For the first time in the last 17 years, the investment pause in Russia lasted for three years, experts from the Russian Academy of National Economy and Public Administration (RANEPA) indicate. Last year, the real decline in investment in the segment of large and medium-sized enterprises exceeded 10 percent. This year, according to the forecast of the Ministry of Economic Development, the decline will continue. What is the fundamental reason for what is happening, and what needs to be done to reverse the trend, DW looked into it.

How investments were reduced

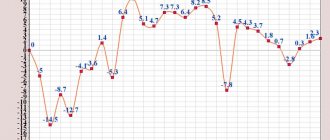

“The investment pause began in Russia already in 2013, despite formally positive indicators. The real growth in investment then amounted to 0.8 percent - in fact, it was no longer growth, but stagnation,” Olga Berezinskaya, a researcher at RANEPA, told DW.

Russian rubles

Then events developed in a downward direction: in 2014, real investments decreased by 1.5 percent, in 2020 - by 8.4 percent (and in the segment of large and medium-sized enterprises - 10.2 percent). The total volume of investments in fixed assets last year amounted to 14.6 trillion rubles.

“In the period from 2013 to 2020, the reduction in investment turned out to be significantly deeper than the decline in GDP and industrial output; the investment pause significantly reduces demand in the economy, worsening not only its current dynamics, but also its prospects,” notes the operational monitoring issued by RANEPA together with the Gaidar Institute and the All-Russian Academy of Foreign Trade.

Sanctions and crisis have nothing to do with it

The timing of the investment pause indicated by experts suggests that it began long before the imposition of sanctions and the devaluation of the ruble. This is confirmed by the author of the study, Olga Berezinskaya. She explains what happened this way: “After 1998 and until 2006, the Russian economy grew on import substitution, entrepreneurial activity and the beginning of a rise in oil prices. Then, until 2008, the decisive factor was the influx of capital and world prices. After the completion of correctional growth in 2012, a new growth driver was needed. However, he was never found. And this, in fact, is the main reason for the investment pause that has begun.”

Yakov Mirkin, head of the department of international capital markets at the Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, agrees with this. “Even before the introduction of sanctions in Russia, the rate of investment began to fall. The state sharply reduced large investments. Private business has been in a limited investment mode for the last 25 years. Russia is a capital export country. Add to this the chronic shortage of long-term money in the economy,” he told DW.

Government investment is not enough

One of the manifestations of the investment pause was stagnation in the construction segment, which provides more than a quarter of all financial investments in infrastructure. According to Berezinskaya, already in 2013 the construction complex went into conservation mode. “There were, of course, large projects - construction for the APEC summit, for the Olympics in Sochi. The construction complex grew and worked on them, increasing its capacity. But after the tasks were completed, investments began to decline. Doping in the form of state programs had dried up at that time,” says the expert. New large projects needed for further investment growth, in her opinion, are not enough.

And this despite such “constructions of the century” as the Kerch Bridge and stadiums for the 2018 World Cup. As Yakov Mirkin explains, this kind of government investment is not enough because it does not provide “self-sustaining growth.” It is based not on government megaprojects, but on the initiative of private business, which should have an interest in working over “long investment horizons.” The economy of the “great turning of the rivers” with an inflated military budget will not add to this, the economist is sure.

No trust - no “long horizons”

Work on “long horizons” is becoming less and less available today. This is a new trend, says Ruslan Galeev, director of the group’s department. “Currently, there is active integration of short-term projects, when receipts and returns occur within a short period (less than a year or operating cycle). In fact, companies are fiercely competing for them,” he told DW. The level of business confidence in long-term projects has decreased.

Context

Reducing the cost of living in Russia: a magical way to save?

Lowering the cost of living reduces the number of people living below the poverty line in the Russian Federation.

According to a number of economists, the authorities are artificially lowering it, saving on social payments. (03/17/2016) Meanwhile, it is in the long term that investments ensure the stability of economic growth, notes Olga Berezinskaya: “Investments have a double effect: in the short term they can increase current demand, in the long term they ensure the quality and stability of growth through modernization.”

