Features of OKVED

This classifier does not take into account:

- form of ownership of the business entity;

- his OPF and attitude towards a particular department;

- there is no division into trade within the country or outside its borders.

What are the OKVED codes?

The OKVED codifier contains in its structure almost all types of work and services legally permitted in Russia.

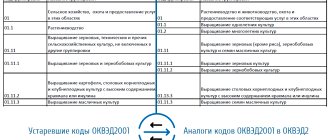

Since there are a large number of encodings in the list, for practicality and ease of use there is a certain structure:

- X X. – class;

- X X. X. – subclass;

- X X. X X. – group;

- X X. X X. X. – subgroup;

- X X. X X. X X – view.

Internally, the encoding from class to view is separated by a dot character.

How the code is assigned

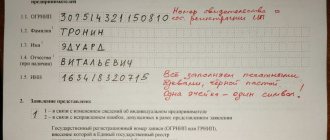

- When creating a legal entity or individual entrepreneur, each of these entities must think over the type of its activity and clarify it in the classifier.

- Then, when applying to the Federal Tax Service for state registration of the status of an individual entrepreneur or legal entity, this code must be indicated in the application for registration. The selected encodings will be assigned to the specified persons and will be entered into unified registers for legal entities or individual entrepreneurs.

- The number of selected values from OKVED cannot be more than 50. Among them, you need to choose the main one, according to which the revenue will be at least 60% of the amount of income received from this activity.

Attention!

- There are OKVED codes under which it is necessary to license your activities, therefore, having chosen such a code, you must apply for a license to the appropriate structure.

- From July 4, 2013, applicants must indicate the code in their applications to the Federal Tax Service in at least a 4-digit format.

What is it used for?

- calculation of the amount of taxes, fees, duties for individuals and legal entities;

- systematization and ordering of types and types of activities in various areas;

- significantly simplifies the classification of a huge number of types of economic activities;

- for statistical observations;

- for analytical purposes, for making economic forecasts.

Chapter

Codifier sections begin with "A" and end with "Q". In turn, they contain subsections.

List of current sections:

- “A” – the sphere of agricultural activity and forestry economics.

- “B” – fish farming, fishing.

- “C” – extraction of minerals.

- “D” – occupation in the field of processing.

- “E” – production and distribution of water resources, gas and electricity;

- “F” – activity in the field of construction.

- “G” – sale of cars, their repair, as well as repair of household appliances.

- “N” – entrepreneurship in the field of restaurant business and hotels.

- “I” – the sphere of transport and communications.

- “J” – financial.

- “K” – real estate transactions.

- “L” – public administration and military security.

- “M” – educational activity.

- “N” – social services, healthcare services.

- “O” – public services, social services.

- “R” – housekeeping services. farms.

- “Q” – extraterritorial activity.

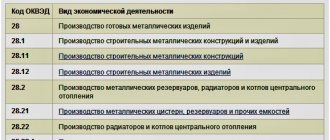

For example:

- Section “A” is associated with forestry and agricultural activities, hunting. “A” has a subsection “AA”, which in turn contains classes, subclasses, group, subgroup, type:

- 0 1 – rural farming, hunting and provision of services in these areas.

- 0 1. 1 is growing plants.

- 0 1. 1 1 – specifically: grains, and other...

- 0 1. 1 1. 1 – details: grains and legumes.

- Section “C” – we are talking about the industry in which various minerals are mined. "CA" - fuel and energy

- 1 1. 1 – gas and oil production.

- 1 1. 1 0 – oil and gas production.

- 1 1. 1 0. 1 – ext. crude oil and petroleum. gas;

- 1 1.1 0.1 1 – decanting, etc.

- Section “D” – processing. production.”DM” – production transport. funds and equipment.

- 34. 1 – car production.

- 34.10 – car production.

- 34. 1 0 . 1 – production of internal combustion engines for cars.

- Section "E" - creation and distribution. electricity, gas and water.

- 40. 1 – Production, transmission and distribution. electricity.

- 4 0. 1 0 – Producing, transmitting and distributing Electricity

- 4 0. 1 0. 1 – Electricity production.

Name

Each section contains its own transcript. For example, “G” is the wholesale and retail trade of cars and motorcycles, their repair, repair of household appliances and personal items.

"G" contains sections 50 through 51.1.

Let's consider code 50 - trade in auto and motorcycle equipment, their maintenance and repair.

Divided into:

- 50. 1 – sale of vehicles;

- 50. 2 – car maintenance;

- 50. 3 – trade in auto parts, components, assemblies;

- 50. 4 – sale of motorcycles, parts from them, their repair and maintenance;

- 50.5 – as well as fuel for internal combustion engines at retail.

50. 1 is subdivided into 5 0. 1 0. – trade in motor vehicles.

50. 10 (sale of new and used vehicles) includes:

- cars, pickups and small vans;

- buses, minibuses;

- trucks, special cargo vehicles, special vehicles;

- tractors, trailers and semi-trailers;

- tourist vehicles;

- all-terrain vehicles (SUVs, etc.).

