An organization operating on a commercial basis must understand why it carries out certain expense transactions. According to the main rule in force in this area, all costs must be determined by an economic basis. In other words, the money spent should turn into profit in the future. Therefore, determining expenses that are directly related to the main activities of the organization does not cause any difficulties. But non-operating expenses are another matter. Non-sales payments are payments that must also be made by the company, however, they are not directly related to the sale of the product it produces. We’ll talk about what these expenses are later in the article.

Non-operating expenses

What areas of costs include non-operating expenses?

All expenses of an organization that can be classified as non-operating are taken into account when determining the amount of income tax separately. Each of these areas of costs is presented in Article 265 of the Tax Code of the Russian Federation. Let's look at them further in the list.

- Maintenance of material property objects leased.

- Interest paid on various loans and credits.

- Negative difference between exchange rates.

- Cash contributions to the reserve for doubtful debts.

- Expenses incurred during litigation.

- Expenses spent on paying for the services of a credit institution. Sometimes this item is mistakenly attributed to indirect costs, but this is not the correct approach, since they are non-operating expenses.

If the company sued someone to defend its honor, then the costs taken into account as legal costs will be classified as non-operating, since they were necessary for the company, but did not relate to the production or trade process

- Losses incurred during previous annual operating periods that were discovered directly in the current reporting period.

- The amount of debts considered bad that are not covered by the reserve created to pay off doubtful debts.

- Shortages in inventories can also be included in this list, but only if the person responsible for their formation could not be identified, and, as a result, it was not possible to recover compensation from him.

- Losses incurred as a result of force majeure circumstances, as well as emergency situations.

- Monetary losses that occurred at the time of concluding an agreement on the assignment of the right of claim.

Extract from the Tax Code of the Russian Federation Article 265. Non-operating expenses

This list is designated, as we have already said, by the Tax Code of our country. However, this does not mean that it cannot be replenished with new items. On the contrary, the legislator admits and accepts that the tax base will begin to reflect other non-operating expenses that are not directly listed in the list.

Criteria for recognizing non-operating expenses

The main criteria for recognizing non-operating expenses are:

- data that has documentary evidence;

- indirect economic justification.

The main criteria for non-operating expenses can be considered indirect economic feasibility, as well as the availability of documents confirming them

Study of legislation

To fully enjoy all available rights, they must be known and protected. And in order not to add extra obligations, you also need to know them “in person”. Because there are indirect non-operating expenses that are taken into account as profit. And to do this, let's go through Article 265, which covers all these expenses well. In the future, attention will be paid exclusively to it with mention of certain points of other provisions. After all, we went through the legislative provision of income, but we missed the expenses. Although they are the main topic.

What do non-operating expenses include? As written in Article 265, these include all expenses that are not related to production and/or sales. A clear list of what can be considered from this point of view is given:

- Expenses that were aimed at maintaining property transferred under a leasing or rental agreement, including depreciation. If organizations provide property on a systematic basis and for a fee and/or with the transfer of other exclusive rights that arise from patents for inventions, industrial designs and utility models, then this paragraph also applies to them. After all, the costs go precisely to this point.

- Expenses that come from paying interest on debt obligations of any kind. True, here it is necessary to focus on Articles 269 and 291 in order to avoid problems with regulatory authorities. In addition, this also includes the payment of interest that is associated with the restructuring of debt on fees and taxes in accordance with the procedure provided for by the Government of the Russian Federation. The expense in this case is the amount that was accrued for the actual time of use.

Accounting for non-operating expenses

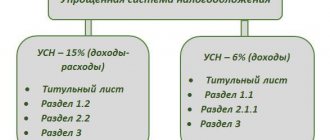

In the income tax report, non-operating expenses are reflected under separate lines in the second sheet of the declaration, which is subsequently submitted for verification to the Federal Tax Service.

