Situations when individual entrepreneurs and organizations decide to switch from one tax regime to another are not so rare. As a rule, the reason for the transition is the desire to optimize tax payments, sometimes the inability to use a particular tax system due to a violation of the conditions for its application. One way or another, sometimes there is a need to urgently, without waiting for the new year, switch to a different tax regime, including quite often - from OSNO and “simplified tax” to UTII.

UTII: briefly about the features

A single tax on imputed income implies that the tax here is paid not on any specific income already received, but on future expected profits. Moreover, the tax can be applied only for certain types of activities that are prescribed in OKUN and OKVED. Each region independently selects from the general list those areas of activity for which UTII can be used on its territory. Thus, while engaging in some work or services that fall under UTII in one administrative district, an enterprise or individual entrepreneur may not always be able to engage in them under the same conditions in another.

Calculation of taxes when switching to OSNO

Imputed income tax replaces VAT, but as a result of the transfer to the general system you are required to pay it. Include in the tax base for calculating VAT the revenue generated as a result of the sale of goods at the time the main system was in effect, even if the advance for them was received during imputation. Amounts of revenue received during the imputation period are not subject to inclusion in the VAT tax base.

The legislator allows you to deduct the amount of VAT on goods purchased but not used in the course of the imputed activity. VAT cannot be deducted:

- for fixed assets that were used in the imputation;

- for work and services completely written off during the payment of tax on imputed income.

In addition to VAT, charge and pay taxes on profits and property, starting from the quarter in which activities under the main system began.

Transition to UTII within a year from different taxation systems

In general, until 2013, the use of the Single Tax was mandatory for some types of activities. Since 2013, this rule has been abolished and the transition to “imputation” has become a purely voluntary matter. At the same time, individual entrepreneurs and organizations can switch to UTII both from the beginning of the new calendar year and (not always, depending on the circumstances) at any other time. It is important to observe only one basic condition, namely, to make sure that the use of UTII in a particular area of activity is possible in the territory where the organization or individual entrepreneur operates.

How to become a UTII payer

IMPORTANT! UTII cannot be used from 2021. It has been canceled throughout the Russian Federation. A number of regions abandoned the special regime already in 2020. See here for details.

The procedure for transition to imputation is specified in Art. 346.28 of the Tax Code of the Russian Federation and provides for:

- registration at the place of activity (or registration) of the company or individual entrepreneur;

- submitting a notice of transition to UTII no later than 5 days from the date of commencement of UTII application.

ConsultantPlus experts explained whether it is possible to switch to UTII in mid-2020 and answered the most common questions from taxpayers:

If you don't have access to the system, get a free trial online.

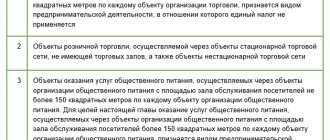

UTII payers can provide the following types of services:

- of a domestic nature;

- veterinary;

- repair and maintenance of cars and motorcycles;

- on the organization of parking lots;

- catering (the area of the premises should not exceed 150 sq. m);

- retail sale of food and non-food products (maximum area limitation - 150 sq. m);

- for transportation by road;

- outdoor advertising on special structures or on vehicles;

- leasing buildings and land plots for retail chains;

- for the placement and residence of people in an area of no more than 500 square meters. m.

Read more about the procedure for registering as a UTII payer here.

From OSNO to “imputation”: transition in the middle of the year

The transition to the Single Tax with OSNO does not require any special efforts from those wishing to do so - it is enough to just submit a corresponding application to the local tax service. True, it must be submitted no later than five days from the beginning of the provision of services or performance of work falling under the “imputation”. This can be done at any time during the year - the legislation does not provide for any restrictions here.

Since the UTII reporting period is a quarter, the tax on imputed income will need to be paid for the first time based on the results of those three quarterly months during which the company switched to UTII.

Important! When switching to UTII from the general regime in the middle of the year, the tax base must be taken into account based on the actual duration of work in the month when the organization or individual entrepreneur was registered with the tax service as a payer of “imputation”.

When switching from the general mode to the “impute” mode, it is important to follow the following rules:

- carry out the procedure for restoring input VAT both on fixed assets and on all other operations. The restored VAT will have to be taken into account in the income tax (in the line “other expenses”);

- In the income tax return, it will be necessary to take into account income and expenses relating to the period when the individual entrepreneur or organization was still on OSNO. This must be done by filling out and submitting to the tax service a profit tax return for the period that preceded the transition period.

