Are gifts to employees subject to insurance premiums?

...in the case of transferring a gift (including in the form of monetary amounts) to an employee under a gift agreement concluded in writing, the organization does not have an object subject to insurance premiums on the basis of Part 3 of Article 7 of Law No. 212-FZ...

- Labor Code of the Russian Federation dated December 30, 2001 N 197-FZ

Article 57. Contents of an employment contract...The following conditions are mandatory for inclusion in an employment contract:......terms of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments)...

- Federal Law No. 212 of July 24, 2009 “On INSURANCE CONTRIBUTIONS TO THE PENSION FUND OF THE RUSSIAN FEDERATION, SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION, FEDERAL COMPULSORY HEALTH INSURANCE FUND AND TERRITORIAL COMPULSORY FUNDS HEALTH INSURANCE"

Article 9.

Please note: the moment of deduction of personal income tax and transfer to the budget depends on the form in which the gift was issued (Letter of the Federal Tax Service dated August 22, 2014 N SA-4-7/16692):

- if a gift is given to an employee in cash, then the tax must be withheld and transferred to the budget on the day the gift amount is issued from the cash register or transferred to the employee’s personal account;

- if the gift is given in kind, then personal income tax must be withheld and transferred on the nearest day of payment of funds to the employee, for example, on the next day of salary payment. If, after delivering a gift to an employee, no payments will be made until the end of the calendar year, then the employer must, no later than one month from the end of the tax period (year), notify the employee in writing, as well as the tax authority at the place of registration, about the impossibility of withholding personal income tax and the amount of tax not withheld. .

1 tbsp. 7 of the Law of July 24, 2009 N 212-FZ). Especially if, in accordance with the internal documents of the organization, gifts are received by those employees who have achieved certain production indicators. This clearly indicates that the gift is given to the employee for his work.

However, despite all the solemnity of the moment, the presentation of gifts to employees from an accounting point of view is a business transaction that must be properly formalized, reflected in accounting, and taxes and contributions calculated. We’ll look at how to do all this correctly and what an accountant should pay attention to in this article.

What is a gift? A gift to a gift is different. In order to correctly formalize the transfer of a gift to an employee, and then correctly calculate taxes and contributions from this operation, it is necessary to determine how this gift qualifies from the point of view of civil and labor legislation. 1. A gift not related to the employee’s work activity (for anniversaries and holidays, etc.).

- the amount of each gift (including those not exceeding 4,000 rubles) is reflected in the certificate as income with code 2720;

- the amount of the gift that is not subject to personal income tax (i.e. up to 4,000 rubles) is reflected in the certificate as a deduction with code 501.

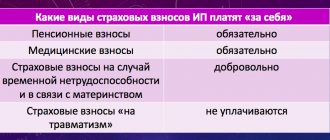

Insurance premiums on gifts to employees To determine whether insurance premiums are calculated on gifts to employees or not, you need to clearly understand the nature of the payments these gifts relate to. According to Law No. 212-FZ, insurance premiums are levied on payments and other remuneration to employees within the framework of labor relations (Part 1 of Art.

Example 1. Non-monetary income of a sewing studio employee

L. T. Sidorenko works as a seamstress in the Beloshveyka atelier. Over the past September 2020, the employer made payments to her partially in non-monetary form. The possibility of remuneration in kind is stipulated in the employment agreement concluded by L. T. Sidorenko with the director of the Beloshveyka atelier.

So, L. T. Sidorenko was given 5 T-shirts and 5 shirts towards September earnings. In value terms, this non-cash income amounted to 20% of the employee’s actual salary for September 2020.

Where to look for what is not subject to insurance premiums

In 2020, to understand what income is not subject to insurance premiums, you need to refer to Article 422 of the Tax Code. This article contains a closed list of positions. And this is important. Let us explain why. If you suddenly wonder what accruals are not subject to insurance contributions and in Art. 422 of the Tax Code of the Russian Federation did not find any mention of the corresponding amounts from your case, which means that contributions will still have to be calculated on them.

Please note that tax authorities extremely do not like broad interpretations of closed lists by the persons they check in their favor. So, be prepared to defend your position if you think that in your case the amounts are not subject to insurance premiums.

