Definition of concepts

Subsidiaries are legal entities created by other (parent) organizations, which vest them with certain powers and functions, and also provide their property for use. It is also worth noting that the main company draws up the charter and also appoints the management of the newly formed one.

Subsidiaries are one of the most common mechanisms for business expansion. When deciding to increase the scale of production or enter new markets, managers often resort to a similar mechanism.

Distinctive features

So, management decided to create an accountable company. Such a company is a subsidiary. It has a number of features that distinguish it from other organizations, namely:

- conducting independent business activities in accordance with the charter;

- relative independence of management in matters related to personnel and marketing policies;

- significant distance from the parent company;

- the ability to independently build relationships with government agencies, partners, competitors, suppliers, and clients.

Branches and subsidiaries

Subsidiaries and branches are often confused, although these concepts cannot be identified. The main difference between these organizations is their empowerment.

Subsidiaries are completely independent organizations. Despite the fact that they are fully accountable to the parent companies, their managers have full authority to make management decisions and also bear full responsibility for their actions. They are also characterized by having their own charter. We can say that from the moment the charter is drawn up and the manager is appointed, the subsidiary receives almost complete independence in relation to personnel and marketing policies, as well as other activities.

Speaking about the branch, it is worth noting that it is absolutely dependent on the head office. In fact, he is controlled by him. Such an organization does not have its own charter, which means that all issues regarding production, advertising and personnel are decided by the highest management.

If we are talking about global expansion of production, then it would be advisable to organize subsidiaries. In the case where the territorial spread is small, it is worth giving preference to branches.

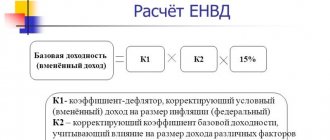

Let's look at the main tax advantages that D P status can promise

1. If the parent enterprise is a small business entity (that is, if its average number of employees for the reporting period (calendar year) does not exceed 50 people, and its annual gross income is 500 thousand euros, and it complies with other requirements of the Law on supporting small businesses), then the DP can switch to a single tax.

For example, if the parent company is a single tax payer, but annual revenue is expected to exceed UAH 1 million. (or the number of employees is 50 people), then the creation of a subsidiary will allow the parent company to continue to enjoy the benefits of the single tax.

2. There are several tax benefits, the application of which depends on the share of sales of a certain category of products (or on the share of employees of a certain category).

For example, to use paragraph. 11.29 of the VAT Law and leave part of the VAT at its own disposal, the amount from the sale of agricultural products of its own production and its processed products for the previous reporting (tax) year must be at least 50% of the enterprise’s gross income.

Therefore, if it is assumed that after expanding the scope of activity it will not be possible to overcome the 50% barrier, then it is worth creating a subsidiary that will take over the production of agricultural products and will be able to apply the VAT benefit.

The situation is similar with payers of the fixed agricultural tax, and in general there are many such examples. Having clarified the essence of DP, let’s move on to their creation and life activity.

Creation of subsidiaries

In order to open a subsidiary, you need to go through the following procedures:

- it is necessary to draw up a charter for the new organization, as well as clearly distribute the shares of capital between the owners;

- the director of the parent company signs a document indicating clear coordinates and contacts of the subsidiary;

- the organization must obtain certificates from the tax office, as well as from credit organizations, confirming the absence of any overdue debts;

- Next comes the turn of filling out a special registration form;

- at the last stage, a chief accountant must be appointed, after which the documents are sent to the tax service, where a decision is made to register the subsidiary.

Absorption

You can create a subsidiary not only from scratch, but also through the absorption of other organizations (by mutual agreement, to pay off debts or in other ways). In this case, the procedure will look like this:

- To begin with, it is worth deciding whether the enterprise’s production will be reoriented to the standards of the parent company or will remain in the same direction;

- the next stage involves the development of statutory documents;

- you should find out the validity of the previous details of the enterprise or assign new ones to it;

- then a director (or manager) is appointed, as well as a chief accountant, to whom responsibility for the management of the subsidiary is subsequently transferred;

- Next, you need to contact the tax and registration authorities with the appropriate application to register a new enterprise;

- Once the registration certificate is received, the subsidiary can operate fully.

