The special tax regime of the simplified tax system (simplified taxation system, “simplified”) is primarily aimed at individual entrepreneurs and small business organizations. The Tax Code of the Russian Federation introduces various restrictions on the application of this tax regime. Such restrictions are, for example, the maximum amount of income and the maximum cost of fixed assets, beyond which the use of the simplified tax system is impossible.

If you want to focus your energy only on business, without wasting time on accounting, pay attention to this remote accounting service. Responsibility, literacy, competitive prices - all this has made this service the most popular in Russia!

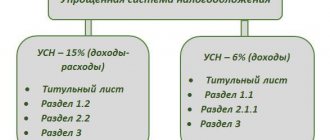

If you have chosen a simplified tax system for income of 6%, it means that the income of your business does not exceed 150 million rubles per year, and the costs are insignificant in order to work on a simplified tax system of 15% (income minus expenses). For 2020, the income limit for the simplified tax system in the amount of 150.00 million rubles was established. For 2020, the income limit remains at 150.00 million rubles.

Convenience of tax on simplified tax system income 6%

The advantages of working on the simplified tax system (USN) income of 6% are obvious upon closer examination, and its use makes life easier for taxpayers, both financially and administratively.

Firstly, there is no need to keep track of expenses and, accordingly, collect various receipts, checks, etc., confirming your expenses. Moreover, not all expenses can be taken into account as expenses when determining the tax base.

If the share of expenses is small, and also if you are initially not ready to “get involved” in taking into account expenses, it is better, of course, to choose the object of taxation “income” of 6%. Tax is paid on the total amount of income received at a tax rate of 6%.

Tax authorities rarely check taxpayers who use the 6% special income regime. Moreover, 6% is the maximum tax rate for the simplified tax system “income”. By checking your local laws, you can find out what tax rate applies in your area. The fact is that regions are given the right to lower the tax rate to 0%. If you pay all taxes and fees on time, and also submit reports on time, communication with the tax office will be an extremely rare episode for you.

simplified tax system 15% or simplified tax 6% - what to choose?

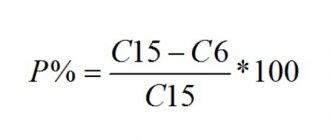

It is always quite difficult for newly registered taxpayers to figure out what is more profitable - a simplified 6% or 15%? In most cases, the choice of taxation object is dictated by what turnover the simplifier will have and what types of activities he plans to engage in.

If the share of expenses for activities on the simplified tax system is significant, it is more profitable to choose the object “income minus expenses” with a rate of 15%, otherwise it is more reasonable to pay tax on income at a rate of 6%.

The place of doing business is also important, because many constituent entities of the Russian Federation establish preferential conditions for simplifiers, reducing taxes for certain categories of taxpayers (or for specific types of activities).

Calculation examples related to the choice of taxation object of the simplified tax system were prepared by ConsultantPlus experts. Get trial access to the system for free and proceed to recommendations.

Advance payments on simplified tax system income 6%

Using this taxation system, you will need to make advance payments at the end of each quarter. If, after calculating the tax, the resulting tax amount is greater than the deductions amounting to the payment of contributions to pension and medical funds for an individual entrepreneur, as well as more than 50% of the amount of contributions paid for employees, if any, then it is necessary to make an advance payment of the simplified tax system.

The deadlines for paying advance payments in 2020 are as follows:

- Until April 30, 2020 for the 4th quarter of 2020.

- Until April 25 for the 1st quarter of 2020;

- Until July 25 for the 2nd quarter of 2020;

- Until October 25 for the 3rd quarter of 2020;

- Until April 30, 2020 for the 4th quarter of 2020.

The deadlines for paying advance payments in 2020 are slightly different from 2020, due to the postponement of weekends and holidays:

- Until April 30, 2020 for the 4th quarter of 2020.

- Until April 27 for the 1st quarter of 2020;

- Until July 27 for the 2nd quarter of 2020;

- Until October 26 for the 3rd quarter of 2020;

- Until April 30, 2021 for the 4th quarter of 2020.

