In the practice of entrepreneurship, one has to be both in the role of a lender and in the role of a borrower. In the first case, situations occur when partners, for one reason or another, do not repay the debt on time or do not fulfill their financial obligations at all. However, such financial situations must still be reliably reflected in the organization's accounting and financial records. A special reserve is created for this purpose.

Is it necessary to create a reserve for doubtful debts on advances issued ?

Let's consider the principles of forming this type of reserve, methods of accounting for it, accounting entries accompanying this process, as well as the nuances of write-off.

Doubtful debts and provisions for them

For a reliable financial reflection of the organization’s receivables in the accounting documents, a so-called reserve for doubtful debts is created. To define this concept, you first need to understand what doubtful debt is.

doubtful if they are unlikely to be repaid in full, as evidenced by the following factors:

- violation by a partner of deadlines for paying off debt;

- obtaining information about serious financial difficulties of the debtor partner;

- absence of any additional guarantees (collateral, deposit, surety, bank guarantee, retention of any property of the counterparty, etc.)

FOR YOUR INFORMATION! Debt reflected in the debit of any accounting accounts, including 60, 62, 72, as well as issued as a loan under subaccount 58-3, may become doubtful.

Doubtful debts are identified based on the results of the inventory of current accounts:

- on loans;

- for goods and/or services sold;

- payment for work performed;

- in some cases - for advances issued to suppliers.

How to use the reserve for doubtful debts ?

In order to correctly reflect this type of debt on the balance sheet, a special type of reserve is created, which is intended to serve as an estimate for accounting. This means that the amount of debt must be reflected in the balance sheet by subtracting from it the funds allocated to the reserve. The content of expenses or income must necessarily display:

- creation of such a reserve;

- its increase;

- reduction of funds.

NOTE! The reserve created for doubtful debts is included in the expenses that are deducted for taxation, therefore, it is financially beneficial for organizations from the point of view of tax accounting to form and take into account the reserve.

What are doubtful debts

The definition of doubtful debt is given in Art. 266 of the Tax Code of the Russian Federation, where the specified term means any debt to the taxpayer that arose as a result of late payments within the time limits specified by contractual obligations and not secured by a pledge, surety, bank guarantee and other means of ensuring the fulfillment of obligations .

Any receivables reflected in the debit of the accounts fall under the doubtful category:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 76 “Settlements with various debtors and creditors.”

In addition, a loan not repaid on time, reflected in subaccount 58-3 “Loans provided,” can be classified as doubtful debt.

Legislative documents

State regulation of issues related to the reserve for doubtful debts is regulated by the following legislative acts:

- Tax Code of the Russian Federation (Part 2) dated August 5, 2000 No. 117-FZ, as amended, entered into force on March 1, 2020;

- Regulations on maintaining accounting and financial statements in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n;

- Accounting Regulations PBU 4/99 “Accounting Statements of an Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n;

- Order of the Ministry of Finance dated June 13, 1995 No. 49 (as amended on November 8, 2010) “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities”;

- Accounting Regulation 21/2008 “Changes in estimated values”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n.

In what cases is it necessary to restore the provision for doubtful debts in accounting?

When and by whom should the reserve be created?

Clause 70 of the regulations on accounting and accounting, which, in addition to the definition of doubtful debt, also reflects the basic rules for working with it, does not make any exceptions from the circle of legal entities obligated to create a reserve for debts recognized as doubtful. Thus, the principle of mandatory creation of a reserve is assigned to all organizations without exception.

Note! Small enterprises are required to form reserves for doubtful debts in accordance with the generally established procedure. Even if simplified accounting methods are used (PBU 21/2008 “Changing estimated values”).

In what situations is it necessary to create a reserve? When a debt that meets the criteria for doubtful debt is identified. At the same time, the provision on accounting and accounting does not limit the type of such debt in any way, i.e. it can be any receivable debt, from the debt of an accountable person to the debts of buyers.

