The concept of “collection order” is known to any accountant from his student days. But accounting workers do not often encounter this form of payment in practice in business activities.

Using a collection order, the bank has the opportunity to write off funds from the current account of its client without obtaining special permission from him to do so. This form of payment is used to write off funds on the basis of the law or if there is a special agreed condition for writing off funds without the payer’s acceptance in the agreement concluded between its parties - the buyer and seller of goods, products or services. In this case, in the “payment purpose” field, a reference to this agreement must be made.

Why is a collection order necessary?

The role of a collection order is simple: to pay for any services or work without the direct participation of the payer and his prior consent. However, such a procedure is only possible if an appropriate agreement has been concluded between the counterparties (i.e., including a clause on collection payment).

In other words, thanks to this document, the bank of the recipient of the goods or service transfers funds to the bank of the contractor or manufacturer, bypassing the parties to the transaction themselves. Neither the customer nor the contractor may provide the bank with any payment orders or other documents; the only thing that happens is that the payer’s bank notifies its client about the transfer of funds, and the recipient’s bank about their crediting to the account.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

In what cases does the tax office issue a collection order?

During a tax audit, inspectors identified arrears of VAT and income tax. The tax authorities issued a demand for payment for this debt. The organization did not comply with this requirement voluntarily, so the tax office made a decision to forcibly collect the arrears of taxes from the company’s funds. To do this, they sent a collection order (46 Tax Code of the Russian Federation) to the bank in which the organization opened an account.

The inability to satisfy tax requirements is usually associated with insufficient funds from the company. Therefore, if there are not enough funds in its current account to repay the debt, then the regulatory authorities have the right to direct collection on the company’s property. In order for them to have this opportunity, the following conditions must be met:

- the tax inspectors previously sent the taxpayer a demand to pay the tax;

- the taxpayer did not pay the tax within the time period specified in the request;

- inspectors made a decision to collect tax arrears from funds in the taxpayer’s current accounts (within 60 days after the expiration of the deadline for fulfilling the requirement to pay tax arrears);

- there is not a sufficient amount of funds in the taxpayer’s current account to pay off the tax debt;

- The tax authority does not have information about the taxpayer's current accounts.

Tax inspectors send a collection order to the bank where the company has an account. For all other accounts (if the company also has other accounts in other banks), tax authorities have the right to decide to suspend operations (76 Tax Code of the Russian Federation). They make this decision if, according to the information provided by the bank, there are not enough funds in these accounts to pay off the arrears on taxes.

Important! If there are not enough funds in the bank account to which the tax authorities sent the collection order, as well as in the taxpayer’s other accounts to repay the debt, then the controllers decide to collect the debt at the expense of the organization’s property.

In what cases is this document required?

It cannot be said that the collection order is widespread. However, in some cases it occurs quite often, for example, in the practice of the tax inspectorate, when a collection order is sent to the tax debtor’s bank and debts are automatically written off from his accounts (such collection orders are subject to unconditional execution and cannot be contested). Or in the activities of public utilities, when an agreement is concluded between public utilities and the recipient of the service with the possibility of direct (i.e., not requiring the permission and participation of the direct payer) payments - in this case, the payment from the bank of the recipient of the service to the bank of the utility organization is also transferred by using a collection order.

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

Applicability

In contractual legal relations, a collection order is a rarity, since under the same contract for the provision of services, the customer must accept the service provided and only then, in the absence of claims, make payment.

That is, settlement through a collection order presupposes, firstly, the existence of a trusting relationship between the counterparties, and secondly, the stable solvency of the payer.

At the same time, collection orders are very popular for undisputed write-offs. So, through collection, money is written off from the accounts:

- debtors under writs of execution. In this case, collection is issued by a bailiff;

- tax debtors. The collection order is issued by financial inspectorates;

- debtors for utility payments, provided that the agreement between the utility service provider and the consumer stipulates the condition of direct payments.

To a certain extent, the parties most interested in payment by means of a collection order are the buyers under supply agreements, purchase and sale agreements, contractual agreements, etc.

