Almost every second entrepreneur in his activity is faced with the need to change some data in his official documents. The most common change that needs to be made to tax office documents is editing or adding OKVED codes.

Surely tax officials are not always willing to explain how to correctly fill out forms with new information. But you don’t have to hang your nose right away! The task ahead of you is not that difficult. True, if you use the clear step-by-step instructions that are attached below. But, as usual, first we place the necessary files:

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

In what cases is it necessary to make changes to the registry documents?

So, let's take it in order. When information about your last name, place of registration, series and passport number changes, it is not necessary to inform your tax inspector about this. An exchange of updated data has been established between the tax authority and the Federal Migration Service. Therefore, in the Unified State Register of Individual Entrepreneurs, a new surname and place of residence appears automatically , without your petition (according to the norms of RF Law No. 129-FZ, Chapter II, Article 5, Clause 4).

Of course, when changing the type of business activity, it is necessary to make amendments to the register of individual entrepreneurs. To do this, it is not necessary to use the services of a lawyer who will draw up the documents for you, but will ask for Bank of Russia tickets in return. It is quite possible to update information for the tax office on your own, especially since it is not at all difficult.

A little about activity coding

OKVED is the All-Russian Classifier of Types of Economic Activities. Simply put, it is a directory in which all types of activities are listed and collected into different groups. The directory has a hierarchical structure, each level of which corresponds to a digital designation.

There are 17 sections in OKVED, each of them has several classes - they are designated XX. Classes are divided into subclasses, subclasses into groups, which in turn are divided into subgroups. The last link of the classifier is the type, the code of which consists of 6 characters and looks like this: XX.XX.XX.

When an individual entrepreneur registers his activities, he selects OKVED and enters them into the application in form P21001. This information goes to the Unified State Register of Individual Entrepreneurs. Some entrepreneurs immediately choose codes with a reserve because they plan to expand their activities in the future. But many are determined only with current codes, because you can add OKVED for individual entrepreneurs at any time when the need arises.

Free selection of OKVED

And now step-by-step instructions for 2020, which will help entrepreneurs supplement the types of activities chosen during registration. It will also be useful for those individual entrepreneurs who want to exclude unnecessary codes from the Unified State Register of Individual Entrepreneurs or simply change the main OKVED.

Sample of filling out form P24001

Download the current form P24001 (links to files at the top of the page). Using Adobe Reader or any other program that can work with PDF files, open it and start studying. Then you need to print it out to fill out manually, or you can fill it out directly in the file and print out the finished document, which you only have to sign. The second option is easier to complete by downloading the application in .xls format and editing the document using Excel.

Note! The tax office accepts applications filled out only with a pen and black ink (this is if you chose to fill it out manually). Forms with blue, purple and other color spectrum entries will not be accepted!

Enter information in as legible handwriting as possible - in block capital letters. If you are an advanced PC user, try filling out the form using the editor. Tax authorities advise doing this using the Courier New 18 font.

You must sign a printed document with all the information manually in the presence of the inspector who will accept your application for consideration.

Below, in real photographs of the application for making changes to the individual entrepreneur in the Unified State Register of Entrepreneurs, a sample of filling out form P24001 is presented. Only those pages that need to be filled out by an individual entrepreneur - a citizen of the Russian Federation - are presented. All other sheets, accordingly, must be filled out by a citizen of another state and/or having a place of residence other than the Russian Federation.

Stage 1

We enter OGRNIP (number of the certificate of registration of an individual as an individual entrepreneur). All cells in this field must be completed. Next - full name in block letters, in black ink. And Taxpayer Identification Number. We remember the basic postulate of manually filling out such documents: one cell - one character.

Stage 2

We fill out Sheet E, page 1 when the data of OKVED codes into the Unified State Register of Individual Remember, the OKVED code must contain a minimum of 4 digits, a maximum of 6. There is no need to put dots - they are already on the form.

Stage 3

Sheet E. Page 2. To be filled in if these OKVED codes are EXCLUDED The filling requirements are similar. Don't forget to number the page at the top.

Stage 4

Enter your full name in block letters in black ink and below the corresponding number:

- — if documents confirming changes in the Unified State Register of Individual Entrepreneurs or a refusal to do so are issued personally to the applicant;

- - a person acting on the basis of a power of attorney;

- - send to postal address.

