From this material you will learn:

- What is venture investment in simple words?

- Pros and cons of venture capital investments

- Is it true that venture investments have a minimal degree of risk?

- Which companies are suitable for venture investment?

- Types and examples of venture investments

- Basics and subtleties of venture investing

- 6 steps on how to make money on venture investments

- Secrets and problems of attracting venture capital investments in startups

- On the development of venture investments in Russia

- Review of Russian venture investment funds: TOP-12

- Interesting facts about venture investing

Venture investments are a fairly new phenomenon in the Russian Federation, but still dynamically developing. Thanks to it, you can make good money for those who want to invest their money in potentially profitable companies.

However, often when faced with venture investment opportunities, people do not know where to start and make a lot of mistakes. So that you can properly understand the basics and intricacies of this process, starting your own business, we have prepared this article for you.

What is venture investment in simple words?

Translated from English, the word “venture” means “risky undertaking.” It follows that venture investments are investments with a high degree of risk for the investor.

How is it that when you make venture investments you are dealing with very high risk? This is explained by the fact that in this case you are investing in the latest technologies and innovative businesses that have no analogues on the market yet.

Eg.

Such familiar things as railways, computer equipment, mobile communications also just appeared once, and investments in them were venture capital. However, at present this is a very ordinary business, investments in which do not involve a high degree of risk.

Investors finance new projects at the initial stage, and when the company gains momentum and becomes stable and profitable, they sell their shares at a good price.

The amount of risk is directly proportional to the future profit received. Although venture investments are quite dangerous investments, but, according to statistics, they are also the most profitable for many investors.

Individuals (most often legal entities) and entire funds can act as venture investors.

A venture fund is a special fund that works with so-called startups (the latest innovative projects).

Of course, investing in one enterprise is very risky. Therefore, funds place them in several dozen projects at once. It may happen that only one startup succeeds, but it will bring such a large profit that it will fully recoup the costs of all other investments.

We recommend

“Business risks: what are they and how can they be reduced” Read more

Venture capital is the general funds of investors intended to finance startups.

The venture investor receives part of the profit from the business, and sometimes can participate in project management (also not for free).

Advantages of venture funds

Venture capital funds have cash, market connections, experience and practical knowledge.

Hence their advantages over other sources of financing:

- Long terms (investments are issued for a period of up to 10 years).

- No annual or monthly interest.

- No collateral or risk insurance required.

- The fund becomes a business partner for the company. He is interested in the growth of the enterprise, is ready to give advice, share experience, contacts, and help in finding clients and new investors.

- If the funds are lost, the company will not be declared bankrupt.

- Venture capital financing can be used as a complement to a bank loan.

The main goal of any venture fund, like any other commercial company, is to make a profit.

By investing in promising enterprises, funds expect not only to recoup their costs by selling shares, but also to make a profit. To do this, the financed company must gain recognition in the market.

Pros and cons of venture capital investments

This investment option has a large number of advantages:

- high level of income;

- making a profit in a short time;

- absence of legal and legal difficulties;

- receiving dividends on an ongoing basis;

- simple investment scheme.

First of all, venture investments are legally safe investments. Investors do not risk anything, since if the enterprise that received the funds breaks the law, then this will fall only on its shoulders. In this case, the investor is not responsible for the actions taken.

The main feature of venture investments is the high risk of investments. According to statistics, only 1 out of 10 startups become successful and profitable. But there are still a number of disadvantages.

The disadvantages of venture investments include:

- incomplete information about potential risks. The organization that created the startup may unconsciously or consciously keep silent about them;

- often understated income of the investor specified in the contract;

- the likelihood of facing high taxes.

To get shares in a stable, mid-income company, you need to spend at least $10,000.

It often happens that companies may break the law to avoid taxes. This usually results in legal liability. In these circumstances, most likely, even a super-successful project will be closed, and investors will lose their invested capital.

Venture capital investments have a minimal degree of risk - is this true?

