or an account may be needed if there is: a determination to deposit your savings in a bank, a desire to receive a salary or a pension through a bank account, a need to make non-cash payments through a bank or make transfers from card to card between close relatives.

Any opening of an account or deposit in a bank is accompanied by the conclusion of a bank account or deposit agreement

, and according to paragraph 2 of Article 846 of the Civil Code of the Russian Federation: “The bank is obliged to conclude a bank account agreement with a client who has made an offer to open an account on the conditions announced by the bank for opening accounts of this type, meeting the requirements provided for by law and the banking rules established in accordance with it” . So, if you are preparing for your first visit to the bank, then remember that the opening of a deposit is carried out along with the opening of an account for this purpose.

Bank deposits for individuals - what they are in simple words and how they work

When deciding what a bank deposit is, you need to take into account that these are cash savings that the client transfers to a financial company for safekeeping for a given period of time in order to make a profit. Banks, while storing citizens' savings, can make a profit from financial transactions. The method of acquiring passive income is profitable, safe and reliable.

Deposit is also more generalized concepts:

- investments in securities;

- confirmation of participation in auctions;

- contributions to courts for the execution of legal proceedings;

- contributions to customs officers to ensure payment of duties, etc.

The deposit allows you to solve the following problems:

- ensuring the preservation of money in the account;

- receiving regular income through interest.

Deposits can be in national or foreign currency. Financiers advise placing savings in different currencies to preserve funds and increase income in changing market conditions.

Features and Benefits

When determining what bank deposit accounts are, the following features are taken into account:

- the contribution is drawn up using a written agreement, the paper is signed by 2 parties;

- it is necessary to open a special account for a bank deposit;

- funds are refundable, because belong to the client organization on the basis of ownership;

- the deposit has a period of use, the dates are specified in the contract;

- the banking organization transfers interest to the client for the opportunity to perform financial transactions with his funds;

- banks make profits from customer deposits.

Advantages of deposits:

- money in the account allows you to receive stable passive income;

- to open an account there is no need to obtain special knowledge;

- an account can be opened online or at a bank office;

- low investment amount allowed;

- deposits are insured.

History of origin

From Latin, the definition of deposit is translated in simple words as property that is transferred for safekeeping. Historians have determined the appearance of this concept during the Hellas period. The era is recognized as an important stage in the formation of the banking sector. Temples received profit from offerings, collection of fines, and transfer of land plots to use.

To increase money, priests lent money to parishioners at interest. Subsequently, the priests began to attract deposit funds to increase capital. The money received could be loaned out. The difference from the interest on the turnover of funds was the profit of the temples.

In Russia, the first bank with a commercial structure opened in 1864 as a joint-stock company. The characteristics of the deposit have been preserved in modern banking.

The difference between a deposit and a bank deposit

When planning the use of funds, it is important to consider what a bank deposit and a deposit mean, as well as the differences in definitions.

A deposit is money that is placed by the owner in a bank to make a profit.

A deposit is a broader concept that includes any type of property and is transferred by the owner for safekeeping to a banking structure. The purpose of the deposit is to ensure the safety of the property.

The following can be used as a deposit:

- money;

- securities (shares, bonds, options, etc.) transferred to the bank;

- funds transferred to customs officers to fulfill guarantees;

contributions to courts and other institutions.

Making a profit on deposits is not always guaranteed. When signing an agreement to order a safe deposit box in a bank for storing valuables and jewelry, the owner does not make a profit. This will require rental costs.

Funds that legal entities place in a bank are often called deposits. When opening an account for an individual, both concepts (deposit and contribution) can be used.

Bank deposits of individuals: required documents

To open an account, a Russian citizen only needs a passport. Bank specialists also have the right to request an INN, but in our practice this has never happened. In the process of opening an account, Russian banks are guided by the Civil Code (clause 2, Article 846 of the Civil Code), which stipulates all aspects of concluding an agreement.

By the way, minors who have reached the age of 14 also have the right to open a deposit if they have a passport. True, some restrictions apply to them, and the deposit is made in the status of a “partially capable citizen.”

If a foreigner opens a deposit, he must provide the bank employee with:

- passport of a citizen of a foreign state;

- migration card;

- temporary residence permit/visa.

A foreigner who has the right to permanent residence in the country must provide two documents: a passport and a residence permit.