50.10 divided into sales:

- 50. 10. 1 – wholesale vehicles (transport from category 5 0. 1 0)

- 50. 10. 2 – retail cars (vehicle category 50. 10)

- 50. 10. 3 – cars through agency agreements (50. 10)

General rules for selecting code for doing business

The concept OKVED stands for a classifier of types of economic activity. It is approved by the Federal Statistics Authority and has nationwide significance. The OKVED list contains all types of activities classified into classes, subclasses and groups. Decoding the code gives an idea not only of the main activity in which the company is engaged, but also of the group and class in which it is included.

The codes chosen by the entrepreneur affect many aspects of the activity:

- The business owner has the opportunity to legally operate

- Formation of a tax base based on the sphere of employment.

- Determining the scope of reporting.

To select a code when registering a business, it is recommended to follow simple instructions:

- Decide what the company will do. For example, this will be retail sales of goods for children, clothing.

- Next, you need to establish the place where the trade will take place - using the example in your own store.

- In such a situation, 47.71.1 is selected, which denotes retail sale of clothing in specialized stores. This includes any type of clothing, including men's, women's and children's.

- Next, you need to fill in the details, since the sale of sportswear and underwear will have different code numbers.

- It is recommended to write down all types of activities that the company will engage in and the codes for them. It is important to note that for each code you need to see if a license is required.

- The code must consist of at least four digits. All subgroups are included in it automatically.

- Then you need to choose your main activity. There can only be one. It is important to indicate the one that will bring the most profit.

If the company has not indicated the main direction of employment within the established time frame, the Social Insurance Fund will determine it independently based on the income received by the company. Tariffs for insurance premiums for employees depend on the main type of activity.

For reference! The law does not limit entrepreneurs in the number of codes. But it is recommended to indicate no more than 20. In practice, most often there are 5-6.

The OKVED structure for retail trade may look like this. In the example, the number 9 indicates the value in the code:

• 99. - class;

• 99.9 - subclass;

• 99.99 – group;

• 99.99.9 – subgroup;

• 99.99.99 – type of activity.

The more symbols in OKVED, the more detailed the activities of the enterprise are deciphered. But lawyers do not recommend specifying codes in too much detail, so that they do not have to be redone if changes occur in one area. For example, an individual entrepreneur sold retail meat and fish, but decided to sell fruit, he will need to redo the code in detail.

The statistics service is responsible for assigning codes and maintaining the register.

Rebus Company

Street trading is carried out only with the permission of local authorities, which must consider the compliance of the selected trading location with the criteria provided by law.

We recommend reading: Subsidy for Large Families in 2020

No. Trade by accepting orders by telephone cannot be classified as stationary or non-stationary trade, including delivery or delivery trade. Trade carried out by accepting orders for goods by telephone with subsequent delivery of goods to customers refers to trade in goods based on samples and catalogs

.

Wholesale trade of household goods

The OKVED code for household goods for wholesale trade is selected as follows:

- find section “G” in the classifier;

- go to class "46".

In class “46” for the wholesale sale of household goods, you can choose the following OKVED encodings:

- 46.15 – household goods, hardware, cutlery and other metal products;

- 46.16 – textile products;

- 46.18 – other goods;

- 46.19 – universal assortment of goods;

- 46.40 – non-food consumer goods.

OKVED code for electrical goods is 46.43. By choosing this encoding, an individual entrepreneur or organization will be able to wholesale trade in electrical household appliances, optical equipment, etc.

Read also: List of licensed activities 2020 according to OKVED

How to choose a section?

When starting to register a business, you need to choose the right OKVED codes.

In order to do this, you need to select a section and subsection according to the description, and in the subsection itself, decide on the desired type of activity. To submit a correct application for registration, you need to use only those codes that have four characters or more. Applications containing three-digit codes will not be accepted.

The number of codes that can be specified is unlimited. But you need to choose some main category of activity, since it is from this category that the percentage of revenue must be at least 60% of the total income in this type of activity.

For example, according to OKVED, retail trade in non-food products can be carried out both through retail outlets and through wholesalers.

Retail trade through multi-purpose stores are subclasses of OKVED 47.1 - OKVED 47.7. Retail trade carried out outside stores – OKVED 47.8 and OKVED 47.9.

Classifier of OKVED codes 2017

The All-Russian Classifier of Types of Economic Activities (OKVED 2) is part of the National Standardization System of the Russian Federation. OKVED 2 is intended for classification and coding of types of economic activities and information about them.

OKVED 2 uses a hierarchical classification method and a sequential coding method. The code designation for identifying groups of types of economic activity consists of two to six digital characters. Its structure can be presented as follows: XX class XX.X subclass XX.XX group XX.XX.X subgroup XX.XX.XX species

We recommend reading: New law on apartments 2020 in Armenia

Abstract for one topic: retail trade 2020

Retail trade organizations can place products as demonstration samples and use them for window displays. In the process of such exploitation, these goods lose their consumer properties.

