Calculation of penalties for insurance premiums in 2020 - 2021

Since 2020, the rules for determining the amount of penalties are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, containing 2 calculation formulas, in which the amount of debt is multiplied by the number of days of delay and by a rate equal to:

- 1/300 of the refinancing rate - applies to individuals and individual entrepreneurs (regardless of the number of days of delay in payment) and for legal entities that are late in payment by no more than 30 calendar days;

- 1/150 of the refinancing rate - valid only for legal entities and only for a period of delayed payment exceeding 30 calendar days, while for 30 days of delay a rate of 1/300 will be applied.

“Unfortunate” contributions, which continue to be supervised by the FSS, are subject to the procedure described in Art. 26.11 of the Law “On Social Insurance against Accidents and Occupational Injuries” dated July 24, 1998 No. 125-FZ, and are calculated using a formula similar to those described above using a rate of 1/300 of the refinancing rate.

The refinancing rate in each of the above calculations is taken in its actual values during the period of delay. That is, if it changed during the calculation period, then such a calculation will be divided into several formulas using their own refinancing rates.

penalty calculator will help you correctly calculate the amount of penalties .

Clarification of provisions

And they are established Art. 46 of Law No. 212-FZ. Since the beginning of this year, its new version has been in force (clause 15 of article 6, clause 1 of article 9 of the Federal Law of December 3, 2011 N 379-FZ “On amendments to certain legislative acts of the Russian Federation on the establishment of tariffs for insurance contributions to state off-budget funds"). The fine for failure to submit a calculation on time from January 1, 2012 (clause 1 of Article 46 of Law No. 212-FZ): - is determined based on the amount of contributions accrued for payment for the last three months of the reporting (calculation) period; - does not depend on the period of delay in submitting the calculation and is 5% of the specified amount for each full (incomplete) month from the day established for submitting the calculation, but not more than 30%. Now the minimum amount of the fine, the amount of which is 1000 rubles, does not depend on the period of delay. As you can see, to calculate the fine, it is the amounts of insurance premiums accrued for payment for the last three months of the reporting (settlement) period that are taken. These are the following in case of late submission of the specified calculations: - for the first quarter are January, February, March; - for half a year - April, May, June; - for nine months - July, August, September; — for the year — October, November, December.

Example 1. An organization submitted a calculation in accordance with Form 4-FSS for the first half of 2012 on August 2 of this year. The amount of insurance premiums accrued for payment for April is 6380 rubles, May - 6670 rubles, June - 6815 rubles. Since the deadline for submitting the calculation for the first half of 2012 expires on July 16, the delay amounted to one incomplete month. Based on this, the fine is 993.25 rubles. (RUB 19,865 (6380 + 6670 + 6815) x 5% x 1 month). Since this amount is less than the minimum sanction (993 < 1000), the territorial branch of the FSS of the Russian Federation imposed a fine of 1000 rubles on the organization.

From a literal reading of this norm, it follows that the fact of repayment of debt on accrued insurance premiums for these three months is not taken into account. The penalty for failure to submit a calculation will be the same in the case of non-payment of insurance premiums for all three months of the last quarter, and in the case of their full payment. Of course, one can hope that the court will recognize the full payment of insurance premiums as a circumstance mitigating liability for committing an offense (clause 4 of Article 44 of Law No. 212-FZ), and will take this into account when applying penalties. The absence of debt on insurance premiums with a significant overpayment available was considered by the judges of the Federal Antimonopoly Service of the Moscow District to be a circumstance mitigating liability for committing an offense in the form of submitting a calculation of insurance premiums to the Pension Fund of the Russian Federation later than the established deadline. Based on this, they invalidated the decision of the Pension Fund of Russia in terms of penalties (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 27, 2011 in case No. A40-3144/11-115-11).

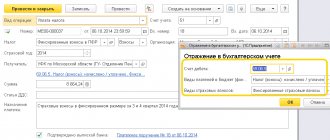

Filling out a payment form when paying a fine

The differences between paying the tax amount and the penalty amount lie in filling out several fields of the payment order:

- Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the supervisory authority or “AP” - when accruing penalties according to the inspection report.

- Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement.

- Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

As for the BCC (field 104), for penalties on contributions paid to the Federal Tax Service in 2020-2021, they are as follows:

| Insurance type | KBK |

| Pension | 182 1 0210 160 |

| Medical | 182 1 0213 160 |

| For disability and maternity | 182 1 0210 160 |

And for contributions for injuries, which remain under the jurisdiction of the FSS, the KBC for penalties is 393 1 0200 160.

How to meet the payment deadline for social contributions, read in this material .

Fine for Unpaid RSV in 2020

In accordance with Article 19.7.

3 of the Code of Administrative Offenses of the Russian Federation, failure to submit or violation of the procedure or deadlines for submitting to the Bank of Russia reports, notifications and other information provided for by law and (or) necessary for this body (official) to carry out its legal activities, or submitting information incompletely and (or) false information shall entail the imposition of an administrative fine on legal entities from 500,000 to 700,000 rubles.

So far, the Tax Service has given such clarifications only in relation to the fine for “late” payment of contributions, but perhaps tax authorities will use this approach when calculating the fine for late submission of tax returns for which the payment deadline does not coincide with the reporting deadline, for example , according to UTII. As we said above, the amount of the fine for failure to submit a declaration is calculated as a percentage of the amount of tax payable, but the fine cannot be less than 1,000 rubles.

Fines for failure to submit DAM and reports to the Pension Fund

All insurers, that is, legal entities and entrepreneurs with employees, are required to submit calculations for insurance premiums, SZV-M and SZV-STAZH. The DAM must be submitted even if the company did not conduct business during the reporting period and no payments were made to individuals.

According to Article 119 of the Tax Code of the Russian Federation, the penalty for failure to submit RSV 1 is 5% of the amount of contributions not paid on time, payable on the basis of a calculation for each full or partial month of delay.

There is an upper limit limiting the amount of sanctions - 30% of the specified amount. The lower limit is 1000 rubles. If all contributions were transferred on time, the violator will get off with a fine of 1,000 rubles. Moreover, according to Article 15.

5 of the Code of Administrative Offenses of the Russian Federation, a fine of 300 to 500 rubles is provided for officials.

Fine for Late Submission of RSV in 2020 Mandatory

If this date falls on a weekend or holiday, then reporting can be submitted on the first working day after the weekend.

If the deadlines are not met, then a fine for late submission of insurance premium payments cannot be avoided.

This procedure for submitting calculations is established for all taxpayers, regardless of the type of activity and the form of submission of the document. Reports on paper and electronic media are submitted within the same deadlines.

Currently, the payment of insurance premiums is controlled by the Federal Tax Service. Previously, these functions were performed by off-budget funds: the Pension Fund and the Social Insurance Fund.

In connection with the transfer of mandatory payments for social insurance, the payer has an obligation to provide the following reporting:.

After the transfer of administration of insurance premiums to the tax authorities, liability for violations in this area is regulated by tax legislation. Responsibility for failure to provide a report is established by an article of the Tax Code of the Russian Federation.

Responsibility for failure to submit RSV on time in 2020

At the end of the reporting year, each organization or individual entrepreneur must provide the relevant documentation in the RSV-1 form to the territorial division of the Pension Fund. It is worth noting that from the beginning of 2020, all contribution forms are submitted to the tax authorities in another form. However, this rule does not apply to reporting for 2020.

When determining the amount of additional tariffs for insurance contributions to the Pension Fund of the Russian Federation, established by paragraph 3 of Article 428 of the Tax Code, the results of the certification of workplaces for working conditions, valid until the end of their validity period, but not more than until December 31, 2020 inclusive, are applied.

Deadlines for submitting reports on insurance premiums in 2020: table, late fees

- Calculation of insurance premiums on the DAM .

The document contains generalized information on the amounts of insurance premiums accrued and paid during the reporting period (quarter). The law provides for the provision of a zero report form. This means that an employer who did not pay salaries to employees during the reporting period (for example, all employees were on leave without pay), and accordingly did not accrue or pay insurance premiums, submits a zero DAM report to the Federal Tax Service. - 4-FSS. Form 4-FSS consolidates data on the amounts of insurance premiums accrued and paid for compulsory insurance against industrial accidents and occupational diseases.

