The concept of the founder and general director (director) of the Company

The activities of a Limited Liability Company are regulated by Federal Law No. 14-FZ dated 02/08/1998 “On Limited Liability Companies”, as well as the provisions of the Civil Code of the Russian Federation.

Paragraph 1 of Article 56 of the Civil Code of the Russian Federation determines that a legal entity is liable for its obligations with all its property. The second paragraph of this article states that the founder (participant) of a legal entity or the owner of its property is not liable for the obligations of the legal entity, and a legal entity is not liable for the obligations of the founder (participant) or owner, except for cases provided for by this Code or other law.

If we rely on Article 56 of the Civil Code of the Russian Federation, it is quite clear that a legal entity, as an independent economic entity, is independently responsible for its debts and obligations, and the founder is independently responsible for his. And how to find the line between the responsibility of the founder of the Society and the Society itself? In order to understand in more detail and try to distinguish between the responsibilities of the founder and the general director (director) of the Company, first you need to understand the difference between these two terms.

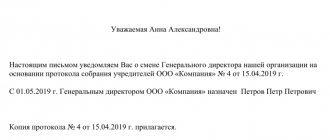

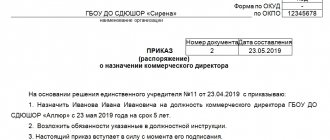

So, the founder is the person who decided to create an LLC, in other words, who “founded” the Company. Having decided to establish a Company, its founder accepts the Charter, makes (pays) his first contribution to the Company in the form of authorized capital, and, of course, determines who will manage his Company. In practice, when registering an LLC, there are increasingly cases where the sole founder simultaneously assumes the functions of the sole executive body - the director of this LLC. In accordance with the legislation of the Russian Federation, he has the right to issue an order to impose obligations on maintaining the Company's accounting records. The law determines that any capable individual, both Russian and foreign citizenship, can establish a Company. The founder may also be another legal entity. The rights and obligations of the founder are regulated by its constituent documents, primarily the Charter of the Company.

Director of the Company is any individual, both the founder himself and an independent person appointed to the position by decision of the founder of the Company. The head, director of the Company is appointed for one sole purpose - management of the current activities of the legal entity. Director of the Company is a person who has the right to act without a power of attorney on behalf of and in the interests of the Company.

Liability of a legal entity

First, let’s find out where the confidence comes from that it is financially safe to conduct business in the form of an LLC? Article 56 of the Civil Code of the Russian Federation states that the founder (participant) is not liable for the obligations of the organization, and the organization is not liable for its debts. That is why, to the question: “What responsibility does the founder of an LLC bear?” the majority answers - only within the limits of the share in the authorized capital.

Indeed, if the company is solvent and pays on time to the state, employees and partners, then the owner cannot be attracted to pay the company’s bills. The created organization acts in civil circulation as an independent entity and is itself responsible for its own obligations. As a result, a false impression is created of a complete lack of responsibility of the LLC owner to creditors and the budget.

However, the limited liability of a company is valid only as long as the legal entity itself exists. But if an LLC is declared bankrupt, then the participants may be subject to additional or subsidiary liability. True, it is necessary to prove that it was the actions of the participants that led to the financial disaster of the company, but creditors who want to get their money back will make every effort to do this.

Article 3 of Law No. 14-FZ dated 02/08/1998: “In the event of insolvency (bankruptcy) of a company due to the fault of its participants, these persons, in the event of insufficient property of the company, may be assigned subsidiary liability for its obligations.”

Subsidiary liability is not limited to the size of the authorized capital, but is equal to the amount of debt to creditors. That is, if a bankrupt company owes a million, then it will be recovered from the founder of the LLC in full, despite the fact that he contributed only 10,000 rubles to the authorized capital.

Thus, the concept of limited liability within the authorized capital is relevant only to the organization. And the participant can be held to unlimited subsidiary liability, which in a financial sense makes him equal to an individual entrepreneur.

Property liability of the founder of the Company

Having defined the concepts of “founder” and “director” of the Company, let’s try to analyze the individual responsibility assigned to them for the Company’s debts.