When making investment decisions, you need to understand that in any innovative business you may encounter a large number of risks. Let's look at the main ones.

- Risks associated with the manufactured product. First of all, the product must reach the market and bring a certain profit.

- Risks arising from the wrong choice of market type. The following are distinguished: new, actually existing and resegmented existing. The right product promotion strategy is chosen based on the type of market.

- Competitive risks. There will always be people who want to make money on a truly profitable product.

Be sure to conduct a thorough risk analysis. Only after this can a decision be made in favor of investing in venture enterprises. In this case, there is no need to rush.

Recommended articles on this topic:

- Competitive advantages of a company: how to form and develop

- How to make a business successful and not become a “firefighter” for your company

- Company marketing strategy: from development to analysis

As we can see, such risky investments have a high risk of capital loss. A business may face a variety of risks, from misallocation of cash flows to errors in projected profit forecasts. In this case, it is worth financing projects in which the amount of potential risk is covered by high profits in case of success. Typically, venture investors are mutual funds, venture capital firms, or private investors.

Investors, as a rule, are closely connected with all work processes of the enterprise.

They jointly conduct examinations, plan and calculate potential risks and profits, and also actively conduct consultations during business meetings. It follows from this that venture investors invest not only their money in the project, but also time and experience throughout the entire process of establishing a new company.

But it is worth noting that most investors are looking for the most profitable enterprises that have a more realistic chance of successfully entering the market. All this is because the main and, perhaps, the only goal of all venture investments is to obtain the greatest profit.

How to attract investment

If you are an entrepreneur with innovative ideas, you may be wondering how to attract the attention of venture capital funds to your business.

Here's what you need to do:

- Analyze the market for venture capital companies and select suitable funds . Which of them work with enterprises in your area and provide investments in the amount you need. Always give preference to professionals with a long history in the market, and you will not have to doubt their reliability.

- Present your project . The presentation should not go into technical details and details. Your task is to describe as clearly as possible the benefits that an investor can receive. The key components here are the team, the idea and the confidence to achieve the goal.

- Talk to investors in person . Be prepared to answer provocative questions, do not lose confidence in your idea and do not hesitate. It is on the basis of a personal meeting with the project manager that the fund’s decision will be made.

- Provide a statement of expenses and income for the next three years . Don't forget to note how the expenses will help you make the most profit in the future.

- Make a deal . At this stage, the help of lawyers will not hurt. Agreeing on all clauses of the contract may take several months. A limited partnership agreement is drawn up.

Which companies are suitable for venture investment?

First of all, so-called risky investments will be interested in enterprises with good growth potential. Here we are not talking about the current position of the company, but rather about the prospects for further development.

Those projects that will actively and with high turnover develop in the next five years can receive venture investments.

From this we can identify general criteria for the attractiveness of companies for potential investors:

- good chances for growth and development;

- results-oriented team;

- qualified management;

- the ability to implement plans.

Types and examples of venture investments

Venture financing is usually divided into types depending on the companies to which investors contribute funds:

- Startup. This is usually the name given to a young company that does not have its own sufficient budget, but already has a unique, fundamentally new idea that has no analogues on the market. Potentially, this product should be of interest to the consumer.

- A company that does not have enough own funds to increase its sales market and increase productivity.

- A company that has already created a product but has not brought it to market. In this case, she still does not know how necessary it is and what attitude the consumer will show towards it.

An investor who has invested money in a potentially profitable project may not participate in the process of its management, leaving this work to the creators and developers. With this approach, this will be a short-term financial contribution, which is relevant precisely at the stage of development of the company. Afterwards, the investor receives either a positive result in the form of profit, or a negative result in the form of loss.

Let's look at options for promising ideas on the Russian market:

- Prisma

. Using this application, a social network user can turn his photo into an artistic canvas. And just one touch. - Cardberry

. A device to save space in your bag or pocket. Enter into its memory all the plastic cards you use. If necessary, just go to the application and select the one you need. - SVET

is a company that develops natural light bulbs of unusual shapes. You can also further adjust their brightness.