The fact is that the condition of payment under a collection order gives the buyer the opportunity to vary between payment and refusal to pay for the goods or products delivered.

What needs to be done for the “scheme” to work

If enterprises are interested in making payments between them without their direct participation, they need

- conclude an agreement between themselves in which it is required to include a clause on settlements through a collection order;

- submit this agreement to the servicing credit institution.

After the agreement is concluded and the transaction is completed, the supplier’s (seller’s) bank forwards the collection order to the consumer’s (buyer’s) bank. Then the bank notifies the buyer about receipt of the document for payment and, if confirmed, the transfer occurs, then the recipient's bank similarly informs its client about the crediting of funds to the account.

Who is interested in the collection form of payment?

First of all, collection is beneficial to the buyer. This is due to the fact that he always retains the right to transfer the payment or refuse it (this determines the low reliability of these transactions). However, the seller can hedge his bets by pre-stocking certain documents, in the absence of which the buyer will not be able to take possession of the goods legally.

This is important to remember, given that this banking operation is carried out in conjunction with the acceptance of such a payment, which implies the immediate shipment of products under the current contract, regardless of whether funds have been received from the buyer or not. The buyer pays the price of the goods upon receipt of a complete package of payment documents, which must first be checked by the seller to ensure compliance with its cost, quality and quantity with the conditions specified in the contract.

The payment procedure by collection orders has one significant drawback: documents go through banks for quite a long time, so payment may not occur as quickly as we would like. Along with this, there is an advantage: in banks this service is quite cheap.

Rules for registration and preparation of a collection order

The collection order must be drawn up in a certain form. It contains

- information about the parties to the agreement (names of enterprises),

- information about the banks between which direct transfer of funds occurs,

- numbers of current accounts of organizations,

- transfer amount,

- number and date of document preparation.

If there is an undisputed collection of funds from the payer’s account (for example, when writing off tax debts and other reasons), then the collection order must also indicate a reference to the rule of law.

The document is drawn up in four copies :

- the first one remains with the employees of the credit institution and on the basis of it the funds are written off from the payer’s account;

- the second copy is transferred to the receiving bank. In cases where the accounts of both organizations are in the same bank, the second copy of the collection order receives the status of a memorial order when funds are credited to the payee's account;

- the third copy is intended for the account holder himself;

- the fourth copy is certified by a bank employee and the seal of the credit institution and handed over to the client.

Features of this instruction for the tax authority

The tax office has the right to forcibly collect unpaid taxes in accordance with Article 46 of the Tax Code of the Russian Federation if the payer does not voluntarily fulfill his obligations within 2 months from the date of the demand.

Important: in this case, the authority issues a demand for payment of all arrears and blocks accounts until the debt is paid in full.

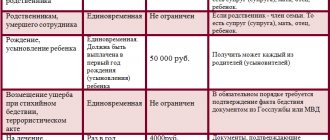

Collection order form with details.

Further events develop in the following direction:

- The bank writes off debts during the next business day after receiving collection if there is a debt;

- The company makes the payment itself and notifies the tax office before the accounts are blocked;

- If there is not enough money or there is no money, the claim is transferred to the bailiffs, who will seize and sell the debtor's property to pay off the debt.

Important: since 2020, all collection through the court has become much simpler; now only a single court decision is required without inviting the parties within 10 days.

Document processing

When processing a collection order, the bank is guided by Central Bank Regulation No. 383 P.

Important: execution of a collection order is mandatory from the moment it is received.

Revocation procedure

The territorial tax authority has the right to revoke a collection order previously issued by another similar authority, for example, by a successor after the reorganization of the authority.

A recall can occur for many reasons:

- Independent payment of debt by the debtor;

- The court's decision;

- Changing or canceling a previously made decision.

Important: this review can be in full or partial; for settlement checks, a partial version is not possible.

This action takes place on the basis of clause 2.17 of Appendix No2-P in accordance with the application submitted to the bank in 2 copies, containing in full all the necessary information and details for the revocation.

Both documents are certified by authorized persons, certified by a seal and transferred to the payer’s bank.