But the regulations on accounting and accounting do not establish the rules that must be followed in identifying doubtful debts. And the organization itself will have to determine, reflecting the established procedure in its accounting policies, the following points:

- frequency of debt inventory;

- signs by which a debt should be considered doubtful;

- debtor insolvency criteria;

- principles for assessing the likelihood of repaying the debt in full or in part;

- factors influencing the size of the created reserve.

For information on how the results of debt inventory are compiled, read the article “Inventory of receivables and payables.”

How to create a reserve for doubtful debts

The specifics of creating and disposing of a reserve for doubtful debts are not clearly regulated by law. Organizations must independently develop appropriate provisions and consolidate them in internal regulations. In this case, it is necessary to take into account the generally accepted features of the regulation of a company’s financial reserves.

- Basis for creation - for this type of reserve they will be the results of the inventory of receivables carried out on the last reporting day.

- The amount of reserve contributions is determined separately for each defaulter (analytical accounting of doubtful debts). At the same time, the solvency of each partner is taken into account (real financial prospects and opportunities for full or partial repayment of debt).

- Method for creating a reserve can be chosen by the organization independently based on the specifics of its activities and the nuances of the debt itself. There are three possible ways to create a reserve fund for doubtful debts:

- interval - the amount of reserve contributions is calculated every billing period (month, quarter) by calculating a percentage of the debt amount, which may vary depending on the degree of delay in payment;

- expert - the amount of debt that will not be paid on time is assessed separately for each debtor, this will be the amount of reserve contributions;

- statistical – data on bad debts is taken into account for several reporting periods for different types of debt.

IMPORTANT INFORMATION! The organization must record the chosen method and features of calculation in its accounting policies. For each type, you need to specify the appropriate conditions. For example, for the interval method, the accounting period and the percentage of deductions must be indicated (not necessarily the same as that used in tax accounting); for an expert – criteria for the debtor’s solvency, etc.

Methods for creating a reserve

Creating a reserve for doubtful debts of an organization (enterprise) can be carried out in the following ways:

- interval;

- expert;

- statistical.

Interval method. The interval method of reserve formation is one of the most accurate, but also more labor-intensive methods for determining the reserve amount. The bottom line: each debt for a month or quarter (reporting period) is taken and, depending on the time of delay in days, it is multiplied by the percentage (50 or 100%) established by law, as mentioned above.

Expert method. You can do it differently: estimate the amount of debt that will not be received by the company, based on data on the financial solvency of debtors, without taking into account the period of delay.

Statistical method. Statistics know everything. Therefore, we take the same reporting period for several previous years and find the average amount of doubtful accounts receivable - the simplest method, which is quite close to reality.

Accounting for reserves – accounting or tax?

The features of creating a reserve for doubtful debts in accounting and tax accounting differ significantly, since these types of accounting have different purposes. Let's compare the rules specific to accounting and tax accounting regarding the reserve.

- Mandatory creation. In accounting, such a reserve is required, since it is required by paragraph. 1 clause 7 of the Accounting Regulations. If an organization uses the accrual method for tax accounting, then the accountant himself decides whether to create such a reserve for tax accounting or not (this right is reflected in clause 3 of Article 266 of the Tax Code of the Russian Federation).

- Characteristics of deductions. Accounting defines reserve contributions as “other expenses,” and for tax accounting they must be taken into account among non-operating expenses.

- Interpretation of the doubtfulness of debt. For accounting purposes, any debt that is not repaid on time or in full is eligible for compensation as a reserve, but for tax purposes, only late payment for goods, services, and work can be recognized as such.

- Determining the amount of deductions . For accounting, the priority of establishing the size remains with the accountant (taking into account the characteristics of the debt), and for tax accounting the sizes are clearly defined by the Tax Code of the Russian Federation.

- The total size of the reserve fund . In accounting it is not limited, and in tax accounting it cannot be more than one tenth of revenue.

Do provisions for doubtful debts count as estimated liabilities ?

In what order to create a reserve?

Form the reserve for doubtful debts in the following order. First, determine the amount of each individual doubtful debt. A reserve will need to be created for each such case. At the same time, determine its size also taking into account the assessment of the debtor’s financial condition and the likelihood of repaying obligations in whole or in part. After all, the amount of the reserve for doubtful debts is an estimated value. It is not necessary to include the entire amount of doubtful debt.

