Every company needs income to pay off current debts and ensure the subsequent uninterrupted functioning of the company. There are several types of income. Classification, as well as accounting for each of them, has another goal - determining the tax base and paying taxes. Sales revenue is the main source of cash flow for most companies.

Definition

Information about what income is and what it is is presented in detail in the Tax Code of the Russian Federation. In particular, sales income is considered to be receipts for goods and property sold. Article 249 of the Tax Code states that sales income is revenue from goods sold (directly produced by the company) and services sold, which are the main activities of the company. It could also be revenue from resold goods. In addition, this article includes income received for the provision and sale of property rights.

What is gross revenue from product sales

So, revenue from the sale of products (goods and services) represents the amount of income received during the sale of goods or provision of services, which is important - without subtracting the amount of the cost of production. That is, revenue is measured in the prices of final products at which the goods were sold.

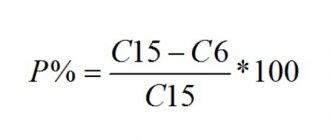

It follows that a large amount of revenue will not always indicate high project efficiency and high profitability. But despite this, revenue is the main indicator that allows you to get a general idea of the company. In order to better understand the essence of this concept, let’s look at the difference between revenue and profit. But first, let's present a formula for calculating revenue .

Selling goods

Goods mean products, services or works. They are considered realized when a certain reward is received for the right to use and dispose of them. Usually in monetary terms. But sometimes the reward may be another product or service. Depending on the agreement of the parties. If income from the sale of goods is not received in any form, that is, provided free of charge, they are not considered realized and do not fall into the tax base.

The amount of revenue is determined based on accounting for all income received from the sale of goods and services in the form of cash, non-cash and in kind. In the case where payment occurs in the form of goods or property, it must be set off in monetary terms. Usually it is the equivalent of the amount for which the company planned to sell its products.

To determine the base from which profit tax will be calculated from the revenue indicator, it is necessary to subtract the amount of VAT, excise taxes and export customs duties.

Revenue

Business

10.01.2020

6651

Revenue is the amount of material benefits in monetary or other terms received by a person, as a rule, carrying out entrepreneurial or other activities on a reimbursable basis. Revenue for an enterprise is the main source of income and cost recovery.

Last news:

How much does it cost to transfer a business to Lithuania: a step-by-step guide

Due to devaluation and the coronavirus crisis, Belarusians began to buy more online

Revenue is distinguished:

- from the sale of the enterprise’s main products, works, services;

- from the sale of real estate of the organization;

- from the sale of inventory items;

- from the sale of own shares, interests, interests;

- from financial transactions, for example with securities;

- from other non-sales transactions, for example - receipt of rental payments, payment for the use of copyright and property rights.

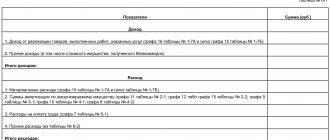

The total amount of receipts in monetary terms is called gross receipts.

The volume of revenue can be determined:

- cash method - as payment is made, funds are received at the cash desk or into the account of the enterprise, while the cost of goods received (in a barter transaction, for example) is also recalculated into the amount of funds at the time of receipt;

- accrual method - otherwise, by shipment. Revenue is taken into account at the moment the buyer of products and services has obligations to the enterprise.

The above methods do not in any way affect the content of the concept of revenue, but are important in accounting and calculation of the tax base.

Regardless of the calculation method, the amount of revenue is recorded in the revenue book, or in several books, if required by the structure of the organization or the form of taxation.

The simplest revenue formulas are:

Revenue = cost per unit of product or service * number of units sold:

Or:

Revenue = cost (for trade – purchase price) + added value.

According to the legislation in force in the Republic of Belarus, proceeds in the form of funds received at the cash desk of an enterprise must be transferred to the bank servicing the enterprise directly or through enterprises of the Ministry of Communications, or handed over to employees of the collection service. Only the limit of funds approved by order for the enterprise can remain in the organization’s cash desk for current settlements. The size of the limit is determined by a resolution of the National Bank of the Republic of Belarus.

