Concept of cash transaction

Cash transactions include

- reception

- issuance

- storage

- cash recalculation,

and

- filling

- conducting

- reception

- issuance of documents that accompany monetary transactions.

Any movement or movement of funds must be reflected when conducting a cash transaction. There is a certain order that must be strictly followed.

Theoretically, only those who do not handle cash can be relieved of the duties of maintaining a cash register and conducting cash transactions. Accordingly, they can only accept money and make payments by bank transfer. In reality, this option is an exception to the rule.

In this case, during the audit, the tax inspector is informed in free form that only non-cash payments are carried out. The application must be documented.

Financial statements of a small enterprise under a magnifying glass: why, when and how.

If there are female employees on staff, then the article about maternity leave is relevant for you.

Cash documents and accounting procedures for cash transactions

Cash documents can be drawn up immediately after the transaction or at the end of the working day on the basis of fiscal documents drawn up in accordance with Art. 1.1 of the law “On the use of cash register equipment” dated May 22, 2003 No. 54-FZ (clause 4.1 of the instruction of the Central Bank of the Russian Federation No. 3210-U).

Cash transactions are carried out by responsible persons appointed by order of the director of the company or entrepreneur, who may be:

- accountant;

- Chief Accountant;

- other official;

- person conducting accounting;

- the head of a company or individual entrepreneur in the absence of accounting employees.

Documents drawn up on paper are signed by the cashier, accountant, chief accountant, and if there is no accountant or cashier on staff, by the director.

The cashier who has received a paper cash document must check that it is filled out correctly and that the signatures of the responsible persons comply with the pre-issued samples (except in the case of the document being drawn up by the director himself).

Cash documents are systematized and stored in the accounting department for 5 years after registration of cash transactions (clause 362, clause 1.4 of the order of the Ministry of Culture of Russia “On approval of the list of standard management archival documents” dated August 25, 2010 No. 558).

The procedure for organizing work on conducting cash transactions, storing cash documents and conducting a cash inventory is determined by a legal entity or individual entrepreneur (clause 7 of the instruction of the Central Bank of the Russian Federation No. 3210-U).

NOTE! The current procedure for conducting cash transactions allows for the execution of cash documents manually on paper or electronically using special programs (clause 4.7 of the instruction of the Central Bank of the Russian Federation No. 3210-U).

New order from June 1, 2014

On June 1, 2014, instead of the expired Regulations of the Central Bank (CB) of the Russian Federation dated October 12, 2011 No. 373-P, the Central Bank Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions” came into force. operations by individual entrepreneurs and small businesses." The document has passed state registration with the Ministry of Justice of the Russian Federation.

Now, according to the new procedure, for individual entrepreneurs (IP) and small businesses (small enterprises - SE), the limit on the amount of cash in the cash register has been lifted. The limit rule remains only for organizations that are not small businesses.

There, the formulas by which the cash limit is calculated remain the same: either based on actual cash expenses, or based on the volume of revenue. But the relaxation was still made. Now such enterprises can choose the formula for calculating the cash limit that is more favorable to them.

In particular, the strict rule for enterprises that do not have cash revenue to set a cash limit only on actual cash expenses has been canceled. That is, now such enterprises can change the limit to their advantage. Moreover, the tax inspectorate is deprived of the right to recalculate the newly established limit and can only control whether it is observed or not.

However, in order to avoid conflicts with tax authorities, it is better for the owners (or executive directors) of such enterprises to play it safe - to issue an order with reference to the Central Bank Directive No. 3210-U stating that from June 1, 2014, a new procedure for setting the limit has been established.

It is recommended that all separate divisions of enterprises that are not classified as small businesses have such orders if they donate cash proceeds not to the cash desk of the parent enterprise, but directly to the bank.

Innovations for individual entrepreneurs and small businesses

They are as follows:

— an individual entrepreneur is no longer required to maintain both the cash book itself and, accordingly, cash receipts and cash orders (the rule for maintaining cash documents applies only to those individual entrepreneurs who operate under special tax regimes specified in tax legislation);

— another relaxation applies to both individual entrepreneurs and small enterprises: they were removed from the obligation to draw up a register of deposited amounts (before the entry into force of Central Bank Directive No. 3210-U, an individual entrepreneur or a cashier of an individual enterprise was required to enter into the register on the last day of cash disbursement the funds not received by for any reason by employees of the amount of “cash”). According to the new procedure, on the last day of issuing money, an individual entrepreneur or an MP cashier must only write down “deposited” in the statement (opposite the employee’s last name) and seal the entry. Then the individual entrepreneur displays in the statement the amount of “cash” issued in fact and the amount to be deposited, and signs the statement. In a small enterprise, the procedure is the same, only the cashier performs them, after which he passes the statement to the chief accountant or another authorized person for signature;