The legal liability of owners and participants in business activities is divided into types:

- material or property (liability of a participant (founder) of the Company within the authorized capital. In other words, if the Company’s debts to creditors and counterparties significantly exceed the actual value of the authorized capital and property owned by the Company, then the owner (founder) of such a Company has the right not to cover the difference in debt with personal money funds or personal property.

- administrative (responsibility of the founders for committing administrative offenses committed by them in the performance of duties related to the registration of the Company (violation of the law on advertising, intellectual property, carrying out activities without a license, etc.);

- subsidiary (liability in the form of additional punishment of persons who may be subject to penalties on an equal basis with a debtor who is unable to repay his debts on his own);

- criminal (liability of the founder (participants) of the Company for deliberately conducting unfair business activities, the losses of which amount to more than 250,000 rubles).

Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” determines that a participant in the Company is liable in the amount of his share in the authorized capital of the Company, and is equally liable for the debts and obligations of his Company only within the framework of the authorized capital he once paid. Thus, the material (property) liability of a participant (founder) of the Company is valid only until the moment the Company carries out its activities, even in a sluggish current manner, but if taxes are paid and debts are paid, the Company is considered operating. But if the Company is at the stage of bankruptcy or liquidation, or even worse, already in the process, the founders may be brought to a subsidiary type of liability, as well as to additional liability.

If several founders participated in the creation of the Company, then they have joint liability until the time of registration of the Company and only for the obligations associated with its establishment. Because, after the Company is registered in the Unified State Register of Legal Entities (USRLE), everyone participating in the establishment of this Company becomes its participants and assumes the responsibility provided for by the Charter of the Company and the current legislation of the Russian Federation. And as already mentioned just above, the participants of the Company are liable only to the extent of their share in the authorized capital of this Company and the value of the property owned by it. That is, if the share of a member of the Company is equal to three or five thousand rubles, then the liability of such a participant will not exceed the specified amount.

The liability of the founder for the debts of a legal entity to the state is also prescribed by law. Thus, according to Article 49 of the Tax Code of the Russian Federation, if the funds of a liquidated organization are not enough to fully fulfill the obligation to pay taxes and fees, penalties and fines, the remaining debt must be repaid by the participants of the said organization.

The possibility of repaying the Company's obligations at the expense of the personal funds of the owner (participant, founder) is provided for by Federal Law No. 127-FZ dated October 26, 2002 “On Insolvency (Bankruptcy)”. According to the amendments made to the said Law on June 5, 2009 (the current version of the Federal Law), creditors have the right to hold the founder (participant) of the Company, as well as other senior officials of the Company (general director, director, chief accountant, manager, etc.) financially liable. in the presence of the following circumstances:

- the founder made a decision regarding the activities of the Company, the implementation of which brought losses to counterparties and creditors of this Company;

- the founder approved a decision, the execution of which resulted in the bankruptcy of the Company or influenced its course;

- the founder (general director, chief accountant) did not ensure the appropriate maintenance and safety of tax reporting and accounting documentation of the Company;

- the founder and/or director of the Company did not submit an application to the arbitration court to declare the Company bankrupt, in the presence of all the relevant circumstances and signs.

If at least one of the above circumstances is present in the activities of the Company, a creditor or any other interested party has the right to demand repayment of the Company’s debts at the expense of the personal funds of its founder (participants).

Three main myths about the subsidiary liability of founders

Recently, a lot has been said and written in the media about the responsibility of the founder of an LLC. However, some business owners are not impressed because they believe such myths.

Myth 1. Cases of being brought to subsidiary liability are very rare, this definitely will not affect me.

Indeed, the instrument of subsidiary liability was launched only in 2009, and at first, cases of involving managers and founders for the debts of an LLC were isolated. But since 2020, this practice has shown significant growth.

As can be seen from the graph, the most applications (1621) were submitted in the second quarter of 2020. If we compare these figures with statistics on companies being declared bankrupt (for the same period, 3,146 organizations), it turns out that this is as much as 52%. That is, in every second bankruptcy situation, creditors try to bring to subsidiary liability persons related to the debtor organization.