The recipe for restoring business confidence is simple and has been voiced more than once: “cheaper credit, shock tax breaks for investments, for modernization, reduction of administrative burden, moderately weak exchange rate of the ruble,” lists Yakov Mirkin.

Another wasted year

According to him, the situation will change radically only if any economic instrument in the state is subordinated to the goals of increasing investment and “releasing business energy.” When and whether this will happen, experts cannot say. The head of the Ministry of Economic Development, Alexey Ulyukaev, is sure that it will definitely not be in 2016.

“This year we do not yet see an opportunity for investment demand to exit the negative sector,” he said on March 24 at the RSPP congress. And he gave his forecast: a reduction in investment in fixed capital at the level of 3-3.5 percent. “Minus 3.5 percent is possible under a scenario in which the weighted average oil price for the year is $40 per barrel. If this is the case, it will mean another lost year for the economy,” concluded Olga Berezinskaya.

See also:

How to survive a crisis: Russians are looking for a way out

How do private investors make money?

The leaders of investments in Russia are currencies, stocks and precious metals.

Currency

. You can make money quickly from exchange rate differences. And just as quickly lose everything. In 2020, those who invested in dollars found themselves at a loss - investors lost 5.5% of their investments due to exchange rate differences. In 2020, on the contrary, the dollar rose in price by 20.6% and investors made a profit.

The risk of losing money is moderate.

Stock

. Stocks don't always make money in the first year. The average waiting period for income is 3–4 years. Novice investors make the mistake of dumping stocks that are unprofitable at the end of the year - next year everything can change dramatically.

Thus, in 2020, shares became a loss-making investment - the Moscow Exchange index fell by 7.8%, and in 2020 the return on shares was 11.79%.

The risk of losing money is moderate.

Precious metals

. Long-term investment if you invest in bullion. Risky - if into jewelry. You can get quick income by trading on the stock exchange - the cost of a gram of metals can change significantly within a day.

In general, this is a profitable investment - there is always a demand for precious metals. In 2020, it was profitable to invest in palladium - its price increased by 24.6%. If we translate into rubles, then this is 51% of the profit.

The risk of losing money is low.

Some investors prefer a small but stable income. Such instruments include bank deposits, federal loan bonds and corporate bonds. On average, you can get from 7 to 9% profit on your invested money.

The risk of losing money is low, the investment is long-term.

Not all currencies are created equal. If you place part of your funds in dollars, then you can still get a small percentage of profit from your bank deposit with these funds. Savings in euros no longer generate income, since the eurozone has a negative deposit rate. If you invest in a currency, you need to remember that there are quite long periods when this currency loses to the ruble. Therefore, we always advise keeping part of your money in domestic currency. In 2020, the ruble continues to have prospects for strengthening and stability. The current range could be 62.0–67.0 per dollar.

When investing in stocks, an investor must find companies with real businesses and fairly shareholder-friendly policies. That's why we say that there are no bad times in the market, but only weak and strong stocks. Accordingly, for 2020 you can also put together a good portfolio that can generate income through dividend payments and growth in asset values.

Investing in precious metals is a complex topic. There are times when they are in high demand due to extremely dovish policies of leading central banks or geopolitical tensions. The recent decision to remove VAT from transactions with physical gold may lead to the creation of new investment products that may be of interest to ordinary citizens. In particular, debt instruments denominated in physical gold may appear, which will also bring a small, but still income.

Attributes of a stable past

“Labor” and savings books have long been attributes of stability for Russians. But they are becoming a thing of the past: savings books are being replaced with plastic cards, and “labor” cards are no longer needed due to the lack of official work. During the crisis, more and more Russians are being laid off or leaving due to unfavorable conditions themselves, joining the ranks of the so-called “informally employed.” Today there are about 20 million of them in the Russian Federation.

How to survive a crisis: Russians are looking for a way out

Any whim at 750 percent

Many banks refuse to issue loans to borrowers - the risk of non-repayment is too high. Some people do not try to get a loan themselves, because in order to confirm their solvency, they must provide information about their employment and regular salary. Microfinance institutions offer a solution - when issuing an express loan, they only ask for a passport. The rate can reach 750 percent per year.

