Share premium

See what “Share premium” is in other dictionaries:

- Share premium is the income of a joint stock company generated by the difference in the price of all shares if the market price of shares is higher than the issue price. The share premium goes to the reserve fund or increases the total balance sheet profit. In English: Issue profit See ... Financial Dictionary

- Share premium - (paid in capital) a premium to the par value of shares, an excess of the par value of issued shares, received in cash or other form ... Economic and mathematical dictionary

- share premium - A premium to the par value of shares in excess of the par value of issued shares, received in cash or other form. Topics: economics EN paid in capital... Technical Translator's Guide

- Share premium is the income of a joint-stock company generated by the difference between the nominal and selling (market) prices of shares... Commercial electric power industry. Dictionary-reference book

- ISSUE INCOME - the difference between the sale price and the par value of a security (share) ... Encyclopedic Dictionary of Economics and Law

- Share premium - Amounts received in excess of the nominal value of issued shares by a joint-stock company (minus the costs of their sale). clause 44 of the Methodological Recommendations on the procedure for forming indicators of the organization’s financial statements, approved. By order... ... Dictionary: accounting, taxes, business law

- Share premium of a credit organization (JSC) - The share premium of a credit organization in the organizational and legal form of a joint stock company is understood as: the positive difference between the value (price) of shares when they are sold to the first owners and the par value of the shares and (or) the difference... ... Official terminology

- Share premium of a credit organization (LLC) - The share premium of a credit organization in the organizational and legal form of a limited (or additional) liability company for the purposes of these Regulations is understood as: the positive difference between the cost of shares of a credit... ... Official terminology

- Premium to the nominal value of shares (share premium) - excess of the nominal value of issued shares in cash or other form ... Economic and mathematical dictionary

- issue income - The amount of the difference between the par value and the sale price of a security. Accounting is carried out on the credit of the Reserve Capital account, the sub-account Share premium, and the debit of the accounts for accounting for funds or other valuables transferred to the company in payment... ... Technical Translator's Directory

Income from the sale of shares at an increased cost

Such an operation is possible only in joint-stock companies and in the event that their shares are sold at a profit. The amount exceeding the par value of the shares is charged to subaccount 83.2 by posting Dt “Settlements with founders” Ct “Equity income”. In this case, the debit of account 75 indicates the nominal value, and the credit indicates the actually paid value. As a result, a loan balance is formed, which is completely “extinguished” by posting with account 83.

Accounting for account 83 will contain the following entries when recognizing share premium:

- DT “Settlements with founders” CT “Authorized capital” – the par value of the shares is taken into account.

- DT “Current account” (property or cash accounts) DT “Settlements with founders” – paid for shares.

- DT “Settlements with founders” CT “Share premium” - in terms of additional capital, share premium is recognized.

Postings to account 83 accounting

Account 83 is used in accounting practice quite often and includes many operations and activities. After all, the increase in the active part of the enterprise may be reflected within the structure of additional capital.

It acts as part of the organization’s total fund and is subject to reflection in passive account 83. It is an element of the total capital along with the reserve fund.

What is additional capital

Additional capital represents the total assessment of assets that are not in circulation; it also includes budgetary funds aimed at replenishing current assets.

In addition, this line can include other income to the organization’s own capital. Additional capital is a liability item on the balance sheet, which consists of several parts:

- share premium - the difference between the selling and nominal value of the organization's securities;

- differences in exchange rates are differences in the process of paying for a share of the authorized capital in foreign currency;

- the difference during the revaluation of fixed assets - it arises in the event of a change in the value of fixed assets.

In practice, the element under consideration relates to the composition of the organization’s own funds. It is necessary to have information about the features of its formation and accounting measures.

When to use this account

Account 83 is intended to summarize materials about the presence and movement of additional capital of an enterprise. Changes in the value of assets must be reflected in the debit of the line in which the increase is determined, as well as in the credit of element 83. In addition, the loan reflects the following areas:

- increase in size;

- the amount of the difference between the selling and nominal value;

- other quantities.

