3050

February 28, 2020 at 12:49 pm

( 2 ratings, average: 5.00 out of 5)

The owner of an online cash register is required to re-register the device in cases established by law. In certain situations, it will be necessary to replace the fiscal drive. This can be done either by submitting an application to the Federal Tax Service or through the taxpayer’s personal account. To avoid penalties, it is better to meet the deadlines provided by law.

What is an online cash register

An online cash register is a cash register that meets new requirements:

- prints the QR code and link on the receipt,

- sends electronic copies of checks to OFD and customers,

- has a fiscal drive built into the case,

- interacts freely with accredited OFDs.

All requirements for online cash registers are described in the new law and are mandatory for all cash registers from 2020.

An online cash register is not necessarily a completely new cash register. Many manufacturers are refining previously released cash registers.

For example, all cash desks and fiscal registrars of Wiki can be upgraded to an online cash register. The price of the modification kit is 7,500 rubles. The total takes into account the cost of the fiscal drive (6,000 rubles), nameplate and documentation with the new cash register number (1,500 rubles). Software updates on all Wiki cash desks occur automatically.

New cash registers (modified and completely new) are included in a special register of cash register models and approved by the Federal Tax Service.

How does the online cash register work and what should now be on the receipt?

The sales process at the online checkout now looks like this:

- The buyer pays for the purchase, the online cash register generates a receipt.

- The check is recorded in the fiscal drive, where it is signed with fiscal data.

- The fiscal drive processes the check and transmits it to the OFD.

- The OFD accepts the check and sends a return signal to the fiscal storage device that the check has been received.

- The OFD processes the information and sends it to the Federal Tax Service.

- If necessary, the cashier sends an electronic check to the buyer's email or phone number.

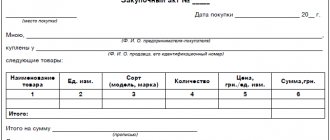

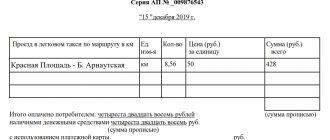

The online cash register receipt contains:

If the buyer asked to send an electronic copy of the check, then in the paper one you need to indicate the client’s email or subscriber number.

The sales address varies depending on the type of trade. If the cash register is installed indoors, you must indicate the store address. If trade is carried out from a car, then the number and name of the car model are indicated. If the goods are sold by an online store, then the website address must be indicated on the receipt.

The cashier's last name does not need to be indicated on receipts from online stores.

New terms

Fiscal Data Operator (FDO)

- an organization responsible for receiving and transmitting fiscal data to the tax office. The Operator also stores this information for 5 years and ensures that copies of electronic receipts are sent to clients. The list of accredited OFDs is presented on the Federal Tax Service website.

Register of online cash registers

- this is a list of cash register equipment that is ready to work according to the new rules and officially approved by the Federal Tax Service of Russia. As of December 2020, the register of cash register equipment contains 43 cash register models. The list is updated and anyone can view it on the tax website. Each specific cash register is also included in the register of cash register copies.

Fiscal storage

encrypts and transmits fiscal data to the OFD. FN came to replace EKLZ.

Fiscal data

— this is information about financial transactions carried out at the checkout. The technical requirements for a fiscal drive are described in the law; currently one model of a fiscal drive is available for purchase on the market. Each copy of the FN is also included in a special register.

Validity period of the fiscal accumulator

It is different for all entrepreneurs and depends on the applicable taxation system:

- OSNO – 13 months

- USN, PSN, UTII - 36 months

The beginning of the service life of a fiscal drive is the date of its activation. The owner of the cash register is obliged to store the FN after replacement for 5 years. An entrepreneur can change the FN independently. But in order to avoid problems with registering or replacing a fiscal drive, we still recommend contacting service centers.

Buy a fiscal drive

you can at your service center. The cost of FN is from 6,000 rubles.

Agreement with OFD

— a mandatory document according to the requirements of the new law. Without it, you won’t even be able to register an online cash register. However, the owner of the cash register can change the operator at any time. The cost of OFD services is from 3,000 rubles per year.