All operations for transferring cash to a bank (either independently or by a collection service) in the Republic of Belarus are regulated by the instructions of the Ministry of Taxes and Duties and the National Bank. Violations of the established procedure are punishable under the Administrative Code.

The concept of revenue has the greatest practical significance for assessing and forecasting the results of an enterprise’s activities, as well as for tax calculations.

Revenue is the simplest and “fastest” indicator for the current assessment of the state of affairs of the organization. Revenue planning is a mandatory component of any enterprise planning. Revenue, as the main source of financing for an organization, includes, in monetary terms, all past and future costs of the enterprise and income (if any) from activities. The amount of future income can be predicted by knowing the total revenue and the amount of costs already incurred and planned. Thus, the cost of a product or service can be considered already produced; calculated taxes and other payments can be considered planned. The difference between revenue and the total amount of all costs will be net income from the activity, i.e. the main (declared) purpose of the activity of a commercial enterprise.

Property rental

This item of income, in accordance with the law, usually refers to non-operating income of the company. If they are taken into account by the taxpayer as income from sales, this means that the rental of premises (sublease) is the main or one of the main sources of cash receipts and is carried out on an ongoing basis. In the event of a one-time rental, financial income is classified as non-operating. At the same time, the legislation does not define the frequency of rentals to classify income into one or the second group. Therefore, each organization can decide independently which rules to follow for accounting for income received under rental agreements.

Definition of income and their types

What is income? What is your definition?

To be smart:

Income represents economic benefit (more precisely, its increase), resulting either from the receipt of assets or the repayment of liabilities and leading to an increase in the organization’s capital.

In simple words:

Income is a certain benefit expressed in monetary (directly in the form of money) or in kind (some property) form.

So, for the purpose of calculating income tax, all income is divided into three types:

- Income from sales;

- Non-operating income;

- Income not included in the tax base.

What happens? The first two groups of income are directly involved in the calculation of tax; for this they are taken into account using one of the selected methods - either cash or accrual. The third group does not participate in the calculation in any form and under any conditions - these incomes do not affect the tax in any way.

Now let's take a closer look at each group.

Finance lease

There are no discrepancies in matters relating to the rules for accounting for proceeds under leasing agreements. These are the same income from sales. This is written in Letter of the Ministry of Taxes of Russia No. 02-3-08/13 dated April 22, 2004. But if the agreement indicates the final redemption value of the leased item, which will ultimately become the property of the lessee, then it will be taken into account separately. Since this applies to transactions relating to purchase and sale. Therefore, when indicating the total amount, you will need to correctly divide it and correctly post it to income items.

Municipal property

Income from the sale of property that is municipal and received for economic management is not subject to taxation. This is due to the fact that the funds have already been transferred to the municipal budget.

In situations where property belongs to an enterprise on the basis of economic ownership, the possibilities for disposing of it are very limited and are prescribed in Civil Legislation. In particular, there is a ban on selling and leasing, using it as collateral, or contributing it as part of the authorized capital. These actions require permission from the owner.

If such property is sold, the taxpayer may reduce income by the cost of goods sold and property rights. When selling property that is subject to depreciation costs, accounting for income from the sale must be kept taking into account its possible adjustment (reduction) to the residual value of such property.

Ways to earn income

Payment through electronic payment systems

If payment for goods (work, services) is made through electronic payment systems (for example, through an online store), then the date of receipt of income from the sale of goods is the day the goods (work, services) are paid for using electronic money (letter of the Ministry of Finance of Russia dated June 5, 2013 No. 03-11-11/163, dated January 24, 2013 No. 03-11-11/28).

Financiers noted that when paying for goods through electronic payment systems, the seller is registered in one of such systems as a payee. In this case, a document confirming the fact of payment for the goods may be an account statement from the payment system operator or a message from the payment system operator.v

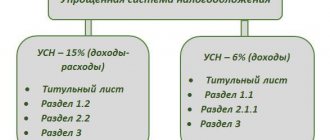

Read also “How to take into account income under the simplified tax system”

Often, individual entrepreneurs who use the simplified tax system with the object “income” use bank terminals for settlements with customers. Money from buyers goes to their current account minus bank commission. What amount is considered income?