Monies that were credited to this account are traditionally not subject to write-off. Debit entries can only take place in exceptional situations:

- repayment of the value of assets that are not in circulation, revealed as a result of revaluation;

- if funds were allocated to increase the authorized reserve (capital);

- if the amounts are distributed among the founders of the company.

The organization of analytical accounting must be debugged in such a way that the formation of an information base is ensured within the framework of the sources of formation and directions of expenditure of funds.

When account 09 should be closed at the end of the year. What transactions should be made when closing it?

If the organization continues to operate without changing the taxation system, then at the end of the year accounting account 09 is not closed. In the balance sheet, this amount will be taken into account in line 1180 “Deferred tax assets”. The amount of loss must be transferred to another subaccount.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

The posting will be as follows: Dt 09 “Future expenses” Kt 09 “Loss of the current period”.

But if an organization, for example, has a drop in income and management decides to take the opportunity to switch to a simplified taxation system, then account 09 should be closed at the end of the year.

Postings for closing account 09 at the end of the year: Dt 99 Kt 09.

The same entry is made upon disposal of an asset for which a deferred tax asset was accrued.

Are there subaccounts?

The following subaccounts are used for this account, detailing the main accounting transactions:

- 83-1 – fund of revaluations, in the process of which the entry Dt 01 (4, 7, 8, 10, 16, 41, 43, 45) Kt 83-1 is compiled.

- 83-2 – issue proceeds. Within the framework of this account, actions appear when the shares of a joint-stock company are sold at a cost that exceeds the nominal value.

- 83-3 – exchange rate differences that appear during the formation of the authorized capital.

- 83-4 – the entry reflects the fund for replenishing one’s own fixed assets, which are formed through deductions of 6% of gross income. In this case, the wiring Dt 90 Kt 83-4 is often recorded.

- 83-5 – accumulation fund. Its formation is carried out when the funds of the fund are used in the activities of the organization. The contents of the operation are as follows: Dt 84 Kt 83-5.

- 83-6 – fund of used target funds. In this case, there is correspondence Dt 86 Kt 83-6.

The account, as you can see, has a rich and varied structure, and therefore implies the possibility of compiling a large number of entries.

Formation of a reserve for doubtful debts

The current legislation does not have adopted documents regulating the procedure for creating a reserve for doubtful debts. Therefore, the management of the organization independently decides how the designated reserve will be formed.

However, before talking about such operations, you should understand what is meant by a doubtful receivable obligation. The designated term should be understood as an obligation that with a high degree of probability will not be repaid or is not secured by the presence of an appropriate guarantee.

Such amounts are usually identified during the inventory process of existing mutual settlements with partners.

The procedure for forming the designated reserve should be fixed in the accounting policies of the organization's management. The amount of contributions to this fund should be determined by the solvency of the debtor, the probability of his repaying the debt.

Basic accounting entries

For each operation performed, a corresponding record is compiled that characterizes it fully:

- Dt 01 Kt 83. The increase in the cost of fixed assets is reflected. An accounting certificate is used as the main document.

- Dt 83 Kt 02. Reflection of an increase in depreciation.

- Dt 75-1 Kt 80-1. In this case, we are talking about reflecting the registration of an additional issue of shares.

- Dt 80-1 Kt 80-2. The subscription of shareholders is reflected.

- Dt 75-1 Kt 83 – reflection of emission revenues.

- Dt 83 Kt 01 (03, 07, 08). The value of the decrease in the value of assets outside of circulation is written off.

- Dt 83 Kt 80. This entry implies the allocation of funds to increase the size of the authorized capital.

- Dt 83 Kt 84 - this operation contains information about the use of additional capital funds to cover the loss.

- Dt 86 Kt 83 - posting shows the fact of using targeted financing money received from investment sources.

This is not the entire list of transactions that are compiled within this account, but they are the main ones.

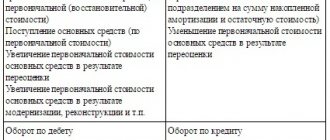

Capital Accounting

- by the amount of additional assessment of the initial cost of the object

Debit 83 Credit 02

— 45 thousand rubles. - by the amount of adjustment of accrued depreciation.

It is easy to verify that in this case, before the revaluation, the degree of deterioration of the object was 75% (150 thousand rubles: 200 thousand rubles x 100%). After wear adjustments were made, this ratio remained the same.