How to survive a crisis: Russians are looking for a way out

Full attachment

Such investments in production consist in the fact that only one investor invests his funds, on the basis of which the project is implemented, equipment is purchased, or production volumes are increased. This process has both pros and cons. The features of a full investment include the following:

- you really have to invest a lot of money;

- the procedure is characterized by increased investment risk;

- if the goal of the investment project is not achieved, the investor will have to face high losses;

- if a positive result is obtained from the investment, then the only investor will receive high profits, which will not have to be shared with other investors.

Most often, full investments are used by large and long-established investors in the market. They must have the appropriate capital and the necessary knowledge. Only in this case will it be relevant to increase investment in production with a low risk of loss of funds.

Market economy

Clothing markets, which seemed to have almost completely turned into a relic of the 90s, are regaining popularity. As a rule, they are located near metro stations. The people who work here are mainly people from Central Asia and the Caucasus. A vest or T-shirt can be bought for 150 rubles (about 1.7 euros), a shirt for 500 (about 5.8 euros). Of course, we are not talking about any cash receipts.

How to survive a crisis: Russians are looking for a way out

"Alik" is the best Chinese friend

Middle-class Russians and young people prefer to buy clothes and equipment on the Internet, and foreign stores are becoming increasingly popular. Recently, the Chinese website AliExpress has taken the lead. Shopping here is cheaper than on eBay, not to mention regular stores and shopping centers. Sometimes you have to wait several weeks for a package, but the savings are worth it.

How to survive a crisis: Russians are looking for a way out

What do investments in production involve?

Investing in this area requires the investor to have large capital. Investments are aimed at increasing the volume of fixed capital, which includes:

- Material and technical base. Investments help reduce enterprise costs for the purchase of industrial equipment and production equipment;

- Financial assets – cash and securities – shares and bonds, company certificates, shares. The investor receives the benefit from such investments after their sale or in the form of profit from dividends;

- Intangible assets. Intangible investments are used in the form of rights to innovative developments and know-how.

Video revealing the advantages of investing in production:

Time to pick up the knitting needles

Pensioners in Moscow live much better than in the periphery, but even here it has become very difficult to live on a pension. After paying utility bills, about 8 thousand rubles (about 93 euros) remain on hand. With this money you need to buy food and medicine for a whole month. Elderly women are increasingly trying to earn money through their handicrafts: they knit socks, shawls, scarves and sell them near the metro.

How to survive a crisis: Russians are looking for a way out

Stale press

If you want to read a glossy magazine, but don’t have the money for it, you can buy a magazine that’s three or four months old at a discount. If previously unsold, expired magazines were mostly thrown away or distributed free of charge to libraries, now kiosk owners prefer to give them away for resale. After all, there is demand.

How to survive a crisis: Russians are looking for a way out

How to optimize investments?

Every investor who has been working in the field of investing for a long time understands that for successful activity it is necessary to carefully evaluate the investment object, analyze the prospects for the development of a production enterprise, compare different offers, and also optimize investments. Only in this case will investments and production of goods be effective.

To optimize investments, we use professional advice:

- the state of the country's economy as a whole is analyzed;

- tax legislation is assessed, as well as changes made to it regularly;

- the specific market segment in which the manufacturing enterprise operates is studied;

- all competitors in the market are identified;

- analyze supply and demand for specific goods produced by a manufacturing company;

- return on investment is assessed;

- The approximate payback period of the investment is calculated.

Additionally, the investor must regularly carry out work based on which production costs are minimized. Only in this case will investments and production volumes grow, so the investor will receive high returns from his work.

Farm hunting season is open

Despite the presence in Russia of the so-called list of vital and essential drugs, the prices of which are regulated by the state, finding the right medicine at an affordable price is not so easy: drugs become more expensive in direct proportion to the depreciation of the ruble. Pharmacies have appeared in different areas of Moscow, positioning themselves as extremely cheap. In reality, this is just a publicity stunt.