The Ministry of Finance believes that the entire amount transferred by the buyer, including the bank commission (letter dated September 19, 2020 No. 03-11-11/54526). The financiers' explanation is as follows.

Income under the simplified tax system includes income from the sale of goods (work, services), property rights and non-operating income (Article 248 of the Tax Code of the Russian Federation). Revenue from sales is determined based on all receipts associated with payments for goods (work, services) sold (clause 2 of Article 249 of the Tax Code of the Russian Federation). Since “simplified” people use the cash method, the date of receipt of income is considered to be the day funds are received in bank accounts or cash desks.

Read also “Income not taken into account under the simplified tax system”

This means that when buyers pay for “simplified” goods with plastic cards through a bank terminal, their income is calculated based on all receipts for goods sold without reduction for expenses. That is, an entrepreneur using the simplified tax system in this case must pay tax based on the entire amount transferred by the buyer, without deducting a bank commission from it.

General approach to tax accounting of sales income in foreign currency

Income from the sale of products received in another currency for tax purposes must be accounted for in rubles. To do this, you must use the official rate of the Bank of Russia. In this case, income can be recognized on the day of actual payment (cash method) or the day of shipment (sale), when the transfer of ownership occurs. According to the law, both options are legitimate. The choice depends on the accounting policy that is established at the enterprise.

Moreover, if the payment is divided into parts and the taxpayer receives a partial prepayment (advance), then it is recalculated at the official rate established on the date of receipt of the corresponding payment.

When working with foreign counterparties, another difficulty arises. When paying for services or goods in another currency and converting them into rubles, an exchange rate difference arises, which is included in non-operating income.

If prices for goods are fixed in conventional units, then the proceeds received in foreign currency must be recalculated into rubles on the day of sale. Exchange differences are included in income from non-operating activities if they are positive. If the amount is negative, it is included in non-operating expenses.

Income from sales and non-operating income

Let us first turn to the text of Art. 249. It defines income from the sale of goods, works, services, and property rights. The article contains references to Art. 271 and 273. They deal with the accrual method and the cash method as applied to income. The essence of the accrual method is to recognize income based on the legal fact of the possibility of its actual receipt. The essence of the cash method is to recognize income when it is actually received in cash or in kind.

Extract from the Tax Code of the Russian Federation

Article 249. Income from sales

1. For the purposes of this chapter, income from sales is recognized as proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

2. Sales proceeds are determined based on all receipts associated with payments for sold goods (work, services) or property rights, expressed in cash and (or) in kind. Depending on the method of recognition of income and expenses chosen by the taxpayer, receipts related to payments for sold goods (work, services) or property rights are recognized for the purposes of this chapter in accordance with Article 271 or Article 273 of this Code.

3. The specifics of determining sales income for certain categories of taxpayers or sales income received in connection with special circumstances are established by the provisions of this chapter.

End of extraction.

Non-operating income is determined in accordance with Article 250 of the Tax Code of the Russian Federation. First, the text of this article is given, after which explanations are provided for some points of this article.

Extract from the Tax Code of the Russian Federation

Article 250. Non-operating income

For the purposes of this chapter, non-operating income is recognized as income not specified in Article 249 of this Code.

Non-operating income of a taxpayer is recognized, in particular, as income:

1) from equity participation in other organizations, with the exception of income allocated to pay for additional shares (shares) placed among the shareholders (participants) of the organization;

2) in the form of a positive (negative) exchange rate difference resulting from the deviation of the sale (purchase) rate of foreign currency from the official rate established by the Central Bank of the Russian Federation on the date of transfer of ownership of foreign currency (the specifics of determining bank income from these operations are established by Article 290 of this Code);

3) in the form of fines, penalties and (or) other sanctions for violation of contractual obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as amounts of compensation for losses or damages;

By Resolution of the Constitutional Court of the Russian Federation dated June 22, 2009 N 10-P, the provisions of paragraph 4 of part two of Article 250 were recognized as not contradicting the Constitution of the Russian Federation to the extent that they involve inclusion in the tax base for the income tax of organizations of the income of state educational institutions of higher professional education from the delivery of lease of federal property transferred to them for operational management and the emergence of the obligation for these institutions to pay corporate income tax on the specified income.

