurs after deducting all expenses (which means that certain expenses can be included (write off) as business expenses). In addition, in some cases, tax rates for business (6% for the simplified tax system (when choosing “income” as the object of taxation; 15% - when choosing the object “income minus expenses”) are lower than the tax rates for personal income tax (13% for tax residents of the Russian Federation and 30% for non-residents).

It should be borne in mind that when receiving income, it is not always necessary to register an individual entrepreneur (PBOYUL).

When is it not necessary to register an individual entrepreneur?

The procedure for registering both an individual entrepreneur and any legal entity is essentially the same, and the differences are associated only with the characteristics of a particular organizational and legal form. This procedure consists of two steps:

- preparation of necessary documents;

- submission of documents for registration.

The entire process of creating a legal entity can be schematically represented as follows:

As can be seen from this diagram, the entire process of creating an organization consists of the following actions:

- Preparation and correct execution of necessary documents for registration.

- Registration of an organization with the tax office

- Registration with the Pension Fund of Russia, FFOMS, Social Insurance Fund

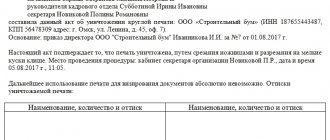

- Making a seal

- Opening a current account in a bank and reporting this to the Federal Tax Service, Social Insurance Fund, Pension Fund

Procedure for creating a limited liability company

To create a limited liability company (hereinafter referred to as the Enterprise), the founding enterprises or individual founders (hereinafter referred to as the Founders) convene a constituent meeting at which they decide to create this Enterprise. Such a decision is documented in the minutes of the constituent meeting.

At the founding meeting, the founders must consider and approve the following issues:

- On the creation of the Enterprise;

- On approval of the Foundation Agreement and Charter;

- On the distribution and approval of parts between the founders;

- On approval of the size of the Authorized Fund; Today, the minimum size of the Authorized Fund is determined by one hundred minimum wages. At the time of registration, each of the founders is obliged to make at least 30% of the contribution specified in the constituent documents, which is confirmed by documents issued by the banking institution. To obtain such a certificate, the bank institution must provide: a constituent agreement (notarized), minutes of the constituent meeting, in which it is necessary to indicate the person responsible for registering the Enterprise, and a property acceptance certificate with a clear list of property that is contributed to the Authorized Fund , and the estimated value of the contributed property;

- On the election of the director of the Enterprise;

- On state registration (the founders entrust state registration to the director or appoint another person to whom they issue a power of attorney, which indicates the powers and his passport details).

It should be noted that before holding the constituent meeting, the founders (this applies to founding enterprises) must receive from their authorized bodies a decision on the creation of such an Enterprise and the amount of the part that will be made as a contribution to the Authorized Fund. In order to clarify the competence of the authorized bodies, it is necessary to obtain constituent documents from them.

After making a decision and preparing the necessary documents, the documents are submitted for state registration. Such documents are:

- Constituent documents in triplicate (memorandum of association and charter);

- Registration card of the established form, which is also an application for state registration;

- A document certifying payment of the state registration fee;

- A document certifying the payment by the founders of the contribution to the Authorized Fund of the Enterprise (such documents are a certificate from the bank or an acceptance certificate in the case of a contribution made by property);

- Certificates of state registration of founding enterprises (notarized copy);

- Premises rental agreement (legal address).

After state registration, the Enterprise must be registered with the authorities of state statistics, the Pension Fund, the Social Insurance Fund, the Employment Fund, the tax police (in order to register with the tax police, the director of the Enterprise and/or heads of the founding enterprises, individuals must come to the reception in person) and the tax office of the relevant district. Then an account is opened at a banking institution and an application is submitted to the relevant internal affairs body to obtain permission to produce seals and stamps.

An enterprise is considered established and acquires the rights of a legal entity from the date of its state registration.

- Transformation of an LLC is a reorganization of a company, as a result of which the organizational and legal form of the Company changes to another (according to Article 56 of the Federal Law “On LLC”). A limited liability company can be transformed into:

- Economic company of another type;

- Economic partnership;

- Production cooperative.