There are many situations when, together with or instead of a standard package of various documents, a tax specialist must also provide an application. According to federal law, a statement is considered a request, a person's demand that his rights be realized. Representatives of the authorities, in our case, tax specialists, are obliged to assist the citizen in this request. In other words, an application for the Federal Tax Service is an appeal containing a request for the exercise of rights and freedoms. In particular, this may be a request for a TIN, a requirement for a tax deduction or a benefit. In these and other cases, a competently and correctly drawn up statement will help. In the text we will look at the most common situations and show examples of what sample applications to the tax office should look like.

Sample applications to the tax office

Application to the tax office: general points

Many citizens believe that the application is drawn up in free language and written on a white sheet of paper by hand. This is not true - most applications to the tax office must be filled out according to instructions and specialized forms must be used for this. Regardless of what application you are preparing to submit to the inspector, you must remember the basic rules:

- The upper right corner of the application is always occupied by the details of the tax department. To find out them, you can log on to the website nalog.ru and enter your address. The system will tell you which tax office the citizen belongs to at his place of residence, and, accordingly, will offer the details, address and operating hours of the branch.

- The header of the application must contain the personal data of the applicant - here you need to indicate passport details, full name and TIN number. If a citizen does not have information about the payer identification number, he can use the “Find out TIN” service launched by the country’s tax service.

- If the document is filled out by hand, it must be written in block letters, only black or blue ink is allowed, and it is forbidden to cross out or correct errors.

- If a document contains several sheets, each must be endorsed with the citizen’s personal signature. Some applications are required by law to contain a certified autograph - for this the paper must be signed in the presence of a tax inspector.

- Any information in the application must be current, reliable and verified. It is necessary to double check all information provided on the application, especially the numbers.

Now let's move on to the features of filling out and examples of statements that are used most often.

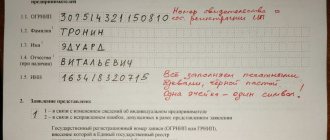

Obtaining a TIN

Every citizen of Russia, no matter whether a future (minor) payer or an existing tax payer, must register with the Federal Tax Service. To do this, you need to obtain a document - TIN. This can be done through the Federal Tax Service website. Within five days after the application, the tax service will be ready to provide the TIN. If a citizen prefers to interact with paper media or prefers to visit government agencies in person, he must download and fill out form No. 2-2-Accounting. We recommend downloading this form, like the form for any other application, exclusively from the official resource of the Russian Tax Service. In the case of an application for a TIN, it would be most advisable to type keywords in a search on the site and get a sample form from the first link. It looks like this.

The application for registration with the tax authorities is very simple to fill out.

Using an example, we demonstrate the upper part of the form that a citizen needs to fill out. Next comes a field in which information about the official representative of the payer is entered, if he cannot independently contact the Federal Tax Service, as well as fields for filling out by tax specialists. As you can see, nothing complicated.

Write letters

Taxpayers can submit a written appeal in person to the office of the tax authority, or send it by mail or electronically (clause 37 of the Regulations). A recommended sample form of a written request is given in Appendix 4 to the Regulations.

In this case, the written request must contain the following mandatory information (clause 40 of the Regulations):

- for an individual: last name, first name, patronymic, signature and postal address;

- for an organization: full name, TIN, postal address, last name, first name, patronymic and signature of the head or authorized representative of the organization who submitted the application, an image of the organization’s seal if the application is submitted on paper other than company letterhead.

If the written appeal submitted to the inspection by the taxpayer in person is missing at least one of the specified details and if there are grounds on which free information can be refused, in accordance with paragraph 42 of the Regulations, the appeal must be returned to the taxpayer.

Clause 39 of the Regulations allows 30 days from the date of registration of the appeal to prepare a written response.

We recommend that all written requests be submitted in duplicate. If you decide to personally submit an appeal to the inspectorate, then on the second copy the tax authority official must put a mark on acceptance of the appeal and the documents attached to it, indicating his surname, initials and position, as well as the date of its acceptance. Applications sent by mail are recommended to be submitted by registered mail with notification and a description of the attachment. The date of submission of the written request will be considered the day of dispatch. If you send a letter via communication channels, you must receive a message stating that the letter was sent from a specialized operator and confirmation of receipt from the tax authority.

Certificate of absence of debts

A document indicating that a citizen has no debt to the state may be needed in a number of cases, for example, for mortgage lending. To obtain such a certificate, you need to contact the territorial Federal Tax Service with a corresponding application. There is no strict form for paper yet, but the tax office recommends following the same content and structure of the request.

Even such a simple application requires tax details at the top right

Installment or deferment of tax payments

Before December 1, most citizens are required to pay for certain types of taxes, for example, on land, transport or property. But it happens that a person finds himself in a difficult situation when the financial situation becomes extremely unstable. In this case, you can contact the tax office with a request to postpone the date of tax payment or break the amount into smaller parts. You must bring an application to the institution using the following form.

An application requesting a deferred payment will be on one sheet of paper.

The form of this application is very simple; you can also download it from the official website of the Federal Tax Service. You can discuss filling out the second part of the document with the tax inspector, telling him about your current life situation.

Important point! The state can provide deferred or installment payment when we are talking about the amount of debt that does not exceed the value of the citizen’s property, in addition to what cannot be collected (a single apartment, for example).

