What is it needed for

Let's look at 41 accounting accounts (for dummies), because the topic of accounting for goods occupies a key place in the financial and economic activities of the organization.

Here goods are meant as a set of inventory items acquired by an enterprise for the purpose of further sale (clause 2 of PBU 5/01). Inventory and materials can also be transferred to the organization by other legal entities. Account 41 in accounting - “Goods”, is used by organizations on the basis of the chart of accounts approved by Order of the Ministry of Finance No. 94n dated October 31, 2000. Account 41 reflects only those inventory items that directly belong to the institution as property rights. All inventory items that are in storage or on commission and do not belong to the enterprise are accounted for off-balance sheet (accounts 002, 004).

Reflection of revenue and accounting for markups in 1C

After completing all the previous steps, the “Products” account and its quotes will open. To reflect revenue from retail trade, you need to open the “Bank and cash desk” sub-item “Cash documents” in the main menu of the program and create a new receipt order as follows:

- Designate the type of transaction: “retail revenue”.

- Fill in the fields: date, payment amount (select “excluding VAT”).

- Post the document.

After viewing the transactions made on the account, you need to go to the “Operations” item, sub-item “Month closure”. In the menu that opens, select the closing month and the item “Calculation of trade margins on goods sold.” Account entries will show that the markup has been written off. Returning to the “Month Closing” menu, select the “Write off trade margin on goods sold” item, after which the trade margin report on goods sold for the selected month will open.

An example of total accounting of goods was considered using the 1C: Accounting 8.3 (rev. 3.0) program.

What applies to goods

A product is understood as the result of the financial and economic activities of an enterprise, which is subject to sale, operation or exchange. At the same time, goods in the general sense include not only manufactured material products, but also objects of civil rights, intangible property, work performed by the company or services provided.

In other words, goods are property assets of an organization that are produced directly for sale. This definition is specified in the Tax Code of the Russian Federation. The economic definition of a product is the result of labor, including works and services. All produced goods must have a certain consumer value and are intended for sale in order to exchange for other products or money.

Products include:

- material (material) products that have different physical characteristics and properties;

- services or intangible property (provision of services, results of mental work).

Tangible goods are the most common group. They are also called inventory assets, which are used directly for the purpose of further sale. At the same time, the materials themselves, which are purchased for the manufacture of goods, performance of work, provision of services, general production and general economic needs, are also inventory assets.

Accounting for such property is carried out at actual cost. The cost is formed from the costs of purchasing inventory items (money paid personally or transferred to the seller’s account), transportation costs, commission payments and other expenses.

Consolidation of knowledge

Having carefully studied all the information presented and summed up, we can outline the key points about the characteristics and accounting of accounts. 41:

- goods are among the assets of the enterprise;

- account 41 - active, inventory;

- upon receipt of goods, the account is debited excluding VAT;

- the sale of goods results in the debiting of amounts from account 41;

- The trade margin is reflected by posting Dt 41 Kt 42.

Regardless of how accounting is kept at the enterprise (in 1C or in writing), knowledge of the properties of account 41 will simplify the work of a novice accountant.

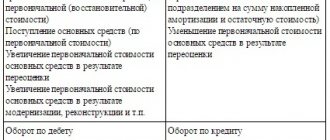

Count 41 – active or passive?

Account 41 is active, used by the accountant to reflect the cost and quantitative characteristics of products. The acquisition and receipt of goods and materials is recorded as a debit, the decrease (disposal) of inventory is reflected as credit 41. Goods are current assets of the enterprise, therefore, data on 41 accounts are indicated in the asset form No. 1 - balance sheet (Order of the Ministry of Finance of the Russian Federation No. 67n dated July 22, 2003 G.). The balance for 41 accounts is formed only by debit. If the generated report reveals a negative balance, it means that the accountant made a mistake in accounting for goods, and the information needs to be double-checked.

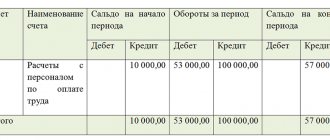

To check accounting data and transactions performed, an accountant can create a balance sheet. It presents information on movements and balances at the beginning and end of the reporting period for account 41 and its sub-accounts. The document can be generated using various analytical accounting data - organizational units, types and batches of goods (works/services), as well as storage locations for products. A specialist can check the balance at the end of the period using the following formula - the balance at the beginning of the period DT 41 minus CT 41.

The generated account card 41 also helps with accounting, which reflects data on transactions and postings, balances and turnover for the specified period.

