In conditions of an unstable economic situation, devaluation of the ruble and bankruptcy of financial institutions, it is becoming increasingly important to place savings in accounts located outside national borders in more stable and reliable financial institutions. How to open an account in a foreign bank? This is exactly what this article will discuss.

- Pros and cons of offshore companies

- Choosing a bank to open a foreign account

- Is it possible to open a foreign account without leaving Russia?

- What documents are required for a Russian citizen?

- Procedure for opening an account abroad for an individual

- Features of transferring money abroad

- Tax reporting

Opening an account abroad: pros and cons of offshore companies

Opening accounts offshore is a traditional practice for many business entities. This allows you to ensure a high level of safety of your savings, as well as beneficially reduce the tax base.

Nowadays, there is a gradual transition in favor of servicing accounts of Russian individuals by foreign banks. Citizens transfer their savings to Liechtenstein, Andorra, Switzerland and Cyprus.

+'What are the advantages of this kind of offshore accounts:

- Firstly , the confidentiality of information regarding the account owner is maintained.

- Secondly , there is a complete removal from domestic economic risks.

- Thirdly , opening an account is very simple; in most cases, the investor does not even need to travel outside the country: all procedures will be carried out remotely.

)

As for the obvious shortcomings, they include:

- The need to interact with the tax service in matters of opening and maintaining a foreign account.

- Difficulty in crediting and withdrawing funds from the account.

- Lack of control on the part of the national bank of a given country over the activities of financial institutions from other countries of the world, which creates a certain insecurity for the client.

) It should be added that when choosing a foreign bank to open an account, you should also evaluate the stability of the political and economic situation in the country where the financial institution is located.

Open an account in a foreign bank for an individual: features, description of the procedure and recommendations

based on some questions on smartlab Opening an account abroad is one of the most popular services. Funds abroad may be required by individuals and corporate entities. It is desirable that the account opening procedure be quick and confidential. This is especially true against the backdrop of deoffshorization processes. Banks do not need lengthy checks and in-depth analysis of each client’s transaction.

For whom?

Is it possible for a Russian to open an account in a foreign bank? Yes. The need for this service may arise from individuals who intend to conduct online business abroad or simply want to deposit funds at a higher interest rate.

How to open a bank account for a foreign citizen:

- Select the account type and country to invest funds.

- Collect a package of documents and provide them to the intermediary or financial institution directly.

- Register a company (for legal entities).

Let's take a closer look at each stage.

Country selection

Individuals can open an account with a credit institution without intermediaries. However, the list of banks that are ready to communicate with the client is very small. Especially when it comes to conducting financial transactions in Luxembourg or Monaco. Although, against the backdrop of modern political realities, even such industry leaders as Switzerland and Singapore are losing their positions due to pressure from international organizations. Reputable banks open an account only after personal communication with the client and making a minimum deposit amount.

You can open a current account in a foreign bank in offshore countries. These financial institutions prefer to work through intermediaries, who not only conduct an initial check of clients and the source of funds, but also determine which credit institution is best to cooperate with.

Western European banks are not interested in cash settlements of non-residents. Very high tariffs are set for such operations. To conduct frequent transactions, it is better to open an account in a foreign bank in Estonia or Latvia. Financial institutions in Singapore and Hong Kong welcome foreigners doing business in East Asian countries and only accept deposits for very large deposit amounts. An account in Switzerland is best used to preserve capital rather than for active trading. Credit institutions set high minimum balance requirements, and the number of transactions is limited.

Russians' interest in the banks of the Baltic countries is increasing every year. In financial institutions, services are provided in Russian for a small fee. Before choosing a specific institution, it is worth clarifying the bank’s reliability rating, the size of the minimum deposit and requirements for foreign clients.

Lithuanian banks also require, as additional documents, a certificate confirming the source of funds. This could be an extract from a personal account, a contract or documents on ownership of real estate. A notarized copy of the beneficiary's domestic and foreign passport translated into English may also be required. Some banks register an account only after a personal visit of the manager to the branch of the financial institution.

It is much more difficult to register an account in an Austrian bank. The client needs to prepare in advance a large package of documents, answers to questions about the origin of funds, as well as a minimum deposit of 200 thousand euros. Some financial institutions open an account after depositing 5 thousand euros. This amount is not used as a deposit, but is immediately credited to the account and can be used by the client.

Types of accounts

Before opening an account with a foreign bank, an individual must select the type of account. The highest requirements are provided for investment. They are designed to diversify assets consisting of classic and new investment products. Here it is important to choose the right strategy - risky or with minimal profit. Such accounts are not suitable for regular payments. A large commission is charged for transferring funds.

To carry out regular operations, it is better to open an account in a foreign bank with a retail focus. In such institutions you can open a classic deposit, savings account or use standard investment products. You will not have to overpay for service fees.

