What is OGRNIP

What is OGRNIP for individual entrepreneurs? This is one of the key state registration numbers of an individual entrepreneur, which carries numerous important information. All of them are directly related to the taxpayer.

OGRNIP for individual entrepreneurs is a key detail

Each individual entrepreneur has a huge number of personal codes that have their own unique functions and features.

Finding out the OGRNIP by the TIN of an individual entrepreneur will not be difficult; just use a specialized service on the Internet and submit an application online. Individual entrepreneurs have the right to find out the OGRN by TIN in the same way.

Having received the individual entrepreneur number from a specially developed database, it is possible to submit an application for a certificate with comprehensive data about a specific entrepreneur.

OGRNIP - number of a businessman from the small business sector

An extract according to federal legislation has several forms:

- electronic. The issuance period takes no more than 5 minutes. To receive it, you only need to enter the number in a specially designated line on the official tax resource;

- paper (printed). For the purpose of production, it is enough to submit the appropriate application and submit it to the territorial tax authority by registered mail with a list of the contents and notification of receipt. Additionally, you must attach a receipt of payment.

Federal legislation regulates the following key rules for providing information from the developed register:

- a certificate, which includes comprehensive information regarding the individual entrepreneur, is issued to the director free of charge. The issuance period does not exceed five days from the date of application;

- The period for issuing a certificate to third parties is standard (five days), subject to payment of a fee of 200 rubles*;

- Registration of an extract urgently (within one day) costs applicants 400 rubles.

Thanks to the issued document, applicants reserve the full right to find out comprehensive information, not only about the individual entrepreneur himself, but also his field of activity, namely:

- full initials of the individual entrepreneur (full name);

- OGRNIP details;

- TIN (taxpayer identification number);

- citizenship of an individual entrepreneur, including his permanent residence address;

- sphere of business activity;

- date of tax registration as a representative of a small business in Russia, including legal address, OKPO, postal code, checkpoint;

- comprehensive data regarding issued valid licenses;

- information about the termination (liquidation) of the status of a businessman from the small business sector, contributions to various funds (pension, compulsory medical insurance, etc.), whether the entrepreneur is disabled or not.

For your information! The main task of OGRNIP is to check the reliability of a potential partner who works as an individual entrepreneur.

Without exception, all data contained in the state register is not only reliable, but also relevant. The database in a specially designed register (it can be used via the Internet) is updated quarterly.

USRUL registration sheet for 2020-2020

The legal address to which this extract will be sent to the customer is also important. The application is sent to the tax authority, and an invoice for payment for the relevant services must be attached to it.

“How to open an individual entrepreneur in 2020? Step-by-Step Instructions for Beginners”

- legal name of the company;

- information about the head of the company;

- method of formation of a legal entity;

- legal address;

- information about the founders;

- complete information about the essence of the company’s economic activities;

- information about the availability of a license for specific types of economic activity (for example, the sale of alcoholic beverages);

- dates of all changes in the Unified State Register of Legal Entities.

This is interesting: The cost of hot water per cubic meter according to the meter in 2020 Chelyabinsk

All organizations received it, including those that were created earlier. Until recently, a certificate of state registration was provided by the tax authority if a positive decision was made on the application for the formation of a legal entity.

Does it differ from OGRN

How to find out OKATO IP by TIN: what is it and why is it needed

What is OGRNIP for individual entrepreneurs (decoding) was discussed above. OGRN for individual entrepreneurs has its own characteristics.

OGRN is not much different from OGRNIP

The content in its meaning and legal significance in each subspecies under consideration is standard. At the same time, the tax service clearly indicates in its explanations the following differences:

- information about the entry in the case of OGRN is encrypted with a 5-digit code value, in the case of OGRNIP the code contains seven characters;

- To be able to check the full compliance of the provided details, it is necessary to divide the existing indicator by 13 in the case of OGRNIP or 11 if we are talking about OGRN.

