- September 2, 2019

- Accounting

- Anastasia Ivanova

This type of analysis is used by consulting firms to understand where conventional accounting has fallen short. It answers the questions: “What do you need to pay attention to?” and “How to restore the profitability of the company or individual divisions?”

Dividing costs into variable and fixed helps solve a number of management problems:

- Find out where the money is going.

- Distribute resources between products.

- Determine the required minimum production.

- Calculate the margin of financial strength for your company.

The concept of variable and fixed costs

In this article, the concepts of fixed and variable costs, expenses and costs will be used interchangeably, although some scholars do not share these terms.

Variable costs are those company expenses that decrease or increase with production volume. In other words, the more products a company produces, the higher its variable costs and vice versa. Examples of variable expenses include piecework wages for workers, materials for production, electricity for production equipment, and payment for transporting goods.

Fixed costs are those expenses that a firm must always pay, no matter how much output it produces. There are fixed costs even when products are not produced at all. These include management salaries, electricity for office premises, depreciation, rent, etc.

Variable expenses

Such costs are those that vary in direct proportion to the volume of products produced or services provided.

For example, in the balance sheet there is such a line as raw materials and materials. They indicate the total cost of those funds that the enterprise needs for production activities.

Let's assume that you need 2 square meters of wood to produce one wooden box. Accordingly, to create a batch of 100 such units of product you will need 200 sq.m of material. Therefore, such costs can be safely classified as variable.

Wages can relate not only to fixed, but also to variable expenses. This will happen in cases where:

- the changed volume of production requires a change in the number of employees employed in the manufacturing process;

- workers receive percentages that correspond to deviations in the working standard of production.

Under such circumstances, it is quite difficult to plan the amount of labor costs in the long term, since it will depend on at least two factors.

Also, in the process of production activities, fuel and various types of energy resources are consumed: light, gas, water. If all these resources are used directly in the manufacturing process (for example, the production of a car), then it would be logical that a large batch of products would require an increased amount of energy consumption.

Types of costs

In business it is very difficult to find “pure” variable and fixed expenses. This division is used to simplify the analysis. The types of variable and fixed costs in real life are semi-fixed and semi-variable costs.

Their peculiarity is that some of the costs are variable, and some are constant. An example is a worker’s wages, which consists of a salary and a bonus for each part made. The salary portion will be a fixed cost, and the additional payment for parts will be a variable cost.

Types of fixed expenses

The list of fixed expenses will vary depending on the specifics of each specific enterprise, but their single distinguishing feature can be identified - these are always investments that do not depend on production volumes. Although such “independence” exists only to certain limits.

Main types of fixed expenses :

— Salaries of non-production personnel (accounting, legal department, technical support group, security guards and other categories of personnel not directly involved in the production of goods and services, but ensuring the maintenance of all business processes of the enterprise);

— Payment for utilities (primarily this includes lighting of premises, water supply not intended for the manufacture of products, heating, etc.);

— Security system of the organization (functioning of video surveillance, alarm systems, etc.);

— Costs of developing an advertising campaign;

— In many cases, this can also include write-offs of costs associated with depreciation of equipment;

fixed expense items “in their pure form.” Therefore, when classifying expenses at an enterprise, the concept of semi-fixed expenses is used. These can be called costs that will be considered constant only up to certain limits. For example, paying for lighting will be a fixed cost if we are talking about a small enterprise, where it does not matter how many machines one light bulb illuminates, it is necessary in any case. But, for example, if this light bulb functions on each machine and their number depends on the volume of production, then in this case we will be talking about variable costs.

Graphical representation of variable and fixed costs

Variable costs appear as a straight line on a graph. The starting point is the origin because at zero production variable costs are zero. A graph is considered to be a linear function of the form:

- Y = k*x, where y is the value of variable costs in monetary terms, x is the quantity of products produced, k is the amount of variable costs per unit of production

The fixed cost graph is also straight, but not from the origin, but parallel to the horizontal axis. This is due to the already described features of fixed costs. The equation looks like:

- Y=k, where y, k is the value of fixed costs in monetary terms.

Composition of variable costs

The classification of variable costs depends primarily on the specifics of the company's work. At the same time, there are also general classification features.

The main types of variable costs are:

- raw materials and materials;

- wages of production workers;

- deductions from wages to funds;

- bonuses associated with increased production volume;

- additional payment to sales managers, agents, intermediaries;

- taxes corresponding to the company's taxation system.

