Sending an employee on a business trip involves issuing an appropriate order and issuing money in advance for expenses. An order, a memo and an advance report are considered mandatory - travel expenses in this case, provided that each form is filled out correctly, will be included in the accounting records. The specifics of the procedure for confirming business trip expenses and preparing accompanying documentation are given in the Government Resolution dated October 13, 2008, No. 749.

Business trip assignment - sample filling

If you want to use a work assignment form when registering a business trip (which is no longer necessary, since paragraph 6 of the Business Travel Regulations, which requires the employer to draw up this document, has become invalid since January 2020), this fact should be reflected in the local regulatory act. You can use the T-10a form as a sample. The procedure for compiling a task consists of:

- management decisions to send an employee on a business trip;

- filling out the first 11 columns of the job assignment form;

- familiarizing the traveler with the purpose of the trip.

In what cases and who compiles

The document is drawn up directly by the posted employee. If several employees go on a trip at once, such a document is drawn up by each of them or a responsible person appointed by the head of the group. The need for preparation is determined by the head before the trip.

Typically a report is prepared if:

- The purpose of the trip is of great importance to the organization.

- An employee or group is faced with quite a lot of tasks.

- Goals are related to financial expenses, for which a separate document is drawn up - an expense report.

- The tasks are related to signing documents with partners, which also needs to be reported on.

The paper is submitted along with other official and financial documents (to the accounting department):

- an advance report, which records all the employee’s expenses on a business trip and the presence of surpluses;

- payment documents confirming expenses incurred (checks, receipts, travel tickets, etc.);

- travel certificate (if available).

sample business trip assignment

The trip report will be based on the data specified in the assignment. Among the information that it is advisable to reflect in the job assignment is the following:

- details of the employing company;

- information about the employee indicating his position;

- destination;

- duration of the trip, including the start and end dates of the trip;

- details of the business trip order and purpose of the trip.

At the end, signatures are affixed, and at the end of the business trip, the employee fills out the result - whether the task assigned to him was completed or not.

Deadline and procedure for submitting a business trip report

Preparation for a business trip begins in advance - the manager sets goals and gives written and verbal instructions. Achievement of these goals and confirmation of completed tasks must be reflected in the report.

Step 1. Drawing up a job assignment

Even before sending an employee on a business trip, the manager sets the goals of the trip, which can be recorded in writing and then transferred to the report. As a rule, they are written down in an official assignment, which is drawn up according to form No. T 10-a or in any form. In fact, this paper reflects the same information as in the report - the name of the traveler, date of trip, goals, etc.

Step 2. Compiling a trip report

Then the employee must report for achieving the goals, and it is not enough to simply write “Completed.” As a rule, the manager requires a detailed description of the actions - for example: “Held negotiations with the partner, full name and signed a framework agreement on cooperation.”

The report must be drawn up immediately upon returning from a business trip. This is usually given 3-5 working days, after which the employee is required to report to the manager. The specific period depends on the company’s regulations, but in any case it should not exceed 30 calendar days.

The document is usually drawn up in printed form, less often in handwritten form. The employee is recommended to make 2 original copies, one of which to give to the manager, and the second to keep for possible clarification of any information related to the trip.

Step 3. Submission and approval of documents

The accounting department accepts financial documents and makes the necessary calculations. The manager accepts the trip report and the attached papers - signed negotiations, photos, videos, etc. After this, the report is revised if necessary and undergoes final approval.

To avoid rework, the employee must prepare the report clearly in accordance with the goals set, which are formulated in the job description and/or orally. The document is drawn up as briefly as possible, each action is confirmed by the attached documents.

How to write a business trip report - example and formatting rules

A business trip report is a sample document drawn up in any form, which is approved by a local act for the enterprise. Each organization determines the need to use it in practice independently. From 2020, again, you can do without this form.

If you decide that you need a business trip report, an example of its structure should contain several blocks:

- details of the document indicating the place of its preparation, date and registration number;

- the period for which the trip report form is filled out;

- the reason that served as the basis for sending on a business trip;

- tasks that had to be completed during a business trip;

- achieved results (it is better to describe them in as much detail as possible).

When filling out a business trip report, the writing example may contain a concise summary of the results of the trip or a more detailed disclosure of the current situation. Sometimes the allocated space to reflect the results is not enough. In this case, you are allowed to attach a blank A4 sheet and continue presenting the information on it.

A business trip report, a sample of which is being developed by the enterprise, is needed to justify the need for a specific business trip to regulatory authorities. It is for this purpose that detailed answers are given about the results of the trip. If the set goal was not achieved, then the trip report must contain an explanation of the reasons that served as an obstacle to completing the task.