Each considered identifier can be used to search for comprehensive data about the organization of interest in the approved Unified State Register.

How many numbers does it have and what does it look like?

The approved code includes 15 characters. Federal legislation provides for a specially approved document plan, the contents of which are encoded with the following designation: XYYTTIIIIIIIV.

Each individual symbol carries personal significant data. Decryption does not entail any difficulties and implies the following:

- the first character X includes only one numeric value that can characterize a specific company affiliation. For representatives of small businesses - 3, for municipal departments - 2;

- the designation YY hides the year in which the small business representative was officially entered into the Unified State Register;

- the TT designation displays the assigned code of one of the Russian regions. A similar code designation for each individual region is established separately. This is stated in detail in Art. 65 of the Russian Constitution;

- the symbol IIIIIIIII displays the unique assigned number itself, under which the entrepreneur is listed in the Unified State Register. The code part can consist of 6-12 characters;

- symbolic designation V - control parameter. It is determined by dividing by the remaining amount of available funds.

Note! Thanks to the sequence of numeric designations, everyone reserves the full right to verify the accuracy of the data regarding the belonging of the code to the document.

Who can receive a registration sheet from the tax office?

Application for issuance of a duplicate certificate

drawn up in any form on behalf of an individual entrepreneur or head (other authorized person) of a legal entity indicating the OGRNIP or OGRN. The application is signed by the entrepreneur or head of the organization who requests a duplicate.

Duplicate OGRN when changing the name of the LLC

Attention! Persons registered in the Unified State Register of Individual Entrepreneurs since 2020 indicate in invoices, acts, contracts and any other documents the details from the Unified State Register of Individual Entrepreneurs registration sheet. It also contains the OGRNIP, the date and name of the Federal Tax Service, which carried out the registration of the individual entrepreneur, and the full name of the individual.

However, in practice there are often situations where the OGRN certificate may be lost or irreparably damaged. In this case, to restore it, the only way out is to obtain a duplicate of the OGRN certificate (record sheet) from the registration authority. It should be borne in mind that due to changes in the legislation of the Russian Federation and the abolition of the OGRN certificate as such, instead of it the organization will receive a record sheet from the Unified State Register of Legal Entities, which will reflect all the necessary information.

This is interesting: When should a foreign citizen register in the Russian Federation?

How and where to find out the registration number of an entrepreneur

IP details - what they include, where you can find them

Finding out the registration number of an individual entrepreneur in 2020 is provided in one of the few ways, namely:

- using the provided certificate, which is issued to all individual entrepreneurs immediately upon completion of tax registration as an individual entrepreneur;

- by issuing an extract from the register. This can be done online or by visiting your local tax office in person.

Information is provided remotely

Important! OGRNIP is rightfully considered a kind of license with which you can conduct official business activities on the territory of Russia. Conducting any business without an assigned state registration number entails administrative and, in some cases, criminal liability.

The issued certificate, in accordance with federal legislation, is relevant in all regions of Russia and does not have an expiration date. It is for this reason that if you move to another region, there is no need to replace it.

Is it possible to find an individual entrepreneur using this number?

Find out the IP INN: where to find it and why it may be needed

How to find out OGRNIP by TIN of an individual entrepreneur was indicated above. The Tax Inspectorate provides the opportunity to find data on whether an individual entrepreneur has a OGRN or not, or whether OGRIP and other important data are used.

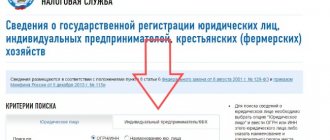

To do this, just submit a request online (you can check it through the Federal Tax Service service). The procedure is simple and contains the following sequence of actions:

- You need to go to the official resource of the tax office.

- A user, for example, who decides to check an employer, goes to the “Electronic Services” category, which will allow him to accurately determine the further format of cooperation.

- At the next stage, you need to go to the menu for checking yourself and your counterparties.

- After this, it is enough to select the section for checking individual entrepreneurs; you do not need to indicate the reason for this.