Transition from UTII to OSNO

There are also two options here:

- Loss of rights;

- Entrepreneur's desire.

If you decide to stop operating on UTII of your own free will, you must convey your desire to the tax office. There is a five-day period for this, from the moment the transition is made. In the application, you must indicate that your company needs to be deregistered as a UTII payer.

The voluntary procedure can be carried out only from the first month of the next year; the transition day will be January 1st. You reflect this date in the application, and count 5 days from it.

Simply inform the Federal Tax Service that you no longer want to use UTII.

Example of VAT recovery on fixed assets

In February, Shelkopryad LLC bought equipment worth 130 thousand rubles (including VAT 23,400 rubles). Input VAT on the purchased equipment was successfully accepted for deduction in a timely manner, and from July Shelkopryad LLC decided to switch to UTII. Accordingly, it became necessary to calculate the amount of VAT to be restored.

The residual value of the equipment, based on tax accounting data, as of June was equal to 103 thousand rubles. As a result of simple calculations, it turns out that the amount of VAT to be recovered is:

RUB 23,400 x 103 thousand rubles. : (130 thousand rubles – 23,400 rubles) = 22,609 rubles.

Input VAT deduction

Input VAT presented to an organization during the period of application of UTII can be deducted if the purchased goods (work, services) were not used in activities on UTII (clause 9 of Article 346.26 of the Tax Code of the Russian Federation). If all the conditions for applying a VAT deduction are met, you can use it in the same tax period in which the organization switched from UTII to the general taxation system (letter of the Ministry of Finance of Russia dated June 22, 2010 No. 03-07-11/264).

An example of input VAT accounting. The organization switched to a common taxation system with UTII. Income and expenses are determined using the accrual method

In connection with the cessation of activities on UTII in April of this year, Alfa CJSC switched to a general taxation system. The organization paid UTII for the first quarter.

As of April 1, Alpha’s accounting records reflected:

- debt of buyers for services rendered in the amount of 100,000 rubles;

- remnants of materials not used in activities on UTII, worth 59,000 rubles. (including VAT – 9000 rubles).

In the second quarter, accounts receivable were repaid. The remaining materials were used up in production. When calculating income tax for the six months, Alpha’s accountant included:

- included in income – 100,000 rubles;

- included in expenses - 50,000 rubles. (RUB 59,000 – RUB 9,000).

Input VAT in the amount of 9000 rubles. "Alpha" accepted for deduction in the second quarter.

Input VAT, which was included in the cost of a fixed asset acquired during the period of application of UTII, is not deductible upon transition to the general taxation system. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated February 26, 2013 No. 03-07-14/5489.

Situation: can an organization deduct the restored VAT amount again after returning to the general taxation system? When switching to UTII, the organization restored and transferred to the budget VAT on the residual value of fixed assets.

Answer: no, it cannot.

VAT amounts presented to an organization upon the acquisition of fixed assets are accepted for deduction at a time in full after the objects are registered (clause 1 of Article 172 of the Tax Code of the Russian Federation). When an organization switches from the general taxation regime to UTII, the amounts of input VAT accepted for deduction are subject to restoration in the tax period preceding the transition to this special regime (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation). Recovered tax amounts are not included in the cost of fixed assets, but are taken into account as part of other expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). Therefore, an organization that used UTII and again switched to the general taxation system does not have the right to deduct previously restored VAT amounts. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated June 30, 2009 No. 03-11-06/3/174, dated January 29, 2009 No. 03-07-11/23.

Transition from simplified tax system to UTII in the middle of the year

Businessmen who use the simplified tax system as their main tax regime do not have the right to switch to other taxation systems in the middle of the tax period, which for them is a year. Exceptions are those cases when the taxpayer’s income at the end of the reporting period exceeds 60 million rubles. In such situations, an automatic transition of the “simplified” to OSNO occurs immediately after the quarter in which this excess was recorded. As for UTII, in this case, taxpayers can switch to it only from the beginning of the next calendar year and nothing else.

OS cost: how to take into account

The cost of the OS, which you did not take into account using the “simplified”, is taken into account during the transition as follows:

- If before using the simplified system you had already used OSNO, then the objects that were acquired before the “simplified system” can be depreciated after you return to OSNO;

- If you purchased the property at the present time, before the quarter in which OSNO began to be used, then calculate the cost also using depreciation.

Example. Your individual entrepreneur uses OSNO. You purchased OSes with a lifespan of five years. Every month depreciation is 7,777 rubles.