Pension deposit is an account for calculating pensions. To open such a deposit, you must provide a pension certificate confirming that the depositor is a pensioner. Having all the above documents, a potential client has the right to contact the bank.

Main types of deposits

Main types of deposit accounts:

- urgent;

- savings;

- target;

- cumulative;

- currency;

- multicurrency;

- poste restante.

Poste restante

A demand deposit is a deposit without specifying the exact date for withdrawal of savings. Savings are issued to the bank client if necessary. Capital is protected in a current account.

You can open a demand account to solve the following tasks:

- preservation of a financial asset;

- the ability to withdraw funds at the right time.

The interest rate on the deposit is low (about 0.01%).

Urgent

When determining what a term deposit account is in a bank, it is necessary to take into account the rules for working with this savings. The deposit is made to a financial institution for a specified period. This type of deposit is the most in demand and is offered with different conditions.

The percentage of income differs according to the deposit amount, period and can be 4-8% per annum. However, if the contract is terminated before the specified period, the interest will be minimal.

Savings and accumulative

A savings deposit is a deposit that is issued for an unlimited period; it provides the opportunity to replenish the account, partially withdraw money or withdraw all savings. The account can be linked to a plastic card for convenient transfer of part of your salary to savings. The current rate is from 1.5%. This type of deposit brings in a small income, solving the problem of saving money.

A savings account is a subtype of a fixed-term account. However, the terms of provision are more flexible. Some organizations calculate interest based on the daily balance. Other banks take into account the full month. You need to know that the organization can change the annual rate unilaterally. This deposit is optimal for saving money for an expensive purchase. The annual rate is 5-8%.

Target

When deciding the question of what a target deposit is, it is necessary to take into account the objectives of the type of savings. The deposit is opened to achieve a goal and for a specified period. Children's deposits are popular; these funds are saved until the child grows up and then becomes his property.

Savings for the elderly, etc. are popular. There are few proposals for targeted savings in the bank, because... This type of deposit is not flexible and complicates the ability to conduct banking operations when the exchange rate changes.

Foreign exchange

This type of savings allows you to save savings in any foreign currency.

A foreign currency deposit is a deposit that allows you to receive the following types of income:

- interest on the amount of savings;

- profit from an increase in the price of foreign currency.

The interest rate on foreign currency accounts is lower than the standard one, however, with a large increase in the exchange rate, the disadvantage will not affect profits.

Multicurrency

A multi-currency deposit, according to the rules, allows you to invest money simultaneously in 3 types of currencies (₽, €, $). The currency ratio is determined by the client. If necessary, you can transfer money to another currency; the number of transfers is not limited.

For this type of deposit, you will need to open 3 deposit accounts in different currencies. The profit level is formed from interest charges and exchange rates.

What is a deposit and why is it opened?

A bank deposit is a transfer of money to a bank under certain conditions. In essence, the depositor issues a loan to the bank for a certain period and at interest. The bank, in turn, uses this money to issue loans at a higher interest rate.

Opening a bank deposit is one of the options to save and increase your money, and compared to other investment options it has its advantages and disadvantages:

| Advantages | Flaws |

|

|

A bank deposit can be considered as a source of stable income, which is usually higher than the rate of inflation and allows you to simply save your money. Opening a deposit is quite simple, as is managing it. Money invested in a bank deposit account does not lie dead weight at home, but works in the economy and brings income to the depositor.

Many people confuse the concepts of bank deposit and bank deposit, but there is a difference between them:

- deposit - means the transfer of certain things for safekeeping: money, securities, precious metals, etc. under certain conditions;

- deposit - implies the transfer of funds to the bank for storage at interest under the agreement.

Therefore, in any case, a deposit is a deposit, but not every deposit is a deposit. But, as a rule, people more often transfer money to banks than other things for storage, therefore, in everyday life, deposit and deposit are equal concepts.

Opening a deposit - 4 main stages

Opening a deposit occurs in several stages:

- selection of a bank or other financial organization;

- program definition;

- conclusion of an agreement;

- depositing funds into the account and confirming its opening.

Choosing a credit institution

The financial institution is selected taking into account the following criteria:

- Company availability level. It is optimal to choose a bank with offices within walking distance. The organization must have the ability to make transactions on invested savings online.

- The degree of reliability of the bank. The rating of a financial company is verified in open sources.

- It is recommended to read customer reviews on online sources.

