Content

- Concept of maternity leave

- Periodicity

- Maternity leave period

- Rules and deadlines for registration

- Documents for maternity leave

- Is it possible to go on vacation before maternity leave?

- Is it possible to work and stay in DO

- Registration of leave for husband

- Registration for other relatives

- Whose responsibility is it to pay maternity benefits?

- Who benefits are paid to?

- How to calculate and pay benefits

- How to apply for benefits if a woman is unemployed

- Early exit from maternity leave

- What to do if your employer refuses to provide maternity leave

- Conclusion

Waiting for the birth of a baby is an exciting event for every family. All relatives usually prepare for it. Information on how to properly arrange maternity leave is important both for the new mother herself and for managers. We'll talk about this today.

Rules and deadlines for registration

First, the date from which maternity leave will begin and when it will end is determined. It begins from the date when the doctor issues the employee a certificate of incapacity for work.

To find out its end date, you need to add 140 to the first day that is a non-working day. The date that follows after the end of this time will be the start date of parental leave.

If a woman is expecting several babies, then the sick leave will be issued to her fourteen days earlier, and closed after 194 days.

Childbirth with complications is a special situation. In this case, the woman is given additional sick leave for a period of 16 days. It can be provided immediately after the required 140 days are over.

The employer does not have the right to dismiss an employee who is pregnant, and providing leave is his responsibility.

Payments on maternity leave

You should pay attention to the procedure for calculating maternity benefits and child care benefits up to 1.5 years.

Choice of two years

Federal Law of December 29, 2006 N 255-FZ

(ed. dated June 28, 2014)

“On compulsory social insurance in case of temporary disability and in connection with maternity”

Article 14. The procedure for calculating benefits for temporary disability, pregnancy and childbirth, and monthly child care benefits.

1. Benefits for temporary disability, pregnancy and childbirth, monthly child care benefits are calculated based on the average earnings of the insured person, calculated for two calendar years preceding the year of temporary disability, maternity leave, parental leave, including during work (service, other activities) with another policyholder (other policyholders). Average earnings during work (service, other activities) with another insurer (other insurers) are not taken into account in cases where, in accordance with Part 2 of Article 13 of this Federal Law, benefits for temporary disability, pregnancy and childbirth are assigned and paid to the insured person for all places of work (service, other activity) based on the average earnings during work (service, other activity) with the insurer assigning and paying benefits. If in two calendar years immediately preceding the year of occurrence of the specified insured events, or in one of the specified years, the insured person was on maternity leave and (or) child care leave, the corresponding calendar years (calendar year) at the request of the insured person, they can be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this leads to an increase in the amount of benefits.

3.1. Average daily earnings for calculating maternity benefits and monthly child care benefits are determined by dividing the amount of accrued earnings for the period specified in Part 1 of this article by the number of calendar days in this period, with the exception of calendar days falling in the following periods :

1) periods of temporary disability, maternity leave, parental leave;

2) the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if insurance contributions to the Social Insurance Fund of the Russian Federation are paid for the retained wages for this period in accordance with the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation” Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund” were not accrued.

Documents for maternity leave

The employee submits the completed package of documentation to the personnel department of her organization. Let us consider and give a brief description of this list.

A completed certificate of incapacity for work.

The date from which the employee goes on maternity leave must also be the date from which sick leave is opened.

Statement.

Be sure to make sure that it is filled out correctly: indicating the name of the organization, with the surname and initials of the employee herself.

She must indicate that she is asking for maternity leave and benefits. You should also check the correct date of maternity leave and return to work date.

Woman's passport.

No comments are needed here: it must be provided.

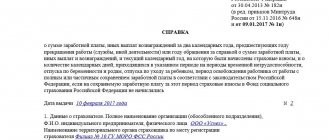

A certificate confirming income for the 2 years preceding the decree.

If a woman worked in another organization, then the certificate should be taken from there. If for various reasons it is impossible to obtain the data, a request is made to the Pension Fund. It takes about 10 days to process, so plan accordingly.