Moreover, in the recent Ruling 306-ES14-2206 (17) dated July 3, 2019, the Supreme Court considered a case in which the arbitration manager did not file an application to bring the persons controlling the debtor to subsidiary liability, because he saw no grounds for this. The court recognized that such inaction of the manager violates the property rights of creditors.

Thus, the Supreme Court actually obliged the bankruptcy trustee to declare subsidiary liability in all cases of bankruptcy. And it will be up to the court to decide whether there are grounds for this. Thus, if a company goes bankrupt, there is a very high probability that the persons controlling the debtor will be held accountable. Who are they? Let's tell you further.

Myth 2. I have no formal connection with this LLC at all. What complaints can there be against me?

Even if you are not listed as a manager or on the list of participants in the company, the court may recognize you as a beneficiary or a person controlling the debtor (CDL). In this case, the debtor is understood as a bankrupt organization, and the person controlling it is the one who could give instructions to act in a certain way.

Article 61.10 of Law No. 127-FZ of October 26, 2002 provides the characteristics of such persons:

- relationship of kinship, property or official position with the head or members of the debtor’s management bodies;

- the presence of authority to make transactions on behalf of the debtor, based on a power of attorney, regulatory legal act or other special authority;

- use of official position (for example, filling the position of chief accountant, financial director or other position that provides the opportunity to determine the actions of the debtor);

- coercion of the head or members of the debtor's management bodies or exerting a decisive influence on the head or members of the debtor's management bodies in any other way.

The last definition of “exerting a decisive influence on the head or members of the debtor’s management bodies” can include many different situations.

This article further states that, until proven otherwise, the person controlling the debtor is recognized as:

- head or management organization, member of the executive body, liquidator, member of the liquidation commission;

- a participant who, independently or jointly with interested parties, disposed of more than half of the shares of the authorized capital of the LLC or more than half of the votes in the general meeting of participants of the legal entity or had the right to appoint (elect) the head of the debtor;

- one who benefited from the illegal or dishonest behavior of the persons specified in paragraph 1 of Article 53.1 of the Civil Code of the Russian Federation. i.e., the leaders of the organization.

As you can see, the last definition is also very general. But the most important thing is that the arbitration court can recognize a person as a CDL on other grounds not specified in the law. Thus, the letter of the Federal Tax Service of Russia dated August 16, 2017 N SA-4-18/ [email protected] states that such grounds can be any informal personal relationship.

Arbitration courts have already learned to unravel the complex chains between the real beneficiary and the debtor organization. Therefore, in order to be held vicariously liable for the debts of an LLC, it is not necessary to be its official manager or founder.

For example, in case A33-1677-3/2013, the ultimate beneficiary (a person who directly or indirectly owns an organization or has a significant influence on its decision-making) was brought to subsidiary liability. The ruling of the Arbitration Court of the Krasnoyarsk Territory dated June 13, 2020 obliged Abazekhov Kh.Ch. to pay 8,229,091,182 rubles of tax debts, although he was neither the founder nor the head of the debtor organization.

Myth 3. All activities of the LLC were managed by the general director and chief accountant, let them deal with them. I am generally the injured party in this matter.

In this case, we are talking about the recognition of the founder’s guilt in the bankruptcy of his company. However, the Federal Tax Service proceeds from the fact that no one will carry out business activities with a systematic loss for themselves. If a person is a member of an LLC, that means he benefits from it. And the bankruptcy of an organization may be precisely in the interests of the owner, who simply does not want to pay the bills.

Here it is worth quoting in full paragraph 10 of Article 61.11 of the law of October 26, 2002 N 127-FZ: “The person controlling the debtor, due to whose actions and (or) inaction it is impossible to fully repay the claims of creditors, does not bear subsidiary liability if he proves that his fault in the impossibility there is no full repayment of creditors' claims.

Such a person is not subject to subsidiary liability if he acted in accordance with the usual conditions of civil circulation, in good faith and reasonably in the interests of the debtor, his founders (participants), without violating the property rights of creditors, and if he proves that his actions were committed to prevent further greater damage to the interests of creditors."

This rule shows that when bringing to subsidiary liability there is a presumption of guilt of the CDL. That is, it is enough to prove that the founder is the person controlling the debtor, but there is no need to prove his guilt in bankruptcy. On the contrary, the owner needs to convince the court that he is not involved in the financial insolvency of his company.