Sample of filling out a collection order

- First, write the document number and indicate the date it was completed.

- Next, indicate the type of payment and amount (necessarily in words and numbers).

- Then information about the payer is entered into the form: in the required cells put

- TIN and checkpoint numbers,

- full name of the company,

- information about the payer's bank (indicating its BIC).

- Next, in a similar manner, information about the payee and the credit institution in which he is serviced is entered into the collection order form.

- On the right side of the document, the current accounts of all organizations specified in the document are entered, and below:

- type of payment,

- purpose of payment

- and its order (if necessary).

- Then an agreement is entered into the document, according to which it became possible to use this document in settlements between enterprises (number and date of its preparation).

- Finally, the document must be signed by a responsible bank employee.

Payments based on collection orders

Payments based on collection orders. A collection order is a document used to withdraw money from the bank account of the sender of the money without his consent. The previously existing temporary provision on non-cash payments provided for a wide range of grounds on which money could be withdrawn without acceptance. In connection with the adoption of the program of the second stage of legal reform, one of the cardinal problems was ensuring the actual security of property relations that were established during the period of market reforms carried out from 1991 to 1999.

One of the measures in this direction was to eliminate the possibility of collecting certain amounts of money by decision of non-judicial authorities, in particular investigative authorities, tax, customs and other authorities.

Therefore, the norm of Article 15 of the Law of the Republic of Kazakhstan “On Payments and Money Transfers” as amended by the Law of the Republic of Kazakhstan “On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on Banking Secrecy” dated March 29, 2000 seems quite logical. It now provides for the possibility of withdrawing money without the consent of the sender on the basis of writs of execution or orders issued in accordance with decisions, sentences, rulings and rulings of courts or a court order for the recovery of money. In this regard, I would like to note that the provisions of the rules for the use of payment documents and making payments and money transfers on the territory of the Republic of Kazakhstan contradict the above legislative norm. Clause 39 of these rules states that one of the payment documents used to withdraw money from the accounts of the sender of money without the consent of the sender of money is a collection order from the tax service and customs authorities.

Due to the fact that the dispositive provisions of civil law do not apply to this payment method, an impression may be created about its public law nature. In some cases, payments under collection orders are actually mediated by public legal relations, in particular, when administrative fines and fines are collected as criminal sanctions. However, one should not discount the fact that these coercive measures often also ensure the fulfillment of civil obligations, that is, settlements based on collection orders do not lose the nature of the execution of civil obligations, but in a special (exceptional) manner.

However, the essence of the issue does not lie entirely in this. The fact is that during collection settlements, the bank’s obligations regarding ensuring the proper transfer of money are retained, which, if we do not take into account the involuntary nature of payments and some other features, must also be fulfilled in accordance with the general rules for the fulfillment of settlement obligations.

To collect money, the collector must submit to the bank of the sender of the money or to the branch in which the collection order is serviced, attaching the originals of writs of execution or orders issued in accordance with decisions, sentences, rulings and rulings of the courts or a court order for the collection of money, confirming the validity of his claims or their copies certified by the seal of the court. The collection order indicates the purpose of the payment with reference to a legislative act providing for the right to withdraw (collect) money (its date and number) from the sender’s bank account without his consent. The amount of the collection order must match the amount specified in the executive document. Documents for the withdrawal of money from the bank account of the sender of the money without his consent are presented to the bank of the sender of the money within the statute of limitations established by law. If the statute of limitations for presenting executive documents expires, then this is the basis for the bank’s refusal to accept the collection order.

Suspension or termination of withdrawal of money is carried out only:

1) by decision of the authority (that is, the court) that previously made a decision on the seizure of money;

2) by decisions of law enforcement agencies to suspend the seizure of money in connection with the initiation of criminal cases;

3) based on a written order of the beneficiary;

4) in other cases that will be provided for by the legislative acts of the Republic of Kazakhstan.

The creditor bears responsibility for the correctness of the collection, as well as references to the grounds for writing off funds without the consent of the sender of the money. Banks are not required to consider the merits of money senders' objections to debiting funds from bank accounts without their consent.