CCP re-registration process

Regardless of the reason why there is a need to re-register the cash register and enter the relevant information about it into the registration card, you must:

- Fill out an application in accordance with Order of the Federal Tax Service of the Russian Federation No. ММВ -7-20/ [email protected] and send it to the tax service. The form of the document and the procedure for filling it out can be found in the Order itself (Appendices 1 and 5, respectively). You can submit an application in person in a paper copy or through the Personal Account of the online cash register user.

- Wait until the tax service issues a new KKM registration card. The law allows 5 working days to complete this task from the moment the Federal Tax Service receives the application. The finished card will be sent to the entrepreneur through his Personal Account or through the fiscal data operator with whom he has an agreement. If the owner of the cash register wishes, he can come to the Federal Tax Service and receive a card in paper form.

Important! If cash register devices are re-registered with replacement of the FN, it is necessary to submit, along with the application to the tax authority, reports on the closure of the FN and on changes to the information on registering cash register equipment.

In certain cases, the tax authority has the right to refuse a taxpayer to re-register if the owner of the cash register provided insufficient information and/or documents to carry out the procedure, or an attempt was detected to register the cash register with a tax fund that is not in the register.

The best offers in price and quality

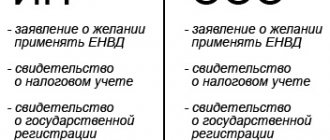

Who should switch to online cash registers

The transition to online cash registers takes place in several stages and affects:

- entrepreneurs who already use CCP,

- traders of excise goods,

- owners of online stores,

- entrepreneurs providing services to the population and not using cash registers, including individual entrepreneurs on UTII, simplified tax system and PSN,

- owners of vending and vending machines, as well as payment terminals.

The named categories are required to transfer copies of checks to the OFD and issue them to clients.

Entrepreneurs who use strict reporting forms (SSR) also fall under the innovations.

The form of strict reporting forms is changing. From July 1, 2020, all BSOs must be printed using a special automated system. This system is a type of online cash register and it also transmits data online. Vladimir Smykov recently wrote about changes to strict reporting forms.

Time frame for the transition to online cash registers: 2017–2018.

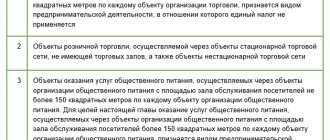

| February 1, 2020 | Owners of newly registered cash registers The transition to online cash registers begins and the replacement of electronic cash registers and registration of cash registers according to the old procedure ceases. |

| March 31, 2020 | All organizations and individual entrepreneurs that sell alcohol ! Exception: organizations and individual entrepreneurs on UTII and individual entrepreneurs on PSN that sell low-alcohol drinks. Sellers of excisable alcohol are required to use online cash registers from April 1, 2020. Sellers of beer, cider and other low-alcohol drinks are switching to online cash register systems, depending on the chosen taxation system. |

| July 1, 2020 | Organizations and individual entrepreneurs on the OSN, simplified tax system and unified agricultural tax After this date, you cannot use cash registers with EKLZ; all cash registers must work with a fiscal drive. |

| July 1, 2020 |

|

| July 1, 2020 |

|

Very often, entrepreneurs ask the question: “If a company operates under two taxation systems, the simplified tax system and the UTII tax system, when should it switch to the new rules?”

From July 1, 2020, taxpayers using the simplified tax system must use the online cash register. Parallel tax regimes do not play any role. In addition, a separate check is issued for each mode.

Who is exempt from online cash registers?

The following people are exempt from working with cash registers, as before: representatives of small businesses providing shoe repair services, sellers in unequipped markets, sellers of products from tanks and carts, newsstands, people renting out their own homes, organizations with non-cash payments, credit organizations and companies involved in the securities market, conductors and catering establishments in educational institutions.

Religious associations, sellers of handicrafts and postage stamps can also continue to operate without cash registers.