Best business ideas

When an enterprise operates in several interrelated areas, the owners of the company can legally create subsidiaries. The subsidiary acts as a separate full-fledged legal entity with simultaneous ownership of the main organization. The branch has the right to enter into contracts and make decisions independently. Governing rights are vested in the director and executive body of the parent company.

To open a subsidiary, you need to collect the following papers: documents for the main company, the charter of the subsidiary, the decision to create a subsidiary, an application form form p11001 and a document that indicates the absence of debt obligations of the head office. So, the actual procedure for opening an enterprise.

To begin with, you will need a well-drafted charter of a subsidiary company with the conditions specified in it. If there are several owners of the starting capital, then it is necessary to sign a memorandum of association indicating the distribution of shares for each investor. Typically, the parent company owns a minimum of 20 percent of the subsidiary's total shares.

Next, you need to draw up a protocol of founders, if there are several of them. If there is only one founder, then a sole decision is drawn up. The document is signed by the chairman, secretary of the founding council or the sole founder.

In the document, the director of the main company must write down the legal address of the company being created.

The main company should not be burdened with debt obligations in relation to the state budget and tax authorities. The Registration Chamber can issue the necessary letter, which will prove the absence of debts.

Now you need to fill out form p11001. It indicates the necessary information about the legal form of the organization being created, its name, address, authorized capital, presence of founders and executive body.

The completed form along with other documents, with a certificate of state registration of the main company, copies of the passport data of the new director and chief accountant are submitted to the local tax office. After registration with the tax authorities, the subsidiary can carry out its activities in full, that is, sign contracts, make transactions, have its own budget, bank account and seal.

How to make money from a hobby - read on. How to make money selling drinks - more on that later.

There are no similar articles.

Category: Business via the Internet

How control is carried out

Control over the activities of subsidiaries can be carried out in the following ways:

- monitoring - implies continuous study and analysis of information contained in the reporting documents of the subsidiary;

- periodic mandatory reports from directors of subsidiaries to senior management on performance results;

- collection and analysis of enterprise performance indicators through the efforts of employees of the internal control department;

- involvement of third-party auditors in studying the state of affairs and financial flows in the subsidiary;

- periodic audits with the participation of the parent company’s regulatory authorities;

- Also quite an important aspect are inspections by state control bodies.

Full list of subsidiaries

Before traveling abroad, it is worth checking in advance whether there is a Sberbank subsidiary in a given country and where exactly its branches are located. It is also advisable to first find out the list of services provided there, as well as their cost .

Kazakhstan

In 2006, PJSC Savings Bank opened the first subsidiary representative office of SB Sberbank JSC in the Republic of Kazakhstan. At the moment, this division has more than 90 branches operating throughout the republic.

The central banking department is located: 050059 Bostandy district, Almaty, Al-Farabi Ave., building 13 fraction 1. Contact:

- tel.: +7-(727)-25-030-20; t/f: +7-(727)-25-000-63;

- official portal: www.sberbank.kz;

The share of Sber shares in the Kazakhstan subsidiary is 100%, SB OJSC Sberbank is joined to the unified trade promotion and development program of the CBRD and acts as a confirming banking structure.

Belarus

2009-2010 was marked for the SB of the Russian Federation with a new acquisition - the opening of a subsidiary of BPS-Sberbank OJSC in the Republic of Belarus. The plans for the development of the Belarusian subsidiary include active steps to attract and develop sources of financing and increase the financial share in the bank lending market.

Structure of the subsidiary branch of Sberbank in Belarus

The central office is located in the capital of Belarus: 220005, Belarus, Minsk, Mulyavin Blvd., building 6. Contacts:

- tel.: +375-(29)-51-481-48; t/f: +375-(17)-21-003-42;

- official portal: www.bps-sberbank.by;

PJSC SB RF owns 97.91% shares of the Belarusian subsidiary OJSC BPS-Sberbank.

Ukraine

The Security Council of the Russian Federation entered the Ukrainian credit and financial sphere in 2007–2008. During this period, the universal commercial banking structure of PJSC Sberbank was acquired in the capital of Ukraine, which is currently included in the list of ten leading financial corporations operating in this country. The Sberbank subsidiary occupies one of the central positions among other banking organizations in terms of reliability criteria (both from autonomous expert commissions and partner structures and individuals) .