How to survive a crisis: Russians are looking for a way out

Not from the shelf, but from under the counter

During a crisis, some entrepreneurs justify their name by being particularly entrepreneurial. As you know, one of the cost items for grocery stores is a license to sell alcohol. You can save money by refusing it and removing all goods from the shelves. And for regular customers, bring the goods from the warehouse in an opaque bag. The price is arbitrary. There is a risk, but those who don’t take risks don’t sell champagne.

How to survive a crisis: Russians are looking for a way out

Investments in production facilities and equipment increased annually during the 60s, and expansion of production became a central point of management strategy in companies.

The latest equipment was installed in the chemical, mechanical engineering, fiber and electrical appliance industries, and Japanese production capacity reached and in some industries even surpassed that of the United States. Investments in production expansion to modernize equipment and save energy have grown at an extremely high rate, increasingly requiring long-term planning. [p.48] Planned increase in value 9120 Investments in expanding production and trading activities 9190 Double counting to accounts 9101-9120 [p.235] Often the company’s obligations to shareholders conflict with its need to throw additional shares onto the market (this is necessary for restructuring companies). Investments in expansion of production reduce revenue growth, which reduces the company's ability to enter the capital market. Private companies have proven that their non-state status gives them the freedom to focus their efforts on strategic issues. New markets provide greater freedom of action for private companies, which are more willing to take risks than state-owned companies. Shareholders of state-owned companies consider such freedom too risky, but such an attitude to risk negatively affects the dynamics of the price of their shares. [p.407]

Investments in production expansion [p.125]

Investments in production expansion. Their goal is to expand the volume of production of goods and services for already established markets within the framework of existing production facilities. [p.87]

Let's consider some enterprise that produces consumer products. Let's ask ourselves how investments in expanding the production of this enterprise affect the growth of its products. Obviously, an increase in investments i(i) leads to an increase in production y(t). But the whole question is in what extent this happens. How to express this dependence analytically [c .196]

Investments in production expansion. The purpose of such investments is to expand the volume of production of goods and services for established markets within the framework of existing production facilities. [p.101]

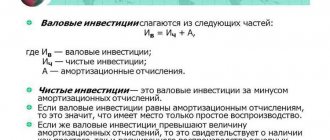

There are investments in the creation of a new enterprise (or a branch of an existing one), complementary and current investments. Complementary investments include investments in expansion of production (increasing production capacity) in research and development, investments in rationalization of production to ensure production stability. [p.300]

Investments in production expansion are aimed at increasing the production capacity of the enterprise. Investments in production rationalization are aimed at reducing costs, for example through robotization. Investments in ensuring production stability are aimed at preventing negative phenomena that could lead to a crisis situation in the enterprise [p.300]

Problem 2.5. The average net profit of an enterprise intending to invest in expanding the production of previously mastered products amounted to 380,000 rubles per year in real terms. The residual book value of the company's assets is RUB 1,530,000. The initial book value of the enterprise's assets was RUB 2,300,000. What discount rate, taking into account business risks, can be used to discount the income expected from expanding production [p.49]

Attracting investment in expanding production in order to modernize equipment and save energy requires work to develop long-term planning strategies. [p.77]

A company's growth strategy can be based on internal (investment in production expansion) or external (acquisition of new business units) sources. Internal growth is carried out, as a rule, in the form of creating new or changing existing products, or introducing products to new markets. External growth usually occurs in the form of diversification, when a company acquires similar product lines or offers the opportunity to enter new areas of the firm's business. International growth strategies often involve joint ventures. [p.284]