Let’s say right away that there have been no global changes regarding payments that are not subject to insurance premiums. Their composition is quite uniform across different companies and individual entrepreneurs, so they almost mirrored the transition from the Law on Insurance Contributions No. 212-FZ to the new Chapter 34 “Insurance Premiums” of the Tax Code of the Russian Federation.

Also see “New chapter on insurance contributions to the Tax Code of the Russian Federation since 2017.”

Determining the amount of income in kind

When calculating insurance premiums from income in kind, the main problem comes down to its monetary definition - after all, it is from the final amount of income that the premiums themselves are calculated. Typically, an employer can accurately price a product or service that it will later pass on to the employee as part of compensation. At the same time, the 2020 edition of the Tax Code, namely Article 421, provides the main thesis for determining the cost of remuneration in kind necessary for calculating insurance premiums. In such a case, employers should focus on the actual cost of goods or services transferred to the employee, if it corresponds to the average market price.

At the same time, the amount of natural income includes VAT and excise taxes provided for by law and allocated as part of the price, but excludes that part of the cost of goods or services that the employee paid independently. Do not forget that personal income tax is also paid on income in kind, and you must report on it in Form 6-NDFL and when submitting the register of certificates 2-NDFL.

A complete list of what is not subject to insurance premiums

For convenience, we will show which payments are not subject to insurance premiums in 2020, in the form of a table.

| Type of payment | Explanation |

| State federal, regional and local benefits | This includes unemployment benefits and other amounts required under compulsory social insurance. |

| All types of compensation from the state (within standards) | They may be associated with: • harm from damage to health; • free provision of housing, payment for housing and communal services, food, fuel or their cash equivalent; • issuing products or money in exchange; • payment for some sports nutrition and other attributes for professional sports; • dismissal (exception: a) compensation for unclaimed leave; b) severance pay and average monthly salary over 3 times the amount (six times in the northern territories); c) compensation to the manager, his deputies and the chief accountant in excess of three times the average monthly salary); • training, retraining and advanced training of personnel; • costs of the contractor under a civil agreement; • employment of those laid off due to layoffs, in connection with the reorganization or closure of an organization, individual entrepreneur, notary, lawyer, etc. • performance of labor duties, including moving to another place (exception: money for negative labor factors), compensation for dairy products , for unclaimed leave (when not related to dismissal). |

| Disposable mat. help | • people due to natural disasters or other emergencies for compensation for material damage or harm to their health, as well as victims of terrorist attacks in the Russian Federation; • an employee whose family member has died; • employees at the birth (adoption) of a child (including guardianship) in the first year. Limit: up to 50 tr. for each child. |

| Income of indigenous peoples from their traditional trade | Exception: wages |

| Amounts of insurance contributions | Includes: • contributions for compulsory personnel insurance; • contributions under contracts of voluntary personal insurance of employees with a period of 1 year for medical payments. expenses; • contributions under medical contracts. services to employees for a period of 1 year with licensed honey. organizations; • contributions under voluntary personal insurance contracts in the event of one's death/or harm to health; • pension contributions under non-state pension agreements. |

| Additional employer contributions to funded pension | Up to 12 tr. per year per employee |

| The cost of travel for workers from the northern territories to the place of vacation and back and baggage allowance up to 30 kg kilograms | If you are on vacation abroad, then the cost of travel or flights (incl. luggage up to 30 kg) is not taxed. |

| Payments from election commissions, referendum commissions, from election funds | To positions elected in the Russian Federation: from the President of the Russian Federation to the local level |

| Cost of uniforms and uniforms | Issued by force of law, as well as to civil servants. Free or with partial payment. Remains for personal use. |

| Cost of travel benefits | Provided by law to certain categories of workers |

| Mat. assistance to employees | Up to 4000 rub. per person per billing period |

| Payment for employee training | For basic and additional professional educational programs |

| Amounts to employees to pay interest on loans and credits | This means that the loan was taken for the purchase and/or construction of housing |

| Cash allowance, provision of food and things | Applies to the military, police department, fire service, heads of federal courier communications, employees of the penal system, customs authorities |

| Payments and other remuneration under labor and civil law contracts (including author’s orders) in favor of foreigners, stateless persons temporarily staying in the Russian Federation | Exception: when such persons are recognized as insured under Russian law |

Note that in many of the cases listed above, an employment agreement or a civil law contract allows you to issue not only money, but also some kind of bonus. Which insurance premiums are not subject to will be clear from the type of contract (agreement) with the person. In other cases, there are no premiums that are not subject to insurance contributions.

