Why should an individual entrepreneur make a power of attorney?

A power of attorney is issued by an individual entrepreneur in various situations when it is not possible to independently engage in one or another business.

The following options are possible:

- submitting the report to the tax office;

- concluding agreements with extra-budgetary funds;

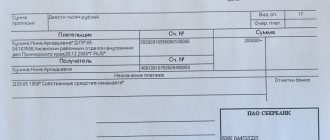

- the right to receive or, conversely, deposit funds;

- representing the interests of an entrepreneur in arbitration or other judicial authorities, government bodies;

- signing agreements with partners;

- participation in registration of transactions.

The list of possible powers does not end there. It can go on for a long time.

Do I need to notarize?

Notarization of powers of attorney is primarily mandatory. This is due to the fact that most institutions require notarized confirmation of authority. An individual entrepreneur, as a person who constantly deals with risks, must understand that it is not worth saving on a service that can later save him from problems.

Important! Powers of attorney subject to mandatory certification:

- registering rights and transactions;

- involving the disposal of one’s own rights;

- to conclude transactions with mandatory certification;

- in which the ability to revoke a power of attorney by an attorney is limited;

- on representation of interests in the Federal Tax Service.

From a legal point of view, it does not matter which notary you contact - a private or a public one. Their visas have the same legal force.

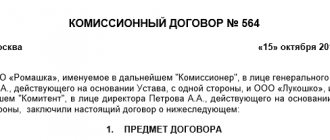

Drawing up a document for representation of interests

Before compiling, you should determine what type of document is needed. The legislation establishes 3 main types:

- One-time. It is drawn up to perform one specific action, for example, the principal authorizes a person to submit a report to the Federal Tax Service on his behalf. The representative has no other rights. Therefore, the document can only be used once.

- Special. It is issued to perform a certain range of actions in a specific area. For example, a trustee is authorized to represent the interests of an entrepreneur in court. The representative has the right to act only within the limits of the list of powers described by the power of attorney.

- General. It is drawn up to completely transfer to the trustee the right to act everywhere on behalf of the individual entrepreneur in any legal matters. The document must be registered in a special database because it is of particular importance.

To draw up a power of attorney to represent the interests of an individual entrepreneur, a special version of this document is more suitable.

Paperwork does not take much time. An individual entrepreneur draws up a power of attorney in simple written form, signs it and gives it to the representative. In some cases, this procedure is complemented by a visit to a notary’s office.

Important! The individual entrepreneur has the right to choose any person to delegate authority to him. Russian legislation does not limit the circle of such citizens. Typically, entrepreneurs choose one of their subordinates, their right hand, for this purpose.

In what form is a power of attorney issued from an individual entrepreneur to an individual?

According to paragraph 1 of Art. 185 of the Civil Code of the Russian Federation, a power of attorney is a written document. The following types of powers of attorney need to be certified by a notary:

- To carry out transactions for which a notarial form is required; for state registration of rights and transactions; to dispose of registered rights (clause 1 of article 185.1 of the Civil Code).

- Irrevocable, that is, limiting the freedom of their cancellation by the represented person (clause 2 of Article 188.1 of the Civil Code).

- To represent the interests of an entrepreneur in the tax authorities as a taxpayer (clause 3 of article 29 of the Tax Code of the Russian Federation).

In other cases, a simple form is sufficient. Then the power of attorney is certified by the signature of the individual entrepreneur, and if there is a seal, by its imprint.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

Sample power of attorney for an individual

There is nothing complicated in drawing up a power of attorney. The document contains the following information:

- Place and date of registration. The date must be indicated. Without it, the document will be invalid.

- Personal data of the principal and the authorized representative. For an individual - information from the passport, INN, for an individual entrepreneur - full name, OGRNIP, INN.

- List of powers of the representative.

- Validity. This item is optional. If you do not specify a time period, it will be equal to one year.

- Possibility of transfer.

- Signature of an individual entrepreneur.

Note! If an entrepreneur gives a representative the right to sign documents for him, it is recommended to include an example signature in the power of attorney.

DOC format

Before filling out the form, you should look at a sample power of attorney to represent the interests of an individual entrepreneur so that you know approximately what to write.

Compilation rules

There are no significant differences from other types of powers of attorney. It is enough just to adhere to a business style of design, and do not forget to indicate important points. It is important to remember that if you miss any detail, the power of attorney may be invalid.

A conditional power of attorney can be divided into several parts:

- Date of issue . It is recommended to write it not in numbers, but in words. It is believed that capital letters cannot be corrected without being noticed. The specified date is the beginning of the validity of this document. As a rule, the current date is indicated. However, specifying a past or future date is also acceptable. For example, if the attorney has already fulfilled his obligations under this power of attorney, and these actions need to be recorded legally, a past date is set. Sometimes it is necessary for the power of attorney to come into force not immediately after its preparation, but after some time. In this case, a future date is set.

- Information about an individual , namely his passport details.