The wages of workers are taken into account here as a variable factor in the part that depends on the volume of production (piecework payment), and deductions from it are taken into account according to the same principle.

Allowances for managers and agents are included in variable costs, even though they relate to sales and not production itself. If the services of outsourcing companies were used, these costs are also included in the variables.

With rare exceptions, the size of the tax base depends on the products produced and the costs of them, so the amount of the tax is a variable value.

In addition, other classifications of variable costs are used. Note that a linear increase (decrease) in variable production costs due to changes in output does not always take place, which is also reflected in the classification.

The dependence on the volume of output can be:

- proportional (by how many percent the volume increases or decreases, by the same amount the costs);

- degressive (growth in production volume outpaces growth in costs);

- progressive (cost growth outpaces production growth).

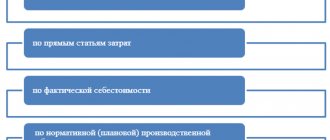

Attribution to the cost of production gives classification into costs:

- straight;

- indirect.

The former can be attributed to the cost of specific products (raw materials), but the latter cannot (wages of finished product warehouse workers), but it is clear that they depend on the production of products as a whole.

However, as we have already said, the classification depends on the specifics of production. A typical example is transportation costs. If a company is engaged in transportation, the costs are classified as direct; if the transport department serves production, they are classified as indirect.

Costs in relation to the production process are divided into:

- production;

- non-productive.

Non-productive ones include, for example, bonuses for managers, and production ones include the consumption of raw materials and materials.

The so-called statistical principle of dividing variable costs into total and average is used. General costs include costs for the entire range of products produced, while average costs per unit of product or product group.

Analysis time interval

As the company develops and turnover increases, for example, when acquiring additional capacity or hiring new managers, fixed costs change. On the graph it looks like steps.

The division into variable and fixed costs can only be made in the short term. The fact is that in the long term, turnover grows, payments, rental prices and utility bills increase under the influence of inflation and other external factors. As a result, all company expenses become variable.

Fixed cost type: what is it?

Fixed costs in entrepreneurship are those expenses that a company incurs, even if it does not sell anything. In addition, it is worth remembering that when converted to a commodity unit, this type of expense changes in proportion to the increase or decrease in production volumes.

Fixed costs include:

- A constant part of the remuneration for the administrative and accounting departments, the salary of the administrator, the cleaner of production premises, repair service workers, the secretariat and others.

Costs of this type also include part of the salary of full-time employees, accrued regardless of production volumes. The payment of this salary does not depend in any way on production volumes. As a rule, these expenses also include the salary of a sales specialist, which is calculated regardless of the effectiveness of his work. The percentage share or bonus part of the salary will be classified as variable costs, because it is this share that depends on the performance and production volumes. Security costs - Payment for additional services related to the stable and uninterrupted operation of the enterprise. Enterprise security, banking services and advertising agencies. Of course, these services also include utility costs. For example, fees for water, electricity, telephone and Internet.

- Rental of premises. This is a fairly indicative example of the fixed costs that one has to face in almost every type of business. When renting space for office and warehouse space, as well as workshops, the entrepreneur is obliged to constantly pay rent, regardless of how much profit he received, provided services or sold his products. As a result, you will need to pay rent in any case, as there will be a danger of termination of the contract and deprivation of the rented premises.

- Depreciation deductions. Accrued depreciation rates are also considered typical indicators of fixed expenses.

- Payment of taxes for static taxable objects. For example, an organization’s property tax, land tax, unified social tax, paid on a permanent salary basis. In addition, an illustrative example of costs of a fixed type are various fees for the right to trade, environmental pollution and transport taxes.

- Payment of bank interest, discounts on debt securities, as well as interest on loans.

CVP analysis

The “Cost – Volume – Profit” analysis is used to determine the volume of production at which a change from loss to profit occurs. This type of analysis can be represented graphically:

The “Total costs” line is formed by adding two straight lines: “Fixed costs” and “Variable costs”. The point where revenue and total costs intersect is called the break-even point. It reflects the situation when the profit is 0. To the left and right of the break-even point are areas of loss and profit.

CVP analysis is a simplified model for assessing the situation in a company. Like all other models, it has a number of limitations:

- The selling price per unit does not change.

- Variable costs per unit are constant.

- Total fixed costs are fixed.

- Everything the company produces is sold, without reserve.

- Changes in production volume are the only factor that affects fixed and variable costs in the cost of production.

