Do you need a legal entity to run a vending business?

Certainly. Any business activity requires a legal entity. As a rule, they choose an individual entrepreneur or LLC (for a beginner this is easier and more convenient). Moreover, it is easier to open an individual entrepreneur, but more difficult to close. But with an LLC it’s the other way around – it’s more difficult to open, but easier to liquidate.

If you do not understand the intricacies of registering a legal entity, it is easier to contact a law firm. It’s inexpensive (about 10,000 rubles), but they’ll do everything right the first time, you won’t have to redo anything, resubmit documents, etc. In general, a minimum of body movements.

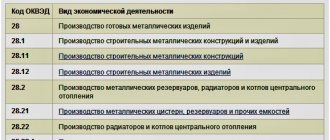

Decoding OKVED codes and their classification 2020

Classifier of OKVED codes 2020 Classifier of OKVED codes 2020 is an all-Russian classifier that defines types of economic activity. Its codes are used if a company wants to change the type of activity.

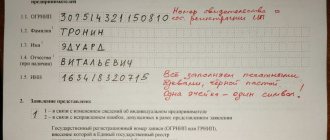

According to the new order of the Russian standard, the official entry into force occurred on July 11, 2020. In accordance with the rules of OKVED, regardless of the form of ownership and source of investment, the classifier is the same for everyone, so it is important to take this into account when registering. Any person who wants to start their own business must register as an individual entrepreneur and indicate the type of activity in accordance with the OKVED 2020 code classifier.

Beginning entrepreneurs face difficulties due to a lack of knowledge on the use of OKVED and its practical purpose. As a result, they have many questions related to specifying the activity code.

What inspections of vending machines can there be from the state?

In our experience, tax authorities have never inspected vending machines. Perhaps the only authority that may be interested in you is the SES, and then only based on a private complaint from a client or when the machine itself is in complete disrepair.

In fact, in 100% of cases, if clients have any complaints, they will not bother contacting any authorities, but will go straight to the landlord. So what you should be more afraid of is not the tax authorities, but the loss of a profitable place if you do not take care of the maintenance of the machine and do not maintain its performance.

What documents do you need to have when checking?

It is advisable to have certificates for the products that you sell through the machine. But the machines themselves do not require certificates. You can do them, but according to the law, certification is voluntary. Rather, this can be used for a PR move (you can actively tell the lessor that your machine is certified, tested, etc.).

The importance of the correct choice of OKVED for vending

For example, when registering an individual entrepreneur, an entrepreneur declared the type of activity “retail trade” and the use of the simplified tax system. In the process of work, balances of funds were formed in his bank account, on which the bank accrued interest under the terms of the agreement. Income arose in the form of the amount of accrued interest. This type of activity was not declared when registering an individual entrepreneur. Having considered this situation, the Ministry of Finance came to the conclusion that these %% are a direct consequence of the implementation of individual entrepreneurial retail trade and are subject to taxation by the simplified tax system.

Another situation: for simplicity, let’s take the same individual entrepreneur. He issued the remaining money at his disposal as a loan at %% (it doesn’t matter to whom, it’s important that it’s in a non-cash manner, that is, this operation is completely transparent to controllers). It would seem, how does this money differ from account balances? After all, they were also formed by individual entrepreneurs as a direct consequence of their retail trade using the simplified tax system. But, nevertheless, in this case, the Ministry of Finance came to the conclusion that this is a completely independent type of economic activity of this individual entrepreneur

. And since it was not declared as such, it is subject to taxation not according to the simplified tax system, but according to the OSN, that is, personal income tax at a rate of 13%.

The logic here is as follows: income from activities falling under the type of activity specified by the individual entrepreneur upon registration or as a result of making appropriate changes to the Unified State Register of Individual Entrepreneurs is recognized as income received from business activities. Accordingly, a simplified tax system is applied to them. All other income is personal income and is subject to personal income tax. And although this practice is somewhat contrary to the law, nevertheless, it must be taken into account so that you do not have to defend your case in court.

As for organizations (LLC, CJSC, OJSC), by virtue of clause 2 of Article 2 of the Federal Law of 02/08/98 N 14-FZ “On Limited Liability Companies”, the company may have civil rights and bear the civil responsibilities necessary to conduct any types of activities not prohibited by federal laws, unless this contradicts the subject and goals of the activity. In addition, the company has the right to engage in any type of activity that is not prohibited by law and in accordance with the Civil Code of the Russian Federation (clause 1, article 49).