4) from leasing property (including land plots) for rent (sublease), if such income is not determined by the taxpayer in the manner established by Article 249 of this Code;

5) from the provision for use of rights to the results of intellectual activity and equivalent means of individualization (in particular, from the provision for use of rights arising from patents for inventions, industrial designs and other types of intellectual property), if such income is not determined by the taxpayer in accordance with the procedure established by Article 249 of this Code;

6) in the form of interest received under loan, credit, bank account, bank deposit agreements, as well as on securities and other debt obligations (the specifics of determining bank income in the form of interest are established by Article 290 of this Code);

7) in the form of amounts of restored reserves, the costs of the formation of which were accepted as part of expenses in the manner and on the terms established by Articles 266, 267, 267.2, 292, 294, 294.1, 300, 324 and 324.1 of this Code;

in the form of gratuitously received property (work, services) or property rights, except for the cases specified in Article 251 of this Code.

in the form of gratuitously received property (work, services) or property rights, except for the cases specified in Article 251 of this Code.

When receiving property (work, services) free of charge, income assessment is carried out based on market prices determined taking into account the provisions of Article 105.3 of this Code, but not lower than the residual value determined in accordance with this - for depreciable property and not lower than production (acquisition) costs - for other property (work performed, services provided). Information on prices must be confirmed by the taxpayer - the recipient of the property (work, services) documented or through an independent assessment;

9) in the form of income distributed in favor of the taxpayer with his participation in a simple partnership, taken into account in the manner prescribed by Article 278 of this Code;

10) in the form of income from previous years identified in the reporting (tax) period;

11) in the form of a positive exchange rate difference arising from the revaluation of property in the form of currency values (except for securities denominated in foreign currency) and claims (liabilities), the value of which is expressed in foreign currency (except for advances issued (received) in including on foreign currency accounts in banks, carried out in connection with a change in the official exchange rate of foreign currency to the ruble of the Russian Federation, established by the Central Bank of the Russian Federation.

For the purposes of this chapter, a positive exchange rate difference is an exchange rate difference that arises when revaluing property in the form of foreign currency assets (except for securities denominated in foreign currency) and claims denominated in foreign currency, or when devaluing liabilities denominated in foreign currency;

11.1) in the form of an amount difference arising from the taxpayer, if the amount of obligations and claims incurred, calculated at the rate of conventional monetary units established by agreement of the parties on the date of sale (receipt) of goods (work, services), property rights, does not correspond to what was actually received (paid) amount in rubles;

(clause 11.1 introduced by Federal Law dated May 29, 2002 N 57-FZ)

12) in the form of fixed assets and intangible assets received free of charge in accordance with international treaties of the Russian Federation or with the legislation of the Russian Federation by nuclear power plants to improve their safety, used not for production purposes;

13) in the form of the cost of received materials or other property during dismantling or disassembly during the liquidation of fixed assets being taken out of service (except for the cases provided for in subparagraph 18 of paragraph 1 of Article 251 of this Code);

14) in the form of property (including funds) used for other purposes than for its intended purpose, works, services received as part of charitable activities (including in the form of charitable assistance, donations), targeted income, targeted financing, with the exception of budgetary funds . In relation to budget funds used for purposes other than their intended purpose, the provisions of the budget legislation of the Russian Federation are applied.

Taxpayers who received property (including money), work, services within the framework of charitable activities, targeted income or targeted financing, at the end of the tax period, submit to the tax authorities at the place of their registration a report on the intended use of the funds received as part of the tax return. .