- If a company sells more than one product, their revenue ratio does not change.

What are fixed costs

Briefly, fixed costs can be defined as expenses, the value of which does not depend on the volume of production of the enterprise. Such expenses include the cost of paying “non-production” personnel, paying for lighting, up to certain limits, rental payments, etc.

Fixed expenses differ from investments in that they are “shorter” investments, but are similar in that they are one-time expenses for a certain period of time.

Fixed costs are an integral part of any production and, one might say, its foundation. Moreover, the larger the production, the smaller the share of fixed costs per unit of output. If the profit from the production and sale of products does not cover the amount of fixed costs, then efforts to develop such an enterprise are meaningless.

Break-even point and margin of financial strength

These figures can be calculated using a formula if you divide the costs into variable and fixed for your business. The formula for calculating the break-even point is as follows:

- Break-even point (in units) = Fixed costs / (product price - variable costs per unit)

If you multiply the break-even point in units by the price of the product, you get the amount of revenue for break-even production.

The formula works for enterprises producing only one type of product.

To calculate the margin of financial safety (FSA), you need to subtract the break-even point from the company’s revenue:

- ZFP = Revenue - Break-even point (in monetary terms)

The name of the indicator speaks for itself. It demonstrates the amount that a company can count on in case of unforeseen circumstances. The greater the margin of financial strength, the further the company is from an unprofitable state.

Examples of costs:

Each production cycle corresponds to a specific amount of costs that remain unchanged under any conditions. There are other costs that depend on production resources. As was previously established, costs over a short period of time can be variable or constant.

Such characteristics are not suitable for a long time, because the costs will vary in this case.

Examples of fixed costs

Fixed costs remain at the same level for any volume of product output, in a short time period. These are costs for the company's stable factors that are not proportional to the number of units of the product. Examples of such expenses are:

- payment of interest on a bank loan;

- depreciation expenses;

- payment of interest on bonds;

- salaries for managers at the enterprise;

- insurance costs.

All costs independent of the production of a product, which are constant in a short period of the production cycle, can be called constant.

Variable Cost Examples

Variable costs, on the contrary, are essentially investments in the production of goods, and therefore depend on its volume. The amount of investment is directly proportional to the quantity of goods produced. Examples could include costs for:

- for raw material reserves;

- payment of bonuses to employees producing products;

- delivery of materials and the product itself;

- energetic resources;

- equipment;

- other expenses for the production of goods or provision of services.

Consider the variable cost graph, which is a curve. (Figure 1.)

Fig. 1 - graph of variable costs

The path of this line from the origin to point A depicts the increase in costs as the quantity of goods produced increases. Section AB: more rapid increase in costs in conditions of mass production. Variable costs may be affected by disproportionate costs for transport services or consumables, improper use of released goods with reduced demand for them.

Break-even point for multiple products

In reality, you rarely see a company producing one type of product. Therefore, a method was invented to calculate the break-even level for a set of products. However, it has one important limitation: the share of different products in the company's revenue must be constant. In other words, whenever X units of product A are sold, Y units of product B and Z units of product C are also sold.

To better understand how to calculate the indicator, consider an example.

A certain company produces and sells two products: lemonade and water. Water sells for $7 per unit and has variable costs of $2.94 per unit, while lemonade sells for $15 per unit and has variable costs of $4.50 per unit. The marketing department estimates that for every 5 units of water sold, 1 unit of lemonade will be sold. The organization's fixed production and management costs are $36,000.

Let's calculate the break-even point for this company.

Step one: calculate the difference between price and variable costs per unit of production. This difference is also called the specific contribution margin.

- For water: 7 - 2.94 = $4.06

- For lemonade: 15 – 4.5 = 10.5 dollars.

Step two: calculate the marginal profit for the product set.

- (4.06 * 5) + (10.5 * 1) = $30.8

Step three: substitute the values into the break-even point formula:

- 36,000 / 30.8 = 1169 sets

Step four: calculate the number of products of each item that must be sold to make zero profit.

- 1169 * 5 = 5,845 bottles of water

- 1169 * 1 = 1169 bottles of lemonade

Step five: calculate the break-even point in monetary terms.

- (5845 * 7) + (1169 * 15) = $58,450

In order for production not to be unprofitable, the company needs to receive revenue of $58,450. Let us recall that this figure is correct only if five bottles of water are sold for every bottle of lemonade.