Who can apply this tax system

Individual entrepreneurs who meet the following criteria can switch to the simplified system:

- there are no more than 100 people on staff;

- revenue received for the year does not exceed 60 million rubles;

- fixed assets are put on the balance sheet, the total residual value of which does not exceed 100 million rubles.

Who cannot apply the tax system

Note! Federal legislation provides restrictions for business entities that cannot apply the simplified tax regime. These are organizations that have operating branches, companies, among the founders of which there are legal entities. persons owning a share of 25% or more, individual entrepreneurs conducting certain types of activities.

An example of calculating the simplified tax system for income 6%

I will give an example of calculating advance payments on the simplified tax system for income of 6% without employees:

Advance payment for the first quarter

1. Let's say your income for January, February, March, i.e. for the 1st quarter of the current year amounted to 500,000 rubles. 500,000×6% = 30,000 rubles.

2. Determine the amount of the deduction (these are your contributions that you should have paid during the first quarter of 2020):

- for compulsory pension insurance 7,338.50 rubles;

- for compulsory medical insurance 1,721 rubles.

Your total deduction for the 1st quarter of 2020 will be 9,059.50 rubles.

3. 30,000 - 9,059.50 = 20,940.50 rubles. This is the amount called the advance payment for the first quarter of 2019.

Advance payment for six months

A. Sum up the income for the first quarter (500,000) with the income for the second quarter, let’s say it is equal to 400,000 rubles. 500,000 + 400,000 = 900,000×6% = 54,000 rubles.

B. Determine the amount of the deduction (these are payments to the funds for two quarters of 18,119 plus an advance payment for the first quarter of 20,940.50 rubles). This results in a deduction of 39,059.50 rubles.

C. 54,000 - 39,059.50 = 14,940.50 rubles - the amount of the advance payment to the tax office for the first half of the year.

The advance payment for nine months and for a year is calculated in the same way. Just remember to pay your pension and health insurance contributions quarterly, and then you will have the right to deduct these amounts from your advance quarterly tax payments to the Federal Tax Service.

Let us explain the meaning of the numbers 1,721 rubles and 7,338.50 rubles indicated in paragraph 2 of the Example. In 2020, fixed contributions payable for pension and health insurance are determined by specific figures, unlike previous years, when contributions were calculated based on the minimum wage.

In 2020, the following amount of fixed contributions of individual entrepreneurs for themselves was determined:

- the amount for pension insurance is 29,354 rubles (with an annual income of less than 300,000 rubles),

- for medical insurance – 6,884 rubles.

If we divide these amounts into equal parts for equal payment quarterly, we get 1,721 rubles and 7,338.50 rubles. Although, at your discretion, you can pay contributions not necessarily in equal installments.

In 2020, the amounts of fixed contributions for individual entrepreneurs for themselves, with an income of less than 300,000 rubles, are:

- for pension insurance – 32,448 rubles;

- for medical insurance – 8,426 rubles.

With an income of over 300,000 rubles in 2020 and 2020, the individual entrepreneur must, in addition to fixed contributions, transfer to the Federal Tax Service 1% of the difference between annual income and 300,000 rubles. The deadline for transferring the additional payment for pension insurance for 2020 and 2020 is until July 1, 2020 and until July 1, 2021, respectively.

If you have employees, then the contributions paid for them also go towards reducing the simplified tax system payments, but according to a different rule. For example:

- Income for the 1st quarter amounted to 500,000 rubles. The tax, based on the tax rate of 6%, will be 500,000 x 6% = 30,000 rubles.

- You paid fixed contributions for yourself during the 1st quarter in the amount of 7,338.50 + 1,721 rubles, as well as contributions for employees in the amount of 15,000 rubles.

- Despite the fact that the total amount of contributions was 7,338.50 + 1,721 + 15,000 = 24,059.50 rubles, you can only reduce the tax by 50% of the calculated tax amount: 30,000 x 50% = 15,000 rubles.

- The advance payment for the 1st quarter for individual entrepreneurs with hired employees will be 15,000 rubles.