Considering directly the nuances of filling out the declaration, it is also necessary to talk about the division into subcategories of non-operating expenses associated with the payment of income tax. So, the costs in this regard can be:

- indirect;

- straight.

However, both of these subcategories are not non-sales; they are directly related to the expenditure of funds aimed at the production or sale of goods. The required division has nothing to do with Article No. 265 of interest to us, and is carried out in accordance with another part of the Tax Code - Article No. 318.

Tax Code of the Russian Federation Article 318. The procedure for determining the amount of expenses for production and sales

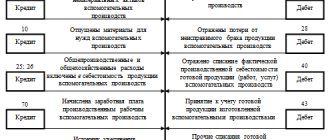

As for accounting, in this area even the very concept of non-operating expenses is absent. As a consequence, answering the question of which account they will belong to is not so simple.

The required category of payments may relate to non-operating payments from a tax point of view, and in accounting they can be recorded as others. As a result, in practice they will be reflected in the debit of account 91-2.

However, it cannot be said that non-operating and other expenses in each case will be the same according to the list of items. So, the list of other expenses in the accounting department will need to include payments related to the organization and implementation of:

- sports events;

- recreation;

- various entertainment events.

Accounting and tax accounting for non-operating expenses will be very different, simply because these are different areas, however, in both cases, the available data must be reflected

In tax accounting, these expenses are generally not taken into account as an element of the formula for calculating income tax; of course, this means that, in principle, they cannot be classified as non-operating.

That is why, when reflecting payments for designated activities in accounting and tax accounting, you will constantly notice the difference in the final result for the current period of time. However, this is unlikely to be avoided, since you, as a representative of a commercial organization, simply do not have the right not to reflect any payments or receipts of funds in the accounting department, even in cases where this does not directly affect the calculation of the company’s tax liabilities.

Accounting for non-operating expenses is the responsibility of any organization engaged in commercial activities, since they must be displayed in the declaration to calculate the amount of income tax

Production costs

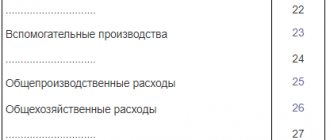

So, classification group I of costs is expenses for core activities. These include the following:

- Material costs. These are expenses for the purchase of all types of raw materials, materials, components, equipment, works and services of a production nature, etc.

The features and nuances of accounting for these expenses are described in detail in this article .

- Labor costs. And this is not only salary, but a much wider range of accruals in favor of employees: bonuses, various additional payments and compensations, payment based on average earnings for legally unworked periods, dismissal, etc.

article is devoted to general issues of “salary” expenses .

Our other materials will help you correctly account for your expenses:

- bonuses;

For accounting nuances, see here and here ;

- vacation pay;

We wrote about them here .

- salary supplements;

this publication about them .

- and other expenses.

- Amounts of accrued depreciation. Our articles will help you decide on its method and correctly calculate the amounts:

- “What method to choose for calculating depreciation in tax accounting?”;

- “Linear method of calculating depreciation of fixed assets (example, formula)”;

- “A practical example of using the non-linear depreciation method”;

- “The essence and features of the application of the accelerated depreciation method.”

- Other expenses. These are all other expenses in addition to those listed above. For example, for rent, business trips, etc.

Find the main issues of their accounting in this article .

Formation of non-operating income and expenses

Income/expenses of this option are generated for various reasons and are not related to the main activities of the enterprise; it is unacceptable to take into account here:

- income from product sales

- provision of services to other enterprises

- purchase of raw materials and materials

- subtracting your own waste

- agricultural procurement

Also, expenses and income are not planned or do not depend on the activities of the enterprise, with the exception of income received as a result of increasing the capacity of the enterprise.

All existing profits and expenses are divided into categories, including operating and non-operating. In this case, non-operating income reduced by the amount of non-operating expenses is subject to taxation.

These indicators are also taken into account, despite the fact that they occupy a small part of the financial turnover of the enterprise.