When all the documentation has been collected, an order is issued in a special form. As soon as the order is signed, the employee has the right not to fulfill her duties.

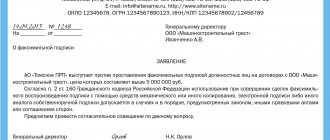

Application for provision of rest days during pregnancy and childbirth

An application for maternity leave does not have special standards or forms approved by law. It must contain data that will make it clear what this statement is about, on whose behalf it is written and what grounds are attached for its execution.

Its structure includes:

- “hat” – position and name of the manager;

- the name of the document itself in the center of the sheet;

- textual formulation of the essence of the application for leave and its payment on the basis of a certificate of incapacity for work;

- list of attached documents;

- applicant's signature and date of writing.

Maternity leave is one of the important periods in a woman’s life, which is under state protection. The basis for its initiation is a certificate of incapacity for work correctly drawn up by a gynecologist. When providing it, the employer must provide the woman with leave within a clear time frame, assign and pay for it according to the specified details.

Is it possible to go on vacation before maternity leave?

It happens that it becomes physically difficult for an expectant mother to work before the official date of maternity leave. For such situations, the law provides that the employer can grant the employee another annual leave before she goes on maternity leave. Its duration is the standard 28 days.

A woman can use her right to such leave only if during the period worked there are days of unused leave. If the vacation was taken in advance, and the employee quit before leaving maternity leave, her vacation pay will be withheld.

Registration of leave for husband

Instead of the baby's mother, the father may also be on maternity leave. The only thing is that there are some nuances in the design, which we will talk about further.

Let us note that now the situation when the child’s father goes on maternity leave is not a rarity. Of course, this is not yet as widespread as in European countries, but it also occurs.

Let us also clarify that the legislation of the Russian Federation does not prohibit this; there is nothing illegal in such a situation.

The procedure itself for a man is no different from what a woman undergoes.

No employer can refuse to provide additional training to a male employee.

The only thing is that the man provides a certificate from his wife’s work stating that she did not take out maternity leave and that benefits were not accrued to her. Based on these documents, the employer issues an order and assigns payments.

Packages of papers for conducting the procedure

In order to go on maternity leave without problems, a woman needs to collect some documents.

Going on maternity leave

To go on maternity leave and apply for maternity benefits:

- Sick leave.

- Certificate that the pregnant woman is registered with the antenatal clinic (in the first 12 weeks).

- Statement to the boss at work. A sample application for maternity leave is provided by personnel department employees.

- Passport.

- A document confirming the amount of income that the woman received over the past 12 months at her last place of work.

- Details of the bank card or bank account to which maternity leave payments will be transferred.

For maternity leave:

- Passport.

- Child's birth certificate (original and copy).

- Bank card or bank account information.

- Statement.

A working woman must take all these documents to the accounting or personnel department. If it does not work, the documents are provided to the Social Insurance Fund. No more than 10 days are given for consideration of documents. Accrued funds must be issued on the next payday.

A pregnant woman should be assisted by the HR department when writing an application for leave. The application must provide the following information:

- Request for leave based on sick leave.

- Request for the issuance of the required funds according to the most convenient option for her (indicate the card or account number).

- List of documents that are attached to the application (sick leave and certificate of registration at the antenatal clinic).

After this, the head of the enterprise draws up a vacation order, which indicates the following information:

- The exact start and end date of the vacation.

- Official documents confirming this fact.

- The amount of material payments under the BiR.

The employee must be familiarized with the essence of the order. This is confirmed by her signature on the document.

Both the woman’s statement and the manager’s order are certainly recorded in journals, which are stored for a specified period. Employees of the HR department display the period during which the woman is on leave on the B&R time sheet. There are special designations for this: “P” or “14”.

Who benefits are paid to?

In addition to those employees who work officially, there are a number of categories of women who have the same right to claim benefits:

- Full-time students in higher and secondary educational institutions;

- Those who lost their jobs due to downsizing or liquidation of an enterprise or closure of an individual entrepreneur;

- Who do not have citizenship, but have lived in the Russian Federation for a long time;

- Refugees;

- Citizens of other states, if insurance is taken out in the Russian Federation.