Documentation

In order to open a current account in a foreign bank, you need to provide:

- application with the original signature of the owner;

- a copy of the owner’s passport or driver’s license;

- letters of recommendation from other institutions;

- company documentation package.

The deadlines for processing documents depend on the internal rules of the bank. Some institutions open an account within one day, while others verify documents for more than a month.

Permitted operations

To an account opened in a foreign bank, individuals can deposit:

- the amount of interest on deposits;

- minimum deposit required to open an account;

- cash received as a result of conversion;

- transfers of Russian currency between foreign accounts of two residents or their close relatives;

- transfer of foreign currency by a resident to the account of another resident opened in a bank outside the Russian Federation, provided that the transaction amount for one day does not exceed $500 at the Central Bank exchange rate.

Company registration

Offshore companies today are used not so much for doing business, but for owning assets and foreign accounts. You can contact an intermediary and buy an already registered company. The paperwork process will take one day. Individuals who are truly ready to do business abroad are better off registering their own LLC. Moreover, a foreign company that owns a Russian company undertakes to resolve any property disputes within the framework of international law.

Open an account in a foreign bank remotely

The account registration procedure is quite lengthy. You need to collect a large package of documents, translate them into English and have them certified by a notary. In order not to waste a lot of time, you can open an account in a foreign bank via the Internet. The main advantage is that the client does not have to personally visit a bank branch. However, it will not be possible to carry out a transaction without intermediaries.

The global trend indicates that offshore banking is becoming more expensive. Just five years ago, you could open an account for $200 and spend the same amount on annual maintenance. Today, banks are doing more transaction verification. As a result, the cost of payments and account maintenance fees are constantly increasing.

Offshore

It is easier for a legal entity to open a bank account in a foreign bank than for an individual. This service is provided immediately after company registration. Abroad, foreign companies cannot carry out financial work using cash.

You cannot buy an offshore company with an already opened account. The bank can recommend the jurisdiction with which it cooperates. But this does not mean that the specified company will provide the services the client needs. For example, some Latvian banks do not officially accept documents from classic offshore countries such as Anguilla, Antigua, UAE, Panama and Belize.

Tighter rules

In 2013, Russia became a participant in the system of automatic exchange of tax information. Now it can receive data on foreign accounts of Russians from other countries. By law, Russians are required to inform about the presence of an account in a foreign bank. With the introduction of the new system, it will be easier to track “silent people”.

What does it mean?

A citizen of the Russian Federation has the right to open an account in a foreign bank. However, according to the Federal Law “On Currency Regulation”, currency residents are required to notify about the opening and change of account details in a foreign bank. The declaration must be submitted to the Federal Tax Service annually by 01.06. This norm came into force in 2020.

Restrictions

Before opening an account in a foreign bank, you need to inquire about the restrictions. Thus, currency residents cannot credit income from the sale of real estate and grants to their accounts. The fine for violating this requirement is 100% of the transaction amount. If a citizen works in Estonia, sold an apartment in Tallinn, and transferred the funds received to an account in a local bank, then his next visit to the Russian Federation will end in failure. In such cases, you need to open an account with a foreign bank in Moscow and then transfer funds abroad. This restriction does not apply to persons who have lived and worked in Estonia for many years and do not come to the Russian Federation at all.

Reporting

Citizens of the Russian Federation are required to report to the Federal Tax Service on the opening, closing, changing of details and on the movement of funds in each foreign account. In this case, tax authorities may request additional information about individual transactions. A reporting form has been developed specifically for this purpose. You can independently hand over the completed declaration to a tax officer or send it through the taxpayer’s account. Persons who are not registered in the Russian Federation can send a letter to the territorial branch of the Federal Tax Service at their last place of registration.

Taxation

Not all currency residents transfer taxes to the Russian budget. If a person is not considered a tax resident, then he is not obliged to pay funds to the treasury of the Russian Federation. In many ways, this also depends on Russia’s agreements with a particular country.

According to Art. 207 of the Tax Code of the Russian Federation, tax residents are citizens of Russia who:

- live in the Russian Federation more than 183 days a year;

- have a residential property or registration at their place of residence in the Russian Federation.

Fines

If tax authorities independently find out about opening an account abroad, a fine of 2-3 thousand rubles will be imposed on the taxpayer. In case of violation of reporting deadlines for up to 10 days, the amount of the fine will be reduced to 500 rubles. For a repeated offense you will have to pay 20 thousand rubles.