Selecting a deposit program

At the next stage, a program is selected. Banks offer to familiarize themselves with the conditions on official websites and perform calculations using special calculators.

Main parameters for analysis:

- annual interest;

- presence of capitalization;

- frequency of accruals;

- opportunities to replenish and withdraw savings;

- conditions for termination of the agreement before the specified period.

It is important to evaluate the parameters comprehensively and consult with bank specialists.

Conclusion of an agreement

The contract is concluded according to the standard scheme. You will need to present your passport and fill out a card with sample signatures. Specialists may require other papers (certificates, income certificates, pension certificate, etc.). Before signing the agreement, you need to study the text of the agreement with the bank.

Need to check:

- amount;

- validity;

- annual rate;

- additional conditions.

Copies of the agreement are signed by both parties. When registering online, a copy of the agreement will be sent to your email inbox.

Replenishment and receipt of confirmation of opening

After signing the agreement, the client transfers the money to the bank’s cash desk and receives a receipt order with the organization’s stamp and the signature of a specialist. A card will be issued for the deposit; after connecting to the online bank, you can perform financial transactions without visiting a branch.

What documents will be required?

Opening a deposit in a bank is quite simple; just go to the nearest bank branch with the necessary documents and the actual funds.

A minimum package of documents will be required:

| 1 | Passport |

| 2 | at the request of the bank - TIN; |

| 3 | when making special deposits, you will need a supporting document - a pension certificate for pensioners, a student card for students, etc.; |

| 4 | if the deposit exceeds 600,000 rubles, the bank may require confirmation of the legality of receiving this amount - a work book, a tax return, etc. |

After registering the deposit, the client receives his own copy of the deposit agreement, which specifies the main conditions: subject of the agreement, interest rate, commissions, deposit term, responsibilities of the parties and termination conditions.

In addition to the deposit agreement, the client receives:

- cash receipt order with the necessary signatures and seals or payment order;

- a savings book with a note about the acceptance of money (lately it has not been issued for new deposits);

- a bank payment card or an agreement to open a bank account, to which interest on the deposit will be transferred.

Opening a bank deposit takes relatively little time and does not require a large package of documents. It is important to keep the deposit agreement and all other documents until the end of the agreement.

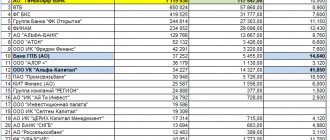

The most profitable deposits for today - top 3 best banks

The deposit can be used in trusted banks:

- Sberbank;

- UBRD;

- Rosselkhozbank.

Sberbank

Sberbank is considered the largest bank, with branches in Moscow, St. Petersburg and other cities of the country. You can view the programs offered on the website, and you can open an account online.

The advantages of Sberbank include the availability of bonus points, discounts provided to clients, stable activities and government support.

Ural Bank for Reconstruction and Development

UBRD is the largest in the Sverdlovsk region in the fields of deposits. The company's offices are open in other regions of the country (more than 40 branches). The bank's deposits are insured, the organization has high creditworthiness. Annual deposit rates reach 10%. The organization provides online banking services.

Rosselkhozbank

Rosselkhozbank presents various loan programs that are offered to residents of rural areas. However, other citizens of the country can also manage funds left on deposits. The bank offers seasonal promotions for services. Signing an agreement on storing savings on deposit and paying for services is possible online.

Features of an individual's deposit account

Deposit accounts for individuals have a number of features:

- Limited functionality - intended only for savings; most banks completely prohibit the account holder from carrying out any transactions (without loss of income).

- Interest accrual – financial institutions offer different rates, which depend on the type of deposit, its currency, the term of the agreement and the amount of funds. For example, annual interest on a ruble deposit “Catch the Benefit” from Sberbank can reach 7.76%. The bank can pay the client for the use of money every month or upon expiration of the contract.

- The retention period is the period during which the financial institution, at its discretion, disposes of the money, is prescribed in the agreement and is strictly observed by both parties. With a term deposit, premature withdrawals are excluded.

- Incoming and outgoing transactions. Possible if the client has issued a special type of time deposit (settlement). Withdrawals are allowed up to the minimum account balance established by the bank. Replenishments may be provided in other deposit options. Such features are enshrined in the contract.

- Insurance. According to the legislation of the Russian Federation, if the license of a financial institution is revoked, the deposit will be paid in the amount of 100% of the amount, but not more than 1.4 million rubles. If the deposit exceeds this figure, then everything above the established limit can be reimbursed based on the results of the sale of the property and assets of the financial institution.

