Legislation and highlights

- According to Part 3 of Art.

2 Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity”, individual entrepreneurs are subject to social insurance, but only if they have entered into voluntary legal relations with the Social Insurance Fund. Attention! It is important to note that an individual entrepreneur who has employees must pay insurance premiums for them. - The Labor Code of the Russian Federation equates persons who work for an entrepreneur under an employment contract with persons who work in organizations (Article 183).

- The recommended form of application, on the basis of which obligations of the Social Insurance Fund to individual entrepreneurs arise, is established by Order of the Ministry of Labor of the Russian Federation No. 108n (Appendix 2).

- Calculation of disability benefits is carried out according to the rules established by Art. 4.5 Federal Law No. 225 and clause 2 of Art. 425 Tax Code of the Russian Federation.

- The rules for paying voluntary insurance premiums are established by Government Decree No. 790 dated October 2, 2009.

Compulsory and voluntary insurance for individual entrepreneurs

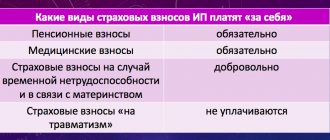

There are two types of social insurance for individual entrepreneurs:

- mandatory contributions - for employees;

- voluntary contributions - for yourself.

When an entrepreneur has employees, he must make contributions to payments included in the wage fund in the amount of 2.9%.

Important! If a person works for an individual entrepreneur, and not in an organization, then he will also receive payments from social insurance.

In the second case, the entrepreneur independently decides whether to register with the Social Insurance Fund and whether to pay voluntary contributions.

Can an individual entrepreneur register a business license for himself?

If there is a voluntary social insurance agreement and regular contributions, an entrepreneur can go on sick leave and receive monetary compensation for the days missed. The condition for receiving payment for sick leave is the payment of the amount specified in the Social Insurance Fund agreement for all 12 months.

It must be paid by December 31 of the year in which the contract was concluded, regardless of the date. After fulfilling this condition, the individual entrepreneur has the right to receive sick leave :

- in case of illness or injury;

- for pregnancy and childbirth;

- for child care;

- caring for a sick relative.

In addition to these cases, women entrepreneurs have the right to count on other social services. benefits, including a one-time benefit for pregnant women, if they are registered before 12 weeks (Article 9 of the Federal Law No. 81 “On state benefits for citizens with children”), as well as a one-time benefit for the birth of a child (Article 11 of the Federal Law No. 81).

general information

There are about four million individual entrepreneurs in the Russian labor market. This is a significant number of workers to whom the state must guarantee rights and social benefits. protection.

One of these areas is temporary disability of an individual entrepreneur (individual entrepreneur). If the individual entrepreneur conscientiously complied with the law, then he, like employees employed under a contract, has the right to sick leave and to receive benefits.

Unlike pension and compulsory health insurance, temporary disability insurance is implemented on a voluntary basis; the entrepreneur is not required to pay insurance contributions, but then he will not have the right to receive benefits .

How to register with the FSS?

The procedure for concluding a voluntary insurance contract does not take much time. To do this, the entrepreneur needs to fill out a special form, which can be found on the FSS website or filled out through the State Services website.

The necessary documents can also be submitted through the specified portal, but all copies must be signed with a qualified electronic signature . Registration is carried out within 3 days from the date of application.

Package of documents

You will need to prepare the following package of documents:

- Application for voluntary insurance.

- The applicant's passport and its copy.

- Certificate from the Unified State Register of Individual Entrepreneurs and its copy.

- TIN and its copy.

The Order of the Ministry of Labor establishes a recommended application form , which must contain the following information:

- date of completion;

- name of the territorial branch of the FSS;

- information about the applicant (full name, address, contact details);

- passport details;

- information about state individual entrepreneur registration (registration authority, number and date);

- information about the activities carried out (type, OKVED2 code, address and contact details);

- information about tax accounting (name of authority and TIN);

- information about an account with a credit institution.

Next, you need to select the method of receiving notification of registration with the Social Insurance Fund:

- personal delivery;

- by mail;

- in the form of an electronic document, if the application was submitted through State Services.

The application is signed by the applicant.

What is the insurance premium?

According to Federal Law No. 255, the amount of the insurance premium is the product of the minimum wage (at the beginning of the year in which the contract was concluded) and twelve times the size of the insurance premium rate (2.9%).

