It is obvious that any enterprise or commercial project is created for a reason. Each entrepreneur and partner expects a certain return on investment of funds, effort and time, in the form of receiving a certain amount of income. One of the basic indicators of profitability of any project is revenue . But often many people confuse such concepts as, for example, “ Revenue ”, “Profit”, “Margin”, “Turnover”, and the word “Revenue” sometimes means all of the above concepts at once. Therefore, in this article we will understand what Revenue , how to calculate it and what significance its calculation has when drawing up a business plan.

What is gross revenue from product sales

So, revenue from the sale of products (goods and services) represents the amount of income received during the sale of goods or provision of services, which is important - without subtracting the amount of the cost of production. That is, revenue is measured in the prices of final products at which the goods were sold.

It follows that a large amount of revenue will not always indicate high project efficiency and high profitability. But despite this, revenue is the main indicator that allows you to get a general idea of the company. In order to better understand the essence of this concept, let’s look at the difference between revenue and profit. But first, let's present a formula for calculating revenue .

How to calculate gross profit?

How is gross profit determined in practice? The formula for calculating gross profit looks like this:

PRval = Vyr – C,

Where:

PRval - gross profit,

Vyr - sales revenue,

C is the cost of goods sold (work, services).

For a trading company, gross profit can be calculated in another way - using an average percentage. In this case, the gross profit formula will look like this:

PRval = Inhale – C,

Where:

PRval - gross profit,

Inhalation is gross income,

C is the cost of goods sold.

For information on calculating gross income, see the article “How to correctly calculate gross income?” .

There is also a formula for determining gross profit based on turnover - in this case, gross profit is calculated in this way:

PRval = T × Rnadb /100 – C,

Where:

PRval - gross profit,

T - trade turnover,

C - cost of goods sold,

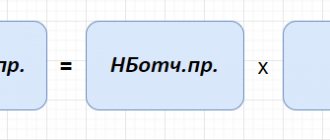

Rnadb is the estimated premium when calculating gross profit, which is found using the formula:

Rnadb = Tnadb /100 + Tnadb,

Where:

Tnadb - trade markup when calculating gross profit in %.

Read about the peculiarities of organizing accounting in trade in the material “Rules for maintaining accounting in trade.”

Formula for calculating revenue

At first glance, the calculation of the indicator in question is one of the simplest types of analysis of a company’s financial results. But it is not always the case. We'll explain why in later sections, but for now let's look at the formula for calculating revenue .

Gross Revenue = Unit Price x Number of Items Sold.

Thus, gross revenue shows what total income was received from the sale of goods and services, so to speak, at buyer prices.

But despite the apparent simplicity of the calculation, analysis of revenue , profit and other profitability indicators requires special attention and often special knowledge. It is especially important not only to determine these parameters after the fact or during implementation, but it is better if they are determined at the planning stage. Moreover, you need to properly integrate income planning into the structure of your business plan. To do this, we advise you to use a ready-made template for such a document as a guide, which will allow you to build a good concept for your project.

Documents that confirm the sale of goods, works, services

When preparing reports, it is advisable to present a document that confirms the sale of funds. Namely the following:

- The act of providing services;

- Act of Handover;

- Invoice for goods;

- Consignment note, etc.

The forms of such documents are developed by the organization, everything is approved by the head. But the form must contain standard details that are stipulated by law. Organizational documents are used to display income and expenses when calculating taxes.

The Russian Tax Service has created a list of common electronic documents, for example, an act of provision of services or work performed. The Federal Tax Service recommends using standard electronic forms for uniform record keeping.

What is the difference between revenue and profit

As they say, revenue and profit are always somewhere nearby. But despite this, they are fundamentally different concepts. The fact is that revenue includes both profit and cost. In order to understand this, let's look at how the unit price is formed.

Price = Cost (Expenses) + Trade margin.

The trade margin in this formula is the source of profit. Profit is formed by multiplying the trade margin by the number of products sold.

Revenue is formed by multiplying the price by the quantity of products sold. Based on this, you can modify the form of profit as follows:

Profit = Revenue - Cost amount = (Price - Cost) x Number of goods sold.

In this case, the profit formula may also vary depending on the availability of data for calculation. In the simplest case, profit is the difference between revenue and cost. But, if we remember that the cost includes only costs associated with production (raw materials, water supply and electricity for production purposes, wages of production personnel), then you can see that the formula looks slightly unrealistic. In most cases, the sale of products is also accompanied by the need to incur commercial and administrative expenses, advertising and promotion costs, rental of premises and other types of costs, which are also deducted from the cost of products sold when determining the amount of profit.

The revenue indicator is the basis of the Profit and Loss Statement of an enterprise, the structure and methods of filling it out have their own characteristics.

What is the difference between revenue and income

The relationship between revenue and income is in many ways similar to the profit example discussed above. Let us note once again that the amount of revenue does not mean that the amount of income will be similar. Thus, income is a more “purified” concept.

Let's look at this with an example.

You produced 100 units of products and then sold them at a price of 50 rubles per unit. Then the revenue amounted to 5,000 rubles. But this does not mean that the income is the same amount.

Firstly, the unit cost of production was 15 rubles per unit. And for the entire sales volume this is 15 x 100 = 1500 rubles.

Secondly, during the sale of products the following types of expenses were also incurred (in total):

- Management costs = 150 rubles;

- Commercial expenses = 350 rubles.

Thus, we subtract the above-mentioned areas of costs from Revenue and find that the profit is:

Profit = Revenue - Cost - Selling expenses - Administrative expenses = 5000 - 1500 - 150 - 350 = 3000 rubles.