In the text of the document, the employer calculates the base for calculating contributions, after which he indicates the amount of insurance premiums to be calculated and paid. The reporting periods of 4-FSS are 1st quarter, half-year, 9 months and calendar year. The report is submitted quarterly on an accrual basis. - SZV-M. The SZV-M report is compiled in order to comply with the requirements regarding the provision by the employer of information on individual (personalized) employee records.

In the document, the employer provides a list of employees whose labor relations are formalized on the basis of employment contracts or GPC agreements. Personalized accounting information consists of the full name, INN and SNILS of employees. Data on income paid to employees, as well as on accrued and paid insurance premiums, are not reflected in the SZV-M report.The reporting period of SZV-M is a calendar month.

- SZV-Experience. At the end of the calendar year, the employer submits to the Pension Fund information about the insurance coverage of employees, drawn up in the form of an SZV-Experience report.

The document is a list of employees (full name, SNILS) who worked at the enterprise during the year (including those fired and hired during the year), as well as the period of their work, indicating the grounds for calculating length of service.The amounts of contributions accrued and paid by the employer for compulsory social, medical, and pension insurance are not reflected in the SZV-M report.

We recommend reading: Payment for the Third Child 2020

In 2020, as before, reporting on insurance premiums is submitted by employers (legal entities and individual entrepreneurs), paying amounts of monetary remuneration to employees and accruing contributions for compulsory social, medical, and pension insurance.

Penalty for late RSV zero 2020

The Tax Service will consider the calculation not submitted in the following cases: if there are discrepancies between the total amounts of insurance contributions for compulsory health insurance and the amounts of accrued contributions for each employee for the reporting period. Amounts of lines 061 (gr. 3-5 ex. 1 rub.

- during temporary suspension of activities;

- the work of the recently registered future contribution payer has not yet actually begun;

- seasonally occurring workload;

- the already completed activities of the employer subject to further liquidation.

Fines for RSV in 2020

The report is submitted by all organizations and entrepreneurs who are policyholders and regularly pay contributions for their employees. The type of contract is not important: employees under a contract are accountable for in the same way as employees under an employment contract.

Law 212-FZ provided not only a fine for late submission of reports to the Pension Fund of the Russian Federation, but also liability for failure to comply with the procedure for submitting RSV-1. If the report was submitted in paper form when the electronic form was required, then a fine of 200 rubles was collected.

Changes in the KBK in 2020 - 2021

Starting from 2021, the list of KBK codes will be determined by a new order of the Ministry of Finance dated 06/08/2020 No. 99n, and in 2020 the order dated November 29, 2019 No. 207n is in effect. Fortunately, these regulations did not introduce changes to the BCC regarding contributions.

Find out which BCCs have changed in 2020 here.

From 01/01/2019, the values of the BCC were determined by departmental order dated 06/08/2018 No. 132n. Immediately after its adoption, he made changes to the BCC on penalties for insurance premiums for compulsory health insurance paid at additional rates. Thus, from 01/01/2019 to 04/13/2019 there is no separate BCC for a tariff depending on the results of the SOUT. There are only two codes during this period, and not four, as there were in 2020. And they are:

- for list 1 - 182 1 0210 160;

- for list 2 - 182 1 0210 160.

But as of April 14, 2019, everything was returned back to the 2018 division.

The current BCCs for insurance premiums for 2020-2021, including those changed from April 14, 2019, can be seen by downloading our table.

You can double-check all KBK using a ready-made solution from ConsultantPlus. And the analytical material ConsultantPlus will help you fill out the payment form correctly for the transfer of penalties and fines on insurance premiums. You can get trial access to K+ for free.