Important! The minimum wage in 2020 is 11,280 rubles + regional coefficient, if it is established by law for a constituent entity of the Russian Federation.

Thus, 11280 x 2.9 x 12 = 3925.44 rubles.

Accounting for contributions to the Social Insurance Fund

The specified amount must be paid before December 31 of the year in which the contract was concluded. However, the Foundation staff recommends doing this in advance, before December 25, so that there are no difficulties with payment.

Thus, from January 1, an entrepreneur will be able to count on receiving temporary disability benefits . If the amount is not paid, the voluntary insurance contract will be terminated.

Features of registration for individual entrepreneurs without employees

For all individual entrepreneurs without employees who are registered with the Social Insurance Fund, the deadline for filing an application for sickness compensation is until the 15th day of the calendar month following the reporting month. The money arrives in the businessman’s bank account no later than December 31 of this year.

When applying for sickness compensation, a businessman performs the following actions:

- He goes to the local clinic to see his attending physician, who issues a sick leave.

- Draws up an application for compensation for a certificate of incapacity for work for a specific period.

- Attaches a photocopy of the receipt, which certifies the fact of payment of insurance premiums.

- All collected documentation is provided to the FSS.

Then, the individual entrepreneur receives a certain compensation for his sick leave. This depends on the time of registration of the businessman with the Social Insurance Fund.

How to get: opening and closing BC?

- Opening a sick leave certificate .

There must be a reason for this (illness or injury in oneself or a child, another relative). The attending physician sets the appropriate code (usually “01”). The start date of sick leave is the day of application. If a visit to a medical institution occurred after a working day or the day was almost completely worked, its calculation begins from the next day. - Closing and filling out sick leave .

Upon recovery, the sick leave is closed and a corresponding note is made. The individual entrepreneur must put his signature on the printed version. The second part of the sheet, intended for the organization’s accounting department, is filled out by the individual entrepreneur independently. The patient is given a printed version of the sick leave certificate. If a medical institution uses electronic sick leave, and the individual entrepreneur has the opportunity to receive this version of the bulletin, it is also sent to him (since due to the lack of employees, the entrepreneur himself handles the accounting reporting).

How to extend sick leave?

When extending sick leave, the individual entrepreneur contacts the same therapist who issued him this special form. Then the doctor assembles a medical commission. Doctors examine the patient and decide whether to close the sick leave or extend it.

The validity of the certificate of incapacity for work is extended for a maximum of 30 days. The number of such extensions of this form is not limited by law, but in the end they do not exceed 12 months.

Register now and get a free consultation from Specialists

Payment

Let's consider who pays for the BL and how. Sick leave is paid on the same principle as for ordinary individuals carrying out activities under an employment contract with an organization. But there are a number of features.

- When it comes to employees, their sick leave is paid by the employer (the first 3 days).

- The disability of individual entrepreneurs whose social insurance contract has entered into force is paid by the Social Insurance Fund from the first day.

How much is the fee?

The amount of sick leave benefits will not exceed the minimum wage established by law , because the payment is based on this amount, and not on the average salary (Part 2.1, Article 14 of Federal Law No. 255).

The benefit is calculated based on the number of years that the individual entrepreneur has been operating or worked under an employment contract in any organization (total insurance length):

- more than 8 years – 100% minimum wage;

- from 5-8 years – 80% of the specified payment;

- less than 5 years – 60%.

Let's consider an example of calculation . IP L.N. Kuleshov had no previous insurance experience. He registered with the Social Insurance Fund last year and paid his contribution on time. His sick leave was 15 days. The average daily earnings is 11280/31 (number of days in a month) = 364 rubles (taking into account rounding of the amount).

The payment amount is calculated as follows: 364 x 60% x 15 = 3276 rubles. If Kuleshov had been registered with the Social Insurance Fund more than 8 years ago or had a total insurance experience of 8 years and 1 year as an individual entrepreneur (also with voluntary insurance), the benefit would be equal to 5,460 rubles (364 x 15).

Payment of sick leave in individual entrepreneurs - calculation and receipt of funds

Every year on the territory of the Russian Federation there are more and more citizens registering individual entrepreneurs. In this regard, many situations that an ordinary person may not think about become more relevant and require additional study.