How is a change in the fair value of BP reflected in accounting?

In accounting, the amount of upward changes in the fair value of objects is included in the PD.

In tax accounting, the procedure for reflecting an increase in the fair value of an object depends on the method of accounting for such an object.

Thus, a VR object is taken into account as:

- object of fixed assets (hereinafter referred to as fixed assets), then an increase in the fair value of the asset is considered as an additional valuation. Therefore, the pre-tax financial result should be reduced by the amount of the revaluation within the limits of the depreciation amount previously expensed. That is, if the fair value of the object was not discounted, the income tax base increases by the entire amount of the revaluation;

- as a separate category (in this case the rules established for fixed assets do not apply), then the increase in fair value is reflected in income, that is, it does not participate in the adjustment of the financial result.

Important: enterprises whose annual income exceeds 100 million rubles are required to adjust their pre-tax financial results.

back to menu ↑

Definitions of the concept of income, non-operating income

Non-operating income is income the receipt of which is not directly related to the production and sale of products.

The term “income” is an economic category. For many centuries, the essence and role of profit in the economy has been studied.

Regarding the definition of this concept among scientists, there is no consensus, and there are also contradictions associated with its economic essence, with their classification, especially during the formation of enterprise income in the process of their operating activities.

This requires deep theoretical studies of the economic essence and classification of income.

Some scientists believe that the analysis of the concept of “income” has its origins in the studies of the classics.

Scientists consider various provisions of this concept and interpret it in different ways.

This category has become the subject of wide debate among academic economists who belong to various economic schools and movements.

At one time, the famous English specialist economist John Richard Hicks spoke about this and noted that most scientists had some confusion when they accepted different interpretations of income, which were quite contradictory and not completely satisfactory.

Several modern theories that are based on these approaches and to a certain extent integrate them, the following should be noted:

- The income of an enterprise in the factor theory is considered as the result of the beneficial use of all types of economic resources or production factors;

- The theory of entrepreneurial income - interprets income as compensation to the entrepreneur for carrying out entrepreneurial activities at his own risk;

- A separate type of additional income received from conducting effective organizational and technological innovations that help increase labor productivity is considered by the theory of innovative income;

- The theory of monopoly income explains the receipt of higher income due to insufficient competition.

back to menu ↑

Is it possible to take into account non-operating expenses that are not mentioned in paragraph 1 of Art. 265 of the Tax Code of the Russian Federation?

Yes it is possible.

The list of non-operating expenses in Art. 265 of the Tax Code of the Russian Federation is open. This is directly indicated by sub. 20 clause 1 of this article, relating to non-operating “other reasonable expenses”.

The main thing here is that the costs comply with the general requirements that the Tax Code imposes on expenses, namely:

- economically justified;

- documented;

- related to income generation.

For example, on this basis you can take into account:

- discounts provided under contracts for the performance of work and provision of services (see letters of the Ministry of Finance of Russia dated October 20, 2014 No. 03-03-06/1/52651, dated January 31, 2011 No. 03-03-06/1/40);

For more information about this, see the material “Can discounts and bonuses provided for work and services be considered non-operating expenses?” .

- expenses for maintaining the trade union.

E.S. Grigorenko, 2nd class adviser to the state civil service of the Russian Federation, answered some questions from taxpayers on the application of Art. 265 Tax Code of the Russian Federation. You can get acquainted with the change of official in ConsultantPlus:

If you don't have access to the system, get a free trial online.

We briefly explained the general points related to non-operating expenses. Now let's look at some of them. Let's take those on which officials or judges have recently spoken out.

Types of expenses

Expenses for income tax are divided into three types:

- Production and sales costs;

- Non-operating expenses;

- Expenses not included in the tax base.

Here, the same as with income: the first two types of expenses directly affect the amount of tax, expenses of the third type do not participate in the calculation of the tax in any way and under no circumstances.

Which expenses are of which type? Let's tell you in order.