- the new procedure contains another relaxation for individual entrepreneurs operating under special tax regimes and small enterprises - an individual entrepreneur or cashier may not keep a cash book on days when there were no cash payments;

— according to the Directive of the Central Bank No. 3210-U, MP cashiers can make changes to cash documents (but not to cash receipts and debit orders!). For example, in a cash book you can cross out an incorrect entry, enter the correct one next to it and seal the correction with the cashier’s signature (but be sure to decipher the essence of the corrections - why, in connection with what).

Which legal acts regulate the procedure for conducting cash transactions in the Russian Federation in 2020

Conducting cash transactions in 2020 is still carried out in the manner approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as Directive No. 3210-U).

Let us remind you that it is valid from 06/01/2014. At the same time, the provision “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved. Bank of Russia October 12, 2011 No. 373-P (hereinafter referred to as Regulation No. 373-P). NOTE! From August 19, 2017, a number of changes were made to the procedure for conducting cash transactions, which we will consider in more detail below (directive of the Bank of Russia dated June 19, 2017 No. 4416-U).

Read about changes in accounting for imprest amounts here .

Find out how to reflect cash transactions in accounting in ConsultantPlus. Get trial access to the system and access the material for free.

Types of cash transactions

The cash register carries out incoming and outgoing cash transactions.

- Receipt cash transactions are the receipt of money to the cash desk from any sources.

- Expense cash transactions define the action associated with the withdrawal of cash from the cash register.

Expense cash transactions include:

- payment of advances and salaries to employees

- issuance of travel and hospitality expenses

- issuance of cash for business needs

- transferring money to the bank

- social payments

Regulatory regulation of corporate accounting

KO accounting is regulated by the rules for accounting (order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n) and PBU 3/2006 (order of the Ministry of Finance of the Russian Federation dated November 27, 2006 No. 154n), dedicated to the accounting of foreign currency obligations.

It should be borne in mind that settlements in foreign currency between residents on the territory of the Russian Federation are prohibited (Article 9 of the Law of the Russian Federation of December 10, 2003 No. 173-FZ), with some exceptions related to settlements in which banks or non-residents participate. For cash payments through the company's cash desk, the issuance and receipt of accountable amounts for foreign business trips is important.

Read more about currency transactions in the material “Currency transactions: concept, types, classifications”

The forms of primary documents used when registering accounting transactions were approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. Despite the fact that the current law on accounting abolished the obligation to use unified forms when registering accounting transactions (clause 4 of article 9 of the law of the Russian Federation dated December 6, 2011 No. 402), in relation to KOs, these documents must still be drawn up on the forms established by the State Statistics Committee (information of the Ministry of Finance of the Russian Federation No. PZ-10/2012 to the Law of the Russian Federation No. 402).

Read about the requirements for primary documents in the article “Primary document: requirements for the form and the consequences of violating it”

The same document of the State Statistics Committee establishes the form of cash inventory acts and strict reporting documents stored in the cash desk. The procedure for conducting an inventory is subject to the rules established by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

Let us remind you that inventory is required:

- when changing materially responsible persons;

- before preparing annual accounting reports;

- when a shortage is identified.

Who can conduct cash transactions

Cash transactions have the right to be conducted by a cashier or another person who is vested with these powers by the head of the organization. In both cases, it is necessary to issue an appropriate order.

Most likely, in a small business, based on workload standards, one cashier will be enough. But if there are several of them, then the position of senior cashier is introduced according to the staffing table.

If we consider a situation where there are no employees, then cash transactions are carried out by an individual entrepreneur.

Documentation of cash transactions

1. To confirm the movement of funds, a receipt (PKO) and an expense (RKO) cash order are used. They relate to primary documents for cash transactions and have a generally accepted approved form.

Receipt order It indicates the source of receipt of funds.

According to the rules, an order form and a receipt for this order must be filled out. But in practice, there are cases when they are limited to filling out only the receipt. The filling rules do not allow this option. First, the order form must be filled out, and then a receipt must be issued.

When additional documents are attached, they must be indicated in the order. Such documents can serve as an act of work performed or services rendered.

The cash receipt order is signed by an accountant or other authorized person. But these powers must be confirmed by a power of attorney.

Money must arrive at the cash desk on the day the receipt order is drawn up. Otherwise, it is invalid. Timely preparation of an order is one of the points of compliance with cash discipline.