- Unlike an individual entrepreneur without employees, an individual entrepreneur with employees can reduce the simplified tax system tax by no more than 50% of the calculated tax amount (clause 3.1, article 346.21 of the Tax Code of the Russian Federation).

Object of Calculus

The entrepreneur must choose the taxation scheme himself. At the end of the year, individual entrepreneurs can write an application to change the type of simplified tax system. For entrepreneurs providing services who do not have large material expenses, it is more profitable to use the simplified tax system (6% income). Individual entrepreneurs engaged in trade or production should choose a scheme that reduces costs.

As for the interest rate, the key factor here is the profitability of the business. If the planned amount of expenses is 60% (or more) of income, it is more profitable to use the second scheme. At the same time, it is important to keep records correctly and have primary documents (with signatures and seals) confirming expenses.

Sample accounting policy of simplified tax system income 6%

- I take charge of tax accounting myself.

- To calculate the single tax, use the object of taxation in the form of income. Reason: Article 346.14 of the Tax Code of the Russian Federation.

- The tax base for the tax is determined according to the book of income and expenses. At the same time, income in the form of property received within the framework of targeted financing is not reflected in the book of income and expenses. Reason: Article 346.24, subparagraph 1 of paragraph 1.1 of Article 346.15, paragraph 2 of Article 251 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-11-06/2/77.

- The book of income and expenses of the simplified tax system is kept automatically using the standard version of the Book of Accounting. Reason: Article 346.24 of the Tax Code of the Russian Federation, paragraph 1.4 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n (as amended by Order of the Ministry of Finance dated December 7, 2020 No. 227).

- Entries in the book of income and expenses are made on the basis of primary documents for each business transaction. Reason: clause 1.1 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n (as amended by Order of the Ministry of Finance dated December 7, 2020 No. 227), Part 2 of Article 9 of Law dated December 6, 2011 No. 402-FZ.

- The amount of tax (advance payment) is reduced by the amount of contributions for compulsory pension and health insurance. Reason: clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated March 10, 2011 No. KE-4-3/3785 and dated May 12, 2010 No. ShS-17-3

The accounting policy must be approved by order.

The material has been edited in accordance with current legislation 10/11/2019

Disadvantages of the simplified tax system

- Restrictions on types of activities. Financial institutions, notaries and lawyers, non-state pension funds and other organizations listed in Art. 346 Tax Code of the Russian Federation.

- There is no possibility to open representative offices. This factor can become an obstacle for companies that are planning to expand their business.

- Limited list of expenses for the second scheme.

- No obligation to prepare invoices. On the one hand, this saves time on paperwork. On the other hand, it may become an obstacle for counterparties who pay VAT. They will not be able to claim the tax for refund.

- The inability to reduce the basis for losses incurred during the period of using the simplified tax system when switching to other modes, and vice versa.

- Under the second scheme, tax will have to be paid even if the company incurred losses during the reporting period.

- In case of violation of regulations, the right to use the simplified tax system is lost.

- Reducing the basis due to advances that in the future may turn out to be erroneously credited amounts.

- Preparation of reports upon liquidation of an organization.

- In the case of selling fixed assets purchased during the period of using the simplified tax system, the tax base will have to be recalculated, an additional fee and a penalty will have to be paid.

This might also be useful:

- Pros and cons of the simplified tax system and UTII in comparison

- Minimum tax under the simplified tax system in 2020

- Tax system: what to choose?

- VAT accounting for individual entrepreneurs using the simplified tax system in 2020

- Individual entrepreneur reporting on the simplified tax system without employees

- simplified tax system for individual entrepreneurs in 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Changes for 2020

In the new year, income limits increased by 32.9%:

- 79.74 million rubles. — the maximum amount of income at which you can remain on the simplified tax system in 2020;

- 59.805 thousand rubles. the income limit that will be in effect in 2020;

- no more than 51,615 thousand rubles. Entrepreneurs must earn money in 9 months of 2020 in order to switch to the simplified tax system in 2020.

Amendments introduced by Federal Law No. 232 allow regions to reduce rates: from 6% to 1% for the first scheme and from 15 to 7.5% for the second.