Payments using bills of exchange. The use of bills of exchange has a long history. Moreover, traces of bill circulation are found in a number of states of the past, with different legal systems. The bill of exchange was previously widely used in Kazakhstan1, but during the period of Soviet civil law, bill circulation sharply narrowed the scope of its application. With the transition to market relations, this market instrument also began to acquire more serious significance. Now we can say that the use of bills of exchange over the years of independence has gone through certain periods associated with adjustments to the legislative regulation of bill circulation.

In the original version of the newly adopted Civil Code of the Republic of Kazakhstan (General Part), a bill of exchange was considered as a security. Now a bill of exchange is defined as a payment document of a strictly defined form, containing a unilateral unconditional monetary obligation. Considering the payment function of a bill of exchange, we should not forget that a bill of exchange has both a security and a credit function.

The use of bills of exchange as a method of payment is regulated by special legislation. Currently, the Law of the Republic of Kazakhstan dated April 28, 1997 “On bill circulation in the Republic of Kazakhstan” is in force. It establishes the basis for the use of promissory notes and bills of exchange on the territory of the Republic of Kazakhstan as a means of payment and lending. Legal entities and individuals have the right to use bills of exchange denominated in tenge in settlements between themselves without restrictions. Their use in calculations must be directly stipulated in the relevant agreement and not contradict the legislation governing bill circulation. In the form of issuing a bill of exchange, arrears of payment can be formalized (deferment for any period).

Payments by bills of exchange can be carried out through accounting offices in the manner established by the National Bank of the Republic of Kazakhstan. Acceptance of bills by accounting offices under endorsement before the maturity date with payment of the bill amount to the bearer of the bill is called discounting of bills. The accounting office has the right to withhold from the bill amount a discount established by it independently.

The National Bank is rediscounting bills. Rediscounting is the acceptance, upon endorsement, by the National Bank of the Republic of Kazakhstan from the accounting office of bills discounted by it before the maturity date with payment of the bill amount and withholding the discount. The procedure for rediscounting bills, as well as accounting for bills, is established by regulatory legal acts of the National Bank of the Republic of Kazakhstan. National Bank of the Republic When making payments through bills of exchange, a commercial bill of exchange and a promissory note are used (bill of exchange - clause 1 of Article 78 of the Law of the Republic of Kazakhstan “On Bill Circulation”).

A bill of exchange (draft) is a bill containing an unconditional offer (order) of the drawer (drawee) to a third party (drawee) to pay the first holder of the bill (remitee) either by his order at a certain time in the future, or upon presentation of the amount of money indicated in the bill. The relationship of a bill of exchange lies in the fact that, taking into account the presence of a monetary obligation to it, the drawer issues an order to a third party to make payment on the bill in favor of its creditor - the holder of the bill (remitee). In the future, if the bill of exchange is alienated by the bill holder, then the right of the remittor passes to any other person. That is, one of the significant aspects of using a bill of exchange as a medium of exchange is the abstract nature of the transaction for issuing a bill of exchange.

A bill of exchange may be issued as payable upon the order of the drawer. It can be issued to the drawer himself. A bill of exchange may provide for payment at sight or at a specified time after sight.

A promissory note is defined as a solo bill, that is, as containing an unconditional obligation of the drawer to pay on demand or at a certain future date the amount of money indicated in the bill to the bill holder. The difference between a promissory note and a bill of exchange is that the obligation to pay the bill rests with the drawer, and the creditor to him is the primary holder of the bill. Moreover, the transfer of the creditor's rights under a bill of exchange obligation arising on the basis of a promissory note can only be carried out by way of a general assignment of the claim. Due to these reasons, a promissory note is as close as possible to the so-called “debt receipt” and practically loses its significance as a universal means of payment.

Both types of bills can be issued as a commercial (commodity) bill, that is, issued on the basis of a purchase and sale transaction. In this case, the bill replaces traditional cash payment for goods. A bill of exchange can be used as a payment instrument in banking. In particular, to clear debts on loans, a bank may issue a financial bill to another bank. The content of a bill of exchange obligation is largely determined by the mandatory requirements that apply to the bill of exchange.