How to prepare an advance report for a business trip - sample

After returning from a business trip, the employee is given a three-day period to prepare and submit an advance report with attachments. Drawing up an advance report for a business trip is a prerequisite for covering the relevant expenses at all enterprises. This document needs to be drawn up. After checking the documentation and accepting it for accounting, the final payment is made to the employee. How to fill out an advance report for a business trip? The sample must contain information about:

- employee personal data;

- documents with which you can confirm the issuance of money for the trip in advance;

- dates of expenses incurred and their purpose, indicating the main details of supporting documents.

How to prepare an advance report for a business trip?

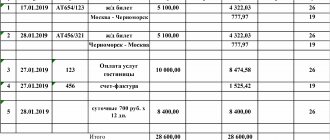

The sample form AO-1 looks like this:

How to report for a business trip

In accordance with the norms of stat. 168 of the Labor Code, the employing enterprise must reimburse the business traveler for all expenses incurred during the business trip. These are daily allowances, travel and accommodation costs, as well as other types of expenses when they arise. In order to receive money from the employer without delay, the employee is required to provide a financial report on the business trip upon his return; a sample can be found on the Internet. Or you can create an expense report.

The report indicates how much money was received from the employer for the trip, what debts the company or employee owes, and how much money was spent during the trip. A 3-day period for reporting on travel expenses has been established for submission to the accounting department (clause 26 of Resolution No. 749). Additionally, to justify the actual costs incurred, the business traveler must attach all documents for travel, housing, etc. No documents are required for daily allowance.

AO1 sample page 2

Algorithm of actions when submitting an advance report:

- An advance report for a business trip is filled out by an employee returning from a business trip.

- Within three days after return, the completed form with attachments is submitted to the accounting department for verification.

- If the documentation is completed correctly, the manager signs the report.

- If there is a justified need to reimburse the funds spent by the employee in excess of the advance during a business trip, they are covered by the enterprise. If there is an unspent balance of the advance, the excess is handed over to the cashier.

The advance report for a business trip is drawn up in one copy. Receipts with checks and other documents confirming expenses must be glued to a sheet of A4 paper. The following originals may serve as accompanying documents:

- travel certificate (not required from 2020);

- checks and receipts recording the amounts spent on accommodation at the destination;

- tickets;

- a brief report on the completion of the business trip assignment.

Sample of a completed report

The need for “travel” reporting

Since 01/08/2015, “travel” document flow has been simplified. Among the official documents required to be provided, the following have been cancelled:

- an official assignment containing a detailed list of activities required to be carried out in another locality with an indication of deadlines;

- a business trip report containing information about the work done and the result in the form of a conclusion on the completion of the task.

- travel certificate, including notes on the arrival and departure of the receiving party, sealed with dates, the signature of the responsible person and the seal of the organization.

The cancellation of the official assignment did not make an adjustment to Article 167 of the Labor Code of the Russian Federation, which defines a business trip as a trip by order of the manager to another locality or country to resolve production issues. How to write a report on a business trip if drawing up a document is not necessary? How to confirm the fact of completing a task in order to classify the trip as a business trip?

Download the Business Trip Report Form (24.5 KiB, 446 hits)

Business trip report (writing sample) (25.5 KiB, 717 hits)

Mandatory documents necessary and sufficient for carrying out accounting expenses and final settlement with the accountable person are:

- Order (instruction) of the manager, including:

- Full name and position of the person being sent;

- purpose of the trip;

- the period counted from the moment of departure to the moment of arrival;

- assigned tasks to complete.

- Advance report for a business trip - a unified form on expenses incurred, approved by Decree of the Government of the Russian Federation No. 749 of October 13, 2008, with the mandatory attachment of supporting documents, including:

- transport tickets, luggage receipts and luggage storage receipts;

- hotel invoices or other documents confirming the rental of accommodation;

- commission fees and duties;

- currency exchange costs;

- a copy of the international passport attached to confirm border crossing according to the marks of the border guards;

- waybills, gas station receipts attached to the report on travel expenses to confirm the costs of fuel and lubricants when traveling on official or personal transport.

Download Unified Form N AO-1 Advance report (115.1 KiB, 185 hits)

In Excel:

Expense report form (.xls) (41.0 KiB, 184 hits)

From January 1, 2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. At the same time, forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws (for example, cash documents) continue to be mandatory for use.

Information No. PZ-10/2012 on the entry into force on January 1, 2013 of the federal law of December 6, 2011 No. 402-FZ “On Accounting”

The advance report contains a section on the advance received and the amount of expenses for documents and daily allowances established by the manager, but the standard form does not include information about the fulfillment of the production task reflected in the order. Therefore, a sample business trip report in free form or in a trip regulated for each purpose must be approved by internal documents.