Similar entries are made when revaluing intangible assets:

Debit 04 Credit 83

- for the amount of revaluation carried out

Debit 83 Credit 05

- by the amount of adjustment of accrued depreciation. The posting is completed simultaneously with the above

Debit 83 Credit 04

— by the amount of the markdown (within the limits of the amounts of previously made revaluation)

Debit 05 Credit 83

— by the amount of depreciation adjustment when carrying out markdown.

EXAMPLE 2

The management of the organization decided to carry out a markdown of an intangible asset that was previously overvalued. The replacement cost of the object at the time of markdown is 100 thousand rubles, the amount of accrued depreciation is 40 thousand rubles. The revaluation index is 0.8.

It is assumed that the credit balance on account 83 for this object allows the write-off of write-off amounts in full at the expense of additional capital.

The following entries will be made in accounting:

Debit 83 Credit 04

— 20 thousand rubles. - by the amount of depreciation of the original cost of the object

Date added: 2015-08-21; ; Does the published material violate copyright? | Personal data protection |

Didn't find what you were looking for? Use the search:

Normative base

The use of the account is carried out in accordance with the regulatory framework of the Russian Federation, which contains a large number of documents:

- government and departmental regulations;

- orders;

- agreements drawn up between the enterprise and partners;

- local acts and regulations;

- instructions and legal provisions related to the functioning of additional capital.

Failure to comply with these legal norms by the accountant and other employees entails administrative and criminal liability. As practice shows, the legislation in this regard is strict.

Formation, increase or decrease of DC

The formation of additional capital occurs individually at each enterprise and is under the guidance of the management team. The process of its formation is reflected through a large number of special accounting entries and includes several directions. During the entire period of operation of this fund, it may be subject to reduction or increase.

Decrease

In the debit of account 83, amounts contributing to the reduction of additional capital are recorded. It may be aimed at repaying corporate losses and increasing the size of the authorized capital of the enterprise. There are several situations in which we can talk about reducing the amount of additional capital:

- Markdown of the value of assets in the event of an additional assessment. This applies to assets that have a useful life of 1 year or more.

- In case of an increase in the amount of the authorized capital at the expense of the company’s own assets, i.e. at the expense of the additional fund.

- Distribution of values between the participants of the company.

- Negative value in exchange rate differences in case of deposits in foreign currency.

The process by which the value of this value decreases is reflected by posting Dt 83 Kt 01 (due to the write-down of property assets), as well as using the entry Dt 83 Kt 84 (85) - respectively, writing off the reserve and distributing capital funds.

Increase

An increase in this value can occur due to additional assessment of property assets (Dt 01 Kt 83), receipt of issue proceeds (Dt 50, 51 Kt 83), as well as through additional capital (Dt 83 Kt 80).

Thus, the additional capital of an enterprise plays an important role in its current and strategic activities and involves many requirements for registration and use.

Account composition

To form additional capital, the arbitrary desire of the enterprise management is not enough. The reason for creating this asset can be a limited number of cases.

Additional capital includes:

- the amount of increase in the value of assets as a result of revaluation;

- income from the issue of securities (shares);

- positive exchange rate differences on founders' contributions;

- additional contributions from the founders.

The increase in additional capital is a credit to the account. Decrease - debit.

The amount of additional capital may decrease in the following cases:

- transfer of part of the additional capital into account of the authorized capital;

- repayment of losses for the reporting year;

- its distribution among the founders (participants) of the organization.

All these cases can be described by the following diagram:

Characteristics of account 83

The provisions of the current Civil Code of the Russian Federation determine that unprofitable enterprises are subject to liquidation. The situation becomes critical if the volume of net assets (NA) for 2 years is less than the value of the declared authorized capital.

Legal entities have the right to improve their financial condition, that is, to increase their net capital, through the formation of additional capital (AC), about which an appropriate decision must be made and approved. The proposed option is not accompanied by the emergence of additional obligations to other persons. Net assets in sufficient volume increase the investment attractiveness of the organization and allow it to pay dividends to its participants. To avoid a critical situation, the NA indicator must be kept under control.