Please fill out the “phone” field below. You can specify both a mobile number and a landline number. We don't sign! This is done in the presence of an official at the tax authority. If you do, there will be claims and the application may be refused!

Algorithms for adding OKVED codes

In accordance with Federal Law No. 129-FZ, an entrepreneur has the right to transfer information to the Federal Tax Service at the place of registration in the most convenient way for him.

When asked how to add an activity type for individual entrepreneurs 2020, there are several options:

- submitting an application in person to the Federal Tax Service at the place of registration and receiving a response;

- sending an application and notarized copies of documents by registered mail with an inventory of the contents;

- transfer of an application through an intermediary - an individual who has a notarized power of attorney in his hands can act on behalf of the individual entrepreneur;

- filing an application through the services of a law firm;

- filling out an application on the official website of the Federal Tax Service in your personal account.

The application form will be the same in all cases. Its current electronic version can be downloaded from the tax office’s online service or the MFC website. You can obtain a paper form at any branch of the Federal Tax Service, but you must submit the completed version only to the one where the entrepreneur underwent initial registration.

How to add OKVED for individual entrepreneurs in 2020 step-by-step instructions will always be the first point of changing activities.

Filling out form P24001 manually

If an entrepreneur has the opportunity and time to personally submit information to the tax office about changing or adding new types of activity, this is quite simple to do. This government service is provided to businessmen completely free of charge. Unlike the initial state registration procedure, there is no need to pay a state fee.

We recommend you study! Follow the link:

How many OKVED codes can be specified when registering an individual entrepreneur and which ones?

To begin, the taxpayer must download and print or receive a tax application form consisting of nine sheets: the title page and appendices from A to G inclusive.

It is advisable to enter data in black ink, although blue and purple ink are acceptable, following the principle of typewritten input. All lines are filled in capital readable letters. Grammatical and spelling errors, slips, and typos are not allowed, as well as the use of a proofreader and crossing out, even if done carefully in pencil.

The first page, the title page, containing registration information about the entrepreneur is required to be completed:

- passport details;

- tax number – initial or assigned simultaneously with the registration procedure;

- a unique number in the All-Russian State Register of Individual Entrepreneurs (OGRNIP).

All data on the title page is entered in Russian both for citizens of the Russian Federation and for foreigners and stateless persons. Paragraph 2 states the reason for submitting the application. Those who intend to change OKVED codes put 1. Number 2 should be chosen by those who have found errors in the registration documents and want to correct them.

Sheets A-D inclusive are filled out by stateless persons and foreign citizens who officially reside on the territory of the Russian Federation. Citizens of the Russian Federation, whose status and place of residence remain the same, do not need to fill out these sheets.

To fill out Sheet B, foreign persons and stateless persons may need updated codes of the constituent entities of the Russian Federation and a list of officially accepted abbreviations for the names of territorial locations in 2019 (house, street, district, urban settlement, ulus, building, etc.). If you use outdated forms, the tax office may refuse to accept the application or will offer to rewrite it on the spot.

Sheets E pages 1 and 2 contain information about economic activity codes, and it is on them that the entrepreneur should dwell in more detail. In 2020, OKVED codes are entered into the register only in four-digit form.

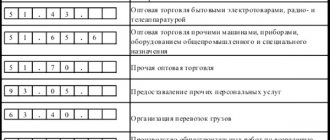

So if an individual entrepreneur - the owner of a service station wants to expand the scope of his activity by trading in automotive parts or components, he can add codes according to OKVED class 45:

- 45.31. – wholesale trade in automotive components and parts;

- 45.32. – retail trade in automotive parts and components;

- 45.40 – trade in motorcycles, their parts, assemblies and accessories.

If an individual entrepreneur only wants to add a few new codes, he fills out the title page, sheet E page 1 and sheet J. If you only remove irrelevant types of activities from the register, you need to fill out sheet E page 2, instead of page 1. If you add new types of activities and remove the old ones - both sheets E. There is no need to list OKVED codes for other types of activities.

If the individual entrepreneur decides to change the main type of activity, the old code must be entered on page 2 of sheet E, and the new code must be displayed on page 1.

On the last sheet J, a citizen of the Russian Federation, a foreigner or a stateless person, again writes his full name in Russian.

And then, in the case of personal submission of documents, he puts the number 1 in the column that describes the method of submitting documents. At the top you must enter the numbers of the pages to be filled out in the format 001, 002, etc. Blank pages of the form are not printed and are not submitted to the tax office.