Representative office of Sberbank in Kyiv

The main Sberbank office is located in the capital: 01601, Ukraine, Kiev, Vladimirskaya str., building 46. Contacts:

- tel.: +380-(44)-35-41-515; fax: +380-(44)-24-74-545;

- official portal: www.sberbank.ua;

The share of PJSC SB of Russia in the Ukrainian subsidiary of PJSC Sberbank is 100%.

Türkiye

In the fall of 2012, Sberbank made its presence known on the hospitable, warm shores of Turkish resorts, one of the favorite vacation spots of our compatriots. This transaction to acquire a controlling stake in DenizBank became the largest in the history of the development of a Turkish banking organization, which dates back more than 180 years. DenizBank occupies a leading position among private financial institutions in Turkey and has high profitability. More than 600 bank branches operate successfully throughout the country, serving about 5.5 million citizens. DenizBank’s strategic development goals focus on:

Advantages of subsidiaries

A company is a subsidiary if it can be characterized as a relatively independent organization that is accountable to the parent company. This form has a number of undeniable advantages:

- bankruptcy of a subsidiary is practically impossible, since the main organization bears responsibility for all debt obligations (an exception is the case when the main company itself suffers serious losses);

- all responsibility for drawing up the budget of the subsidiary, as well as covering its expenses, is assumed by the head office;

- the subsidiary organization can enjoy the reputation as well as the marketing attributes of the parent organization.

It is worth noting that the stated advantages apply specifically to the governing bodies of the subsidiaries.

Relationship between parent and subsidiary

A few words should be said about the peculiarities of conducting transactions between parent and subsidiary enterprises. Let us immediately dispel doubts about the ownership of the first of them to the property on the balance sheet of the second.

In fact, as we have already said, the DP as a legal entity enters into legal relations with third parties on its own behalf, and the assets it acquires are its property. The parent company will be able to claim them only upon liquidation of the subsidiary, if only something remains from the property of the subsidiary after satisfying the claims of creditors (read about this below), as well as upon distribution of profits (of course, if there is any).

And since the subsidiary has ownership rights, its transactions with the parent company for tax accounting are the usual sale of goods (work, services). Therefore, it is necessary to accrue tax liabilities for VAT and, accordingly, reflect them in accounting for income tax. Moreover, the parent and subsidiary enterprises are related entities, which means that for tax accounting it is necessary to constantly remember regular prices, and for accounting - apply the norms of P(S)BU 23.

Very often we are asked whether it is possible to include in the gross expenses of a subsidiary the amounts transferred for the maintenance of the executive apparatus (executive body) of the parent enterprise. Unfortunately, clause 5.3.6 of the Law on Profit does not allow this.

Here it is also worth paying attention to how the obligation to bear such expenses is formulated. If their amount is determined as a specific part of the net accounting profit of the subsidiary, then for tax purposes they will be considered dividends.

Disadvantages of subsidiaries

We can talk about the following disadvantages of “daughters”:

- since the product range and production technology are clearly dictated by the parent organization, the management of the subsidiary will have to forget about ambitions regarding innovation, rationalization, and expansion of scale;

- the directors of the subsidiary cannot freely dispose of capital, since the directions for its use are clearly outlined by senior management;

- there is a risk of closing the enterprise in the event of bankruptcy of the parent company or the ruin of other subsidiaries.

How is management carried out?

The management of subsidiaries is carried out by a director who is appointed directly by the senior management of the parent company. Despite the provision of fairly broad powers, one cannot speak of complete independence, since the “subsidiary” is a structural unit of the parent company. At the beginning of the reporting period, the manager is given a budget “from above”, on the implementation of which he will subsequently have to report. In addition, the subsidiary operates in accordance with the charter, which was drawn up at the head office. Also, senior management monitors the compliance of their department with all legislative and legal norms.