Price issue

The most problems arise when withdrawing cash. Europe has SEPA, the Single European Payments Area. In banks in all European countries, as well as in financial institutions in Hungary, Poland, the Czech Republic, Romania, Bulgaria, Sweden and Denmark, you can withdraw funds from cards without commission. But these rules do not always apply. A client who opened an account in Italy and tries to withdraw funds in Switzerland should be prepared to charge a commission. For interest-free withdrawals, it is better to use Sberbank ATMs, which are present in many countries of Eastern Europe, or Citibank. This international bank has branches in more than one hundred countries around the world. In any country in the world, the operation of cashing out funds from bank cards at “native” ATMs is not subject to commission.

The profitability of deposits is also questionable. In addition to the commission for opening and maintaining an account, the investor will have to pay income tax. In Switzerland, non-resident income is taxed at a rate of 35%. The deposit is accrued income at a rate of 0.25%, and this is only if the account currency does not differ from the national one. That is, it is impossible to make money on a deposit in a European country. But the client will need to pay fees for opening and servicing accounts. source

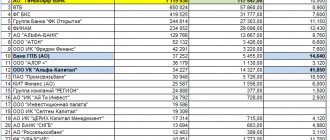

Choosing the right bank to open a foreign account

Any foreign bank will charge an account opening fee to its foreign customers. At the same time, the most reasonable prices are offered by banking institutions located in offshore zones (offshore banks). In order not to make a mistake when choosing a bank, it makes sense to consider the tariffs of the most popular ones.

Tariffs for opening an account in foreign banks

| Bank | Country of registration | Cost of opening an account |

| BankofCyprus | Cyprus | 300 euros |

| NorvikBanka | Latvia | 300 euros |

| CIM Bank | Switzerland | 700 euros |

| ValartisBank | Liechtenstein | 700 euros |

| ABLV BankLuxembourg | Luxembourg | 500 Euro |

| AlSalamBank | Seychelles Islands | 500 dollars |

| ABC Banking Corporation | Mauritius | 500 dollars |

| HSBC Bank | Singapore | 1000 dollars |

| HSBC Bank | Hong Kong | 3000 dollars |

Is it possible to open a foreign account without leaving Russia?

Recently, Russian citizens have been able to open an account in a foreign bank remotely.

Now, in order to register your account, you don’t need to travel to Hong Kong or Mauritius at all - just do the following:

- Choose a suitable foreign bank.

- Fill out the application form online and attach a package of required papers to it.

- Wait for the bank's decision and pay for the account opening procedure.

- Receive the details and place the minimum balance on the account.

Important point: Most modern banks offer foreign clients to use Internet banking mechanisms that allow them to manage their accounts remotely.

What documents are required to open a foreign account for a Russian citizen?

Each foreign financial institution requires from its clients its own list of documents that are necessary to make a decision on opening an account.

However, in most cases, individuals are required to provide:

- A notarized copy of your passport.

- Original certificate from place of residence.

- Resume according to the established form in English.

- Documents confirming the person’s sources of income.

- Certificate from the bank serving the client in his country.

Since an account can be opened remotely, all of them are scanned and certified with an electronic digital signature.

Important point: In the online application you will have to indicate the purpose of opening the account, as well as the approximate planned turnover of funds for it.

Opening a foreign account with Bilderlings: step-by-step instructions

To open an account with Bilderlings, a depositor must register on the site by providing an email address, phone number and access password. Next, the investor should fill out an online form, and then provide electronically a minimum package of documents, which includes:

- A copy of your passport.

- A copy of a document confirming your place of residence.

The depositor must also send an electronic photograph (selfie) in which he is depicted with his passport.

Opening an account is carried out after the depositor provides all the necessary documents and takes no more than one working day.

The procedure for opening an account abroad for an individual: instructions to help

Russian citizens received a real opportunity to open accounts abroad after Instruction No. 100 “On accounts of resident individuals in foreign banks” was adopted in 2001.

Important limitation: Russians have the right to open one or more accounts in foreign banks only in countries that are members of international banking organizations (for example, FATF).

Once a suitable foreign financial institution has been selected, taking into account existing legal restrictions, an individual must perform only two actions:

- Submit an application and receive a positive response from a foreign financial institution.

- Notify the tax service about this within one month after opening the account.

It should be added that the Federal Tax Service will issue the citizen with a notification, which will become a documentary basis for the transfer of funds from banks in a given country to foreign financial institutions.

Important limitation: Individuals can open accounts in foreign banks for purposes unrelated to business activities.

Why trust money to foreign banks?

For citizens of the Russian Federation, having a bank account in another country is an important condition for employment abroad, obtaining a residence permit, and purchasing real estate. Storing funds abroad and investing in local companies help preserve and increase capital. In addition, opening a multi-currency account will allow you to save money when making purchases and paying for services abroad.

For a business, a corporate foreign account is:

- insurance against financial shocks (changes in foreign exchange controls, inflation, devaluation);

- maintaining confidentiality;

- positive impact on business reputation;

- the opportunity to attract new partners to cooperation;

- opportunity to use international credit offers.