Additional capital (AC) is account 83 in accounting. The purpose of its creation does not initially imply further use to cover current expenses. But in exceptional cases, the size of the DC can be reduced:

- if, as a result of the revaluation, a decrease in the value of fixed assets (FPE) is recorded;

- when the authorized capital increases;

- if necessary, make settlements with the founders.

Formation of additional capital as a result of revaluation of fixed assets

The increase in the value of fixed assets based on the results of revaluation is reflected in Kt 83 account.

Example

Antara LLC is revaluing its assets.

The cost of all fixed assets at the end of the year was 2,000,000 rubles, accrued depreciation was 500,000 rubles. As a result of the revaluation, the replacement cost of the fixed assets is 2,200,000 rubles, accrued depreciation is increased to 600,000 rubles.

This situation is reflected by the wiring:

| Dt | CT | Operation description | Sum | Document |

| 01 | 83 | Reflection of the increase in the cost of the OS (2200000 - 2000000) | 200000 | Accounting information |

| 83 | 02 | Reflected increase in depreciation (600,000 - 500,000) | 100000 | Accounting information |

For accounts 01 and 02, the revaluation, just like the markdown, is reflected in the context of objects, that is, for each fixed asset object.

Results of asset revaluation

One of the first situations leading to the emergence of a relationship between the credit or debit of account 83 and the accounts of non-current assets is the result of the revaluation of the enterprise’s property. Let us remember that this category of assets includes fixed assets, intangible assets and unfinished construction. Revaluation of property is carried out maximum once a year by recalculating its residual value. The data is reflected in the balance sheet at the beginning of the annual reporting period.

It is worth considering that the revaluation amount is always written off to the credit of 83 accounts. But the markdown amounts can be indicated in debit 83 only if the opposite situation took place before. In other words, from the amounts of additional capital, only that negative difference in the revaluation of assets, which was previously attributed to account 83 as a positive difference, is repaid. In another case, the markdown is reflected in the part of the uncovered loss.

Formation of 83 accounts as a result of the issue of shares

Selling your own shares or a share of ownership above par is one way to increase additional capital.

PJSC "Sunny Beach" decided to increase the authorized capital by 400,000 rubles through the issue of its own shares, 4,000 pieces at a par value of 100 rubles per share. The shares were placed by subscription at a price of 110 rubles per share. The price of shares is paid entirely in cash.

The following transactions will be reflected in the accounting of the closed joint-stock company:

| Dt | CT | Operation description | Sum | Document |

| 75.1 | 80.1 | Reflection of additional registration share issues | 400000 | Buh. reference |

| 80.1 | 80.2 | Reflection of shareholder subscription | 400000 | Buh. reference |

| 51 | 75.1 | Receipt of DS for shares is reflected | 440000 | Bank statement |

| 75.1 | 83 | Share premium is reflected (440000 - 400000) | 40000 | Accounting information |

Operations related to changes in exchange rate differences on founders' contributions

The founder of PJSC Glarex contributed 1,000 euros to the authorized capital in April. This means that in the next month, May, the founder will become indebted for the contribution to the management company in the amount of the ruble amount of the contribution at the Central Bank exchange rate, which was 65 rubles per euro.

In fact, the contribution was transferred in September, when the exchange rate was already 70 rubles per euro.

In the organization's accounting, these transactions are reflected by the following entries:

| Month | Dt | CT | Operation description | Sum |

| May | 75.1 | 80 | Reflection of debt on contribution to the authorized capital (65 * 1000) | 65000 |

| September | 52 | 75.1 | Reflection of the transfer of the currency amount of the contribution (70*1000) | 70000 |

| 75.1 | 83 | Reflection of positive exchange rate difference ((70-65)*1000) | 5000 |

Accounting for additional capital

Definition 1

Additional capital is an increase in the capital of an enterprise; it is formed as a result of the revaluation of fixed assets, as well as from share premiums. The specificity of additional capital is that it takes into account operations that cannot be carried out using the authorized capital and profit.

Its difference from the authorized capital is that it is not divided into shares that were contributed by the participants; additional capital shows the cost of all participants.

To account for additional capital, the chart of accounts provides for passive account 83 “Additional capital”.