How to make money from this

Success in venture investing depends on the systematic nature of the actions taken, so it is extremely important to develop a plan and strictly follow it in the future. Effective venture investing includes the following steps:

- Collecting the required amount. Without this condition there will be no business.

- Determining the direction for investment. This should be done depending on the situation on the stock market. Try to find a free niche in the economic sphere or invest in a completely innovative area.

- Searching for a promising company and determining a development strategy. After selecting a specific project, be sure to develop a step-by-step path of activity. Here it is better to think everything over from the beginning so that there are no problems in the future.

- Signing the contract. In the absence of knowledge of legal nuances, it is better to hire a specialist who will carefully study the documents and give the go-ahead to sign the deal. Initially, correct design allows you to save yourself from the need to correct errors in the future.

- Monitoring project activities. For a company to make a profit, it is necessary to invest knowledge in its development and take an active part in management.

- Sale of shares. As soon as the startup becomes successful and stable, you can sell shares to other partners who want to earn money with minimal risks.

Basics and subtleties of venture investing

- Investors finance funds at the stage of project creation. It may happen that capital is contributed even before the initial registration of the company. In this case, investors are guided only by the business plan, since the activity is not yet underway and it is not yet possible to see the real profitability.

- There are no guarantees. If the startup you invested in fails, you have no right to demand your investment back. Here you are fully responsible for your capital. The main advice in this case is to choose projects carefully.

- When you invest financially in a specific project, you acquire a part of it. This is stated in a special agreement. After successfully entering the market and making a profit, you are entitled to receive your share. It is worth noting that the size of this share often does not directly depend on the amount of financing. It happens that the author of the idea does not invest money in his project at all, and investors completely bear the financial costs. At the same time, the person who invested in the project cannot own more than 50%. Typically, it is believed that the founder of a startup contributes an intellectual idea, and the investor contributes money.

- Yes, venture investments involve high risk, but at the same time they can bring very good returns. There have been projects that increased investors' investments several times at once in a short period of time. High income is a great plus. One successful contribution can cover several unsuccessful ones at once. It will be great to choose a successful startup if you have the skills to qualitatively evaluate proposed projects.

- A potential sponsor needs to understand that if he has competence and experience in a similar area of business, he may well take part in the development process of the project or advise its authors. It often happens that the investor-creator relationship goes beyond the points specified in the agreement. Sponsors express their ideas and plans and directly participate in the management of the enterprise, thereby increasing the efficiency of the entire process.

- Sometimes a situation occurs when the author of a startup needs funds not at the very beginning of creating an enterprise, but only during the work process. It is at this stage that you can take advantage of additional investments - both interest-bearing and not. The lender sets a specific deadline for repayment of funds. The only thing he needs to understand is that the borrowing company is liable to him only in the amount of its authorized capital. If the debt exceeds the authorized capital, the creditor loses this difference.

- If we talk about classic investing, here the investor seeks to buy a controlling stake in the company.

In this case, he will have the last vote in making significant and serious decisions on the board of directors. If he has access to the top management of the company, he will be able to arrange his career, as well as influence other projects. But in venture investing, things are different. The sponsor does not need to buy back most of the shares. First of all, when investing money, he expects to receive a good profit. The conditions for the investor’s participation in the venture project are stipulated by the contract, that is, all important decisions are made either jointly or individually by the author himself. One of the principles of venture investment is joint and transparent management and development. - In the first few years, the investor rarely makes a profit. All funds received from the activities of the enterprise go towards further development. The investor receives his dividends only after the product has been reliably established on the market. Of course, there are always exceptions to this rule.

We recommend

“How to find an investor: step-by-step instructions + 13 online sites” Read more

e.venures Russia Foundation

The founder of the venture fund is entrepreneur Konstantin Rosset. The fund has secured the support of large foreign investors. One of the most successful projects is the dating site Teamo. The investment amounted to about 5-6 million dollars. Not all Russian funds have achieved any success. One example of unsuccessful projects is the online store selling sporting goods “Heverest”. Several million dollars were invested in the company. But, over time, investors lost interest in the project and the company closed. The fund is currently actively supporting both Russian and foreign companies. Large foreign investors help him in this.