If there are several persons guilty of bankruptcy (or simply suspected of it), not just subsidiary, but joint subsidiary liability may arise. In this case, all persons controlling the debtor are liable jointly, i.e. jointly (Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2020 No. 53).

In this case, the most solvent debtor is most often selected for settlements with creditors. For example, the main blame for bankruptcy lies with the hired manager, and only part of it lies with the founder. If the first does not have the money to pay off creditors, then this responsibility will be assigned to the founder. Later, he has the right to file a recourse claim against the real culprit of the bankruptcy, but the success of this case is very doubtful.

Property liability of the General Director (director, manager) of the Company

In accordance with Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 62, the General Director of the Company, like any other sole executive body of the Company, is responsible with all of its personal property to the Company, as well as to the owners of the business. Now many people are paying attention to this formulation.

In cases where the Company is managed by a hired general director (director), upon taking up duties, such a hired manager assumes part of the financial risks. The responsibility of the sole executive body (CEO, director, manager) of the Company is provided for in Article 44 of Federal Law No. 14-FZ “On Limited Liability Companies”. In particular, this law states that the head (director) of the Company is responsible for losses caused to the Company by his guilty actions (or inaction). The property liability of the director for the Company’s debts arises if there are signs of guilty actions or such inaction:

- execution of a transaction to the detriment of the Company, carried out on the basis of the personal interests of the director;

- concealment of information about the essential details of a transaction or failure to obtain the approval of participants when such a necessity and obligation is provided for by the statutory documents of the Company;

- failure to take measures to verify the integrity of the counterparty in the transaction, information about him that could be important for the transaction was not received, information about the presence or absence of a license to operate the counterparty (contractor, etc.) was not received, if such confirmation is required by the nature transaction being completed, etc.;

- making decisions about a transaction without due diligence, without checking the information received;

- forgery, loss, theft of Company documents, etc.

In such situations, a member of the Company has the right to file a claim against such an unscrupulous manager for compensation for damage caused to the Company. If the director can prove his innocence or non-involvement in certain actions, for example, by being able to prove that in the process of work he was limited by the orders or requirements of the owner (participant) of the Company, as a result of which the Company’s activities led to losses, then responsibility will be removed from him . The presence of unpaid debts of the Company to the budget or counterparties obliges the director (manager) of the Company to take all measures to repay them.

Even if the head (general director, director) resigned at his own request or by decision of a participant (founder) of the Company, or in cases where a participant (founder) of the Company completely sold it to a third party, the current director of such Company who has resumed his duties will be responsible for the mistakes of the former director.

In accordance with the current legislation of the Russian Federation, administrative responsibility lies with current officials. In accordance with Art. 2.4 of the Code of Administrative Offenses of the Russian Federation, an official who has committed an administrative offense is subject to administrative liability in connection with failure to perform (improper performance) of his official duties.

In the current legislation of the Russian Federation today, perhaps, there is no uniform definition of “official”. The definition of an official given in criminal law (Article 285 of the Criminal Code of the Russian Federation) is not universal. And then it applies only to the acts provided for in Chapter. 30 of the Criminal Code of the Russian Federation “Crimes against state power, the interests of public service and service in local government bodies.” An official should be understood more as a person who permanently, temporarily or in accordance with special powers performs organizational, administrative, managerial or administrative functions in the Company.

Administrative responsibility of individual entrepreneurs

An individual entrepreneur bears administrative responsibility in various areas - from environmental safety to tax payment.

Businessmen and individual entrepreneurs are treated as officials in the Code of Administrative Offences.

In accordance with Article 23.1 of the Code of Administrative Offenses of the Russian Federation, an individual entrepreneur is brought to administrative responsibility in court at the request of the control body.

In the field of labor relations

Administrative liability of individual entrepreneurs in the field of labor relations (for violation of labor protection and labor legislation) is expressed in fines of up to 5,000 rubles. In case of repeated violation of a similar law, the individual entrepreneur may be disqualified for a period of 1 to 3 years (clause 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). That is, the entrepreneur loses the right to occupy leadership positions in the executive management body (of a legal entity), to carry out entrepreneurial activities (for the management of a legal entity) and to join the board of directors.