Hence the conclusion: the discrepancy between the declared and actual activities does not entail tax consequences for the LLC

, since the Law does not oblige the company to stipulate in the charter all types of activities it carries out.

However, in practice, tax authorities often deny companies, for example, a VAT deduction if the services provided by counterparties do not match according to OKVED

with the types of activities specified in their constituent documents. The courts, as a rule, take the side of the taxpayer in such situations, but we believe that it is easier to provide for the necessary types of activities in your OKVED than to then defend your case in court.

Are there any other legal dangers?

None. The only real danger is working without a legal entity. However, if you have friends with a registered legal entity, you can “hide behind” them for some time.

If you have any other questions related to taxes and audits, you can write this through the Contact comments at the end of the article.

If you liked the article, join our VKontakte group

Join the Supervending group

Return to list

When you work “for an uncle,” everything is familiar and understandable. And, as they say, “by contradiction,” independent business seems to people like something scary and dangerous. It seems to half of the beginning businessmen: one mistake - and you are already being escorted, and your apartment is being written off as debts. Everything is not so scary and far from so difficult. Here are the most common questions that plague new vendors.

Do you need a legal entity to run a vending business?

Certainly. Any business activity requires a legal entity. As a rule, they choose an individual entrepreneur or LLC (for a beginner this is easier and more convenient). Moreover, it is easier to open an individual entrepreneur, but more difficult to close. But with an LLC it’s the other way around – it’s more difficult to open, but easier to liquidate.

Vending business on a simplified taxation system

When switching to UPS, an entrepreneur can choose the most profitable mode option for his business:

- income – 6% tax is charged on the amount of income;

- income minus expenses - deductions are 15% of revenue minus expenses.

The main advantage of the “simplified tax” over UTII is the dependence of the tax amount on income. With small revenues, the tax also becomes less, while in the case of “imputation” its size remains fixed regardless of the profitability of the business.

Vending (vending machines)

If you do not understand the intricacies of registering a legal entity, it is easier to contact a law firm. It’s inexpensive (about 10,000 rubles), but they’ll do everything right the first time, you won’t have to redo anything, resubmit documents, etc. In general, a minimum of body movements.

What form of taxation should I choose when registering a legal entity?

It all depends on the region. For Moscow – simplified (6% of revenue). For regions - UTII or patent. Here, again, it is useful to take advice from a company that will help you with registration. They know all the intricacies and will be able to suggest the most convenient system. Often, such companies also provide remote accounting services - that is, they can draw up a balance sheet for you for a very reasonable fee.

Do I need to install a cash register?

No, if you trade through machines, then by law you do not need a cash register.

Does each machine need to be registered with the tax office?

No, it is enough to register a legal entity and submit general reports.

What inspections of vending machines can there be from the state?

In our experience, tax authorities have never inspected vending machines. Perhaps the only authority that may be interested in you is the SES, and then only based on a private complaint from a client or when the machine itself is in complete disrepair.

In fact, in 100% of cases, if clients have any complaints, they will not bother contacting any authorities, but will go straight to the landlord. So what you should be more afraid of is not the tax authorities, but the loss of a profitable place if you do not take care of the maintenance of the machine and do not maintain its performance.

What documents do you need to have when checking?

It is advisable to have certificates for the products that you sell through the machine. But the machines themselves do not require certificates. You can do them, but according to the law, certification is voluntary. Rather, this can be used for a PR move (you can actively tell the lessor that your machine is certified, tested, etc.).

What information should be included on the vending machine?

According to the consumer protection law, the following information must be provided:

Owner details (IP or LLC)

Contact number

User manual

Do you need permits or licenses to carry out business activities in vending?

No, no special licenses are needed. But it is advisable to keep the already mentioned certificates at hand.

How often do you need to submit reports to the tax office?

USN (simplified 6%) is submitted once a year. Under the UTII or patent system, all reporting is submitted when a patent is issued. The report to the pension fund and social insurance fund (PFR and FSS) is submitted every quarter and must include information on all employees of the company - starting from you, as the owner, and ending with all employees registered within the legal entity. That is, even if you have an individual entrepreneur in which only you are listed, you also need to submit a report.

What type of activity (OKVED) is suitable for vending?

