Purchase of fixed assets from an individual (nuances)

When purchasing valuables from individuals, it is enough to draw up a purchase act; a purchase and sale agreement is not required.

The act itself can act both as a “primary” and as a full-fledged contract, since the form of the latter can be any. The main thing is that both parties sign the agreement (subclause 1, clause 1, article 161 and clause 2, article 434 of the Civil Code of the Russian Federation). In order to draw up an act, you can use an already developed template in form No. OP-5 (approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. Another option is to develop the form of the procurement act yourself. But you need to remember that the document must contain all the necessary details specified in Article 9 of Federal Law No. 402-FZ dated December 6, 2011. These are:

- name of the document and date of its preparation;

- the name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- the value of natural and (or) monetary measurement;

- the title of the position of the person who made the transaction, his full name and signature.

Whatever form forms the basis of the procurement act, draw it up in two copies. One will remain with the seller, the second will remain with you. Both acts must be signed by your employee who purchased the goods and the seller. A sample procurement act is given below.

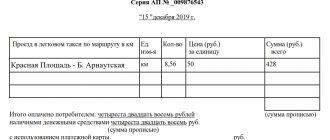

Purchasing act

The only peculiarity is that the specified property is reflected in accounting at the cost that the organization paid for it to the seller. VAT is not deducted from this amount.

If a company has acquired used property, which it has accepted for tax accounting as a fixed asset, it has the right to reduce its useful life for the period of actual operation of this object by the previous owner. But this is only possible if there are documents confirming the time of use of the OS object by the previous owner (clause 7 of Article 258 of the Tax Code of the Russian Federation).

However, the Ministry of Finance of Russia believes that this possibility does not apply to cases of purchasing used property from individuals (letters dated 03.29.13 No. 03-03-06/1/10056, dated 03.15.13 No. 03-03-06/1/7939 and dated 12/14/12 No. 03-03-06/1/658). After all, an individual does not set the useful life of a fixed asset and does not depreciate it for tax purposes.

3 tbsp. 9 of Law No. 402-FZ).

According to paragraph 4 of Art. 9 of Law No. 402-FZ, the forms of primary accounting documents are determined by the head of the organization on the recommendation of the chief accountant. The forms of primary accounting documents are approved in the accounting policy of the organization (clause 4 of PBU 1/2008).

Thus, when purchasing equipment from an individual, an organization must issue a primary accounting document confirming such acquisition. This document must indicate the name of the equipment and its value in monetary terms. Such a document can be an invoice, a purchase act, an acceptance certificate. The document must contain information about the individual seller that allows him to be identified, as well as his handwritten signature.

In accordance with paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which an individual taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of tax calculated on the income paid to the taxpayer. Russian organizations in this case are recognized as tax agents.

According to paragraph 2 of Art. 226 of the Tax Code of the Russian Federation, the calculation of amounts and payment of tax are carried out in relation to all income of the taxpayer, the source of which is the tax agent, with the exception of income in respect of which the calculation and payment of tax are carried out, in particular, in accordance with Art. 228 Tax Code of the Russian Federation.

According to Art. 228 of the Tax Code of the Russian Federation, individuals who received income from the sale of property owned by these persons independently calculate the amount of tax payable to the appropriate budget. In this case, these persons are required to submit a corresponding tax return to the tax authority at their place of registration.

Thus, when purchasing equipment from an individual, the organization does not withhold the amount of tax from his income, but at the same time, the organization, as a tax agent, is obliged to send information to the tax authority (in Form 2-NDFL) about the amount of income paid to the individual. Information is submitted no later than April 1 of the year following the expired tax period (clause 2 of article 230 of the Tax Code of the Russian Federation).

2 tbsp. 226 of the Tax Code of the Russian Federation).

As already noted, the procedure for calculating personal income tax on the income of an individual from the sale of his own property is provided for in Article 228 of the Tax Code. Consequently, organizations that are not tax agents are not required to provide information on the amounts of personal income tax that individuals are required to pay on their own. In addition, organizations are exempt from the need to annually submit information in accordance with Article 230 of the Tax Code.