VAT shortcomings

When calculating this tax, accountants very often make mistakes. The most common of them is the overestimation of the amount of the declared deduction compared to the amount of the accrued fee. This oversight may be the result of a failure during uploading of information or an oversight by an accountant.

In this case, a sample explanatory letter to the tax office should contain the following text: “In response to a request from______, we confirm that there are no inaccuracies in the purchase book. All information in it is provided correctly, in the required time frame and in full. The discrepancy occurred due to a program failure during the creation of an invoice dated "___" _____ ___. Corrections to tax reporting have been made (day, month, year).

Tax deduction

The procedure for returning thirteen percent for income tax payers can be associated with various events: the purchase of real estate, payment for medical or educational services, and so on. The two types of deductions we have named are property and social, the most common. They allow you to return quite significant sums of money - for example, the maximum for property return is 260 thousand rubles.

Read more about property deductions in our article.

Tax service employees accepted applications from citizens in free form until 2020. Now a fixed form has come into effect, according to which the application form must be filled out. We recommend downloading the form from the official website of the tax service nalog.ru, since third-party sources pose a risk of receiving inappropriate paper. The application is included in the standard package of documents for receiving a deduction, so its incorrect spelling may become grounds for refusal to return the funds. The format of this statement is somewhat similar to a declaration, but it is intuitive and should not cause any difficulties.

The first page of the application with the citizen’s personal data

The application is drawn up on several sheets, which must contain the citizen’s data, the full amount of the deduction for which he is applying and the year of expenses incurred. Next, indicate the contact details and address of the payer, the current account for the refund, the name of the bank, the budget classification code and the number of sheets and attachments that make up the application. We remind you that each page is certified by a signature.

Social deductions related to treatment and education

To reduce the tax paid for treatment or education, it is necessary, as in previous situations, to write a special application and confirm it with additional documentation. After this, the citizen will be able to receive a notification from the tax service.

Thus, you can receive deductions according to the Tax Code of the Russian Federation for:

- education;

- treatment;

- payment of additional contributions that are transferred to the funded pension;

- expenses for voluntary pension or life insurance.

You can get tax deductions for education, treatment, etc.

There are also deductions issued for charity or an independent assessment of the qualifications of an organization’s employee, but they can only be obtained by filing a declaration in Form 3-NDFL at the end of the reporting year.

You can receive a social tax deduction.

Providing benefits

A number of taxpayers are legally entitled to tax benefits - for example, a complete cancellation or reduction in the amount of payments for land, property or transport taxes. Tax inspectors will definitely tell every citizen whether he can qualify for the so-called “fiscal amnesty”. If the answer is positive, you should immediately submit an application for benefits to the Federal Tax Service. It looks like this.

Filling out an application to receive benefits is a matter of two minutes

The application must indicate personal data, as well as attach a copy of the document on the basis of which the citizen is applying for a tax break. This can be a pension or veteran's certificate; in regions where benefits are provided to large families - a corresponding certificate.

Refund or credit of tax paid in excess

In the process of fulfilling tax obligations, citizens may overpay - for example, round the tax amount up or not know that they are entitled to a benefit. A simple typo in documents can also lead to overpayment. The tax office itself can report this, but if the payer discovered the overpayment earlier, he can write a corresponding statement. The overpayment amount can be requested to be returned or “transferred” to account for another type of tax. The application form should not cause any difficulties.

An overpayment application is similar to a tax deduction form

Such an application can be submitted within three years from the moment (day) when the overpayment took place. The tax authority will return the excess amount for the month. However, he can be notified of the overpayment to the Federal Tax Service electronically. You need to go to the portal of the Federal Tax Service, go to the section of the same name - “Overpayment/Debt” and fill out the form online.

Video - Make an application for a refund of overpaid personal income tax

Cover letters: what are they and why does the Federal Tax Service ask for them?

A cover letter is a paper that lists the submitted materials and explanations for them. This addition significantly facilitates the interaction of the tax service with taxpayers, since:

- the list of submitted materials allows you to avoid possible misunderstandings regarding the completeness of the set of papers;

- it is easier for office workers to register incoming correspondence, and tax officials will not have questions regarding the purpose of providing certain documents;

- papers will reach the addressee faster.

Existing legislation does not establish a unified form of cover letter. But there are regulations that must be relied upon when carrying out document flow with the Federal Tax Service. This is the order of the Federal Tax Service of Russia dated 07/08/2019 No. ММВ-7-19/ [email protected] and “Methodological recommendations for organizing electronic document management...”, approved by the order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/ [email protected] dated 06/13/2013.

In addition, there are formats approved exclusively for messaging via telecommunications channels. Appendix No. 5 to the Federal Tax Service order No. ММВ-7-6/ [email protected] approved a sample cover letter to the tax office for a power of attorney for filing electronic reports, which is automatically transmitted when submitting tax returns by proxy via EDI. It will not be possible to find such an information message in a traditional written format, but it is not necessary, since it is designed to verify the authority of persons submitting reports for taxpayers online (see letter of the Federal Tax Service dated August 10, 2016 No. GD-4-11 / [email protected] ) .

Another example of an exclusively electronic type of explanation is a sample cover letter for an audit report to the tax office, the format of which was approved by order of the Federal Tax Service dated January 18, 2017 No. ММВ-7-6/ [email protected] As the Ministry of Finance clarifies in the information message dated December 25, 2019 No. IS -accounting-21, the online audit report is sent along with the accompanying document, but if you submit it on paper, additional clarifications on the approved format will not be needed.