Entrepreneurs in hard-to-reach and remote areas can work without a cash register. True, the list of such areas is determined by local leaders.

How to switch to an online checkout

The transition to online cash registers from 2020 is a factor that directly affects the future operation of the business; it should be approached responsibly.

The main thing is not to delay. If you are planning to make the transition, let's say, in late spring, then there is every chance of being late with the transition to an online cash register by July 2020.

The experience of implementing the EGAIS system for alcohol dealers has shown that entrepreneurs put off upgrading equipment until the last minute. This gives rise to many difficulties: manufacturers of online cash registers do not have time to properly prepare equipment, logistics services are under enormous pressure and miss deadlines, and stores across the country are idle without the possibility of legal trade. Or they trade with the risk of getting a fine.

To ensure that replacing a cash register with an online cash register does not cause any trouble, we recommend that you address this issue now.

The experience of implementing the EGAIS system for alcohol dealers has shown that entrepreneurs put off upgrading equipment until the last minute. This gives rise to many difficulties: manufacturers of online cash registers do not have time to properly prepare equipment, logistics services are under enormous pressure and miss deadlines, and stores across the country are idle without the possibility of legal trade. Or they trade with the risk of getting a fine.

To ensure that replacing a cash register with an online cash register does not cause any trouble, we recommend that you address this issue now.

Select an online cash register to switch to 54-FZ

Solutions for any business

Procedure for switching to online cash registers

So, to switch to an online checkout smoothly, plan thoroughly and act step by step:

1. Find out if existing equipment can be modified

Contact your cash register manufacturer. If the equipment can be updated, find out the price of the upgrade kit for the online cash register and, most importantly, whether the fiscal drive is included in this price.

To this amount, add the work of the central technical center (or ASC) to finalize the cash register. Although registering a cash register and storage device on the Federal Tax Service website is not technically difficult, even specialists who register for the first time sometimes make mistakes. If the ASC specialist makes a mistake, then the FN (6,500 rubles) will be replaced for you at the expense of the ASC. If you make a mistake, then you will have to pay for a replacement drive.

If your cash register can be improved, don’t rush to rejoice. It is often better to buy a new online cash register than to remodel old cash register equipment (the cost of reworking some cash registers is comparable to the cost of a new cash register).

To avoid wasting your money, do some market research. Find out how much it costs to upgrade a cash register on average in the market (for different manufacturers), and how much a new online cash register costs. Compare the functionality of the old modified cash register and the new online cash register. If every step and tiny modification costs an additional 100 rubles, this is a reason to think and look for alternatives.

2. Check whether the equipment you are considering is in the Federal Tax Service register:

- Checking online cash registers is a service of the Federal Tax Service for checking copies of cash registers.

- Checking fiscal drives is a similar service for checking fiscal drives (so that they don’t sell you a broken or already used drive).

3. Make a schedule for replacing ECLs

In order not to overpay for ECLZ work, check when its service life ends. Upon completion of the ECLZ operation, it is better for you to immediately install a fiscal drive and switch to online cash registers.

4. Bring the Internet to the store

The Internet for an online cash register must be stable. Find out if the Internet providers in your region have special tariffs (you can also consult your ASC). Find out what is right for you: wired Internet or Wi-Fi modem.

5. Check for updates to the cash register program

If you work with cash register software, for example, with a commodity accounting system, be sure to find out whether it will be modified to work according to the new rules, whether it is compatible with an online cash register, how much the modification will cost and when it will be carried out. Wiki cash registers work with all commodity accounting systems for free - this is our basic functionality.

After all the preparatory work, decide when to switch to an online checkout.

6. Remove the old cash register from the Federal Tax Service register

Contact your central service center and get a report from the ECLZ. Write an application for deregistration and go to the tax office. You should still have the card of the owner of the cash register in your hands with a mark of deregistration.

7. Select the OFD and enter into an agreement with it

This is a prerequisite for registering an online cash register. Explore the possible options, conditions and services provided. The OFD agreement is an offer in electronic form, which you accept when registering on the site. That is, you do not need to fill out paperwork or go to the branch.