The law on the contract system allows even ordinary citizens to participate in government procurement. What are the features and how to execute such transactions, we will consider in this article.

Purchasing goods from an individual

Based on paragraph 1 of Art. 161 of the Tax Code of the Russian Federation, transactions between legal entities and citizens must be made in simple written form. Thus, when purchasing spare parts from an individual, you need to conclude a sales agreement with him.

Typically, when purchasing goods from citizens, companies use a procurement act. This option for formalizing relations is convenient in that this act simultaneously performs the functions of a purchase and sale agreement and an act of acceptance and transfer of goods.

The company develops the form of the procurement act independently (clause 4 of article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as the Law on Accounting)). As a basis, you can take the unified form No. OP-5, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The act developed by the company must contain the mandatory details listed in clause 2 of Art. 9 of the Accounting Law:

1) name of the document;

2) date of preparation of the document;

3) the name of the company that compiled the document;

4) the content of the fact of economic life;

5) the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

6) the name of the position of the person (persons) who completed the transaction and the person(s) responsible for its execution;

7) signatures of the above persons.

The act must state that payment for the goods is made by bank transfer to the seller’s bank card, and provide the details to which the payment should be made.

The act signed by the citizen and the company is a document confirming the transfer of goods from the seller to the buyer.

The company transfers money to a citizen by payment order, in which in the “purpose of payment” column it is indicated: “Payment for goods according to procurement act No. __ dated “__” _______ 2020.” At the same time, the company does not make any deductions of personal income tax from the transferred amounts. The fact is that individuals who receive income from the sale of property owned by them independently calculate personal income tax on such income and pay it to the budget (subclause 2, clause 1, clause 2, 4 of Article 228 of the Tax Code of the Russian Federation) . And according to paragraph 2 of Art. 226 of the Tax Code of the Russian Federation, organizations are not recognized as tax agents for income paid to citizens, which are named in Art. 228 Tax Code of the Russian Federation. Officials confirm that when purchasing property from individuals, the company is not a tax agent for personal income tax and does not have obligations to calculate, withhold and pay personal income tax (letter of the Ministry of Finance of Russia dated April 11, 2012 No. 03-04-05/3-484, Federal Tax Service Russia dated 08/01/2012 No. ED-4-3/ [email protected] ).

Payments and other remuneration to individuals within the framework of civil contracts, the subject of which is the transfer of ownership or other proprietary rights to property, are not recognized as subject to taxation with insurance premiums (clause 4 of Article 420 of the Tax Code of the Russian Federation). Therefore, the amount paid to an individual for spare parts purchased from him is not subject to insurance premiums.

In accounting, the transaction for the purchase of spare parts will be reflected as follows:

Debit 10 Credit 76

— spare parts were received from an individual on the basis of a procurement act;

Debit 76 Credit 51

— payment for the received spare parts was made by transferring funds to the seller’s bank card.

Paperwork

To properly complete the transaction, it is necessary to prepare a purchase and sale agreement. The document must be endorsed by both parties. It represents an additional guarantor for the inclusion of costs in the cost price, as well as confirmation of the operation. However, in practice, an agreement is concluded extremely rarely.

You can also confirm receipt of goods from the seller using a purchase act. For this purpose, use form N OP-5. A document from the company itself indicating the full details also acts as a supporting document.

The act must contain the following information:

- full name, date;

- who draws up the paper (company name);

- type of transaction being carried out;

- literal quantity of production;

- monetary equivalent of the product;

- positions and names of persons controlling the turnover of goods;

- signatures.

The document is drawn up in 2 copies, for both parties. Payment between a private seller and an individual entrepreneur can be made in one of two ways.

As a general rule, all transactions between organizations and individuals must be made in writing (subclause 1, clause 1, article 161 of the Civil Code of the Russian Federation). However, it is not established anywhere that when purchasing property from an individual who is not an entrepreneur, it is necessary to draw up a purchase and sale agreement.

