MFO "Good Money" began its activities in the field of microcredit relatively recently. However, many clients turn to this organization because it already has a reputation as a reliable company.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The company provides its services to both individuals and legal entities. The main activity is aimed at providing loans up to 50,000 rubles, but there are also other lending programs where the loan amount is larger.

Under what conditions can I get a loan?

The Good Money loan is available to people throughout the country. The main advantage is that the loan application is submitted online. To do this, just go to the company’s website and fill out a form to receive a loan.

Basic conditions for receiving funds:

- No collateral or guarantors are required;

- To apply for a loan, you only need to present your passport and SNILS;

- To make it easier for the client to repay the loan, payments are calculated weekly;

- You can pay off the debt not only in parts, but also in a lump sum;

- There is a possibility of early repayment of the loan.

At the time of signing a loan agreement, the company issues a payment schedule, which specifies certain points.

What is indicated in the payment schedule:

- Amount payable once a week;

- Terms and time of payments;

- Separate from the principal amount, there is a column with accrued interest;

- Full debt of principal and interest;

- Information about the borrower and criteria for its evaluation.

Before applying for a loan, a person must be sure that he will not be refused, which means he must meet the minimum requirements.

What the borrower must comply with:

- The client must be over 18 years of age;

- Russian citizenship is required;

- The borrower must have permanent or temporary registration in any region of the country where the company has an office;

- Permanent income does not need to be documented.

Requirements for clients are minimal, and this virtually guarantees 100% approval of the application.

To provide a loan for a large amount, company employees may request additional documentation, but this is in rare cases. And also, when issuing a large amount, the company gives greater preference to those clients who have already taken a smaller amount from the microfinance organization and paid it on time.

Terms of service

provides funds on the following terms:

- The client does not require loan security or a guarantor;

- The lender receives information about the client exclusively from the provided original passport and SNILS;

- The loan is repaid strictly on the allotted calendar days - 7, 14, 21, 28, that is, repayment must occur on a weekly basis;

- Repayment can be made in installments, but there is a scheme for a lump sum payment of the debt in the amount of the full mortgage, consisting of interest and principal;

- The client has the right to repay the debt ahead of schedule, however, there is a clause that the borrower will also be obliged to pay the interest that was initially specified in the terms of the agreement;

In the payment schedule, the lender prescribes the following parameters:

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

- Amount of weekly contribution;

- Payment term and date;

- The separate column shows the amount of interest and the calculation procedure;

- The final loan payment amount.

- Borrower assessment criteria

Like any financial organization, it imposes certain requirements on its borrowers:

- The borrower's age must exceed 18 years;

- The client must be a citizen of the Russian Federation;

- Permanent or temporary registration must be located in the place of presence of the company's office;

- Availability of a regular income that will allow you to repay the loan.

- From the above it is clear that the requirements are minimized when compared with the banking conditions that apply to borrowers. It is also worth noting that when considering an application, the client’s credit history is very rarely reviewed, so the likelihood of receiving a positive decision is quite high. At the same time, both an application for 10 thousand rubles and 100 thousand rubles can receive 100% approval, only in the second case you need to be prepared for the fact that the employees who are reviewing applications may require additional documents from the client. The issuance of a larger amount is most likely if the client has already paid off a small loan before and has managed to establish himself as a loyal borrower.

What you need to know

When filling out an online application, you need to enter the details of some documents in a special form. This is done to verify the borrower.

What documents are required:

- Passport of a citizen of the Russian Federation;

- Second document to choose from: SNILS, TIN, driver's license.

These documents are quite enough to fill out an application for a small amount; if the client requires a larger loan, the organization may require other documents.

What you need to submit additionally:

- Diploma of completed higher education;

- A certified copy of the work record;

- Certificate of income in the form of the bank.

Documents from the place of work must be properly drawn up and certified by the person responsible for this. These requirements are only available for clients who require a large amount to pay out.

If the loan application is submitted by a legal entity, you must submit other documents:

- Information about income for the last 4 months;

- Identification documents of the founders;

- A copy of the company's charter.

MFO programs "Good Money"

MFO Good Money has several programs that a client can count on. He can independently choose the program that is most suitable for him. It is worth understanding that the interest rate on loans depends on several factors.

What does the percentage depend on:

- Whether the client is a regular borrower or came for the first time;

- On the size of the requested loan;

- From other conditions specified in the contract.