After concluding the contract, feel free to proceed to the final part - registering an online cash register.

8. Register an online cash register

The new law allows two options for registering an online cash register: classic and electronic.

The classic method is no different from the old one. You collect documents, take a new cash register with a fiscal drive, go to the tax office, fill out an application and wait. After some time you are given a registration number.

The electronic method of registering an online cash register saves time. To set up an online cash register, you will need an electronic digital signature. Get it in advance at any certification center.

How to register an online cash register:

- Register in your personal account on the nalog.ru website.

- Fill out the application on the Federal Tax Service website.

- Enter the registration number of the online cash register and fiscal drive.

- Fill in the OFD details.

If you did everything correctly, the Federal Tax Service will issue you a cash register registration number. The detailed procedure for registering an online cash register is described in the article by Robert Gumerov.

General nuances of re-registration

Knowledge of the nuances of re-registration of a cash register helps company owners, as well as individual entrepreneurs, to be more aware of this issue and avoid many problems with regulatory government agencies.

In general, the following facts need to be taken into account:

- The re-registration procedure can be carried out on the initiative of both the cash register owner and the Federal Tax Service;

- the reason for initiating re-registration of the FN apparatus is failure or detection of irregularities in its operation;

- re-registration of the device at the initiative of the owner;

- You must apply 1 business day before initiating the procedure for deregistration of the product;

- you need to wait about 5 days allotted for the tax inspectors to hand over the card.

Together with the application for the need to re-register the cash register, the taxpayer submits a report on the closure of the financial fund. This is done when the reason for such a procedure is theft or the product fails. If deregistration of a product is forced, its operation will be restored only after the identified causes have been eliminated. In this case, a document is submitted in the form of a report on the registration of the element together with an application for re-registration of the product.

When deregistering the cash register and closing the presented item, you must provide complete information stored in the product’s memory. This state tax requirement is made for all business representatives. First of all, this applies to those individuals and legal entities who were not able to send reports on their activities via an Internet connection.

New fines

The Federal Tax Service will fine for violations of the new rules. Collections will begin on February 1, 2020. Amount of penalties: from 3,000 rubles, up to a trade ban.

| Use of CCP that does not meet the requirements | For individual entrepreneurs: 3,000 rubles For LLCs: 10,000 rubles |

| Work without an online cash register | For individual entrepreneurs: 25-50% of sales, no less than 10,000 rubles For LLCs: 75-100% of sales, no less than 30,000 rubles |

| If the buyer is not sent a receipt upon request | From 10,000 rubles |

The procedure for registering an administrative violation has become simpler. In some cases, for the first violation, a verbal warning is possible, but for a repeated violation, trade is suspended for up to 3 months, and this is actually death for the store.

To avoid problems, comply with all requirements of the new legislation.

How to choose an online cash register

First of all, make your own list of cash register requirements. Answering simple questions about your outlet will help you determine your requirements.

Are you going to use the cash register as a means of business automation? If yes, then you will need a cash register that can work with common commodity accounting systems (1C and derivatives). If you are not going to, choose a cash register that at least knows how to upload sales data into Excel tables.

Do you sell or intend to sell alcohol? If the answer is yes, then the cash register must be adapted for Unified State Automated Information System, that is, support work with UTM and have functions, for example, writing off balances.

Do you have a friend or a full-time IT specialist? Now a cash register is an IT system, which includes not only a cash register, but also an Internet connection, communication with the OFD and a cryptographic tool. If you do not have an employee on staff who can quickly diagnose the entire system in the event of a breakdown, then it makes sense to enter into an agreement with a service center.

Once you have decided on the basic characteristics, you can make a decision.

Example: select a cash register for a convenience store

Let's say you have a small store near your home: the assortment includes beer and other mild alcohol. Trade is going well, but you want to increase sales without freezing large amounts of goods. You have 1 cashier on your staff, and you personally replace him.

It turns out that you need a cash register that supports EGAIS, work with commodity accounting systems, and you will need technical support.