Secrets and problems of attracting venture capital investments in startups

Investments in newly created companies, so-called startups, the distinctive feature of which is a high level of risk, but at the same time good profit, are called venture capital. It is worth noting that in order to receive funds, the project must already have a finished product. The sphere of innovative technologies most often receives venture investments, being the most highly profitable and promising. These contributions have a clear target orientation and are provided to companies for specific purposes, which are specified in the contract.

1. To receive financial investments, startups need to have certain indicators

Most often, a company manages to receive the necessary investment if the pace of its development is steadily growing. Enterprises that have reached self-sufficiency or already have a small income are more popular.

But there are still other indicators:

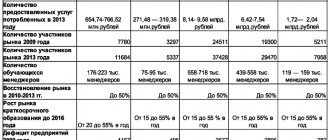

- In the B2B sphere, successful companies are those that have a number of concluded contracts for product implementation.

- In the field of media, marketing and Internet services, the company’s weekly growth rate of real clients must be at least 6%.

- If the activities of a young company involve the production of a specific product, then it is imperative to have a working prototype. In addition, it must already be positively assessed by the consumer (for example, on a crowdfunding service).

- If the company has achieved a stable growth of more than 10%, then investors themselves will actively offer their services. Such an enterprise is considered successful and profitable.

On the Russian market, one of the important criteria for assessing a potentially attractive enterprise is the presence of a well-formed, competent project team. This dreamteam includes:

- A general manager or entrepreneur who has relevant experience and understands a particular area of business

- A developer with extensive experience (more than five years) of working in a large company and possessing all the necessary skills.

This core team creates the base of the product and its presentation to the consumer. Employees such as marketers, designers, accountants and lawyers are not so significant for the investor, since they can be replaced quite easily without harming the project.

Obstacles to obtaining investment:

- No patent or intellectual property rights for the product.

- Simultaneous work of the main team on other projects.

- Personal contradictions among team members.

- Difficulties with scaling the project.

- A small share of the company's ownership is held by its creators.

2. Seed and angel investments

If the company satisfies all the above conditions, then it will easily receive the first, so-called seed investments. They are also venture capital, although they are not yet venture capital in the full sense of the word. They are a pilot investment designed to bring an innovative product to market for the first time. Seed investing is the most risky, but its income is also the highest, even when compared with investments at subsequent stages.

Most often, initial investments are offered by business angels. These are individual private investors who provide financial and expert assistance at the very first stages of company development. Angel contributions are often made using crowdinvesting platforms (equity crowdfunding) to find investors and startups (Angel List, Venture Angels, Runa Capital, Mangrove Capital Partners, Startup Point, Start Track).

Business angels do not have a large amount of cash and can attract each other as co-investors, forming investment clubs. Contribution to such a club starts from $1,000 per year for an individual and $3,000 for companies. In this case, the return on investment is expressed as a percentage of the enterprise's income.

3. How to find an investor for a project

Ultimately, venture capital investments are much more useful for a new project than simply additional funds for ongoing development. With the right professional interaction, the team will be able to get real benefits in their work:

- Make new useful contacts.

- Choose the right development strategy based on the investor’s past experience.

- Make an assessment of the product being manufactured in terms of its financial attractiveness.

Investors, before investing their money in a startup, carefully analyze the company and its scope of activity. They often give preference to companies that intend to operate in business sectors that are familiar to the investor.

4. Main directions for searching for investments

- Attracting personal connections. In this case, you get a big advantage - a trusting relationship with the investor. However, there is also a negative side - a longer process if you yourself do not know the investor personally.

- Become a member of a business incubator. Business accelerators are special organizations that provide support to new companies for a percentage of future profits or for a certain share of shares. They provide startups with everything they need at the initial stage: premises for work, legal and financial support, and attract additional investments.