In practice, the contract is usually not formalized, but is limited to signing only the procurement act. In principle, the procurement act only confirms the fact of transfer of property when purchased from an individual. However, if you include in it the terms of sale and payment, as well as the details and signatures of the parties, then the written form of the transaction will be observed.

Thus, the purchase of property by an organization from an individual can be confirmed using one procurement act. This document will be the basis for recording purchased assets in both accounting and tax accounting. The main thing is that it reflects and fills in all the mandatory details of the primary accounting document (clause 2 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

If the parties have nevertheless drawn up a purchase and sale agreement, the fact of transfer of the acquired property must be formalized in a separate act. This can be either an act of acceptance and transfer of property, or the same procurement act. For these purposes, the procurement act can be drawn up in a simplified form, for example, without indicating in it information about payment for assets purchased from an individual.

Of course, the phrase that the property that is the subject of the transaction has been transferred to the buyer can be included directly in the purchase and sale agreement. Then it is not necessary to draw up an act.

In addition to indicating the fact of payment in the contract or procurement act, when paying the seller money from the cash register, an expenditure cash order is drawn up in form No. KO-2 (approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). If payment is made by bank transfer, the fact of payment is confirmed by a payment order and a bank statement from the buyer’s current account.

Please note that the limitation on the size of cash payments (RUB 100,000 within one agreement) does not apply to payments between organizations and individuals who do not have individual entrepreneur status (clause 5 of the Bank of Russia Directive No. 3073-U dated October 7, 2013). In this case, the basis for payment does not matter. This means that the company that purchased property from a citizen has the right to pay him, under this agreement, in cash an amount exceeding 100,000 rubles. And he can do it in one go.

Draw up a procurement act when purchasing goods from an individual by a legal entity

The question of whether an individual can participate in public procurement is answered by Article 3 of the Law on the Contract System in the Field of Procurement. It determines that a bidder can also be an individual who is not an individual entrepreneur. The purchase of goods from an individual by a legal entity is possible both through a competitive method (contests, auctions) and using the provisions of Article 93 of the Federal Law No. 44. For example, citizens are often performers under contracts such as the provision of teaching services or as a tour guide.

Individuals cannot take part in tenders aimed at such categories of participants as SMP and SONKO (this fact must be indicated by the customer in the procurement documentation).

It must be borne in mind that the application submitted during the procurement procedures by such a supplier must have some differences. These, for example, include:

- Full name and place of residence of the specified supplier (instead of the name and legal address of the organization);

- identification documents (instead of an extract from the Unified State Register of Legal Entities);

- Only participating organizations must indicate the TIN; however, if the supplier is an individual, the customer’s commission does not have the right to require him to indicate this data in the application.

Remember that when concluding a contract with a citizen, its cost must be reduced by the amount of personal income tax (13% of the contract price).

Purchasing act

Individual contributions

Amounts received by an individual from the sale of property owned by him are included in income subject to personal income tax (subclause 5, clause 1, article 208 of the Tax Code of the Russian Federation). However, an organization is not obliged to withhold personal income tax when paying an individual money for assets purchased from him. The fact is that citizens must independently declare such income at the end of the calendar year and pay tax on it (subparagraph 2, paragraph 1, paragraph 2 and 3 of Article 228 of the Tax Code of the Russian Federation).

Thus, in relation to these payments, the company is not a tax agent for personal income tax. Moreover, she is not obliged to report to the inspectorate about the amounts paid to the seller of the property. A similar obligation is established only for tax agents (clause 2 of Article 226 and clause 2 of Article 230 of the Tax Code of the Russian Federation). The Ministry of Finance of Russia adheres to a similar opinion (letters dated 07/02/09 No. 03-04-06-01/149, dated 03/28/08 No. 03-04-05-01/89 and dated 03/12/08 No. 03-04-06-01/ 55).

The organization does not charge insurance contributions to extra-budgetary funds for amounts paid to an individual for property purchased from him. After all, these payments are made within the framework of a purchase and sale agreement, and not an employment contract. And remunerations under civil contracts, the subject of which is the transfer of ownership of property, are not included in the insurance premium base (parts 1 and 3 of Article 7 of the Federal Law of July 24, 2009 No. 212-FZ).

