What is the UTII-2 statement in 2020

The UTII-2 application must be submitted to an individual entrepreneur in order to be registered with the tax authorities as a single tax payer on imputed income.

ATTENTION! Starting from 2021, UTII will cease to be valid throughout the country. But a number of subjects have decided to abandon the special regime now. See here for details.

In addition to the application, no more documents are required from the taxpayer for registration (letter of the Federal Tax Service dated December 28, 2015 No. GD-18-14/1644, clause 1 of the letter of the Federal Tax Service dated September 21, 2009 No. MN-22-6 / [email protected] ).

You can learn about the current registration procedure from this article.

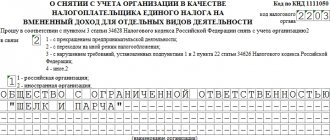

Form UTII-2 was approved by order of the Federal Tax Service dated December 11, 2012 No. ММВ-7-6/ [email protected] and is used for registering individual entrepreneurs.

The UTII-2 form itself with a sample filling will be presented in the article below.

If you need an example of filling out an application for deregistration of an individual entrepreneur as a UTII payer (UTII form-4), you can find it in ConsultantPlus. Get free access to the system and proceed to the sample.

Instructions for filling out an application on the UTII-2 form step by step

An entrepreneur, if he wishes to switch to UTII, is required to submit an application to the tax authority using the UTII-2 form, which was approved by Order of the Federal Tax Service dated December 11, 2012 No. ММВ-7-6/ [email protected] The procedure for filling it out is also an appendix to this order.

The form consists of two pages, one of which is the application itself, and the second is an appendix to it. The step-by-step process of document preparation can be described as follows:

- Filling out the application.

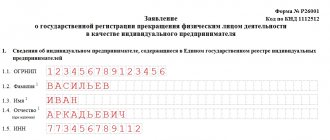

- at the top of the sheet the entrepreneur’s TIN is indicated, which is assigned by the tax authority upon registration;

- indicate the code of the tax authority where the application is being submitted (the exact code can be found on the official website of the Federal Tax Service);

- the surname, first name and patronymic of the individual entrepreneur should be entered in different lines of the field provided for this (necessarily in accordance with the identity card);

- Each person registering as an entrepreneur is assigned a OGRNIP. This number is entered in the appropriate cells of the form;

- regarding the dates of application of UTII, the following points exist: in the case of using “imputation” from the beginning of the activity, this date is indicated (for example, the date of the contract with the supplier or the lease of premises); when switching from another taxation system, indicate January 1 of the year from which UTII will be applied.

- all applications must be counted and their number is indicated in the space provided for this, while the numbers are entered from the first square, the rest are crossed out;

- if the application is not submitted personally by the individual entrepreneur, then the accuracy of the information is confirmed by an authorized representative, whose details are indicated below and certified by signature. In case of personal appearance, with the document of the individual entrepreneur himself, mark 1 is affixed, the act of filing the application and the signature of the businessman;

- the form has a section for completion by the employee of the tax authority receiving documents, as well as the registrar.

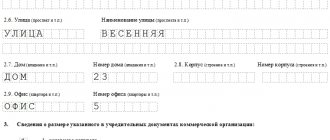

- Filling out an appendix to the application.

- the entrepreneur’s TIN is indicated at the top;

- Next, the codes of the types of entrepreneurial activities of the citizen and the addresses of the places of their implementation are listed.

For types of activities for which it is impossible to determine the exact address, indicate the individual entrepreneur’s registration address

| Kind of activity | Code |

| Household services to the population | 01 |

| Veterinary services | 02 |

| Car services, car washes | 03 |

| Parking lots | 04 |

| Cargo transportation | 05 |

| Taxi, intercity transportation | 06 |

| Shops up to 150 m² | 07 |

| Kiosks up to 5 m² | 08 |

| Kiosks over 5 m² | 09 |

| Trays, carts | 10 |

| Canteens, cafes, restaurants | 11 |

| Fast food kiosks | 12 |

| Stands, banners, static billboards | 13 |

| Advertising boards with changing images | 14 |

| Advertising electronic boards | 15 |

| Advertising on transport | 16 |

| Hotels | 17 |

| Rent of retail space up to 5 m² | 18 |

| Rent of retail spaces over 5 m² | 19 |

| Rent of land up to 10 m² for trade | 20 |

| Rent of land over 10 m² for trade | 21 |

| Trading through machines | 22 |

- the document is certified by the signature of the individual entrepreneur or his representative.

The remaining unfilled cells of the form are crossed out with a dash.

When to submit form 2-UTII

Starting from 01/01/2013 to the present, the UTII-2 application is submitted to the tax authorities within 5 days from the moment when the activities subject to imputation began. Tax authorities will register the entrepreneur as a payer of imputed tax on the day that will be indicated in the UTII-2 form as the day the imputation activity begins.

Please note that the transition to the UTII regime is carried out at the request of the entrepreneur. Considering that in the application he can put any date out of the 5 days that are allotted to him to submit the 2-UTII form, the moment of start of maintenance and the moment of transition may not coincide.

What happens if you miss the application deadline is explained in the Guide from ConsultantPlus. Get free trial access to K+ and proceed to the material.