In ch. 16 indicated that each enterprise needs capital, first in the creation and construction of the enterprise, then in making investments in new equipment to replace outdated ones (see Chapter 12), in maintaining the continuity of production, payment of wages, purchase of raw materials and supplies, costs of selling products (This is discussed in detail in Chapter 13). Financing of these needs occurs both at the expense of one’s own (profit received from various types of activities, depreciation charges, proceeds from the sale of one’s own shares, etc.) and borrowed funds (loans, subsidies, etc.). In addition to these forms, there are special forms of financing: leasing and factoring (see Chapter 16). The peculiarity of financing the needs of an enterprise is that inflows and outflows of monetary resources occur at different times and are unequal in size. Consequently, in order to ensure the stable and progressive development of the enterprise, it is necessary that payment of all the above-mentioned needs occurs in a timely manner and in full, which can only be achieved if there is a balance (equilibrium) between the inflow and outflow of funds, both in time and quantity . This balance is not the result of a purely mechanical establishment of the timing of inflows and outflows of financial resources as a result of the economic activities of the enterprise. It is based on the organization of production and sales of products that ensure the achievement of such a financial condition of the enterprise and its solvency that would allow it to function successfully and invest capital in expanding production. This is due to the fact that the financial condition of the enterprise and solvency are the result of its production, economic and commercial activities related to the sale of products at prices that bring it profit, on the one hand, and the ability to effectively manage its own and borrowed capital, on the other hand. The enterprise constantly faces questions about where and when, in what quantity it should invest available financial resources, how to optimally distribute them according to production needs (Fig. 29.10). [p.667]

Complementary investments concern, like current ones, the equipping of production means in existing locations. Complementary investments include investments to expand production, make changes to the production program and ensure production safety. (For example, this could include investments in energy-saving and environmental measures.) [p.13]

Investments in production expansion lead to an increase in enterprise capacity. A characteristic feature of investments in changes in the production program is the modification of the enterprise for various reasons. Thus, investments in rationalization serve to reduce costs, investments in the transition to a new program - bringing production in accordance with changes in sales volumes of previous types of products, investments in diversification help prepare for changes in the sales program, which is influenced by the release of new products or the development of new markets. The distinction between investments to expand production and investments to change the production program is often difficult, since in most cases the expansion of capacity occurs simultaneously with a change in the production program. [p.13]

The number and type of relationships between investment objects, as well as investment objects and other areas of the enterprise’s activity, are different. Depending on the degree of interdependence, investments can be isolated or interconnected. The former are considered independent if the decision to accept one investment project does not affect the decision to accept another. If they cannot be implemented simultaneously, i.e. the adoption of one of them automatically excludes the other, then such projects are called alternative. With isolated investments, such as certain financial investments, there are almost no connections to other areas of the enterprise that need to be taken into account. On the contrary, in the case of investments to expand production in order to manufacture a new type of product, we are talking about interrelated investments that require coordination with such areas of activity as sales, production, financing, personnel, as well as with research and development. [p.16]

The fact is that J. Keynes did not associate the multiplier effect with the return on investment in the form of the production of additional products or services. He believed that an increase in purchases of investment goods means an increase in the income of those economic agents from whom these goods were purchased. This refers to firms producing machines, machinery, equipment, computers, building materials, etc. An increase in the income of employees of these firms in accordance with the Keynesian consumption function causes an expansion of their consumption based on their own marginal propensity to consume. The growth of consumption, in turn, contributes to a further increase in effective demand and national income. This essentially increases purchasing power in the economy and therefore overall demand. Increased purchasing power ultimately leads to the fact that firms can sell more, which requires them to increase the hiring of labor and the purchase of other factors of production.

RETURN ON INVESTMENT is an indicator of the effectiveness of capital investments in expanded production and new equipment. It can be the profitability of capital investments (investments) Рн and their payback period T [p.259]

Let us combine the last two models - the model of disposal of funds and the model of production growth taking into account bank investments. Let the enterprise produce the products needed by the state. As in the model of disposal of funds, we will assume that the enterprise is rapidly wearing out equipment and tools and the enterprise itself does not invest the proceeds into production ( = - ( )). Only the bank makes investments in production. Moreover, at time t the flow of capital investments amounts to u(t) conventional units and is instantly converted into expansion of production. [p.438]

It follows that the role of credit in expanding production is increasing. Significant changes are also taking place in mortgage lending methods. Thus, a mortgage loan usually involves the provision of loans secured by real estate (buildings, land). Moreover, the loans provided can be used to satisfy various needs, including consumption expenses. Here there are also changes in the applied lending methods, consisting in the fact that loans are provided against the security of part of the objects under construction, for example, in housing construction. In such cases, the loan provided can serve as a source of funds for subsequent construction on the terms of full repayment of the loan debt from the proceeds from the sale of the objects under construction. This confirms that improving lending methods helps to increase the role of credit, in particular in the area of its use as a source of investment. [p.220]