An expense cash order is used to issue cash from the cash register. It is filled out immediately before funds are issued. The amount is entered by hand by the recipient himself.

2. All information is entered into the cash book.

It must be filled out regularly and on time. This is a mandatory document. It doesn't matter whether a cash register is used or not.

Careful maintenance of a cash book is, first of all, cash discipline, which must be strictly observed.

Basic requirements for its design:

- All details must be indicated on the first sheet

- The cash book is intended for maintaining only one calendar year and no more

- All pages must be numbered and then stitched. Their total number is indicated on the last page

The cash book is filled out on the basis of cash orders: incoming and outgoing.

3. If there are employees, then cash payments are formalized by payroll or payroll.

Registration of cash receipts

Each receipt of cash at the cash desk is confirmed by cash receipt order 0310001 (unified form KO-1).

Having received a cash receipt order from the accounting department, the cashier checks that it is filled out correctly and that the necessary records and attachments are available.

Having received cash, the cashier counts it and checks the amount he received with the one for which the order was drawn up.

If all entries are made correctly and the amount deposited corresponds to that indicated in the receipt, then the cashier takes the money, signs it and, having put the seal (stamp) of the organization on the receipt, transfers it to the person who deposited the money.

If irreparable discrepancies are identified, he crosses out the paper receipt and sends it to the accounting department for re-registration.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

NOTE! The rules for conducting cash transactions in 2020 allow, at the request of the payer, to send a receipt of a cash receipt order drawn up in electronic form to the email address specified by him (paragraph 5, clause 5.1 of the instructions of the Central Bank of the Russian Federation No. 3210-U).

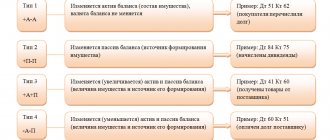

Accounting of cash transactions

Accounting for cash transactions involves monitoring the movement of cash.

To carry out cash-related transactions, account 50 “Cash” is used in the accounting chart of accounts.

Receipts of funds are accounted for as a debit, while expenses (payments) are accounted for as a credit. If necessary, subaccounts are used, such as:

- accounting for receipts and expenditures of money in national currency

- moving funds across different cash desks, if there are several of them

- movement of monetary documents

Synthetic accounting of transactions is carried out on the Cash desk account. It allows you to track all cash movements.

Formatting a sub-report: innovations or everything as before?

In the event that cash is issued for expenses related to the activities of the enterprise, the consumable is drawn up either on the basis of an administrative document drawn up on behalf of a legal entity when receiving money on a systematic basis, or on the basis of a written application from an accountant receiving money on a one-time basis.

The application shall indicate:

- required amount;

- the period for which it is issued.

The application is signed by the head of the company or entrepreneur.

At the end of the period for which the money was issued, the accountant draws up an advance report on the amounts spent by him, to which all documents confirming the expenses must be attached.

It must be drawn up no later than 3 working days from the end of the period for which the money was issued.

The employee submits the prepared expense report to the accounting department for verification and approval by the director of the company or individual entrepreneur.

NOTE! The procedure for conducting cash transactions in 2020 abolished the requirement to write an application for each issue of accountable funds (clause 6.3 of the instruction of the Central Bank of the Russian Federation No. 3210-U).

He also allows the accountant to be given a new amount without waiting for a full report for the previous one.

In many ways, this procedure for conducting cash transactions in organizations and individual entrepreneurs repeats that in force before 06/01/2014.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Audit of cash transactions

The tax inspector checks the cash discipline procedure. In the course of it it turns out:

- How is the cash register monitored?

- Is the cash book maintained correctly?

- checking the compliance of reports with primary documentation

- How fully are the funds received from the bank accounted for?

- correspondence of records with bank data

- use of funds received from the current account for their intended purpose

- control over compliance with the established cash limit is checked

To avoid the imposition of penalties, it is necessary to monitor whether the following are filled out and executed correctly:

- cash book

- reports on receipt and debit orders

- supporting documents that are necessary for operations.

If these mandatory rules are observed, the organization of cash management will be considered satisfactory and the audit of cash transactions will end with a positive result.

Cash flow accounting for private entrepreneurs

Individual entrepreneurs are entitled to the following benefits:

- They are not required to calculate the balance limit.

- Those individual entrepreneurs who maintain simplified accounting in the book of income and expenses do not need to draw up the entire package of cash documents.

In addition, there is no restriction on cash payments for personal needs for entrepreneurs.

So, documenting cash transactions depends not only on their type, but also on the organizational and legal form of the business entity.