Production and sales costs

These expenses relate to core activities and have their own classification. This type of expense is divided into 4 groups:

- Material costs;

- Labor costs;

- Depreciation;

- Other expenses.

Each group of expenses has its own list and characteristics.

Material costs are the purchase of raw materials, materials, tools and other components that are necessary directly for the production process itself. Their list is in Art. 254 Tax Code of the Russian Federation.

Here are its main points:

- Costs of raw materials/materials necessary for production, as well as for packaging and preparing products for sale;

- Costs of tools, inventory, equipment, workwear, personal protective equipment and other property that is not depreciable;

- Costs for the purchase of components, semi-finished products;

- Costs of fuel, energy, water;

- Costs for the acquisition of services (or work) of a production nature (can be performed either by third-party legal entities or individual entrepreneurs, or by their own structural divisions);

- Shortages and losses from spoilage during storage (as well as transportation) of inventories within the limits of natural loss norms;

- Technological losses that occurred during the production / transportation process (if the concept of “technological losses” is applicable to the product).

Labor costs are far from just employee salaries. This group of expenses includes an extensive list of expenses - you can see it in its entirety in Art. 255 Tax Code of the Russian Federation.

Let's name the main ones:

- Wages calculated in accordance with rates / salaries / piece rates, etc.;

- Payments of an incentive nature - this includes bonuses, allowances, bonuses;

- Payments of a compensatory nature - here we can mention, as an example, allowances for working at night, for going out on holidays, for combining professions, etc.;

- Vacation pay and monetary compensation in case of unused vacation;

- One-time payments for length of service;

- Allowances for work experience in the Far North, as well as payments according to regional coefficients in connection with work in difficult climatic conditions;

- Insurance premiums under compulsory insurance contracts;

- Other expenses in favor of the employee in accordance with the provisions of the employment/collective agreement.

Depreciation deductions – apply to those who have depreciable property. It is calculated using the linear method (for each object) or the non-linear method (for each depreciation group). As a result, the cost of fixed assets is gradually written off as expenses.

Other expenses - this remaining group includes all other costs of production and sales that are not included in the first three groups. For any company to operate normally, it needs an office (which is often rented), it needs telephone communications and the Internet, it needs office supplies - all these are other expenses.

The list of other expenses can be found in Art. 264 of the Tax Code of the Russian Federation, the main ones are:

- Taxes/duties/customs payments;

- Costs for product certification;

- Commission fees for services provided to a legal entity by other organizations;

- Recruitment costs;

- Rent and leasing payments;

- Costs of maintaining official transport;

- Travel expenses;

- Expenses for various consulting/legal/audit/information services;

- Costs for publishing reports and submitting statistical observation forms to the relevant authorities;

- Entertainment expenses;

- Purchase of stationery;

- Payment for postal/telephone and other similar services;

- Purchase of computer programs;

- Other miscellaneous expenses.

Important! You can see for yourself that the list of other expenses is very extensive; accordingly, they can make up a significant part of the organization’s total expenses. All of them must be documented and justified, since in the absence of justification, tax authorities will exclude a very significant amount of expenses from the income tax calculation. As a result, you risk receiving not only a decent amount of additional tax payable, but also penalties and fines.

Non-operating expenses

This type of expense includes everything that is not related to either production or sales. See the list in Art. 265 Tax Code of the Russian Federation. Among the main representatives of this group are:

- Interest on debt obligations;

- Costs of issuing its securities and servicing purchased securities;

- Negative exchange rate difference resulting from revaluation of advances (issued/received);

- Expenses for creating a reserve for doubtful debts;

- Costs incurred for the liquidation of fixed assets, their conservation and re-preservation;

- Legal costs;

- Banking expenses;

- Losses from previous years that were identified in the current period;

- Bad debt amounts;

- Losses from downtime due to internal production reasons;

- Identified shortage of food supplies;

- Losses from natural disasters - fires, floods, etc.;

- Other expenses, if justified.