But, again, a profit of 3,000 rubles does not mean that the profitability of the enterprise was 3,000 rubles. For example, an entrepreneur also had temporarily free funds and decided to invest them in another project on the condition of receiving a percentage of the profit from this project. During the investment, he received interest income in the amount of 1000 rubles.

Then the total income of the enterprise from commercial and investment activities amounted to 4,000 rubles (profit + interest income). Thus, income is a concept interrelated with revenue , and to some extent more “narrow”. But more “broad” than profit. Although in many cases these values are identical.

In general, the total income of an enterprise in accordance with international financial reporting standards is formed from three areas of activity:

- Commercial;

- Financial;

- Investment.

Net profit and non-current assets (section I of the balance sheet)

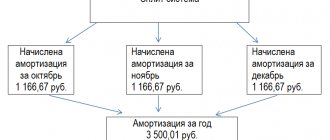

The net profit indicator largely depends on the amount of non-current assets reflected in section I of the balance sheet. For example, large indicators on lines 1110 “Intangible assets”, 1150 “Fixed assets” and 1160 “Income investments in tangible assets” may indicate a large residual value of fixed assets and intangible assets and significant amounts of depreciation on this property.

Accrued depreciation represents an element of cost (for fixed assets and intangible assets involved in the main activity) or part of other expenses (administrative, commercial, etc.). For companies with an extensive material base, accrued depreciation amounts can constitute a significant portion of expenses and have a serious impact on net profit.

For more information about the accounting register for fixed assets, see the article “Features of the balance sheet for account 01”

Another example. The company has large amounts reflected on lines 1150 and 1160, but this does not affect its net profit in any way. Is it possible? This situation arises if fixed assets reflected in the balance sheet do not belong to depreciable property. These are fixed assets whose consumer properties do not change over time: land plots, environmental management facilities, etc. (clause 17 of PBU 6/01 “Accounting for fixed assets”).

And one more nuance. There may be dashes in lines 1150 and 1160 of the balance sheet, but the net profit indicator will change. This is due to the fact that property that meets all the criteria for fixed assets, but costs no more than 40,000 rubles, can be reflected as part of the inventory (clause 5 of PBU 6/01). They will be written off not evenly through depreciation, but at a time, and this will immediately affect the amount of net profit.

Important! For all fixed assets registered after January 1, 2020, the cost criterion allowing for property to be taken into account as part of the inventory increases from 40,000 to 100,000 rubles. (Federal Law “On Amendments...” dated 06/08/2015 No. 150-FZ).

Why determine sales revenue during business planning?

Revenue , its analysis and planning are crucial for the functioning of the enterprise. This is due to many factors, we list some of them:

- Revenue is a determining factor in the effectiveness and efficiency of an enterprise;

- The size of revenue and volumes of products sold determine the feasibility of launching a particular project;

- The timely receipt of revenue determines the financial stability of the company, the state of its working capital, profit margins and timely payment of obligations (payment of wages to employees, settlements with banks on loans, with suppliers for work and services, etc.).

- Revenue is the basis for the break-even of an enterprise, since it is the receipt of revenue that allows the company to cover the costs of production and sales of products.

- From the above, another important meaning of revenue is the source for generating profit.

Thus, it is clear that receiving revenue is a necessary condition for the start and continuation of the activities of any enterprise. But it is equally important not only to obtain and take into account this parameter, it is also necessary to conduct an economic analysis of the revenue . Only in the course of “isolating” from its composition such parameters as “Profit”, as well as correlation with such a parameter as “Income”, allows one to evaluate the actual efficiency of the enterprise.

For example, in financial and investment activities there is no such thing as “ Revenue ”. And, accordingly, if the share of revenue in the total income is small, then the question arises about the feasibility of conducting commercial activity. Then you can, for example, refocus on the investment direction, or search for solutions to problems associated with insufficient performance of commercial activities.

In any case, revenue is not as simple a concept as it might seem at first glance. Therefore, successful companies do more than just keep records of sales revenue and reflect these figures in reporting documents. But they also conduct a thorough analysis of available data and, based on them, identify sources for improving performance.

Revenue is calculated for any project, including business planning for tire fitting. The document will help you launch a successful, promising startup.

Calculation using the algorithm for net profit

The name “net” is given to assets that go to management after calculating all costs and paying all obligations. This part of the funds is formed after obligations to the state budget are fulfilled. Net profit for a business can be calculated in several ways.

Calculation of net profit

Here is the main algorithm and its detailed analysis point by point:

- We determine what the revenue was for the past period based on the financial statements.

- We subtract variable expenses from the resulting amount. We display the value reflecting the marginal profit.

- Next, we subtract the amount of fixed expenses. We receive operating profit.

- We deduct other expenses. It turns out the profit of the enterprise before paying taxes.

- Finally, tax obligatory payments to the budget are deducted last. The result is the amount of net profit.

Small businesses prefer to use contribution margin for analysis. Large enterprises prioritize operational data.

Summarizing

Thus, we hope that the justification given has become good evidence that the income of an enterprise is a vital component of both the organization of the activities of a new enterprise and the development of an existing one. At the same time, income is not limited only to the concept of “ Revenue ” and includes various components that reveal profitability levels from different sides. And each of the presented levels is an important element of the financial and economic analysis of the company.

Often, during the preparation of a business plan, many entrepreneurs have a number of questions related to planning the project’s income and integrating this section into the overall content of the document. Therefore, we advise you to focus on a ready-made sample business plan for an enterprise similar to yours. Or you can turn to professionals who can draw up a full-fledged business plan for your project, taking into account all its features.