The tax office may refuse to register you as an individual entrepreneur. The list of grounds for refusal is quite clear - the registration authority does not add any new grounds. Therefore, when preparing registration documents, you can take into account potential reasons for refusal in advance and insure yourself against them by completing the documents correctly. If you are still rejected, in most cases you can correct the shortcomings and resubmit your documents. If you correct your mistakes within three months and submit the documents again, you will not need to pay the state fee again.

Grounds for refusal to register a business activity

The reason for refusal to register a business activity is established by tax legislation. Therefore, when a person wants to open the state status of an individual entrepreneur, he must have information related to the process of registering an individual entrepreneur, as well as the grounds on which such registration may be refused. When answering the question why they might refuse, the following should be noted.

The current legislation establishes the following reasons for refusal of registration:

- if the application for opening an individual entrepreneur is written incorrectly;

- if a prohibited activity is selected;

- not all the necessary documents required for registering an individual entrepreneur have been collected;

- if the future individual entrepreneur submits the necessary documents to a tax authority that does not serve the administrative territory in which the activity will be carried out, or the person is registered;

- if there is another registration of an individual entrepreneur, on a person who is trying to open another status as an individual entrepreneur;

- if there is a court decision according to which a person is prohibited from opening an individual entrepreneur for a certain time, which has not expired at the time of filing the documents;

- if an individual individual entrepreneur is declared bankrupt and tries to regain the status of an individual entrepreneur within a year.

This is the legislative list on the basis of which the state tax service will refuse to register a business activity.

It is important to know that the state tax service must provide a refusal in writing within five days from the date of filing the application and other documents that are required for registration. Such a response must necessarily indicate the reason for the refusal.

Now we can move on to a more detailed consideration of all the above reasons.

Appeal to the wrong authority

- Establishment by the registration authority of the fact that the applicant lacks full civil capacity is a 100% guarantee of refusal to grant individual entrepreneur status. Cannot be registered:

- persons under 18 years of age (except for those who have undergone the emancipation procedure);

- citizens recognized as legally incompetent or partially incompetent.

- It is impossible to register an entrepreneur who is already one. An individual entrepreneur conducts business without creating a legal entity, so this restriction is quite logical.

- A ban on entrepreneurial activity established by a verdict in a criminal case is an obstacle to the activities of an individual entrepreneur until the criminal record is cleared or expunged.

- Registration will be denied to a person who was previously registered as an individual entrepreneur if his activities led to bankruptcy or were forcibly terminated earlier than a year before filing the application.

If it is fundamentally important for a potential entrepreneur which tax office to register and report to, it is worth changing your registration.

The most common reasons for refusal to register an individual entrepreneur

If we take statistics related to the reasons for refusal to register a business activity, the first places will belong to the following:

- incorrect writing of the application;

- attempting to engage in prohibited activities;

- failure to provide all necessary documents.

In principle, the reasons are clear, and to avoid incidents during future registration, we can advise the following.

- You must carefully fill out all required documents. Write your personal data without errors, in legible handwriting, without corrections or blots. Forms can be downloaded on the Internet and personal data can be printed in printed text.

- Before deciding to become an individual entrepreneur, you need to review the permitted types of activities, which can be found on government websites, as well as resources dedicated to entrepreneurship.

- Collect all required documents. To do this, you can even contact the tax office and write down what is required.

It is important to understand that if all mandatory fees are paid and documents are submitted, they will not be returned if registration is refused. It follows from this that you will have to pay and collect documents again.

Problems of a formal nature

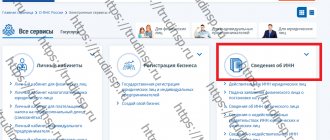

- Failure to provide the necessary documents (most often - TIN) is the most common motivation for refusal of registration.

- Errors in the application, blank fields.

Refusal to register an individual entrepreneur does not limit the applicant’s ability to draw up and resubmit documents after correcting formal errors or termination of prohibiting factors. If the tax authority issues a resolution of refusal, the application and attachments attached to it are not returned to the applicant.

Why is it difficult for individual entrepreneurs to grow? Features of IP. 4 reasons why an individual entrepreneur gets rejected by clients.

Who cannot be an individual entrepreneur

How not to be refused when registering an LLC or individual entrepreneur? Legal failure #2

Refusal of the Tender. Registration of individual entrepreneurs. Master Class.

Refusal of registration due to application to the wrong tax authority

There are cases when future businessmen apply to the tax authority, which does not have the right to register the individual entrepreneur for the person who applied. Accordingly, a mandatory fee is paid, documents are submitted that the tax office is obliged to accept, and a refusal is received. This is a shame, but anyone who decides to become an individual entrepreneur should know the following:

- when registering a patent, a person must contact the tax authority that serves the administrative territory or the subject of the Federation where the activity will be carried out;

- When registering as an individual entrepreneur, without a patent, you must apply at your place of registration.

In other cases, tax authorities may accept documents but refuse to register a business activity. Therefore, you need to approach the submission of documents for state registration carefully.