This procedure is provided for in paragraph 70 of the Regulations on Accounting and Reporting, and how to determine the amount of the reserve follows from paragraphs 2 and 3 of PBU 21/2008.

So, for example, if the counterparty did not pay 1,000,000 rubles on time. and you have no guarantee that this debt will be repaid, you need to create a reserve. In this case, its size can be maximum (RUB 1,000,000) when, for example, you have accurate information about the start of the debtor’s bankruptcy procedure. Or the amount may be lower when it is known that the debtor is negotiating to restructure other debts and its solvency may be restored. If there is information that in the end the debtor will be able to return 600,000 rubles, then create a reserve of 400,000 rubles. Specialists from your financial service will help you more accurately assess possible risks, or, if there are none, you can contact third-party appraisers.

Develop the procedure for creating the reserve yourself and establish it in your accounting policies for accounting purposes.

Situation: is it possible to create a reserve for doubtful debts in accounting in the manner prescribed by tax legislation?

No you can not.

After all, these reserves are created at different moments and for different reasons. There are fundamental differences that do not allow the application of tax accounting rules in accounting.

In particular, here are the main differences between accounting and tax accounting of provisions for doubtful debts:

| Rules by which reserves are formed in accounting | Rules by which reserves are formed in tax accounting |

| Everyone, including small enterprises, is required to create a reserve in the presence of doubtful debts (paragraph 1, clause 70 of the Regulations on Accounting and Reporting) | The decision to create a reserve is made independently. And only those who use the accrual method (clause 3 of Article 266 of the Tax Code of the Russian Federation) |

| A reserve is created for any receivables (clause 70 of the Accounting and Reporting Regulations) | Reserves can be formed exclusively for accounts receivable for goods, works and services. For example, you cannot create a reserve under a loan agreement (paragraph 1, clause 1, article 266 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 12, 2009 No. 03-03-06/1/318) |

| To form a reserve, it is sufficient to be certain that the debtor will not be able to fulfill his obligations. In this case, it does not matter whether the obligation is fully or partially overdue or whether the deadlines have not yet been violated (paragraph 2, clause 70 of the Regulations on Accounting and Reporting) | Only those obligations that are already overdue are reserved (clause 1 of Article 266 of the Tax Code of the Russian Federation) |

Thus, the difference in the methodology for accounting for reserves for doubtful debts in accounting and tax accounting does not allow the formation of reserves in accounting according to the rules of Article 266 of the Tax Code of the Russian Federation.

Conditions for the formation of the reserve

The decrees, orders and letters of the Ministry of Finance of the Russian Federation define a number of conditions necessary to comply with when creating a reserve fund for doubtful debts.

- This fund can be created as a result of settlements with legal entities and individuals - buyers for purchased goods, services or paid work. Advances paid to suppliers are not included in reserve amounts.

- After creating a reserve, the management and/or accounting department of the organization must constantly monitor the dynamics of debts, since their status may change, and the reserve fund must reflect the actual state of affairs (analytical approach).

- In accounting, a debt can be recognized as uncollectible according to the regulations of Art. 266 of the Tax Code of the Russian Federation (as for tax accounting). Otherwise, there is no limit on the timing and size of the reserve fund for debts.

- If the question arises about which accounting procedure to apply for reserve assets, accounting or tax, you should be guided by the following factors:

- if the discrepancies relate to a temporary difference in the correlation of debt terms (for accounting this is a complete non-repayment within 45 days after the expiration of time restrictions), then the difference will lead to the deposition of tax assets, that is, deductible time intervals for certain amounts of funds (clause 8, 11, 14 PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n);

- if the amount of deductions to the reserve fund for accounting exceeds the 10% barrier established by tax accounting, then the company will operate with permanent financial differences (clauses 4, 7 of PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n).

How is the inventory of the reserve for doubtful debts ?

Transfer, use and restoration of reserve

The created reserve enterprise (organization) has the right:

- postpone;

- use;

- restore.