The paragraph has been deleted. — Federal Law of May 29, 2002 N 57-FZ;

In accordance with paragraph 14 of Article 251 of this document, the funds specified in paragraph 15 of this article are subject to inclusion in non-operating income, also if the recipient did not use them for their intended purpose within one year after the end of the tax period in which they were received.

15) in the form of funds used for purposes other than their intended purpose by enterprises and organizations that include especially radiation-hazardous and nuclear-hazardous production and facilities, funds intended for the formation of reserves to ensure the safety of these production and facilities at all stages of their life cycle and development in accordance with the legislation of the Russian Federation on the use of atomic energy;

16) in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization, if such a decrease was carried out with a simultaneous refusal to return the cost of the corresponding part of the contributions (contributions) to the shareholders (participants) of the organization (with the exception of cases provided for in subparagraph 17 of paragraph 1 of Article 251 of this Code);

17) in the form of refund amounts from a non-profit organization of previously paid contributions (contributions) in the event that such contributions (contributions) were previously taken into account as expenses when forming the tax base;

18) in the form of amounts of accounts payable (liabilities to creditors) written off due to the expiration of the limitation period or for other reasons, except for the cases provided for in subparagraph 21 of paragraph 1 of Article 251 of this Code. The provisions of this paragraph do not apply to the write-off by a mortgage agent of accounts payable in the form of obligations to the owners of mortgage-backed bonds;

19) in the form of income received from transactions with financial instruments of futures transactions, taking into account the provisions of Articles 301 - 305 of this Code;

20) in the form of the value of surplus inventories and other property that are identified as a result of the inventory;

21) in the form of the cost of media products and book products that are subject to replacement when returning or writing off such products on the grounds provided for in subparagraphs 43 and 44 of paragraph 1 of Article 264 of this Code. The assessment of the cost of the products specified in this paragraph is carried out in accordance with the procedure for assessing the balances of finished products established by this Code;

22) in the form of amounts of adjustment of the taxpayer’s profit due to the application of methods for determining for tax purposes the compliance of prices applied in transactions with market prices (profitability) provided for in Articles 105.12 and 105.13 of this Code;

(Clause 22 introduced by Federal Law dated July 18, 2011 N 227-FZ)

23) in the form of the cash equivalent of real estate and (or) securities returned to the donor or his legal successors, transferred to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital non-profit organizations", minus the following amounts:

the value (residual value) of real estate for which it was taken into account in the tax accounting of the donor on the date of transfer of such property to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” - when returning the cash equivalent of real estate;

the value at which the securities were taken into account in the tax accounting of the donor on the date of their transfer to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” - upon return of the cash equivalent of securities.

(Clause 23 introduced by Federal Law dated November 21, 2011 N 328-FZ)

If the value of the real estate or securities specified in this article exceeds the cash equivalent of such property returned to the donor or his legal successors, the difference between these values is recognized as a loss and taken into account for tax purposes in accordance with Articles 268 and 280 of this Code.

(Part three introduced by Federal Law dated November 21, 2011 N 328-FZ)

End of extraction

Explanations for some points of this article.

1) The taxation of this income itself does not raise any questions. It is necessary to take into account that when taxing dividends, a rate of 9% is used, and the moment of taxation in accordance with Art. 271 in this case is the date of actual receipt of funds. In Art. 250 there is no reference to Art. 271. This may cause incorrect actions by the taxpayer if he is not informed by anyone about the need to apply Art. 271.

3) In this paragraph, difficulties arise due to the absence in the text of a definition of the concept “in the form of those recognized by the debtor”. In this regard, tax disputes arise between taxpayers and tax authorities, the resolution of which is carried out in arbitration courts. Tax authorities adhere to the point of view according to which the fact that the debtor recognizes penalties and fines for payment arises on the basis of an agreement in the event of failure of one of the parties to fulfill its obligations within the specified period, regardless of the fact of written confirmation of consent to make payments of penalties and fines. Taxpayers take the opposite point of view, believing that in order to accrue income, the written consent of the debtor to pay the required amounts is necessary.