The account credit reflects:

- increase in the value of non-current assets of an enterprise resulting from revaluation. The correspondence will be made up of asset accounts in which such an increase was identified.

- the amount of the sale and par value of shares received during the formation of the authorized capital of a joint-stock company, or in the case of an increase in the authorized capital. The source will be income from the sale of shares in excess of the nominal value. In this case, there is correspondence with account 75 “Settlements with founders”

Can not understand anything?

Try asking your teachers for help

From the credit of account 83 “Additional capital” the amounts that were allocated to it are not written off.

The debit shows:

- repayment amounts when the value of non-current assets decreases. Received during revaluation. The correspondence will be made up of accounts in which a decrease in value was identified.

- amounts aimed at increasing the authorized capital. The corresponding accounts will be: account 75 “Settlements with founders”, or account 80 “Authorized capital”.

- amounts distributed among the founders of the enterprise. correspondence with account 75 “Settlements with founders”.

According to account 83 “Additional capital”, analytical accounting is maintained. Analytical accounting ensures the formation of information in the context of sources of funds and in the directions of use of funds.

Sub-accounts can be opened to this account:

83-1 “Increase in property value due to revaluation”

83-2 “Share premium”

83-3 “Exchange differences”, etc.

Figure 1. Account 83 “Additional capital”

Correspondence of accounts for account 83 “Additional capital”

- Dt 01 – Kt 83 – reflects the amount of revaluation of fixed assets

- Dt 83 – Kt 02 – reflects the difference in accumulated and recalculated depreciation amounts

Both of these postings are carried out simultaneously.

- Dt 51- Kt 75-1 – authorized capital paid

Dt 75-1 – Kt 80 – authorized capital increased

Dt 75-1 – Kt 83 – attribution to added value of the difference between the selling price and the nominal value of the share of the authorized capital

These entries are generated if the formation of additional capital is carried out at the expense of share premium.

- Dt 75-1 Kt 80 – formation of authorized capital from a share owned by a legal entity

Dt 51 – Kt 75-1 – making a deposit to a current account

Dt 52 – Kt 75-1 – making a deposit to a foreign currency account

Dt 75-1 Kt 83 – formation of additional capital due to positive exchange rate differences.

- Dt 76 – Kt 86 – receipt of targeted funds

Dt 08 – Kt 75 – capitalization of equipment

Dt 01 – Kt 08 – commissioning of equipment

Dt 86 – Kt 83 – reflection of the source of financing

These postings are made if additional capital is formed using targeted financing amounts.

- Dt-84 – Kt 83 – additional capital was formed from retained earnings.

- Dt 51 – Kt 75 – receipt of funds from shareholders, participants for the formation of additional capital

Dt 75 – Kt 83 – formation of additional capital through contributions from shareholders.

In this case, additional capital is formed from contributions from participants. According to the Tax Code, the formation of additional capital is allowed by the receipt of funds in the form of property, property rights (Article 251 of the Tax Code of the Russian Federation).

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

- for the amount of revaluation carried out

Debit 83 Credit 02

- by the amount of adjustment of accrued depreciation. The posting is completed simultaneously with the above

Debit 83 Credit 01

— by the amount of the markdown (within the limits of the amounts of previously made revaluation)

Debit 02 Credit 83

— by the amount of depreciation adjustment when carrying out markdown.

EXAMPLE 1

The management of the organization decided to re-evaluate a fixed asset item with an initial cost of 200 thousand rubles. using index 1.3. The amount of accrued depreciation is 150 thousand rubles. The amount of the revaluation should be credited to the additional capital account.

The following entries will be made in accounting:

Debit 01 Credit 83

— 60 thousand rubles.

What is defined by the concept of “additional capital”

Additional capital (AC) formed by a legal entity has an important property: it is not related to the company’s obligations to its business partners. The amount of additional capital directly affects the company's net assets, business stability and its valuation.