Transfer

The created reserve is not always used in the reporting period for which taxes are paid to the budget (quarter or year). In this case, the balance can be carried forward to the next reporting period. To do this you need:

- at the end of the new reporting period, conduct an inventory of doubtful debts;

- calculate the volume of the reserve for the reporting quarter;

- check the accrued amount for compliance with the requirement for a limit of 10% of revenue;

- compare the resulting reserve amount with the balance on the first day of the reporting period.

There are two possible situations here:

- the amount of the new reserve is less than the transferred balance. In this case, the difference is included in non-operating income of the tax period;

- the balance is less than the accrued reserve, then the reserve is replenished from non-operating expenses.

If in the first quarter of next year a decision is made to abandon the accounting for the provision for doubtful debts, when calculating taxes you need to:

- make changes to the previously approved tax policy;

- show the balance of the reserve as of December 31 of the reporting year in non-operating income, increasing the capital of the organization;

- the operation should be reflected in the declaration on line 100 of Appendix No. 1 to sheet 02 and on line 020 of sheet 02 as part of general non-operating income.

Usage

The purpose of creating a reserve for doubtful debts is to reduce the amount of budget contributions in the form of income tax. Write-off of bad receivables is carried out in the following order.

- Documents are being collected. Some of them must show how the debt arose: supply or purchase and sale agreements, shipping documents or certificates of work performed, letters of claim to the debtor. The second part is required to confirm the fact of the impossibility of collecting: extracts from the State Register of Legal Entities or the tax inspectorate on the liquidation of the debtor, court decisions, etc.

- A certificate signed by an accountant is being prepared justifying the need to write off the debt.

- An order from the manager is issued to write off the debt at the expense of the reserve.

Recovery

After the debt is written off, an inventory of doubtful debts is again carried out at the end of the reporting period. If it is greater than the balance, the reserve is restored at the expense of non-operating expenses.

Reflection of the provision for doubtful debts in accounting

Since contributions to this reserve are the dynamics of the estimated value, they must be reflected on the balance sheet at a certain frequency. They are included in the expenses of the period in which changes in the movement of assets in this reserve were observed. Therefore, data on the state of the reserve must be contained in each accounting report (Article 15 of the Federal Law of December 6, 2011 No. 402).

We carry out accounting

Provisions for doubtful debts should be reflected in debit 91 “Other income and expenses” and credit 63 “Provisions for doubtful debts”.

We carry out bad debt

If a debt that was previously listed as doubtful is recognized as uncollectible, its reserve will be written off in debit 63 “Provisions for doubtful debts,” which corresponds with account 62 “Settlements with buyers and customers” or 76 “settlements with various debtors and creditors.” If the amount of bad debt is greater than the reserve for it, it will have to be written off as debit 91 “Other expenses and income.” If a debt has been written off for which the statute of limitations has expired, it must be kept for 5 years in off-balance sheet account 007 “Debt of insolvent creditors written off at a loss” in case the debtor’s solvency returns and the possibility of repayment becomes available.

We make partial payment

If payment is received from the debtor for doubtful debts with the formed reserve, at least partially, this affects the dynamics of funds in the reserve in a positive direction, which must be reflected as a recovery in debit 63 “Provisions for doubtful debts”, correspondence with account 91 “Other income and expenses."

We carry out the unused reserve

If the reserve could not be used before the end of the accounting year that follows the one in which the reserve was created, then this amount on the balance sheet should be added to the financial results for this year under debit 63 “Provisions for doubtful debts”, credit 91 “Other” income and expenses".

Posted as tax obligations

If only mandatory accounting of reserves is carried out, and tax accounting is not carried out, then permanent taxable differences must be recognized as tax liabilities, reflecting them in debit 99 “Profits and losses” and credit 68 “Calculations for taxes and fees”.

Examples

EXAMPLE 1 . Based on the results of the quarterly inventory, the organization revealed doubtful debts in the amount of 12 thousand rubles. according to payments for goods sold. A reserve of 100% was created for this debt. On the date the reserve is created, the accounting records will contain the following entry:

- debit 91-2, credit 63 – 12,000 rub. – a reserve for doubtful debt has been created.