INVESTMENTS - investing in the expansion of production, securities, new technologies, etc., as a result of which an economic and social effect is achieved. [p.286]

INTERNAL GROWTH - the growth of a company through investments in its production, expansion, reconstruction. [p.345]

As world experience shows, when a product reaches a maturity stage, further investments in expanding or modernizing production turn out to be ineffective; it is necessary to change the production facility or transfer its production to developing countries. [p.520]

As for monetarism and Keynesianism, the question here is more complicated. In world economic science, the struggle between these (and some other leading directions) has been going on for several decades with varying success. Both currents have influenced the economic policies of many developed countries. Keynesians - followers of the great English economist J. Keynes - insist on the need for government intervention in the course of economic processes; monetarists (followers of the American economist, Nobel laureate M. Friedman) - supporters of broad liberalization, market freedom and put the role of money in the economy at the forefront. Keynesians have always proposed to combat an economic downturn, if it occurs, by artificially (using the issuance of money) expansion of aggregate demand for products, while monetarists consider it necessary, first of all, to create conditions for investment in expanding production, for which purpose to achieve financial stabilization of the economy. Throughout the book, we will observe how these theoretical provisions are reflected in the proposals and demands of various political forces in Russia. [p.71]

The subordination of the enterprise’s private plans and the place of the investment plan among them depend on the type of investment. Thus, investments in expanding production make sense only when, on the basis of marketing research, the sales opportunities and competitiveness of the manufactured products have been sufficiently reliably established. In this case, based on the implementation plan, a production program and production plan are formed, from which the need for additional capacity and new equipment follows. If investment calculations confirm the profitability of the production expansion project, then the sales division of the enterprise develops proposals for advertising events, new sales channels, etc., which will cause new changes in the investment plan. [p.31]

A single niche strategy is more viable during the emerging and growth stages of a market. As the market matures, its implementation becomes more difficult. Initially, a pioneer company can set itself the goal of either becoming a market leader or occupying a modest niche in it, which is especially attractive to the company’s management for several reasons. Firstly, pioneers often do not have sufficient resources to make large investments in expanding production and promoting goods. Therefore, targeting a narrow market segment seems like the only reasonable solution. Secondly, market competition often takes on harsh forms when it is unrealistic for a small company to achieve leadership. Thirdly, the company’s personnel may have knowledge and skills that are adequate not to the market as a whole, but only to one of its segments. For example, the Hewlett-Pakard company has great capabilities in the market of knowledge-intensive products, but has no experience in the market of consumer goods. This circumstance kept the company from entering the growing mass market, first with its electronic calculator and then with the personal computer. Finally, many firms occupy a single niche simply because they are unable to cope with the task of entering mass markets. [p.208]

The Bridgestone Tire and Rubber Company, which became one of the world's three largest tire manufacturers, developed a strong research capacity, followed by large investments in manufacturing. In 1965, when it built a tire plant in Tokyo, it included a large technical center that included a research laboratory, a new product design department, and a tire design department. The company was the first to switch to nylon cord, polyester cord and the production of tires with steel radial cords, which has become one of the main factors of the company's success in recent years. At the company. There is now a powerful technical center with 1,100 employees (6% of all personnel), it spends 4% of the value of sales on research and development. In addition to the four plants it had in 1960, it built nine large plants in Japan and four in other countries over the next 20 years. The timing of capital investments is carefully calculated so that construction falls during the years of depression. Sales grew from 37 billion yen in 1960 to 500 billion yen in 1980 (13 times in absolute terms and 3.25 times in real terms), but the number of employees increased only from 9,370 to 17,800 people. Although two overseas factories (in Iran and Singapore) were considered unprofitable, extensive investment in expanding production became one of the company's success factors. To coordinate the expansion of various capacities and potentials, the company's president drew up a detailed long-term plan, and since 1967 the company has introduced a permanent system [p.334]

Making the most appropriate decisions in the process of investing large funds. A successfully operating corporation has a rapidly growing volume of product sales, which requires new investments to expand production (purchase of equipment, R&D, etc.). The financial manager must determine the optimal growth rate of sales volume, the structure of funds raised, methods of mobilizing them, methods of investment - through bank loans or by issuing their own shares and bonds in the case of a bank loan - long-term or short-term. [p.96]