Chapter 1 of the Law of the Republic of Kazakhstan “On bill circulation” is called: “On the preparation and form of a bill of exchange.” In accordance with Article 1 of this law, a bill of exchange must contain:

1) the name - “bill”, which is included in the text of the document and must be expressed in the language in which this document is drawn up;

2) an unconditional order to pay a certain amount of money;

3) the name of who must pay (payer);

4) indication of the payment term;

5) an indication of the place where the payment must be made;

6) the name of the person to whom or on whose order the payment should be made;

7) indication of the date and place of drawing up the bill of exchange;

signature of the person who issued the bill (drawer);

signature of the person who issued the bill (drawer);

The form of a promissory note, with some exceptions due to its essence, corresponds to the form of a bill of exchange. It must also contain the name “bill” included in the text itself and expressed in the language in which the document itself is drawn up. Instead of an order for payment, a promissory note contains a promise by the drawer himself to pay a certain amount of money. For an obligation from a promissory note, the payment term is also essential (the payment term must be indicated in the promissory note). An indication of the place at which the payment is to be made and an indication of to whom or to whose order the payment is to be made are required. The date and place of drawing up of the bill must be indicated. A promissory note is also signed by the person who issued the bill.

If the document does not contain any of the listed designations, then it does not have the force of a promissory note. Some cases are not included here. For example, if a document does not indicate a due date, this does not exclude its validity as a promissory note; it is considered payable upon sight. If there is no other specific (special) indication, then the place of drawing up the document is considered the place of payment and at the same time the place of residence of the drawer. When the place of drawing up of a promissory note is not indicated, it is considered signed in the place indicated next to the name of the drawer. A bill obligation arises from the moment of transfer of a duly executed bill by the drawer. The legislation on bill circulation provides for a certain relationship between civil law norms regulating bill obligations and tax legislation. If stamp duty in respect of a bill of exchange is not paid, the exercise of the rights arising from the bill of exchange is suspended until the stamp duty is paid. This approach is fully consistent with the provisions of the Geneva Convention of June 7, 1930 “On Stamp Duty in Respect of Bills of Exchange and Promissory Notes” (Part 2 of Article 1 of the said Convention).

The legislation provides for direct requirements for the content of the obligation arising from bills of exchange (certain provisions on bills of exchange apply to promissory notes, unless they are incompatible with the nature of the promissory note - Article 76 of the Law of the Republic of Kazakhstan “On bill circulation in the Republic of Kazakhstan”),

One of these requirements is the requirements regarding the place of execution of the bill of exchange obligation. Generally, a bill of exchange is payable at the place of residence of the third party or at the same place as the place of residence of the payer. The choice of a specific place of performance of the bill of exchange obligation will depend on the conditions of the place of payment specified in the bill itself.

In a bill of exchange payable at sight or at a specified time after sight, the drawer may stipulate that interest will accrue on the amount of the bill. In any other bill of exchange, such a condition is considered unwritten. If no specific date is specified, then interest is accrued on the day the bill is drawn up.

In relation to a bill of exchange obligation, special rules are established for the interpretation of its content.

We are talking about possible contradictions between the digital and alphabetic (capital) designations of the bill amount. In case of such contradictions, preference is given to indicating the amount of the bill in words. If the amount in a bill of exchange is indicated several times, either in words or in numbers, then in the event of a discrepancy (contradiction) between these designations, the bill of exchange is valid only for the smaller amount.

When a bill of exchange contains signatures of persons who are not capable of being bound by the bill of exchange, forged signatures or signatures of fictitious persons, or signatures that for any other reason cannot bind those persons who put them or on whose behalf it was signed, then the signatures other persons still do not lose their strength. A missing signature on a bill of exchange can be filled in provided that there is an officially certified statement written on the bill of exchange certifying the will of the person who was supposed to sign.