- Take part in startup competitions. This is a great chance to communicate with a large number of people at once who are ready to invest their money. Such competitions can be held at the regional, state and international levels. Here you can get funding through grants and cash awards.

5. Difficulties for startups when working with investors

- Since venture capital investment is a very risky undertaking, the investor can leave the company at a difficult time or help sell it to larger market participants. Here he will not pay attention to the interests of the entire team. In this case, it is important for the company to correctly distribute shares in the enterprise in order to ensure a positive outcome when terminating the contract.

- Investors may have hidden intentions to devalue your startup in order to later buy it out or attract valuable team members to work on other projects.

- In the venture investment market, the rules of operation are clearly shaped by the investor-creator. They must be strictly followed. If we are talking about a creative project, then disagreements may arise.

6. How to find a project to invest in

With a smart investment, an investor works with several startups at once. He is immediately prepared for the fact that not every project can bring profit. In practice, only one company out of ten becomes successful. This means that the profitability of the project must be at least ten times the amount of financing. Experienced investors do not wait for proposals from the founders of a startup, but look for them themselves, constantly analyzing the market. Most often, future investors join venture funds.

Such organizations are engaged in building a company’s development strategy in the market, selecting specialists in certain fields, and providing legal support. The objective of the fund is to form a single investment portfolio for investing in a large number of startups. The main difference between a fund and business angels is the use of its own and private funds for investment. The advantage of their activities is the ability to conduct risky activities at the legislative level, including lending to companies. In addition, it is not prohibited to attract each other as co-investors.

Investors often monitor awards and competitions for the best startup so as not to miss out on truly interesting projects. They go to conferences, seminars, presentations. Monitor crowdfunding platforms and thematic blogs.

Difficulties for investors with new projects:

- You have to be patient and clearly see the startup’s prospects. An idea can bring profit both in a year and in ten years. This cannot be predicted in advance.

- The team’s passion for the project idea to the detriment of its profitability causes conflict situations.

7. What documents does the new company provide to the investor?

To attract direct venture capital investments into their project, the creators need to provide documents with their business idea. This list includes:

- Teaser. A brief advertising summary of the project, which describes its main idea, assesses competitors and target audience, and makes forecasts for the next few years. This is the first document that the investor receives.

- Presentation. More detailed description of the startup. Provided if the investor is interested in the teaser.

- Memorandum. Proof of the effectiveness of the strategy and justification of the main provisions presented in the presentation. This is its integral application.

- Description of the financial model. This document details profit generation, cash flow and cost allocation. Most often provided in the form of charts and tables.

- Provisions of the investment agreement. Explanation of the purpose of the funds received, the amount, distribution scheme. The conditions under which the parties can terminate the contract are also separately noted.

- Agreement on cooperation. A document that stipulates the conditions for transferring a stake in a company to an investor. At the initial stage, a preliminary version of it is prepared, since the provisions may change during the work.

With the development of modern technologies, the emergence of venture investments is an absolutely natural phenomenon. This is the most promising mechanism for interaction between investors and creators of startup projects.

How can a startup entrepreneur find venture investors in the Russian Federation?

First, you can use acquaintances. Advantages – trust of a business angel. Disadvantages - a labor-intensive and lengthy process if there are no direct contacts with investors willing to help the young company.

Secondly, you can join business incubators. These are companies that support startups in exchange for a share in the business. Employees provide premises for work, hire an accountant and lawyer, provide information support, and help raise money for the project.

Thirdly, it is necessary to actively participate in startup competitions. By participating at various levels and presenting a truly innovative product, you will attract the attention of many investors.

Each method is good in its own way. In my opinion, it is better to start with competitions.

Development of venture investments in Russia

Although venture capital investments in Russia amount to more than two billion rubles, by global standards this is a small amount. Most often, startups involve international firms and organizations that have received government approval. This primarily reduces risks, but also hinders the investment procedure. It follows from this that venture investments in Russia have not yet reached the world level of development.