From 01/01/16, small companies are exempt from non-tax audits. If an organization is included in the audit plan by mistake, it can exclude itself from the list. To do this, you need to write an application, attach certified copies of the report on financial results, information about the average headcount and submit a package of documents to the Rospotrebnadzor office.

Comments

View all Next »

Tatyana 09/17/2015 at 12:15 # Reply

taxes

Is income what goes into a bank account?

Natalia 09/18/2015 at 08:17 # Reply

Tatyana, income is money received via non-cash (to a current account) and cash (to the cash desk) payment.

Oleg 10/22/2015 at 04:06 # Reply

Hello! I'll ask a few questions. I plan to open an auto parts store, work as I understand better under the simplified tax system, income is 6%. 1) Which categories should I open? (OKVEDs seem correct), there will be body parts, filters, light bulbs and various spare parts. 2) Under the simplified tax system, income is 6%. I pay only from the profit and I don’t have to collect any receipts from where I purchased the goods, right? 3) If things go very badly and when calculating the tax given above: I earned only 3000 rubles in the 1st quarter. 3000×6% = 180, contributions to funds 5,565.35. 180 - 5,565.35= -5385.35 ... and so on. quarter, the same story, in this case, I’ll just put 5,565.35 into funds every quarter and that’s it? well, 22000 rub. in year. Or they could declare me bankrupt or give me an audit like why is there no profit? 4) Do I need a cash register when selling spare parts? Or do I somehow fall under the exception - “for small-scale retail trade, with the exception of goods of high technical complexity, as well as food products that require special storage and sale conditions” and can simply issue a sales receipt to the buyer? 5) Can I (as they say, will it work))) if I rent a room in a residential building on the ground/ground floor, hang up a “spare parts” sign, or not)) and work to order, and if it’s available, sell issuing a sales receipt without opening an individual entrepreneur? And until I get around to it, don’t spend money on deductions, taxes, cash registers, etc. Please answer in detail, I really need to know! Thank you in advance!

Natalia 10/22/2015 at 08:22 pm # Reply

Oleg, Good afternoon. 1. OKVED code for an auto parts store: 50.30.2 Retail trade in automobile parts, assemblies and accessories 2. With the simplified tax system, income is 6%, you do not need to confirm your expenses for the purchase of goods, you keep records of income. 3.You have the right to reduce the advance payment of the simplified tax system by the amount of fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund for the quarter in which they were paid. Those. If the amount of fixed contributions paid per quarter is greater than or equal to 6% of your income, then you do not pay tax under the simplified tax system. You will not be declared bankrupt if you do not owe anyone money. An audit can be carried out in any case, whether you have a profit or not. 4. When applying the simplified tax system for retail trade, you are required to install a cash register; a store is not a retail outlet. But if you use PSN or UTII, you can do without a cash register by registering a BSO. 5. What you are talking about in paragraph 5 is a violation of the law, which will lead to fines. This is illegal - illegal business activity.

Christina 10/29/2015 at 11:08 am # Reply

help me please!

If it suddenly turns out that we did not pay extra or overpaid the simplified tax system, will it be possible to adjust the amount after a year?

Natalia 10.29.2015 at 12:47 # Reply

Christina, Good afternoon. Read carefully and remember: 1. According to the Tax Code of the Russian Federation, clauses 3, 4, Article 346.21, if you use the simplified tax system, you are obliged to pay an advance tax payment at the end of each reporting period. 2. According to the Tax Code of the Russian Federation, paragraph 2 of Article 346.18, the reporting period for the USE is 1st quarter, half a year, nine months of the calendar year. 3. According to the Tax Code of the Russian Federation, clause 7, article 346.21, advance payments of the simplified tax system must be paid no later than the 25th day of the first month following the reporting period. 4. According to the Tax Code of the Russian Federation, clause 4, article 75, if you have not paid or have not paid the advance payment in full, then the taxpayer is charged a penalty in the amount of one three hundredth of the Central Bank refinancing rate in force at that time for each day of delay. Do not wait for the tax office to send you a request for incomplete payment of the advance payment, calculate and pay as early as possible so that the penalty is not high. 5. According to the Tax Code of the Russian Federation, paragraph 3, clause 3, article 58, the imposition of a fine for late or incomplete payment during the tax period of advance payments under the simplified tax system is not provided. 6. If you paid more than required, then at the end of the year (until March 31, 2016) when calculating the final tax payment, you will take into account the overpaid amounts. The simplified tax system tax is calculated incrementally, so add up all the amounts of income received for the year, subtract the fixed payments paid and the advance payments paid.