Filling out account card 41

Account card 41 is used by accountants to check the correctness of data, since in this register you can track where this or that amount came from, check turnover and balance. The report is generated for any period, even for one shift. The report is not regulated, but an accountant can protect himself from the mistakes of others by preparing a report for his shift and signing it. The register is used by managers online.

The title of the card reflects the selected period, account and division. The tabular part indicates the details of each transaction: date, document, debit or credit amount, current balance. The totals for the account at the beginning and end of the period and turnover are displayed.

Sample card:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Subaccounts

Account 41 “Goods” is subject to detailed financial analysis; a number of sub-accounts are opened for it, detailing accounting:

- Account 41.01 - “Goods in warehouses”. The subaccount is used to register cost data on inventories at wholesale and distribution bases, warehouses, storerooms, refrigerators of public catering organizations, etc.

- 41.02 — “Products in retail trade.” Reflection of the cost of inventory items that need to be sold in retail outlets, buffets of catering organizations, etc.

- 41.03 - “Containers under the goods and empty.” The subaccount takes into account packaging and other containers used by the buyer during the sales process (except for glass containers).

- 41.04 — “Purchased products.” It is used if you need to buy inventory materials of industrial and manufacturing enterprises using account 41.

An institution can open other sub-accounts depending on the scope of its activities, information and analytical needs, as well as the level of accounting organization.

Analytical accounting for this account is carried out in the context of the names of commodity values, persons responsible for storage, and storage locations directly (Order No. 94n).

Basic postings

You can ensure full accounting of inventory items using postings. The most commonly used postings are presented in the table:

| Debit accounts | Credit accounts | the name of the operation |

| 41 | 60 | Purchase and receipt of goods from suppliers |

| 62 | 90 | Selling goods to consumers |

| 90 | 62 | Return of goods |

| 90.02 | 41 | Cost of goods sold |

| 60 | 41 | Return of purchased goods to the supplier |

| 76.01 | 41 | Return of purchased goods through a claim |

| 41 | 91.01 | Receipt of surpluses discovered during inventory |

| 94 | 41 | Write-off of shortages discovered during accounting |

Account 41 must be maintained in quantitative and monetary terms. The account records the balances and total volume of goods movement for a certain period of time.

Methods of accounting for goods

Accounting for goods on 41 accounts can be carried out in the following ways:

- At purchase price (at acquisition price) - in this case, the cost of purchased products reflects not only their prices minus VAT, but also acquisition costs. For example, among other things, this cost includes procurement and delivery costs. The entire list of such costs is given in clause 6 of PBU 5/98.

- At sales price (at selling price) - with this method, products are accounted for at cost, taking into account the trade margin. This method is only possible for companies engaged in retail trade

- At discount price – all products are accepted at established discount prices. To reflect the difference between the purchase and accounting price in rubles. or other currency, account 15 is used - “Procurement and acquisition of material assets.” The difference is written off through account 16 - “Deviation in the cost of material assets.”

Please note that VAT has changed since January 1, 2020 – the new rate is 20%.

Let's consider an example for method 1 - imagine postings for the receipt of products at the purchase price.

| Postings | the name of the operation |

| DT 41 KT 60 | Arrival of products at the seller's price excluding VAT |

| DT 19 KT 60 | Posted VAT on documents from the supplier |

| DT 41 KT 60 | Transport and procurement costs excluding VAT |

| DT 19 KT 60 | VAT on transport and procurement costs |

| DT 68.02 CT 19 | VAT deduction |

| DT 60 CT 51 | Transfer of funds to the seller separately for products and transportation costs |

Example 2 – for accounting at sales price.

| Postings | the name of the operation |

| DT 41 KT 60 | Receipt of products at the seller's price excluding VAT |

| DT 19 KT 60 | VAT presented by the seller |

| DT 41 KT 60 | Transport and procurement costs excluding VAT |

| DT 19 KT 60 | VAT on transport and procurement costs |

| DT 68.02 CT 19 | VAT deduction |

| DT 44 KT 60 | The cost of transportation and procurement costs as part of sales costs |

| DT 60 CT 51 | Transfer of funds to the seller separately for products and transportation costs |

| DT 41 KT 42 | Reflection of trade margins |

Example 3 – for receipts at accounting prices.

| Postings | the name of the operation |

| DT 15 KT 60 | Cost of products according to documents from the seller without VAT |

| DT 19 KT 60 | Allocation of VAT according to documents from the seller |

| DT 15 KT 60 | Transport and procurement costs excluding VAT |

| DT 19 KT 60 | VAT on transport and procurement costs |

| DT 68.02 CT 19 | VAT deduction |

| DT 60 CT 51 | Transfer of funds to the seller separately for products and transportation costs |

| DT 41 CT 15 | Arrival of products at discount prices |

| DT 16 CT 15 | Difference between book and purchase prices |

Account 41 “Goods” in accounting

In accounting, goods are recorded in 41 accounts.