Similar articles

- Features of registration of primary cash documents

- Main tasks and goals of auditing cash transactions

- Cash transactions in 2020

- Maintaining and recording cash transactions in foreign currency

- Accounting of cash transactions

Rules for conducting cash transactions

The general procedure for cash transactions includes:

- reception, safety and issuance of funds

- preparation of the attached documents

- cash register audit

- compliance with cash discipline.

Based on this, rules for conducting cash transactions have been established.

A small business representative or individual entrepreneur must necessarily set a cash limit.

A special place is allocated in the premises for cash register operations. At the end of the day, the remaining cash is calculated and withdrawn. This must be done daily.

To set a limit, an administrative document is drawn up. It is fixed by order in any form. There is no need to notify anyone. The period for which the limit is set is also decided independently.

Individual entrepreneurs and small businesses are required to:

- determine the limit on the balance of money in the cash register. Released funds in excess of the established limit must be kept in bank accounts

- All cash transactions must be documented with a receipt (PKO) and an expense (RKO) cash order. All necessary cash documents must be available

- Maintain a cash book daily. Enter all entries into it, i.e. make a full posting of cash to the cash desk

- The head of the organization (individual entrepreneur) is obliged to provide the organization with complete management of cash transactions

- Accumulation of cash in excess of the established limit is not allowed. An exception may be paydays and weekends (non-working holidays) if cash transactions were carried out.

The safety of cash is ensured on our own. The head of the enterprise (individual entrepreneur) is responsible for the timely transfer of money to the bank and for the limit of funds in the cash desk.

The cashier is responsible for maintaining cash documents; cash transactions are monitored by the manager and accountant.

Cash transactions can be carried out in paper form or electronically. Cash documents maintained on a computer must be printed and filed into the cash book once a year.

General issues of organizing cash work in credit institutions

The main regulatory document regulating the organization of cash operations in banks is the Regulation of the Central Bank of the Russian Federation No. 630-P “On the procedure for conducting cash transactions and the rules for storage, transportation and collection of banknotes and coins of the Bank of Russia” dated January 29, 2018.

The Bank of Russia establishes general rules for organizing cash work in commercial banks, which establish:

- general procedure for organizing and conducting cash register work;

- rules for the transportation and storage of banknotes, coins and other valuables;

- the procedure for identifying banknotes that have signs of counterfeiting and insolvency;

- procedure for replacing and destroying banknotes of the Central Bank of the Russian Federation.

Each credit organization (for example, a commercial bank and its branches) at its location creates a cash office and cash vault, in accordance with the requirements of the Central Bank of the Russian Federation for their technical condition. The cash desk is used to provide cash services to citizens, enterprises and organizations, as well as to carry out all types of transactions with cash and other valuables. The size of premises and their number are established by banks independently, based on the scale of activity and the volume of transactions performed.

Banks carry out the following types of cash transactions:

- acceptance, issuance and exchange of banknotes and coins of the Central Bank of the Russian Federation;

- exchange of ruble cash if it shows signs of insolvency;

- cash processing, namely, counting, sorting banknotes into bundles, into cassettes, forming coins into bags, as well as into other packaging means;

- exchange of ruble cash for foreign currency and vice versa;

- cash services for clients, which include the following operations: accepting cash from legal entities, individual entrepreneurs and individuals (citizens) for crediting to their accounts, as well as operations for issuing funds to them while simultaneously debiting them from their accounts.

In agreement with the RCC of the Central Bank of the Russian Federation, where the commercial bank has a correspondent account, a cash limit is established in the operating cash desk of the head bank, its branches and additional offices. The actual cash balance in the cash register must be no less than the established limit. The size of the limit depends on the scale and volume of activity of each specific commercial bank. Cash is needed by the bank to satisfy all customer requirements for receiving cash from their accounts.

All transactions with cash and other valuables are carried out on the premises of the bank, as well as its internal structural divisions, equipped in accordance with the requirements of the Central Bank of the Russian Federation, which are as follows:

- such premises are located in such a way as to exclude the presence of any unauthorized persons in them, except for cash and collection workers;

- such premises are equipped with a separate entrance, which is guarded by a security officer and technical means of security and surveillance;

- these premises must be equipped with fire and security alarms with a signal output to the bank's security department;

- The storage of funds and valuables is a specially equipped safe room with metal cabinets and safes of at least 1st resistance class.

A credit institution can insure all cash and other valuables in its operating cash register. Also, many credit organizations insure the health and life of cash and collection workers.

