Content

- Does the director of an LLC need a power of attorney?

- How to issue a power of attorney from the director and/or accountant for the right to sign in an LLC. What should be in a power of attorney

- In what cases is a power of attorney required?

- When a power of attorney expires

- Types of powers of attorney from LLC management

- Power of attorney from LLC to represent interests

- General power of attorney LLC

- Representation of LLC interests in court

- Samples of powers of attorney for the right to sign for a director

The need for a power of attorney

The head of a company, especially a large one, does not have the physical ability to represent the interests of the company everywhere. The director comes to the aid of his deputies and other employees, to whom he temporarily transfers part of his powers.

These same cases include periods of his absence for various reasons from the enterprise, as well as when employees are sent on business trips and conclude agreements and contracts there.

Continuity of business activities requires constant signing of both incoming and outgoing documentation. For this purpose, the company administration issues a power of attorney to its employees for the right to sign documents. A special feature of this form is that it does not need to be certified by a notary. In such cases, the signature of the head of the enterprise and the company seal are sufficient.

However, the company may have this document notarized. This practice is used when concluding contracts for large sums, during state registration and in other cases. Powers of attorney are available for the right to sign agreements and contracts, accounting documents (bills, invoices, invoices, acts, etc.), decisions, acts and protocols of regulatory authorities, and others.

These forms can be issued not only for the right to sign for the director of the organization, but also for the chief accountant. As a rule, they apply to accounting documents and are issued to his deputies or senior accountants.

It is also possible to issue a power of attorney for the simultaneous right to sign documents for the chief accountant and director. Such documents are used mainly in subscriber departments with a large number of buyers and customers.

A power of attorney can be drawn up for a one-time representation of authority, or it can give the right to permanently sign certain forms for a strictly established time.

Does the director of an LLC need a power of attorney?

A power of attorney is a special document on the basis of which one person (representative) can exercise the powers of another person (principal).

One of the most common is the question of whether the director of any organization, including an LLC, needs such a document. After all, he is considered authorized to conclude transactions, manage a legal entity, sign orders, financial documents and much more. In essence, he serves as a representative of the organization he manages.

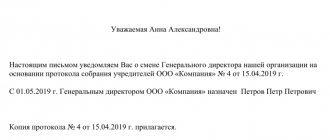

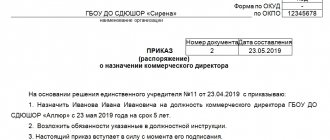

Does a director need a power of attorney? No, he doesn't need it at all. The fact is that the director is appointed to his position by order of the sole founder or by decision of a collegial body. Any of these documents secures the director’s right to represent the interests of the company.

In what cases is a power of attorney required?

It may be necessary to transfer the powers of the first person to an organization in different cases. Perhaps the head of the organization is on vacation or absent for another valid reason.

However, the business sector does not tolerate any delays and the work of the organization must continue. For these purposes, a power of attorney is drawn up for the right to sign for the director to another person who will manage the organization and ensure the work process.

This document is also necessary if the organization has branches under its jurisdiction. A power of attorney for the head of a branch provides the necessary powers to the head of this division of the organization in accordance with the goals of the activity.

Such a power of attorney is a detailed document that specifies a limited list of powers and maximum amounts for transactions that the head of the branch has the right to conclude.

How to properly issue a power of attorney

The content of the power of attorney is determined depending on the extent of the powers of the legal directors. persons

Below we will consider what legal requirements should be observed by authorized persons in the case of issuing a power of attorney for the right to sign a director of a legal entity. faces

In the power of attorney, the represented person must indicate:

- date of execution, otherwise the document loses its validity;

- place of execution and justification for the extradition;

- company;

- information about the principal (job position, full name);

- information about the attorney;

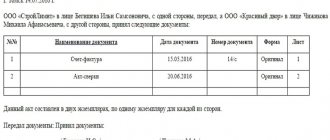

- a list of documentation confirming the identity of the attorney, as well as documents that the attorney is required to sign in the future;

- validity period, otherwise the document will lose validity some time after issue;

- signature of the attorney and director of the company;

- seal of the LLC with a note about inclusion in a special journal.

The list of delegated powers indicates a package of documents that the attorney is required to sign. The last person in the company receives the authority to sign papers not only on the basis of a power of attorney, but also on the basis of an internal order.

From financial

A package of documents that comply with powers, statutory requirements, and orders.

Notarized power of attorney for representation of interests

How to draw up a power of attorney for an insurance company from a legal entity, read here.

How to draw up a power of attorney for Sberbank from a legal entity, read the link:

Important! In almost all companies, the chief accountant has the right to sign the second signature. The charter, as well as a special order, contains a list of documents that are strategically important for the enterprise, which the director of the company can entrust to other citizens to sign.

From the General

Contains a specific list of documents to be signed by an attorney. If the list, approved by seals and not included in the special register of the LLC, does not include papers, then the latter are not entrusted for signing. To do this, this power of attorney must be certified.