For similar reasons, the company does not charge insurance premiums to the Federal Social Insurance Fund of the Russian Federation for injuries on the specified payments (Clause 1, Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

According to generally accepted rules, when an individual receives any amounts, for example, a salary, the organization is the taxpayer. Personal income tax is already withheld from these amounts initially. However, when purchasing goods or equipment from a private seller, the individual entrepreneur does not pay this fee.

Article 217 of the Tax Code of the Russian Federation states that proceeds from the sale of goods grown on private farms are also not taxed. This includes poultry, livestock, nutria, crop and beekeeping products.

When alienating property as an owner, the private owner must independently pay personal income tax. It is also his responsibility to file tax returns on time.

Purchasing real estate from an individual - taxes and online cash register

As a general rule, all transactions between organizations and individuals must be made in writing (clause 1, clause 1, article 161 of the Civil Code of the Russian Federation).

Therefore, draw up a purchase and sale agreement with him.

Personal income tax

In the situation under consideration, an organization acquires an object of real estate owned by an individual. At the same time, the organization does not have duties as a tax agent, since the calculation and payment of personal income tax in relation to income received from the sale of such property is carried out by individuals independently (clause 2 of Article 226, subclause 2 of clause 1 of Article 228 of the Tax Code of the Russian Federation).

VAT

Individuals who are not registered as entrepreneurs are not VAT payers (clause 1 of Article 143 of the Tax Code of the Russian Federation). Consequently, when purchasing property from them, there is no “input” VAT that the buyer could deduct.

However, if the organization subsequently decides to sell this property, it will have to charge VAT on its value at a rate of 18%, as with any other sale transaction (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The rental of this property will also be subject to VAT.

Corporate income tax

The cottage is included in the depreciable property at its original cost (clause 1 of Article 256 of the Tax Code of the Russian Federation). The initial cost of a depreciable fixed asset is determined in accordance with clause 1 of Art. 257 of the Tax Code of the Russian Federation as the amount of costs for the acquisition of this object, which, in particular, includes the cost of the premises established by the real estate sale agreement.

In the general case, used depreciable property objects purchased by an organization are included in the depreciation group (subgroup) in which they were included from the previous owner (clause 12 of Article 258 of the Tax Code of the Russian Federation). At the same time, an organization acquiring used fixed assets, in order to apply the linear method of calculating depreciation for these objects, has the right to determine the depreciation rate taking into account the useful life reduced by the number of years (months) of operation of this property by the previous owners. In this case, the useful life of these fixed assets can be defined as their useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of this property by the previous owner (clause 7 of Article 258 of the Tax Code of the Russian Federation).

However, in the situation under consideration, the property was purchased from an individual who is not registered as an individual entrepreneur. Obviously, such an individual does not establish the useful life of the residential premises and does not assign it to any depreciation group. In this regard, according to the explanations of the Ministry of Finance of Russia, the norm of paragraph 7 of Art. 258 of the Tax Code of the Russian Federation does not apply in such cases (Letters dated 03/29/2013 N 03-03-06/1/10056, dated 03/15/2013 N 03-03-06/1/7939).

Thus, residential premises are included in the depreciation group in accordance with its useful life, which is determined by the organization independently on the date of commissioning of this fixed asset taking into account the Classification of fixed assets (clause 1 of Article 258 of the Tax Code of the Russian Federation).

Depreciation on an acquired property is accrued monthly in accordance with the generally established procedure, starting from the month following the month of its commissioning, regardless of the date of state registration of the transfer of ownership of it (clauses 2, 4 of Article 259 of the Tax Code of the Russian Federation).

CCP

If an organization or individual entrepreneur buys a product, work, or service from an individual, then it does not need to use CCT. The departments noted that the buyer should not punch the cash register receipt. But the Federal Tax Service makes an exception to the rule - an organization is obliged to punch a receipt if it buys goods from an individual for resale.