Anastasia 12/15/2015 at 04:21 pm # Reply

in the first quarter my advance payment was zero, just like the second quarter, and in the third quarter the amount of tax (6%) increased the mandatory contribution. How to calculate the advance payment for the 3rd quarter and how for the rest of the year?

Natalia 12/15/2015 at 07:58 pm # Reply

Anastasia, good evening. If your amount of the simplified tax system for the third quarter exceeded the amount of insurance premiums paid in the third quarter, then you had to make an advance payment for this amount to the Federal Tax Service by October 20, 2015. If you haven’t done this, then do it now, but you will already have a penalty added to this amount for the overdue advance payment of the simplified tax system. The calculation of advance payments is carried out on an accrual basis, because now the legislation defines not the 1st, 2nd, 3rd, 4th quarter, but the 1st quarter, the first half of the year, 9 months of the year. Therefore, for the third quarter (it’s correct to say 9 months) it is calculated as follows: - All income for 9 months is added up, 6% is calculated, the amount of fixed contributions paid for 9 months of the calendar year is subtracted from this amount, etc. - for the year - all income received in the calendar year is added up, 6% is calculated, the following is subtracted from the amount received: - the amount of advance payments of the simplified tax system made during the calendar year - the amount of fixed contributions paid during the calendar year.

Natalya 12/16/2015 at 01:58 pm # Reply

Hello! My tax amounts for all three quarters are lower than the mandatory insurance contributions and, accordingly, no advance payment was paid. And according to preliminary calculations for the year (Q4), it turns out that the amount of calculated tax (6%) is also less than the mandatory contributions made during the year. In this case, is tax paid for the year and how will it be calculated then?

Natalia 12/16/2015 at 2:25 pm # Reply

Natalya, good afternoon. If the amount of paid fixed contributions is greater than the amount of payment under the simplified tax system, then the tax is not paid, it is either zero or negative. Provided that you are an individual entrepreneur, without employees. In each of the periods - 1 quarter, half a year, nine months, and for the period from October to December, you pay fixed contributions, and accordingly reduce the advance payments and the final payment of the simplified tax system by their amount.

Sergey 01/18/2016 at 22:07 # Reply

Hello Natalya. Tell me what to do. I am an individual entrepreneur on the simplified tax system, 6% income from the account. without hired ones. As far as I know, I am required to receive payment for cargo transportation via cash account. cashless Can I receive payments to a personal bank card as an individual and show these receipts as additional income, or should I switch to another type of taxation? Thank you.

Natalia 01/19/2016 at 10:42 am # Reply

Sergey, good afternoon. If an individual entrepreneur accepts payment by bank transfer, he must open a bank account as an individual entrepreneur. The bank transmits information about this account to the Federal Tax Service. You cannot accept funds from business activities onto your personal bank card. Systematic additional income requires you to register as an individual entrepreneur. If you provide services to the public, then even using the simplified tax system you can accept cash by issuing a strict reporting form to the client. You can also install a cash register, and then you can accept cash from both the population and legal entities (LLC). Even if you change the simplified tax system to UTII, you will be able to work with legal entities in the same way as with the simplified tax system - non-cash payment at the expense of individual entrepreneurs or cash payment through a cash register.

Svetlana 01/27/2016 at 09:48 pm # Reply

Good evening, Natalya! IP opened from 4Q. without employees, revenue 44 thousand. the amount of fixed contributions is 6122.00. Do I understand correctly that the tax due is zero or can I reduce the amount of calculated tax by no more than 50%?