- Attorney Information . Enter information about the person who will play the role of trustee. Naturally, this must be an adult. All information is copied from his passport.

- Powers . This is one of the most important sections. The principal must provide clear definitions of permitted powers.

- Possibility of reassignment . It is noted whether the representative is allowed to draw up a transfer of power to someone else, or whether he does not have such an opportunity. If such permission is available, when drawing up a power of attorney, the authorized person is obliged to inform the principal about this.

- Signature of the authorized representative . It cannot be said that this signature is simply necessary for this document. However, in the modern world it is customary to use this clause. By signing, the attorney confirms that he is ready to fulfill the obligations assigned to him.

- Validity . You can specify the period during which the document will be valid. It is also allowed to indicate a specific date upon which the power of attorney will lose its force.

- Principal's signature . The use of a graphic copy of the autograph is not permitted. In other words, the signature must be “live”, even if the document was printed on a computer.

This is important to know: Is it possible to rent out an apartment with a mortgage?

Are there any restrictions on powers?

There are no special restrictions regarding the transfer of powers to a representative. But there are actions that cannot be performed by another person. Civil law prescribes that the participation of a representative is not allowed when making transactions in which the person’s personal presence is required.

For example, it is prohibited to transfer the right to sign a will to someone else. This is a purely personal transaction requiring the presence of the testator himself. But such prohibitions apply more to individuals, not individual entrepreneurs. After all, a will is still written on behalf of a citizen, and not on behalf of an entrepreneur.

Formulation of powers. Where can I obtain a general power of attorney from an individual entrepreneur?

ConsultantPlus has many ready-made solutions, including a form of general power of attorney from an individual entrepreneur. If you don't have access to the system yet, you can sign up for a free trial online! You can also get the current K+ price list.

Judicial practice shows that general formulations of powers are not always sufficient:

In clause 5.6 of the MR it is specifically noted that it is impossible to issue a power of attorney to carry out business activities in general. But an individual entrepreneur has the right to transfer specific powers to represent interests in any legal relationship in which he is a participant: concluding transactions, managing a current account, submitting reports to the Federal Tax Service, etc.

Based on the nature and scope of powers, powers of attorney are distinguished:

- general (for disposing of property, making transactions, representation);

- special (for performing a number of similar actions);

- one-time (to fulfill a specific order).

Thus, in cases established by law, a power of attorney from an individual entrepreneur must be notarized. Even if we are talking about a simple power of attorney, it is better to indicate the information in it in accordance with the MR. It is necessary to individualize the representative and the represented, as well as specify the powers.

More useful information is in the “Power of Attorney” section.

A power of attorney from an individual entrepreneur is a document through which an entrepreneur transfers certain or all of his powers to another person. Having such a document, a citizen has the right to perform on behalf of the principal the specific actions prescribed in it.

When do you need notarization?

Notarization of a power of attorney from an individual entrepreneur is required if:

- the powers delegated to the citizen are related to transactions requiring the presence of a notary, for example, a rent agreement;

- powers relate to transactions subject to state registration or related to the disposal of real estate.

When contacting a notary, you do not need to bring the already completed document. The power of attorney is issued directly at the reception. The lawyer himself issues a special form with an individual number. This code is required to enter paper into the database.

Procedure for registration through a notary:

- Visit of an individual entrepreneur and an individual to a notary office. You must have a passport with you, and the entrepreneur must also have documents certifying his status.

- Drawing up a power of attorney by a notary.

- Checking the document by the parties for errors, typos, and inaccuracies.

- Signing of the paper by the entrepreneur, if it is drawn up correctly.

- Certification of the document with the signature and seal of a notary, entering data into the database.

- Transfer of power of attorney to an authorized person.

Important! A document acquires legal force only after it is certified by a notary.

What types of powers of attorney are there?

Lawyers distinguish several types of powers of attorney:

- simple. Its significance lies in the transfer by an individual entrepreneur of everyday responsibilities to his attorney, such as drawing up reports, signing acts on behalf of the individual entrepreneur and other actions, an exhaustive list of which is reflected in the text of the power of attorney. Such a power of attorney can be drawn up in printed or handwritten form;

- one-time Allows a person to perform one specific action on behalf of the individual entrepreneur. For example, sell a car;

- special. Such a document assigns certain functions to the trusted person, which he must perform for some time (the terms are also indicated in the text). For example, preparing financial statements;

- general. It is a cross between the previous types. Based on such a power of attorney, the entrepreneur trusts the person to perform all the functions that are specified in the document during the term of the contract;

- notarial The subject is more serious actions that are entrusted to the attorney, therefore such a power of attorney is drawn up in the presence of a notary, who additionally guarantees the correctness and legality of the power of attorney. For example, it is drawn up if it is necessary to transfer to a third party the responsibility for maintaining reports for the tax or Pension Fund;

- general Like a notary, it is executed by a notary, and its main difference is that the attorney receives a wide range of powers in a certain area. For example, an individual entrepreneur can entrust a person in whom he is confident to carry out any transactions with his securities. It is important that one such power of attorney is issued only to one person.