Note! Finance abroad is limited in functionality: residents of the Russian Federation are allowed to transfer only certain categories of income to foreign accounts. For example, from 2020, restrictions have been lifted on income received from the sale of foreign real estate, shares, as well as non-cash transfers from domestic banks.

When opening, the type of account is indicated:

- Settlement: allows you to conduct frequent transactions (accrual or debit of funds). This is important if you plan to trade or provide services to foreign partners. The bank has the right to set a limit on the minimum non-expendable amount, which must remain regardless of the volume of transactions.

- Savings (accumulation): help to increase savings, so using them for current payments is very problematic.

How to use the account: features of transferring money abroad

Once an account in a foreign bank is opened, all that remains is to transfer funds from Russia to it.

How this process happens:

- Transfers of funds from Russia are considered as foreign currency payments and are regulated by the relevant section of Russian legislation.

- To replenish your account, you must open a current account in any Russian bank and transfer money abroad exclusively through it as an international transfer.

- To transfer funds to a Russian bank serving a client, you will need to submit documents such as a passport, an application and a copy of the agreement on opening an account in a foreign bank.

- The depositor must receive written confirmation with a stamp from a foreign bank that an account has been opened with it. This document is sent to the Russian bank.

It remains to add that such a mechanism for transferring funds assumes that the Russian bank monitors all transfers of funds to an account at a foreign financial institution.

Can a Russian open an account abroad: legal basis

Ten years ago, to open an account abroad, a Russian citizen permanently residing in the Russian Federation required special permission from the Central Bank, which was very difficult to obtain. Now the procedure has been significantly simplified. The Federal Law “On Currency Regulation and Currency Control” (Article 12, clause 1.) allows all residents of the country to open accounts in foreign currency in banks located outside the territory of the Russian Federation without restrictions. However, some categories of citizens will still not be able to become depositors in foreign banks - the full list of categories is specified in Law No. 79-FZ “On the prohibition of certain categories of persons from opening and having accounts (deposits), storing cash and valuables in foreign banks located outside territory of the Russian Federation" dated May 7, 2013.

We will tell you in more detail how account opening is carried out in practice.

Tax reporting. What awaits the owner of a foreign account?

As mentioned earlier, opening an account in a foreign bank requires a Russian citizen to notify the tax service, which is carried out no later than a month after opening the account. Only on the basis of a notification from the Federal Tax Service can you subsequently make transfers of funds to foreign banks.

When using an account in a foreign bank, an individual will also need to submit to the tax authorities once a year (before June 1) reports in the established form regarding the movement and balances of funds in foreign accounts (Resolution No. 1365 of December 12, 2020).

It is important to follow these rules:

- Reflect the sum of inflows, outflows and account balances.

- Prepare a separate report for each foreign account.

- Send the document to the Federal Tax Service through the taxpayer’s online account or by registered mail.

When submitting reports to the tax service, there is no need to attach statements of accounts in foreign banks.

Opening an account in a foreign bank is a convenient opportunity to protect your funds from inflation and other domestic risks. This practice seems very convenient for individuals who often leave the country. However, the seemingly simple procedure for opening an account requires transactions through the accounts of domestic financial institutions, as well as mandatory notification to the tax authorities.

Where and how can I open an account?

Residents of the Russian Federation, who are not subject to the ban, are given the right to open deposits in foreign banks located under any jurisdiction. The most popular banking jurisdictions among Russians are:

- Cyprus;

- Latvia;

- Switzerland;

- Hungary;

- Czech Republic;

- Montenegro;

- Hong Kong;

- UAE;

- USA.

Foreign banks

Many financial institutions operating abroad set minimum limits on the amount of deposits placed by citizens of other countries. Practice shows that serious banks rarely open deposits for foreign clients who place less than 50 thousand dollars in their account, and Swiss financial institutions specializing in private banking are open to cooperation with persons who place at least 100 thousand dollars.

Bilderlings

An alternative to placing deposits in foreign banking institutions is to open a European and British account with individual details (IBAN) with Bilderlings. The innovative fintech platform, which offers various types of banking services, operates under an electronic money issuer license issued by the British financial regulator FCA. Having a license gives you the right to open accounts, process payments and use other financial instruments. However, unlike traditional banking institutions, Bilderlings does not use customer funds to issue loans and finance its own activities.

The main advantage of Bilderlings is high-quality service and high speed of service. If opening an account for a resident of the Russian Federation by a foreign bank can take from a week to several months, then carrying out a similar operation in Bilderlings takes no more than one working day, and also does not require the provision of a large package of documents.

Bilderlings account holders have the opportunity to accept and make unlimited payments from all over the world (more than 100 countries), as well as conduct transactions for exchanging euros, dollars and other currencies at the interbank rate (21 currencies in total).