Postings regarding the deduction of mandatory contributions from the income of the donee employee

As is customary for the general case, compulsory insurance premiums are taken into account using an account. 69: for credit - accrual, and for debit - payment. Subaccounts are added to it depending on the specific type of insurance. Thus, the accounting department records the calculation of mandatory contributions as follows:

- DT 20 (25...) KT 69-1 - VNiM.

- DT 20 (25, 26, 44) KT 69-2 - PFR

- DT 20 (25...) CT 69-3 - Compulsory medical insurance

- DT 20 ... KT 69-11 - for injuries.

The actual payment of mandatory contributions is reflected by the following entries:

- DT 69-1 KT 51(50) - VNiM.

- DT 69-2 CT 51 (50) -PFR.

- DT 69-3 CT 51 (50) - Compulsory medical insurance.

- DT 69.11 CT 51 (50) – for injuries.

For information, non-payment (partial payment) of contributions due to an understatement of the base for their calculation or due to accounting errors is punishable by fines and penalties (Article 122 of the Tax Code of the Russian Federation). In especially serious cases (evasion of payment, failure to submit reports, submission of false information), criminal liability is provided (under Articles 198, 199 of the Criminal Code of the Russian Federation).

Payments for business trips

Let's focus on excess daily allowances. These amounts remained the same in 2020: from 700 rubles. within Russia and from 2.5 thousand for foreign trips. But in 2020, contributions will have to be calculated for exceeding these values.

This income tax rule also applies to large daily allowance contributions. Therefore, it is only a stretch to say about daily allowances that this is income not subject to insurance premiums.

For more information about this, see “How per diem is assessed in insurance premiums from 2020.”

Here’s something else that is not subject to insurance premiums and is directly related to business trips. These are the costs for:

- the path to the destination and back;

- airport taxes;

- commissions;

- way to the airport, train station (including transfers);

- baggage transportation;

- rental housing;

- mobile communications;

- fee for obtaining a foreign passport;

- visa fees;

- commission for currency exchange (check at the bank).

Similar rules on payments that are not subject to insurance premiums apply to members of the company's senior management bodies. When they come to a meeting of the board of directors, board, etc.

Civil contracts

In 2020, insurance premiums are not imposed on payments under civil contracts, for the purchase of property or property rights. As, indeed, under lease, loan, leasing, donation and other agreements, under which property and property rights are transferred for temporary use. An exception is contracts for construction, paid services, as well as copyright agreements. Payments under these agreements are subject to contributions. This follows from paragraph 4 of Article 420 of the Tax Code.

Prizes, pensions and scholarships

There is no need to charge insurance premiums when issuing prizes to customers, supplementing pensions to former employees, or paying scholarships under student contracts (including to full-time employees).

Material benefit

There is no need to pay insurance premiums for the material benefit that the employee receives due to savings on interest when receiving an interest-free loan from the employer.

Payments within the framework of labor relations

Let us repeat that Article 422 of the Tax Code of the Russian Federation establishes a closed list of payments that are exempt from insurance premiums in 2018. In particular, these are:

- state benefits that are paid in accordance with the legislation of the Russian Federation (subclause 1, clause 1, article 422 of the Tax Code);

- all types of compensation to employees determined by law within the limits established by the legislation of the Russian Federation. For example, severance pay within three times the average monthly salary (subclause 2, clause 1, article 422 of the Tax Code);

- amounts of one-time financial assistance to parents, adoptive parents or guardians upon the birth or adoption of a child. But only when such assistance is paid within the first year after birth or adoption and in an amount of no more than 50,000 rubles. for each child (subclause 3, clause 1, article 422 of the Tax Code);

- contributions for compulsory insurance of employees (subclause 5, clause 1, article 422 of the Tax Code);

- payment for training of employees for basic and additional professional programs (if the training is related to the professional activity of the employee and is carried out at the initiative of the organization) (subclause 12, clause 1, article 422 of the Tax Code), etc.

Are gifts to employees subject to insurance premiums?