Regulatory acts

All actions related to obtaining the status of an individual entrepreneur or accompanying refusal of registration are regulated by the following regulations:

- Civil Code of the Russian Federation.

- Law No. 129-FZ of August 8, 2001. “On state registration of legal entities and individual entrepreneurs”

- Federal Law No. 79-FZ dated July 27, 2004. “On the state civil service of the Russian Federation.”

- Federal Law No. 167 of December 15, 2001. “On compulsory pension insurance in the Russian Federation.”

- Federal Law No. 184 of December 27, 2002. "On technical regulation".

- All-Russian Classifier of Types of Economic Activities OK 029-2014 (OKVED2), (letter of the Federal Tax Service of Russia dated July 7, 2016 N GD-4-14/12160).

- Order of the Ministry of Finance of the Russian Federation No. 87n dated June 22, 2012.

- Order of the Ministry of Finance of the Russian Federation No. 169n dated September 30, 2020 (as amended on October 19, 2020).

In addition to the listed legislative acts, there are letters and clarifications from relevant ministries and departments that clarify certain provisions of articles of laws.

Refusal to register if a person is declared bankrupt

These cases are rare, but still occur in practice. According to current legislation, before the state registration of an individual entrepreneur, the tax authority checks the person against a database of entities that have been declared bankrupt, or are generally prohibited from engaging in entrepreneurial activity for a certain time. Usually this is one year from the date of the court's decision. To avoid getting into such an unpleasant situation, people should know in what cases they may be declared bankrupt and may be prohibited from engaging in entrepreneurial activities:

- if there are various debts on taxes and other obligatory payments to the state and other territorial budgets;

- there is an outstanding loan for which a person has been declared bankrupt by a court decision;

- there are debts on mandatory payments to various state funds that the individual entrepreneur cannot pay, and because of this he is declared bankrupt;

- the presence of outstanding loans for which the entrepreneur cannot fulfill his obligations.

In general, it is worth noting that it is the presence of outstanding and overdue debts and loans that entails creditors going to court. Typically, such demands first consist of forced collection of a debt or loan, and then, when the person does not have the means to comply with the court decision, he is declared bankrupt. This is a complex procedure, but it entails restrictions on state registration of individual entrepreneurs.

What to do if a negative result is obtained?

The application for registration of an individual entrepreneur contains information about the planned types of activities.

Enterprises with the form of individual entrepreneurs are not allowed to conduct activities in the production of medicines, alcohol-containing substances, the production of aviation equipment, air transportation and other forms.

When preparing data, you must take into account:

- Code information is indicated in an amount not exceeding 4 numbers.

- It is allowed to enter data on any (up to 20) number of species.

- The source of code information is the OKVED reference book. Data changes regularly. The latest version of the document must be reviewed.

When resubmitting documents, you must pay an additional state fee.

To engage in entrepreneurial activity, you need to register an individual entrepreneur. Going through a simple procedure will help you do business legally. All you need is to collect a package of documents and submit it to the territorial body of the Federal Tax Service.

However, according to current legislation, there are several categories of citizens who cannot register an individual entrepreneur.

These include:

- military;

- officials;

- incapacitated citizens (without the permission of a guardian);

- citizens of another country who have not received permission to reside and work in the Russian Federation.

To engage in some activities, you need to reach a certain age, and these include: cargo transportation, private investigation and the production and sale of medicines

According to 129-FZ, there are the following reasons for refusal to register an individual entrepreneur:

- incapacity of a citizen;

- The individual entrepreneur is in the process of liquidation or has already been registered;

- the applicant is declared bankrupt;

- a prohibited type of activity has been selected;

- a package of documents was submitted to the wrong authority;

- an incorrectly completed or completed application;

- The court imposed a ban on business activities.

Federal Law No. 129

Sometimes all people make mistakes, and tax officials are no exception. What to do in this case? You can re-submit documents for registration.

To do this, you need to reassemble the package, rewrite the application, eliminate any errors found, and pay the state fee again.

To eliminate any shortcomings, you can contact a lawyer and write out a power of attorney for him.

If you are still denied registration, you can file a corresponding lawsuit in court. With the support of an experienced lawyer, the case will likely be won.

In this case, you will be able to claim restoration of documents, a positive decision on the registration case and compensation for damage caused by the refusal.

However, legal proceedings will take a lot of time and effort.

It is worth noting that the tax office very rarely refuses to register an individual entrepreneur without good reason.

Most often this happens due to incorrect completion of the application or the absence of one of the acts.

Thus, in order to minimize the likelihood of refusal to register an individual entrepreneur, you need to carefully consider collecting the package of documents.

If registration was denied due to the applicant’s inattentiveness or incorrect filling out of documents, the shortcomings must be corrected and the procedure must be repeated.

Can tax officials reject an application again? Yes. In this case, it is recommended to contact a lawyer to check the validity of the refusal.

If your rights have been violated, you can contact a higher authority. The application must be submitted in writing in person or online.

The complaint must bear the signature of the originator or representative.

The statement states:

- FULL NAME;

- place of residence;

- information about the decision made by the registration authority;

- full name of the authority that refused registration;

- grounds for appealing the decision of the registration authority;

- the requirements of the person filing the complaint;

- Contact Information.