Expenses not taken into account for tax purposes

Art. is dedicated to these expenses. 270 Tax Code of the Russian Federation. They do not take part in tax calculations, so you cannot reduce your profits by them. Such expenses, for example, include:

- Dividends accrued from profit after tax;

- Penalties, fines and other sanctions paid to the budget;

- Contributions to the authorized capital, contributions to a simple / investment partnership;

- Advance payment for goods (works/services) - when the organization uses the accrual method;

- Donated property;

- Financial assistance to employees;

- Other expenses from Art. 270 Tax Code of the Russian Federation.

Entering information on expenses into accounting

According to the norms, an accountant must take into account such expenses in the existing tax period, since they will affect the size of the tax base in the future tax period.

According to the regulations on non-operating income and expenses, the amounts may not coincide with tax accounting. Therefore, non-operating income in accounting is related to “Other” and is taken into account with the main income, which affects the occurrence of differences in amounts that must be adjusted.

Income/expenses arising outside the sale of products are determined in accordance with the lists established at the legislative level. The accountant in the reporting must take into account all the features of these amounts and make the appropriate entries. In addition, it is necessary to maintain tax registers, according to which the tax base for deducting income tax will be formed.

Top

Write your question in the form below

a term used in Chapter 25 of the Tax Code (on corporate income tax), meaning income not related to income from sales (not specified in Article 249 of the Tax Code). Non-operating income of a taxpayer is recognized, in particular:

1) income from equity participation in other organizations;

2) income from transactions of purchase and sale of foreign currency;

3) income in the form of fines, penalties and (or) other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages;

4) income from leasing (subleasing) property;

5) income from the provision for use of rights to the results of intellectual activity and equivalent means of individualization (in particular, from the provision for use of rights arising from patents for inventions, industrial designs and other types of intellectual property);

6) income in the form of interest received under loan agreements, credit, bank account, bank deposit, as well as on securities and other debt obligations (the specifics of determining bank income in the form of interest are established by Article 290 of the Tax Code);

7) income in the form of amounts of restored reserves, the costs of the formation of which were accepted as part of expenses in the manner and on the conditions established by Art. 266, 267, 292, 294 and 300 NK;

income in the form of gratuitously received property (work, services, property rights), with the exception of income not taken into account when determining the tax base;

income in the form of gratuitously received property (work, services, property rights), with the exception of income not taken into account when determining the tax base;

9) income received by participants in a simple partnership agreement, as well as income in the form of an excess of the value of the returned property over the value of the property transferred by the taxpayer as a contribution to the simple partnership upon the withdrawal of the taxpayer (successor) from this simple partnership;

10) income in the form of income from previous years identified in the reporting (tax) period;

11) income in the form of a positive exchange rate difference received from the revaluation of property and claims (liabilities), the value of which is expressed in foreign currency, including on foreign currency accounts in banks, carried out in connection with a change in the official exchange rate of foreign currency to the ruble of the Russian Federation, established by the Central Bank RF;

12) income in the form of a positive difference received from the revaluation of property (except for depreciable property, securities), made in order to bring the value of such property to the current market price in accordance with the legislation of the Russian Federation (with the exception of the positive difference resulting from the revaluation of precious stones when the price lists of estimated prices for precious stones are changed in accordance with the established procedure);

13) income in the form of the cost of received materials or other property during dismantling or disassembly during the liquidation of fixed assets being taken out of service (except for income not taken into account when determining the tax base);