From 01/01/2018 the company switched to the simplified tax system, and from 01/01/2019 it returned to OSNO. At the same time, the residual value of the fixed assets amounted to 340,000 rubles.

During the first year of its activity, half the cost of the operating system should be written off, that is: 340,000 * 50% = 170,000.

It turns out that the residual value of the fixed assets at the time when the company returned to OSNO = 340,000 - 170,000 = 170,000. Starting from 01/01/2019, the individual entrepreneur will write off this amount through depreciation at 7,777 rubles.

Documents required for transition to “imputation”

To proceed to UTII, the interested party must provide the tax authorities with a number of documents.

If this is an individual entrepreneur , then you will need:

- statement of desire to apply UTII;

- passport;

- tax registration and state certificates registration as an individual entrepreneur.

To switch to UTII, the founders of an LLC

- statement of desire to apply UTII;

- tax registration and state certificates registration.

Results

In connection with the transition to the UTII regime, a taxpayer who meets the criteria limiting the use of this special regime must register with the tax authority as a payer of the specified tax by submitting an appropriate application to this effect. The transition is voluntary and is possible both with the start of activity and during its process, both from the beginning of the year and during it. UTII payers, like other tax payers, are subject to the requirements of current legislation and may be held accountable for violating them.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ

- Federal Law of April 1, 1996 No. 27-FZ

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Partial transition to UTII

In some cases, individual entrepreneurs or organizations combine two tax systems at once - this is legally permissible. The single tax is combined with “simplified” and OSNO, that is, part of the activities that a commercial company carries out are on one of the main taxation systems, and part (based on the types of activities) falls under “imputation”. In this case, the main rule that must be followed is to keep separate records of income and expenses. In the same way, it is necessary to use separate accounting if the taxpayer applies UTII for several types of activities at once.

How to switch to UTII

Submit a tax application within five working days from the date from which you began to conduct the imputed activity.

For organizations, the application form is UTII-1, for individual entrepreneurs - UTII-2.

For now, the question remains controversial from what date to count 5 days if current activities are transferred to UTII. After all, in fact, you have already started it and 5 days have passed since the beginning. The Ministry of Finance writes in its letter:

If interpreted literally, the application must be submitted within 5 days after you yourself decide to switch to UTII. To be completely sure, we advise you to clarify this point with your tax office.

When you can’t use UTII

At no time and under any conditions is it possible to move to “imputation” if the organization or individual entrepreneur violates the following conditions:

- the number of hired personnel exceeds 100 people;

- other legal entities and organizations have a share in the authorized capital of more than 25%;

- the enterprise is a simple partnership;

- the transition of individual entrepreneurs to the simplified tax system took place on the basis of a patent;

- the taxpayer applies a single agricultural tax.

In addition, there are a large number of restrictions on the use of UTII for businessmen directly within the field of activity. Here are some examples:

- those motor transport enterprises in which the number of transport units is above 20 are not entitled to apply UTII;

- for retail sales, the sales floor area should not exceed 150 sq.m.;

- in the advertising business, only those companies that are involved in the placement or distribution of advertising can work with imputation. The production of advertising structures, leasing of advertising space or development of services are no longer suitable for UTII;

- the use of UTII is impossible if an enterprise or individual entrepreneur works not only with individuals, but also with legal entities in the types of activities falling under the “imputation”.

This is not the entire list of such restrictions. A more detailed list can be found in the Tax Code of the Russian Federation. So, before switching to “imputation”, you must make sure that both the type of activity and its conditions do not contradict the rules for applying UTII in a particular region.

Thus, the transition to imputation in the middle of the year is possible only if the organization or individual entrepreneur applies the general tax regime. It is impossible to switch from the simplified tax system to “imputation” within a year, therefore, no matter how much you would like it, you will have to wait for the new calendar year.

Content

- A little about OSNO

- Why are we moving?

- Pros of OSNO

- Transition of individual entrepreneurs from simplified tax system to OSNO

- Important information

- Transition process since the beginning of the year

- Mid-year transition process

- Revenue accounting procedure

- Cost accounting procedure

- How to recover VAT

- OS cost: how to take into account

- Reports for individual entrepreneurs on OSN

- Transition from UTII to OSNO

- Transition from OSNO to patent

- Transition from OSNO to simplified tax system

- Nuances

- Conclusion

So, how an individual entrepreneur will make the transition to OSNO depends on the reasons for such changes. The transition can be performed voluntarily or automatically. We will analyze the actions in each specific case.