One of them is sick pay in individual entrepreneurs. And if for an ordinary company employee this does not become a serious problem, then for an individual entrepreneur solving this issue will require some effort. Let's figure out what to do if you have registered as an individual entrepreneur and need to get sick leave.

Each individual entrepreneur, like other institutions, pays insurance premiums for each employee. The amount of contributions is approved at the legislative level, and all payments are sent to the Social Insurance Fund.

However, the entrepreneur himself does not have a fixed salary, and may not make these deductions. In this regard, if a situation arises when an entrepreneur falls ill, insurance payments for sick leave from the Fund will not be made.

Situations in which an individual entrepreneur can count on paid sick leave

This is possible if an individual entrepreneur enters into a voluntary insurance agreement with the Social Insurance Fund. Fulfilling this condition and following all the standards prescribed in this agreement during the year will allow the individual entrepreneur to receive cash benefits for the following reasons:

- In case of loss of ability to work due to illness.

- If there is a need to care for a relative in need of outside help, or a child.

- During pregnancy or childbirth.

- One-time payment of benefits at the birth of a child.

All these reasons, supported by relevant documents confirming their validity, will be paid in accordance with the law.

Drawing up an agreement with the Social Insurance Fund

Carrying out this action will require the entrepreneur to prepare the following documents:

- a photocopy of a document confirming the identity of the entrepreneur. It is enough to make copies of the first two pages;

- a copy of the document issued after registration with the tax service;

- It will also be necessary to make a photocopy of an extract from the State Register of Individual Entrepreneurs.

Important! If you visit the FSS in person, you will need to have the originals of these documents. This is necessary so that Foundation employees can verify the authenticity of the copies you provide and approve them. If copies are sent by registered mail, then they must be certified by a notary.

Next, after five working days, the FSS should receive a notification confirming your registration as an insured person. After this, you need to make a contribution, the payment of which, at the request of the entrepreneur, can be made either in one amount or divided over several months.

This condition must be met before the last working day of the year. If an individual entrepreneur, for any reason, does not fulfill this condition, the FSS will terminate the existing contract. After timely payment is made, the agreement will come into force on the first calendar day of the next year.

How is the amount of sick leave paid to individual entrepreneurs calculated?

It is calculated using a formula based on the insurance length of the entrepreneur and the minimum wage (minimum wage). Experience affects the indicators in the formula as follows:

- Individual entrepreneur's insurance experience is less than five years. In this case, 60% of the total minimum wage will be taken into account;

- experience from five to eight years. A figure equal to 80% of the minimum wage is taken;

- more than eight years - 100% of the minimum wage.

Note! Work experience includes the time of official work in any enterprise or individual entrepreneur when insurance payments were made to you by the Social Insurance Fund.

The following formula is used for calculation:

Amount = (minimum wage x 24/730) x SN x KS

where CH is the period of incapacity for work of the entrepreneur, KS is the length of service coefficient.

When calculating the expected payments, it turns out that in order to recoup the insurance contributions to the Fund, you need to spend about two weeks on sick leave every year. Because of this, many entrepreneurs prefer not to bother themselves with the procedures associated with drawing up an insurance contract with the Social Insurance Fund.

Stages of receiving money for being on sick leave for individual entrepreneurs

If, as an individual entrepreneur, you get sick, the first thing you need to do is go to the clinic at your place of residence. There, the doctor will issue a sick leave for you, which will reflect the reasons for your disability, and its presence will be considered the basis for receiving insurance payments.

To receive the money you are entitled to, you need to complete the following sequence of actions:

- draw up an application indicating a request to transfer the funds due to you to the specified bank account;

- have with you a sick leave certificate for individual entrepreneurs, filled out by your attending physician and confirming your temporary disability;

- copies of certificates confirming compliance with payments to the Social Insurance Fund in accordance with the required rules.

After this, taking into account that all documents have been filled out correctly, insurance payments should arrive in your account within 10 days.

Important! After leaving sick leave, you can contact the Social Insurance Fund with a request for payment of insurance benefits not immediately, but within six months. After their expiration, it will no longer be possible to receive the required payments.

When filling out the application, you must consider the following details:

- You must fill out the form with a black pen. Preferably gel;

- letters should not be capitalized, but printed;

- you cannot go beyond the boundaries marked on the form;

- It is prohibited to correct errors in the document. If you fill it out incorrectly, you must take a new form.