Banks offer dozens of types of deposits with different interest rates, amounts, and terms. Before registering an account, you should carefully study all offers and choose the most suitable one. Bank deposit - practical part:

Composition of the account number

The number is a set of 20 digits. Each combination carries certain information about the deposit. The first 5 digits indicate the period for which the deposit is made:

- 42301 – on demand;

- 42302 – up to 30 days;

- 42303 – from 31 to 90 days;

- 42304 – from 91 to 180 days;

- 42305 – from 181 days to 1 year;

- 42306 – from 1 year to 3 years;

- 42307 – more than 3 years.

The following 3 show the deposit currency:

- 810 – Russian ruble;

- 840 – American dollar;

- 978 – euro.

The last 7 digits are the account number itself; each bank independently sets the algorithm for decoding the combination. Using the number, employees of a financial institution can find out all the necessary information about the deposit within a few seconds. This greatly simplifies and speeds up customer service.

Calculation of profitability - step-by-step instructions

Before using the program, experts recommend making preliminary calculations of profitability. Bank websites offer special calculators.

You can perform calculations using the following sequence of actions:

- determination of the scheme when forming the annual rate;

- multiplying the initial payment amount by the percentage;

- calculation of profit from capitalization;

- determining a favorable annual rate;

- profit calculation.

Scheme for calculating interest

Banks use 2 interest calculation schemes:

- Simple - calculated by adding the annual rate to the deposit amount.

- The capitalization scheme is more complex to calculate. After standard interest has been calculated, the deposit amount increases and interest will need to be calculated on interest.

Multiplying the initial deposit amount by the interest rate

At this stage, calculations are performed using a calculator. To determine the annual profit, you need to multiply the deposit amount by the interest rate. When replenishing your account by 100 thousand rubles. and an annual rate of 12%, the yield will be 12,000 rubles.

Income from capitalization

If there is capitalization, the accrued profit increases the size of the deposit, interest is accrued on the deposit and interest added to the amount.

Capitalization is calculated using the following steps:

- the frequency of adding interest to the total deposit is determined;

- interest on the first deposit must be added to the original amount;

- then the profitability for period 2 is determined and added to the amount for the previous stage;

- Calculations must be completed in stages by the end of the year.

Effective interest rate

Determining the effective rate is required when using a capitalization scheme, when the bank client does not collect interest. It is necessary to determine the number of capitalizations. The interest rate for the capitalization period will need to be raised to this power to determine the profitability.

Profit calculation

At the final stage, the final profit is calculated; for this it is necessary to determine the amount of funds in the account at the end of the contract.

You will need a financial formula: S=N*(1+(Y*J/100*T))A.

The formula uses the following concepts:

- S—total deposit amount;

- N—initial contribution;

- Y—annual interest rate;

- T—savings period (in days);

- J is the number of days for the capitalization period;

- A is the number of capitalizations for the period.

What to pay attention to

Placing money in a bank allows you to receive a certain income in the form of interest, which will prevent it from depreciating due to inflation. However, there is a risk of bank bankruptcy. Thus, since 2014, the Central Bank of the Russian Federation has revoked the licenses of almost half of Russian banks, their number decreased from 923 at the beginning of 2014 to 518 in August 2018. As a result of the revocation of licenses from banks, their depositors receive compensation from the state corporation Deposit Insurance Agency (DIA), while the amount of compensation is limited to 1.4 million rubles. All Russian banks that attract deposits from the public are insured by the DIA.

Thus, the most important criterion for choosing a bank is its participation in the deposit insurance system. You can open a deposit in any bank if the amount does not exceed 1.4 million rubles. If the amount is larger, you should pay attention to the scale of activity of the bank and its owner (it is best to place a large amount of money in a state-owned bank).

In addition, it is worth checking whether it has a banking license - if a credit institution has non-bank status, it may not participate in the deposit insurance system. You can check the availability of a license on the website of the Central Bank.

Next, when choosing a deposit, you need to pay attention to the terms of the deposit. Such conditions include:

- interest rate on deposit;

- deposit currency;

- term of deposit placement;

- method of interest payment, frequency, possibility of capitalizing them;

- possibility of replenishment and partial withdrawal of deposits;

- bonuses and other benefits.