How to calculate and pay benefits

The pregnancy of an employee implies not only her going on maternity leave, but also the payment of all amounts due to her. This is what the Labor Code of the Russian Federation says.

The basis for the calculation will be the woman’s average salary for the previous two years. The benefit amount is 100% of wages.

If the employee officially worked for less than six months, then the average earnings are calculated based on the minimum wage. From January 1, 2020, it is 11,280 rubles.

In order to calculate the actual amount of benefits, you need to divide the amount for two years by 730 days, and multiply what you get in the end by the days of maternity leave.

An example of calculating the maximum benefit in 2019.

- Maximum salary in 2020: RUB 755,000; in 2020: RUB 815,000;

- Period: 730 days;

- We calculate: (755,000 + 815,000)/731 * 140 = 301,096 rubles.

Example of calculation if pregnancy is multiple.

Employee N. is expecting twins. She provided sick leave, which has been open since 02/01/2019. She has been working in the organization for 6 years. In 2020 she earned 460,000 rubles, in 2020 - 508,000 rubles.

- 460,000 + 508,000 = 968,000 rubles;

- Period: 730;

- We count: (460,000 + 508,000) / 730 * 194 = 257,249 rubles.

Calculation of maternity benefits accrual

Maternity benefits are calculated using the average salary for the previous two years and are not tied to length of service. There are several nuances that need to be considered in detail.

- When calculating average earnings, the maximum amount for which insurance contributions to the Social Insurance Fund (FSS) are calculated is taken into account. By law, it amounted to 718 thousand rubles in 2020, and 755 thousand rubles in 2017.

- The law also limits the amount of average earnings. It is calculated as follows: add up the maximum amounts for the previous two years and divide by 730.

- The following were removed from this period:

- time of maternity leave;

- sick leave period;

- maternity leave time;

- time during which insurance premiums were not withheld from wages.

Women who have been on maternity leave or caring for children for the last two years have the right to replace this period with another previous one if this increases the amount of payments. Women who go from maternity leave to maternity leave can write an application to change their years.

Early exit from maternity leave

It often happens when a woman wants to start work earlier. She has the right to do this at any time. There are no clear regulations for this procedure; it is built based on legislative norms.

If an employee wishes to terminate her vacation early, the employer’s wishes do not matter here. This is confirmed by existing judicial practice in this category of cases.

Initially, the woman must write a statement. It states that maternity leave will be interrupted and the date from which she will begin her duties.

It is also worth deciding what work mode will be set for this employee. In particular, it is specified whether she will work full time or on a reduced schedule. This will determine what kind of childcare benefit she will receive.

Having received the employee’s application, the employer issues a corresponding order. No unified form of such an order has been approved; it is permissible to draw it up arbitrarily.

The employer does not have the right to refuse to return to work early. If such a right is violated, a woman can turn to the judiciary to protect her rights.

What to do if your employer refuses to provide maternity leave

The obligation of any employer in the Russian Federation is to provide parental leave. When he refuses to do this, the expectant mother must turn to the judicial authorities, who will definitely take her side.

But if she quits of her own free will, then she will not be paid benefits for employees. Therefore, lawyers do not recommend that women agree to such employer conditions under any circumstances.

Is maternity leave issued for the husband or other relatives?

Maternity leave can only be granted to an expectant mother or a woman who has already given birth. After all, it is she who carries the child and gives birth, and not some close relative or husband.

The basis for registration of such leave is a certificate of incapacity for work issued by a medical institution with the corresponding disability code “05”. This strict reporting document is issued only to a woman seen by a gynecologist, based on the tests performed and medical findings.

Close relatives of the baby (father, grandfather or grandmother, etc.) can go on parental leave until the child reaches the age of one and a half years, which immediately follows maternity leave.

They will be accrued and assigned a care allowance for up to one and a half years (Clause 1, Article 11.1 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”).