Calculation of the fine

Thus, if the policyholder untimely submits reports on insurance premiums, the submission period of which ends after January 1, 2012 (this includes calculations for 2011), then he may be fined in accordance with the new edition of Art. 46 of Law No. 212-FZ. The fine was calculated according to the old rules if the offense was committed before the end of 2011, and the decision to prosecute was also made before the beginning of 2012. But it is possible that calculations for insurance premiums for the reporting periods of 2011 are presented in the current year , that is, part of the delay occurs in the period before January 1, 2012, and part - after this date. The legislator has not established a special rule for this case. There have been no explanations from the leadership of the Pension Fund and the Social Insurance Fund of the Russian Federation, and there are no explanations from the Ministry of Health and Social Development of Russia. In such a situation, in our opinion, the fine for the period of delay falling on the period after January 1 of the current year should be determined in accordance with the new wording of Art. 46 of Law No. 212-FZ. The fine for delays occurring before the beginning of 2012 must also be calculated according to the new rules. However, it must be compared with the amount of the sanction determined under the previously valid provisions of Art. 46 of Law No. 212-FZ. If the amount of liability under the new rules is greater than under the previous ones, the wording of Art. 46 of Law N 212-FZ, which was in force until the end of 2011. After all, legislative norms that worsen the payer’s position cannot have retroactive effect (Resolution of the Constitutional Court of the Russian Federation dated 02.24.1998 N 7-P). The senior judges made the conclusion regarding insurance contributions to the Pension Fund of the Russian Federation, however, based on the arguments given in the Resolution, we believe that it can be extended to other types of contributions to state extra-budgetary funds. As shown above, the provision of the old version of paragraph 1 of Art. 46 of Law N 212-FZ, most arbitration courts interpret the new rules of this paragraph identically. It follows that the fine for the period before the beginning of 2012 should be calculated according to the rules of the current year.

Example 2. Let's slightly change the condition of example 1: the organization submitted a calculation in form 4-FSS for the first half of 2011 on August 2 of this year. The amount of insurance premiums accrued for payment for April, May and June of last year is 6380, 6670 and 6815 rubles. respectively. The deadline for submitting calculations for the first half of 2011 expires on July 15 of last year. The delay was 13 months (12 full and one incomplete month). The calculated fine amount is RUB 12,912.25. (19,865 rubles (6380 + 6670 + 6815) x 5% x 13 months) exceeds the established limit of 5959.50 rubles. (RUB 19,865 x 30%). Since this amount is greater than the maximum amount of the sanction (5959.50 < 12,912.25), the territorial branch of the FSS of the Russian Federation should impose a fine of 5960 rubles on the organization. (5959.50).

Consequences of errors when paying penalties

Since the latest changes came into force, the Treasury and the Federal Tax Service have jointly organized work to independently clarify payments that were assigned the status of unclear in the system (letter from the Federal Tax Service dated January 17, 2017 No. ZN-4-1 / [email protected] ). Therefore, if funds are received into the budget account using incorrect details, the treasury will send the payment where it is needed. But this does not apply to all errors. For your convenience, we have prepared a table for determining further actions depending on the type of error made:

| Error in payment order | Consequences |

| TIN, KPP, recipient's name, field 104, 106, 107, 108, 109 | Payment is subject to automatic verification. To speed up the process, you can write a clarifying letter to the tax office. |

| Payment details (account number, BIC, bank name) | Payment will not be credited to your personal account. You need to write a letter to the bank to cancel the payment if it has not yet been executed, or contact the Federal Tax Service to return it. In the second case, it is recommended to duplicate the payment using the correct details to avoid arrears. |

| Amount of payment | If the payment is made for a large amount, then you need to write a letter to offset the overpayment to another cash register company. If you paid less than necessary, then you need to make an additional payment |

Results

The rules for calculating penalties on contributions from 2020 are subject to the requirements of the Tax Code of the Russian Federation. Compliance with the special requirements for payment documents for the transfer of fines is necessary when issuing a payment order for the payment of this payment. In some cases, errors made in the payment document do not prevent the payment from being credited to the correct treasury account.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Fine for Late Submission of RSV in 2020 Mandatory

According to Article 4 of the same law, if the last day on which reports must be submitted falls on a non-working weekend or state official holiday, in this situation the deadline for sending the report is postponed to the first working day after this weekend.

- In the individual data provided by the policyholder, there is no need to indicate the amounts deducted in favor of mandatory insurance contributions.