If someone signs a bill on behalf of a person from whom there was no authority, then he (the person who did not have authority) is bound in the same way as the party to the bill (the drawer). The same is the position of a representative who has exceeded his authority.

The peculiarity of bills of exchange is that even if they were issued without indicating an order, they can be transferred by means of endorsement. Accordingly, this changes the composition of the participants in the bill of exchange. The endorsement of a bill may be limited. This may be related to the interests of the drawer.

If endorsement is limited in this manner, the bill can be transferred only in compliance with the form and consequences of an ordinary assignment. The endorsement can even be made in favor of the payer, regardless of whether he accepted the bill or not. The possibility of transferring rights under a bill is also provided in relation to the drawer or another person obligated under the bill. They, in turn, can also endorse the bill.

The requirements for endorsement are that it must be simple and unconditional. Any condition limiting endorsement is considered unwritten. Partial endorsement is invalid.

The endorsement is written on the bill of exchange or on a sheet attached to it (allonge).

Allonge draws up a single document with a bill of exchange. To do this, it must contain an inscription that makes it possible to clearly determine that the allonge relates to this bill. An allonge may be attached to a bill of exchange in such a way that the endorsement begins on the bill itself and ends on the allonge.

The endorsement must be signed by the endorser. An endorsement may be made in favor of a specific person. It may not contain an indication of the person in whose favor it is made, or it may consist of a single signature of the endorser (blank endorsement). In the latter case, the endorsement, in order to be valid, must be written on the back of the bill of exchange or on an additional sheet (allonge). A bearer endorsement has the force of a blank endorsement.

The one who holds the bill of exchange is considered as the legal holder of the bill. For this, however, it is necessary that he base his right on a continuous series of endorsements. Crossed out endorsements are considered unwritten. When a blank endorsement is followed by another, the person who signed the last endorsement is considered to have acquired the bill under the blank endorsement.

Despite the fact that the current legislation excluded the bill of exchange from the list of securities, the regulation of bill of exchange relations retained elements related to the regulation of the turnover of securities. As a result, significant restrictions are provided for the reclaiming of bills of exchange that have left the possession of their holders. The person who has the bill is subsequently obliged to return it to the previous owner only if he acquired it in bad faith, that is, intentionally, knowing that the bill should not belong to him, or, when acquiring the bill, committed gross negligence. Despite the fact that endorsement under condition or with restrictions is not allowed, the legislation provides for the possibility of committing a surety endorsement. It is an inscription on a bill of exchange made by the holder of the bill and with the purpose of transferring not all, but only some rights on the bill of exchange. The limits of the transferred rights are determined by the endorser himself, however, taking into account the above-mentioned current prohibition on conditioning the endorsement, a guarantee endorsement becomes possible only under certain relations between the endorser and the endorsee.

One of these cases is the establishment in a specific way of relations of representation between the named subjects. Taking into account the requirement for flexibility and prompt use of bills of exchange in settlements makes it possible to register a representative office in this way. Based on his needs to exercise the rights under the bill, the endorser can instruct the endorsee to perform any specific actions. As a result of this, he must, when endorsing, use formulations that clearly indicate its trustworthy nature. Otherwise, the universality of rights under a bill will simply lead to its alienation. The surety endorsements must contain the clauses “currency to be received”, “for collection”, “as entrusted” or any other clauses referring to a simple order. As a result, the endorsee will have to put it up for collection and receive payment, or receive payment voluntarily and then dispose of it as directed by the endorser. In this type of endorsement, the obligated persons can raise against the holder of the bill (endorser) only such objections as could be opposed to the endorser. Unlike ordinary representation, the assignment contained in the endorsement does not terminate due to the death of the guarantor or the onset of his incapacity.

In some cases, a bill of exchange acts as a pledge. The claim on the bill in this case is security for certain property claims of the endorser (bill holder) to the endorser. The due performance on a bill of exchange (payment), since it is unconditional, is quite capable of becoming collateral. It should be taken into account that, in accordance with the law, the use of a bill of exchange as collateral is allowed only in certain cases. In particular, a bill of exchange is pledged to ensure payment of a letter of credit or repayment of a bank loan. In other cases, pledge of the bill of exchange is not allowed. Pledge of bills and registration of such transactions on the territory of the Republic of Kazakhstan are carried out through the relevant accounting offices.