Experts define the place of additional capital as intermediate between the authorized capital and net profit. The free use of DCs is prohibited, at the same time, a number of legislative, regulatory, and explanatory documents from regulatory authorities provide instructions for what purposes additional funds of the organization’s capital can be used. First of all this:

However, the specifics of the accumulation of DC funds and the use of capital are such that the aforementioned regulatory framework for effective asset accounting is not enough. Numerous clarifications from the Ministry of Finance indicate that funds similar in origin to the authorized capital are allocated to additional capital. For a number of reasons, they cannot be sent to the Criminal Code.

The use of additional capital funds is strictly regulated. In exceptional cases, it can even be used to reduce losses.

A number of economists define DC as the most mobile part of the authorized capital. The logic here is as follows:

- the size of the charter capital can be changed only after re-registration of the statutory documents;

- entries reflecting the value of the active, functioning part of the capital cannot be recorded on account 80;

- a separate account is required, a special accounting object - additional capital.

Clue. Additional capital should not be confused with reserve capital, the source of which is deductions from net profit as a percentage, according to the decision of the founders. Reserve capital is intended directly to cover future losses.

How is additional capital formed?

Having analyzed the regulatory framework relating to additional capital, we are able to identify the sources of its formation:

- Additional valuation of non-current assets (CNA) - fixed assets and intangible assets, funds in excess of the par value of shares in a joint-stock company - share premium (pr. 34n, clause 68, PBU 6/01, clause 15, PBU 14/2007, clause 21).

- Contribution by a participant to the management company of an amount greater than the nominal value of the paid share. The difference is included in the DC (letter 03-03-06/1/582 dated 15/09/09 of the Ministry of Finance).

- Participants' funds transferred to DCs in order to increase net assets (letter of the Ministry of Finance No. 03-03-06/1/45463 dated 10/28/13).

- Receipt from the owner of a unitary enterprise of property exceeding the size of the authorized capital (letter of the Ministry of Finance No. 07-04-09/2355 dated 01/22/16, p. “Disclosure by a Federal State Unitary Enterprise of information on property received for management in excess of the size of the authorized capital ").

- VAT on property received as a contribution to the management company, subject to deduction (Article 171 of the Tax Code of the Russian Federation, clause 11, letter of the Ministry of Finance No. 07-05-06/302 dated 12/19/06, p. “Reflection... of VAT amounts at transfer of property as a contribution to the management company").

- Receiving targeted financing as an investment (Chart of Accounts, account 86, letter of the Ministry of Finance No. 03-06-01-04/83 dated 04/02/05).

- Positive exchange rate difference when depositing funds into the management company or as a result of recalculation of assets used for business activities abroad (PBU 3/2006, clauses 14 and 19).

As an example, consider the situation: a legal entity, not a resident, deposits an amount in foreign currency into the Criminal Code by non-cash payment. Since the value of the authorized capital of a Russian organization must be expressed in rubles, by the time of payment after the conclusion of the agreement, a positive exchange rate difference may arise, due to which the contribution to the charter capital occurs in excess of the cost of the share. The difference will be used to increase not the authorized capital, but the additional capital (PBU 3/2006).

For all the features of additional capital in accounting, as well as the corresponding entries, see

What is taken into account on account 09 in accounting

According to the chart of accounts, deferred tax assets (DTA) are reflected in account 09. It is used to summarize information about their accrual and write-off. They are accepted for accounting (AC) in the amount determined as the product of deductible differences that arose in the reporting period by the current income tax rate.

This is necessary when expenses are recognized in accounting earlier than in NU. For example, if you decide to transfer a loss to NU to future tax periods. It is necessary to write off tax liabilities at the time of recognition of these expenses in NU (clause 14 of PBU 18/02).

The same applies to income, if they are recognized in NU earlier than in BU. As soon as income is recognized in accounting, IT can be written off.

Posting Dt 09 Kt 68 reflects ONA, increasing the amount of conditional expense (income) in the reporting period.

Posting Dt 68 Kt 09 reflects the decrease or full repayment of IT to reduce the conditional expense (income) in the reporting period.

Posting Dt 99 Kt 09 reflects the write-off of OTA upon disposal of the asset object for which it was accrued.

Account analytics is carried out by type of assets and liabilities in the valuation of which a temporary difference has arisen.