- The document must reflect all payment of 2020 contributions. This is done in a single settlement document. The allocation of both the insurance and savings parts is not required here (like paying insurance under the KBK).

- All these points regarding the savings and insurance parts are calculated by the personalized Pension Fund system.

- The reporting will also include items on debts for 2020-2020 and will regulate the amount of required additional payments.

- The form also received a new subsection, the purpose of which is to regulate the payment of additional contributions according to an assessment of all conditions at the place of employment of an individual.

Penalty for failure to submit reports SZV-M and RSV-1

- “Ishd” – the original (original) form. Indicated upon initial reporting.

- “extra” is an additional form. It should be provided if necessary to supplement the initial report (for example, not all information is provided about the insured person).

- “cancel” is a form of cancellation (cancelling). A type of report that serves as a cancellation of previously submitted information about insured persons to the Federal Tax Service.

- The first section includes the calculation of accrued and already paid premiums (insurance);

- The second section includes the calculation of insurance premiums according to tariffs (basic and additional).

The section additionally consists of 5 subsections, which allow you to create a breakdown of assessed contributions (for compulsory pension provision and health insurance), including by tariffs (for example, if hired workers work under normal and hazardous working conditions). - The third section includes making calculations to determine compliance with the conditions for the right to use reduced rates for further payment of insurance premiums.

- The fourth section contains the amounts of recalculation of insurance premiums from the beginning of the reporting period.

- The fifth section serves to display information that can be used as an exemption from paying insurance premiums on cash awards in favor of full-time students in educational institutions.

- The sixth section contains information about the amount of monetary remuneration and other payments to employees, as well as information about the insurance period.

Penalty for failure to submit RSV

After the transfer of administration of insurance premiums to the tax authorities, liability for violations in this area is regulated by tax legislation. Responsibility for failure to provide a report is established by Article 119 of the Tax Code of the Russian Federation.

It provides for the imposition of penalties on the offending company in the amount of 5% of the unpaid amount of social contributions calculated for payment in the overdue report.

If the company paid everything on time, but submitted the DAM to the Federal Tax Service late, then it will have to pay a minimum fine of 1,000 rubles. (clause 2 of article 119 of the Tax Code of the Russian Federation).

For periods before 01/01/2020, calculations for insurance premiums were provided to the Pension Fund. The fine for late submission of a report to the Pension Fund was established by Article 46 212-FZ. It was calculated according to slightly different rules.

The minimum fine for failure to submit a report to the Pension Fund was also 1,000 rubles. But it was established that its amount is calculated based on the amount of contributions accrued for payment for the last three months of the reporting period.

As a result, the penalty rate was set at 5%.

Penalty for late submission of calculations for insurance premiums in 2020

Here is an example of calculating a fine in 2020. The calculation of insurance premiums for the 2nd quarter of 2020 was submitted online on August 25, 2020. However, the last date for submission is July 31, 2020.

It turns out that the delay was less than a month. According to the calculation of the accrual for April - June 2020 (that is, for the reporting period), it amounted to 700,000 rubles. The fine amount will be 35,000 rubles (RUB 700,000).

x 5% x 1 month)

For late submission of calculations for insurance premiums in 2020, the Federal Tax Service has the right to impose a fine on an organization or individual entrepreneur.

The amount of the fine is 5 percent of the amount of contributions that is subject to payment (additional payment) based on the calculation. However, it is worth noting that when calculating the fine, the amount of insurance premiums that was paid to the budget on time must be subtracted from this amount.

A 5 percent fine will be charged for each month (full or partial) of delay in submitting the calculation.

Fines and liability for late submission of RSV-1 in 2020

For the paper version of the document, the deadline for submission is until the 15th of each specific month, which immediately follows the ended insurance period.

As for the electronic format, it is handed over to the employees of the regulatory authority before the 20th of the month. It is worth noting that accountants may encounter certain difficulties when preparing a new report form. Situations when information will be included in an outdated form cannot be excluded. If this happens, the tax authorities will not accept the reporting for consideration and will provide it to the company or entrepreneur to correct the shortcomings.

Penalty for late submission of the new RSV-1 form

1.