The pledge is formalized by means of an endorsement containing the clause “currency as security”, “currency as pledge” or any other clause referring to the pledge. If the debtor (the original bill holder) fails to fulfill his obligation, the secondary bill holder (endorse) can exercise all the rights that arise from the bill of exchange. During the period of validity of the pledge, the endorsement delivered by the holder of the bill is incomplete and can lead to the alienation of only the security right to the bill (is a guarantee endorsement). Obligated persons cannot raise objections against the bill holder that are based on their personal relationship with the endorser. An exception will be the case when the holder of the bill, when receiving the bill, acted to the detriment of the debtor.

For an endorsement, a missed payment date made after the due date does not matter; it has the same effect as the previous endorsement. But if the endorsement is made after the bill has protested for non-payment or after the expiration of the period established for making the protest, such an endorsement will give rise to the same consequences as an ordinary assignment. There is a presumption that an undated endorsement was made before the time specified for protesting the bill.

A bill of exchange obligation is an independent obligation that has its own content and exists autonomously. According to the applied classification of obligations, according to the criterion of independence, it can be called basic. Consequently, an auxiliary (accessory) obligation may arise in relation to it. Although the obligation from a bill of exchange, like any other civil obligation, should provide for the possibility of securing it with all the provided measures, the situation in this area is somewhat different. Special regulation in this matter has an unconditional priority, and it should be noted that the legislation regulating bill circulation provides for the possibility of collecting a penalty - as a measure of liability and at the same time a measure of ensuring the fulfillment of the bill obligation and aval.

Aval is a bill of exchange guarantee, by virtue of which the person who made it accepts responsibility for fulfilling the obligations of other persons obligated under the bill. The Aval is given on the bill of exchange itself or on an additional sheet. The aval can also be issued in a separate act indicating the place where it was given. It is expressed by the words “count as aval” or any other equivalent formula and is signed by the one who gives the aval. For an aval, only one signature put by the avalist on the face of the bill of exchange is sufficient, unless this signature is put by the payer or the drawer. The aval must indicate for whom (payers, endorsers) it was given. If such an indication is absent, it is considered to be given by the drawer. As follows from the content of the rules stipulating the requirements for an aval, despite the fact that it is called a “guarantee”, by its legal nature an aval is a guarantee of a bill of exchange. This is clear from the formulation “the avalist is responsible in the same way as the one for whom he gave the aval.” To put it differently, the avalist is jointly and severally liable. Payment on a bill of exchange can be secured by aval for the entire bill amount or for part of it.

However, aval also has features that are distinctive from a guarantee. In particular, this security for a bill of exchange can be given not only by a third party, but even by one of the persons who signed the bill of exchange. That is, there may be mutual guarantee (guarantee) between the drawers. Another difference from a regular guarantee is that, once given, it even acquires some “autonomy” from the promissory note. The obligation of the avalist is valid even if the obligation which he guaranteed turns out to be invalid for any reason other than a defect of form. Of course, the accessory nature of the aval will be clearly manifested in cases where the bill of exchange obligation is fulfilled by the payer himself (not the avalist). Upon fulfillment of the bill of exchange obligation, aval loses its meaning.

By paying a bill of exchange, the avalist acquires rights to it. He can exercise these rights against the one for whom he gave the guarantee, and against those who, by virtue of the bill of exchange, were obliged to the payer for whom the aval was given. All of the above once again demonstrates the possibilities of using bills of exchange in payments.