Basically, account 41 “Goods” is used by organizations that conduct trading activities, as well as organizations that provide services in the field of public catering.

The corresponding sub-accounts shown in the figure can be opened for account 41 “Goods”:

Typical transactions and examples of transactions for 41 accounts

In accounting, goods are accounted for at actual cost, including the following costs:

- Amount of payment for the goods;

- Expenses for services related to the purchase of goods (information and others);

- Remunerations to intermediaries and other expenses associated with the purchase of goods.

Account 41 is used to reflect the cost of goods and record their quantity.

For enterprises using the simplified tax system, the cost of goods includes VAT if reflected in the supplier’s documents. For companies on OSNO, the purchased VAT will not be included in the price.

Let's look at typical transactions for 41 accounts in the tables.

Table 1. Reflection of warehouse operations on account 41:

| Account Dt | Kt account | Wiring Description | A document base |

| 41 | 60/76 | Receipt of goods and materials to the warehouse from the supplier/other contractors | Packing list |

| 41.01 | 41.11(12) | Moving goods from a wholesale warehouse to an automated (manual accounting) retail outlet. When returning goods to the main warehouse, a reverse entry is generated, for example, if the goods were not sold | Invoice certified by the signatures of the persons issuing and receiving goods and materials (TORG-28, MX-10) |

| 45.01 | 41.01 | Goods and finished products have been shipped from the warehouse | Sales Invoice |

| 45.02 | 41.01 | Containers for shipped goods are written off from the warehouse | Sales Invoice |

| 45.05 | 41.01 | Write-off of the cost of goods under a commission agreement | Sales Invoice |

| 94 | 41 | Write-off of the cost of damage or shortage of goods | Write-off act, inventory sheet |

Example 1. Accounting for goods on account 41 at the purchase price

Xenopolis LLC took out a loan in the amount of RUB 100,000.00. to purchase goods. Monthly loan expenses amounted to RUB 1,250.00. Xenopolis LLC purchased goods from Zhuravl LLC (RUB 100,00.00, VAT RUB 15,254.00) and received it into the warehouse. Upon the sale of goods to Ptichka LLC, inventory and materials were written off from the warehouse (RUB 169,000.00, VAT RUB 25,780.00)

According to the accounting policy, Xenopolis LLC reflects inventory items in the warehouse at the purchase price.

Table 2. Postings to account 41 for accounting for goods at the purchase price:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 66 | 100 000,00 | Bank loan credited | Bank statement |

| 41.1 | 60 | 84 746,00 | Purchased goods are included in the warehouse (excluding VAT) | Packing list |

| 19 | 60 | 15 254,00 | VAT amount reflected | Packing list |

| 68 VAT | 19 | 15 254,00 | Tax deduction reflected | Invoice |

| 91.2 | 66 | 1 250,00 | Loan costs taken into account | Banking agreement |

| 90.2 | 41.1 | 84 746,00 | Write-off from warehouse due to sales | Sales Invoice |

| 62 | 90.1 | 169 000,00 | Reflection of revenue from the sale of inventory items | Sales Invoice |

| 90.3 | 68 VAT | 25 780,00 | VAT reflected | Invoice |

| 51 | 62 | 169 000,00 | The goods were paid for by Ptichka LLC | Bank statement |

Example 2. Accounting for goods on account 41 at the selling price

Solntse LLC purchased goods (components for split systems) at a price of RUB 145,000.00, VAT RUB 22,119.00. for the purpose of subsequent sale. Trade margin - 29% (RUB 35,635.00). VAT on sales - RUB 28,533.00. The total markup including VAT is RUB 50,652.00. The product was sold to Gavan LLC.

Table 3. Accounting for goods at sales price - postings to account 41.01:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 41.1 | 60 | 122 881,00 | The components are included in the warehouse (excluding VAT) | Packing list |

| 19 | 60 | 22 119,00 | VAT amount reflected | Packing list |

| 68 VAT | 19 | 22 119,00 | Tax deduction reflected | Invoice |

| 60 | 51 | 122 881,00 | Payment for components has been made | Payment order |

| 41.1 | 42 | 50 652,00 | Trade margin taken into account | Calculation of markup |

| 90.2 | 41.1 | 173 533,00 | The goods are written off from the warehouse due to sale (122,881.00 + 50,652.00) | Sales Invoice |