Since the general director is endowed with a wide range of responsibilities and rights, special attention is paid to entering information on behalf of the general director. Typically, this power of attorney allows the representative to carry out a specific task for a limited period of validity.

When a power of attorney expires

Civil legislation clearly lists the cases in which a power of attorney (including a power of attorney to represent the interests of an LLC) loses its legal force.

Let's list them:

- The period specified in the power of attorney has expired; usually the power of attorney is not valid the next day after the expiration date;

- The power of attorney has been revoked by the person to whom it was issued. If a power of attorney was issued by several persons, then the basis for its cancellation will be the cancellation even from one of these persons;

- The representative himself may renounce his powers by providing a waiver of the power of attorney;

- The legal organization has been liquidated or undergone reorganization;

- The principal or representative has died;

- The powers of the person who issued the power of attorney were revoked.

It is worth remembering that there is a so-called irrevocable power of attorney. Such a power of attorney cannot be revoked by the principal before its expiration, except in cases of abuse of his powers by the representative.

Validity period and termination procedure

[ads-pc-2] [ads-mob-2]

Since 2013, the norms of the Civil Code of the Russian Federation have established that this power of attorney can be issued for any period. This document must contain information about the duration of its validity. If it is missing, then it is considered that the power of attorney form is issued for 1 year starting from the date of its preparation.

This document ceases to be valid upon expiration of the period for which it is issued. The employer has the right to revoke the power of attorney at any time, and the employee can refuse the powers granted to him by this document. It terminates upon liquidation of the company, as well as in the event of death (recognized as incompetent) of the person to whom it was issued.

When dismissing an employee, it is advisable to revoke all valid powers of attorney issued to him, and to warn the contractors with whom the resigning employee worked.

Types of powers of attorney from LLC management

There are 3 main types of powers of attorney:

- One-time . For the purpose of performing any one action. For example, if it is necessary to authorize a person to carry out any transaction, make a purchase on behalf of an organization, or accept goods or services.

- Special . The most common type of power of attorney, which grants a person to exercise powers of a certain kind. Represent a legal entity in law enforcement agencies, courts, bailiff service, negotiate with clients, customers, and perform other functions.

- General . It is called this way not because it is a power of attorney from the general director, but because it gives its owner the broadest powers, including concluding various transactions and agreements, managing the organization’s property and making other decisions.

Power of attorney from LLC to represent interests

A special power of attorney for the representation of various interests issued by an LLC allows the authorized person to exercise a limited list of necessary powers.

Most often, an LLC issues such a power of attorney to represent its interests in various negotiations and interactions with other organizations and enterprises, provided that such interaction does not concern the conclusion of financial transactions.

Such a power of attorney can be issued for organizing cooperation, carrying out business activities, managing branches or separate divisions.

General power of attorney for the right to sign documents

A general power of attorney provides the rights to the appointed person to represent the interests of the principal to resolve any transactions permitted by law. Of course, this must be a person whom the principal trusts completely.

Such a form is issued if, for example, management is unable to attend a business “date” on the date of the transaction.

Any person can act as a principal of an individual:

- Spouse).

- Next of kin.

- Best friend.

- Company employee.

It is important to keep in mind here that, having such a power of attorney, the authorized person is capable of abusing his right, for example, taking out a loan for the principal and appropriating the funds for himself. That is why the principal must think carefully before issuing such a form.

Standard templates for general powers of attorney are always available from a notary, who will always tell you what rights the law allows when drawing up a power of attorney. It is drawn up according to a standard template, like any other document. The maximum validity period of the document is no more than 3 years.

General power of attorney LLC

The main feature that distinguishes a general power of attorney from an LLC from a regular one is the granting of broad powers to the principal, including the disposal of the organization’s property.

The contents of this document should be given special attention. If necessary, the specific rights of the trustee must be described in detail. Otherwise, the structure and content of this document are no different from the usual form of power of attorney.

Unlike an individual entrepreneur, an organization is not required to notarize this document, except in cases where the authority for state registration is transferred.

What documents can only be signed by the director of the company?

There are certain documents that only the manager has the right to sign. These include:

- Documents that are sent to the Federal Tax Service for state registration of a legal entity. Such documents can be signed and sent only by the director or another person who has the right to act on behalf of the legal entity without a power of attorney. In addition to the director, founders, bankruptcy trustees, etc. are also vested with this right.

- Documents that, according to the company's Charter, can only be signed by the manager. For example, the company's charter stipulates that financial and accounting statements can only be signed by the director. If the company's Charter does not provide for a ban on the transfer of authority to sign reports, then a power of attorney can be issued (

Representation of LLC interests in court

Particularly popular is the provision of powers to represent the interests of the organization in court. A power of attorney from an LLC to represent interests in this case does not require notarization and to draw it up, information about the principal and representative, powers, validity periods, as well as the signatures of the parties is sufficient.

The powers that are specified in a judicial power of attorney are the right to:

- To file a statement of claim, various petitions, complaints, requests;

- Providing evidence;

- Speaking at a court hearing;

- Carrying out other procedural actions necessary to resolve the case.

The special powers to withdraw the claim and conclude a settlement agreement must be specified.