Some amounts that are not subject to insurance premiums are somewhat different from all of the above. They are obviously not included in the contribution base (see table below).

| What are the fees? | What amounts |

| Contributions to OPS | Payments to: • prosecutors, investigators, federal and magistrate judges; • full-time students for activities in official student groups under labor or civil law agreements. |

| Contributions for illness and maternity | Any payments under the GPA: copyright, on the alienation of exclusive rights, publishing, licensing on the right to use a work of science, literature, art |

The second option for paying for medical services is through employees. That is, hired employees are sent for a medical examination, pay for all procedures independently, and later submit an application to the employer for reimbursement of the funds spent, accompanied by supporting documents. Rostrud indicates that this method of payment is legal.

- letter of the Ministry of Finance dated 02.02.2018 No. 03-04-06/6205;

- Federal Tax Service letter dated September 3, 2018 No. BS-4-11/ [email protected]

There are court decisions on the imposition of insurance premiums for medical examinations, which indicate that there are no grounds for charging contributions and personal income tax for this type of compensation payment. The main argument in these resolutions is that a medical examination is a mandatory element of the labor relationship; its results are needed by the employer, and not by the employee himself.

Compensation for medical examination expenses, insurance premiums for which, in the opinion of regulatory authorities, should be accrued by the employer, is recognized by tax authorities as the amount of the employee’s income. The written explanations from the Federal Tax Service state that insurance premiums are not subject to compensation payments, which are listed in paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation.

The Ministry of Finance insists that only the employer should pay for the medical examination directly, because The Labor Code does not provide for this form of compensation for workers. If the payment was made by the employee, and then the costs were compensated by the employer, these amounts should not be taken into account by the employer in the tax base for profits.

Thus, insurance premiums for a medical examination may not be charged only in the case where the employer himself directly paid for the services of the medical institution under the contract.

If the amounts of compensation to employees for the medical examination they paid for are repaid from the company’s retained earnings, personal income tax is not charged on them (clause 10 of Article 217 of the Tax Code of the Russian Federation).

Article 9.

As a general rule, the object of taxation is payments and other remuneration accrued by companies in favor of individuals within the framework of labor relations and civil contracts, the subject of which is the performance of work or the provision of services (Article 7 of the Federal Law of July 24, 2009 No. 212-FZ ( hereinafter referred to as Law No. 212-FZ)).

Accordingly, the amount of income from a valuable gift is fully subject to insurance premiums, including contributions for injuries. Insurance premiums As for insurance premiums for gifts given in honor of the holiday, according to the position of the Federal Antimonopoly Service of the North-Western and West Siberian districts (post of the Federal Antimonopoly Service of the North-Western Territory dated 20.02.

2014 No. F07-184/14, FAS ZSO dated 05/08/2013 No. F04-1405/13) their cost is not taken into account when calculating the base for insurance premiums. gift agreement between employer and employee If the presentation of gifts occurs en masse, for example, to all employees by 8 Marta, then there is no need to conclude separate contracts with each employee.

In this case, it is advisable to draw up a multilateral gift agreement, in which each of the gift recipients will put his signature (Article 154 of the Civil Code of the Russian Federation). 2. A gift as a reward for work. The Labor Code of the Russian Federation provides for the right of an employer to reward its employees with valuable gifts as incentives for work (Article 191 of the Labor Code of the Russian Federation).

In this case, the cost of the gift acts as part of the salary, and the transfer of the gift occurs not on the basis of a gift agreement, but on the basis of an employment contract with the employee. Gifts given to employees as incentives for work are, in fact, production bonuses. The judges indicated that such transfers are carried out on the basis of civil transactions, the subject of which is the transfer of ownership.

It is not directly related to the performance of work duties by employees, is not an incentive or compensatory payment, and is of a one-time and optional nature. The cost of gifts is determined regardless of the employee’s length of service and the results of his work. Thus, when presenting a valuable gift to an employee in honor of a holiday, the company must formalize the gift agreement in writing.

In this case, when transferring a gift, she does not have an object subject to insurance premiums (Part 3 of Article 7 of Law No. 212-FZ; letters of the Ministry of Health and Social Development of Russia dated 08/12/2010 No. 2622-19, dated 05/19/2010 No. 1239-19, dated 05/07 .2010 No. 10-4/325233-19). Let us note that according to civil law (clause 2 of Art.