Bottom line

Whether to enter into an agreement with the Social Insurance Fund or not is a personal matter for each entrepreneur. Many individual entrepreneurs prefer to complete all the required documents and have insurance in case of a force majeure situation. After all, even small amounts of payments due while on sick leave are still better than nothing.

However, some individual entrepreneurs refuse to formalize an agreement with the Social Insurance Fund, citing the fact that the effort expended on this procedure does not pay off in the future. However, it is worth noting that the state increases the minimum wage every year, on which the number of payments depends, and tries to provide more comfortable conditions for supporting an individual entrepreneur.

Legal consultation

Take advantage of free legal assistance by phone or via the feedback form below:

+8 ext. 107 Russia +7 ext. 696 Moscow and Moscow region +7 ext. 726 St. Petersburg

Source: https://Pensiolog.ru/articles/oplata-bolnichnogo-ip/

How is the ballot filled out?

The key is to fill out the second part of the ballot , which is usually completed by the employer (or chief accountant). How to fill it out? It is important to consider the following points:

- filling is carried out with a black gel pen (if we are talking about an electronic document - black font);

- letters must be capitalized and printed;

- going beyond the cells is prohibited;

- corrections are prohibited;

- a space is highlighted by skipping a cell.

The following lines must be completed:

- place of work - indicate the full or abbreviated name of the individual entrepreneur;

- mark as the main place of work;

- under the registration number the insurance number in the Social Insurance Fund is entered;

- TIN and SNILS;

- act N-1 is indicated only if the injury was received during the direct implementation of business activities;

- the start date of work is not indicated (clause for those working under an employment contract);

- number of years and months of insurance experience (total, previous jobs under TD are also taken into account, if any);

- the minimum wage and its daily calculation are indicated as the average earnings (per month);

- calculated amount of insurance benefit (based on the number of days of sick leave, the minimum wage and its derivative depending on the length of insurance);

- The individual entrepreneur enters himself as the manager, the accountant is not indicated.

The ballot must be signed.

Sample of filling out a sick leave certificate for an individual entrepreneur:

How to get benefits?

The first step is to contact the Social Insurance Fund , where you must provide the following documents (no later than 6 months from the date of the insured event):

- Application for payment of temporary disability benefits in any form indicating the following information:

- in the header of the application - the name of the territorial body of the Social Insurance Fund;

- in the main part - indicate information about the individual entrepreneur and place of residence;

- information about registration with the Social Insurance Fund;

- account number to which the benefit amount should be transferred;

- reference to Federal Law No. 255;

- indicate that the application contains a certificate of temporary incapacity for work;

- date and signature.

- Passport or other identification document.

- Completed hospital form.

Attention! The Fund's specialists check the validity of the sick leave certificate and the correctness of the calculated payment. Benefits are calculated within 10 days from the date of application.

Can an entrepreneur take a ballot for the BiR?

Voluntary social insurance involves payment not only in case of illness or injury, but also for pregnancy and childbirth. Submitting an application on the basis of a sick leave certificate is carried out in the same way as for temporary disability:

- the person must be insured;

- established premium - paid until the end of the year preceding the insured event.

Accordingly, if registration with the Fund was carried out in the same year in which the individual entrepreneur gave birth to a child, she will receive benefits only in the amount established for unemployed citizens.

What will the benefit be?

The amount of the benefit will depend, first of all, on the minimum wage (used as of the child’s birthday) and the vacation period indicated on the sick leave:

- 140 days – standard;

- 156 days – if there are complications during childbirth;

- 194 days – at the birth of 2 or more children.

Regardless of length of service, 100% of the minimum size will be used . The average daily earnings are calculated from the minimum wage amount, which is multiplied by the number of days of maternity leave.

Reference! If an individual entrepreneur is registered before the 12th week of pregnancy, she is also entitled to a one-time benefit in the amount of 649.84 rubles (from February 1, 2020).

Sick leave for pregnancy and childbirth

This benefit is available to all pregnant women who have consistently made contributions to the Social Insurance Fund and have been registered there for at least a year. It is too late to enter into an agreement with the Fund and start making insurance payments after pregnancy, because you can only claim benefits next year.

The amount of “maternity leave” is calculated based on the minimum wage, and its minimum amount today is:

*Payments for early registration are fixed.

The payment may be increased if the pregnancy is multiple or has serious complications.

You can apply for sick pay for pregnancy no later than six months after it ends.