14) income in the form of property (including money) used for other purposes than for its intended purpose, work, services received as part of charitable activities (including in the form of charitable assistance, donations), targeted revenues, targeted financing, with the exception of budgetary ones funds. In relation to budget funds used for purposes other than their intended purpose, the provisions of the budget legislation of the Russian Federation are applied. Taxpayers who received property (including money), work, services within the framework of charitable activities, targeted receipts or targeted financing, at the end of the tax period, submit to the tax authorities at the place of their registration a report on the intended use of the funds received in a form approved by the Ministry of the Russian Federation on taxes and fees, and taxpayers who received budget funds - in a form approved by the Ministry of Finance. For tax purposes, the specified income is subject to inclusion in non-operating income at the moment when the recipient of such income actually used it for other than its intended purpose (violated the conditions for receiving it);

15) income in the form of received target funds intended for the formation of reserves for the development and ensuring the functioning and safety of nuclear power plants used for other purposes;

16) income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization, if such a decrease was carried out with a simultaneous refusal to return the cost of the corresponding part of the contributions (contributions) to the shareholders (participants) of the organization (for except in cases where the reduction is carried out in accordance with the requirements of the legislation of the Russian Federation);

17) income in the form of refunds from a non-profit organization of previously paid contributions (contributions) in the event that such contributions (contributions) were previously taken into account as expenses when forming the tax base;

18) income in the form of amounts of accounts payable (liabilities to creditors), written off due to the expiration of the statute of limitations or for other reasons, with the exception of amounts of accounts payable of the taxpayer to budgets of various levels, written off and (or) otherwise reduced in accordance with the law Russian Federation and (or) by decision of the Government of the Russian Federation;

19) income received from transactions with FISS (taking into account the provisions of Articles 301-305 of the Tax Code);

20) income in the form of the value of surplus inventory items identified as a result of inventory (Article 250 of the Tax Code). The procedure for tax accounting of certain types of non-operating income is established in Art. 317 NK. When determining non-operating income in the form of fines, penalties or other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages, taxpayers who determine income using the accrual method reflect the amounts due in accordance with the terms of the agreement. If the terms of the agreement do not provide for penalties or compensation for losses, the taxpayer-recipient does not have an obligation to accrue non-operating income for this type of income. When collecting a debt in court, the taxpayer's obligation to accrue this non-operating income arises on the basis of a court decision.

How to take into account interest if an operating system was purchased through a loan?

Definitely, as part of non-operating expenses (subclause 2, clause 1, article 265, article 269 of the Tax Code of the Russian Federation). There is no need to increase the initial cost of the fixed asset by the amount of this interest.

Of course, interest on a loan spent on the purchase of a fixed asset can be regarded as expenses associated with the acquisition of fixed assets, which, according to the rules of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation are included in its initial cost.

However, interest is an independent type of expense, for which the Tax Code of the Russian Federation has provided a separate basis and its own clear accounting rules. They should be followed in this case. This has been confirmed more than once by officials (letter of the Ministry of Finance of Russia dated March 10, 2015 No. 03-03-10/12339, sent by letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3/ [email protected] , letter of the Ministry of Finance of Russia dated June 28, 2013 No. 03-03-06/1/24671, etc.).

If you are interested in the position of the judges, see the material “How to take into account interest on a loan through which depreciable property was purchased?” .

We also recommend that you read the material “How to take into account the costs of liquidating an under-depreciated fixed asset in tax accounting?” . These expenses are also considered non-operating expenses.

Dividing costs into direct and indirect

Above is one of the classifications of expenses - according to their inclusion (non-inclusion) in the calculation of income tax. But it is important to remember that costs must also be divided into direct and indirect.

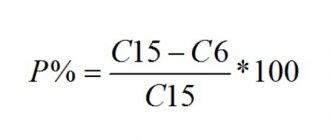

What are direct costs? This is everything that goes directly into creating the product. For simplicity, we show this in the form of a formula:

Direct costs = material costs + wages of production personnel + depreciation of production fixed assets

That's all! All other costs associated with production and sales are indirect.

Important! The list of direct expenses should be established in the accounting policy, since it can also vary depending on the characteristics of the activity.

Why divide them?

To take it into account correctly when calculating tax: direct and indirect expenses have different recognition periods.