In accordance with Article 5.28 of the Code of Administrative Offenses of the Russian Federation, if the employer evades participation in negotiations related to the conclusion of a collective agreement (and if the permissible period for its conclusion is violated), he will pay a fine of up to 3,000 rubles.

A fine of 3,000 rubles is also provided for those employers who do not provide information for collective bargaining (Article 5.29 of the Code of Administrative Offenses of the Russian Federation).

A fine of up to 5,000 rubles is provided for individual entrepreneurs who refuse to conclude a collective agreement (Article 5.30 of the Code of Administrative Offenses of the Russian Federation).

Violation (failure to fulfill) obligations under a collective agreement threatens the entrepreneur with a fine of up to 5,000 rubles (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

In economic activity

If an individual entrepreneur works without registration as an individual entrepreneur, in accordance with Article 14.1 of the Code of Administrative Offenses of the Russian Federation, he will need to pay a fine of up to 2,000 rubles.

An individual entrepreneur who has changed his place of residence must notify the registration authority about this within three days (clause 5 of Article 5 of the Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”). Without reporting a change of residence, an entrepreneur will pay a fine of up to 2,000 rubles (Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

In accordance with Article 14.5 of the Code of Administrative Offenses of the Russian Federation, an individual entrepreneur who does not have a cash register may be fined up to 4,000 rubles.

Criminal liability of a participant (founder) for the debts of the Company

Bringing criminal liability to the founder for the debts of his Company is more difficult and longer than, for example, an individual entrepreneur, since the bankruptcy procedure of an LLC is quite a lengthy process. But since 2020, the tax authorities have another tool for collecting arrears and tax debts by initiating a criminal case against the guilty person under Article 199 of the Criminal Code of the Russian Federation. The Supreme Court of the Russian Federation, in its ruling dated January 27, 2020 No. 81-KG14-19, found the director and sole founder of the Company liable for non-payment of tax (VAT) on a large scale and confirmed the legality of recovery from an individual (founder of the Company) of damages to the state in the amount of the unpaid amount tax This ruling by the RF Armed Forces has become a judicial precedent, after which all similar or similar cases are considered easier and faster. Only the founder (participant) of the Company who is guilty of such actions, in addition to the main obligation assigned to him to pay off the debt, also receives a criminal record.

The legislation of the Russian Federation provides for criminal liability of the founder (participants) of the Company for unlawful actions in relation to its activities. In practice, in 2020, proving unlawful actions of the founders (participants) of Limited Liability Companies was the most common case in which the owner received criminal punishment. These include:

- concealment of the Company's property, falsification of information about its actual value;

- illegal disposal of property (property) of the Company;

- illegal repayment of material claims of the Company's creditors;

- satisfaction of property claims from debtors in a financially inadequate amount.

Article 179 of the Criminal Code of the Russian Federation provides for the possibility of bringing the founder of the Company to criminal liability if his actions contained coercion to conclude a transaction (or refusal), which subsequently directly or indirectly affected the infliction of losses to the Company.

If proven guilty, the founder may face a fine of up to 300,000 rubles, or imprisonment if his fault causes losses to the Company in the amount of more than 250 thousand rubles.

Criminal liability of the founder (participant) of the Company occurs if he initiated or committed actions that led to:

- evasion of payment by the Company of taxes and fees established by the state;

- to abuse during the issue of the Company’s own securities;

- to illegal transfer of funds in foreign currency;

- to evasion of customs duties.

Bringing the founder of the Company to criminal liability is carried out within the framework of legal proceedings. The plaintiff in such proceedings can be either a creditor or a counterparty of the Company.