Watch the video. How to properly issue a power of attorney from a notary:

Termination

A tax power of attorney from an individual entrepreneur to an individual or for other purposes loses its force at the end of the period established by it. In addition to expiration, there are a number of other reasons for the termination of a document. These include:

- execution of the powers specified in the power of attorney of a one-time nature;

- termination of the activities of an individual entrepreneur;

- carrying out bankruptcy proceedings in relation to individual entrepreneurs;

- death of a trustee or principal;

- recognition of one of the parties as incompetent by a court decision;

- recognition by the court of one of the participants as dead or missing.

Also, either party has the right to terminate the document early. If the initiator is a representative, then he draws up a written refusal, if the principal - a canceling document.

Thus, a power of attorney is necessary for an individual entrepreneur to transfer any powers to a citizen. The list of possible actions is practically unlimited by law. For proper preparation, you can at any time review or read the power of attorney from an individual entrepreneur to an individual to conduct business or other actions in word or other format.

Validity periods

Most often, a document is drawn up for a period of three years.

However, this is not necessary. The duration is determined solely by the principal. Often the deadline is specified in the document. Sometimes a specific date is set, upon which the power of attorney loses its force. If there is no deadline, the document will be valid for one year. The law provides for situations when the validity of a document is terminated early:

- the attorney or principal has died, gone missing, or become incapacitated;

- the principal for some reason has lost the right to issue a power of attorney;

- if the role of an attorney is played by a company that has been declared bankrupt or has ceased to exist;

- the trustee no longer wishes to fulfill the obligations assigned to him;

- if this power of attorney is no longer necessary, the principal has the right to revoke it.

Who can be a representative

The representative of the future entrepreneur can be anyone: a friend, relative, acquaintance or an employee of a law firm that provides registration services. The main thing is that this person has reached the age of 18, has legal capacity and has Russian citizenship.

Having identified who can become a representative of a future entrepreneur, we will briefly consider the main reasons why it may be necessary to register an individual entrepreneur by proxy. So, registration in this way is relevant in the case of:

- If the applicant lives in another city or region and does not have the opportunity to contact the Federal Tax Service at the place of registration.

- If a beginner individual entrepreneur, due to illness or other reasons, is not able to independently prepare and submit documents for registration.

- If the applicant does not have enough time or desire to engage in the registration process.

When can you trust an assistant?

Let's decide whether an individual entrepreneur needs a power of attorney. The document may be needed under a variety of circumstances. There are cases of its use established by law, and those that are directly related to the intricacies of the work of your enterprise.

Main cases of using a power of attorney:

- To represent an individual entrepreneur to the tax office (for registration, liquidation, filing a declaration, obtaining certificates, consultations, etc. For example, a power of attorney to close an individual entrepreneur will allow you to liquidate the enterprise without your participation);

- To manage bank accounts (banks have developed power of attorney forms, in which you only need to enter information about the individual entrepreneur and the representative. The document allows you to withdraw money, make transfers, open or close accounts);

- Upon receipt of postal items;

- To contact local authorities;

- Receipt of goods and other valuables (such a power of attorney has a unified form of a recommendation nature, that is, it is not obligatory to use);

- To represent an individual entrepreneur in court (this can be done on a regular basis by a full-time lawyer);

- Carrying out transactions with partners (receiving money, drawing up and signing contracts);

- Buying, selling real estate or cars and other things.

This is important to know: Sanatorium and resort treatment: how to get a free trip for pensioners

As you can see, the list of operations is quite impressive. Therefore, the question of the unnecessaryness of a power of attorney in the activities of an individual entrepreneur disappears.

Power of attorney from an individual entrepreneur: when to use

A representative of an individual entrepreneur can contact the tax authorities only if he has a notarized power of attorney (paragraph 2, paragraph 3, article 29 of the Tax Code of the Russian Federation).

Individual entrepreneur as an employer in accordance with Part 2 of Art. 53 of the Civil Code of the Russian Federation can certify a power of attorney, including in situations where the principal as a citizen is himself (determined by the Kostroma Regional Court of June 17, 2013 in case No. 33-1047).

In this case, the individual entrepreneur’s power of attorney certificate must contain not only the individual entrepreneur’s signature, but also a seal.

Thus, in the resolution of the deputy chairman of the Sverdlovsk Regional Court dated March 7, 2014 No. 4a-257, it was noted that the magistrate legally considered the case in the absence of the offender, since the power of attorney submitted by the defense attorney, signed by the individual entrepreneur, was not sealed.

A sample power of attorney can be downloaded from the link: Power of attorney from an individual entrepreneur - sample.

You may also find the form of power of attorney from an individual entrepreneur to conduct a case in an arbitration court, developed by ConsultantPlus, useful. If you do not yet have access to the ConsultantPlus system, obtain it for free.