Upon dismissal, the employee is issued a number of documents, including SZV-STAZH. Not all business managers know what this form is or how to fill it out correctly. Also relevant is the question of whether it is necessary to provide an employee with an extract from SZV-Stazh upon dismissal. To understand, you need to understand what kind of reporting this is and what it is intended for.

What is this form and who takes it?

SZV-STAZH is a form that contains information about the pension experience of the company’s employees. It reflects information about employees who are on the company’s payroll and have been fired. This report is regularly submitted by the company's management to the pension fund.

The form is required to be completed:

- legal entities;

- individual entrepreneurs;

- detectives;

- notaries and lawyers.

It serves to collect information from the Pension Fund about length of service and contributions. Such information is reflected in the individual personal accounts of the insured persons. Based on these reports, an insurance pension is assigned.

Information is provided on all employees with whom the following agreements are concluded:

- labor contract;

- civil contract;

- license agreement;

- copyright agreement.

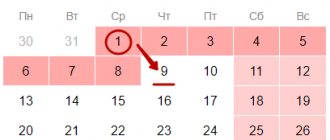

SZV-STAZH, regardless of the circumstances, is sent to the pension fund annually no later than March 1st. In the event of liquidation or reorganization of a company, such a report must be submitted within a month from the date of the documented decision to close the company or reorganize it.

Many employers wonder who actually has to fill out the SZV-STAZH form, the HR or accounting department. The legislation does not establish clear requirements in this regard.

Therefore, each company has the right to decide for itself who will prepare and submit such a document to the pension fund. Reporting is generated not only for employed citizens. It also includes the unemployed. But this responsibility falls on government agencies.

Employment centers must regularly submit SZV-STAGE to the Pension Fund of the Russian Federation about citizens who are registered.

SZV-STAZH has been used since January 2020 instead of RSV-1.

Do I need to submit a report to the Pension Fund if an employee quits within a year?

Since the SZV-STAZH form was introduced not so long ago, many employers have a number of questions regarding its completion and submission to the pension fund. For example, not all managers understand whether it is necessary to submit the SZV-STAZH to the Pension Fund of the Russian Federation when an employee leaves within a year.

It all depends on the circumstances. If the dismissal is not related to retirement, then reporting should be submitted in the general manner, that is, no later than March 1 of the next year.

Otherwise, the accountant or personnel officer must prepare the SZV-STAZH form within three working days after the termination of the employment relationship with the employee and send it to the pension fund.

How to fill out SZV-STAZH when liquidating an LLC in 2020

SZV-STAZH includes all employees who worked under an employment or civil contract, not forgetting those employees who were fired during the year.

If a company is liquidated, SZV-STAZH must also include employees of the liquidation commission, regardless of the form of the agreement concluded with them.

The report is compiled for the period from January 1 of the year to the day of liquidation of the company. The day of liquidation of an organization is considered to be the day on which an entry about liquidation was made in the Unified State Register of Legal Entities (clause 9 of Article 63 of the Civil Code of the Russian Federation).

Let us recall that the SZV-STAZH form was approved in Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

In section 2, enter the calendar year for which you are submitting reports. In a separate block “Type of information”. put o. When liquidating, you need to select the original one.

In section 3, enter the details of employees and the period of their work.

If employees performed work under a civil contract and received remuneration for this, enter “AGREEMENT” in column 11. This is exactly how you need to enter information about the services of a liquidator. If the company has not yet paid for his work, indicate “NEOPLDOG” or “NEOPLAUT” in the column.

Sections 4 and 5 of the form should be left blank; these sections are for reporting on retired employees.

An example of a completed SZV-STAZH form in 2020

Form SZV-STAZH in 2020

How to reflect dismissed employees?

The SZV-STAZH form for the Pension Fund lists dismissed employees. Many managers do not know for what period and which employees need to be indicated. The document displays all subordinates with whom an employment contract was concluded and who were dismissed from January to December of the reporting year.

Information for previous periods is not indicated, since it is already in the pension fund. The information is entered into a special table. For example, at the Vector enterprise, 5 employees quit in 2020: two salespeople, a driver and a carpenter.

Information about these subordinates must be entered into the SZV-STAZH form and submitted to the Pension Fund of Russia by March 2020. If several employees demanded that the head of the company provide SZV-STAZH upon dismissal or for calculating a pension, then statements are prepared separately for each employee indicating personal data.

How to fill out SZV-STAZH when working part-time

Employees who work part-time under normal conditions at SZV-STAZH do not need to be allocated in any special way. It is enough to indicate in SZV-Experience: full name, SNILS and validity periods of employment contracts.

In the SZV-STAZH form, part-time work is reflected if the enterprise operates under special conditions and employees have the right to early retirement.

Where the SZV-STAZH form reflects data on part-time work

In section 3 of the SZV-STAZH report, you need to reflect the scope of work or the share of the rate in accordance with clause 2.3.6 of the Filling Out Procedure.

Information about part-time work reflects:

- or in column 8 “Territorial conditions (code)”. In this column, enter the code of territorial conditions and the share of the rate;

- or in column 9 “Special working conditions (code)”. In this column the special conditions code and the rate share are entered.

To indicate territory codes with special working conditions, you need to use the Classifier of parameters used when filling out information for maintaining individual (personalized) records. This Classifier is approved in the annex to the Procedure for filling out the SZV-STAZH.

Is it necessary to issue a certificate to a dismissed employee?