Criminal liability of the sole executive body (director) for the debts of the Company

Criminal liability of the head (director) of the Company may arise in the following cases:

- coercion to complete a transaction or refuse to complete it (Article 179 of the Criminal Code of the Russian Federation);

- illegal receipt and disclosure of information constituting a trade secret (Article 183 of the Criminal Code of the Russian Federation);

- abuses during the issue of securities (Article 185 of the Criminal Code of the Russian Federation);

- failure to return funds in foreign currency from abroad and evasion of customs duties (Articles 193, 194 of the Criminal Code of the Russian Federation);

- unlawful actions during bankruptcy, concealment of the Company's property, fictitious and deliberate bankruptcy (Articles 195 - 197 of the Criminal Code of the Russian Federation);

- evasion of taxes and fees (Articles 199, 199.1, 199.2 of the Criminal Code of the Russian Federation).

The director and founder of the Company will not be able to avoid criminal and subsidiary liability by “leaving the game.” If the former founder (participants) of the Company or the former director (general director) committed a crime, then the punishment will fall on them.

As for the property liability of the director (general director) of the Company in practice in 2020, you can familiarize yourself with the Decision of the Arbitration Court of the Moscow District dated June 14, 2016 No. F05-7325/2016 , according to which the former director of the Company should be held vicariously liable for outstanding tax debts of the Company, and is obliged to compensate the loss to the state from his own pocket.

Current conclusion

Often, many people have the opinion that criminal liability is imposed only on the head (director) and chief accountant of the Company. It's a delusion. Accomplices – employees of the Company – may also be brought to criminal liability on the basis of Article 33 of the Criminal Code of the Russian Federation. Most often, in addition to directors and chief accountants, those accused include business owners, participants (founders) of the Company, as well as financial and commercial directors, heads of departments, departments and other persons authorized to make independent decisions, especially related to the payment of certain works (services) included in expenses or decisions related to the amount of taxes paid.

Responsibility provided for in Article 199 of the Criminal Code of the Russian Federation for evasion of taxes and (or) fees may fall on the director of the Company and the chief accountant, against whom a case may be opened if they do not submit tax returns or other documents that must be provided to tax authority in accordance with the requirements of the tax legislation of the Russian Federation. Of course, in cases under the above article there are tax returns, so investigators bring charges against participants and managers of companies, including chief accountants, for intentionally including false information in a tax return. The main evidence of the guilt of the suspected persons is the fact of filing such a declaration. And usually in criminal cases brought against directors of companies, the expenses for which were included in such declarations, are called shell companies. It is almost impossible for the owners and directors of such companies (fly-by-night companies) to prove their non-involvement and lack of intention to evade paying taxes. In this case, the investigator will only have to formalize the case.

Article 199 of the Criminal Code of the Russian Federation provides for several types of liability depending on the extent of the crime committed. The measure is determined by the severity of the crime committed and the presence of qualifying features: a fine of 100,000 rubles. up to 500,000 rubles; a fine in the amount of wages or other income of the convicted person for a period of one to two years; forced labor for up to two years; arrest for up to six months; imprisonment for up to six years.

A person who has committed a crime under this article for the first time, as well as Article 199.1 of the Criminal Code of the Russian Federation, is exempt from criminal liability if this person or the Company, evasion of taxes and (or) fees with which this person is charged, has fully paid the amounts of arrears and the corresponding penalties, as well as the amount of the fine in the amount determined in accordance with the Tax Code of the Russian Federation.

conclusions

- The liability of the LLC founder is not limited only to the size of his share in the authorized capital of the company. A stable judicial practice has already developed, which shows that business owners are charged with the obligation to repay multimillion-dollar debts to LLC creditors.

- Most often, the founders are brought to subsidiary liability during the bankruptcy procedure of the organization. However, in a number of cases specified in the law, this is possible outside the framework of bankruptcy. In addition, the founder may be found guilty of committing a tax crime even before it becomes clear that the organization will not be able to independently transfer taxes to the budget (details in the Constitutional Court Resolution No. 39-P dated December 8, 2017).

- The founder must be aware of the financial activities of the company, especially if a manager is hired from outside the owners, and control the maintenance of records. You should not allow debt for an amount exceeding 300 thousand rubles, the repayment period of which expired more than 3 months ago, since in this case creditors may initiate bankruptcy proceedings.

- In a situation threatening bankruptcy, immediately seek advice from specialists with experience in winning cases. Here, as in treatment, everything is very individual. Following unqualified advice can lead to criminal liability for the founder!