Natalia 01/28/2016 at 04:35 pm # Reply

Svetlana, good afternoon. You understood everything correctly. 44000 x 6% = 2640 - 6122 = less than 0. You do not have the simplified tax system.

Svetlana 02/04/2016 at 01:49 pm # Reply

Natalya, when I pay advance payments and I suspect that almost the whole year I will be able to reduce the entire tax on contributions to the Pension Fund, in general there will be zero payable, how does the tax office look at this?

Natalia 02/04/2016 at 01:58 pm # Reply

Svetlana, good afternoon. This is a legal norm, especially since you document your income by filling out the KUDiR based on primary documents. Individual entrepreneurs who use the simplified tax system for income minus expenses have the concept of a minimum tax of 1% of income if expenses exceed or equal income. Individual entrepreneurs have no such concept of income and are not required to pay the minimum tax. You pay the amount of the simplified tax system on the basis of (income x 6%) - fixed payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Anastasia 03/07/2016 at 11:37 # Reply

Good afternoon. Tell me, if the amount of fixed contributions paid per quarter is greater than or equal to 6% of my income, then I will not pay tax under the simplified tax system. And then what ? Every quarter I will contribute 5 and a kopeck to the funds and that’s it? Or, in addition to this amount, another 23 thousand at the end of the year? Or only 23 thousand?

Natalia 03/08/2016 at 09:47 # Reply

Anastasia, good afternoon. You are required to contribute to the funds, regardless of whether you have income or not. In 2020, for 12 months, this amount is equal to 23,153.33 rubles. If the amount of the simplified tax system, in your case 6% of income, is less than or equal to the amount of fixed contributions, you will have 0 for the simplified tax system, you do not have to pay it. You can pay the amount 23153.33 in installments, or you can pay it one time until 31.12. If you pay in installments quarterly, then you can reduce the advance payment of the simplified tax system by this amount. In addition to this amount, you do not have to pay 23 thousand at the end of the year. If your annual income exceeds 300 thousand rubles per year, then to the Pension Fund you will have to pay 1% of the difference between the annual income and 300 thousand rubles.

Olga 03/28/2016 at 08:04 pm # Reply

Good evening! Since 2014, the Pension Fund has introduced a tax of 1% on amounts exceeding 300,000 rubles. income for the year. I have paid this tax. Is it possible to deduct this amount paid from the simplified tax system along with the amount of fixed contributions? I have a simplified tax system of 6%.

Natalia 03/29/2016 at 09:24 # Reply

Olga, good morning. You have the right to reduce the simplified tax system for the amount of contributions paid to the Pension Fund and the Federal Compulsory Medical Insurance Fund. The 1% you paid on an amount exceeding 300,000 rubles of income per year can be deducted from the simplified tax system for the period during which you paid this amount. Those. if you paid 1% during the 1st quarter of 2020, then the advance payment of the simplified tax system for the 1st quarter of 2020 can be reduced by the contribution you paid in the amount of 1%. If you paid before December 31, 2015, you can reduce the simplified tax system for 2020.

Angela 03/31/2016 at 15:13 # Reply

Natalya, good afternoon, please tell me if I have 7,700 tax due on the simplified tax system, and 18,000 in contributions. I can show 7,700 in the contribution declaration, so as not to pay tax and there will be no overpayments in the report. Or is it better to pay at least 100-200 rubles so that there is less digging?

Natalia 07/03/2016 at 23:05 # Reply

Angela, in your declaration you indicate not the actual amount of contributions paid, but the amount of insurance premiums that reduce the amount of the calculated advance payment for the tax period. You don’t have to pay anything extra and you won’t have any overpayments on your report. You had to pay contributions in 2020 - to the Pension Fund 6204 x 26% x 12 = 19356-48; in the Federal Compulsory Medical Insurance Fund 6204 x 5.1% x 12 = 3796.85. Total 23156-06, if you have registered as an individual entrepreneur since the beginning of 2020. Check if you calculated -18,000 rubles correctly. In any case, the amount of your fixed contributions exceeds the amount of tax, therefore you do not have to pay the simplified tax system.

View all Next »