Issuing an extract from SZV-STAZH to a dismissed employee is the responsibility of the enterprise management. This certificate is provided to all employees with whom an employment contract has been drawn up. It does not matter whether the subordinate asked for such a document or not.

In accordance with Article No. 84.1 of the Labor Code of the Russian Federation, upon dismissal, an employee must be given documents about his earnings and work experience. This information is contained in the work book, SZV-M and SZV-STAZH. Failure to provide the necessary certificates entails punishment for the enterprise administration.

Terms and procedure for issuance

An extract from the SZV-STAZH form is required by law in two cases: upon his written application and upon dismissal. Depending on what is the basis for providing the employee with such a report, the timing of its execution and the procedure for issuing vary.

If an employee has applied for an extract, then the company management must prepare it within five working days. Upon dismissal, the SZV-STAZH form is given to the subordinate along with the work book and other documents.

An extract from the SZV-STAZH is prepared in two copies: one is issued to the employee against signature, and the second remains at the enterprise. Both options must be personally signed by the head of the company and have a seal.

Expert opinion

Irina Vasilyeva

Civil law expert

In accordance with the fourth paragraph of Article No. 11 of Federal Law No. 27 of April 1, 1996, the SZV-STAZH extract is issued to employees on the day of dismissal.

Instructions on how to correctly compose according to the new rules

From January 1, 2020, by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018, a new form of SZV-STAZH was introduced. The updated report also consists of five sections.

The changes affected the structure of the form:

- Report pages no longer need to be numbered. Props "page" excluded from the SZV-STAZH form;

- the policyholder's registration number, checkpoint, and tax identification number are no longer duplicated in the document. This defect has been corrected in the new report form.

The filling rules have also changed:

- from 2020, the form includes information about the heads of organizations who are the only founders;

- if the report is prepared by the employment center, then o is entered in column 14 of the table;

- field 14 is filled in if the dismissal occurred on December 31 of the reporting year. Written 12/31/YYYY. Previously, there was an “X” sign here;

- if the code “DETIPRL” is indicated in column 11 of the table, then the eighth column is left empty.

Step-by-step instructions on how to fill out the SZV-STAZH when dismissing an employee are given below:

- in the first section in the header, enter the KPP/TIN of the company, its registration number in the pension fund. Enter the employer's name in abbreviated form. Select the type of information to be submitted (you must put an “X” next to the desired type). There are three options available: supplementary, original, form, which is submitted when assigning a pension;

- in the second section, indicate the reporting period for which information is submitted;

- the third section is presented in a table. Information about subordinates should be entered in it in order. The periods of work of the insured persons, their surnames, first names, patronymics, and insurance certificate numbers are indicated. It is necessary to note on what dates employees were on sick leave during the reporting year. If a subordinate has periods of work that give him the right to early retirement, then this is reflected in the ninth column with a special code. If special working conditions cannot be documented, then fields 9, 12, 13 are left blank. If an employee is dismissed, the fourteenth column of the table is filled in. When entering information in columns 8-13, use codes from the “Parameters Classifier” application;

- The fourth and fifth sections are filled out only when submitting information for the assignment of a pension. They indicate the periods for payment of insurance and pension contributions;

- in the final part, sign the director of the company with a transcript and the date of filling out the form, stamp.

The procedure for filling out the SZV-STAZH form is given in Resolution of the Board of the Pension Fund of the Russian Federation No. 3p of 2020.

SZV-STAZH - to every dismissed person

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated April 1, 1996 “On personalized accounting” establishes that no later than March 1, policyholders are required to submit SZV-STAZH reports to the Pension Fund of Russia.

RULE OF LAW

The policyholder annually, no later than March 1 of the year following the reporting year (except for cases where other deadlines are provided for by this Federal Law), submits information about each insured person working for him (including persons who have entered into contracts of a civil law nature, the remuneration for which is In accordance with the legislation of the Russian Federation on taxes and fees, insurance premiums are calculated) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- the date of hiring (for an insured person hired by this policyholder during the reporting period) or the date of concluding a civil law contract, for the remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- the date of dismissal (for an insured person dismissed by this policyholder during the reporting period) or the date of termination of a civil contract for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- periods of activity included in the length of service in the relevant types of work, determined by special working conditions, work in the Far North and equivalent areas;

- other information necessary for the correct assignment of an insurance pension and funded pension;

- the amount of pension contributions paid for an insured person who is a subject of the early non-state pension system;

- periods of labor activity included in the professional experience of the insured person who is a subject of the early non-state pension system;

- documents confirming the right of the insured person to early assignment of an old-age insurance pension.

In accordance with paragraph 4 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ, on the day of dismissal of the insured person or on the day of termination of a civil contract for which insurance premiums are calculated, the policyholder is obliged to transfer to the insured person the information provided for in paragraph 2 Article 11.

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated 01.04.1996 talks about the information contained in reporting in the SZV-STAZH form. Consequently, on the day of dismissal of an employee or on the day of termination of a civil law contract, the organization or individual entrepreneur is obliged to issue the insured person with a completed SZV-STAZH form.

In the SZV-STAZH report, in general, it is necessary to include information on all insured persons. In section 3 “Information about the periods of work of insured persons,” individuals are listed in a list.

However, a dismissed employee is prohibited from issuing a report if it includes information about other people. The fact is that such information refers to personal data. And it is impossible to disclose personal data of individuals without consent. Also see “Personal data from July 1, 2020”. Upon dismissal, only one person must be indicated in SZV-STAZH. After all, this report concerns only him.