| 90.2 | 42 | 50 652,00 | Reversal of trade margin | Sales Invoice |

| 62 | 90.1 | 173 533,00 | Reflection of revenue from the sale of inventory items | Sales Invoice |

| 90.3 | 68 VAT | 28 533,00 | VAT reflected | Invoice |

| 51 | 62 | 173 533,00 | The goods were paid for by Gavan LLC | Bank statement |

- VAT when returning goods from the buyer

- Transportation costs in accounting: entries and examples

- Postings for returning goods to the supplier

- Account 50 in accounting: typical entries, examples

Typical accounting transactions

We present the main accounting records for operations with inventory items in the table:

| Wiring | the name of the operation |

| Dt 41 Kt 60, 76 | Receipt of shopping centers from suppliers and other contractors |

| Dt 41 Kt 15 | Receipt of goods and materials at the warehouse using the services of third-party delivery and unloading agencies |

| Dt 41 Kt 42 | Trade markup has been formed |

| Dt 90 Kt 41 | Write-off of the cost of shopping centers in case of their sale |

| Dt 45 Kt 41 | Shipment of goods and materials from the warehouse |

| Dt 94 Kt 41 | Write-off of the cost of damage and shortage of shopping centers |

In inventory accounting, account 41k is also used - adjustment of goods from the previous period. It is used to correct detected errors if the reporting period has already closed.

Features of using account 41

All inventory items (material assets) stored in warehouses and bases of the enterprise for future sale must be taken into account. The PBU provides a special tool for this purpose - account 41 “Goods”. The accounting policy of the organization should specify the procedure for accounting for inventory items, namely the following areas:

- formation of the cost of goods - taking into account purchase costs or not;

- reflection of the resulting cost in accounting;

- accounting for trade margins.

In some cases, it becomes necessary to keep records of inventory items according to a specially developed nomenclature - this fact should also be reflected in the accounting policy of the enterprise.

Companies in different industries can use account 41, but usually these are organizations working in the catering industry. For enterprises specializing in production or industry, account 41 is needed if:

- materials, products, products purchased for resale;

- the cost of completing finished goods not included in the cost price.

Inventory items that are in custody or intended for subsequent sale under a commission agreement should not be displayed on account 41.

Personal account 41 in the Treasury

Account 41 in accounting is responsible for the presence and movement of inventory items, but it should not be confused with a special treasury register. There is a special 41 personal account in the Treasury, why it is opened, we will explain further on our website.

Personal account 41 is registered with the Federal Treasury in the case when legal entities - non-participants in the budget process - need to make mutual settlements with state and municipal customers as executors under concluded contracts. However, not every contract that is concluded with such a contractor in accordance with the legislation in the field of public procurement requires the opening of a special personal account.

For example, the need to register special accounts with the Federal Treasury applies to suppliers fulfilling obligations under state defense orders or specialized government programs and areas. The condition of special account 41 is necessarily stated in the contractual provisions.

Examples of postings for the 41st accounting account

Please note that all the examples of postings for the 41st account refer specifically to the sale of your own goods. Accounting for consignment goods is done in a different way.

- Dt 90.02.01 - Kt 41.02 A typical example of selling goods at retail.

- Dt 90.02.01 - Kt 41.01 But this is an example of the sale of goods in wholesale trade.

Of course, there are more entries in real documents. To make it clear to you what it actually looks like, below we have provided an example screenshot for the last transaction from the shown list.

As you can see, there are quite a lot of postings. Pay attention to the very first entry in the list, since this is where the goods are written off against sales. The remaining entries relate to the display of other operations necessary when selling goods.

Let's look at the opposite example, namely the purchase of goods. If the goods come from a supplier, then account 41 will already be in debit like this.

- Dt 41.02 - Kt 60.01 A typical example of posting when goods from a supplier arrives at a retail store.

A screenshot for this operation is given below. In this document, six types of items were purchased. The loan invoice is 60.01, about which you can read a separate article here.

You can watch more examples in our video course. We also recommend that you try to write down several transactions simply on paper to understand the principle. If you are interested in how this is done without a computer, read this article.

What is reflected

41 accounts are active. Receipts of inventories are reflected as a debit, disposals as a credit. The debit balance corresponds to the actual quantity of unshipped goods in warehouses. In the balance sheet, the balance of goods is reflected on line 1210.

What groups of goods are taken into account on 41 accounts? We are talking about inventory items that are initially purchased for subsequent resale. It is worth considering that goods accepted for safekeeping are not considered as assets belonging to the organization. For them, there is a special off-balance sheet account 002 or 004, intended for goods accepted for commission.