The interest rate on a deposit depends on many factors. The main ones are the term and amount. As a rule, banks are interested in attracting large amounts of deposits for a long term and in this case they will offer the maximum rate. The size of the bank also matters - large banks offer lower rates than small credit institutions. In addition, high rates are typical for deposits that cannot be withdrawn before the end of the term.

To get an idea of the interest rate, you can find deposit calculators on the websites of many banks. This tool will show the interest rate for a certain amount and deposit period.

When choosing a deposit currency, you need to take into account that although the same insurance rules apply for foreign currency deposits as for ruble deposits, interest rates on them are more than 2 times lower. In addition, when exchanging rubles for foreign currency and then back, part of the amount will be lost. It is advisable to make deposits in foreign currency for those who receive income in this currency or plan expenses. In other cases, it is worth considering deposits in rubles.

Some banks offer clients multi-currency deposits - they can store money in several currencies at once and, if desired, change the ratio between them.

The term is also an important condition of the deposit agreement. There are time deposits (placed for a certain period) and perpetual deposits (on demand). Demand deposits have a lower interest rate and it is worth choosing this option if you may need money at any time. For time deposits, the interest rate depends on the term - the longer the term, the higher the rate. According to the terms of a fixed-term deposit, a prolongation may be provided - if the depositor does not apply to the bank for money at a certain time, the term of the deposit is extended. As a rule, when extending a time deposit, it is converted into a demand deposit (accordingly, with a lower interest rate).

There are several options for paying interest on a deposit:

- payment at the end of the deposit term along with the principal amount;

- periodic payment (once a month, quarter, year);

- capitalization of interest (addition to the principal amount).

If a deposit is opened in order to receive periodic income from it, you should choose the option with periodic interest payments. For convenience, interest is credited to a bank card account or a regular bank account. If the purpose of the deposit is to increase the initial amount, you should choose the option with interest capitalization. In this case, interest is accrued periodically, but is not paid to the depositor, but is added to the principal amount of the deposit. Accordingly, in the next period interest is accrued on a larger amount.

If interest is capitalized, its rate is usually less than if it is paid at the end of the term. In order to make the right choice, it is enough to compare the amounts that will be paid at the end of the deposit term for both options.

The ability to replenish a deposit or withdraw part of the amount is a fairly important condition for those who choose a bank deposit as a savings tool. Having this opportunity allows you to manage your money more flexibly. The preferred option is that in case of partial early withdrawal of interest, the bank pays interest for those periods when the money was in the account.

Regarding the possibility of replenishment, banks often introduce restrictions on amounts, which should also be taken into account when choosing a deposit. It is necessary to calculate in advance what amount is expected to be deposited and with what frequency, and, depending on this, select a deposit.

Finally, many banks offer additional bonuses to depositors. Their most popular type is additional interest on deposits. For example, for opening a deposit without visiting a branch, one of the banks offers an additional 0.5% per annum. Similar bonuses may be offered when extending a deposit or opening several deposits in one bank. Also, depositor clients can be offered Gold standard bank cards without issuance and maintenance fees, cashback when using income cards and many other bonuses.

The final choice of bank and deposit should be taken into account all the above conditions. Most of them can be studied and compared on specialized websites in a convenient and visual form.

How to profitably open a deposit - 5 tips

A deposit is a deposit that has some financial risks. “Dummies” are advised to take into account the advice of professionals in financial transactions.

Don't focus solely on bet size

When choosing a financial program, they focus on obtaining a high income. However, it must be taken into account that profit is affected not only by the interest rate, but also by other deposit parameters. When analyzing the option, the conditions for accrual of income and capitalization parameters are determined. Some banking organizations change the rate during the agreement.

Distribute capital between several deposits in different currencies

It is recommended to distribute capital between several accounts and place funds in different currencies or enter into a multi-currency deposit agreement.

When opening accounts in different currencies, the following nuances are taken into account:

- when studying the conditions in banks, pay attention to the minimum deposit amount;

- the capital is first divided into equal shares, then conversion is carried out;

- It is important to renew contracts on time if there is no relevant information in the agreement.

Give preference to the simplest and most transparent programs

When choosing a program, it is recommended to choose simple packages of bank services, the profitability of which is stable and predictable. Having many schemes at the initial stage may not result in great returns on savings.