The seller, as an individual, does not use CCT.

Example: an organization rents an apartment from an individual. For any form of payment, neither party is required to issue a check.

Documents: Letter of the Federal Tax Service of Russia dated August 10, 2018 N AS-4-20/ [email protected]

Letter of the Federal Tax Service of Russia dated August 14, 2018 N AS-4-20/15707

Letter of the Ministry of Finance of Russia dated August 10, 2018 N 03-01-15/56554

Purchase agreement with an individual

The process of concluding such an agreement is similar to how it is signed with any commercial organization. Article 161 of the Civil Code of the Russian Federation stipulates that transactions with a citizen are confirmed by concluding an agreement in simple written form.

However, there are some features that are important for budgetary organizations to keep in mind. Among them are:

- the customer has an obligation to pay insurance contributions (Pension Fund and Compulsory Medical Insurance Fund);

- as already stated above, the contract must include a condition that its price be reduced by the amount of tax payments.

For all participants, including non-entrepreneurs, the rules for concluding government contracts are the same: the terms of the application must comply with the provisions specified in the notice and tender documentation. But in this case there is a peculiarity. If a contract is concluded with an individual, with the exception of an individual entrepreneur or other entrepreneur who is engaged in private practice, it includes a mandatory condition on reducing the amount of payment by the amount of tax payments (personal income tax).

In accordance with Part 1, Clause 1, Art. 161 of the Civil Code of the Russian Federation, transactions between organizations and citizens must be confirmed by a document in simple written form. Not only the purchase and sale agreement is appropriate here, but also the purchase act, because There are no strict requirements for the type of document.

If in accordance with Ch. 30 of the Civil Code of the Russian Federation, draw up a sample; a purchase contract from an individual must include the following data:

- Information about the purchased products (name, quantity, description and cost).

- Rights and obligations of the parties (terms of payment and sale).

- Details (for the seller: full name, passport details, address, INN, account number).

- Signatures of the parties to the transaction.

As a basis, you can take one of the standard contracts that are presented on the EIS website.

Purchase agreement from an unregistered entrepreneur

For all participants, including non-entrepreneurs, the rules for concluding government contracts are the same: the terms of the application must comply with the provisions specified in the notice and tender documentation. But in this case there is a peculiarity. If a contract is concluded with an individual, with the exception of an individual entrepreneur or other entrepreneur who is engaged in private practice, it includes a mandatory condition on reducing the amount of payment by the amount of tax payments (personal income tax).

In accordance with Part 1, Clause 1, Art. 161 of the Civil Code of the Russian Federation, transactions between organizations and citizens must be confirmed by a document in simple written form. Not only the purchase and sale agreement is appropriate here, but also the purchase act, because There are no strict requirements for the type of document.

Accounting

A transaction for the acquisition of assets from an individual is reflected in the accounting records of the purchasing organization with the following entries (depending on what kind of property was purchased): DEBIT 10 (41) CREDIT 60 - materials or goods purchased from an individual are accepted for accounting;

DEBIT 08.4 CREDIT 60—reflects the debt to an individual for a fixed asset purchased from him;

DEBIT 01 CREDIT 08.4— fixed asset accepted for accounting;

DEBIT 60 CREDIT 50 (51) - paid for materials, goods or fixed assets purchased from an individual.

Inform the citizen seller about the need to pay personal income tax on the income from the transaction

When selling property owned by them, individuals are required to independently calculate and pay personal income tax to the budget on the income received. In addition, they are required to submit a tax return to the Federal Tax Service at their place of residence within the time limits established by law (clause 2 of Article 226 and subclause 2 of clause 1 of Article 228 of the Tax Code of the Russian Federation). Therefore, you, as a buyer, in this case are not a tax agent for personal income tax. And you don't need to remit tax.

The same goes for insurance premiums. There is no requirement to charge insurance premiums for payments under civil contracts, the subject of which is the transfer of things into ownership (Clause 3, Article 7 of Federal Law No. 212-FZ of July 24, 2009).