For 41 accounts, complete information is generated on the movement of goods, including their warehouse movement, disposal, and write-off. For more complete accounting, it is customary to use subaccounts that form groups of goods depending on their use and application.

| Subaccount | Subaccount name | Subaccount purpose |

| 41-1 | Goods in warehouses | Inventories stored in warehouses |

| 41-2 | Products in retail trade | Inventory and materials intended for further retail sales |

| 41-3 | Tara | Accounting for containers and packaging, including empty ones |

| 41-4 | Purchased products | Products purchased for further processing. The sub-account is used by production organizations and is not included in the total cost; the invoice is issued to the buyer separately. |

If necessary and in accordance with the needs of the organization, the list of subaccounts can be supplemented.

Capital contribution

Accept goods received as a contribution to the authorized capital for accounting in the valuation agreed upon by the founders (participants, shareholders) (clause 8 of PBU 5/01).

To confirm the conformity of the assessment of the founders (participants, shareholders) with the market value of the contribution, involve independent appraisers. For an LLC, an independent assessment of the property contribution is mandatory only if its size exceeds 20,000 rubles. A joint stock company must engage an independent appraiser, regardless of the value of the contribution. The founders (shareholders) can approve the value of the property contributed to the authorized capital not higher than the assessment of an independent expert (i.e. lower or in the same amount). Such rules are established by paragraph 2 of Article 15 of the Law of February 8, 1998 No. 14-FZ and paragraph 3 of Article 34 of the Law of December 26, 1995 No. 208-FZ.

Reflect the receipt of goods as a contribution to the authorized capital by posting:

Debit 41 (15) Credit 75-1

– goods were received as a contribution to the authorized capital.

This procedure is established by the Instructions for the chart of accounts.

Situation: is it possible in accounting to increase the cost of goods received as a contribution to the authorized capital by the amount of costs incurred by the organization in connection with the receipt of goods?

Answer: yes, you can.

When receiving goods as a contribution to the authorized capital, you can take into account the costs associated with their receipt (clauses 11 and 8 of PBU 5/01). At the same time, keep in mind that the obligation to transfer the contribution to the authorized capital lies with the founder (participant, shareholder). Therefore, the costs associated with such a transfer must be borne by the transferring party, and not by the receiving party (clause 1 of Article 16 of the Law of February 8, 1998 No. 14-FZ, clause 1 of Article 34 of the Law of December 26, 1995 No. 208-FZ). In particular, this means that such expenses will not reduce the taxable profit of the organization (clause 1 of Article 252 of the Tax Code of the Russian Federation).

An example of reflecting in accounting the receipt of goods as a contribution to the authorized capital of an organization

CJSC "Alfa" is the founder of LLC "Torgovaya". Alpha's share is 118,000 rubles. As a contribution to the authorized capital of Hermes, Alpha contributed goods worth 118,000 rubles. (including VAT – 18,000 rubles). The cost of these goods is confirmed by the appraiser's report and approved by the decision of the founders. The organization records goods on account 41 at actual cost (without using accounts 15 and 16).

The Hermes accountant made the following entries in the accounting:

Debit 75-1 Credit 80 – 118,000 rub. – Alpha’s debt for its contribution to the authorized capital of Hermes is reflected;

Debit 41 Credit 75-1 – 100,000 rub. – goods were received as a contribution to the authorized capital;

Debit 19 Credit 75-1 – 18,000 rubles. – VAT is allocated on the cost of goods received as a contribution to the authorized capital.

Organization of accounting of goods in the warehouse

A warehouse is a room that is specifically designed for storing materials and supplies. An organization's warehouse can be either an integral part of it or act as an independent structural unit. In the first case, the warehouse is used exclusively as one of the stages of the production process; in the second case, the warehouse can act as a separate object (for example, a retail outlet from which goods are sold).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The technological process in a warehouse consists of several stages:

- acceptance of goods and materials (including preliminary preparation of goods for acceptance).

- placing goods in warehouses and ensuring their storage.

- preparing goods for release from the warehouse and its subsequent release.

Warehouse accounting at an enterprise can be organized using the varietal or batch method. In the first case, each type of product in the warehouse is accounted for separately. The basis for accounting for goods is a quantitative and cost accounting card (form TORG-28), which is drawn up when goods and materials arrive at the warehouse. With the varietal method, it is permissible to record several goods (for example, similar in price) in one TORG-28 card.

If an organization uses the batch method to record inventory in a warehouse, then the arrival and movement of goods is reflected by batch. The basis document for these operations is the batch list (form MX-10), which is drawn up when a batch of goods arrives at the warehouse and is filled in as it is written off.