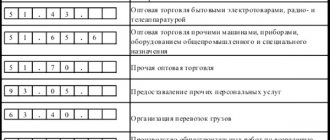

There is no special code for vending activities, but you can choose a close one - 52.63. Other retail trade outside stores or 52.48. Other retail trade in specialized stores.

Are there any other legal dangers?

None. The only real danger is working without a legal entity. However, if you have friends with a registered legal entity, you can “hide behind” them for some time.

has been operating since 2012. The main specialization is the sale of equipment for maintaining the drinking regime at large industrial enterprises in Russia:

Who should use the simplified tax system in the vending business?

The simplified tax system is the most popular taxation system for the vending business, which involves paying one tax quarterly, in advance payments. With this system, an entrepreneur needs to submit reports only once a year.

Tax under the simplified tax system is calculated on profit (about 15%) or income (6% of revenue). A simplified taxation system can be used by entrepreneurs whose annual business income does not exceed 120 million rubles.

The simplified tax system for income is excellent for vending with high profitability and low revenues. As a rule, this applies to businesses related to the sale of cheap goods through vending machines.

Vending in the legislation of the Russian Federation - 2020

The concepts of “vending” and “vending business” have entered our lives relatively recently.

In Russia, as in Western countries, there is no whole law that would regulate business activities through sales using vending machines.

But . In our country, several codes, laws, and regulations in one way or another affect vending and regulate activities related to it.

Required! The vending business is, first of all, an entrepreneurial activity aimed at making a profit. The status of an individual entrepreneur or legal entity, be it LLC, JSC or other forms, is required. According to the law, as a private individual you cannot legally engage in the vending business.

A state registration procedure is required. No additional documents are required to start a vending machine business. After receiving legal status and purchasing your first machines, you will enter into legal relations with the owners of retail outlets.

Depending on the form of work, it will be rent, commission or delivery. First of all, these relations must be supported by the mandatory conclusion of contracts with the most detailed indication of the rights and obligations of the parties. It is worth paying attention to the following points:

- Which party is responsible for the safety of vending machines?

- Maximum detail of the contract.

- Sequence of actions of the parties: details of rights and obligations.

The more detailed and detailed the contract is drawn up on paper, the more it will happen.

From the moment the vending machines are installed and sales begin, the entrepreneur enters into a new legal relationship - this is purchase and sale. The bottom line is that a legal entity carries out retail trade through a machine. The sale of goods using vending machines is regulated primarily.

The article states that “in cases where the sale of goods is carried out using machines, the owner of the machines is obliged to provide buyers with information about the seller

Vending: how to start a successful business in 2020

Vendings, as a full-fledged sales channel, sell goods of different purposes and prices - from groceries and hot coffee to ties, equipment and alcoholic beverages.

No additional documents are required to start a vending machine business. After receiving legal status and purchasing your first machines, you will enter into legal relations with the owners of retail outlets.

We recommend reading: Lenin Tax Inspectorate of Saratov official website

According to statistics, in Western countries the number of vending machines already exceeds 6 million units. Japan is considered the leader in the vending trade, with more than 20 buyers per vending machine. In Russia, vending trade is just beginning to develop.

For example, there are no more than 2,000 customers per vending machine. The number of machines and the list of goods and services offered through them are also not yet diverse. But the share of “smart” machines equipped with telemetry, a device for cashless payments and other digital tools is gradually growing. More and more machines are abandoning plastic cups and containers, moving in the spirit of the global trend to environmentally friendly types of packaging.

Sales format is growing rapidly

Vending code OKVED 2020

Activities for photocopying and preparation of documents and other specialized support activities to support the operation of the office This class includes: - copying, preparation of documents and other specialized support activities to support the functioning of the organization The activities included in this copying and printing of documents are short-term in nature This class includes: - preparation of documents; – editing or proofreading documents; – printing and word processing; – secretarial services; – document rewriting and other secretarial services; – writing letters and resumes; – rental services for mailboxes and other postal and parcel services, for example, pre-sorting, writing addresses, etc.; – photocopying; – production of duplicates; – photocopying; – other document copying services (without printing services, for example offset printing, fast printing, digital printing, pre-press services) This group does not include: – document printing (offset printing, fast printing, etc.), see OKVED code 18.12 ; – provision of pre-press services, see OKVED code 18.13; – development and organization of postal advertising campaigns, see OKVED code 73.11; – activities in the field of shorthand and postal dispatch, see OKVED code 82.99; – public stenography services, see OKVED code 82.99 OKVED-2 – New classifier of economic activity codes.