- Direct expenses form the expenses of the current period as products (works / services) are sold, in the cost of which they are included. That is, you incurred production costs for the product in the 1st quarter, but sold it only in the 2nd quarter: this means that you take these costs into account when calculating the tax based on the results of the six months, and not in the 1st quarter.

- Indirect costs are fully recognized in the current period. The same goes for non-operating expenses. When these expenses occurred, take them into account during this period.

If you classify expenses incorrectly, this will result in them being incorrectly allocated to periods. As a result, again, you will face tax recalculation, penalties and fines. To minimize this risk, close attention should be paid to the classification of expenses, their confirmation and justification.

What income is not realized?

When the definition states that the defined concept includes all indicators except those listed, then the necessary factors can be calculated by the method of elimination. It can be said that all types of income not mentioned in Art. 249 of the Tax Code of the Russian Federation. In turn, in Art. 250 of the Tax Code of the Russian Federation states that all income of an organization is recognized as non-operating, except :

- amounts received as a result of sales;

- tax-free financial income (they are specifically stipulated in Article 251 of the Tax Code of the Russian Federation).

What are the features of accounting for the sale of fixed assets?

In accounting, an asset that an enterprise plans to sell is transferred to non-current assets intended for sale.

Tax accounting does not provide for the allocation of fixed assets planned for sale into a separate group, therefore, at the time of sale they continue to be considered fixed assets.

Enterprises that adjust their pre-tax financial results in the reporting period in which the fixed assets asset was sold must:

- Increase accounting financial results by the amount:

- depreciation accrued in accounting before the facility was decommissioned;

- markdowns and losses from reduction of utility included in the expenses of the reporting period;

- residual value of the object in accounting.

- Reduce the accounting financial result by the amount:

- depreciation accrued in tax accounting until the moment the facility is decommissioned;

- revaluation, which was included in income in the reporting period of sale of an asset within the amount of depreciation previously included in expenses;

- residual price for the object, determined according to the rules of the Tax Code.

back to menu ↑

Article 120 “Non-operating income”

Non-operating income includes:

- payment of fines, penalties, penalties;

- profit from reimbursement of delivered expenses;

- profit for the previous period;

- the amount of monetary obligations for which the claim period has expired;

- the difference in rates that arose during the revaluation of property and obligations expressed in foreign currency;

- the amount of additional valuation of assets based on the results of revaluation;

- the price of property accepted for accounting and classified as surplus;

- the amount of income of the reporting period, which is associated with the receipt of gratuitous assets starting from 01/01/2000.

To schematically imagine what non-operating income is, we can consider the dynamics of non-operating income of one company.

As we can see from the graph, non-operating income may change throughout the year, but not significantly.

back to menu ↑

Non-operating operations

Regular activities are divided into operational and other (investment and financial).

The main activities of the enterprise, as well as other activities that are not financial activities, are called operating activities.

During its main activities, an enterprise produces certain products or provides services.

In this case, material assets and labor are used, and their value is transferred to the resulting product, so it also has its own value.

Core activities include operations related to the production or sale of products (goods, services), which are the main purpose of creating an enterprise and replenish the main part of its income.

In investment activity in the country as a whole, a significant part of expenses is made up of expenses for investments in fixed assets (42%).

Expenses on non-sales operations amount to 33%, expenses on other sales - 20%, and expenses on maintaining social facilities - 5%.

As can be seen from the graph, during investment activities, expenses for non-operating operations constitute a significant part.

Other non-operating income includes:

- sale of foreign currency,

- operational lease of assets,

- lease of other current assets,

- receiving income or receiving losses from exchange rate differences,

- definition of subsidies and guarantees,

- formation of reserves for doubtful debts,

- carrying out research and development,

- reserves assessment,

- payment of sanctions under business contracts and the like.

Financial activity is understood as one that is associated with changes in the size and composition of equity and debt capital of an economic entity.

back to menu ↑