- The details of the taxpayer identification number are indicated.

The check can be performed an unlimited number of times; there is no counter. A prerequisite is that there must be a personal account; in its absence, preliminary registration is required.

You can find the data of interest by number

The system automatically generates a detailed report and provides it to the applicant for review regarding a specific entrepreneur. The main advantage of this method is considered to be the absence of fees for the services provided, and there is no need to contact the authorized government body in person.

The only disadvantage is the need to register on the portal of a potential applicant.

Note! The OGRNIP number in the provided report is displayed first in the list of data, only after that the personal data of the individual entrepreneur follows.

Where to get OGRNIP

The details in question, according to federal legislation, must be issued to all entrepreneurs without exception, regardless of the field of activity and region of registration. The tax office issues a unique number.

In accordance with tax legislation, entrepreneurs reserve the right to initiate a replacement of the assigned number together with the certificate only in exceptional situations, which include:

- making changes to passport data;

- loss of a previously issued certificate;

- making changes to personal initials;

- gender change by entrepreneur.

The tax office reserves the legal right to correct the certificate if it is declared invalid due to mechanical damage. In this case, there is an urgent need to prepare and submit for consideration an evidence base establishing the fact of an accidental occurrence.

Important! It is strongly recommended not to laminate the provided certificate, since the tax service has a negative attitude towards this fact. In the future, numerous misunderstandings may arise with authorized specialists.

What does a legal entity's registration certificate look like?

Note that the tax service has completely abandoned the use of such certificates of enterprise registration. Therefore, if you registered a company before 2020 and were issued a certificate of LLC registration, but today you have lost it and you request a new one from the Federal Tax Service, then you will still only be given a Unified State Register of Legal Entities sheet. After all, the tax authorities don’t even have forms on which to issue that very certificate of state registration of an LLC.

What does a certificate of entry into the Unified State Register of Legal Entities look like?

The Federal Tax Service, by order dated September 12, 2020 No. ММВ-7-14/ [email protected] , announced that starting from 2020, a certificate of registration of a legal entity will no longer be issued. The fact of state registration of a legal entity from the new year is confirmed by a record sheet in form No. P50007. However, the old-style LLC registration certificate will continue to be valid after 2020; it does not need to be replaced.

As a rule, upon such a request they provide copies certified by the signature of the director and the seal of the company. In some cases, for example, when opening a current account or when making transactions with shares through a notary, for the accuracy of the copies it is necessary to submit the originals.

- Tax authorities have become scrupulous about legal addresses, checking them for mass distribution and issuing refusals if the owner does not confirm the fact of renting. Therefore, if you do not have the opportunity to register an LLC at your registration address or do not have your own premises, and also do not have the opportunity to rent premises, then you need to purchase a good legal address, with a guarantee and the possibility of subsequently opening a current account.

LLC registration in 2020

If it is in the process of reorganization or liquidation, then a record sheet is issued. It notes the circumstances on the basis of which information is entered into the register of legal entities, records who the applicant is for state registration, and other information reflected in the Unified State Register of Legal Entities from the date of registration of the LLC.

This is interesting: Volgograd Kirov district financing of child benefits

From January 1, 2020, when registering an enterprise, instead of a registration certificate, tax authorities will issue a registration sheet in the Unified State Register of Legal Entities. At the moment, this sheet is an appendix to the certificate (form No. P51003). The certificates themselves will be cancelled. Tax authorities introduced such innovations by order dated September 12, 2016 No. ММВ-7-14/481.

Validation check

You can check the accuracy of OGRNIP on the tax service portal. To do this, just go to the appropriate section and fill out a specially designed form. The service is provided instantly, no payment is required.

Accuracy check is possible on the Federal Tax Service website

OGRNIP is an analogue of a license, without which it is impossible to conduct business in Russia. The document and number are issued immediately after tax registration. You can find out the details of the certificate in different ways.

*Prices are as of July 2020.