Choose credit institutions with foreign capital

When determining a bank, organizations with foreign capital are more reliable. These companies operate internationally. The presence of foreign exchange reserves increases the stability of financial organizations and reduces the risks of inflation and other changes in the economic market. The presence of large capital allows banks to offer favorable conditions to clients.

Open deposits only in banks

It is recommended to open deposits only in banks. Other financial companies, individuals and credit unions are less reliable because... This activity is not regulated by law and there is a risk of losing savings. Interest rates on deposits in banks are low, but stable, allowing you to save customer funds.

What documents for the deposit should be completed in your hands?

So, the opening of a deposit or current account at the bank is completed, but do not rush to leave the operating room and the bank. You should step aside and, in a calm atmosphere, once again review the completed documents in part:

- Correct spelling of your details in the contract: full name, passport number and series, residential address.

- The presence in your copy of the deposit (account) agreement or the depositor’s questionnaire, which in a number of banks replaces the agreement, the signature of a bank employee, certified by the round sadness of the bank

or its branch intended for carrying out transactions. Sometimes individual bank employees or banks replace round seals with company stamps or corners, which are intended for the bank's internal use, and such an agreement will not have legal force. You need to return to the window where registration took place.Such a “mistake” when drawing up an agreement was encountered in the work of one commercial bank. When drawing up an agreement for deposits, I drew the manager’s attention to the absence of a round seal. The workers spent a long time running around trying to figure out whether a seal was needed or not. They tried to prove to me that this is their custom. Ultimately, the mistake was admitted and a seal was put on it.

The seal and signature may not be affixed even due to the simple inattention of a bank employee and this must be monitored.

FAQ

In the list of questions from beginners for making a profit from deposits:

- how to open a bank account for an individual;

- features of a foreign currency deposit;

- benefits of investment deposits, etc.

What is a bank account for an individual

A deposit account for an individual limits the use of the balance in a given period of time. The bank can carry out financial transactions of its choice. At the end of the period specified in the agreement, the client can receive the invested money and accrued interest. Placing funds in an account helps reduce the impact of inflation on savings.

What is a foreign currency deposit in USD/EUR

A foreign currency deposit provides an individual with greater returns. The currency is determined at the stage of concluding the contract. A bi-currency deposit is offered at a high rate and provides the bank with the opportunity to earn income from the difference in the rates of $ and €.

Agreements of this type are concluded for a short time - 0.5-1 year. It is necessary to take into account the impossibility of early withdrawal and the lack of extension of the deposit.

What are investment deposits

Investment deposits consist of 2 parts:

- standard bank deposit;

- the second part is invested in mutual funds.

Part of the savings is insured by government protection programs. The second part of the funds does not have this protection, but allows you to get increased profits.

Notary depot - what is it?

For a notary, a deposit is a deposit that allows you to fulfill financial obligations to the lender and increases the security of transactions. When performing large transactions (sale of an apartment, house), the tool will reduce the risks that arise when transferring large amounts.

What is a depot when renting an apartment?

When concluding a residential rental agreement, a security deposit is often applied. Cash is transferred to the lessor to secure obligations under the agreement. When drawing up an agreement, you can add clauses to solve the common problems of the tenant and the person providing housing. The paper must be in writing. Be sure to specify the conditions for returning the deposit.

What is a depot in a restaurant/cafe

Some restaurants and clubs provide a deposit service. The client deposits funds into the organization's account and subsequently makes payments from savings. A deposit in a restaurant can be conveniently used when organizing special events or family gatherings for an anniversary.

Deposit on financial markets

When trading on: forex, stock exchanges and crypto exchanges, a trader to trade on international markets must open a trading account and fund it - add money to the forex broker's deposit, only after that he will be able to carry out financial transactions.

What documents are needed to open a deposit?

If a deposit account is opened by an existing client, then he will not need any papers at all. You don't even need to go to the office. Opening a deposit is done through online banking in a couple of clicks. The amount for opening an account is transferred from the main settlement account. All document flow will also be electronic.

If we consider what documents are needed to open a deposit in Sberbank or any other bank, then as standard only one passport is sufficient. Other possible additional papers:

- if a parent or guardian opens an account for their child, their documents are needed;

- If a power of attorney is drawn up, the presence of the authorized person and his passport are required.

The depositor can draw up a power of attorney for any person who will have access to account management. The power of attorney is drawn up on the spot when opening a deposit; it reflects the actions available to a third party. Full involves not only replenishment, but also withdrawal.