— Consulting on computer hardware 72.20.

The indication of OKVED Code 82.19 Subclass 82.1 Section N of Class 82 is necessary when registering legal entities and individual entrepreneurs, also the indication of OKVED Code-2 82.19 Subclass 82.1 Section N of Class 82 is necessary when changing types of activities. OKVED Class 82.19 Section N - decoding and detailed description.

Okved for individual entrepreneurs for vending machines for 2020

— — OKVED codes in our registration application will reflect the areas of activity in which your business will be conducted.

You must specify at least one such code that will be considered the main one. For vending in 2107 you need to indicate the code: 47.99.2

“Activities related to trading through vending machines”

.

If, in addition to vending, the organization plans to conduct other types of business, it is necessary to indicate OKVED codes for each new type of activity. The number of codes is not limited, you can even write out the entire classifier, but of course you shouldn’t do this. By specifying codes “just in case,” you can select those that require additional documents (for example, a certificate of no criminal record).

updated OK 029-2014 (NACE Rev.

We recommend reading: Benefit for the birth of the 3rd child in the Khabarovsk Territory

2). All-Russian classifier of types of economic activity" (approved by Order of Rosstandart dated January 31, 2014 N 14-st) (ed. UTII, USN, Patent)

- OKVED code: Plumber, welder (UTII, USN, Patent)

- OKVED code: Programming, development and testing. (USN)

- OKVED code: Selling links from a website (STS)

- OKVED code: System administration (sysadmin) and PC repair (USN)

- OKVED code: Promotion, website promotion (SEO, CEO) (USN)

- OKVED code: Design (interiors, architecture, land management) (USN)

- IT and Internet

- OKVED code: Freelance, design (Internet, advertising) (USN)

- OKVED code: Website creation and development (USN)

Currently there is a list of OKVED codes version OK 029-2001 (NACE edition 1).

This list is valid until January 1, 2020. Since the classifier does not have an unambiguous OKVED for vending, we also recommend contacting your Federal Tax Service on this issue.

Let's consider questions about OKVED codes received from users of the Taxcon.ru system in 2013 -2014.

1. What OKVED codes should be used for coffee machines, namely to work with machines for selling/preparing drinks: coffee, tea, chocolate, lemonade, oxygen cocktail, etc.? What OKVED codes need to be added when working with a vending machine for selling sparkling water on tap?

It would seem that code 52.25.2 suggests itself here - “Retail sale of non-alcoholic drinks.”

Vending OKVED 2020

The Russian Federation has been granted this right until July 1, 2020, with the exception of organizations engaged in trading activities (my comment: that is, the deferment does not apply to LLCs with trade), as well as individual entrepreneurs engaged in trading activities with the involvement of employees (my comment: that is, there will be no deferment for trading individual entrepreneurs with employees).

Based on the text of the Order, all individual entrepreneurs without employees will receive a deferment until 07/01/2020, regardless of whether they are engaged in trade or provide services.

I will say more, the order contains no restrictions on taxation systems, so even those vendors who work on the simplified tax system have a great chance of delaying the installation of online cash registers until 2020.

Thank you for your attention. They began using the new devices last summer. The bulk of the business was obliged to switch to the new payment procedure from July 2020.

For individual entrepreneurs and organizations conducting activities related to trade through vending machines, the legislator has established the following deadlines for the transition to online cash registers. Table No. 1. Time frame for the transition to online cash registers for the vending business from July 1, 2020 from July 1, 2020 Organizations running a vending business (regardless of the presence of employees) Individual entrepreneurs engaged in vending without the involvement of hired workers Individual entrepreneurs conducting this activity with the involvement of hired workers How As can be seen from the table, only entrepreneurs operating without the involvement of personnel received a deferment for a year, until July 2020. The rest of the vending business must switch to online cash registers this summer.

Currently, a bill is being considered in the State Duma that establishes a number of changes affecting the operation of vending services with online cash registers.

After the Federal Tax Service Inspectorate receives the application, it will assign a registration number to the cash register, which will need to be entered into the fiscal drive.

- Fiscalization of the cash register

After the registration number of the cash register is received from the tax inspectorate, it will need to be entered into the fiscal drive (FN) along with other information: name of the organization or full name of the individual entrepreneur, TIN, address of the location of the cash register (settlements), data on the OFD and taxation system .