The new edition of the Rules for the sale of goods in retail trade by sample contains a list of information that the seller must provide to buyers before concluding a retail purchase and sale agreement and at the time of delivery of goods. The seller should do this in full and in a certain way, otherwise, at the time of delivery of the goods, the “uninformed” buyer has the right to refuse to purchase the goods without reimbursement of the costs associated with their delivery.

OKVED for flower trade 2020

- To work, you will need shelves for goods; allocate about 30,000 rubles for this.

- Buy 3 office chairs, their total cost is 10,000 rubles. You also need an office table for employees; it is best to buy 2 tables at once. This is another 10,000 rubles.

- To operate a flower kiosk, you need flower vases and all kinds of stands. Don't forget about consumables. Allocate approximately 25,000 rubles for this.

- Retail outlets near public transport stops, places in shopping centers and stalls in markets. The profitability of a business depends on the location. There should be a lot of people around the trading place.

- Flower boutiques where customers will be offered luxury-class products. It is worth opening in expensive shopping centers, near other boutiques. The products are aimed at wealthy buyers.

- Small shops, usually opened in business districts. Ideal location - shopping center. You can expand your range with related products. These could be soft toys, potted plants, different types of packaging and souvenirs.

- Online stores. There are very few such offers in rural areas, so this is a promising area of sales.

OKVED for flower trade 2020

In the flower business, it is suppliers who provide half the success of the business. On the decisive days of the year, on holidays, it is the supplier who will ensure emergency delivery of goods. Choose those partners who will not let you down, then your business will develop successfully.

To summarize, we can say that to start this field you need to have 75,000 rubles. It’s worth calculating expenses for 3 months at once. Don't forget about rent, its cost will vary depending on the city. If we accept that for 1 month you will have to pay approximately 60,000 rubles, then prepare 180,000 for 3 months.

Delivery and distribution trade

When spaced

food

trade can only be sold in original packaging: soft drinks, confectionery, cakes, ice cream, chocolate, bakery products. When hawking, you cannot sell medicine, jewelry, weapons, audio and video products, computer programs, or alcohol. These restrictions are established by the rules for the sale of certain types of goods, which are approved by Government Decree No. 55 of January 19, 1998.

When delivering and peddling trade, sellers are required to comply with many rules and regulations - from the law on the protection of consumer rights, sanitary and hygienic standards, rules for the use of cash registers, etc. to more private ones, which operate depending on the specific conditions of distribution and distribution trade.

OKVED 2020 – breakdown by type of activity

For organizations, the procedure for notifying about changes in OKVED codes will depend on whether the relevant types of activities are indicated in the Charter. Please note that if the list of types of activities contains an indication of “... other types of activities not prohibited by law” (or something similar), then there is no need to make changes to the Charter. Changes in OKVED codes without changing the Charter are reported using form P14001.

But here you need to be careful. The fact is that the calculation of contributions for workers for insurance against industrial accidents and occupational diseases occurs according to the tariffs for the main type of activity. The more risky (traumatic or provoking occupational diseases) the activity is, the higher the insurance premium rate.

Current OKVED codes for 2020

ATTENTION! Example: if you are involved, for example, in clothing (sale, manufacturing, etc.), enter “CLOTHING” in the field, and the script will display ALL OKVED codes that are associated with clothing. That is, mentions of clothing in all cases. Try it, it's convenient!

- When choosing OKVED codes, future businessmen, in particular the founders of an LLC, should remember that there must be a 100% coincidence of the types of activities specified in the application and those indicated in the charter, otherwise tax officials can easily refuse registration. But even if the initial stage of registration with the tax service is completed successfully, problems may well arise when opening a bank account, since bank employees check documents no less carefully;

- The law does not in any way limit the number of OKVED codes included in the application for registration of an enterprise. Therefore, businessmen often enter not only those specific types of activities that they actually plan to engage in, but also those that they envision only in theory. The accumulation of codes from the classifier included in title documents entails a number of dangers. Let's give just one fairly common example: some types of activities may be subject to a special UTII tax regime, and in such cases, tax authorities may require an entrepreneur or organization to submit separate reports on them. Thus, experts advise holding back and not adding more than two dozen OKVED codes to the constituent documents and, when choosing them, carefully study the features of each type of activity, including from the point of view of tax legislation;

- It is extremely important to correctly understand and interpret the names of the types of activities listed in OKVED. Otherwise, an incident may arise in which the most necessary and relevant type of activity will not be included in the state register for a given organization or individual entrepreneur. The consequences of such an incident are unpleasant. Firstly, if necessary, it will be impossible to obtain a license, and secondly, it will be impossible to switch to UTII, which operates for strictly defined types of activities at the local and municipal level.

We recommend reading: What is required for a third child in the Krasnodar Territory in 2020

Outbound trade code OKVED 2020

- wholesale trade in agricultural machinery and equipment, such as: plows, fertilizer spreaders, seeders, harvesters, threshers, milking machines, poultry keeping equipment, beekeeping equipment, tractors used in agriculture and forestry

- retail sale of goods such as personal computers, stationery, paints or wood, although these products may not be suitable for personal or household purposes. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging

We recommend reading: What is required of a Young Family by the State in 2020