First, the complaint is submitted to a higher tax office. If they do not reconsider the decision, the application is sent to the court or the Federal Tax Service of Russia.

If the tax inspectorate exceeds the established deadlines and there is no notification of an extension of the period for consideration of the complaint, you can immediately go to court.

While the tax office is considering your claim, you can supplement it with other documents.

Please note that this right remains until they make a decision.

The complaint must be filed within 3 months from the date of refusal of registration. If your application was rejected by a higher authority, it can be submitted to the Federal Tax Service or the court within 90 days from the date of the decision on the first application.

Please note: if you have missed the deadline for filing a complaint, it will not be considered. However, if there are good reasons, the tax office may allow you to file a petition.

The complaint will not be considered if:

- there is no signature (in this case, you can put it and submit it again);

- it was signed by a person who does not have such rights;

- it was withdrawn;

- a similar claim was filed previously;

- The court's decision on this issue came into force.

The tax inspectorate may not satisfy the complaint if the reasons for refusing to register an individual entrepreneur are considered sufficient. If a violation of your rights is confirmed, the decision will be reviewed within 5 working days.

Sometimes future entrepreneurs apply for registration of individual entrepreneurs to the wrong authority. As a result, they pay a mandatory fee, submit a package of documents and are refused.

To avoid this, you need to remember that to register an individual entrepreneur without a patent, you need to apply at the place of registration, and with a patent - to the tax office, on the territory of which the activity will be carried out.

The following categories of citizens will receive a negative decision from the registration authority:

- having debts on taxes or other government payments;

- having an outstanding loan for which the person was declared bankrupt;

- having debts on mandatory payments to state funds;

- having outstanding loans that the entrepreneur cannot close.

In addition, the presence of outstanding or overdue debts is the basis for collecting the loan in court. After being declared bankrupt, a person is released from fulfilling these obligations, but he is prohibited from registering an individual entrepreneur for one year.

In case of registration of several individual entrepreneurs for one person, a tax waiver will also be received. To get rid of debts or start a business in another place, you need to declare yourself bankrupt or completely liquidate the individual entrepreneur and then open it in another region.

In this case, you will be able to register as an entrepreneur again without any restrictions from the tax authorities.

Please note: if you have been declared bankrupt, you can register an individual entrepreneur only after a year

Why can they refuse to register an individual entrepreneur?

According to current legislation, this can happen for the following reasons:

- incorrectly completed application;

- provision of an incomplete package of documents;

- error with registration selection location;

- re-registration of individual entrepreneurs without liquidation of the previous one;

- the restriction period imposed by the court during which a person cannot engage in entrepreneurial activity has not expired;

- less than a year has passed since the forced liquidation of the individual entrepreneur or declaration of bankruptcy.

Registration of an individual entrepreneur will also be denied if a prohibited type of activity is chosen.

These include:

- production and sale of alcoholic beverages;

- production and distribution of narcotic substances, as well as any related activities;

- production of medicines;

- air transportation;

- development and repair of aircraft;

- space activities;

- production and distribution of pyrotechnics of the 4th or 5th class;

- private security activities;

- sale of electricity;

- organization of investment and non-state pension funds;

- employment of citizens abroad.

An individual can exercise his right and appeal the refusal to register an individual entrepreneur in court.

However, in practice, proving this is either very difficult or requires a large investment of time and effort.

In most cases, it is much easier to take into account the mistakes made, correct them and contact the Federal Tax Service again.

Sometimes the Federal Tax Service refuses to register an individual entrepreneur due to minor violations. In this case, you can contact the tax office again with the corrections made.

Such situations include:

- submitting an application with erasures and corrections that are prohibited on accounting forms;

- filling out the application with a colored pen (the Federal Tax Service only allows blue or black);

- presence of a signature on the application when submitting a package of documents (the signature must be affixed personally in the presence of a tax inspector);

- indication of incomplete data in the application (in this case, the inspector will provide the opportunity to fill in the empty fields directly when submitting the document in person - if submitted via the Internet or by mail, a refusal will be issued);

- provision of an incomplete package of documents.

To resubmit documents for individual entrepreneur registration, you must collect a package of documents.

It includes:

- statement;

- copy of passport;

- confirmation of payment of state duty.

If you are acting through a representative, you will also need a notarized power of attorney and a copy of his passport. When specifying some types of activities, you will need to present a police certificate.

The number of the individual entrepreneur registration certificate is indicated on the certificate form, which is issued to the entrepreneur in case of successful registration.

The actions after registering an individual entrepreneur are described in detail in the article at the link.

The list of documents for individual entrepreneur registration can be found here.

Registration of an individual entrepreneur is a simple procedure that anyone can go through on their own. To do this, you need to submit an application to the tax office in form P21001, a copy of your passport and a receipt for payment of the state duty.

And yet, despite such a small package of documents, some applicants are refused registration as an individual entrepreneur. The most unpleasant thing is that in case of refusal for any reason, the paid fee of 800 rubles is not refunded.