The situation is aggravated by the fact that the actual accrual of income and payment of income tax on it does not guarantee that the accrued amounts will actually be received, even if they are provided for in the business agreement. The debtor may simply not pay them. In this case, the other party may go to court to collect the specified penalties and fines. This in itself creates problems. since the buyer of products and goods against whom judicial sanctions have been applied may refuse further cooperation with the taxpayer.

The issuance of a positive court decision on the collection of penalties and fines also does not guarantee their actual receipt, since the payer may not have the funds to pay them. In this case, the bailiffs will not be able to enforce the court decision. In this case, funds not received may be written off against the reserve for doubtful debts, if such a reserve was created, or as bad debts in accordance with Art. 265.

The problem is partly resolved by including in the text of the contract a clause requiring written consent to pay penalties and fines. Without this, the position of the tax authorities seems more justified.

6) Difficulties for taxpayers are caused by ambiguity in determining the moment when income arises if interest accruals are ahead of their actual payment so that these two facts appear in different tax (reporting) periods.

Problems of taxation of the estimated value of property received free of charge, as a rule, are associated with the fact that depreciation of such property for profit tax purposes turns out to be impossible. In accounting, this depreciation, on the contrary, is usually provided for. There are differences in the assessment of accounting and taxable profits. When such property is sold, income from the sale arises, but expenses associated with this sale also do not arise. This results in double taxation. In accounting, an amount previously recorded as income is written off as an expense, so double counting of profits is eliminated. In taxation, double taxation cannot be avoided. A similar situation arises when receiving work and services free of charge. In this case, double taxation of profits also arises.

Problems of taxation of the estimated value of property received free of charge, as a rule, are associated with the fact that depreciation of such property for profit tax purposes turns out to be impossible. In accounting, this depreciation, on the contrary, is usually provided for. There are differences in the assessment of accounting and taxable profits. When such property is sold, income from the sale arises, but expenses associated with this sale also do not arise. This results in double taxation. In accounting, an amount previously recorded as income is written off as an expense, so double counting of profits is eliminated. In taxation, double taxation cannot be avoided. A similar situation arises when receiving work and services free of charge. In this case, double taxation of profits also arises.

A special case involves obtaining an interest-free loan. There were several proceedings in arbitration courts in connection with attempts by tax authorities to accrue in such cases additional income to taxpayers at the refinancing rate of the Central Bank of the Russian Federation, as income from the gratuitous receipt of financial services. The arbitration courts did not support the position of the tax authorities, considering that in this case there is no financial service, therefore the transfer of an interest-free loan is not a service. If arbitration courts had followed a different interpretation of the event, taxpayers would have had to pay income tax twice. Once in connection with the actual reduction in expenses when receiving an interest-free loan, the second time from calculated income at the refinancing rate of the Central Bank of the Russian Federation. In this situation, uncertainty remains for taxpayers, since this issue is not regulated in the Tax Code, and the position of arbitration judges may change.

13) When dismantling fixed assets, scrap metal usually appears. It must be taken into account for tax purposes at the market price and income must be calculated. Due to the fact that previously, when selling this scrap metal, only the amount of tax calculated from the accrued income could be taken into account as expenses, double taxation arose. Taxpayers, in order to avoid double taxation of profits, usually did not receive scrap metal, and did not take into account the expense when selling it. This provision has now been corrected in Art. 254 were amended accordingly. Now you can accept the amount of previously accrued income as an expense. However, the practice of not collecting scrap metal has persisted. It is difficult for taxpayers to rid themselves of doubts in this regard.

20) Surpluses identified during inventory are subject to capitalization with simultaneous accrual of income for tax purposes. When selling these surpluses, you can now include the amount of previously accrued income as an expense. The complexity of this point lies in the fact that in trade organizations the phenomenon of misgrading often occurs, that is, when instead of a product listed in a warehouse or at a retail outlet, another product is found at the same or close to it price. In this case, organizations prefer not to record either shortages or surpluses. It is not right. the shortage of a specific product should be attributed to the guilty parties, and the surplus should be capitalized and income accrued for income tax purposes and for accounting purposes.