When to submit an application for UTII

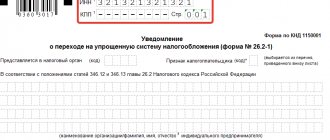

If a company or individual entrepreneur wants to use UTII in future activities and they meet the requirements of tax legislation, they should submit an application for imputation to the tax authority.

Registration for the transition to UTII is required. For information about who can use imputation, read the material “Who can apply UTII (procedure, conditions, nuances)?” .

ATTENTION! A number of constituent entities of the Russian Federation have already abandoned UTII. And from January 2021, the special regime will be abolished throughout Russia. Read more in the material “Cancellation of UTII in 2021: latest news, changes from January 1, 2020.”

For such an operation there are certain deadlines established by clause 6 of Art. 6.1, para. 1 clause 3 art. 346.28 Tax Code of the Russian Federation. In accordance with the norms of these articles, an application must be submitted within 5 days from the moment the taxpayer begins working for UTII.

The moment of transition may not coincide with the actual start of activity on UTII. There is nothing wrong with this, since the taxpayer himself indicates in the application the start date of application of this special regime. It will also be the date of registration as a UTII payer (paragraph 2, paragraph 3, article 346.28 of the Tax Code of the Russian Federation).

Example

Sigma LLC began providing car washing services on February 11, 2020. Until this date, the organization used the simplified tax system with the object “income minus expenses” in its activities. However, car washing in the region where this organization is registered as a taxpayer is subject to UTII. It was decided to switch to this special regime from March 14 - this is the date that appeared in the statement.

In order for the organization to be registered from the specified date, an application for the transition to UTII must be submitted to the tax authority within 5 working days. This period is counted from the next day after the date defining its beginning. Such rules are established in paragraph 2 of Art. 6.1. Tax Code of the Russian Federation.

In these circumstances, the period allotted for registration begins on March 15 and ends on March 22.

In other words, in order to be considered registered as a UTII payer on March 14, Sigma LLC must submit an application before March 21 inclusive.

ConsultantPlus experts have prepared answers to the most frequently asked questions from taxpayers:

If you do not have access to the K+ system, get a trial online access for free.

How to fill out UTII-2: procedure and features of filling out

The UTII-2 application (form used in 2020) has a strictly regulated form and procedure for filling out.

The UTII-2 form indicates the taxpayer’s INN and OGRNIP, his last name, first name, patronymic (if any). In addition, it is necessary to indicate the start date of imputation. It is also necessary to mention the annexes to this application.

The application is signed by the taxpayer or his authorized representative. The date of signature is indicated.

If the UTII-2 application is drawn up and submitted by an authorized representative of the entrepreneur (clauses 1, 3 of Article 26 of the Tax Code of the Russian Federation), along with the application he needs to have a copy of the document confirming his authority. This is the requirement of Order No. ММВ-7-6/ [email protected] (see notes to the application form for registration of an individual entrepreneur as a UTII taxpayer (UTII-2), as well as clause 10 of Section II of Appendix 10).

When submitting UTII-2, the tax inspector must put a mark on the form indicating the date on which the application was accepted and under what number it was registered. Then the tax authorities reflect information about the registration of an individual entrepreneur as a payer of imputed tax.

The explanations of K+ experts will help you choose the right Federal Tax Service for registering and submitting an application. Get trial access and go to the UTII Guide.

To learn about receiving a notification about registration as a holder, read the article “How to receive a notification about applying UTII?” .

Sample UTII-2 application for individual entrepreneurs

Filling out this form, which consists of only two sections, is not difficult at all. The main difficulty is to indicate the correct tax object codes. After all, tax specialists want to see in the form not OKVED2, but the values from the appendix to the tax return for the single tax. In this list, for example, 01 means “Providing household services.

More details can be found in Appendix No. 5 to the order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3 / [email protected] (as amended on October 19, 2016). There are twenty-two such codes in total.

On the title page of the application you must indicate all the details of the individual entrepreneur: full name, tax identification number and OGRNIP, tax authority code and the start date of UTII application.

At the end you must put a personal signature and date of completion.

The second page provides data on types of activities. There may be several of them.

Within 5 days, the Federal Tax Service will consider the received application, after which they will send a notification about registration as a payer on the “imputation”. This is a very important document, because it is it that serves as evidence of the right to apply a single tax, and not the OSNO or the simplified tax system. The start date of such taxation should be the date when the sample UTII-2 (2017) application form for registration as a payer was compiled.

What is reflected in the annex to the UTII-2 form

The appendix to the UTII-2 form is an integral part of it and contains information about the types of activities that the entrepreneur plans to engage in and the places where they are carried out.

The application should also reflect the address of business activity, indicating the activity code for each address. The code for the type of business activity is indicated in accordance with the appendix to the procedure for filling out the UTII tax return for certain types of activity.

If the number of activities on the imputation exceeds 3, the entrepreneur must fill out as many sheets of appendices to the UTII-2 application as necessary to fully reflect all types of his activities.

Results

The application form for registering an individual entrepreneur as a UTII payer was approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected] and did not change during 2013–2018. In 2020, registration of individual entrepreneurs on UTII is carried out on the same form.

See also: “Deregistration of UTII: conditions and terms.”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.