The Wiki Mini F cash register is suitable for you - it fully complies with the requirements of 54-FZ, has all the functions necessary to work with Unified State Automated Information System and is compatible with all commodity accounting systems. Technical support will be provided to you by a regional certified partner from whom you will purchase the cash register.

Example: choose a cash register for a hairdresser

Or in other words: you have several hairdressing salons around the city. Naturally, you do not sell any alcohol and do not intend to. You collect information about clients into a common CRM system. There is a computer specialist on staff who sets up this system and helps solve other technical problems.

In this case, a budget kit is enough for you: KKT Wiki Print 57 F and the Wiki Micro system unit. Your technician will find all the necessary instructions in the support section of Dreamkas and the OFD that you choose.

If you do not have an ordinary hairdressing salon, but a premium salon, then the Wiki Classic and Wiki Print 80 Plus F set is more suitable for you - it does not differ much in function from budget cash registers, but its design is designed specifically for boutiques, salons and expensive cafes.

HOW IS DATA TRANSFERRED TO THE FTS?

- The cashier punches the check.

- The check data is sent to the fiscal storage of cash register equipment. After this, they are transmitted to the fiscal data operator (hereinafter FDO) via an Internet connection.

- The OFD sends a response to the cash desk about receiving the information and at the same time transmits the data to the Federal Tax Service. If your connection is lost, the data is stored in the fiscal drive for up to 30 days and sent to the OFD as soon as the connection is restored.

- The buyer can view all information about transferred checks at any time in the OFD personal account. OFD stores information about checks for 5 years.

Choose your online cashier

Wiki cash desks fully meet the requirements of 54-FZ and EGAIS.

| Budget Wiki Micro | Universal Wiki Mini |

HOW TO START WORKING IN A NEW WAY?

Today, there are several options for how to bring your cash register in accordance with Federal Law-54 with minimal costs and maximum benefit for business:

Refinement of existing CCP

To modify an existing CCP to meet the requirements of 54-FZ, you must perform the following steps:

- Buy a kit for upgrading an old cash register.

- Deregister the old cash register with the Federal Tax Service.

- Modernize the CCP in accordance with the new requirements of Federal Law-54.

- Replace ECLZ with a fiscal drive

- Update cash register software in accordance with the new requirements of Federal Law-54.

- Register a new cash register (online cash register) in the OFD.

- Buy CEP.

- Register a new cash register (online cash register) with the Federal Tax Service, incl. physically activate the operation of the cash register with FN.

provides the following types of services to prepare clients for Federal Law-54:

- deregistration of the old cash register with the Federal Tax Service

- modernization of fiscal registrars from the register of cash register equipment of the Federal Tax Service*

- cash register software update

- services for registering cash registers in the OFD (Fiscal Data Operator)** / concluding an agreement with the OFD**

- obtaining CEP*** (Cryptographic Electronic Signature) for the Federal Tax Service

Purchasing a new cash register

What needs to be done in order to buy a cash register that meets the requirements of Federal Law-54:

- Buy a cash register (online cash register) that meets the new requirements of Federal Law-54

- Buy, update or install cash register software in accordance with the new requirements of Federal Law-54.

- Buy CEP.

- Register a new cash register (online cash register) with the Federal Tax Service, incl. physically activate the operation of the cash register with FN.

- Register a new cash register (online cash register) in the OFD.

provides the following types of services to prepare clients for Federal Law-54:

- deregistration of the old cash register with the Federal Tax Service

- buying a new cash register

- cash register software update

- services for registering cash registers in the OFD (Fiscal Data Operator)** / concluding an agreement with the OFD**

* The register of cash register equipment subject to modernization is available on the Federal Tax Service website

** DataKrat works with all OFDs that have been granted permission to process fiscal data by the Federal Tax Service. List of fiscal data operators.

*** To register in the Personal Account of the Federal Tax Service, a cryptographic electronic signature (ES) will be required. You can also purchase CEP from our company.

CHECK YOUR CCP >>>