An individual entrepreneur can reimburse the cost of purchased products using cash or non-cash payment. A common option is to purchase goods for sale through an accountable person. The representative is appointed by order, which is signed by the head of the company. The appointed employee becomes financially responsible for the entire period of the transaction. If a shortage occurs, the accountable person undertakes to compensate for the damage.

After purchasing the product, the employee must report on the transaction. The documentation provided must include the purchase act and a copy of the invoice confirming the receipt of goods. The remaining funds (if any) must be deposited into the cash register.

The next payment method is to give money to the individual entrepreneur directly from the cash register. You can also make a non-cash payment. The terms of the transaction are fixed in the contract. For non-cash payments, the document must contain information about the seller’s bank account.

It is noted that there are restrictions on the amount of 100,000 rubles. when making payments to a private seller for goods for personal consumption. However, the rule applies exclusively to cash payments between entrepreneurs and legal entities. Payments for purchases from individuals can be made for amounts without restrictions.

Depending on the taxation system, an individual entrepreneur can use goods purchased or for sale. A correctly executed purchase and sale transaction allows you to purchase products from a private owner for cash and sell them by bank transfer.

Purchasing from an individual by a legal entity is a traditional practice for our country. Even before the revolution, government supplies could be carried out not only by a merchant, but also by an ordinary person. Is this the case today? Can an individual participate in government procurement?

Art. 861 of the Civil Code of the Russian Federation allows customers to pay non-entrepreneurs both in cash and non-cash, without limiting the amount.

When paying in cash (for example, goods were purchased from an individual by a legal entity), payment for the transaction is confirmed by a cash receipt order, and in case of non-cash payment - a payment order and a bank statement from the buyer.

How LLCs and individual entrepreneurs can buy goods from an individual using a procurement act

The forms of primary accounting documents are approved in the accounting policy of the organization (clause 4 of PBU 1/2008).

Thus, when purchasing equipment from an individual, an organization must issue a primary accounting document confirming such acquisition. This document must indicate the name of the equipment and its value in monetary terms. Such a document can be an invoice, a purchase act, an acceptance certificate. The document must contain information about the individual seller that allows him to be identified, as well as his handwritten signature.

In accordance with paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which an individual taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of tax calculated on the income paid to the taxpayer. Russian organizations in this case are recognized as tax agents.

According to paragraph 2 of Art. 226 of the Tax Code of the Russian Federation, the calculation of amounts and payment of tax are carried out in relation to all income of the taxpayer, the source of which is the tax agent, with the exception of income in respect of which the calculation and payment of tax are carried out, in particular, in accordance with Art. 228 Tax Code of the Russian Federation.

According to Art. 228 of the Tax Code of the Russian Federation, individuals who received income from the sale of property owned by these persons independently calculate the amount of tax payable to the appropriate budget. In this case, these persons are required to submit a corresponding tax return to the tax authority at their place of registration.

Thus, when purchasing equipment from an individual, the organization does not withhold the amount of tax from his income, but at the same time, the organization, as a tax agent, is obliged to send information to the tax authority (in Form 2-NDFL) about the amount of income paid to the individual. Information is submitted no later than April 1 of the year following the expired tax period (clause 2 of article 230 of the Tax Code of the Russian Federation).

VAT Individuals who are not registered as entrepreneurs are not VAT payers (clause 1 of Article 143 of the Tax Code of the Russian Federation). Consequently, when purchasing property from them, there is no “input” VAT that the buyer could deduct. However, if the organization subsequently decides to sell this property, it will have to charge VAT on its value at a rate of 10 or 18%, as with any other sale transaction (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The only exception is the sale (clauses 4 and 5.1 of Article 154 of the Tax Code of the Russian Federation): - cars purchased from individuals for resale; - agricultural products and products of their processing purchased from citizens, which are not excisable goods and are included in a special list, approved by Decree of the Government of the Russian Federation dated May 16, 2001 No. 383. When selling these goods, the organization charges VAT at the calculated rate of 10/110 or 18/118.