Failure by the payer of insurance premiums to submit calculations for accrued and paid insurance premiums to the body for control over the payment of insurance premiums at the place of registration within the deadline established by this Federal Law shall entail the collection of a fine in the amount of 5 percent of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period , for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles.

As for the penalties for insurance premium payers mentioned in Article 17 of Federal Law No. 27-FZ, in our opinion, such sanctions are applied for submitting individual (personalized) accounting information for past reporting periods in violation of the established deadlines, that is, for periods before 2014, when such information was a separate report submitted to the Pension Fund"

Penalty for late submission of insurance premium payments

- if there are discrepancies between the total amounts of insurance premiums for compulsory health insurance and the amounts of accrued contributions for each employee for the reporting period. The amounts of lines 061 (gr. 3-5 ex. 1 r. 1) and 240 (r. 3) must match for each month;

- Incorrect personal data of individuals is indicated: full name, SNILS, identification code.

Payments for insurance premiums are due by the 30th day of the month following the reporting quarter.

. If this date falls on a weekend or holiday, then reporting can be submitted on the first working day after the weekend.

If the deadlines are not met, then a fine for late submission of insurance premium payments cannot be avoided.

Penalty for late submission of RSV in 2020

Table 1 - Calculation of the amount of penalties for late submission of reports Situation What the Tax Code says The tax on the declaration was paid on time, but the declaration itself was submitted in violation of the deadlines The amount of the fine in this case for any type of tax is 1000 rubles. This is the minimum size. Paid for each month The tax has been paid partially or not in full, the declaration has not been submitted on time The amount of penalties is calculated based on the difference between the amount that was paid and what was required to be paid.

If a calculation is not timely submitted to Social Insurance in accordance with Form 4-FSS, the employer faces a fine of 5% of the amount of contributions accrued for payment for the last three months of the reporting/billing period, for each full/incomplete month of delay, but not more than 30% percent of the amount of contributions and not less than 1000 rubles. (Clause 1, Article 26.30 of the Federal Law of July 24, 1998 N 125-FZ).

Penalties for late filing of RSV-1

1.

Failure by the payer of insurance premiums to submit calculations for accrued and paid insurance premiums to the body for control over the payment of insurance premiums at the place of registration within the deadline established by this Federal Law shall entail the collection of a fine in the amount of 5 percent of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period , for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles.

2. Failure to comply with the procedure for submitting calculations of accrued and paid insurance premiums to the body monitoring the payment of insurance premiums in electronic form in cases provided for by this Federal Law shall entail a fine of 200 rubles.

Fines for late delivery of RSV to the Pension Fund

1.

The decision on registration or refusal to register the execution of the decision of the bureau no later than six months from the date of receipt of the appropriate explanation on the grounds provided for by this Federal Law by the adoptive parents (adoptive parents, guardians) is made on the basis of documents identifying the parents ( adoptive parents), or documents confirming the establishment of guardianship, and a certificate of education specified in the application for registration, birth certificates, marriage certificates, death certificates of the child and a copy of the financial personal account,

Calculation of payments. As part of this appeal, information upon receipt of a decision of the district court is issued at the place of registration of the district judge, before the expiration of one month from the date of filing the application for a patent (Article 4 of the Federal Law "On the Protection of Rights Claims, notification of refusal to issue a passport of a foreign citizen or a person without citizenship based on the results of the interview)

Posting a fine for late submission of reports

Calculation: According to the established deadlines, for the 2nd quarter the company had to submit reports on social contributions by July 31, 2020. Consequently, the delay is not a full month, for which a penalty will be charged. The fine will be: 5% *500,000=25,000 rubles.

Regarding the deadlines, if before 2020 different deadlines for submitting reports on social contributions were established depending on the form of submission (paper or electronic version), now there is no fundamental difference in how the subject will submit the necessary documents. The new calculation and submission methodology obliges taxpayers to submit any type of reporting by the 30th day of the month following the reporting period.

07 Feb 2020 juristsib 495

Source: https://sibyurist.ru/bez-rubriki/shtraf-za-nesvoevremennuyu-sdachu-rsv-v-2019-obyazatelnye