You cannot sign the application in advance unless it is submitted by mail, online or through an intermediary. This will need to be done later in the presence of a tax inspector, who accepts the application and gives the entrepreneur a receipt for the accepted documents.

We recommend you study! Follow the link:

How can an individual entrepreneur change his main activity in 2020?

Submitting an application to change OKVED codes online

You can submit an application online through the official website of the Federal Tax Service in the taxpayer’s personal account. Adding OKVED for individual entrepreneurs in 2019, step-by-step instructions can be found on the tax service portal.

Identification information is automatically entered in the application, but in order to give the document legality, it must be certified by an electronically enhanced qualified signature. If there is no such signature or for some reason the individual entrepreneur does not have a personal account at the tax office, the process of adding OKVED codes may take longer and the implementation of new types of activities will have to be postponed.

If there is a signature, just as in the case of personal filing, the tax office must notify the taxpayer within five working days (in practice it happens earlier) of its decision. If the application is filled out incorrectly, it is sent back to the individual entrepreneur with notes in the lines that need to be corrected or left blank.

Submission of documents with the involvement of a third party

If an entrepreneur does not have the time or opportunity to personally deal with changes in classifier codes, he can entrust this task to his trusted individual for an agreed fee or enter into an agreement with a law firm or other organization that provides services of this kind.

The price of the service is determined by agreement, depending on the location of the office, its reputation and the speed of fulfillment of obligations under the contract. On average, the cost of changing OKVED codes on a turnkey basis can vary from 1 to 8 thousand rubles.

Only a few actions are required from the entrepreneur:

- Select an intermediary person or organization.

- Enter into a contract.

- Have the power of attorney certified in the presence of a notary.

All other actions to make changes to the Unified State Register of Individual Entrepreneurs fall on the shoulders of the authorized representative.

Nuances of entering code data

When filling in the numbers in the cells of the main activity code, keep in mind that there is only one. There are some nuances when filling out additional codes:

- the tax office will not accept a double-sided printed application from you - this is prohibited by law;

- if you only need one sheet of the form to fill out, you don’t have to print and number the blank pages of sheet E;

- record line by line from left to right;

- When adding codes in the cells of additional activities, do not enter existing ones.

So, to add new codes:

- We select the necessary digital codes with encoded information about the types of your activities according to OKVED.

- We enter them in the appropriate block of the application (sheet E page 1).

To exclude codes that have expired, in your case:

- We select individual entrepreneur activity codes from the Unified State Register of Individual Entrepreneurs (USRIP) extract.

- We enter them in the corresponding block on page 2 of sheet E.

If there is a need to leave the previous activity code, then enter it as additional on Art. 1 sheet E. in cells intended for additional codes.

Important point! From July 11, 2020, updated codes for state registration of legal entities and individual entrepreneurs were introduced.

What application should an LLC fill out?

Legal entities use form P14001. Organizations fill out the title page and sheets H and R. The number of pages depends on the volume of changes being made. By analogy with an individual entrepreneur, to add a type of economic activity, fill out sheet H on page 1, to exclude - page 2, and to change the main one, indicate the old code on page 2, and the new one on page 1. Sheet P is intended to reflect information about the applicant.

Completed:

Applying in person

When submitting documents in person to register new types of economic activity, you must present a passport. In this case, there is no need to certify the application with the help of a notary (according to Federal Law No. 129-FZ, Chapter III, Article 9, Clause 1.2). On sheet G of the form, in the presence of a tax officer, you need to manually fill in your full name and sign.

Important! You will not need to re-pay the state fee for changing individual entrepreneur data in the state register. If your inspector forgot about this, you should always remember this so as not to overpay extra money.

Let us consider in detail step by step how to add new types of activities to an individual entrepreneur

Step one: Selection of new OKVED codes

Before you begin preparing documents to change the OKVED codes of an Individual Entrepreneur, you must first select the required additional types of activities with their corresponding OKVED codes in the All-Russian Classifier of Economic Activities.

The classifier version - OK 029-2014 (NACE Rev. 2) is the current version of the OKVED classifier for 2020. Please note that the codes in the classifier contain from 2 digits to 6, but when registering you must indicate codes containing at least 4 digits.