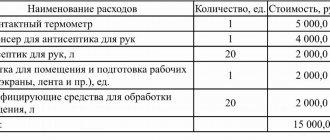

Table of loan conditions:

| Loan program | Amount to be paid | Terms of use of the service | Interest rate per day | Conditions |

| Lifebuoy | 1500–35000 | 1–30 days | 0.6–1.6% | Issued to first-time clients |

| Admiral | 2000–50000 | 1–60 days | 0.7–1.25% | Age must not exceed 35 years |

| cabin boy | 1000–15000 | 1–14 days | 0.5–1.5% | For borrowers under 25 years old |

| New wave | 5000–50000 | 2–60 days | 0.4–1.7% | Payment terms can be increased by agreement of the parties |

| Second wind | 35000–150000 | 1 year | 0.75% | Provided upon collateral |

The mailbox has been created. How to make money with Mail.ru

Working online is possible at home, for this we have created and will use a mailbox on mail.ru. You can choose any popular or not so popular way of earning money that is suitable for you. In any case, to receive money, you first need to create an account (electronic wallet) in payment systems - then we are going to receive money, right? To begin with, accounts on Webmoney, Payеer, Perfect Money will be quite enough. Next, register on one or more sites to earn money from the list. We earn money, withdraw it to an electronic wallet, then to a bank card, and withdraw cash from the ATM! Those who don’t want to get paid for completing tasks or being on social networks or earning money from clicks can easily earn money by writing articles. A good type of income brings in at least $300 per month. You can create your own website for free and earn good money from it too. But, in all cases, to register on these sites and systems you need a free mailbox. You can use free mail Mail.ru for this. Thus, you have seen for yourself that mail is a key element of the online earning system. I may repeat myself, but you can earn money not only with a Mail.ru mailbox. It is recommended to have several on different services, most of them are free. But, most importantly, you should have understood that without a mailbox it will be simply impossible to make money online

How to get

In order to receive a loan you need to fill out an application. There are two ways to do this.

How to apply:

- At the company office;

- Via an Internet service.

The application should indicate:

- Desired amount to receive;

- Loan terms;

- Personal data of the borrower;

- Methods of receiving and returning funds.

Find out what the consequences are if an individual declares bankruptcy.

Need a sample thank you letter? See here.

How to withdraw money

A person turning to a non-profit organization expects help in a difficult life situation. provides its clients with this opportunity.

How to get a loan:

- At the company office;

- To a bank card;

- A bank employee will bring the money to your home;

- To electronic wallets.

The main advantage is that receiving funds is not accompanied by paying a commission.

The client can pay a commission only for withdrawing funds from his electronic wallet.

Hand-made clothing and accessories

High-quality natural clothing and accessories are what a modern person needs and what money will be invested in. People strive to express their individuality and to art and creativity, so a small studio or online store selling exclusive hand-made items - bags, jewelry, clothes - will be in demand on the Kursk market. By opening your online store, you can save on renting premises for sale, but then it is important to invest in a good advertising campaign.

Positive and negative points

MFO Good Money cooperates with all clients who contact the organization. Cases are different, so the company tries to help people who find themselves in difficult life situations. At the same time, it has a number of advantages and disadvantages.

Advantages of working as an MFO:

- Relatively low interest rates compared to other organizations;

- The company provides its services to both individuals and legal entities;

- A well-thought-out schedule for debt repayment;

- No hidden fees;

- Possibility of obtaining a loan, both in the company’s office and online;

- The borrower can independently choose a method of debt repayment that is convenient for him;

- In fact 100% approval;

- The loan is issued without providing collateral or guarantors;

- Filling out an application and waiting for a response does not take much time;

- Registration does not require a large package of documents;

- Regular customers can always count on receiving a loan for a large amount.

The only disadvantage of MFOs is that:

- When checking, the company always requests information from the credit history bureau;

- If there are open arrears or your credit history is damaged, taking out a loan will be problematic.

Conditions for issuing microfinance loans

When you urgently need a small amount before your salary or a scholarship, microfinance organizations come to the rescue, offering to quickly obtain a loan. All microloans can be divided into two types:

- for individuals for a small amount;

- for small businesses for larger amounts.

Most often, you can take out a loan from an MFO from the first category with an issue amount of up to 100,000 rubles. You won't find long-term loans here. Estimated time frame: 1-3 months. Interest rates start from 0% per day, that is, many times higher than the rates of banking organizations.

You can apply for a loan in 2020 either in the company’s office or remotely using an online application for a microloan on the website.

Requirements for the borrower

A low-interest loan can be obtained from the age of 18.

The main requirements are Russian citizenship and the presence of a permanent source of income. Certificates from work are most often not required, as are guarantors and collateral. Advantages and disadvantages of loans from microfinance organizations

| Advantages | Flaws |

|

|

|

|

|

|

|

|

| |

| |

|