Fixed costs, variable costs: division into elements

All costs - fixed and variable - constitute the total costs of the enterprise.

To correctly reflect costs in accounting, calculate the sales value of a manufactured product and carry out an economic analysis of the company’s production activities, all of them are taken into account according to cost elements, dividing them into:

- supplies, materials and raw materials;

- staff remuneration;

- insurance contributions to funds;

- depreciation of fixed and intangible assets;

- others.

All costs allocated to elements are grouped into cost items and accounted for as either fixed or variable.

Margin analysis

This type of analysis is used to select the most profitable products. To apply it, it is necessary to divide costs into variable and fixed. The basic premise is that the capacity of any business is limited. The main concept is marginal income (MI) or marginal profit. The formula for calculating marginal income is:

- MD = Revenue - Variable costs

Or:

- MD = Profit + Fixed costs

Since fixed costs are shared across the entire enterprise, high-margin products should be prioritized. For clarity, let's look at an example again.

The company produces 3 types of products: crackers, chips and corn sticks. Prices, variable costs per unit and specific contribution margin are presented in the table:

| Product | price, rub. | Specific variable costs, rub. | Specific MD, rub. |

| Crackers | 15 | 5 | 10 |

| Chips | 40 | 20 | 20 |

| Corn sticks | 30 | 8 | 22 |

The company can only produce 20,000 packages per month. The maximum quantity of each type of product that can be produced: crackers - 14,000 packages, chips - 10,000, corn sticks - 8,000.

The maximum MD will be:

- (22 * 8000) + (20 * 10,000) + (10 * 2000) = 396,000 rub.

You can independently calculate the marginal income for all combinations and make sure that a set of 8,000 packs of corn sticks, 10,000 packs of chips and 2,000 packs of crackers is the most profitable.

Using marginal analysis, we used all production capacities and selected the most profitable set of products.

Specific fixed costs

During cost analysis, special attention is paid to the study of specific fixed costs. They represent part of the fixed costs per unit of product. An increase in production volumes entails a reduction in specific fixed costs.

This relationship can be clearly seen with an example.

Example. According to the accounting registers of GRADIENT LLC, the total value of the company's fixed costs for the time period under consideration amounted to 200,000 rubles. During this period, 8,000 units of the product were produced. It turns out that at this time the specific fixed costs were:

200,000/8,000 = 25 rubles.

The following month the amount of fixed costs has not changed. But production volume increased to 20,000 units. And the specific fixed costs now change:

200,000/20,000 = 10 rubles.

That is, the amount of specific fixed expenses has decreased significantly.

But fixed costs remain static up to a certain point. Upon reaching its level of production volume in each case, the constant component of all costs can also change - decrease or increase. An example with rent was given earlier. The same applies to depreciation charges. An enterprise that has expanded its economic turnover is forced to purchase new equipment, which, accordingly, will entail an increase in variable expenses in terms of depreciation.

Fixed and variable expenses in accounting

Accounting for fixed and variable costs is optional. It is used by managers to make management decisions. However, in accounting, this division can be useful when calculating costs using the “Direct Costing” method.

It also adds a division into direct and indirect costs. The essence of this method of cost accounting is that the costs of producing products form production costs, and general business costs are written off as period expenses. The cost of production is accumulated on account 25, and production maintenance costs are accumulated on account 26. The entire amount of the 26th account is written off as expenses for the period, regardless of how many products were sold.

The role of cost accounting when developing a business plan

Planning the expenditure side of a project is one of the most time-consuming parts of business planning. When drawing up a business plan, you will need to specify not only the amount of fixed and variable expenses , but also take into account investment investments, which to some extent are also associated with fixed expenses.

Let us explain how this relationship manifests itself. Investments are, as a rule, one-time capital investments, the value of which is also indirectly included in the cost of finished products through depreciation charges. Thus, investment investments, as well as fixed expenses, are “stretched” as part of the cost over a certain payback period.

Taking into account all expenses when planning a project is also fundamentally important because the relationship between the amount of expenses, investments and income from the project is the basis for determining the possible amount of profit and the feasibility of the project.

The indicators of financial calculations also depend on the correct distribution of expenses among variable and fixed items. At the same time, if the business plan has an automatic financial model, it will be possible to easily trace the change in the share of fixed expenses in the cost of production, the change in the total amount of expenses depending on the change in the volume of manufactured products.

Our company is developing standard business plans, including a business plan for a bottled beverage store. In it you will find calculations of all financial and investment indicators.