The Tax Code allows losses received to be carried forward to future periods in whole or in part an unlimited number of times. Write-offs can be carried out already in the next reporting period, if necessary. But the profit received from 2020 to 2020 cannot be reduced by more than 50% (clauses 1, 2.1 of Article 283 of the Tax Code of the Russian Federation).

Example 1

At the end of 2020, Listva LLC received a loss in the amount of RUB 958,500.

The accountant decides to accept the entire amount at once in the accounting department, and gradually in the NU.

IT will be: (958,500 rubles × 20%) = 191,700 rubles.

For the 1st quarter of 2020, profit at NU amounted to RUB 850,000. We partially reduce the profit received by the loss of last year in the amount of 425,000 rubles.

For 6 months of 2020 - RUB 2,700,000. For half a year, we write off the entire loss of 2020.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

| Wiring | Date of operation | Contents of operation | Amount, rub. (calculation details) |

| Dt 09 Kt 68.PR | 31.12.2017 | SHE is reflected | 191 700 |

| Dt 68.PR Kt 09 | 31.03.2018 | ONA decommissioned | 85 000 (425 000 × 20%) |

| Dt 68.PR Kt 09 | 30.06.2018 | ONA decommissioned | 106 700 ((958 500 – 425 000) × 20%) |

How to use additional capital

Additional capital funds are used quite rarely. Most often they go to:

- increase in capital;

- distribution of funds between founders;

- if the value of VNA decreases after revaluation - to repay this difference.

(According to the text of the “Instructions”, section 83).

PBU 3/2006 (clauses 14, 19), similar to positive ones, allows you to attribute exchange rate differences “with a minus” to additional capital, which will reduce it. Disposal of excess property from the owner of a unitary legal entity will also find expression in a decrease in the DC.

When a disposal of fixed assets or intangible assets occurs, the amount of its revaluation is withdrawn from additional capital and transferred to an account that takes into account retained earnings and uncovered losses (PBU 6/01 clause 15, PBU 14/2007 clause 21). The most controversial aspect of the use of additional capital is the ability to repay the organization’s losses with the accumulation of these funds.

It is known that the Methodological Recommendations for the Application of the Chart of Accounts in the Agro-Industrial Complex (Prospect of the Ministry of Agriculture No. 654 dated 06/13/2001) contain the possibility of covering losses from DCs if other sources are insufficient for this. However, the letter of the Ministry of Finance No. 04-02-05/2 dated July 21, 2000 contains a ban on covering losses from DCs in terms of funds from the revaluation of fixed assets (their revaluation).

It is noteworthy that there are no tax or other sanctions for using additional capital in this way in the legislation. The Ministry of Finance officials themselves admit this in the above document.

Briefly

- The additional capital of an organization is closely related to the authorized capital and essentially characterizes its movement, which cannot be reflected in the authorized capital account due to the peculiarities of accounting and registration. Additional capital occupies an intermediate position between authorized capital and net profit.

- The increase in investments occurs primarily due to the revaluation of fixed assets and intangible assets and share premium. Quite often, DCs are increased by company participants at the expense of their own resources, by contributing funds to the management company that exceed the cost of the share. Other sources of capital replenishment are less common.

- Additional capital is also used relatively rarely, only in certain areas (increasing the capital, repaying the results of negative revaluation of assets, distribution of funds to founders, etc.).

- A controversial point is the use of credit cards to cover losses. On the one hand, the legislation does not contain a direct ban. Some departmental documents contain permission to cover losses at the expense of the DC. At the same time, the Ministry of Finance claims that it is possible to cover these losses without affecting a certain part of the DC formed through the revaluation of fixed assets.

The procedure for forming a reserve

First of all, the legality of the formation of the fund must be supported by the results of an inventory of the state of receivables. All nuances in which the state has established the company’s independence must be reflected in its accounting policies.

Due to the fact that there is no mandatory requirement to create a source of security for debts that are unlikely to be collected in tax accounting, unlike accounting, each company has the right to decide to create such a resource and thereby reduce the amount of income tax.

Attention! The management of the organization must take the most responsible approach to the formation of a fund to cover the debts of debtors, since Federal Tax Service employees carefully check all aspects of the activities of Russian companies that reduce the amount of income tax payable to the budget.