The actual exercise of rights under a bill depends to a large extent on the presentation of the bill for payment (acceptance). In relation to bill circulation, acceptance also acquires a specific character. The wording “acceptance” does not simply express the payer’s consent to satisfy the demand of the bill holder, much less the assumption of an obligation under the bill, since this obligation already exists. Acceptance is a written consent to pay the bill. Along with the fact that the acceptance of a bill expresses consent to payment (often in the future, that is, recognition of an obligation), the written form of acceptance turns it into a kind of security measure. The presence of an acceptance of payment on a bill provides the right to demand the undisputed debiting of the amount payable from the bank account of the acceptor, while the requirements for a protest on a bill due to non-acceptance must be met (they will be discussed later).

Let's consider the conditions of acceptance. Let's start with the fact that the drawer can prohibit the bill from being presented for acceptance. This is due to the fact that other property relations of the parties to a bill of exchange (related to this bill of exchange obligation) may change after a certain time, for example, the holder of the bill may improperly fulfill his obligation to the drawer. An accepted bill of exchange in the presence of a controversial situation will create unjustified advantages for the bill holder, determined by the unconditional nature of the bill of exchange obligation and aggravated by the possibility of an undisputed write-off of funds from the payer, which may also be the drawer himself.

However, the prohibition of acceptance cannot take place if the bill is payable to a third party, is payable at a place other than the place of residence of the payer, or is payable after a certain time upon sight.

In any bill of exchange, the drawer may stipulate that the bill must be presented for acceptance with or without setting a deadline. He may also stipulate that presentation for acceptance cannot take place earlier than the appointed time. This right belongs to each of the subsequent bill holders (endorsers).

Unless otherwise agreed, any person, the holder of the bill, or even just the person who holds the bill, has the right to present it to the payer for acceptance at his place of residence. This right can be exercised before the payment deadline.

Bills of exchange payable at a specified time after presentation must be presented for acceptance within a year after their issue. The drawer may shorten this period or stipulate a longer period. In subsequent transfers of the bill of exchange, these terms may be reduced by the endorsers.

Upon presentation of the bill, it is shown to the payer (he is given the opportunity to make an appropriate inscription). The payer may demand that the bill be presented to him a second time after the first presentation. Interested parties whose rights compete with the rights of the holder of the bill may refer to the fact that this requirement has not been met only if this requirement was mentioned in the protest. The holder of the bill is not obliged to transfer to the payer the bill that is presented for acceptance.

Acceptance is noted on the bill of exchange. It is expressed by the word “accepted” or any other equivalent word and is signed by the payer. A simple signature of the payer on the face of the bill has the force of acceptance. If a bill is payable at a certain time from sight or if it must be presented for acceptance within a certain period due to a special condition, then the acceptance must be dated on the day of issue, and if the holder of the bill so requests, it may be dated on the day of sight. If the date is missing, then the holder of the bill, in order to preserve his rights of recourse against the endorsers and against the drawer, must certify this omission by promptly filing a protest against the undating of the bill (acceptance).

Acceptance must be simple and unconditional. The payer, however, can limit it to part of the amount. It is considered that any change made by acceptance in the contents of a bill of exchange is tantamount to a refusal of acceptance. But, nevertheless, the acceptor is responsible for the bill in accordance with his (partial) acceptance.

When the drawer indicated in the bill of exchange a place of payment other than the place of residence of the payer, without indicating the third party with whom the payment should be made, the payer himself may indicate this third party. In the absence of such an indication, it is assumed that the acceptor has undertaken to make the payment himself at the place of payment indicated by the drawer. If the bill is payable at the place of residence of the payer, he is given the opportunity to indicate a specific address at his place of residence where payment is to be made.

The meaning of acceptance, in addition to what is stated above, also lies in the fact that through it the payer accepts the obligation to pay the bill of exchange on time, and doubts about the identity of the payer disappear. In case of non-payment, the holder of the bill, even if he is the drawer, will have a direct action against the acceptor based on the bill of exchange.

If the payer, having put an inscription of his acceptance on the bill of exchange, crosses it out before returning the bill, it will be considered that acceptance was refused. Moreover, it is presumed that the crossing out was done before the document was returned. Regardless of the fact that the acceptance note is crossed out, if the payer has communicated his acceptance in writing to the holder of the bill or to any of the signatories, he is bound according to the terms of his acceptance.