After some time, the debtor company repaid part of this receivable in the amount of 7 thousand rubles. The posting on the date of deposit will be as follows:

- debit 63, credit 91-1 – 7,000 rubles. – the provision for repaid receivables was restored.

EXAMPLE 2 . The organization previously recognized a doubtful debt in the amount of 10,000 rubles. A reserve of 7 thousand rubles was created for it, which was then replenished to 100% of the debt amount. After the expiration of the statute of limitations, this debt was recognized as uncollectible and written off at a loss. Let's look at the transactions (each for its own date of a particular operation):

- debit 91-2, credit 63 – 7,000 rub. – a reserve for doubtful debt has been created;

- debit 91-2, credit 63 – 3,000 rub. – additional provision for doubtful debt has been accrued;

- debit 63, credit 76 – 10,000 rub. – bad debts are written off against the reserve.

Reflected in the balance sheet

To reflect doubtful debts in the balance sheet, line 1230 is intended. It reflects the amount of debts minus the reserve created for them.

Creation or additional accruals to the reserve take place on line 2350 of the financial report (“Other expenses”).

Separately, the balance on account 63 “Provisions for doubtful debts” is not displayed in the balance sheet; the total amount of accounts receivable is simply reduced accordingly.

Types of doubtful debts

All doubtful debts can be divided into four large groups depending on the possibility of their collection (see Table 1).

Table 1. Types of doubtful debt.

| Type of debt | Characteristics |

| Overdue | Debt not repaid within the terms specified in the contract, but with the prospect of forced collection in the future, including through the court |

| Restructured | The debtor was granted an installment plan or deferment through peaceful negotiations or a court decision |

| Doubtful | Debt that is not secured by any guarantees, with the prospect of becoming uncollectible |

| Hopeless | The statute of limitations has expired |

All of the above in simple language: a doubtful debt is a debt that is unlikely to be collected using legal means .

The right to tax accounting of reserves for doubtful debts

It is not necessary to reflect doubtful debts and provisions for them in tax accounting. But if the accounting department deems it necessary to do this, this right is ensured and regulated by Art. 266 Tax Code of the Russian Federation.

For tax purposes, the definition of doubtful and bad debt is no different from accounting purposes. We discussed the difference in detail above. The procedure for creating and changing the reserve for the following debts differs:

- if the debt period exceeds 3 months, then the amount of the reserve will be fully equivalent to the amount of the debt;

- if the debt payment is overdue for a period of 45 to 90 days, only half of the amount can be deposited into the reserve;

- Before the debt is 45 days overdue, changes to the reserve are not permitted.

For each doubtful debt, analytical records must be constantly maintained for a prompt response in the event of a change in the financial situation of the debtor.

NOTE! In tax accounting, the reserve for doubtful debts can be used exclusively to cover losses on written-off bad debts.

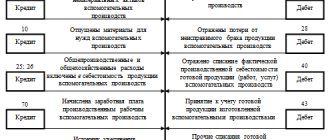

Typical accounting entries

| DT | KR | Business transaction |

| 91-2 subaccount "Other expenses" | 63 | Creation of a reserve. |

| 63 | 60, 62, 76 | Debts previously recognized as doubtful have been written off (at the end of the statute of limitations, by a court decision, after liquidation, or bankruptcy of the debtor). The amount indicated in this posting must be duplicated in an off-balance sheet account. 007 and remain there for the next 5 years. If the debtor's financial situation improves, it may be possible to write off the debt. |

| 76 | 68 | The VAT on the written-off deed is shown. |

| 63 | 91-1 | The unused amounts of reserves are combined to the profit of the current period, which follows the period of creation. |

| 51 /63 | 62/91 | Full repayment of debt. |

| 91 | 62 | Attributing the excess balance to income. If the reserve was not created, then bad and other debts should be included in the organization's expenses. |

| 51 | 91 | The debtor repays the debt in whole or in part. The same amount must be displayed as a credit to off-balance sheet account 007. |