The net present value method really loses its meaning when market imperfections limit shareholders' choices in constructing their investment portfolios. Let's say the Nevada Aquaculture Corporation (NHA) was founded by one founder, Alexander Halibut. Mr. Halibut has no money of his own and no credit options, but he is convinced that investing in expanding his operation has a high net present value. He tried to sell the shares, but found that potential investors, skeptical about the prospects for developing fish farming in the desert, offered him much less than what he valued his company. To Mr. Halibut, the capital market is as if it doesn't exist. It makes no sense for him to discount expected cash flows at a rate equal to opportunity cost. [p.126]

Today, Nestlé is the leader in the Russian coffee market, chocolate market, baby food market and ice cream market, and is also strengthening its presence in the culinary products and caramel markets. Nestlé's long-term success in the Russian market was achieved due to a number of factors. First of all, Nestlé strengthened its position and expanded its presence in Russia through investments in local production and industrial infrastructure, active promotion of brands, as well as the constant expansion and development of the national sales network. [p.162]

"Networkers" win

Purchasing activity in Russia decreased by about 10 percent during the crisis. They began to buy less, trying to choose cheaper goods. However, many, having received a salary or pension, try to immediately spend it by buying food and household chemicals for future use: they do not become cheaper, but the income depreciates due to inflation. Preference is given to chain supermarkets where promotions take place.

How to survive a crisis: Russians are looking for a way out

conclusions

It is difficult for investments to recover in conditions of high external and internal uncertainty. It is obvious that the Russian economy cannot manage without foreign investment. Against the backdrop of a decline in production, domestic sources of investment are not enough to increase economic growth and its quality. Russian sources of domestic investment need to improve monetary and exchange rate policies. The government must direct economic policy to increase productivity. At the same time, the growth of investments must be systemic; not only government investments within the framework of special projects must grow.

Over six years, Russia will have to spend 25.7 trillion rubles on national projects. Projects relate to healthcare, education, housing and the urban environment, ecology, roads, labor market, science, digital economy, culture, small business, export and main infrastructure. The federal budget envisages expenses of only 13 trillion rubles; the remaining funds are planned to be raised from private investors, both domestic and foreign [27].

The contribution to investment growth is largely provided not only by budget expenditures and investments of state-owned companies, but also by significant private investments. Their share in the structure of investments is large, and without their growth, investment activity in the country cannot grow significantly. In the current foreign policy and economic situations, the issue of attracting private investors is complex; measures are needed to stimulate investment activity, improve the investment climate, and reduce the regulatory burden, since they limit investment activity. It is important to encourage banks to issue investment loans, create special guarantees to protect financing, and make investments by the state and state-owned companies more efficient. The state must provide infrastructure for investors - transport, energy, and also invest in healthcare and education systems. The assignment of an investment rating by three leading agencies is a positive argument for investors who want to invest in Russia. But, above all, consistency in the behavior of the state and equal conditions for all economic agents are important to fulfill the main task - increasing the volume and improving the quality of investments in the Russian economy.

Don't worry about middlemen!

A place of honor on newspaper shelves is occupied by publications dedicated to finding housing and work. Looking for an apartment through a realtor is expensive - you have to pay him a commission for services, so the demand for renting without intermediaries has increased. The same applies to work - not every employer or applicant wants to pay for the services of recruitment agencies. Advertising in a newspaper carries risks, but you can still find useful information.

How to survive a crisis: Russians are looking for a way out

Process nuances

Investment in production is represented by the transfer of money to production, which involves the creation of new material goods. Their main purpose is to meet the needs of society.

Investments in new production facilities can be presented in different forms, since they depend on the chosen direction of the company’s work. Most often, large and experienced investors prefer to invest their own funds in the following areas:

- industry;

- construction of production facilities;

- forestry or fisheries;

- agricultural complex;

- information Technology.

The above areas are considered the most promising and interesting for many investors. For them, the risks of losses are minimal, since the demand for production results is considered high.