For almost each of the remaining paragraphs of Article 250 of the Tax Code, one can find certain difficulties with their application or the possibility of different interpretations on the part of tax authorities and taxpayers. This is the difficulty of applying Article 250.

Non-operating income

When calculating the amount of income tax, in addition to income received from the sale of goods, services, property and property rights, non-operating income is also taken into account. These include the following articles:

- rental payments, if they do not relate to sales income;

- equity participation in other organizations;

- when receiving goods free of charge;

- interest received on loan agreements and overdue payments;

- positive result when recalculating exchange rate differences;

- purchase and sale of currency;

- written off accounts payable;

- any other income, the receipt of which is in no way directly related to the production and sale of core goods;

- income from previous periods received in the current reporting period.

Thus, accounting for income from sales is necessary for calculating and paying income tax, as well as analyzing the current state of the enterprise. Depending on the field of activity of the company, their composition may vary. In addition, the taxes that must be paid to the budget depend on the chosen taxation scheme. All issues related to taxes are set out in the Tax Code of the Russian Federation.

Determination of income: features

There are certain features with the definition of proceeds from sales for individual persons obliged to pay taxes, and certain types of income from sales, which are associated with separately arising circumstances.

Such amounts from profits include

- Equity interests related to other companies. The proceeds transferred to pay for equity shares put up for sale within the framework of internal exchange trading among existing shareholders are excluded.

- Exchange rate differences (negative and positive) arising as a result of daily fluctuations in the exchange rate officially set by the Central Bank of the Russian Federation (Central Bank of the Russian Federation).

- The appearance of debt obligations with a court decision; These are fines, penalties and/or other imposed sanctions that arose after non-compliance with the obligations stipulated in the Agreement; these can also include damage or loss caused indirectly or directly.

- Transfer/letting of movable and immovable property (land plots) for rent and sublease by the lessor, excluding income established by Article 249 of the current tax code.

- Intellectual activity, use of rights to it. The following can be considered intellectual activity: patents for industrial inventions, samples, models, as well as useful inventions.

- Interest accrued due to the existence of a bank deposit/s, a bank current account, both in foreign currency and in national equivalent, loans, loan agreements, as well as other debt obligations.

- OS (fixed assets) and intangible assets (intangible assets) related to gratuitous assistance received to establish general safety and modernize production. Only for nuclear power plants,

- Property transferred into the ownership of government agencies based on a decision made by executive bodies.

- Acceptance by a Russian company of property as a gift from:

- a company whose authorized capital depends 50% on the company receiving property free of charge,

- an individual who has invested 50% of his share.

Property received as a gift is not income taken into account for company taxation if, after the current year, it has not been re-registered to third parties.

- Guarantee contributions paid to intermediary funds considered special. The main activity of which is to reduce risks when, in certain cases, these obligations are not fulfilled. This applies to securities trading and clearing companies.

- Special-purpose financing. In this case, it is mandatory to maintain separate accounting records for the enterprise. Failure to comply with these conditions will lead to the fact that during an audit/tax audit, funds received that are not properly accounted for will be subject to taxation. In this case, taxes will be calculated from the date of receipt.

These and other points described in Art. 250 of the Tax Code of the Russian Federation are recognized as non-operating income of an enterprise.

Calculation of profit from sales

The main goal of every company on the market is to obtain significant profits, which will cover all costs that arise in the process of activity. By using certain methods for calculating sales income over time, it is possible to realistically assess the effectiveness of the financial and economic activities of an enterprise and subsequently eliminate shortcomings and increase the level of sales.

Formula

TxV = B, where C is the price per unit of production, V is the sales volume, and B is revenue.

If there is more than one product, then each item will be taken into account in the calculation.

C₁ x V₁+ C₂xV₂….p = B (total).

Net profit is the deduction of all taxes and expenses incurred.

Similar articles

- Profit before tax

- Income reduced by expenses

- Non-operating income and expenses

- Loan agreements on the simplified tax system

- Income and expenses from ordinary activities