There is an acute shortage of private investors in our country. Most investors choose developed companies that can provide certain income guarantees. In Russia there is a startup database where authors post a presentation of their product and can request financial assistance. Online platforms are being created where sponsors can view new projects and decide to invest.

The path to developing venture investments in Russia is not the easiest, but conditions are being created to improve the situation. Special funds are already operating that provide support to investors. With their help, you can avoid risks and increase your income. This creates favorable conditions for business development in the country.

Review of Russian venture investment funds: TOP-12

In Russia, venture funds are very popular, as the number of companies that are ready to invest in start-up projects is constantly increasing. In addition, there are real market veterans who have been working for a long time and have fully earned the trust of investors.

- Runa Capital. This company works with projects that introduce new ideas in the field of knowledge, experience and skills. This fund works with companies that are engaged in innovative developments in the IT industry.

- VC actively promotes mobile technologies. It is more focused on the foreign market, although it was founded in Moscow in 2011. Has offices in London and San Francisco. Has invested in more than 40 successful startups. Currently, he actively promotes games on social networks and smart applications for smartphones.

- Ru-Net Ventures. Has many of its own developments. Area of activity: energy technologies, Internet, outsourcing, automation and integration. Invests in advertising developments and interactive entertainment.

- Kite Ventures. This fund provides not only financial, but also advisory support to developers. It is popular, although it has often been criticized for the not always successful implementation of new projects. The most successful startups are ZeptoLab, Ostrovok, Trends Brands. If he is interested in the project, I am ready to invest up to $10 million.

- Well-known Russian foundation. Founded in 2006. Software oriented. The fund's specialists have extensive experience and provide comprehensive support to project authors not only at the launch stage, but also during the growth process. On average, it invests up to $3 million.

- Russian Ventures. It was launched as a platform with optimal flexibility and quick decision making. It has been working for more than 20 years. Has a capital of $2.5 million. Competently adapts Western experience to Russian realities. A distinctive feature of the fund is determining the attractiveness of a project in 30 minutes. Participating companies include the Ogorod community startup, the Okeo advertising network, and Pluso.ru, a convenient social network builder for webmasters.

- Addventure II. This fund for investing in the early stages of projects positions itself as a platform for business angels. It offers a huge number of opportunities for investors. You can not only invest capital, but also manage it in the future. The main activity of the fund is crowdfunding, the creation of collective procurement projects, the implementation of ideas in the field of electronics, trade, and the Internet. The most popular implemented project is the joint acquisitions site DARBERY.

- Foresight Ventures. The investment volume is approximately 10 million dollars. The fund invests up to a million in one project. Participated in the development of applications and games, task service YamLabs. Provides for minimal investor intervention in the management of a new project.

We recommend

“Storage of personal data: law 2020, nuances, recommendations” Read more

- Addventure I. Founded in 2008 with starting capital of 300 thousand dollars. The foundation was able to quickly gain momentum thanks to participation in such successful projects as Roomix and MMO. Invests funds in innovative startups at the creation stage.

- RVC. Russian State Fund. Operating since 2009. Invests capital at the project development stage. A prerequisite for his work is the provision of an expanded package of documents for both parties: for the depositor and for the author. This fund is an excellent option for investors who want to be fully involved in developments. He invested in projects such as Membrane Technologies and Ceramic Transformers.

- Softline Venture Partners - the fund was bought by the Softline group of companies, it has belonged to it for 10 years. The main field of activity is projects in the Internet sphere. At the same time, he is involved in a dozen large-scale projects. The fund's capital is more than $20 million. Invests capital only at the first stage of project launch.

- Prostor Capital. This fund entered the market relatively recently, since 2011. It stands out for its very professional approach to investing. The staff employs only highly qualified specialists in the field with extensive experience. The fund often participates in high-profile startups. Projects include the popular “Diary” and Vita Portal.