Positive aspects of holding companies

Due to the fact that the legislation does not have clear conditions and requirements for the composition of companies that qualify them for the status of “holding”. Their hierarchical structure can have a very diverse component. As a result, it is impossible for each holding company considered separately to be considered as promisingly the best.

Or an insufficiently efficient company, in terms of prerogatives or “defects”. The entire promising alternative depends purely on commercial activities and individual “subsidiaries”. But, nevertheless, a number of motivating advantages can be identified for creating a holding company.

Capitalization Center

This is undoubtedly a plus for all holding companies. Because it depends on various situations in the financial market, in the sphere of money and commodity turnover and in the economic segment as a whole. The main capitalization can be redirected to different business areas.

Scale of holding resources

Investment funds, production income and labor resources open up the opportunity to maneuver them. To improve the efficiency of the economic policy of the entire holding network. Moreover, the scale of resources often attracts not only large and reliable investors, but also qualified employees.

Credit component

Due to the prestige of the holding company and its financial scale, credit institutions willingly cooperate with these “giants”.

Risk minimization

Since the subsidiaries are part of the “every man for himself” policy, the holding’s head office has limited risk. Why this state of affairs occurs, and how it generally works, we will talk further below. In the meantime, let's look at other advantages of holding...

Competitiveness

The fact is that given the availability of such a scale of funds and flexibility in the distribution of authorized capital. The holding company has the opportunity to give a tough rebuff to competitors. And not only in the financial market and in the economic sector, but also in the market of goods, services, and even in the labor market!

Trying to master trading on your own means signing up for a “mess in your head” and agreeing with a total misunderstanding of the roar. I suggest getting rid of this once and for all. A clear and consistent study program.

Get rid of the mess in your head once and for all

Tax component of the holding

Yet again. Due to their global status, holding companies have increased efficiency in planning not only the commercial and financial components. But they also have alternative elements of taxation.

Scientific and experimental segment

Due to the combination of common interests and further financial gain. Subsidiary commercial branches of the holding can be combined into one production facility. So, adopt scientific and technical experience and share the latest revolutionary alternative research developments.

What responsibilities does the parent organization have?

According to regulatory documents, a subsidiary is a separate legal entity. At the same time, it has its own capital, which makes it possible to independently bear responsibility for its debt obligations. Therefore, we can say that the “daughter” and the parent company have nothing to do with each other’s debts.

Nevertheless, the legislation identifies several cases that lead to liability on the part of the parent organization, namely:

- If the “daughter” concluded a certain transaction at the direction or with the participation of the parent company. If this fact is documented, then both entities are liable for debt obligations. In the event of insolvency of a subsidiary, the entire burden is transferred to the parent organization.

- The bankruptcy of a subsidiary can also lead to liability on the part of the parent company. In this case, insolvency must occur precisely as a result of the execution of orders or instructions of the second. If the property of a subsidiary turns out to be insufficient to cover all debts, then the obligations for the remaining share are assumed by the parent company.

Despite the fact that the subsidiary has a fairly high level of freedom and broad powers, its financing is provided by the parent organization, which also determines the direction of production activities. Also, despite the relative independence of the subsidiary, the head office exercises constant control over its financial and marketing activities.

Full list of subsidiaries

For travelers, businessmen, and people with dual citizenship, a list of organizations related to the leading bank in Russia will be useful:

- The doors of the subsidiary representative of SB Sberbank JSC are open in Kazakhstan.

- Ukrainian PJSC Sberbank is also wholly owned by the Russian financial corporation.

- More than 97% of the shares of the Belarusian OJSC BPS-Sberbank belong to the parent Russian bank.

- The Swiss representative office of Sberbank (Switzerland) AG is owned by a domestic business - the share of shares is 99.15%.

- Representative office in Turkey with a share capital of 99.85%. Name - DenizBank A.Ş.

- A 100% subsidiary of Sberbank in European countries is Sberbank Europe AG. The group includes Austrian, Hungarian, Czech, Croatian branches. Representative offices of the bank are also open in Bosnia and Herzegovina, Slovenia, Serbia, and Slovakia.

Many readers are also interested in the following question: are there branches of Sberbank of the Russian Federation in Crimea? The answer is negative. There are no branches of the most popular Russian bank on the peninsula yet.