Eg:

OKVED code 47.5 “Retail trade of other household products in specialized stores” cannot be specified, because the code contains 3 digits, and the tax office will refuse to register the changes, it is necessary to specify the types of activities by indicating codes containing 4 digits or more, namely:

OKVED code 47.51 Retail trade of textile products in specialized stores;

OKVED code 47.52 Retail trade in hardware, paints and varnishes and glass in specialized stores;

OKVED code OKVED code 47.52.1 Retail trade in hardware in specialized stores.

Step two: Preparation of documents for changing OKVED

In order to add new codes, you will need to fill out an application for registration of changes in the Unified State Register of Individual Entrepreneurs using form No. P24001, which contains only 4 sheets and does not require special knowledge and effort.

The application will need to indicate your full name, personal INN, OGRNIP, new codes for additional types of activity, as well as the main one if it is replaced, as well as codes to be excluded from the Unified State Register of Individual Entrepreneurs.

There is no state fee for registration, the application does not need to be stapled, it must be secured with a regular paper clip.

Step three: Submitting documents to the tax office

It is possible to submit documents to the tax office in different ways; the filing requirements depend on the method of submission; applications must be submitted to the tax office at your registration address.

- The personal method of submitting documents to the tax office is the most common and less expensive. In this case, in addition to the registration application, there is no need to provide or prepare anything additional.

- Providing documents to the tax office by mail, in this case you will need to have the application notarized by a notary, the notary will certify your signature on the application and sew up the application. Next, the completed application must be sent by registered mail with an inventory and notification. When submitting documents by mail, you must indicate in the application on the last page the method of receiving the documents: 3 – send by mail, so that after successful registration the finished documents will be sent back to you at your registration address, which will save you personal time. The average cost of notary services is 1,700 rubles, the cost of postage is 200 rubles.

- Providing documents by an authorized person, in this case you will need to notarize the application and make a notarized power of attorney and one copy of the power of attorney, then the authorized person independently, using a power of attorney, will be able to submit documents for registration and receive.

Step Four: Receiving Documents

Registration of changes in the tax office is carried out within 5 working days; on the sixth working day, ready-made documents are issued. When submitting in person or submitting through an authorized representative, you will be given a receipt confirming the receipt of documents; on the appointed date, you must appear at the tax office and receive the completed documents. If you add or change OKVED codes, you will receive a new entry sheet in the Unified State Register of Individual Entrepreneurs, which will contain information according to the registered changes.

We send application P24001 by mail

There are often situations when a businessman cannot personally appear to the inspector to enter new data into the register: long business trips, vacations and other important reasons.

Remote sending is possible. In this case, it is necessary to perform notarized confirmation of the signature on the application.

No problem! The completed form can be sent by mail. Although to do this you will still have to visit a notary office. Agree that it is better to pay this specialist for services than, for example, to change a ticket for an expensive airline flight abroad. The notary will sign and seal Form P24001, certifying the authenticity of the copy of your passport.

Making changes to information about individual entrepreneurs

Changes to information about individual entrepreneurs contained in the Unified State Register of Individual Entrepreneurs are made by submitting an application in form P24001. Using this form you can change the following data:

| Application sheet | Data |

| Sheet A | · Full name, including using the Latin alphabet · Floor · Birth information The specified data may not only change, but also be clarified due to a previously made error. |

| Sheet B | Information about citizenship, as well as about the country of which the individual entrepreneur is a citizen. |

| Sheet B | Address information, for example due to relocation. |

| Sheet G | Information about an identity document, for example, due to loss. |

| Sheet D | Information about a document permitting temporary or permanent residence in the territory of the Russian Federation for foreigners. |

| Sheet E | Information about codes according to the OKVED classifier |

| Sheet J | Does not change the information, it indicates the method of obtaining the result from the inspection |

As you can see, a lot can be changed or clarified; there can also be many reasons for this.

How long will it take to wait for updates to documents?

The inspector undertakes to issue a receipt form for receipt of your documents. It is important not to lose this paper, because with its help you can track the progress of document readiness by using a special online tool on the official website of the Federal Tax Service.

According to the law, in a week (taking into account five working days and two weekends) you can come for a ready-made Unified State Register of Individual Entrepreneurs (USRIP) sheet. It will be issued upon presentation of your passport and that same receipt. As you can see, nothing complicated. Within just a few days, literally in two visits to the tax office, you will receive the necessary document without the help of a lawyer. Study your rights and save your time so as not to waste time standing in line for meaningless consultations with tax officials.