In addition to the above, there are many more funds that provide all stages of venture investment. Some investors prefer to act directly, contacting companies interested in financial injections directly. In this case, the risks will be higher, but the profits will be greater.

How does a venture fund work?

Let's take a closer look at how the venture financing mechanism works.

Stage 1. Experienced economists and businessmen create the fund. They unite around themselves the rest of the fund’s participants, who, by their own decision, provide the funds necessary for business development. Participants in the fund can be not only individuals, but also entire companies, banks and funds.

Venture can be internal, organized by the entrepreneur himself, or external. In the latter case, funds are raised through pension funds, government funds, and other investors.

Stage 2. Experts select startups and business ideas with high potential. The expected profit must cover expenses many times over in order to recoup not only itself, but also other investments that will not justify themselves.

The most profitable startups will be:

- Targeted at mass consumption;

- Innovations that have no analogues.

Stage 3. Selected objects are carefully analyzed, all risks are calculated. Modern funds prefer to work in several areas at once (about ten projects), which reduces risks (according to statistics, no more than a quarter of startups ultimately bring profit).

Stage 4. A strategy for further development of the business idea is being worked out. Sometimes fund specialists not only develop a financing plan, but also give recommendations on creating a company operating strategy.

Stage 5. The fund invests its assets in the issue of shares of the company (the controlling stake in any case remains with the company itself). Also, the investment may not be money, but commitments - that is, a promise to contribute funds when they are needed.

Stage 6. Along with the development of the project, the value of its shares increases.

Maintaining a balance between expenses and income, it is necessary to achieve a stable profit, and also, if possible:

- Increase production volumes;

- Expand the staff;

- Development of new areas in the global market;

- Open branches;

- Develop as many unique products as possible.

This stage usually lasts about five years.

Stage 7. Investment exit is carried out. The fund sells its shares through a public offering or to new investors.

The venture capital fund is not allowed to invest in the banking or insurance industries.

Finally, some interesting facts about venture investing

- America ranks first in terms of venture investment volumes. Every year, projects totaling about $20–30 billion are financed there. In addition, the country’s legislation contributes to this.

- No other country in the world has been able to approach such a high figure for the United States. If we add up the volume of venture capital investments from Australia, Israel, Hong Kong and the UK, the figure we get is only $15 billion.

- In Russia, it is not yet possible to make an objective assessment of the volume of venture investments. There are reasons for this. In our country, venture capital is significantly intertwined with offshore accounts.

- At the moment, Alibaba is considered the most successful venture project. One day, a Chinese teacher came up with the idea of creating a special platform that would act as a kind of intermediary between the buyer and the seller. Yes, there are external similarities with eBay and Amazon, but there are still a number of differences. For example, this service only works with Chinese goods, and their prices are always fixed. The developer’s very first investors were his friends. It turned out to be a very good investment. In 2020, the site made a profit of $77 billion.

- Despite Alibaba's success, Chinese firms still find it difficult to compete with American ones. An open and successful venture capital company must initially place its shares publicly available on the stock exchange (IPO). The main indicator is the level of stock prices immediately after entering the stock exchange and some time after. The difference between these numbers serves as an indicator of the success of the enterprise. One successful example is Facebook. If at the stage of entering the market the shares were worth approximately $16 billion, then after that this figure increased to $104 billion.

- If we talk about successful Russian venture projects, then we can say about Ya. It is worth noting that only Yandex managed to make its shares publicly available. At the IPO, the company's value was $8 billion, later rising to $9.8 billion.

As we can see, venture investments are an excellent way to obtain high profits. By sponsoring new innovative projects with a high degree of risk, you can increase your capital. Private investors invest only their own money in projects. Business angels, in turn, participate in the company’s activities, also investing their knowledge and experience.

Therefore, today in Russia, venture investments are a relatively new, but very promising direction. What does it mean? Many specialized funds are ready to help investors effectively manage their funds and choose only potentially profitable projects. The most popular investments are currently considered to be in high-tech businesses, Internet technologies, and the service sector.