Work with cash is carried out by cash workers, and the actual transportation and collection of cash is carried out by collection workers, with whom agreements on full financial responsibility are concluded. Cash and collection employees, in accordance with Regulations of the Central Bank of the Russian Federation No. 630-P, are prohibited from:

- “... carry out orders from clients to carry out cash transactions on bank accounts, deposit accounts, bypassing accounting employees, in the absence of the control system provided for in paragraph 2.6 of these Regulations;

- remove from the client's field of view the cash and documents received from him or given to him until the transaction is completed and a copy of the cash receipt and expenditure document signed by the cashier is issued to the client with the cash register stamp stamped;

- store cash previously accepted from clients on the cashier’s desk;

- destroy, cancel dubious banknotes of the Bank of Russia that have signs of counterfeiting, including by affixing stamps, punching holes, cutting, as well as issue and return them to the client...”

Also, a bank (credit institution) usually independently collects its own funds from the RCC of the Central Bank of the Russian Federation (from its correspondent account) and back. It can also provide services to its clients, legal entities and individual entrepreneurs, for the collection and delivery of funds and other various valuables.

To effectively serve its clients, as well as process cash, each credit organization creates an apparatus of cash departments, which consists of the following types of cash desks - receipts, expenses, receipts and expenses, evening cash desks, and recalculation cash desks. The number of such cash desks, their staff, as well as technical support, depend on the nature and volume of activity of each credit institution.

The main tasks of the cash departments of credit institutions (banks) include:

- settlement and cash services for the population (citizens of the Russian Federation) in rubles and foreign currency;

- making non-cash transfers without opening an account on behalf of individuals using various money transfer systems;

- carrying out various types of cash transactions on behalf of individuals, namely, exchange (purchase and sale) of foreign currency, acceptance of foreign currency on deposits and withdrawal from accounts using, among other things, bank cards;

- acceptance and issuance of cash from legal entities and individual entrepreneurs;

- organizing cash handling when using ATMs;

- processing and recalculation of cash, including identifying counterfeit and dubious banknotes, as well as banknotes that have signs of insolvency;

- ensuring uninterrupted and efficient cash services for all bank clients;

- ensuring proper storage of cash and other valuables (precious metals, securities, strict reporting forms, etc.);

- ensuring the procedure established by law for receiving, processing, storing and issuing cash and other valuables from cash registers and storerooms (storage) of a credit organization (bank);

- carries out preventive measures aimed at eliminating waste, theft, miscalculations and other abuses in cash operations;

- organizing the elimination of shortcomings identified during audits and inspections of the organization of cash operations, as well as identifying cases of embezzlement, theft and other abuses;

- pursuing a policy of automation of cash operations that increases the productivity of bank cash workers;

- organization and implementation of activities aimed at improving the qualifications and professionalism of cash and collection employees of the bank.

The cash department of any credit organization (bank) is headed by the cash manager, with whom an agreement on full financial responsibility is concluded. The safety of cash and other valuables is ensured by the head of the bank, the chief accountant and the cash manager, and they also bear full responsibility for the timeliness and legality of all types of cash transactions carried out by the bank.

The structure of the bank's cash department can be simplified as the following diagram.

Structure of the bank's cash department

All cash transactions carried out in the bank can also be presented in the form of table 2.1.

Cash transactions of credit institutions

Table 2.1

| Contents of operation | Place carrying out | Document |

| 1. Acceptance of cash from organizations | Receipt cash desks. Evening box office | Announcement for cash payment |

| 2. Acceptance of cash through collectors | Receipt cash desks. Evening box office. | Transmittal sheet. |

| 3. Issuance of cash to organizations | Expense cash desks | Cash check |

| 4. Cash exchange for organizations | Change desks | |

| 5. Reception and issuance of cash to individuals | Receipt and expense cash desks | Incoming and outgoing cash orders |

| 6. Issuance and acceptance of cash through ATMs | ATM installation location | Incoming and outgoing cash orders |

| 7. Issuance and acceptance of cash through electronic cashiers | Installation location of electronic cash registers | Incoming and outgoing cash orders |

| 8. Acceptance of cash through automatic safes | Installation location of automatic safes | Transmittal sheet |

| 9. Counting, sorting, packaging of cash | Recount cash desks |

In a modern credit organization (bank), cash operations are focused on the maximum use of automation tools and modern information technologies. Automation of cash processes can significantly increase the productivity of cash workers, the accuracy of execution of cash transactions, the speed of servicing bank clients, the accuracy of the reflection of cash transactions in accounting and reporting, and significantly simplify and improve the quality of control of cash transactions. In general, all of the above can significantly reduce the cost of cash transactions in a credit institution.

The implementation of bank cash operations can be represented as the following diagram.

The procedure for conducting cash transactions